- Ensures consistency regardless of market volatility

- Reinforces trading discipline framework

- Establishes accountability through structured routines

Trading Plan Template

A well-structured trading plan serves as the foundation for consistent market performance. Creating an effective trading plan template requires careful consideration of multiple factors, from risk management to specific entry and exit criteria.

Article navigation

- Create a Winning Trade Plan 🚀

- Understanding the Trade Plan

- What is a Trade Plan?

- Benefits of a Solid Trading Plan

- Common Mistakes in Trading Without a Plan ❌

- Components of a Successful Trading Plan Template

- How to Create a Trading Plan

- Using a Trading Journal Template

- Adapting Your Trade Plan for Different Markets

- Improving Your Trading with a Routine

- Free Resources for Traders 📚

Create a Winning Trade Plan 🚀

In today’s fast-paced trading environment, a well-structured trading plan template is not just a helpful tool–it’s an absolute necessity. Whether you’re trading currencies, commodities, or indexes, success doesn’t come from chance–it comes from planning. This comprehensive guide walks you through creating a powerful trade plan that sets you up for consistent profits while taking advantage of the unique features offered by Pocket Option. From flexible trading tools to social copy trading, Pocket Option empowers traders to execute strategies with precision.

“A trading plan is what separates professionals from amateurs. Without it, you’re trading emotions, not markets.” — Kathy Lien, Managing Director at BK Asset Management

Understanding the Trade Plan

A trading plan template acts as your personal GPS in the world of finance. It keeps your goals in sight, helps you avoid impulsive decisions, and guides your trades with clarity and confidence. On platforms like Pocket Option–where quick decisions can lead to significant results–having a systematic trading approach is crucial.

