- Stability and Demand: Financial services are essential in every economy. Consumer services are equally critical as personalized financial guidance grows.

- Diverse Opportunities: From advising to digital support, roles vary significantly across the sector.

- Lucrative Salaries: Many finance consumer services roles pay well, especially with experience and certifications.

How Many Jobs Are Available in Finance Consumer Services?

Delving into the employment landscape of the finance consumer services sector reveals a dynamic and expanding environment with immense career opportunities. This article explores how many jobs are available in finance consumer services and evaluates whether finance: consumer services is a good career path. According to the U.S. Bureau of Labor Statistics (BLS), the services sector, including finance and consumer services, continues to be one of the largest sources of employment in the economy. Many jobs are available across various specializations, offering broad advancement potential.

Article navigation

- Job Market Overview: How Many Jobs Are Available in Finance: Consumer Services

- Is Finance: Consumer Services a Good Career Path?

- Expert Insights & Industry Outlook

- Entry-Level and Advanced Career Paths in Finance Consumer Services

- Key Trends Driving Job Growth in Finance Consumer Services

- Comparing Consumer Services and Finance Jobs

- Analyst Opinions and Industry Forecasts

- How Pocket Option Supports Career Growth in Finance Consumer Services

- Summary: Allintitle How Many Jobs Are Available in Finance Consumer Services

- Final Thoughts:

Job Market Overview: How Many Jobs Are Available in Finance: Consumer Services

Understanding how many jobs are available in finance: consumer services begins with looking at the data. As of the most recent Bureau of Labor Statistics report:

| Category | Number of Jobs (U.S., 2024) | Growth Projection (2024-2034) |

|---|---|---|

| Financial Analysts | 370,200 | 9% (faster than average) |

| Personal Financial Advisors | 330,300 | 13% (much faster than average) |

| Customer Service Representatives | 2.8 million | 5% |

| Consumer Credit Counselors | 35,000 | 7% |

These numbers highlight the robust demand in both traditional finance roles and consumer-facing financial service roles. With digitalization and fintech expansion, hybrid careers are on the rise, merging analytical roles with high-touch consumer service. Consumer service jobs are also being redefined, blending financial knowledge with personal interaction skills.

Is Finance: Consumer Services a Good Career Path?

If you’re wondering, “is finance: consumer services a good career path?” the answer is increasingly affirmative. Here’s why:

Expert Insights & Industry Outlook

Why Experts Say Finance: Consumer Services Stands Out as a Career Path

Hybrid Expertise Is Key: Financial analysts and advisors are increasingly expected to combine technical fluency with emotional intelligence. The arXiv study and FN quotes highlight coding, AI awareness, and cultural adaptability as future-proof skills.

Mentorship & Networking Propel Growth: Advice from Rising Stars: “Work hard, stay humble” and “build relationships with top professionals.” Recommendation: Actively seek mentors and join finance communities to accelerate career progression.

Credentials Still Matter: BLS and Investopedia confirm that CFA and CFP certifications greatly boost pay and job prospects for financial analysts and advisors.

DeFi Is Creating New Frontiers: With 40% of professionals anticipating DeFi impact, proficiency with blockchain and decentralized tools will position you ahead in the financial service landscape.

Entry-Level and Advanced Career Paths in Finance Consumer Services

A wide range of positions is available depending on experience level. Entry-level roles serve as essential foundations within the services sector and provide critical job opportunities for upward mobility.

Entry-Level Roles:

- Customer Service Representatives in banks

- Operations Associates in finance firms

- Junior Financial Analysts

Mid-to-Senior Roles:

- Investment Advisors

- Risk Managers

- Financial Planners and Wealth Managers

Level

| Role Example | Median Salary | Required Qualifications |

|---|---|---|

| Banking CSR | $42,000 | High school / Associate degree |

| Financial Planner | $88,000 | Bachelor’s + Certification |

| Portfolio Manager | $130,000+ | CFA / MBA |

Key Trends Driving Job Growth in Finance Consumer Services

- Digitalization: Chatbots, mobile apps, and AI have created demand for tech-savvy service agents.

