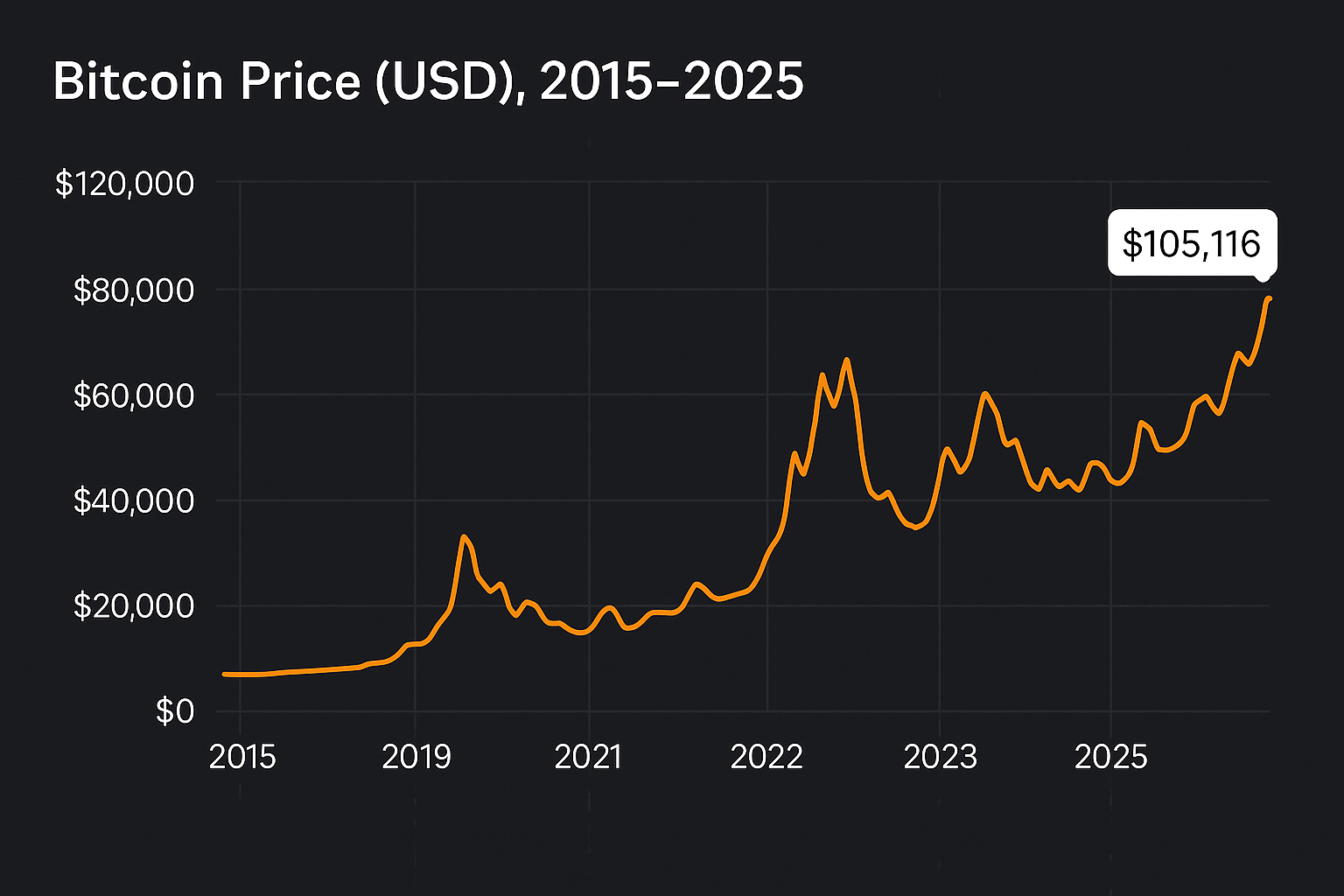

- In 2015, $1 could buy approximately 0.004 BTC.

- By 2025, that 0.004 BTC would be worth around $420, assuming a price of $105,000 per BTC.

Pocket Option Analysis: If I Put 1 Dollar in Bitcoin How Much Will I Get in 10 Years

How much could $1 in Bitcoin grow? This article looks at potential 10-year returns, past performance, and what a small investment today could mean for the future.

