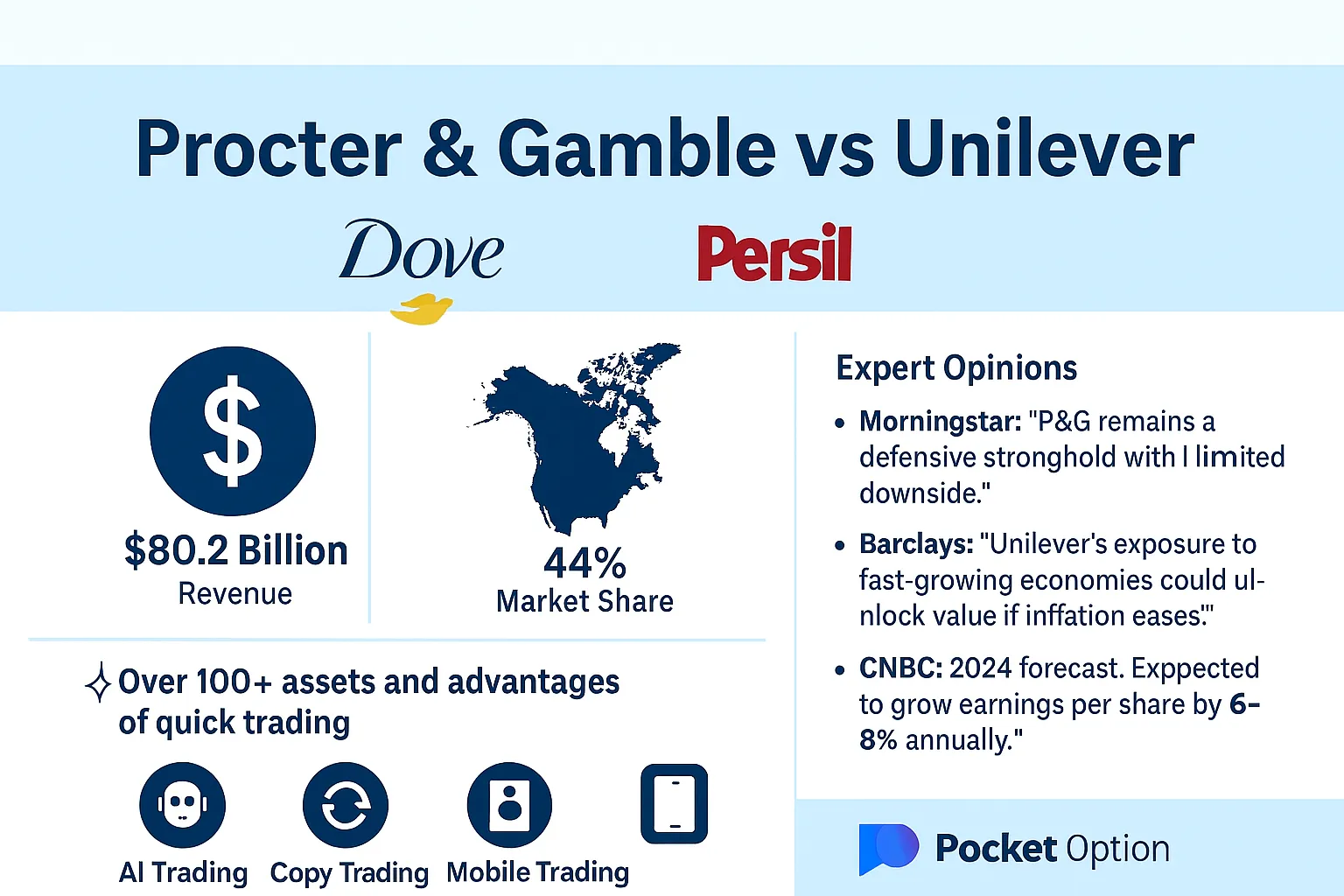

- Morningstar (2023): “P&G remains a defensive stronghold with limited downside. Its focus on margin improvement and innovation keeps it resilient even in market downturns.”

