- 85% Success rate improvement for beginners using copy trading vs. manual trading

- 67% Reduction in learning time before achieving consistent profits

- $5 Minimum starting capital required on leading platforms

Copy Trading for Beginners: Mastering the Art of Mirroring Successful Traders

Revolutionary copy trading technology has transformed how beginners access financial markets, with over 85% of new traders now choosing automated replication strategies over traditional manual approaches in 2025.

Article navigation

- Start trading

- Copy Trading for Beginners: Master Automated Trading Without Years of Experience

- Understanding Copy Trading: The Foundation of Automated Success

- How to Start Copy Trading with Pocket Option

- Key Advantages of Copy Trading for New Traders

- Common Pitfalls and How to Avoid Them

- Developing an Effective Strategy

- Advanced Copy Trading Strategies for Accelerated Growth

- Limitations and Risks

- Step-by-Step Guide to Starting Copy Trading

Copy Trading for Beginners: Master Automated Trading Without Years of Experience

Copy trading represents a paradigm shift in how newcomers can participate in financial markets. Instead of spending months or years learning complex strategies, beginners can immediately access the expertise of successful traders through automated replication systems. This approach has democratized trading, making professional-level market access available to anyone with an internet connection and minimal capital.

The concept is elegantly simple yet powerfully effective: you select experienced traders whose strategies align with your risk tolerance and investment goals, then automatically replicate their trades in real-time. For example, when implementing copy trading on platforms like Pocket Option, beginners can start with just $5 and immediately begin following proven strategies without needing to understand technical analysis or market fundamentals.

Understanding Copy Trading: The Foundation of Automated Success

“Copy trading has fundamentally changed how we think about market access. New traders can now leverage decades of combined experience from day one, dramatically improving their chances of long-term success.” – Sarah Mitchell, Trading Psychology Expert, 2025

The mechanics are straightforward but sophisticated. When your chosen trader opens a position, the system automatically executes the same trade in your account, proportionally scaled to your available capital. This real-time replication ensures you never miss opportunities due to delayed reactions or emotional hesitation.

How to Start Copy Trading with Pocket Option

For a more detailed example of how to copy traders, read here. Launch your copy trading journey in under 15 minutes:

- ✅ Register at Pocket Option and deposit minimum $5 (the deposit amount may vary depending on the payment method).

