- Identify liquidity pools where price might gravitate.

- Time entries for improved risk-to-reward.

- Combine with forex trading sessions (London/New York) for higher probability setups.

FVG Trading Strategy: Common Mistakes and How to Fix Them

In the fast-paced world of trading, the FVG trading strategy (Fair Value Gap trading) helps beginners and smart money trading practitioners spot price action imbalances that signal potential corrections and improve results.

💡 Pro Tip: You can practice the FVG trading strategy on Pocket Option with a free unlimited demo account and start trading 100+ assets 24/7 with as little as $5*.

* minimum deposit may vary depending on geo and payment method

Understanding Fair Value Gaps

What is a Fair Value Gap?

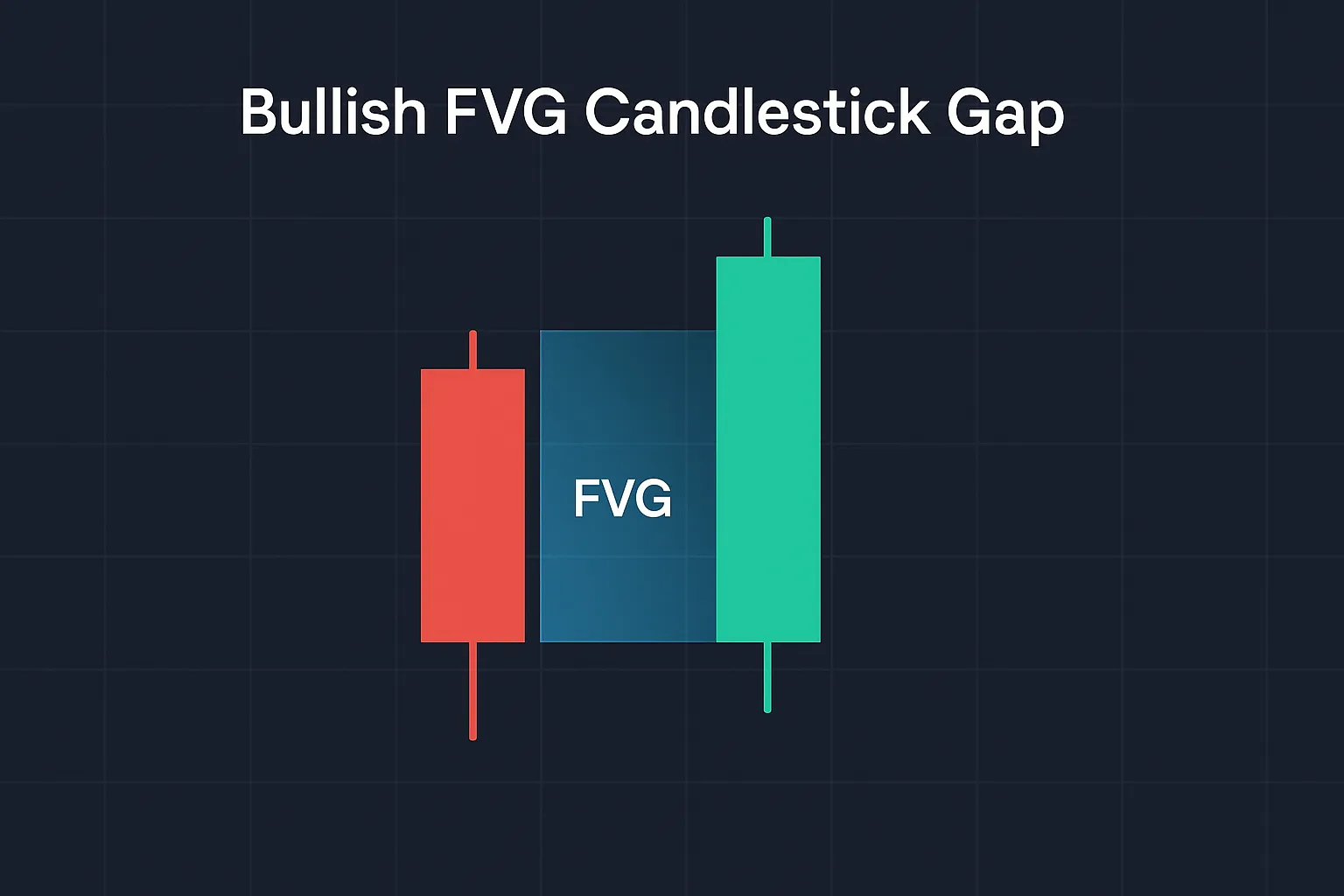

A Fair Value Gap (FVG) is a price gap created by strong buying or selling activity that leaves an imbalance between the high and low of consecutive candles. This gap highlights areas where price may later retrace, offering high-probability trade setups.