- Barclays (2023): “Unilever’s exposure to fast-growing economies could unlock value if inflation eases. Its performance in Asia and Africa, especially in the beauty segment, is underappreciated by the market.”

- CNBC (2024 Forecast): “Both firms are expected to grow earnings per share by 6–8% annually, driven by strategic pricing and digital transformation.”

Procter and Gamble vs Unilever: The FMCG Battle for PG Stock & UL Stock

In the highly competitive world of fast-moving consumer goods (FMCG), two names dominate headlines and investor watchlists: Procter and Gamble vs Unilever. These consumer goods giants have cultivated iconic brands, captured markets across continents, and battled for supremacy in sectors ranging from personal care to home essentials. This article dives deep into their rivalry, analyzing stock performance, market strategies, financial indicators, and what this means for investors and analysts tracking PG stock and UL stock.

Article navigation

Expert Opinions & Market Predictions

Analyst Insights on P&G and Unilever

Additional Expert Commentary

- Erin Lash, Director of Consumer Equity Research at Morningstar: “P&G’s disciplined brand focus and premiumization strategy set it apart. Its strength lies in sticking to what it does best and optimizing margins.”

- Alan Jope, Former CEO of Unilever, noted during his 2023 Financial Times interview: “Digital commerce and purpose-led brands are where Unilever will win future battles.”

- According to a Harvard Business School study (2023), companies that integrate ESG principles into FMCG operations experience 12% faster brand loyalty growth.

Unique Insights & Recommendations

- P&G is a solid pick for dividend-oriented investors, especially in uncertain economic times.

- Unilever offers value for long-term investors betting on emerging markets and sustainability as global catalysts.

- Investors may consider a blended approach: holding both stocks to balance defensive strength with growth potential.

Market Video Highlight

- Bloomberg Analyst Roundtable: FMCG Stocks Outlook 2024: “Unilever’s India strategy and P&G’s AI-driven logistics upgrades are major differentiators in 2024.”

Overview of the FMCG Market

Introduction to FMCG Titans

FMCG, or fast-moving consumer goods, are products that sell quickly and at relatively low cost. The sector is driven by consumer demand and high product turnover, making it both lucrative and intensely competitive.

Procter & Gamble (P&G) and Unilever are pillars of this industry:

- P&G Brands: Gillette, Pampers, Olay

- Unilever Brands: Dove, Persil, Rexona

Their global reach, scale of operations, and brand loyalty position them as leaders in a market expected to exceed $15 trillion by 2025, according to Statista.

Market Share Comparison: P&G vs Unilever

| Metric | Procter & Gamble | Unilever |

| Revenue (2022) | $80.2 Billion | €60.1 Billion |

| Market Share in North America | 44% | 12% |

| Global Market Share (FMCG) | ~23% | ~16% |

| Presence in Asia-Pacific | 10% | 30% |

| Emerging Market Penetration | Moderate | High |

- P&G dominates in North America and Europe with high-margin, brand-premium products. According to Statista, it holds over 40% of the U.S. household and personal care product segment.

- Unilever is stronger in Asia, Africa, and Latin America. Over 60% of its revenue comes from emerging markets, with India alone accounting for 10% of global sales. Its adaptive pricing strategies have fueled growth where disposable income remains volatile.

- In digital penetration, Unilever’s D2C platforms and partnerships with regional e-commerce players in Southeast Asia and Africa continue to outperform industry benchmarks.

Key Drivers of Growth in FMCG

Both companies rely on:

- Innovation: Product R&D spend reached $2.2B for P&G and €1.1B for Unilever in 2022. P&G’s Skin & Personal Care division saw 11% YoY growth, driven by new Olay Regenerist products.

- Sustainability: Unilever’s “Compass Strategy” aims for net-zero emissions by 2039. P&G plans to reduce supply chain emissions by 50% by 2030. Over 75% of their packaging is now recyclable or reusable.

- Digital Transformation: Both companies are leveraging AI for inventory and personalized marketing. P&G reported a 23% increase in digital sales in 2022, while Unilever noted 20% of its total turnover came via digital channels.