Article navigation

Understanding Bitcoin as an Investment

Bitcoin has emerged as a significant player in the investment landscape over the past decade. Initially launched as a decentralized digital currency, it has transformed into a legitimate asset class, attracting investors worldwide. Unlike traditional stocks or bonds, Bitcoin operates on blockchain technology, allowing for secure and transparent transactions. This unique characteristic has contributed to its rise, as many investors perceive Bitcoin as a hedge against inflation and economic uncertainty. An investment in Bitcoin often comes with a level of volatility that can lead to significant profits or losses.

📈 How Much Will 1 Bitcoin Be in 2030?

Bitcoin’s future price is a topic of much speculation. Analysts offer varying predictions:

ARK Invest projects a bullish scenario where Bitcoin could reach $1.5 million by 2030, driven by institutional adoption and macroeconomic factors.

Binance provides a more conservative estimate of $134,000 by 2030.

Jack Dorsey, co-founder of Twitter, envisions Bitcoin exceeding a $20 trillion market cap, translating to over $1 million per BTC.

These projections highlight the potential growth of Bitcoin, though actual outcomes will depend on various market dynamics.

The Rise of Bitcoin Over the Last Decade

The remarkable rise of Bitcoin over the last decade is nothing short of extraordinary. Ten years ago, Bitcoin’s price was just a fraction of a dollar, yet it has skyrocketed to nearly £20k per Bitcoin today. This meteoric rise has led many to question how much their initial investment would be worth if they had invested in Bitcoin back then. As Bitcoin hit various milestones, including its first ETF approval in 2021, it has solidified its place in the investment portfolio of many traders and investors. With projections suggesting that Bitcoin could continue to grow, understanding its historical performance is crucial for potential investors.

💵 How Much Can $1 Make in Bitcoin?

Investing $1 in Bitcoin might seem minimal, but history shows even small investments can grow. Many new investors ask: if I buy bitcoin for $1 or if I buy $1 of bitcoin how much is it worth after a few years?

This illustrates the potential of consistent, small investments over time.

🔮 If I Put 1 Dollar in Bitcoin, How Much Will I Get in 10 Years?

Another common question is: if I invest $1 in bitcoin today how much is it worth in a decade?

To estimate the future value of a $1 Bitcoin investment, we can use Bitcoin’s historical compound annual growth rate (CAGR), which has averaged around 60% since inception.

Here’s how $1 could grow with that average, starting in 2025:

| Year | Projected Value |

|---|---|

| 2025 | $1.00 |

| 2026 | $1.60 |

| 2027 | $2.56 |

| 2028 | $4.10 |

| 2029 | $6.56 |

| 2030 | $10.50 |

| 2031 | $16.80 |

| 2032 | $26.88 |

| 2033 | $43.00 |

| 2034 | $68.80 |

📌 Disclaimer: These projections are based on historical data and do not guarantee future returns.

Factors Influencing Bitcoin’s Value

Several factors influence Bitcoin’s value, making it a complex yet intriguing investment. Market demand, regulatory news, and technological advancements all play a role in driving Bitcoin’s price fluctuations. Additionally, the increasing adoption of Bitcoin by companies and financial institutions has contributed to its legitimacy as a store of value. Inflation rates also affect investor sentiment, as many turn to cryptocurrencies like Bitcoin to preserve wealth. Understanding these factors is essential for anyone considering an investment in Bitcoin, as they provide insight into potential future performance.

Why Invest in Bitcoin?

Investing in Bitcoin offers unique opportunities that traditional investments may not provide. As a leading cryptocurrency, Bitcoin has the potential for high returns, especially for long-term investors. By diversifying a portfolio with Bitcoin, investors can mitigate risks associated with stock market volatility. Furthermore, with the advent of Bitcoin ETFs, investing in Bitcoin has become more accessible to the average investor. Many financial advisors now recommend including Bitcoin in an investment strategy, as it has historically outperformed the S&P 500 in certain periods. As we look ahead to 2030, the potential for Bitcoin as a profitable investment remains an enticing prospect.

