- ✨ An Intuitive Interface: The platform should feel welcoming, not overwhelming. You want to easily find charts, assets, and your trading history without a headache.

- 🚀 Real-Time Data: Prices must update instantly. In a market where seconds matter, delays are not an option.

- 🎓 A Full-Featured Demo Account: This is your personal sandbox. It’s a risk-free zone where you can test strategies, get comfortable with the platform, and make mistakes without losing real money.

- 📱 Seamless Cross-Device Experience: Trade at your desk, but monitor your positions from your phone. Flexibility is your key advantage.

Trading Tools for beginners - Analysis

In 2025, more beginners are entering the world of quick trading than ever before. Mastering the right trading tools is the first step to navigating market trends with confidence.

Article navigation

- Mastering the Market: The Ultimate Guide to Trading Tools for Beginners

- Choosing Your Trading Arsenal: Software and Apps

- Essential Forex Tools for Beginners

- The Foundation: Technical Analysis and Market Learning

- Why Trading Tools Matter for Beginners in 2025

- Understanding Chart Types: Line, Bar, and Candlestick Charts

- Essential Technical Analysis and Trading Tools for Beginners

- Risk Management Tools for New Traders on Pocket Option

- How to Read Trading Charts on Pocket Option: A Step-by-Step Guide

- Further Learning on Pocket Option

Mastering the Market: The Ultimate Guide to Trading Tools for Beginners

Ready to step into the world of trading? Forget crystal balls and guesswork. In 2025, trading success is all about using technology to make smart, informed decisions. Your most important asset isn’t just your starting capital; it’s having the right trading tools for beginners. Think of this guide as your personal roadmap. We’ll break down everything from choosing a platform to analyzing charts, helping you transform from a complete novice into a confident trader.

Choosing Your Trading Arsenal: Software and Apps

Before you make a single trade, your first mission is to choose your “home base”–your trading platform. Should you use a desktop program or one of the many mobile trading apps? The truth is, the best trading software for beginners shares a few key traits, no matter where you use it.

Here’s your checklist for picking the right platform:

Essential Forex Tools for Beginners

The Forex market is a unique beast–it runs 24/5 and plays by its own rules. To navigate it, you’ll need specific forex tools for beginners. These aren’t just nice-to-haves; they are your essential survival kit.

Here are three tools that should always be in your toolkit:

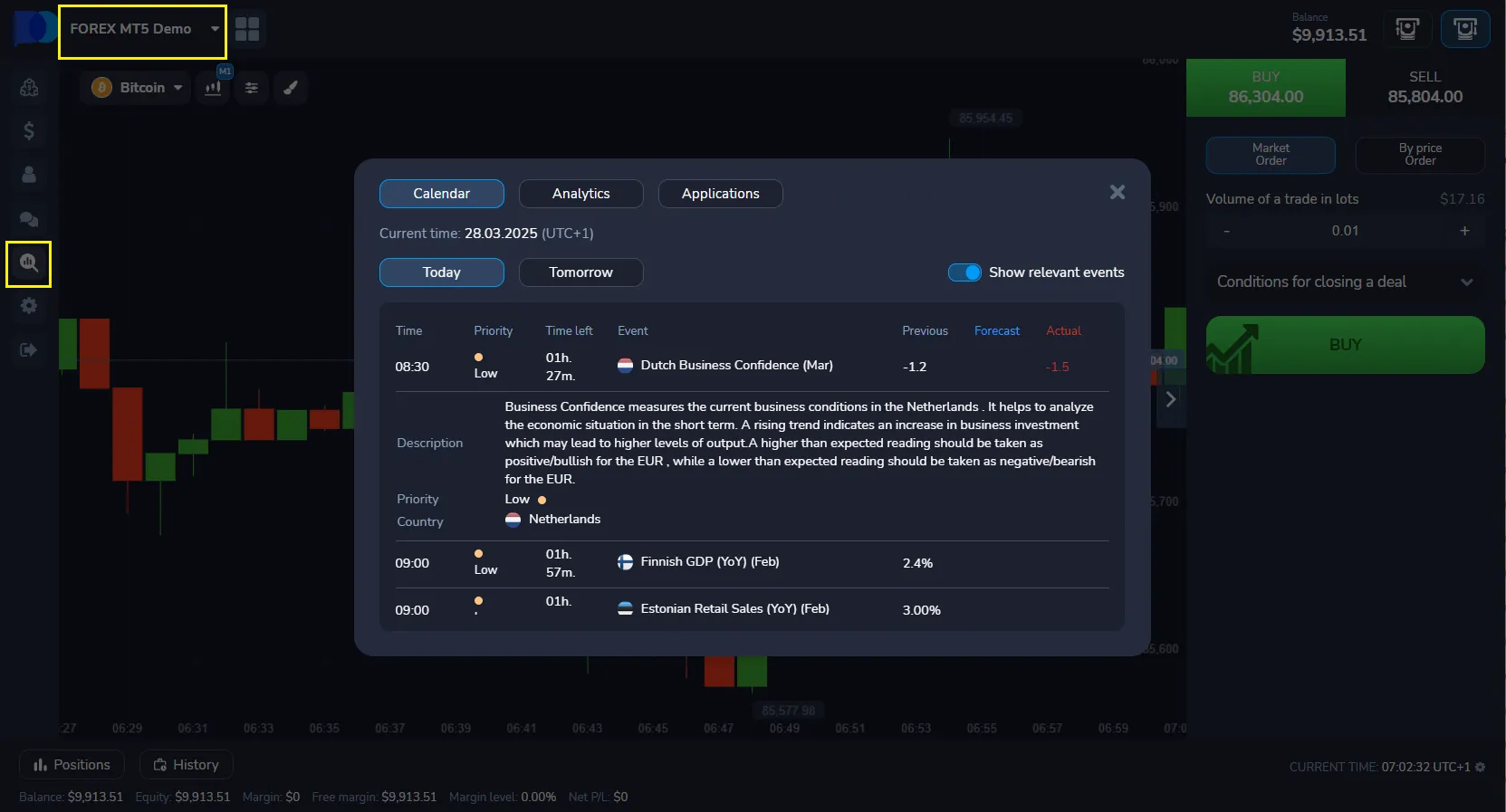

- The Economic Calendar: Your Shield Against SurprisesWhat it is: A schedule of major global news releases (like interest rate decisions, GDP figures, and unemployment reports).Why you need it: When big news hits, the market can go wild. The calendar helps you either prepare for the volatility or simply stay out of the market during these unpredictable moments.

- The Pip Calculator: Your Profit & Loss DecoderWhat it is: A tool that instantly translates price movements (called “pips”) into actual money.Why you need it: So you know exactly how much you stand to win or lose on a trade before you even open it. This is the foundation of risk management.

- The Time Zone Converter: Your Global Market ClockWhat it is: A simple tool that shows you the opening and closing times of the world’s major trading sessions (London, New York, Tokyo).Why you need it: The biggest market moves often happen when the major financial centers are active. This tool ensures you always know when the market “wakes up.”

The Foundation: Technical Analysis and Market Learning

At its core, trading is a skill you build one step at a time. For a newcomer, this process revolves around three pillars: technical analysis, indicators, and stock market learning.

Put simply, technical analysis is the art of “reading” charts. Instead of digging into a company’s financial reports (which is called fundamental analysis), you learn to predict future price movements based on how the price has behaved in the past.

Here’s what this learning process looks like:

- Reading Charts: You learn to understand the language of candlesticks and bars–what they say about the market’s mood.

- Using Indicators: Think of these like the dashboard of your car. They show you the market’s “speed,” whether it’s “overheating” (overbought) or “cooling down” (oversold).

- Spotting Patterns: You start to notice repeating shapes and formations on the chart that often lead to a specific price move.

This isn’t something you master overnight. Continuous stock market learning and consistent practice are what separate serious traders from hobbyists.

