- Capitalize on micro trends: Catch price movements that last only seconds.

- Minimize market exposure: Reduce risk by staying in trades for minimal time.

- Maximize trading frequency: Execute dozens of trades per hour.

- Leverage high volatility: Profit from rapid market fluctuations.

- Build consistent returns: Small but frequent gains compound quickly.

Pocket Option Strategy for Quick Profits: Professional Approach

Recent data shows that 74% of successful quick traders on modern platforms use ultra-short timeframes of 5-30 seconds to capitalize on micro market movements and generate consistent daily profits.

Article navigation

- Master the Pocket Option 5-Second Strategy for Lightning-Fast Trading Success

- Why Choose High-Speed Trading on Pocket Option?

- Essential Technical Indicators for Success

- Step-by-Step Guide: A Live 5-Second Trade Example

- Building a Foundation: A Classic Trend-Following Trade

- Real Success Stories from Pocket Option Traders

- Why Pocket Option is Your Ultimate Trading Playground

Master the Pocket Option 5-Second Strategy for Lightning-Fast Trading Success

In the world of high-frequency trading, speed is everything. The Pocket Option 5-second strategy has emerged as one of the most powerful approaches for traders seeking rapid profits from micro market movements. This ultra-fast trading technique leverages brief market inefficiencies that occur within seconds, allowing skilled traders to capture quick gains multiple times throughout a trading session.

The beauty of 5-second trading lies in its ability to exploit momentary price fluctuations that larger timeframes simply cannot detect. For example, when major economic news breaks or during market opening hours, assets experience rapid price movements that create perfect opportunities for lightning-fast trades on the Pocket Option platform.

Why Choose High-Speed Trading on Pocket Option?

The Pocket Option Quick Trading platform offers unique advantages for ultra-short timeframe strategies. Unlike traditional trading methods that require hours or days to see results, 5-second strategies allow traders to:

“The fast strategy on Pocket Option is like catching lightning in a bottle. You need perfect timing, the right indicators, and ice-cold execution. When done correctly, it’s one of the most profitable short-term approaches I’ve seen in 15 years of trading.” – Michael Chen, Professional Day Trader, 2025

📈 With Pocket Option’s lightning-fast execution and user-friendly interface, you’ll never miss a 5-second opportunity!

