- AUD is the base currency

- USD is the quote currency

AUDUSD Ideas: Australian Dollar vs. USD Analysis

Exploring the dynamic world of currency trading, particularly focusing on the AUD/USD pair, offers a wealth of insights for traders. This article delves into the latest audusd ideas, uncovering key levels, trade setups, and macroeconomic influences. By understanding the characteristics of both the Australian Dollar and the US Dollar, traders can better navigate the forex market and make data-driven decisions. Trading AUD/USD is more than chart watching—it's about understanding monetary policy shifts, rate cut expectations, and strategic opportunities, all while managing risks effectively. Whether you're seeking short-term setups or long-term dollar trade ideas, this analysis will help you monitor the market with confidence.

Understanding the Australian Dollar and USD

The Australian Dollar (AUD) is a commodity-linked currency, highly sensitive to global risk sentiment and commodity prices—particularly iron ore and coal, which make up a significant portion of Australia’s exports. According to the Australian Bureau of Statistics, mining commodities account for nearly 70% of Australia’s exports, reinforcing the AUD’s vulnerability to China’s economic health. Check the AUD to USD chart frequently to detect shifts in trend direction.

Expert Insight: “The AUD behaves like a proxy for global commodity demand, especially from China. Traders often underestimate how much industrial momentum in Asia drives the pair,” says Katherine Ng, FX strategist at Saxo Bank.

How Currency Quotes Work: Simple Breakdown

Let’s say you see AUD/USD = 0.6600. This means 1 Australian Dollar equals 0.66 US Dollars.

If the number goes up, the Australian Dollar is getting stronger compared to the US Dollar.

Example:

If you plan a vacation and exchange 100 AUD for USD when the rate is 0.6600, you’ll get 66 USD. But if the rate rises to 0.7000, you’d get 70 USD instead — that’s how real-world currency strength plays out.

What Affects AUD/USD Price Movement?

Several factors influence this pair and help with AUDUSD analysis:

- Interest Rate Decisions: Policies from the Reserve Bank of Australia (RBA) and the US Federal Reserve impact the AUD/USD rate directly. A rate hike from either central bank can push the currency pair in either direction.

- Commodity Prices: Australia’s economy is tied to exports like iron ore, gold, and coal. When global commodity prices rise, the AUD strengthens, often influencing AUD/USD trading positively.

- US Economic Reports: Key releases like Non-Farm Payrolls or inflation data can strengthen or weaken the USD, impacting AUD/USD movements.

- Global Risk Sentiment: AUD is seen as a “risk-on” currency, while USD is often a safe haven. Risk appetite shifts can swing the pair significantly.

Each of these elements plays a key role in AUDUSD price prediction, helping traders form expectations for short- and long-term moves.

AUDUSD Exchange Rate Factors

A wide range of fundamental drivers affects the AUDUSD exchange rate. These include:

- Interest rate differentials between the RBA and the Fed

- Commodity exports such as iron ore and coal

- Global risk sentiment and capital flows

- China’s demand for raw materials

- Inflation trends in both Australia and the U.S.

Understanding these audusd exchange rate factors helps traders assess potential trend shifts and identify high-probability trade setups.

The Reserve Bank of Australia (RBA) is the principal force behind the currency’s performance. As of June 2025, the RBA maintains a benchmark interest rate of 3.85%, influencing domestic inflation and international capital flows. A dovish tone from the Reserve Bank can weaken the AUD significantly, leading to strategic positioning opportunities. Traders should watch for any signals of a potential rate cut or shift in tone.

Characteristics of the US Dollar (USD)

The US Dollar (USD) is the world’s dominant reserve currency, widely used in global trade and forex markets. USD movements are tied closely to the US Federal Reserve’s monetary policies, inflation data, and geopolitical tensions. In times of global uncertainty, the USD benefits from its “safe haven” status.