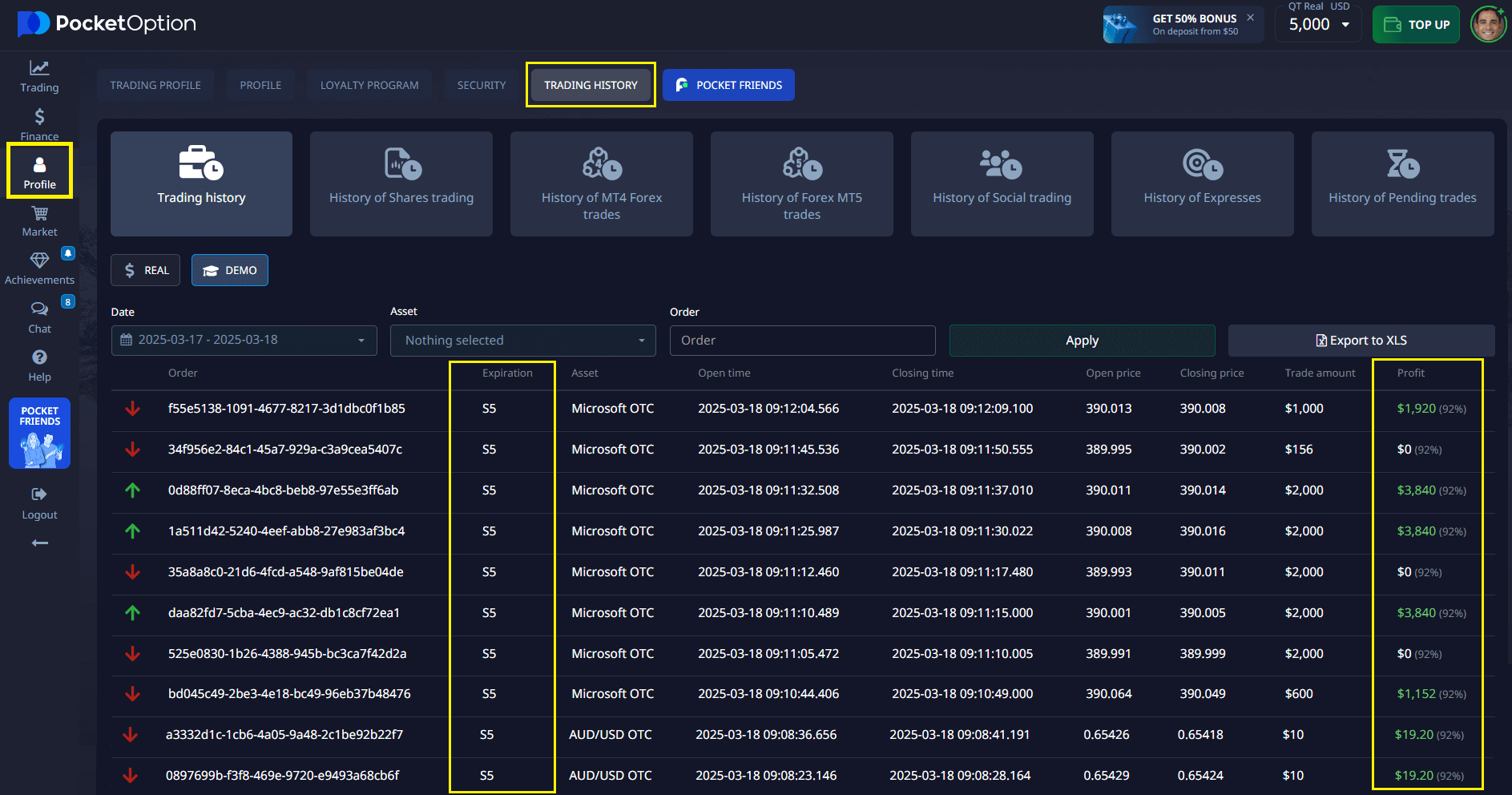

👉 For instance, Pocket Option allows you to view detailed trade history directly within the interface. This makes it easier to refine your strategy based on past performance.

According to a 2024 report by Statista, over 65% of traders who follow a structured plan report consistent returns, compared to just 18% who trade without one.

Why Every Trader Needs One:

| Benefit | Impact on Trading |

|---|---|

| Risk Management | Protects capital, prevents large losses |

| Strategy Clarity | Reduces guesswork, enforces logic-based decisions |

| Emotional Control | Keeps fear and greed in check |

| Performance Tracking | Enhances long-term learning and success |

What is a Trade Plan?

A trade plan is a customized document outlining your approach to market entry, trade management, and exit. It includes:

- Entry and exit rules

- Strategy type (e.g., day trading plan, swing trading)

- Risk parameters

- Personal goals

This document becomes your trading rules template, helping you remain objective and mentally prepared, even during turbulent sessions.

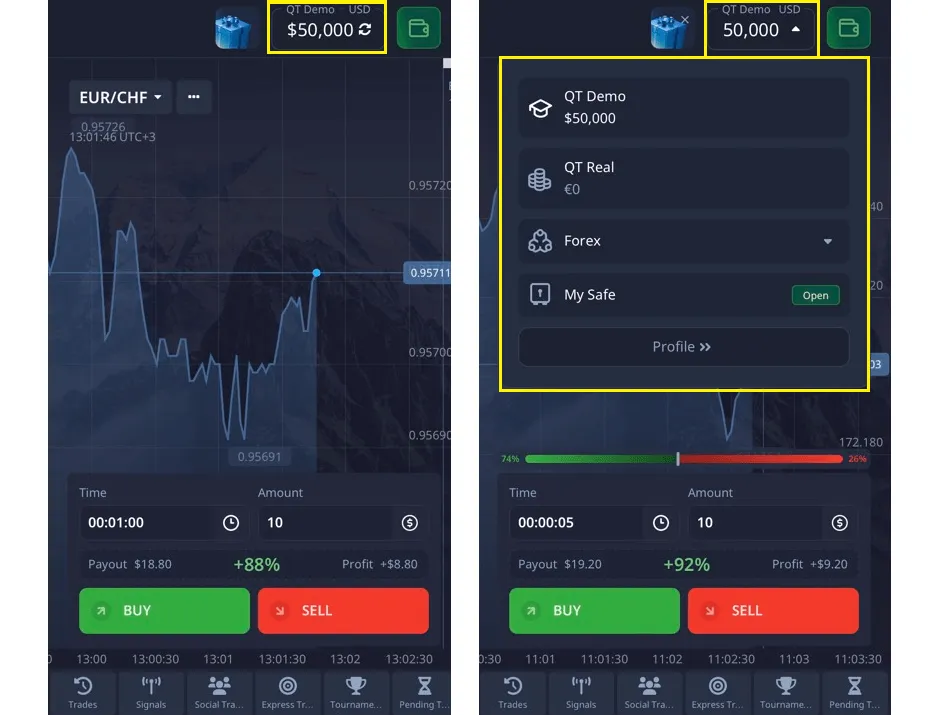

📌 Real Example: A trader using Pocket Option’s demo account can test a strategy with a $50,000 balance, record outcomes in a trading journal template, and refine tactics before going live.