“Fair Value Gaps are one of the clearest footprints of institutional order flow,”

notes Investopedia, emphasizing their role in modern imbalance trading.

Why FVGs Matter in Trading

FVGs often occur during volatile market conditions and can signal possible reversals or continuations. By incorporating a fair value gap strategy, traders can:

📊 Bloomberg Research (2024) found that price action setups involving FVGs have a higher win rate in trending markets compared to random entries.

Identifying Fair Value Gaps on a Chart

Look for these signs:

- Gap between candles: High of candle 1 and low of candle 3 don’t overlap.

- Support from indicators: Moving averages or order blocks confirm the zone.

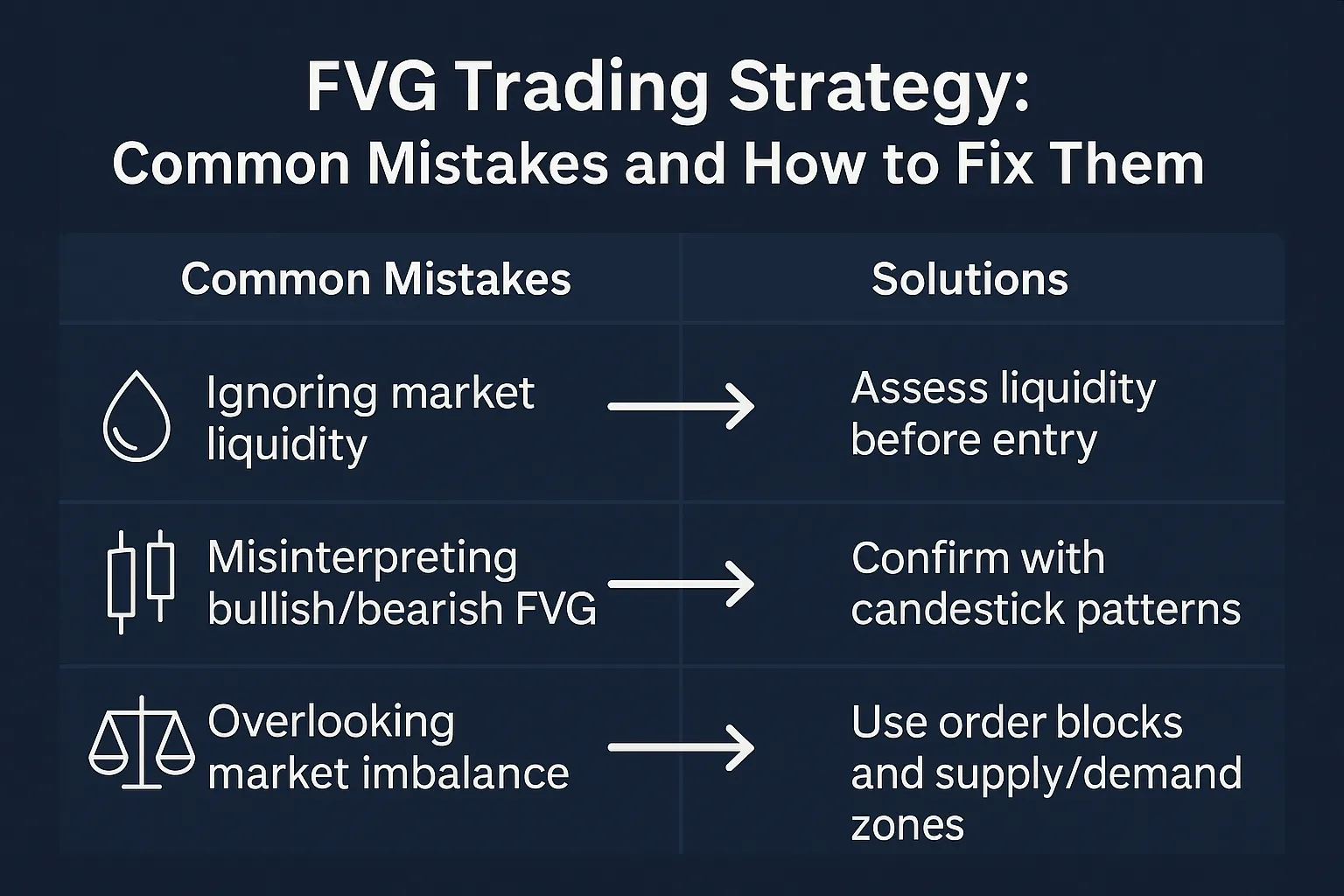

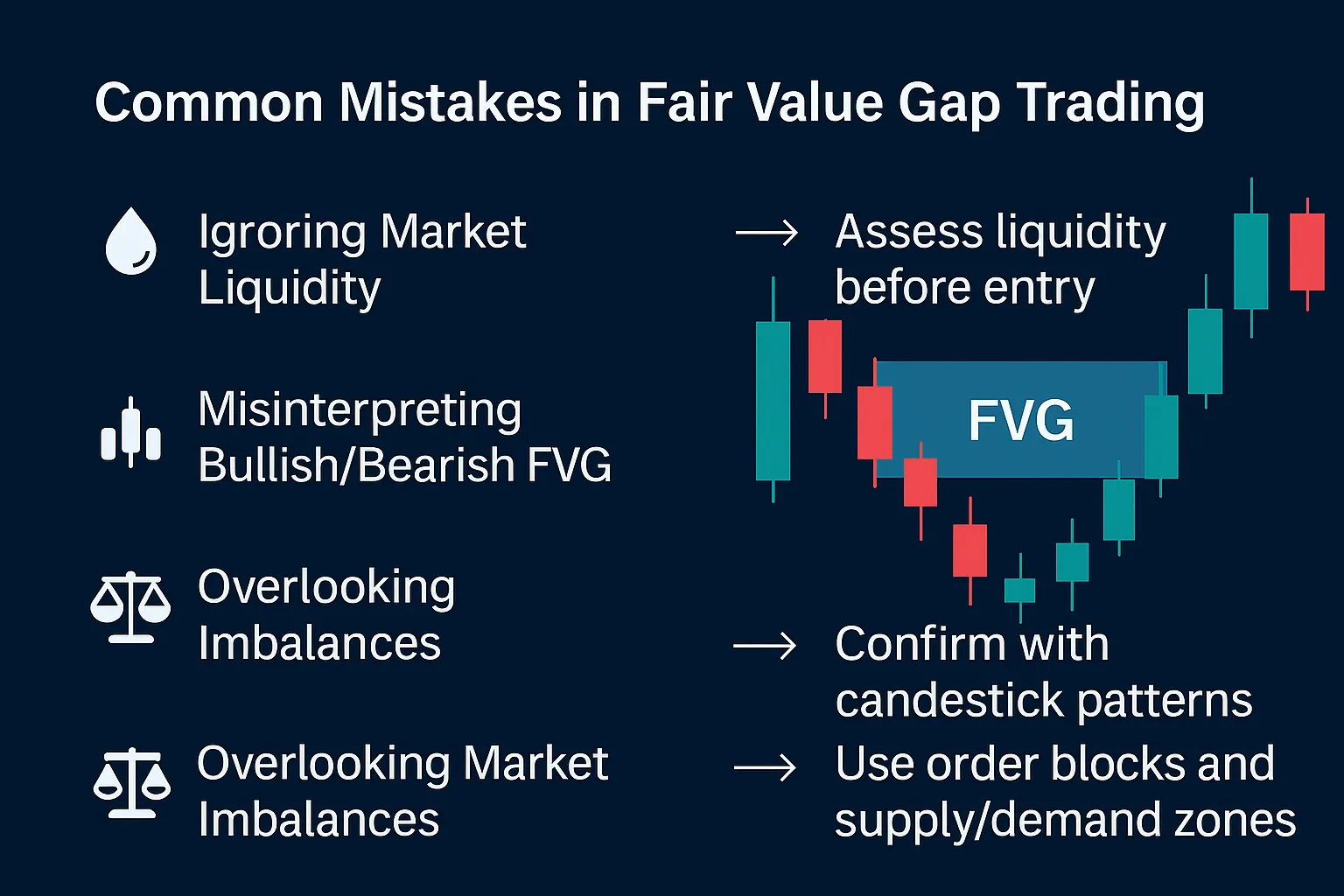

Common Mistakes in FVG Trading

| Mistake | Impact | Solution |

|---|---|---|

| Ignoring market liquidity | Leads to failed fills and slippage | Assess liquidity conditions before entry |

| Misinterpreting bullish vs bearish FVG | Trading against the trend | Confirm with candlestick patterns |

| Overlooking market imbalance | Missed opportunities | Track supply/demand zones and order blocks |

“Liquidity drives markets — not indicators. If there’s no liquidity to fill the gap, price may just continue trending,”

— Morgan Stanley Market Outlook.

Developing a Robust FVG Trading Strategy

Crafting a Trading Plan

A strong plan should include:

- Entry/exit rules based on technical gaps.

- Risk tolerance and position sizing.

- Conditions for trade invalidation.

📌 Expert Insight: Professional traders often backtest FVG setups across multiple pairs before going live.

Risk Management

Using stop-loss orders is essential. For example, when trading EUR/USD, place a stop just beyond the FVG zone to control drawdown.

- Risk only 1–2% per trade.

- Avoid overlapping positions during high-impact news.

Using Indicators for Confirmation

Combine FVGs with moving averages, RSI, or volume indicators. This strengthens the signal and reduces false positives.