Why Trading Tools Matter for Beginners in 2025

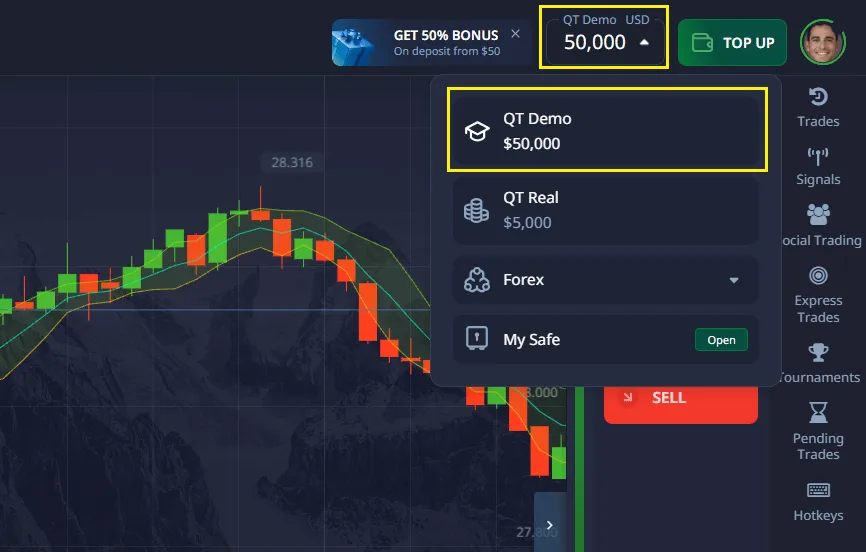

The financial markets are dynamic and often unpredictable, influenced by everything from economic data to global events. For beginners, having access to user-friendly trading tools for beginners can make the difference between guesswork and informed trading. These tools transform complex market data into visual, actionable insights. Pocket Option, for example, provides real-time data, customizable charts, and a demo account with $50,000 virtual funds, allowing new traders to practice strategies without risk. A solid set of tools allows you to:

- Visualize price movements and market trends, turning raw data into actionable insights.

- Identify potential entry and exit points with precision using charting tools.

- Apply technical analysis for better, data-driven decision-making.

- Manage risk effectively to protect your capital from significant losses.

“Beginner traders should focus on mastering the basics–chart reading, trend lines, and risk management–before diving into complex strategies.”– Alex Kim, Trading Coach, 2025

Ready to turn theory into practice? 📈 Pocket Option offers an incredibly user-friendly platform where these tools are just a click away, making your entry into trading smooth and intuitive.

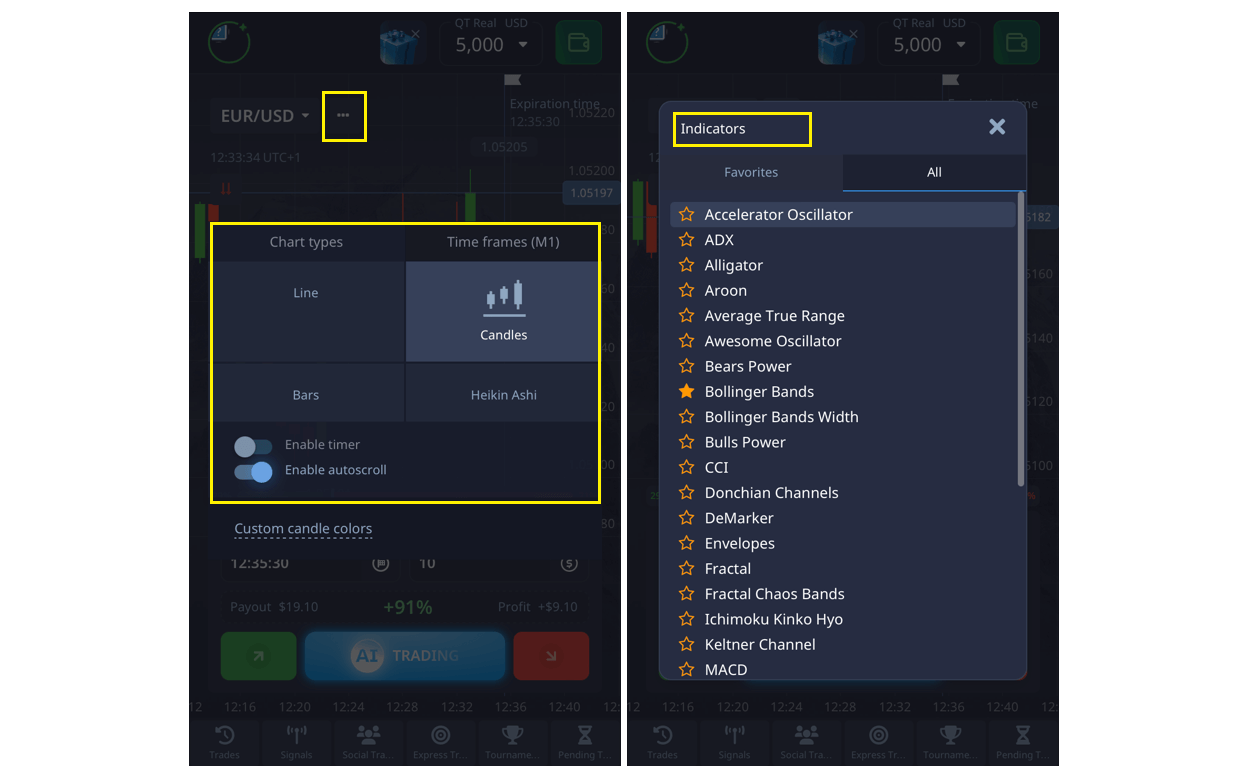

Understanding Chart Types: Line, Bar, and Candlestick Charts

Choosing the right chart type is a foundational skill for any trader, as it determines how you see and interpret market information. Each chart tells a different story about the price action. Pocket Option offers several charting options, including Heikin Ashi, each with unique advantages for beginners looking to analyze the market.