📊 Bitcoin Investment Growth Table

| Year | Investment | BTC Price | BTC Acquired | Value in 2025 |

|---|---|---|---|---|

| 2015 | $1 | $250 | 0.004 BTC | $420 |

| 2020 | $1 | $9,000 | 0.00011 BTC | $11.55 |

| 2025 | $1 | $105,000 | 0.0000095 BTC | $1 |

Assuming a BTC price of $105,000 in 2025.

Many investors wonder: if I buy bitcoin for $1 or if I buy $1 of bitcoin how much is it worth in the long term?

How much money you’d have if you invested $1,000 in Bitcoin 10 years ago

If an investor had invested $1,000 in Bitcoin 10 years ago, the potential returns would be staggering. Back in 2013, the price of Bitcoin was approximately $130 per BTC. This means that with a $1,000 investment, an individual would have acquired about 7.69 Bitcoins. Fast forward to today, with Bitcoin’s price hovering around £20k, that initial investment would be worth a remarkable £153,800. This kind of exponential growth highlights the incredible potential of Bitcoin as an investment. As Bitcoin continues to trade at high values, it prompts many to consider how historical investment decisions could have drastically altered their financial landscapes.

💡 Is Investing $100 in Bitcoin Worth It?

- Diversification: Bitcoin offers exposure to the cryptocurrency market, which can diversify your investment portfolio.

- Accessibility: Many platforms allow investments as low as $100, making it accessible for beginners.

- Potential Returns: While past performance doesn’t guarantee future results, Bitcoin has shown significant growth over the past decade.

However, it’s essential to be aware of risks:

- Volatility: Bitcoin’s price can fluctuate significantly in short periods.

- Regulatory Risks: Changes in regulations can impact the cryptocurrency market.

- Security Concerns: Ensuring the safety of your investment requires understanding and implementing proper security measures.

Always conduct thorough research and consider consulting with a financial advisor before investing.

Calculating Potential Returns on Bitcoin Investment

Calculating potential returns on a Bitcoin investment involves understanding various factors, including market volatility and historical data. Investors can utilize a free Bitcoin profit calculator to assess how much their investment would be worth based on current and past prices. By inputting the amount invested, the historical price of Bitcoin, and the current market value, one can easily visualize potential gains. This method not only demonstrates the power of investing in cryptocurrencies but also shows how a seemingly modest investment can yield substantial returns over time, illustrating the allure of Bitcoin for both seasoned traders and new investors.

📊 Alternative Growth Projection (40% CAGR from 2025)

| Year | Projected Value |

|---|---|

| 2025 | $1.00 |

| 2026 | $1.40 |

| 2027 | $1.96 |

| 2028 | $2.74 |

| 2029 | $3.84 |

| 2030 | $5.38 |

| 2031 | $7.54 |

| 2032 | $10.55 |

| 2033 | $14.77 |

| 2034 | $20.68 |

| 2035 | $28.95 |

📌 These values illustrate a moderate growth forecast and provide another lens for assessing long-term returns.

Mathematical Projections for Bitcoin

Mathematical projections for Bitcoin often rely on historical price trends and market dynamics. Financial analysts use various models to predict Bitcoin’s future value, taking into consideration factors like inflation, market demand, and technological advancements. For instance, if Bitcoin maintains its growth trajectory, it could reach even higher valuations by 2030. A common approach is to analyze the compound annual growth rate (CAGR) of Bitcoin over the past decade, which helps investors estimate future prices based on past performance. These projections indicate that investing in Bitcoin today could yield significant profits in the long term.

Historical Data: 10 Years Ago vs. Today

Examining historical data reveals a stark contrast between Bitcoin’s valuation 10 years ago and its current standing. In 2013, Bitcoin’s price fluctuated around $130, while today, it stands at an impressive £20k per Bitcoin. This dramatic shift underscores the cryptocurrency’s volatility and its ability to generate substantial returns. Comparing Bitcoin to traditional stocks like the S&P 500 also highlights its unique market position. Despite fluctuations, Bitcoin has consistently outperformed many conventional investments, making it an essential consideration for any diversified portfolio. Understanding this historical context is vital for investors looking to navigate the crypto landscape effectively.