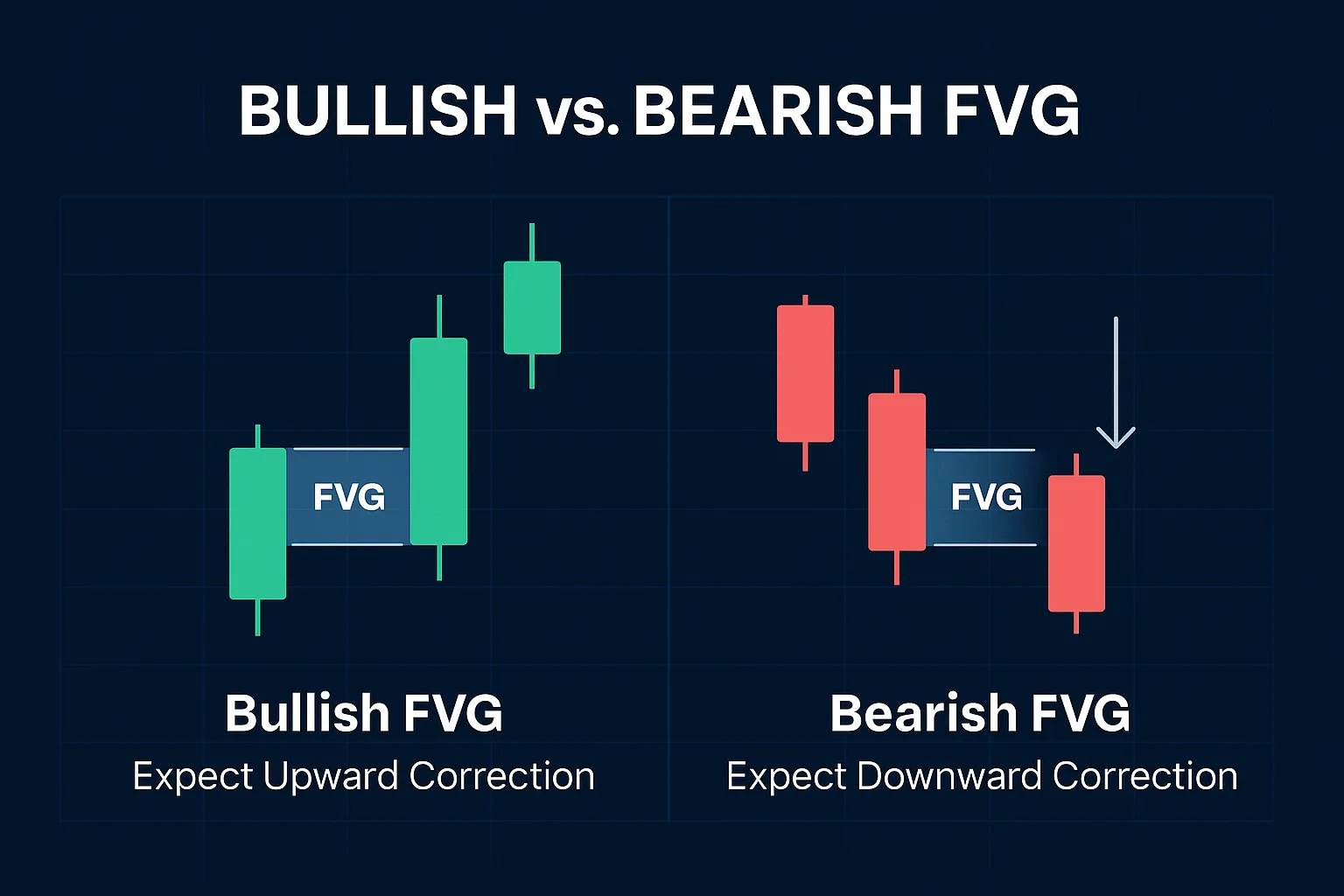

Recognizing Bullish vs Bearish FVGs

| Type | Appearance | Bias |

|---|---|---|

| Bullish FVG | Gap forms during strong green candles | Expect upward correction |

| Bearish FVG | Gap forms during strong red candles | Expect downward correction |

Implementing the Gap Trading Strategy

- Spot the Gap: Identify clear imbalance zones.

- Wait for Retracement: Enter near the FVG zone.

- Confirm Direction: Check higher timeframes for trend alignment.

- Execute & Manage: Place stop loss and take partial profits.

💬 Example: On GBP/USD 15M chart, price retraced into a bullish FVG after London open, giving a 3:1 risk/reward move to previous high.

Practical Example on Pocket Option

Pocket Option traders can use this strategy on EUR/USD OTC pairs even outside market hours:

- Identify a bullish FVG on the 5M chart.

- Switch to 1M for precise entry.

- Place an Up trade with 5-minute expiration when price taps the FVG zone.

- Monitor trade and secure profit before the next liquidity zone.

This allows traders to practice imbalance trading in real time without waiting for major sessions.

Analyzing Order Blocks

Order blocks are areas where institutional orders sit. They often overlap with FVG zones, making them powerful confluence points. By combining order blocks with FVGs, traders align with smart money trading principles.

“Smart money trading isn’t about prediction, it’s about reacting to where liquidity is resting,”

says a senior prop firm mentor.

Improving Your Approach

Review Past Trades