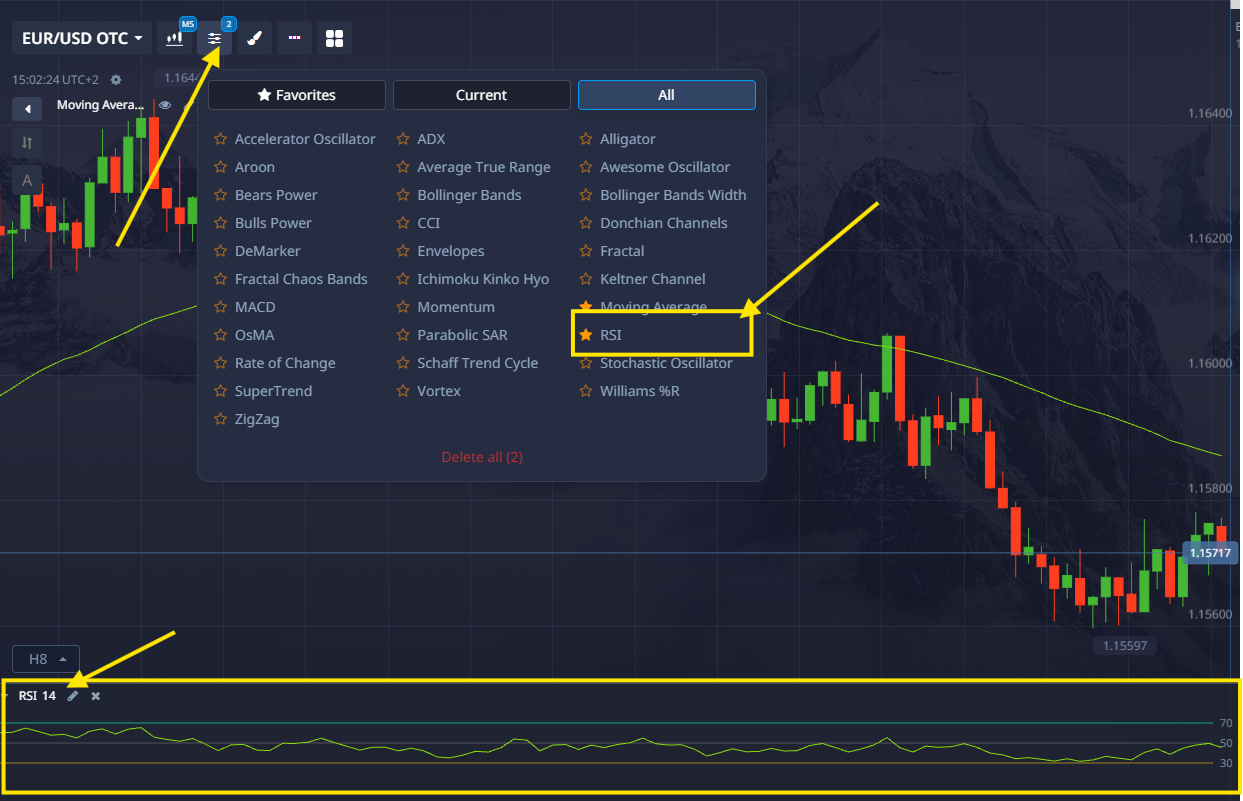

Essential Technical Indicators for Success

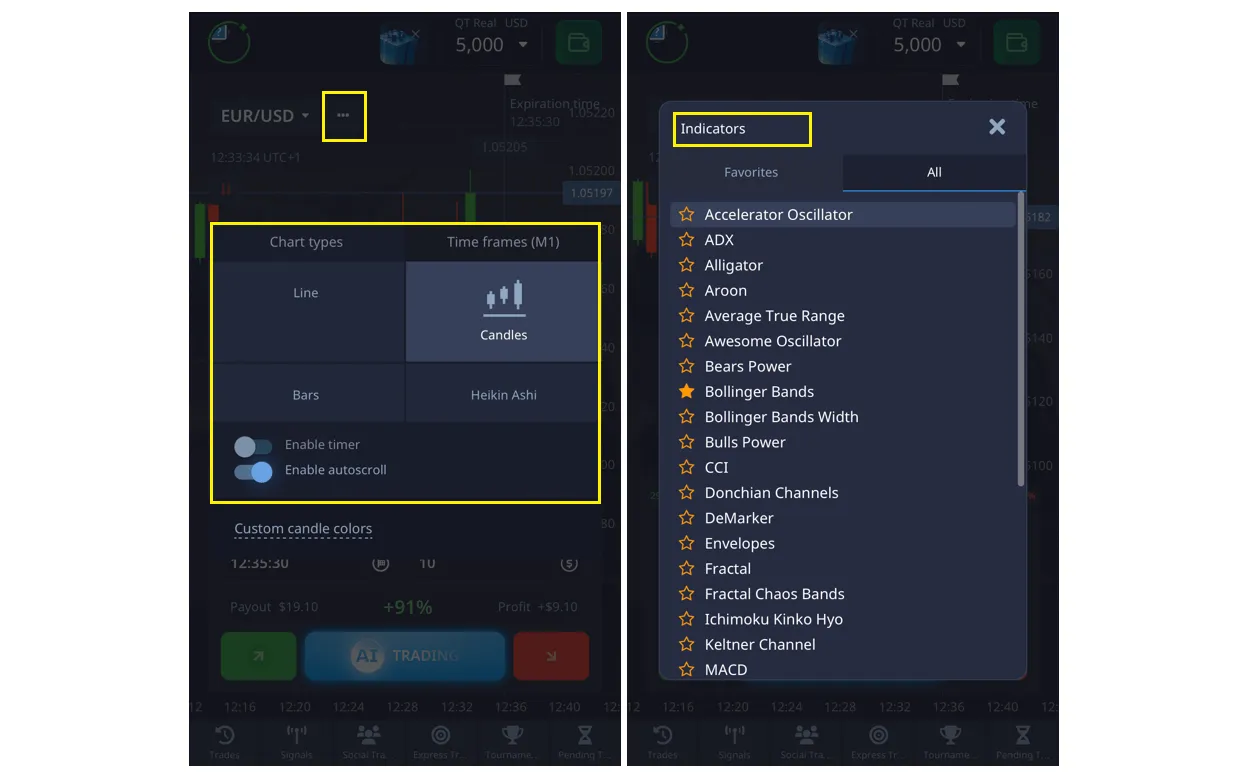

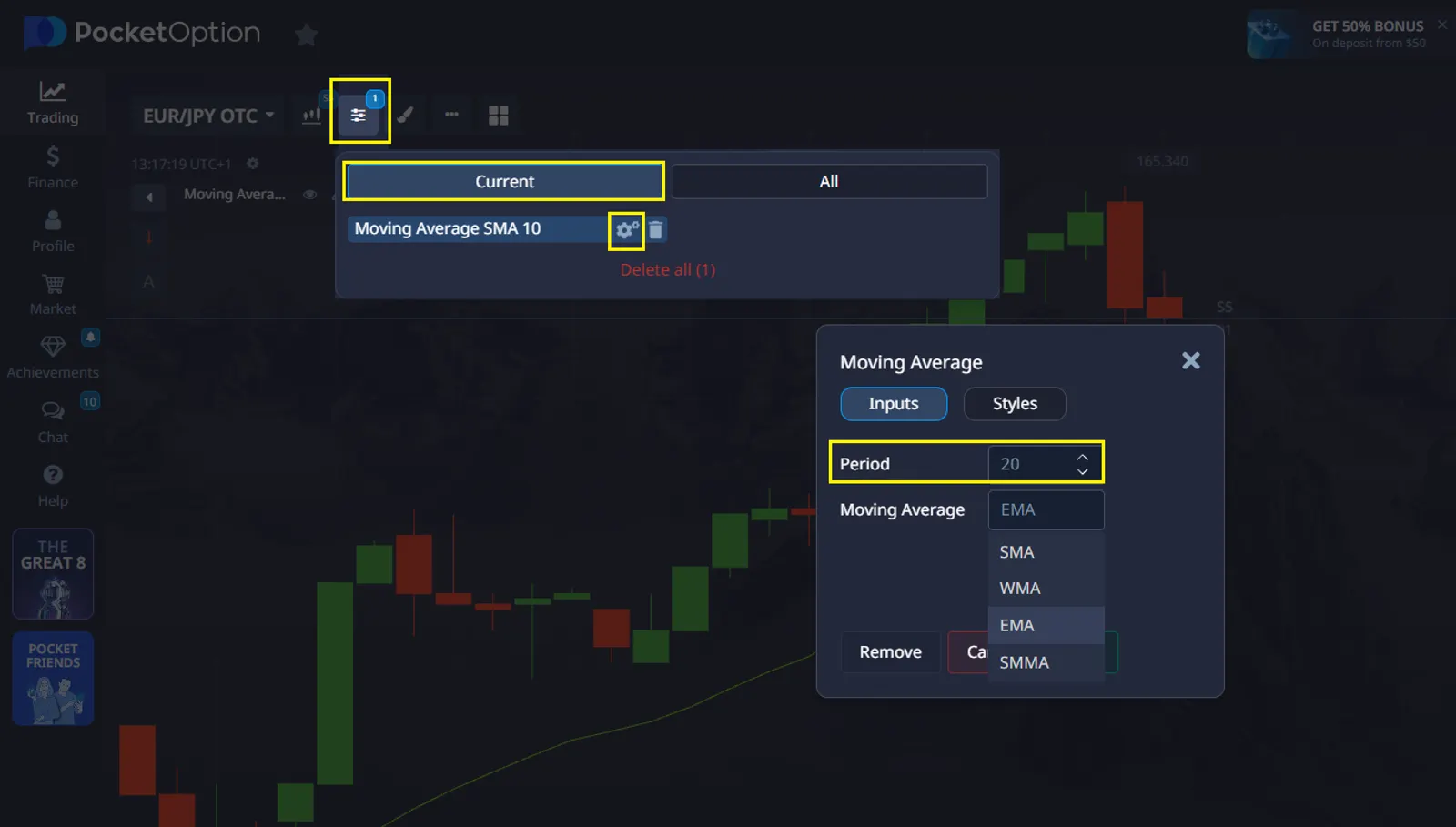

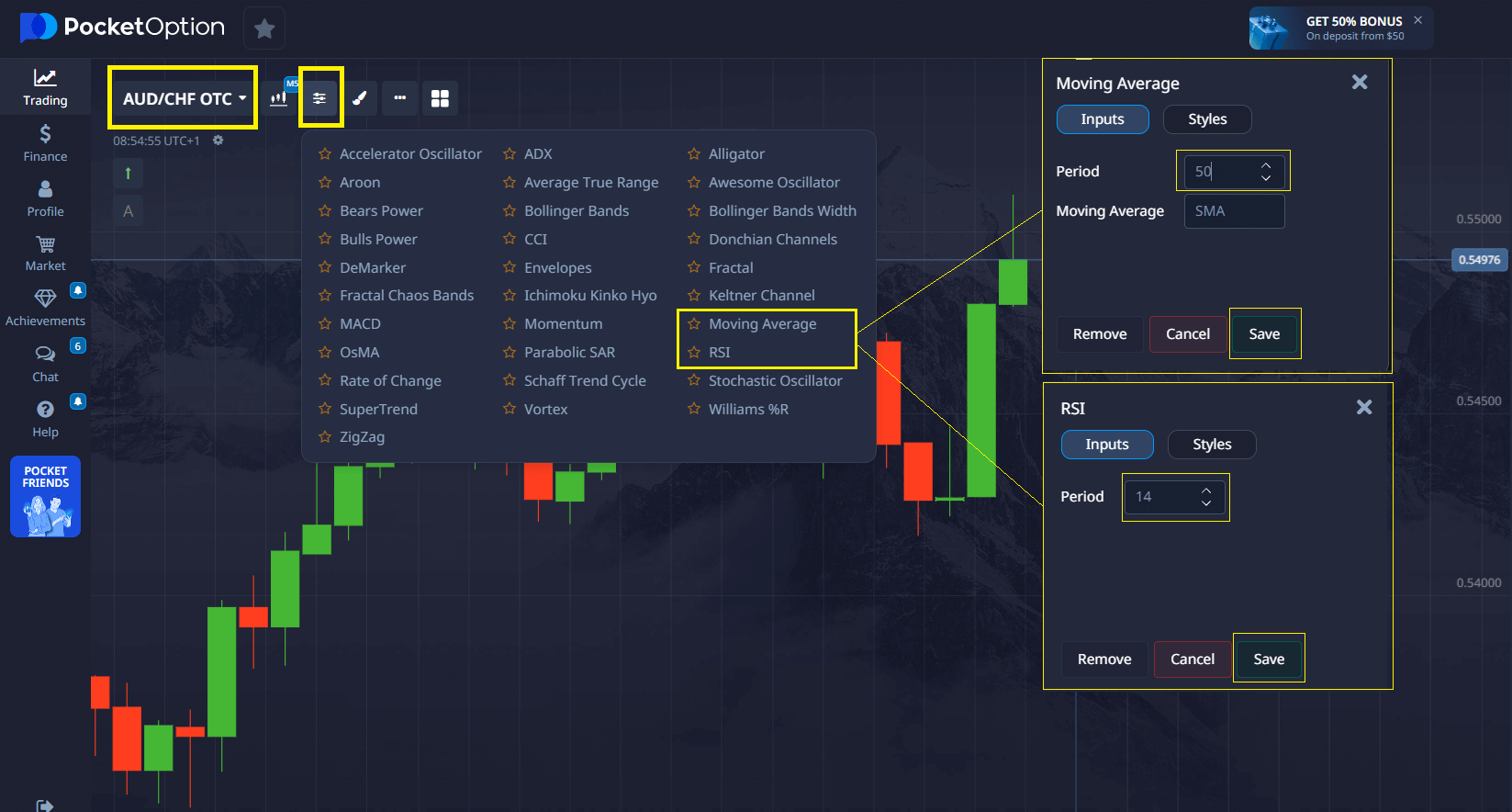

Successful implementation of the Pocket Option strategy requires a precise combination of technical indicators, but their settings must be adapted for ultra-short intervals. Standard settings won’t work. Here is an effective setup combining trend-following and momentum indicators to create a comprehensive trading signal system.

| Indicator | Custom Settings (for 5s) | Purpose | Signal Strength |

|---|---|---|---|

| EMA 20 | 20 periods | Trend direction | High |

| RSI | 2 periods | Momentum confirmation & Reversals | Very High |

| Stochastic Oscillator | 3, 1, 1 | Overbought/Oversold levels | Medium |

| Bollinger Bands | 5 periods, 2.5 SD | Volatility & Reversal Forecasts | High |

The Perfect EMA 20 and RSI Combination

The cornerstone of successful Pocket Option trading in 5-second intervals is the synergy between the 20-period Exponential Moving Average (EMA 20) and a fast Relative Strength Index (RSI). This powerful combination provides both trend direction and momentum confirmation in real-time.

When price breaks above the EMA 20 with RSI showing values between 50-70, it signals a strong upward momentum perfect for HIGHER trades. Conversely, when price falls below EMA 20 with RSI in the 30-50 range, it indicates downward momentum ideal for LOWER positions.