“The Fed’s wait-and-see stance amid inflationary uncertainty in 2025 keeps the dollar buoyant. Markets now price a 42% chance of a rate cut by Q4,” notes Morgan Stanley FX Research.

For AUD/USD traders, understanding the Federal Reserve’s forward guidance and economic projections—especially those concerning inflation and employment—is essential for predicting audusd direction. Investors watching for a buy AUD USD signal will want to evaluate economic divergence and support and resistance area. Trade setups around news.

Comparative Analysis of AUD and USD

| Factor | AUD | USD |

|---|---|---|

| Central Bank | Reserve Bank of Australia (RBA) | Federal Reserve (Fed) |

| Policy Rate (June 2025) | 3.85% | 5.25% |

| Primary Influence | Commodity prices, China demand | Inflation, interest rate expectations |

| Safe Haven Status | No | Yes |

| Sensitivity to Risk | High | Medium |

These contrasting fundamentals mean that audusd ideas today often depend on risk sentiment, commodity prices, and monetary policy divergence between the RBA and Fed. The aud/usd smart money concepts setup latest news chart structure also highlights institutional price zones worth tracking.

Additional Trade Concepts and Forecasts

As we move further into Q3 2025, one notable aud/usd swing trade setup April 2025 continues to influence price action. Traders are still monitoring a structure that has broken above 0.6660, retested and respected as resistance. Bearish target points toward 0.6512 1st support, while a bullish case would involve an ascend past 0.6466 1st resistance.

AUD/USD forecast models from Bloomberg Economics suggest a potential rally toward 0.6850 if China continues commodity imports at the current rate. That trajectory aligns with the broader trend of trading in an uptrend, although the pair currently is in a correction or consolidation.

Market Crosses and Currency Correlations

Comparing major pairs and correlations can yield alternative signals. Traders also exploring EURUSD ideas may find relative strength shifting based on risk sentiment.

| Pair | 3-Month Outlook | Notes |

|---|---|---|

| AUD to Euro | Neutral | Lags due to EU stagnation |

| AUD CAD | Mildly Bullish | Supported by rising oil price |

| AUD/USD | Corrective | Awaiting confirmation break |

These correlations help develop a broader basket of trade ideas in parallel to the AUD to USD chart and live TradingView AUDUSD sentiment tools.