- Emerging Markets: Urban population in emerging economies is projected to grow by 1.5 billion by 2040 (UN). Unilever’s volume growth in India and Brazil outpaces global averages, positioning it well for scale-driven profitability.

According to McKinsey, companies integrating omnichannel sales and sustainable manufacturing have experienced 5–10% higher growth than traditional players over the past three years.

Financial Performance Analysis

Revenue Growth Trends

Procter & Gamble

- CAGR of ~5% from 2019 to 2022

- Strong performance in beauty and fabric care segments

- Focus on value-added products in developed economies

Unilever

- CAGR of ~3.7% over the same period

- Growth led by beauty & personal care, especially in India and China

- Agile pricing strategy in inflation-sensitive regions

Stock Performance: PG Stock vs UL Stock

| Stock | YTD Return (2023) | Dividend Yield | Beta |

| PG | +7.8% | 2.4% | 0.38 |

| UL | +5.3% | 3.2% | 0.54 |

- PG stock appeals to defensive investors due to stability and consistent dividends.

- UL stock attracts those seeking exposure to developing economies and sustainability-driven growth.

Valuation Metrics

Understanding Valuation Ratios

| Metric | Procter & Gamble | Unilever |

| P/E Ratio | 25.3 | 20.1 |

| Market Cap | $360B | €140B |

| EV/EBITDA | 18.7 | 14.9 |

PG’s premium reflects its reliability and market dominance.

UL’s discount may signal opportunity if emerging markets outperform.

Product Segments Breakdown

Personal Care: P&G Strength

- Flagship brands like Gillette and Olay

- Strong U.S. and EU market penetration

- Focus on premium products

Home Care: Unilever Advantage

- Persil, Domestos, and Cif lead global sales

- Major presence in low- and mid-income markets

- Sustainability initiatives increase appeal

Diversification Strategy

| Segment | P&G | Unilever |

| Baby & Feminine | Strong | Moderate |

| Ice Cream & Beverages | None | Strong |

| Health & Wellness | Growing | Expanding |

Investor Insights and Future Outlook

Strategic Moves: Procter & Gamble

- Increased R&D spend (over $2B annually)

- Expanding digital sales footprint

- Sustainability pledge: 100% recyclable packaging by 2030

Strategic Moves: Unilever

- Aggressive acquisitions in vegan beauty and natural products

- Carbon neutrality goals by 2039

- Strong foothold in e-commerce (20% of revenue)

Why Opening a Real Pocket Option Account Pays Off

Opening a real account on Pocket Option gives you instant access to 100+ trading assets including popular company stocks.

Use the promo code “50START” on your first deposit and get a bonus from $25 added to your account! Unlock features like:

- Quick Trading: Forecast market moves and execute trades in seconds

- Copy Trading: Follow and copy successful traders in real-time

- AI and Bot Trading: Automate decisions with smart trading technology

- Tournaments: Compete, learn, and win prizes

- Bonuses & Cashback: Boost your potential with promotional offers

- 24/7 Trading Access: Trade anytime, from anywhere—even via mobile

FAQ

Who is P&G's biggest competitor?

Unilever is often considered P&G’s most direct competitor in the FMCG industry, especially in segments like personal care and home care. The ongoing Procter and Gamble vs Unilever rivalry highlights their overlapping markets and competitive strategies.

Are P&G and Unilever rivals?

Yes, P&G and Unilever are longtime rivals in the global consumer goods space. The competition—Unilever vs P&G—spans over 95 years and includes categories such as grooming, cleaning, beauty, and baby care.

What do Unilever and Procter & Gamble have in common?

Both companies are multinational giants in the FMCG sector. P&G Unilever similarities include diversified product portfolios, focus on innovation, sustainability initiatives, and heavy investments in emerging markets.

Did P&G take lead in 95-year rivalry with Unilever?

P&G has taken the lead in terms of North American market share and overall valuation. However, Unilever's strength in emerging markets keeps the Unilever and P&G rivalry intense and ever-evolving.