“I’ve tested hundreds of indicator combinations, but nothing beats the EMA 20 + fast RSI setup for ultra-short trades. It’s like having a sixth sense for market direction.” – Sarah Rodriguez, Quantitative Analyst, 2025

Step-by-Step Guide: A Live 5-Second Trade Example

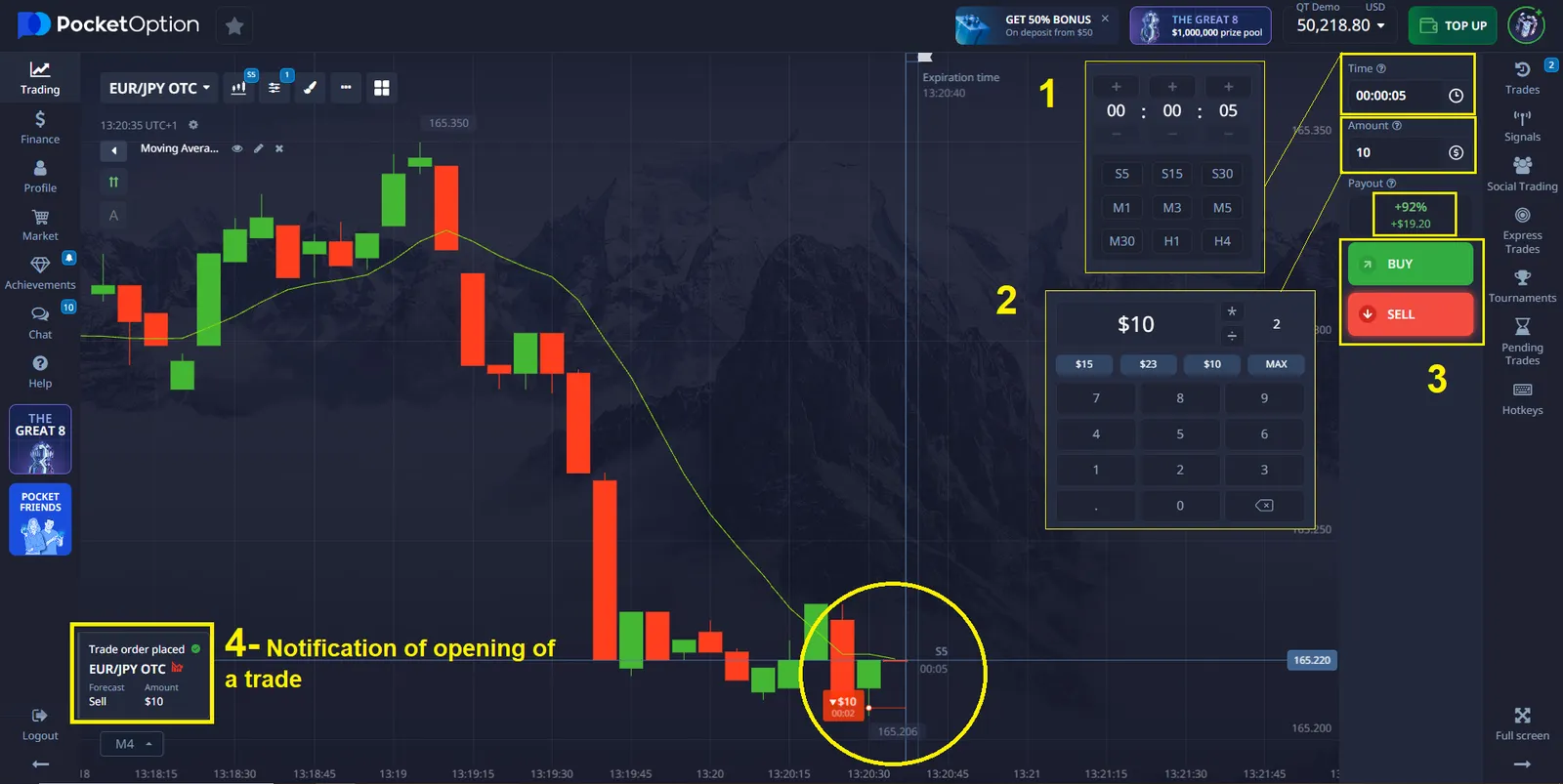

Executing the perfect 5-second trade on Pocket Option requires methodical preparation and lightning-fast decision making. Let’s walk through a real example to see how it works in practice.

Asset: EUR/JPY (during the volatile London session)

Chart Timeframe: 5 seconds (5s)

Tools: EMA (20-period)

- Step 1: Choose Your Asset and Analyze the Market. I selected EUR/JPY because it has high volatility during the London session. I applied the EMA 20 to my 5-second chart. I noticed that the price candles were consistently forming above the EMA line, clearly indicating an upward trend.

- Step 2: Identify the Entry Signal. I watched as a new candle pulled back and briefly touched the EMA line but did not break below it. The very next candle started to form in an upward direction, bouncing off the EMA. This bounce was my signal–a likely continuation of the uptrend for the next few seconds.

- Step 3: Place the Trade. I quickly selected a 5-second trade duration and my trade amount. Believing the price would continue its upward bounce, I clicked the “Buy” (Green) button to open my position.

- Step 4: The Result. After just 5 seconds, my prediction was correct. The price had moved up, and the trade closed in profit. A small investment turned into a quick gain, demonstrating the power of this rapid strategy.

💡 The Pocket Option platform makes this easy with one-click trading and a clear display of potential profit, so you can act instantly on these fleeting signals!

