- Erase the real value of investment returns 💸

- Force central bank tightening, crushing equities

- Raise company costs, cutting margins

- Reduce consumer demand, hurting sales

When to Sell Stocks – Timing Guide for Argentina Market

Investing in the stock market is an exciting but demanding journey. One of the hardest questions investors face is: when to sell stocks?

Article navigation

- When to Sell Stocks- Introduction

- Understanding the Need to Sell a Stock

- 6 Reasons to Sell a Stock

- How Inflation Affects Stock Selling Decisions

- Knowing When to Sell: Key Indicators

- Strategies for Selling Stocks

- Tax Implications of Selling Stocks in Argentina

- Making Informed Decisions on Stock Sales

- MERVAL Trading: Lessons from Argentina

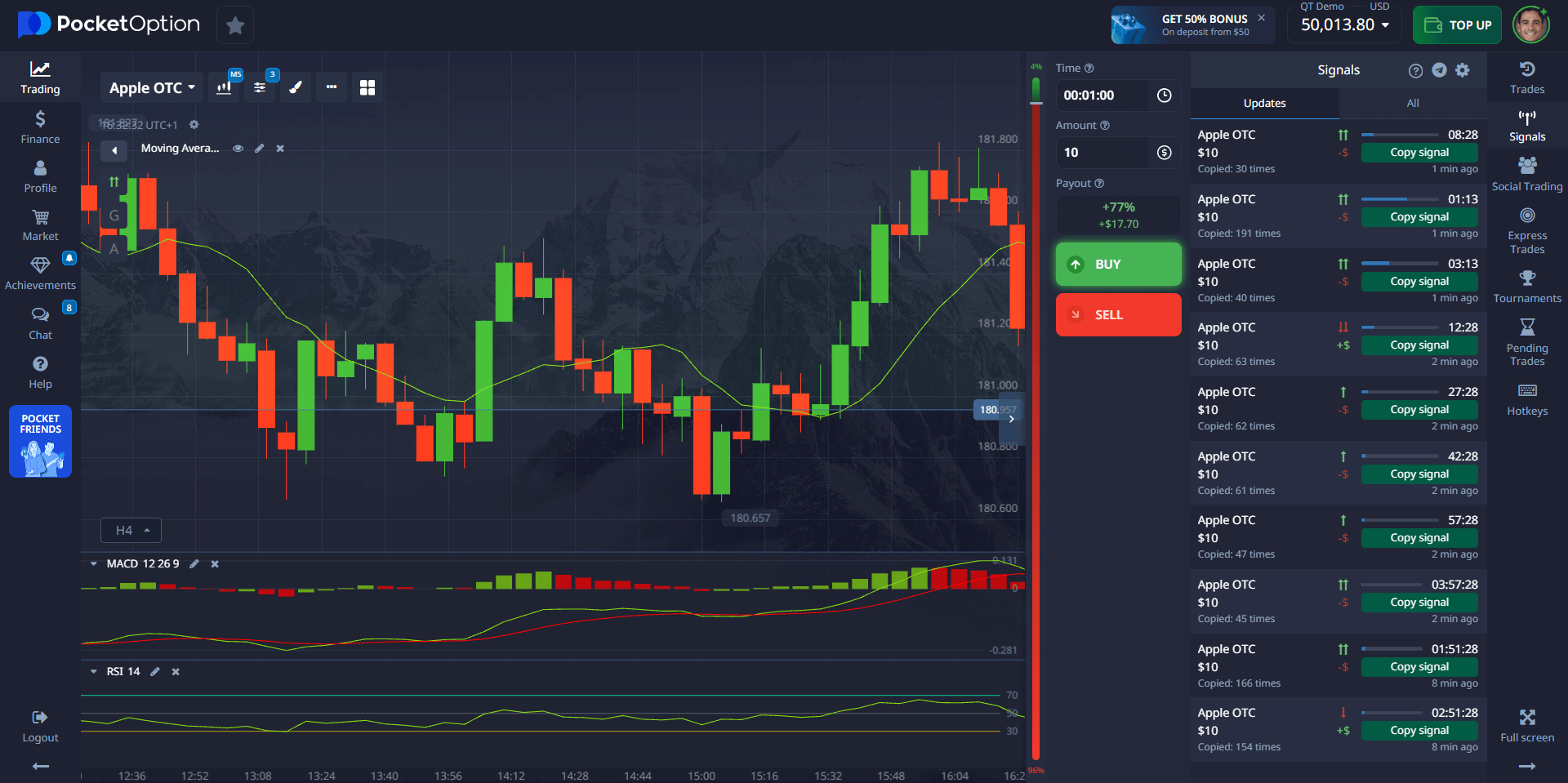

- Pocket Option: A Platform to Practice Timing

When to Sell Stocks- Introduction

Selling is just as crucial as buying, because the wrong timing can wipe out months of gains. This guide focuses on the Argentine market, where market volatility Argentina and inflation make timing even more important.

According to JPMorgan analysts, Argentine and Turkish stocks could deliver over 20% returns this year, driven by Milei’s reforms and easing capital controls. This highlights how timing exits in Argentina can make the difference between securing profits and losing them to volatility.