“Treat your trading plan like a business plan. You wouldn’t run a company without one–why trade without it?” — Mark Douglas, author of Trading in the Zone

Benefits of a Solid Trading Plan

- Decision Clarity — Clear guidelines eliminate hesitation.

- Consistent Execution — Increases discipline over time.

- Risk Control — You always know the worst-case scenario.

- Performance Tracking — Easier with Pocket Option’s real-time analytics.

👥 Combine it with Social Trading to learn from top-performing traders while managing your own plan.

Expert Insight: According to CNBC, disciplined traders are 3.6 times more likely to remain profitable after one year than those without a structured plan.

Common Mistakes in Trading Without a Plan ❌

Without a trading business plan, traders often:

- Enter trades based on emotion

- Ignore stop-loss rules

- Overtrade

Example: Many users on Pocket Option begin trading impulsively with promo bonuses but fail to track results. A trading journal template could have helped identify flawed decisions early.

| Mistake | Solution |

|---|---|

| No stop-loss | Use a fixed-risk model (e.g., 2% per trade) |

| Chasing trades | Define and follow entry rules |

| Random position sizing | Apply a defined position-sizing rule |

| Emotional exits | Stick to pre-defined exit strategy |

Components of a Successful Trading Plan Template

1. Defining Your Trading Goals

Set measurable and realistic objectives:

- Daily or weekly profit targets

- Risk limits

- Skill development (e.g., mastering chart patterns)

Tip: Pocket Option’s learning materials and tutorials help beginners build confidence and reach their goals faster.

Expert Insight: “Trading without a goal is like sailing without a destination,” says Tom Hougaard, professional day trader and coach.

2. Choosing Your Trading Strategies

Your trading strategy template could include:

- Scalping for rapid trades

- Swing trading using trend reversals

- News trading during market events

Example: Use Pocket Option’s Signal Bot or Telegram alerts to identify profitable setups quickly.

In a Bloomberg survey, traders who use pre-tested strategies outperform spontaneous traders by 27% annually.

3. Setting Risk Management Parameters

An essential part of your risk management plan should address:

- Maximum percentage risk per trade (e.g., 2%)

- Daily loss limit

- Use of stop-loss and take-profit tools

| Parameter | Recommended Setting |

|---|---|

| Max Trade Risk | 1–2% of account |

| Max Daily Drawdown | 5% of account balance |

| Reward-to-Risk Ratio | Minimum 2:1 |

🧠 Emotional stability comes from knowing your exposure before you enter the trade.

How to Create a Trading Plan

Creating a reliable trading plan requires intentional effort and thoughtful structure. This section provides a deep dive into how you can design a plan that supports your goals, maintains discipline, and adapts to market changes.

Step-by-Step Guide

Define Your Financial Goals

Before placing your first trade, ask yourself: What do I want to achieve through trading? Your financial goals will shape everything else in your trading plan–from risk tolerance to strategy selection.

Examples of clear goals:

- Earn 5% monthly ROI

- Keep drawdowns below 10%

- Trade only during specific market sessions (e.g., London or New York)

| Goal Type | Purpose |

|---|---|

| Income Target | Sets profitability benchmarks |

| Drawdown Limit | Protects your capital |

| Time Commitment | Aligns trading style with availability |

Choose One or More Strategies

Select trading styles that suit your risk profile and daily routine. For example:

- Day trading is ideal for active traders who monitor charts regularly.

- Swing trading allows more flexibility for those with limited time.

- Trend following works well in long-term directional markets.

Use Pocket Option’s free Signal Bot or copy trading features to discover proven strategies quickly.

Set Entry and Exit Rules

Rules are the backbone of consistency. Without them, your trades are based on emotion rather than logic. Good rules are:

- Specific (e.g., “enter on MACD crossover after a bullish engulfing candle”)

- Repeatable under similar conditions

- Paired with risk and reward targets

Write your rules down–ideally in checklist format.

Design a Trading Journal Template

A journal helps measure what works and what doesn’t. Beyond numbers, it provides insights into emotional and behavioral patterns.

Include:

- Entry and exit times

- Reasons for entry

- Outcome and emotional state

- Screenshot of the setup

Pocket Option’s trade history simplifies this logging process.

Establish Risk Controls

Risk is inevitable–but controllable. Set rules for:

- Risk per trade (e.g., 1–2% of capital)

- Daily and weekly loss limits

- Diversification to avoid overexposure to one asset

Key Insight: Treat risk like a fixed business expense. Your goal is to stay in the game–not to win every trade.