Using Crypto Models to Predict Future Value

Using crypto models to predict Bitcoin’s future value involves assessing various market indicators and historical trends. Analysts often employ technical analysis methods, including trend lines and moving averages, to forecast potential price movements. Additionally, fundamental analysis, which looks at the impact of external factors like regulatory changes and market sentiment, plays a crucial role in these predictions. As Bitcoin continues to gain acceptance, the development of Bitcoin ETFs has further legitimized its status, allowing investors to gain exposure to Bitcoin without directly trading it. These models provide valuable insights for anyone considering an investment in Bitcoin, helping to shape their long-term strategies and expectations.

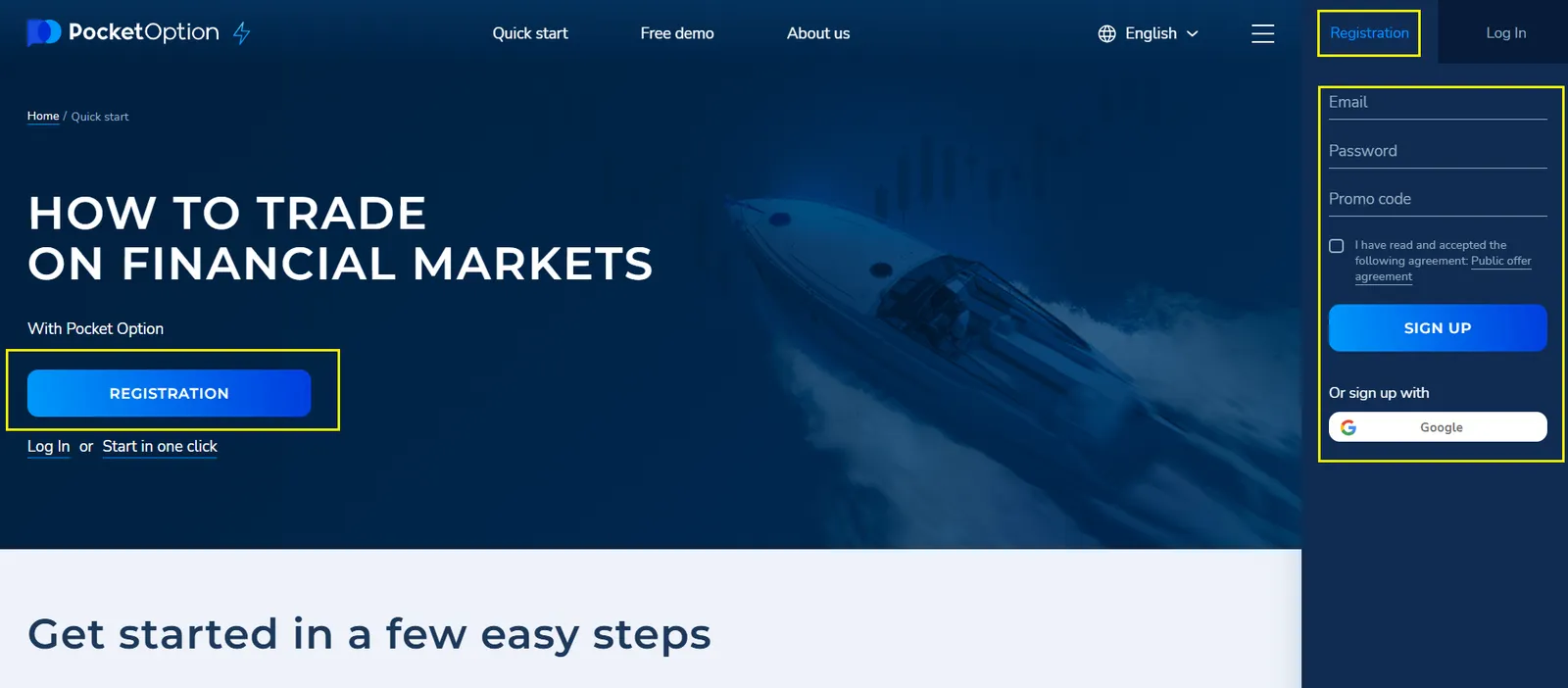

🚀 Start Trading Bitcoin with Pocket Option

Pocket Option provides a user-friendly platform for trading Bitcoin and other assets:

- Ease of Use: Designed for both beginners and experienced traders.