With Pocket Option, you can practice stock selling strategies risk-free on a demo account with $50,000 virtual funds, and then move to real trades from just $5 (may vary depending on geo and payment method). You get access to 100+ assets, 24/7 OTC trading, and tools like AI Trading or a Telegram Signal Bot to refine your exit decisions.

Understanding the Need to Sell a Stock

For investors, knowing when to sell a stock is as important as the initial buying decision. The reasons vary — from personal cash needs to shifts in economic cycles or portfolio rebalancing. Selling is not only about locking in profits; it’s about adapting to change, protecting capital, and capturing new opportunities.

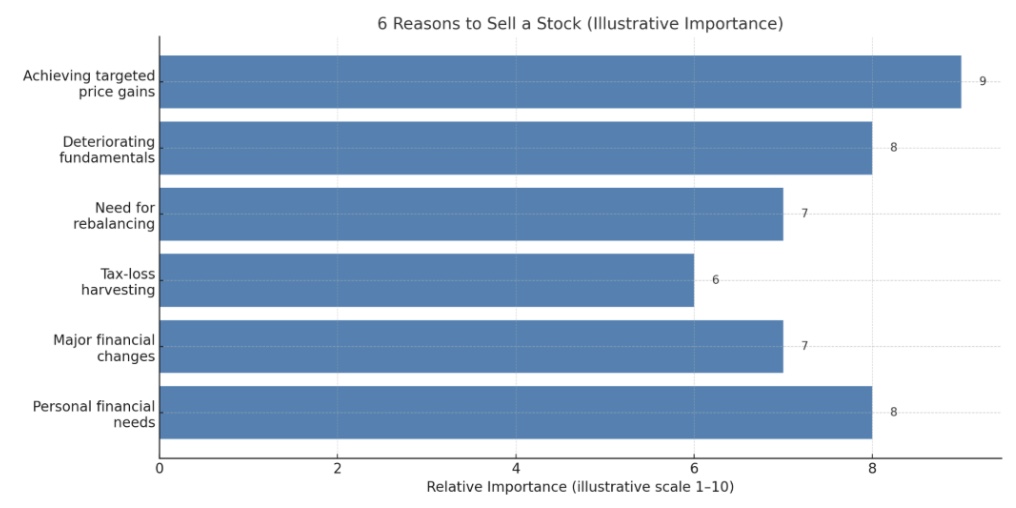

6 Reasons to Sell a Stock

Here are six fundamental reasons to consider selling:

| Reason | Description |

|---|---|

| Achieving targeted price gains | When a stock reaches your pre-set profit target |

| Deteriorating fundamentals | Decline in revenue, earnings, or margins |

| Need for rebalancing | To maintain desired portfolio allocation |

| Tax-loss harvesting | Selling losers to offset gains for tax purposes |

| Major financial changes | Company debt surges, governance shifts |

| Personal financial needs | Liquidity required for expenses or obligations |

📊 These drivers of profit taking and loss-cutting are universal — but in Argentina, they become even more urgent due to inflation shocks and MERVAL swings.