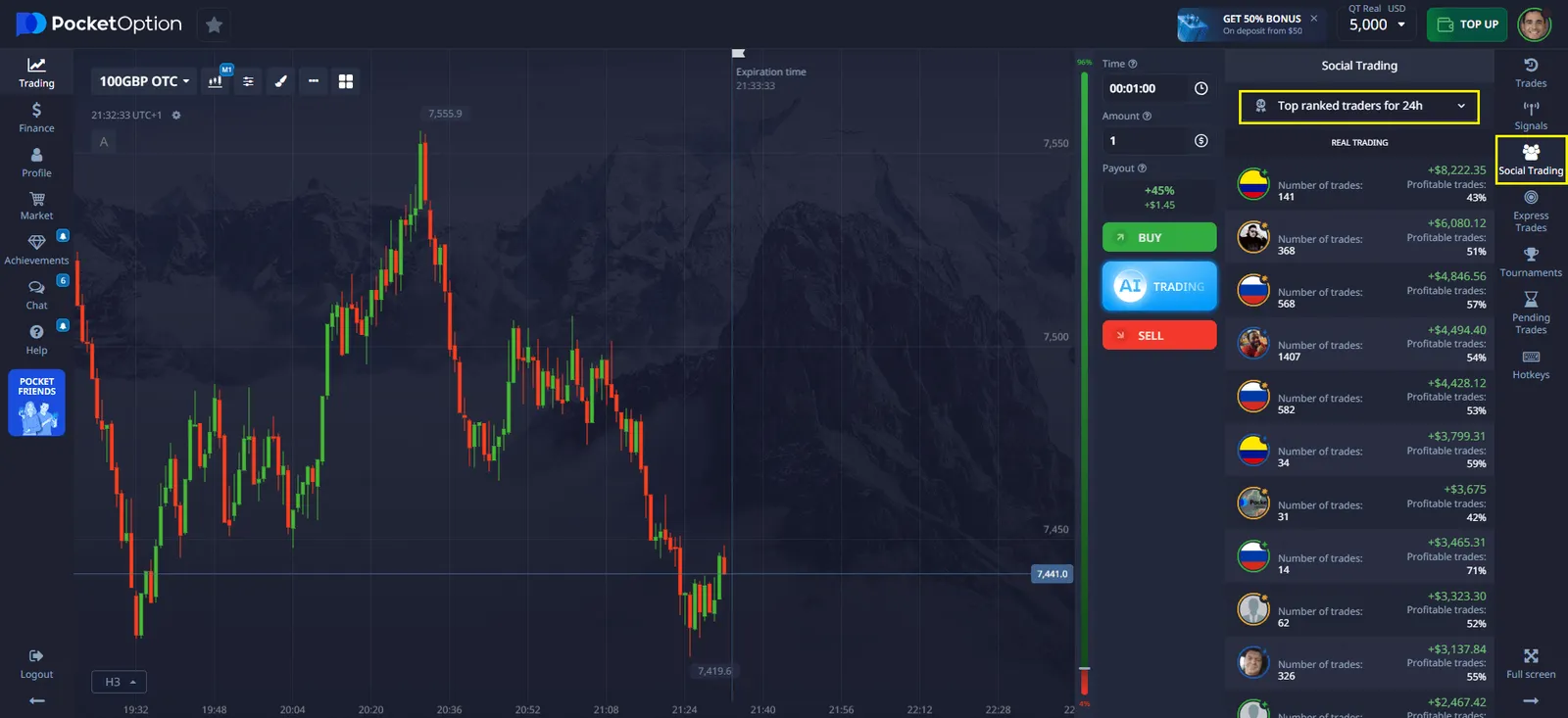

- ✅ Navigate to “Social Trading” in the main menu.

- ✅ Look for the “Top ranked traders”. This is a list of the traders who have the most profitable trades, updated every minute.

✅ Select 2-3 traders with different strategies. Choose a Trader who’s strategy appeals to you the most.