- Fast Transactions: Quick deposit and withdrawal processes.

- Diverse Assets: Access to a wide range of trading instruments.

Many users have shared positive experiences:

- “Pocket Option has been a game-changer for my trading journey. The platform is intuitive, and the support team is always responsive.” – Alex T.

- “I started with a small investment and was impressed by the platform’s features and ease of use.” – Maria L.

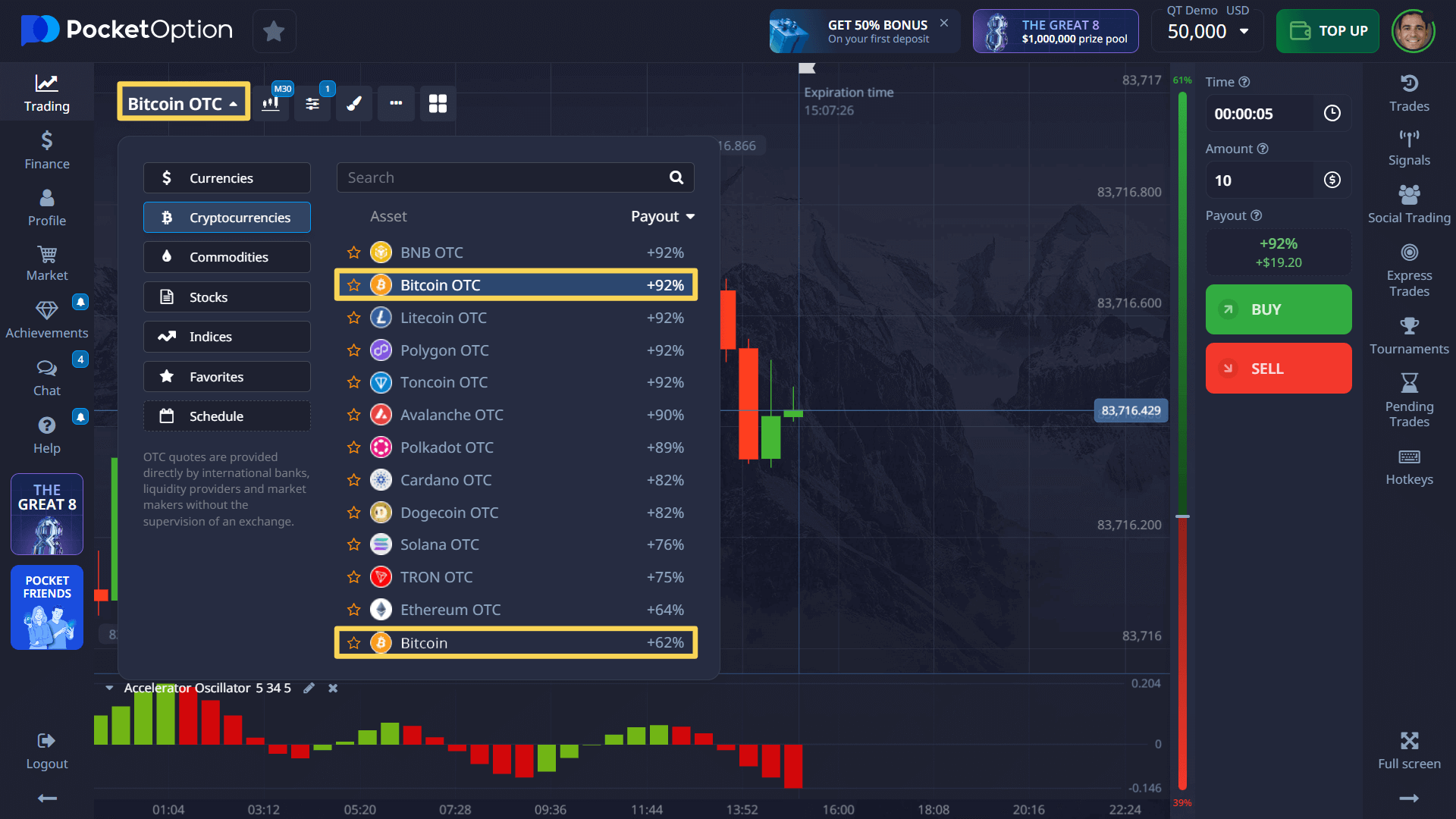

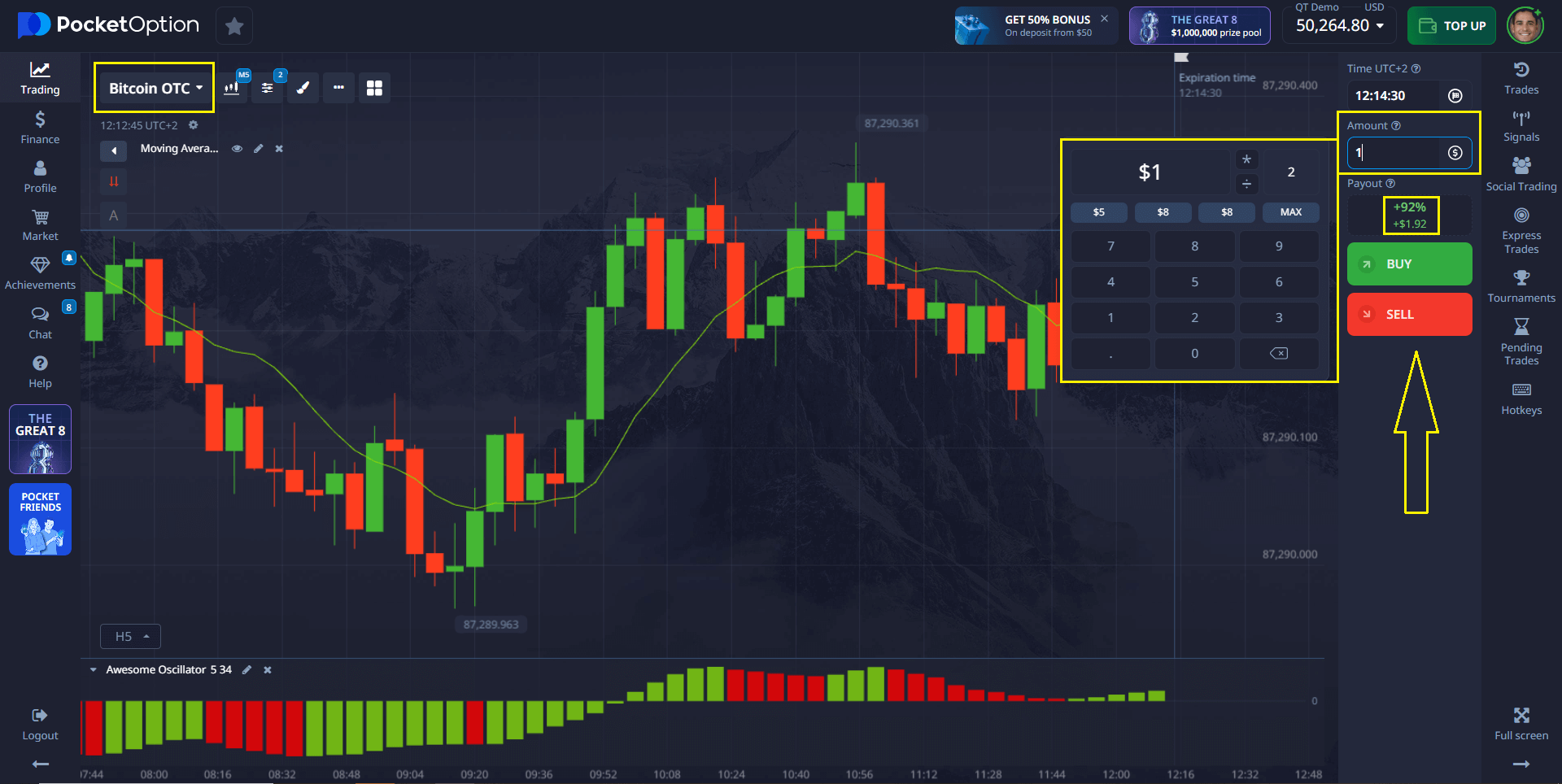

🛠️ Example: How to Open a Trade on Pocket Option

Follow these steps to place your first trade:

- Choose an asset – Select from a wide range including Bitcoin, currency pairs, or stocks.