How Inflation Affects Stock Selling Decisions

Inflation in Argentina exceeded 200% annually before beginning to cool under President Javier Milei. As The Wall Street Journal notes, hedge funds have turned Argentina into the “trade of the year”, betting on reforms that are taming inflation and restoring investor confidence. For investors, these shifts are both opportunity and risk: waiting too long to sell during inflation bursts can wipe out real returns.

Inflation is a critical factor in Argentina. Double-digit or even triple-digit inflation can:

For many investors, inflation spikes act as natural stock exit signals. Selling during these periods helps protect purchasing power and gives the chance to re-enter when stability returns. With Pocket Option’s mobile app 📱, traders in Argentina can instantly act on inflation-driven signals, switching between demo and real accounts in seconds.

Knowing When to Sell: Key Indicators

Here are common red flags that guide when to sell stocks:

- 📉 A prolonged price drop without recovery

- Continuous underperformance vs. benchmarks

- A company missing growth projections

- Sudden changes in management

- Market sentiment shifting from bullish to bearish

💡 On Pocket Option you can monitor such stock exit signals across multiple charts and use a demo account to back-test exits before risking capital. Pocket Option provides 30+ built-in indicators and a Telegram Signal Bot, making it easier to identify these stock exit signals without missing momentum.

Strategies for Selling Stocks

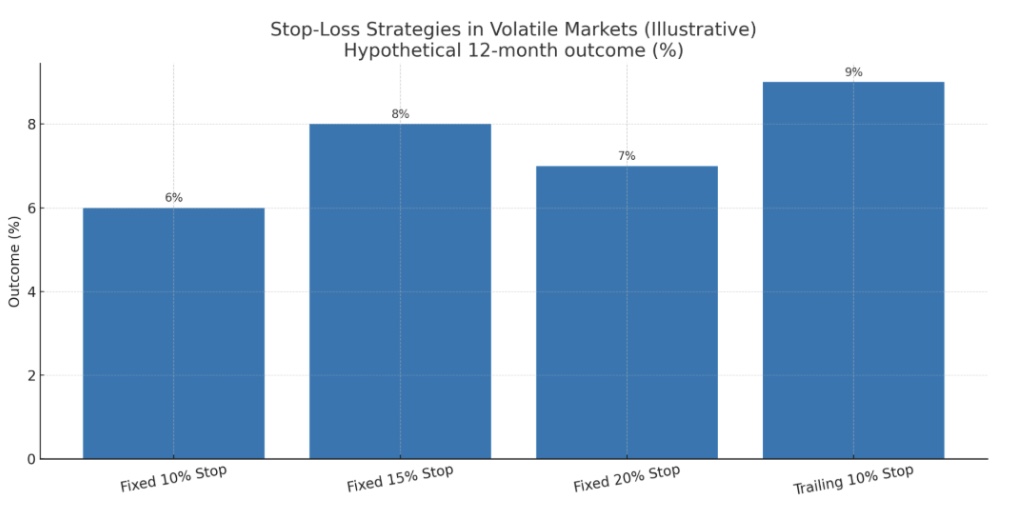

Effective Stop Loss Strategies in Volatile Markets ⚡

In turbulent markets like Argentina, stop loss strategies are essential. A fixed stop (e.g., 10% below purchase) or a trailing stop that moves up with price helps lock profits while limiting downside.

Example: Buy YPF stock at ARS 1,000 → set stop loss at ARS 900. If volatility drags the stock down, your risk is capped. If it rises to ARS 1,300, a trailing stop at ARS 1,200 secures gains.

As Financial Times reports, Milei is still struggling to fully unlock global capital markets. This means Argentine stocks remain exposed to sudden shifts in investor sentiment. Stop-loss strategies aren’t just technical tools here—they’re essential insurance against unpredictable policy shocks.