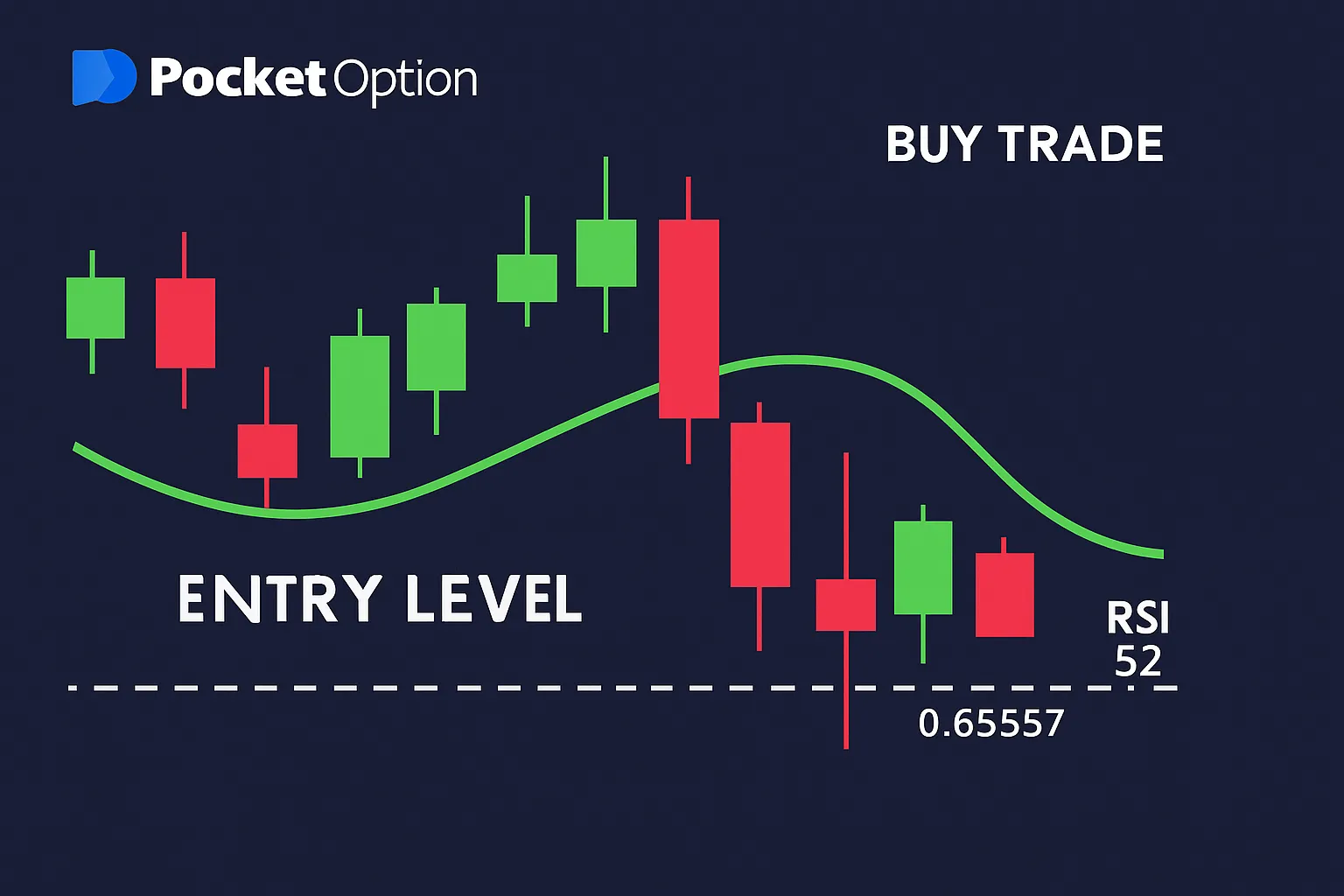

Real Trade Example – AUD/USD on Pocket Option

In today’s trading session we are monitoring AUDUSD for a buying opportunity. Based on the latest chart structure and RSI signal, here’s a realistic example you can apply:

AUD/USD Buy Setup – Quick Trading

- Platform: Pocket Option

- Pair: AUD/USD

- Chart Structure: Resistance broken at 0.6660, now retesting

- Signal: RSI crossed above 50, confirming upward momentum

- Trade Type: 15-minute expiration

- Action: Buy AUD/USD

- Payout: Up to 89% if finished in the money

This setup aligns with current risk tone and reflects how traders can act when audusd is trading near key levels with clear confirmation.