- Analyze the chart – Use built-in technical indicators like trend lines or the Trader Sentiment tool to understand market direction.

- Set your trade amount – Start from as little as $1.

- Choose the expiration time – From just 5 seconds on OTC assets.

- Make a prediction – Click BUY if you think the price will rise, or SELL if you expect it to fall.

✅ If your prediction is correct, you can earn up to 92% profit – this payout percentage is shown in advance when selecting the asset.

💡 On a live account, which can be opened from only $5, you also gain access to:

- Copy trading features

- Cashback rewards

- Exclusive trading advantages

Volatility in the Bitcoin Market

Understanding Market Fluctuations

Volatility is a defining characteristic of the Bitcoin market, significantly influencing how investors perceive and engage with this cryptocurrency. Market fluctuations can occur rapidly due to various factors, including market sentiment, regulatory news, and macroeconomic events. For instance, a sudden announcement about Bitcoin ETFs or changes in government policy can lead to sharp price movements, both up and down. Understanding these fluctuations is crucial for investors, as they can significantly impact an investment’s value over a short-term or long-term horizon. As traders navigate through this ever-changing landscape, employing strategies to mitigate risks associated with volatility becomes paramount.

Bitcoin’s New All-Time Highs and Lows

In recent years, Bitcoin has experienced a series of new all-time highs and lows, marking its unpredictable nature. For example, Bitcoin hit a staggering price of £20k recently, creating excitement among investors and traders alike. However, this volatility also means that Bitcoin’s value can drop sharply, leading to considerable profit or loss for those involved in Bitcoin trading. Monitoring these price movements is essential for anyone considering an investment in Bitcoin, as they reveal trends that could inform future investment decisions. This rollercoaster journey highlights the importance of timing and strategy in the cryptocurrency market.

Strategies for Managing Investment Risk

Effectively managing investment risk in the Bitcoin market requires a multifaceted approach. Investors should consider diversifying their portfolios by including various cryptocurrencies alongside Bitcoin to reduce exposure to any one asset’s volatility. Setting strict stop-loss orders can also help protect against significant declines in Bitcoin’s price, while dollar-cost averaging allows investors to spread their investments over time, mitigating the impact of market fluctuations. Furthermore, keeping abreast of market trends and employing financial advisors can provide valuable insights into the constantly evolving Bitcoin landscape. By implementing these strategies, investors can navigate the inherent risks associated with Bitcoin investing more effectively.

Expert Analysis on Bitcoin’s Future

Predictions from Cryptocurrency Analysts

Cryptocurrency analysts have made various predictions regarding Bitcoin’s future, particularly as the market continues to evolve. Many experts believe that Bitcoin could reach unprecedented heights by 2030, driven by growing institutional interest and technological advancements. As Bitcoin’s adoption increases, it is expected to become more integrated into mainstream financial systems, which could stabilize its price over time. Analysts often utilize historical data and market trends to forecast potential outcomes, providing invaluable insights for investors contemplating their next move in Bitcoin trading.

🧠 Expert Insights on Bitcoin Investment

- Robert Kiyosaki, author of “Rich Dad Poor Dad,” suggests that even owning a small fraction of Bitcoin could be beneficial in the long term.

- Cathie Wood, CEO of ARK Invest, believes in Bitcoin’s potential to reach $1.5 million by 2030, citing institutional adoption as a key driver.

These perspectives highlight the importance of staying informed and considering expert analyses when making investment decisions.

The Role of Institutional Investment in Bitcoin

Institutional investment has played a pivotal role in shaping Bitcoin’s trajectory as a legitimate asset class. Major financial institutions have begun to invest heavily in Bitcoin, further validating its status as a viable investment option. This influx of capital not only boosts Bitcoin’s market capitalization but also introduces a level of stability that can mitigate its traditional volatility. As institutions continue to allocate funds towards Bitcoin and Bitcoin ETFs, the overall landscape of cryptocurrency investments could shift dramatically, making Bitcoin an increasingly attractive option for both new and seasoned investors.