Timing Your Stock Sale: The Importance of Market Trends 📈

Understanding market timing Argentina means tracking:

- GDP growth and inflation

- Peso fluctuations

- MERVAL index trends

- Sector performance (energy, banking, consumer)

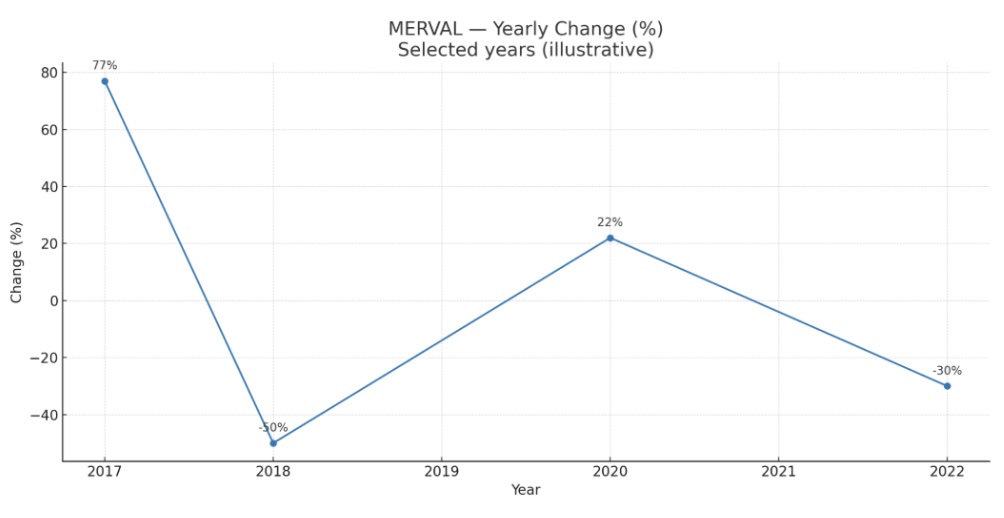

Example: Before the 2018 debt crisis, MERVAL dropped 50%. Investors who sold early preserved capital, while those who ignored signals faced heavy losses.

Reinvesting After a Stock Sale

Smart selling is only half the game. Reinvesting matters:

- Diversify into strong fundamentals (tech, energy)

- Explore alternatives like bonds or commodities

- Use sector rotation Argentina to follow capital flows

- Stay mindful of capital gains taxes

Pocket Option supports 100+ global assets, letting you quickly reallocate across stocks, forex, and crypto. After selling, reinvesting is simple on Pocket Option: from global stocks to forex, crypto, and commodities, with 100+ assets available 24/7 through OTC trading.

Tax Implications of Selling Stocks in Argentina

Understanding Capital Gains Tax

Profits from stock sales are subject to capital gains tax. Rates depend on holding periods and tax brackets. Timing sales around tax calendars can reduce liabilities.

Tax Loss Harvesting

Selling losers to offset winners can cut taxable income. This approach, while counterintuitive, is powerful in volatile markets.

Managing Your Tax Bill

Combine tax-loss harvesting with careful reinvestment. Consulting a tax professional ensures your stock selling strategies align with regulations.

While tax rules require careful planning, you can practice different selling strategies on Pocket Option’s unlimited demo before applying them in the real Argentine market.

Making Informed Decisions on Stock Sales

- Analyzing the Price Before Selling. Check whether price meets your goals or diverges from fundamentals. Compare to benchmarks like the S&P 500 or MERVAL. Use technical indicators such as RSI or MACD for stock exit signals.

- When You Need the Cash. Sometimes selling is about liquidity — for emergencies or planned obligations. Prioritize liquid stocks with minimal disruption to your allocation.

- Buy and Sell for Balance. Rebalancing ensures your portfolio reflects risk tolerance. Selling overweighted winners and reallocating helps maintain stability and capture opportunities.