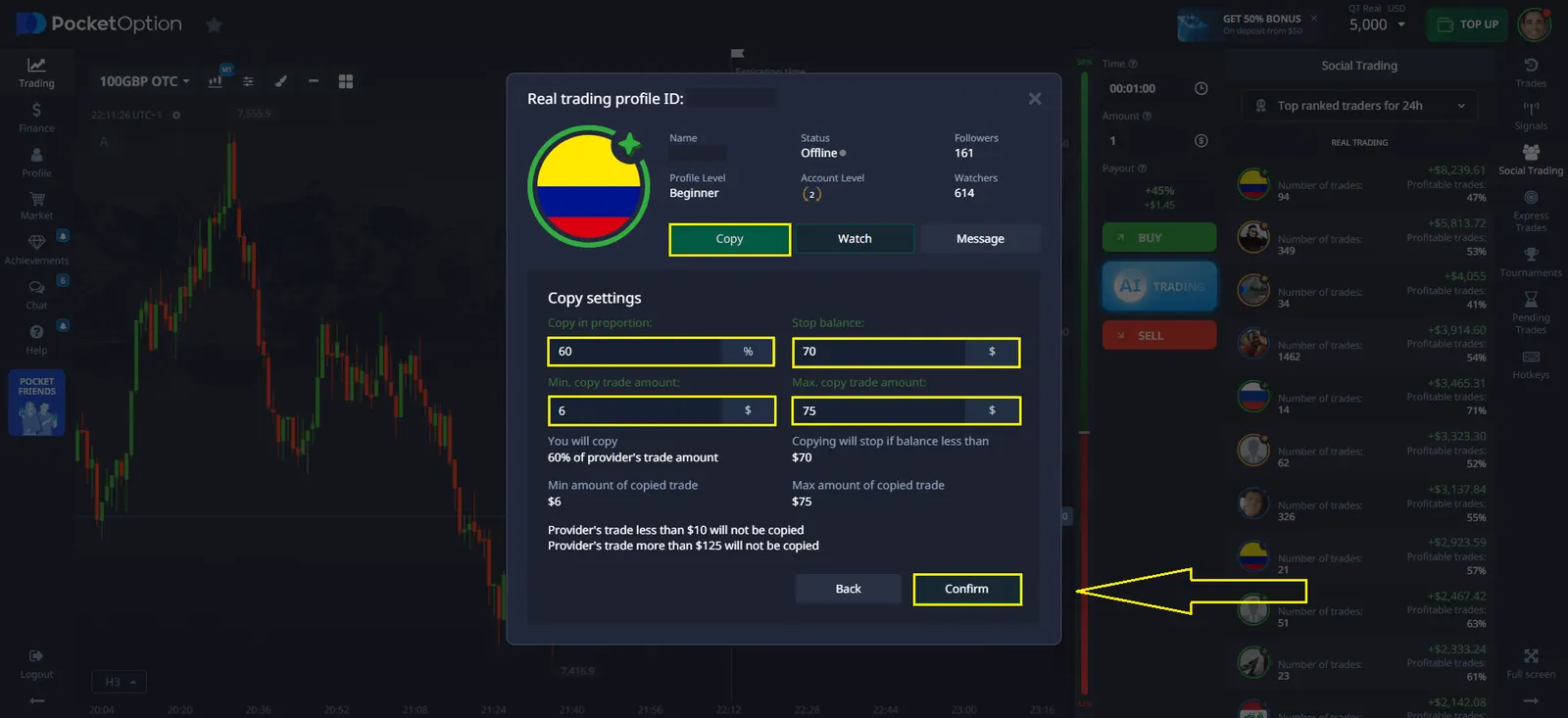

✅ Set Copying Parameters. Define the trade copy percentage and set minimum and maximum limits.

✅ Click “Copy”. Once the settings are confirmed, the system will automatically start copying the selected trader’s trades.

✅ Review performance weekly, reallocate monthly.

When evaluating traders, prioritize those with:

- Consistent 5%+ monthly returns across 6+ months

- Maximum drawdowns under 30%

- 15-40 trades monthly (not overtrading)

- Clear specialization in specific markets

- Transparent trading history spanning market ups and down

Key Advantages of Copy Trading for New Traders

The benefits of copy trading extend far beyond simple trade replication. This approach offers comprehensive advantages that address the most common challenges faced by beginning traders:

- Immediate Market Access: Start trading professionally from day one without extensive market knowledge

- Risk Distribution: Follow multiple traders to spread risk across different strategies and market approaches

- Emotional Discipline: Automated execution eliminates emotional decision-making and panic selling

- Continuous Learning: Observe successful strategies in real-time to accelerate your trading education

- Time Efficiency: Generate returns while maintaining your regular job or commitments

- Performance Transparency: Access detailed statistics on trader performance, drawdowns, and success rates

| Traditional Trading | Copy Trading Approach | Beginner Impact |

|---|---|---|

| 6-24 months learning curve | Immediate professional execution | Start earning from day one |

| High emotional stress | Automated, emotion-free trading | Better sleep and mental health |

| Significant time investment | Passive income generation | Maintain work-life balance |

| High failure rate (80-90%) | Improved success rates (60-75%) | Greater chance of profitability |

“The democratization of trading through copy trading platforms has created unprecedented opportunities for wealth building among retail investors. We’re seeing success stories that would have been impossible just five years ago.” – Marcus Rodriguez, Financial Technology Analyst, 2025

Common Pitfalls and How to Avoid Them

Understanding common mistakes helps beginners navigate copy trading more successfully. These pitfalls often catch newcomers off-guard, but awareness and proper planning can prevent costly errors:

- Overcopying and Capital DilutionMany beginners make the mistake of following too many traders simultaneously, diluting their capital and making performance tracking nearly impossible. Focus on quality over quantity by limiting yourself to 3-5 carefully selected traders.