Comparison of Chart Types for Beginners

| Chart Type | Best For | Key Features | Example Use | Beginner Advantage |

|---|---|---|---|---|

| Line Chart | Absolute beginners | Simple, connects a series of closing prices over a set timeframe. | Spotting the overall trend and major price movements at a glance. | Easy to read and completely uncluttered, perfect for a first look. |

| Bar Chart | Intermediate beginners | Shows the open, high,low, and close (OHLC) for each period. | Analyzing the price range and volatility within a specific period. | Offers significantly more detail than a line chart while remaining clear. |

| Candlestick Chart | Ready for deeper analysis | Visualizes price action through a “body” and “wicks,” showing the open, high, low, and close. | Identifying common reversal and continuation patterns (e.g., Doji, Engulfing). | The most information-rich chart, excellent for spotting market sentiment. |

“Candlestick charts are a game-changer for beginners ready to spot market sentiment and price patterns.”– Priya Desai, Market Strategist, 2025

Speaking of charts, Pocket Option excels by offering four distinct chart types and a full suite of drawing tools, ensuring every trader, from beginner to pro, finds their perfect analytical view. 📊

Essential Technical Analysis and Trading Tools for Beginners

Technical analysis is the backbone of successful trading. It involves using historical price data to forecast future price movements. On Pocket Option, beginners can access a range of technical analysis and charting tools to help analyze market conditions and manage trades effectively.

- Drawing Tools: Draw trend lines to see the market’s direction, map out support (price floor) and resistance (price ceiling) levels, and identify channels directly on charts to frame the price action.

- Indicators: Use a vast library of indicators like moving averages, RSI, MACD, and more to analyze momentum, trend strength, volatility, and market sentiment.

- Fibonacci Retracements: Identify potential reversal points based on the idea that after a significant price move, the price will “retrace” or return partway back to a previous level before continuing in the original direction.

- Customizable Charts: Adjust timeframes (from seconds to months), colors, and layouts to create a personalized trading environment that fits your analytical style.

Popular Technical Indicators for Beginners

| Indicator | Purpose | How Beginners Use It |

|---|---|---|

| Moving Average | Smooths price data, shows trend direction | To confirm a trend. If the price is consistently above the Moving Average, it signals a potential uptrend. |

| RSI (Relative Strength Index) | Measures overbought/oversold conditions | To avoid entering trades in extreme zones. A reading above 70 suggests the asset is overbought; below 30 suggests it’s oversold. |

| MACD | Identifies momentum and trend changes | To time entries and exits using the “crossover” signal. When the MACD line crosses above the signal line, it’s a bullish signal. |

| Bollinger Bands | Shows volatility and price range | To recognize potential breakouts or reversals. Prices hitting the upper band may be overextended; prices hitting the lower band may be oversold. |

“Technical indicators are like a compass for new traders–guiding decisions and reducing emotional bias.”– Samuel Lee, Quantitative Analyst, 2025

Risk Management Tools for New Traders on Pocket Option

Managing risk is crucial, especially for beginners. A single large loss can wipe out numerous small gains. Pocket Option integrates several powerful risk management features and philosophies to help traders protect their capital and trade responsibly:

- Practice with a Demo Account: Use the generous $50,000 demo account to test strategies, understand the platform, and build confidence without any financial risk.

- Start Small: With a minimum deposit that can be as little as $5 (depending on your region and payment method), you can start your trading career without a large capital outlay.

- Diversify Your Trades: Access more than 100 assets, including currencies, commodities, stocks, and cryptocurrencies, to spread your risk.

- Learn from Others: Utilize the copy trading feature to automatically replicate the trades of successful, experienced traders while you learn.

- Access Real-Time Alerts and Notifications: Stay informed about market movements and the status of your trades.

- Monitor Open Trades and Account Balance: Keep a close eye on your performance and equity in real time.