Keep a trading journal and review every FVG setup. Note what worked and what failed.

Adjust to Market Conditions

Be flexible: during high-volatility sessions (like CPI news) expect deeper retracements.

Keep Learning

New tools and indicators emerge regularly. Stay updated with trading education.

Final Thoughts

The FVG trading strategy is a powerful way to capitalize on market inefficiencies when used correctly. Combine it with solid risk management, liquidity awareness, and continuous improvement.

Pocket Option makes practicing easy with:

- Unlimited $50,000 demo account

- 100+ assets 24/7 (including OTC)

- AI Trading & Telegram Bot signals

- Social Trading and tournaments

This way, traders can refine their fair value gap strategy before risking real funds.

FAQ

What is FVG in trading?

FVG stands for Fair Value Gap, a price imbalance between candles that often signals a retracement area

How to trade fair value gaps?

Identify the gap, wait for price to retrace into the zone, confirm with higher timeframe trend, and execute trades with proper stop-loss.

Is FVG strategy profitable?

Yes, when combined with risk management and confluence factors, the FVG trading strategy can yield a high risk-to-reward ratio.

What timeframes are best for FVG trading?

Many traders use 5M and 15M charts for intraday trading, and 1H–4H charts for swing trades. Higher timeframes tend to give more reliable signals.

How to manage risk with FVG trading?

Always risk a small percentage of your account (1–2%), set stop-loss beyond the gap, and avoid overleveraging during high volatility events.