- Emotional Overreaction to DrawdownsEven successful traders experience temporary losses. New copy traders often panic and stop following profitable traders during normal drawdown periods. Understanding that 10-20% drawdowns are typical helps maintain discipline during challenging periods.

“Patience is the copy trader’s greatest asset. The traders you’re following didn’t become successful overnight, and your results won’t materialize instantly either. Trust the process and focus on long-term consistency.” – David Chen, Portfolio Management Expert, 2025

- Inadequate Due DiligenceRushing into copy trading without thoroughly researching trader performance, strategy explanations, and risk management approaches leads to poor selection decisions. Invest time upfront to save money later.

Developing an Effective Strategy

Transform copy trading from passive following into strategic investment by:

- Setting monthly return targets (start with realistic 5-8%)

- Limiting maximum account risk to 25% at any time

- Allocating larger portions (30%+) to traders with 12+ months of consistent results

- Reviewing performance every Monday morning for 15 minutes

- Replacing underperforming traders after 60 days of subpar results

Advanced Copy Trading Strategies for Accelerated Growth

As your copy trading experience grows, implementing advanced strategies can significantly enhance your results. These approaches require more sophisticated understanding but offer substantially improved risk-adjusted returns.

- Portfolio Rebalancing and OptimizationRegular portfolio rebalancing ensures your copy trading allocation remains aligned with your risk tolerance and market conditions.Monthly rebalancing prevents overconcentration in any single strategy while capitalizing on emerging opportunities.

- Correlation Analysis and Strategy DiversificationAvoid following traders whose strategies are highly correlated, as this creates hidden concentration risk. Seek traders who focus on different markets, timeframes, and analytical approaches to maximize diversification benefits.

“The most successful copy trading portfolios combine fundamental analysis specialists, technical analysis experts, and algorithmic traders. This diversity creates resilience across all market conditions.” – Amanda Thompson, Risk Management Consultant, 2025

Limitations and Risks

While Copy Trading offers convenience, traders should remain aware of several important considerations.

The strategy carries inherent uncertainties — even seasoned professionals occasionally misjudge market movements. Financial exposure can increase substantially with improper configuration settings. Additionally, your investment performance becomes directly tied to the decisions made by your chosen signal provider. Note that if your account balance is insufficient, copying will be unavailable.

If you have any further questions, you can reach Pocket Option support bot via “Chat” section:

Step-by-Step Guide to Starting Copy Trading

Perhaps you want to try copy trading on different platforms, then here is a universal copy trading guide:

Phase 1: Platform Selection and Setup

- Choose Your Platform: Research reputable copy trading platforms that offer transparent performance data and robust risk management tools

- Complete Registration: Provide necessary documentation for account verification and regulatory compliance

- Fund Your Account: Start with an amount you can afford to lose while learning the system

- Explore the Interface: Familiarize yourself with trader rankings, performance metrics, and copying controls

Phase 2: Trader Selection and Analysis

Selecting the right traders to follow represents the most critical decision in your copy trading journey. Successful trader selection requires analyzing multiple performance indicators rather than focusing solely on recent gains.

| Key Metrics | Ideal Range | Why It Matters |

|---|---|---|

| Maximum Drawdown | Under 20% | Shows risk management discipline |

| Win Rate | 60-75% | Consistency in profitable trades |

| Monthly Return | 5-15% | Sustainable growth without excessive risk |

| Copying Period | 6+ months | Proven track record across market conditions |

| Number of Copiers | 50-500 | Community validation of strategy |

“The biggest mistake new copy traders make is chasing last month’s winner. Consistency and risk management matter far more than spectacular short-term gains.” – Jennifer Liu, Quantitative Trading Specialist, 2025

Phase 3: Implementation and Risk Management

Once you’ve identified suitable traders, proper implementation ensures your copy trading experience remains both profitable and sustainable. Traders often apply these risk management principles when setting up their copying parameters on platforms like Pocket Option:

- Diversification: Follow 3-5 traders with different strategies and market focuses

- Position Sizing: Allocate 15-25% of your capital to each trader you follow

- Stop Loss Limits: Set maximum loss thresholds for individual traders

- Regular Review: Monitor performance weekly and adjust allocations monthly

Pro Tip: The 3-Tier Approach

Structure your copy trading portfolio with three distinct tiers: 50% in conservative, proven strategies; 30% in moderate-risk approaches; and 20% in higher-risk, higher-reward traders. This balance optimizes both stability and growth potential.

FAQ

Is copy trading safe for complete beginners?

Copy trading is generally safer than manual trading for beginners because you leverage experienced traders' expertise. However, all trading involves risk, and you should only invest money you can afford to lose. Start small and gradually increase your investment as you gain confidence and experience.

How much money do I need to start copy trading?

Most platforms allow you to start with very small amounts, often as low as $5-$10. However, for effective diversification across multiple traders, consider starting with $100-$500. This allows proper position sizing while maintaining reasonable transaction cost ratios.

What are drawdowns and how should beginners handle them?

Drawdowns are temporary declines in account value from peak levels. Even successful traders experience drawdowns of 10-20%. Beginners should expect these periods and avoid making emotional decisions during temporary losses. Focus on the trader's long-term track record rather than short-term fluctuations.

How do I choose the best traders to copy?

Focus on traders with consistent performance over 6+ months, maximum drawdowns under 20%, win rates between 60-75%, and reasonable monthly returns (5-15%). Avoid chasing recent high performers and prioritize risk management over spectacular gains.

Can I stop copying a trader at any time?

Yes, you can stop copying any trader immediately. Most platforms allow you to either close all copied positions immediately or stop copying new trades while keeping existing positions open. This flexibility gives you complete control over your investment decisions.

What's the difference between copy trading and manual trading success rates?

Studies show that 80-90% of manual traders lose money, while copy traders following proven strategies see success rates of 60-75%. The key difference is leveraging experienced traders' expertise rather than learning through costly trial and error.

Do I need to understand markets to succeed at copy trading?

While market knowledge isn't required to start copy trading, developing basic understanding enhances your trader selection abilities and risk management decisions. Use copy trading as both an income source and educational tool for long-term success.

How to stop copying a trader on Pocket Option?

Navigate to the "List of Copied Traders" section. Identify the trader you want to stop copying and click the "Stop Copying" button, then confirm the action.

How much time do I need to dedicate to copy trading?

Most successful copy traders spend 1-2 hours weekly reviewing performance and making adjustments. The automated nature eliminates daily chart analysis and trade execution that typically requires 15-20 hours weekly.

Can I lose all my money with copy trading?

Yes, all trading carries risk. Even professional traders experience losses, which is why Pocket Option provides risk settings for copy trading and recommends allocating maximum 20-30% of your capital to any single trader.

How do I know which traders to follow?

Evaluate 6+ months of performance data, focusing on consistent returns over flashy short-term gains. Pocket Option's filtering tools let you sort by win rate, drawdown percentage, and risk score to match your tolerance. Or simply choose a top trader from the “Top ranked traders” list.

Is copy trading on Pocket Option available for cryptocurrency?

Yes, Pocket Option offers crypto copy trading with a variety of cryptocurrencies including Bitcoin, Ethereum and emerging altcoins. The platform provides specialized crypto traders with verified performance statistics dating back to 2018.

CONCLUSION

Copy trading, also known as social trading or mirror trading, enables investors to automatically replicate the trading decisions of experienced professionals. This revolutionary approach eliminates the steep learning curve traditionally associated with successful trading while providing real-time access to diverse market strategies. Copy trading for beginners provides market access without the typical 1-2 year learning curve. By selecting successful traders on Pocket Option's platform and implementing proper risk controls, you can potentially generate returns while developing your own trading skills.

Start trading