Backtest Your Plan

Run your strategy on historical data before risking real funds. Note the:

- Win/loss ratio

- Average return per trade

- Worst-case scenarios

CFA Institute research shows that traders who backtest their systems increase profitability by over 40%.

Start in Demo Before Going Live

Even the best plan needs testing under live conditions–without the emotional pressure of real money.

💡 Pocket Option offers a $50,000 demo account where you can refine execution and develop confidence.

Using a Trading Journal Template

Consistent journaling is the mark of serious traders. Here’s what to track and why it matters:

| Journal Element | Why It Matters |

|---|---|

| Date & Time | Reveals your most productive time windows |

| Asset & Direction | Shows biases or patterns in your trade selection |

| Entry & Exit Price | Tracks precision and consistency |

| Result (Win/Loss) | Builds stats for performance review |

| Notes | Highlights mindset and rule adherence |

Review your journal weekly. Look for repetitive mistakes–and build on what works.

Adapting Your Trade Plan for Different Markets

Markets differ in volatility, liquidity, and structure. Your plan must adjust accordingly to remain effective.

Forex Trading Plan Considerations

Currency markets are driven by global news, central bank policies, and liquidity cycles.

Key Adaptations:

- Monitor economic calendars for key releases (GDP, CPI, interest rates).

- Focus on major currency pairs for better spreads.

- Adjust position sizing before high-impact events.

Did you know? Pocket Option integrates real-time economic news into its trading panel.

Futures Trading Plan Adjustments

Futures contracts require close attention to margin and expiration.

Adapt your plan by:

- Factoring margin requirements into risk sizing

- Avoiding trades close to contract rollovers

- Using volume data to confirm entries

| Futures Factor | Plan Adjustment |

|---|---|

| Expiration Dates | Avoid holding positions into expiry |

| Contract Volatility | Use wider stops and smaller positions |

| Rollover Gaps | Avoid trading near transition days |

Strategy Transitions

Markets evolve, and so must your strategy. But change should be calculated–not reactive.

Best Practices:

- Backtest new strategies extensively before live deployment

- Transition gradually–start in demo

- Avoid switching after a few losses; give strategies time to prove themselves

Insight: Give each strategy at least 30–50 trades before evaluating its effectiveness.

Improving Your Trading with a Routine

Establishing a Daily Trading Routine 📅

Checklist:

- Morning market scan

- Review your trade plan

- Check economic news

- Execute trades

- End-of-day performance review

Monitoring and Adjusting Your Plan

Markets evolve, and so should your plan. Reassess weekly:

- Are your goals being met?

- Do strategies still work?

- Is risk level still appropriate?

Using Analytics to Enhance Performance

Leverage Pocket Option’s real-time trade history and analytics dashboard. Measure:

- Win/loss ratio

- Average trade duration

- Peak profitability periods

📈 These insights refine your edge and promote a disciplined mindset.

Expert Insight: “A journal without analytics is just a diary. Use numbers to drive decisions.” — Linda Raschke, professional trader

Free Resources for Traders 📚

- Trading Journal Templates — Log and analyze your trades.

- Strategy Backtesting Tools — Validate before live use.

- Educational Materials — Tutorials, video guides, and eBooks from Pocket Option.

- Pocket Option Signal Bot — Automate and enhance trade setups.

List: Pocket Option Advantages

- AI Trading automation tools

- Telegram Signal integration

- Copy trading features

- Mobile-first interface

- Access to promo codes and deposit bonuses

FAQ

What is a trading plan template?

A structured guide outlining your goals, strategies, and risk rules to help you trade consistently and with discipline.

How to create a trading plan?

Set goals, pick a strategy, define entry/exit rules, manage risk, test on demo (like Pocket Option), and track performance.

What should be in a trading plan?

Goals, strategies, risk limits, trade rules, and a journal to review results.

Why do traders need a trading plan?

To avoid emotional trading, stay consistent, and improve long-term success.

How often should I update my trading plan?

Review and adjust your plan monthly, with major revisions quarterly based on performance data.

How detailed should trade documentation be?

Record entry/exit points, position size, rationale, and emotional state for each trade.

What's the most important element of a trading plan?

Risk management rules are crucial - they protect capital and ensure long-term survival in markets.

Final Thoughts

A well-crafted trading plan template is not just documentation—it’s your personal roadmap to success. It reinforces discipline, organizes your decisions, and elevates your trading from emotional guesswork to data-driven precision. With Pocket Option, implementing your plan becomes easier and more effective thanks to flexible trade execution, educational support, and advanced analytics.

Start trading