Long-Term vs. Short-Term Investments in BTC

When considering an investment in Bitcoin, the debate between long-term and short-term strategies is paramount. Short-term investors may capitalize on market volatility, trading Bitcoin for quick profits, but they also face significant risks that could lead to losses. In contrast, long-term investors often focus on the potential for Bitcoin’s appreciation over time, leveraging its historical growth patterns. Those who invested in Bitcoin 10 years ago have witnessed substantial returns, emphasizing the importance of patience and strategic planning in the cryptocurrency market. Ultimately, each investor must determine their risk tolerance and investment goals when deciding their approach to Bitcoin.

Summarizing Potential Outcomes

The potential outcomes for Bitcoin investments are vast and largely dependent on market dynamics and external influences. Predictions suggest that Bitcoin could experience significant growth, potentially reaching new all-time highs by 2030, as institutional interest continues to rise and Bitcoin ETFs become more prevalent. However, investors must remain vigilant, as market volatility can still lead to unexpected downturns. Understanding these potential outcomes allows investors to make informed decisions, balancing optimism with caution as they navigate the ever-evolving landscape of cryptocurrency.

Final Thoughts on Investing in Bitcoin

Investing in Bitcoin remains an enticing proposition for many, given its track record of delivering substantial returns. However, it is vital to approach this investment with a well-informed strategy and an understanding of the inherent risks associated with cryptocurrency markets. As Bitcoin continues to evolve, staying updated on market trends and utilizing tools such as free Bitcoin profit calculators can enhance an investor’s ability to make sound financial decisions. Ultimately, Bitcoin’s future will depend on its adoption, regulatory developments, and technological advancements.

Encouragement for New Investors

For new investors considering entering the Bitcoin market, now may be a prudent time to start exploring opportunities. With the right strategies in place, such as diversification and risk management, investing in Bitcoin can pave the way for substantial financial gains. As Bitcoin trading becomes more accessible through platforms like Coinbase and the rise of Bitcoin ETFs, novice investors have the tools they need to participate in this dynamic market. Embracing Bitcoin as part of a broader investment portfolio could yield promising returns in the long run, encouraging individuals to take that first step toward investing in Bitcoin.

FAQ

How can I accurately calculate potential Bitcoin returns over a 10-year period?

To calculate potential Bitcoin returns over a decade, you need to consider multiple variables rather than simple growth rates. Professional investors use logarithmic regression models, Stock-to-Flow projections, Monte Carlo simulations, and adoption curve analysis. At Pocket Option, we recommend using a combination of models to establish a probability range rather than a single point estimate, typically ranging from 4.6x to 187.4x for a 10-year horizon based on current market conditions.

Is putting $1 in Bitcoin worth it, or should I invest more?

While the question "if I put 1 dollar in bitcoin how much will I get in 10 years" makes for an interesting thought experiment, practical investment strategy typically requires more substantial capital deployment. A single dollar investment, even with Bitcoin's growth potential, is unlikely to generate life-changing returns in absolute dollar terms. Most financial advisors recommend allocating a percentage of your investment portfolio based on your risk tolerance--typically 1-5% for conservative investors and 5-15% for those with higher risk appetites.

How do Bitcoin halving events affect long-term price projections?

Bitcoin's halving events, which reduce the new supply of bitcoins by 50% approximately every four years, create predictable supply shocks that historically correlate with bull cycles. According to the Stock-to-Flow model, these events significantly impact the question "if I buy $1 of bitcoin how much is it worth" over time. Our analysis shows that investments made at similar points in previous halving cycles have yielded an average of 8-12x returns over the following four years, though this pattern may attenuate as the market matures.

How can I track whether Bitcoin is on track for projected growth?

Rather than focusing solely on price, sophisticated investors monitor fundamental network metrics to evaluate Bitcoin's health and adoption trajectory. Key indicators include daily active addresses (user engagement), transaction volume (economic activity), hash rate (network security), UTXO age bands (holding patterns), Lightning Network capacity (scaling solution adoption), and institutional fund flows (professional investor sentiment). Pocket Option's analytics dashboard provides these metrics to help investors contextualize price movements within broader adoption trends.