MERVAL Trading: Lessons from Argentina

| Year | MERVAL Growth | Event | Best Exit Strategy |

|---|---|---|---|

| 2017 | +77% | Peso devaluation boosted exports | Late-year profit taking |

| 2018 | –50% | Debt crisis + IMF bailout | Early stop loss strategies |

| 2020 | +22% | COVID rebound | Mid-year partial exit |

| 2022 | –30% | Inflation >100% | Quick exit recommended |

📊 Lesson: MERVAL highlights why timing matters. Investors who followed stock selling strategies preserved capital; others lost gains.

In a milestone moment, Argentina recently secured an IMF deal and lifted most capital controls, signaling a structural change in market stability. For sellers, this underscores why following macro developments is just as important as watching charts: the MERVAL often reacts more to politics and reforms than to earnings reports.

Pocket Option: A Platform to Practice Timing

Why Pocket Option is Perfect to Refine When to Sell Stocks — Or Rather, When to Exit Trades

While Pocket Option doesn’t involve owning stocks in the traditional sense, it gives you powerful tools to refine your exit strategies — whether you’re forecasting price movement in stock assets, commodities, crypto, or forex.

Here’s why it’s ideal:

- Strategic Timing, Not Asset Selling. You don’t sell assets — you close positions by forecasting price direction. It’s a simplified, action-oriented approach: Buy if you expect the price to rise, Sell if it’s likely to drop.

- Economic Calendar & Signals. The built-in economic calendar highlights key events that impact markets. Combined with free trading signals, you get timely insights to decide exactly when to enter or exit a trade.

- Instant Execution Across Devices. Trade from any device — mobile or desktop — with a responsive interface that lets you close trades in seconds, helping you respond instantly to market shifts.

- Demo Account for Precision Testing. Use the unlimited $50,000 demo account to fine-tune your strategy and test different exit scenarios with zero risk.

- Learn from the Best. Copy trading allows you to observe how top traders exit their positions and adopt smarter exit timing into your own trading behavior.

FAQ

When should I sell my stocks in Argentina?

When volatility spikes, inflation surprises higher, or the MERVAL turns into a clear downtrend. In those phases, combine profit-taking on strength with pre-set stop losses on weakness so you protect capital before momentum snowballs. If your original investment thesis breaks, that’s your sell signal even if the tape looks calm.

What are the best indicators for selling stocks?

On the technical side, fading momentum after MA crossovers turning down and an RSI above 70 rolling over are classic exit cues; a pattern of lower highs and lower lows adds weight. Fundamentally, declining earnings and rising leverage are hard red flags. Strategically, a negative macro cycle or sector rotation out of your names increases the odds that rallies get sold. For Argentina specifically, keep an eye on FX risk—sharp peso depreciation can undercut local-currency gains.

How does inflation affect stock selling decisions?

Inflation erodes real returns, pushes rates higher, and dims demand, which compresses valuations. Many investors trim earlier in high-inflation bursts, sit in safer assets, then re-enter when inflation and rates stabilize. If you’re a foreign investor, remember that currency moves amplify inflation pain—real returns matter more than nominal ones.

What stop-loss strategy works in volatile markets?

Give the trade breathing room with wider stops (about 15–20%), use trailing stops to ratchet profits, and consider partial exits to de-risk without abandoning the position. Place stops where the chart says the idea is wrong—below key support or beyond typical swing ranges—so normal noise doesn’t shake you out.

How to effectively balance technical and fundamental analysis to determine when to buy and when to sell stocks in Argentina?

The optimal verified strategy for Argentina implements a three-layer approach: 1) Macro: Establish the general market context and the phase of the economic-political cycle to determine sector allocation; 2) Fundamental: Select specific companies using inflation and exchange rate adjusted metrics to identify real value; 3) Technical: Determine the precise moment of entry and exit, and position size. The critical factor in the Argentine market is to always start with macro analysis as the main filter, as country-specific factors have a disproportionate impact compared to developed markets.

Conclusion: Timing Is Everything

When to sell stocks depends on discipline, analysis, and market conditions. Argentina’s MERVAL shows that ignoring timing can be costly. Pocket Option makes learning easier: from demo practice to real trades starting at $5, with AI tools and 24/7 markets. Refine your exits, protect your gains, and grow your portfolio wisely.

Start trading