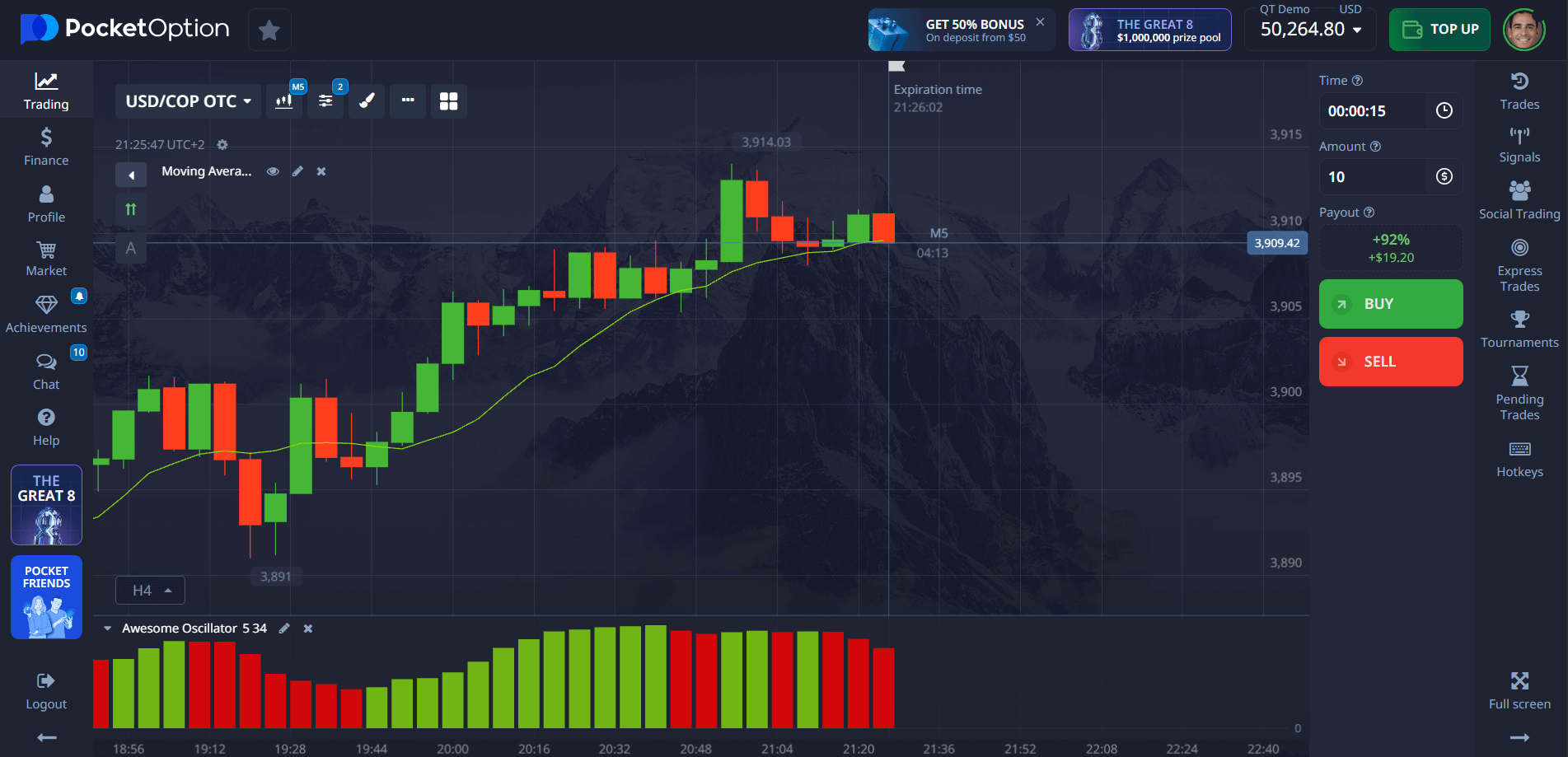

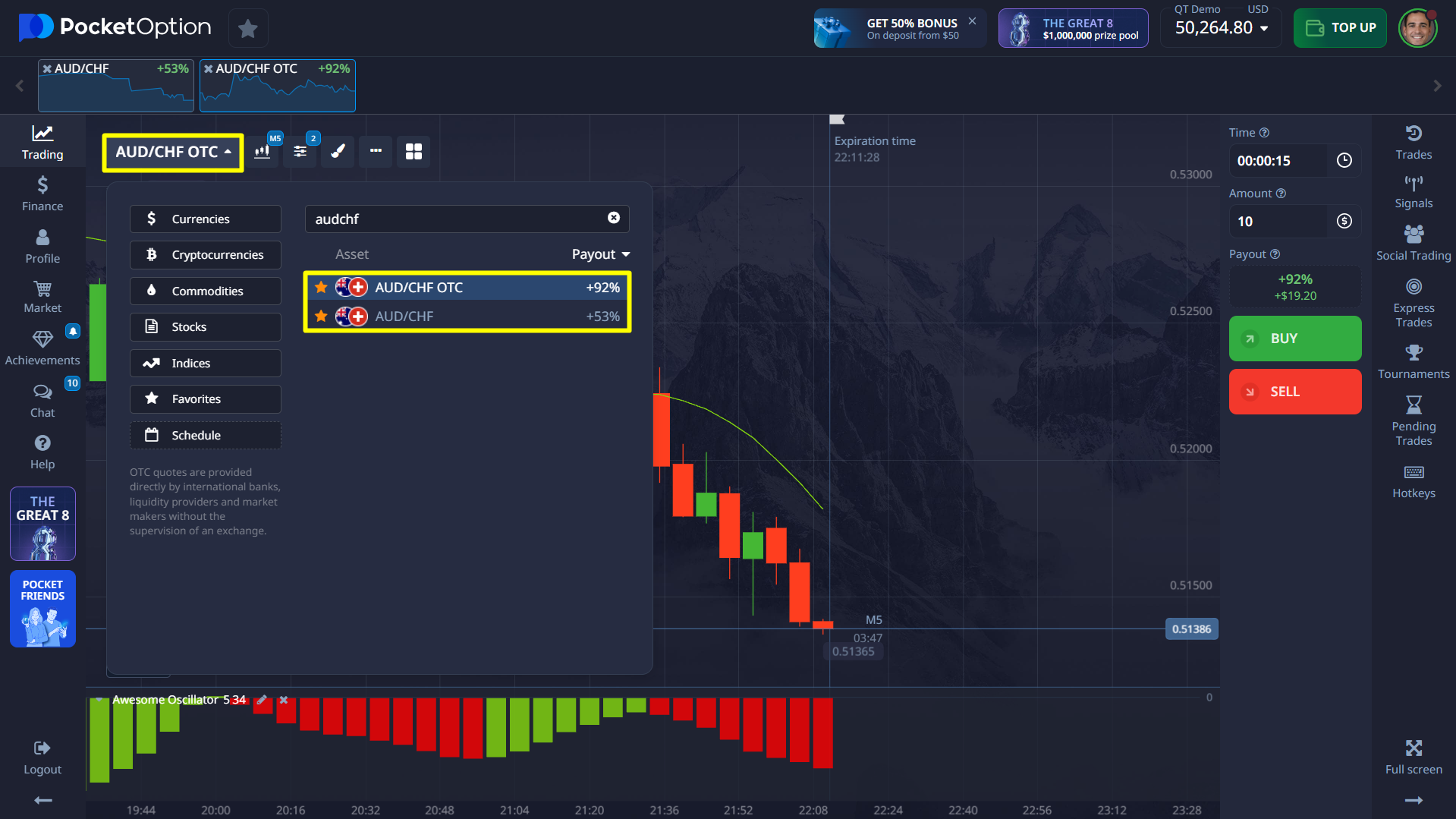

Building a Foundation: A Classic Trend-Following Trade

Before diving headfirst into the high-speed world of 5-second trades, it’s wise to master the fundamentals. Here’s a practical example of a more traditional, yet highly effective, trend-following strategy that you can practice.