“Risk management isn’t just a tool–it’s a mindset every beginner must develop from day one.”– Linda Novak, Risk Consultant, 2025

At Pocket Option, we believe in empowering traders. 💡 That’s why we offer a free, extensive knowledge base with strategies and tutorials, plus a powerful copy trading feature to help you learn and grow safely.

How to Read Trading Charts on Pocket Option: A Step-by-Step Guide

Reading charts may seem daunting at first, but it becomes second nature with a structured approach and consistent practice. Here’s a simple process for beginners:

- Choose Your Preferred Chart Type. Start with a line chart for a simple overview of the trend. As you grow more comfortable, switch to candlestick charts to gain deeper insights into market psychology and price patterns.

- Identify the Overall Trend. Is the price making a series of higher highs and higher lows (an uptrend), lower highs and lower lows (a downtrend), or is it moving sideways in a range? Use the trend line tool to visualize this.

- Mark Key Support and Resistance Levels. Look for horizontal price zones where the market has reversed multiple times in the past. Use the drawing tools to mark these levels. A good rule of thumb is to look for at least two or three price “touches” to validate a level.

- Apply Technical Indicators to Confirm Your Analysis. Use an indicator like the RSI to check if the market is overbought or oversold, or a Moving Average to confirm the trend direction. Never rely on a single indicator; use them in combination to build a stronger case for a trade.

- Practice on the $50000 Demo Account. Before trading with real funds, apply these steps repeatedly on the demo account. This builds the confidence and pattern recognition skills needed for live trading.

“Consistent practice with demo charts builds the confidence needed for live trading.”– Mark Jensen, Trading Educator, 2025

Further Learning on Pocket Option

To continue your journey, explore these resources directly on the Pocket Option platform, which includes a free educational section with strategies and tutorial videos designed to help you start your career:

FAQ

What tools do beginner traders need?

Beginner traders need a core set of tools to start effectively. This includes: a reliable trading platform with a user-friendly interface, multiple chart types (Line, Candlestick), basic technical indicators (like Moving Averages and RSI), drawing tools (for trend lines, support/resistance), and an economic calendar to track market-moving news. A large demo account is also essential for risk-free practice.

What is the best trading platform for beginners?

The best trading platform for beginners is one that prioritizes ease of use, education, and safety. Key features to look for are a low minimum deposit, a substantial demo account (e.g., $10,000 or more), a comprehensive library of educational resources (articles, videos), a wide range of assets to trade, and an intuitive interface. Platforms that offer these features empower new traders to learn and grow in a supportive environment.

Do beginners need trading software?

Absolutely. In the modern era, trading software is not just helpful; it's essential. It is the gateway to the financial markets. Modern web-based platforms and trading apps have made it incredibly accessible, eliminating the need for complex installations. This software provides the charts, analysis tools, and order execution capabilities necessary to participate in the market, analyze price movements, and manage trades.

What is technical analysis and why is it important?

Technical analysis involves studying price charts and indicators to forecast future price movements. It helps traders make data-driven decisions rather than relying on emotions.

How can I manage risk as a new trader?

Use stop-loss tools, set clear trading limits, and never risk more than you can afford to lose. Pocket Option offers built-in risk management features for beginners.

Are there educational resources for learning charting tools?

Yes, Pocket Option provides tutorials, demo accounts, and a knowledge base to help beginners master charting and analysis tools.

What are support and resistance levels?

Support is a price level where a downtrend can pause due to demand, while resistance is where an uptrend can pause due to selling pressure. Identifying these levels helps in making better trading decisions.

Which chart type is best for beginners?

Line charts are simplest for beginners, while candlestick charts offer more detail for those ready to analyze price action and patterns.

How do I read trading charts on Pocket Option?

Start by selecting a chart type (line, bar, or candlestick). Observe price movements, identify patterns, and use drawing tools to mark support and resistance levels. Practice on the demo account to build confidence.

What are the best trading tools for beginners on Pocket Option?

The best trading tools for beginners include customizable charts, drawing tools, technical indicators, and risk management features. These tools help new traders analyze market trends and make informed decisions.

CONCLUSION

Mastering trading tools for beginners is the gateway to confident and successful trading. Pocket Option’s platform offers everything a new trader needs: intuitive charting, technical analysis features, and robust risk management. By practicing with demo accounts and exploring the platform’s educational resources, you can build a strong foundation for your trading journey in 2025 and beyond. Ready to put your knowledge into action? Explore Pocket Option’s trading tools and start practicing today.

Start trading