- Personalized Finance: Consumers increasingly seek tailored advice.

- Remote Services: COVID-19 normalized remote financial advisory roles.

| Trend | Impact | Role Affected |

|---|---|---|

| Fintech Apps | High | Digital Support Specialist |

| Remote Finance | Medium | Virtual Advisors |

| AI Integration | High | Data Analysts |

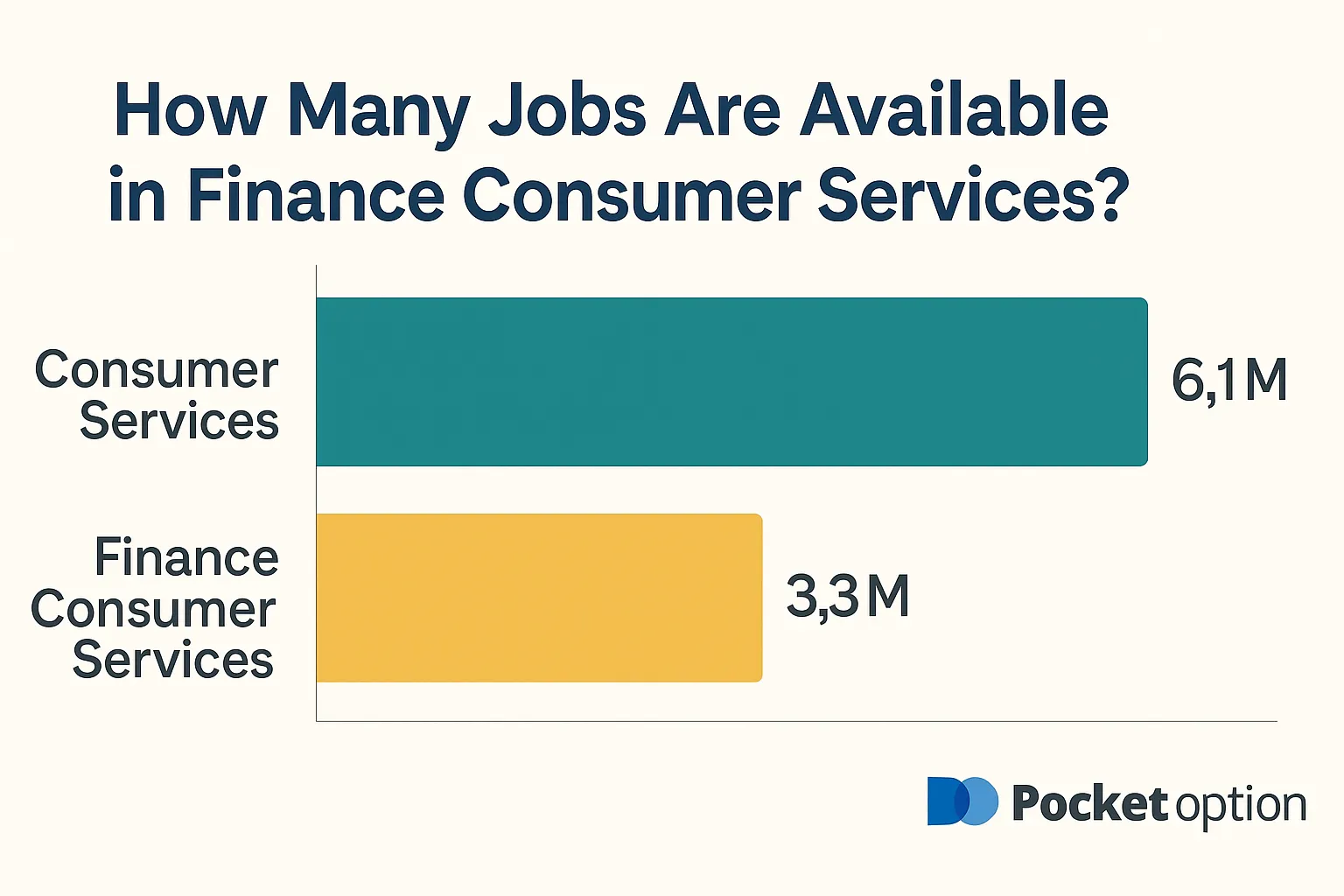

Comparing Consumer Services and Finance Jobs

| Feature | Consumer Services | Finance | Finance Consumer Services |

|---|---|---|---|

| Entry Volume | High | Moderate | High |

| Pay Potential | Medium | High | High |

| Skill Flexibility | Broad | Specialized | Hybrid |

Analyst Opinions and Industry Forecasts

A recent Forbes article highlighted finance consumer services as one of the top 10 future-proof career sectors. Analysts from PwC and Deloitte also point out that roles which combine finance acumen with client service are increasingly vital, especially with Gen Z and Millennial clients expecting seamless and personalized digital experiences. Financial analysts continue to be among the top-ranked professions in terms of demand and compensation.

How Pocket Option Supports Career Growth in Finance Consumer Services

Whether you’re entering the field or already working in finance consumer services, Pocket Option can complement your career path by:

- Providing $50000 demo account to practice analytical skills

- Offering Quick Trading on 100+ assets with simple Buy/Sell logic

- Enabling Copy Trading to learn strategies from experts

- Facilitating 24/7 access, perfect for flexible skill development

Summary: Allintitle How Many Jobs Are Available in Finance Consumer Services

To answer the search query “allintitle how many jobs are available in finance consumer services,” the answer is — thousands, with a growing trend supported by data, analyst opinions, and technological shifts. Consumer services remain integral to economic resilience, and many jobs are available across specializations.

Whether you’re looking to transition careers or scale in your current role, finance consumer services offers a vibrant, sustainable, and high-potential pathway. Platforms like Pocket Option not only support personal growth but also enable real-world experience in financial markets.

Final Thoughts:

- The sector is broad, high-growth, and future-ready

- Career diversity ranges from entry to C-suite roles

- Digital transformation is expanding job definitions

- Pocket Option helps you stay ahead — start your journey today

Still asking yourself, “is finance consumer services a good career path?” or “is finance: consumer services a good career path?” The data and opportunities speak for themselves — and now is the time to act.