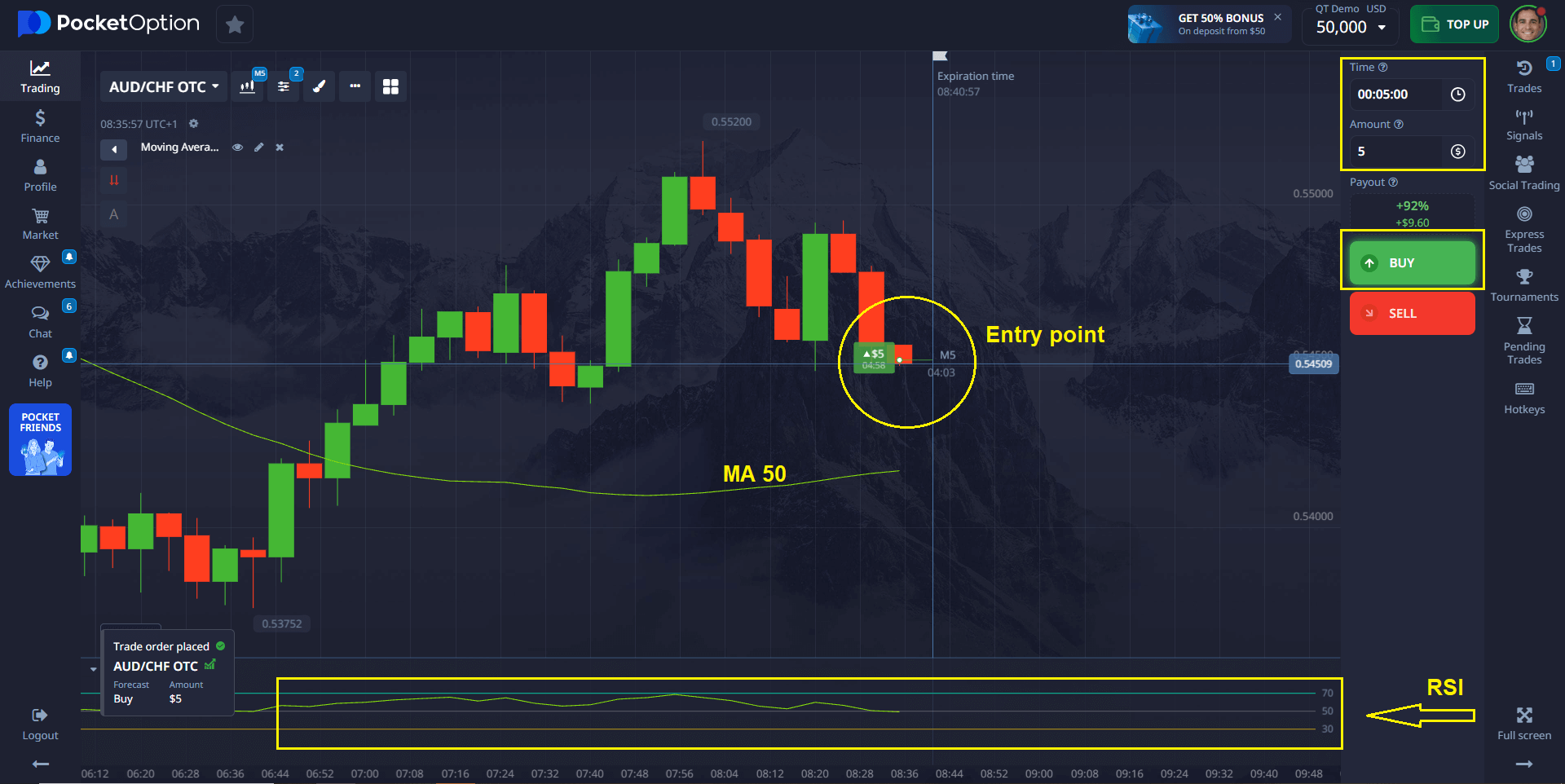

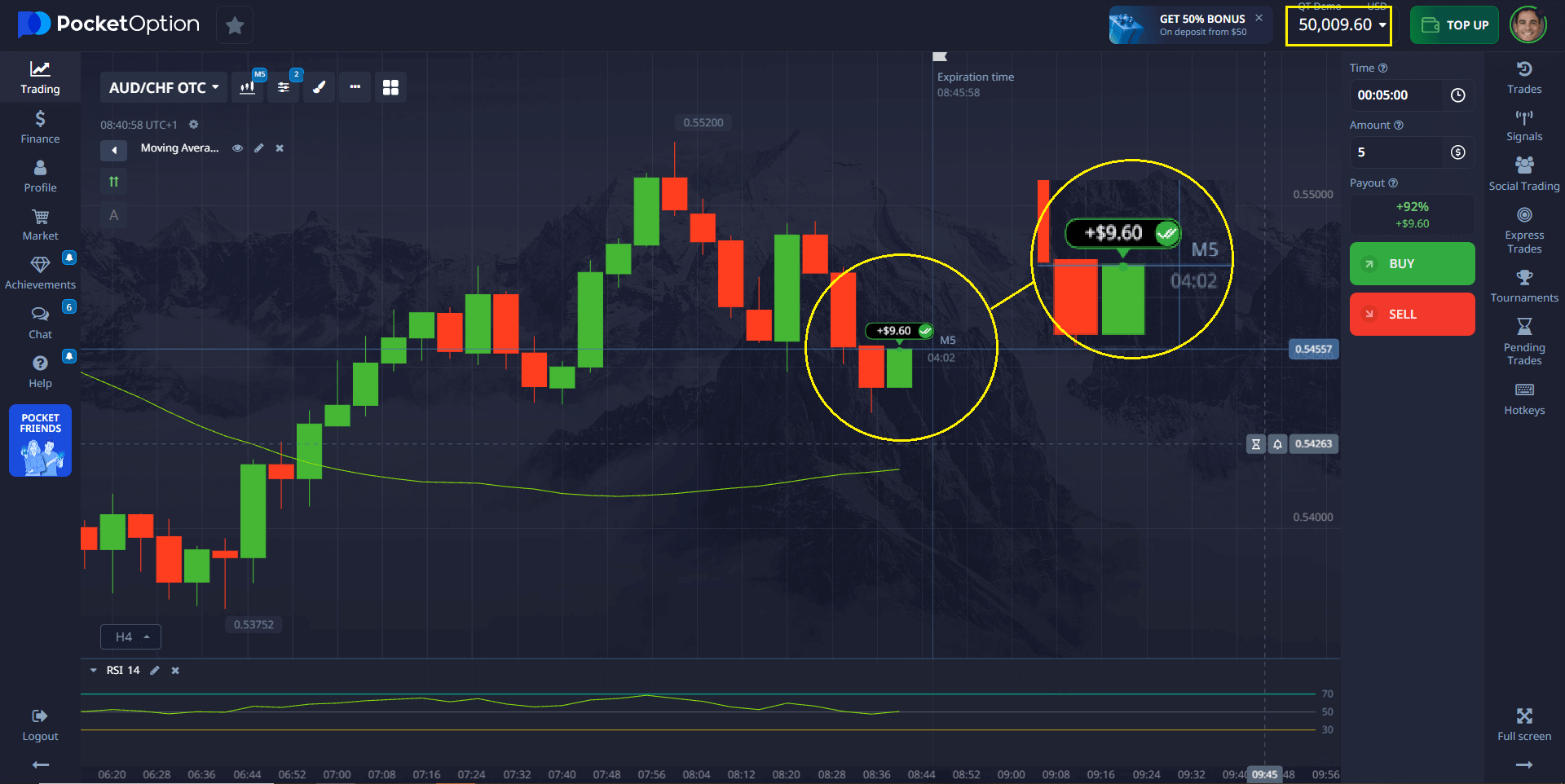

Asset: AUD/CHF

Timeframe: 5 minutes

Trade Amount: $5

Tools Used: Moving Average (MA) 50, Relative Strength Index (RSI)

- Step 1: Identifying the Trend. I opened the AUD/CHF chart and added the MA 50 indicator. The price was trading consistently above this line and moving upward, which told me the trend was bullish.

- Step 2: Confirming the Signal. To be sure, I added the RSI indicator. Its value was 55. Since the RSI was above 50, it confirmed the strength of the uptrend.

- Step 3: Placing the Trade. With a confirmed bullish trend, I waited for a small, temporary dip in the price (a pullback). As soon as that happened, I opened a CALL (Buy) trade for 5 minutes with a $5 investment.

- Step 4: Closing the Trade. Over the next 5 minutes, the price continued its upward journey as predicted. The trade closed in profit, proving that a disciplined, indicator-based approach works.

Real Success Stories from Pocket Option Traders

Many traders have found success by applying disciplined strategies. Here are a few of their stories:

- James, 29 years old: ”I started with a demo account, then tested strategies on real trades. Using the RSI indicator, I made three profitable trades in a row!”

- Sophia, 34 years old: ”At first, I lost money, but when I started using technical indicators and keeping a trading journal, my profitability increased by 40%.”

- Daniel, 41 years old: ”By using the trend-following strategy with Moving Average, I consistently make 10-15% returns on my deposit every week.”

These reviews prove that the right approach and discipline can lead to trading success.

Why Pocket Option is Your Ultimate Trading Playground

To master strategies like the 5-second method, you need a platform built for success. Pocket Option provides a comprehensive ecosystem designed for traders of all levels.

Here are some of the features that give you an edge:

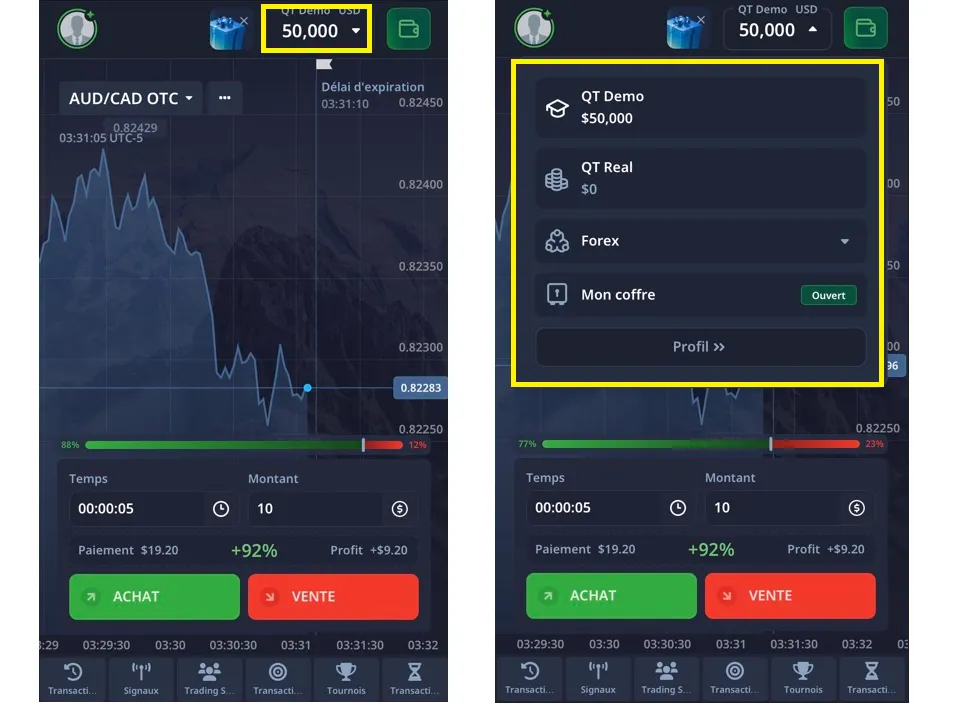

- Free $50,000 Demo Account: Practice any strategy, including 5-second trades, in a risk-free environment with a rechargeable virtual balance.

- Low Minimum Deposit: You can start trading with a live account from as little as $5, making it accessible for everyone.

- Over 100+ Trading Assets: Trade everything from forex pairs and stocks to cryptocurrencies and commodities.

- Free Knowledge Base: Access a huge library of tutorials, guides, and videos on trading strategies to sharpen your skills.

- Advanced Tools: Utilize the mobile app, trading bots, and AI-powered features to enhance your trading.

- Tournaments and Social Trading: Compete with other traders in tournaments or copy the trades of successful users to learn from the best.

🚀 Pocket Option isn’t just a platform; it’s a complete training ground. Use our free educational resources to go from beginner to pro!

FAQ

What's the typical success rate for 5-second strategies?

Professional traders typically achieve 60-70% win rates with 5-second strategies when properly executed. However, success depends heavily on market conditions, technical setup, and trader experience. Focus on risk-reward ratios rather than just win percentage.

Can I use automated trading for 5-second strategies?

While automated trading is possible, 5-second strategies often require human intuition and rapid adaptation to changing market conditions. Most successful quick traders prefer manual execution with pre-configured alerts and indicators.

How important is internet connection speed for ultra-fast trading?

Internet speed is crucial for 5-second strategies. A stable connection with low latency (under 50ms) is essential to avoid slippage and execution delays. Consider using wired connections and avoid trading during peak internet usage hours in your area.

What time zones offer the best opportunities for quick trading?

The London-New York overlap (8:00-12:00 GMT) offers the highest volatility for most currency pairs. Asian market hours (0:00-4:00 GMT) can be profitable for cryptocurrency and JPY pairs. Avoid trading during major holidays and low-liquidity periods.

How do I manage emotions during fast-paced trading?

Develop a strict trading routine with predetermined rules, take regular breaks, keep a detailed trading journal, and never deviate from your risk management rules regardless of winning or losing streaks. Consider starting with smaller position sizes to reduce emotional pressure.

Which assets work best for ultra-short timeframe trading?

Major currency pairs (EUR/USD, GBP/USD, USD/JPY) and popular cryptocurrencies (BTC/USD, ETH/USD) offer the best liquidity and volatility for 5-second strategies. OTC markets can also be profitable during regular trading hours.

How much capital do I need to start 5-second trading?

A minimum of $500-1000 is recommended for 5-second strategies. This allows for proper risk management (2-3% per trade) while providing enough trades to see meaningful results. Always start with demo trading to practice before using real money.

What is the best Pocket Option strategy for beginners?

For beginners, start with 30-second to 1-minute timeframes before attempting 5-second strategies. Master the EMA 20 + RSI combination on longer timeframes first, then gradually reduce your trading intervals as you develop speed and accuracy.м

CONCLUSION

The landscape of quick trading continues to evolve rapidly, with new technologies and market structures creating unprecedented opportunities for skilled traders. Artificial intelligence integration, improved execution speeds, and enhanced analytical tools are making 5-second strategies more accessible and profitable than ever before. As markets become increasingly digitized and retail trading technology improves, we expect to see even shorter timeframes become viable for individual traders. The key to success will remain the same: thorough preparation, disciplined execution, and continuous adaptation to changing market conditions. "The future belongs to traders who can adapt quickly to new technologies while maintaining fundamental trading discipline. 5-second strategies are just the beginning of what's possible in modern quick trading." - Alexandra Petrov, Fintech Innovation Specialist, 2025 Conclusion: Your Path to 5-Second Trading Mastery Mastering the Pocket Option 5-second strategy represents one of the most exciting opportunities in modern quick trading. By combining precise technical analysis with lightning-fast execution, traders can capitalize on micro market movements that traditional approaches simply cannot detect. The key elements for success include: mastering the EMA 20 and RSI combination, developing lightning-fast pattern recognition skills, implementing strict risk management protocols, and maintaining the psychological discipline required for high-frequency trading. Remember that consistent profitability comes from executing a proven system repeatedly, not from seeking the "perfect" trade. Success in ultra-fast trading requires dedication, practice, and continuous learning. Start with demo trading to develop your skills, gradually transition to real money with small position sizes, and always prioritize risk management over profit maximization. The world of 5-second trading on Pocket Option offers unlimited potential for those willing to master its intricacies. With the right preparation, mindset, and execution, you can join the ranks of successful quick traders who have discovered the power of ultra-short timeframe strategies.

Begin Your 5-Second Trading Journey