FAQ

What essential skills are needed for a career in finance consumer services?

Key skills for a career in finance consumer services include analytical thinking, effective communication, problem-solving, and proficiency in financial software. These skills are crucial for analyzing financial data, advising clients, and ensuring compliance with financial regulations.

How do I embark on a career in finance consumer services?

To launch a career in finance consumer services, earn a relevant degree in finance or a related field, gain internship experience, and consider certifications such as CFA or CFP. Networking and ongoing education are also vital for career advancement.

What are the current trends in finance consumer services?

Emerging trends include the integration of artificial intelligence in financial analysis, the rise of fintech solutions, and a heightened focus on ethical finance. These trends are transforming finance consumer services by enhancing efficiency and transparency.

What is the future job outlook for finance consumer services?

The job outlook for finance consumer services is promising, with projected growth driven by increased demand for financial advice and consumer credit management. As the sector expands, so will opportunities for skilled professionals.

How many people work in the financial services industry?

As of 2024, the financial services industry in the U.S. employs over 8.7 million people, including roles in banking, insurance, investment services, and consumer finance. This figure grows substantially when accounting for global markets.

Is finance consumer services a good career path?

Yes, finance consumer services is considered a high-potential career path, blending analytical and interpersonal skills. It offers stability, competitive salaries, and significant room for advancement, especially for those who develop technical and client-facing expertise.

How many finance jobs are available?

In the United States, finance-specific roles include over 370,000 financial analysts and 330,000 financial advisors, alongside operations, compliance, and support roles. Combined, finance contributes to over 7 million jobs in the broader financial services industry.

How many jobs are available in consumer services?

According to the Bureau of Labor Statistics, there are approximately 2.8 million customer service representative roles alone in the U.S., making consumer services one of the largest employment categories. Including retail, hospitality, and digital support, the sector accounts for tens of millions of jobs globally.