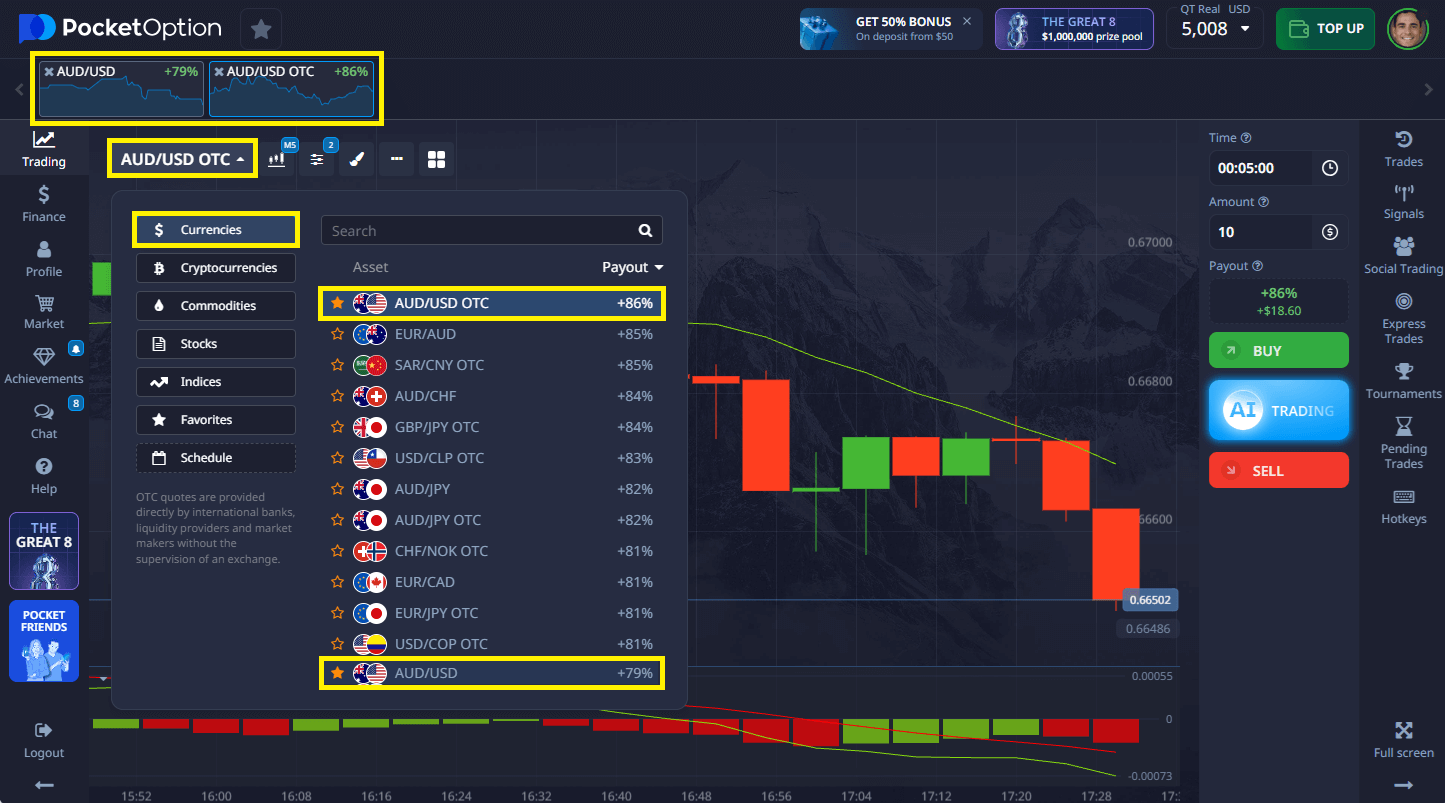

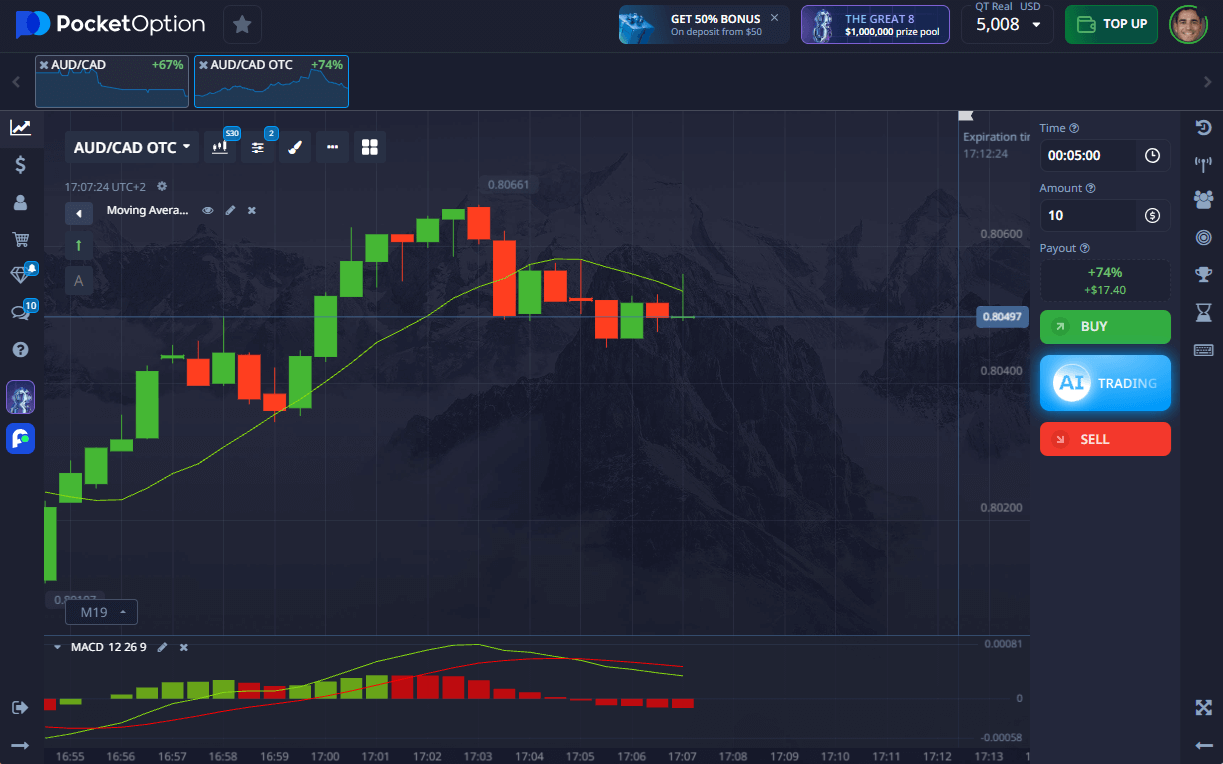

Step-by-Step: Quick Trading on AUDUSD / Example 2

Here’s how to trade AUD/USD on our platform in a few simple steps:

- Open the asset list and select:

Find AUD/USD or AUD/USD OTC. - View the price chart:

Add indicators or check sentiment analysis. - Choose your trade amount:

Start from just $1. - Set the time of your deal:

From 5 seconds and up (for OTC assets, the minimum is 5 sec). - Predict how the rate will move by the end of the period:

If you expect it to rise — press BUY.

If you think it will fall — press SELL. - Review return rate:

Up to 92% for a correct forecast (shown clearly before confirming the trade).

AUD/USD News Today

The latest aud/usd news today centers on heightened volatility following recent RBA minutes, which showed internal debate over future rate cuts. Meanwhile, U.S. macro data continues to surprise to the upside, limiting the AUD’s recovery. Traders remain focused on upcoming speeches from central bank officials and inflation updates from both economies.

Reports from Reuters and FXStreet suggest that liquidity remains thin during the Asia session, adding to price sensitivity. Keep a close eye on bond yield spreads and the USD Index (DXY), as both are influencing short-term AUD/USD direction.

Final Insights and Outlook for AUD/USD

As Q3 progresses, the AUD/USD pair remains influenced by macroeconomic divergence, central bank policy stances, and commodity flows. With the Reserve Bank of Australia leaning dovish and the US economy showing mixed signals, the market structure has entered a correction phase that requires precision.

Traders should:

- Monitor commodity markets (especially iron ore and oil price trends)

- Follow Fed and RBA speeches closely for any rate hike or rate cut signals

- Use tools like TradingView AUDUSD, RSI, and price structure to identify turning points

FAQ

What does AUD/USD represent?

It shows how many US Dollars are needed to buy one Australian Dollar.

How to buy AUDUSD on Pocket Option?

Find AUD/USD or AUD/USD OTC in the asset list, and use the BUY button if you think the rate will rise.

How to invest in AUDUSD as a beginner?

Start with a demo to learn, then switch to a real account with just $5 (deposit may vary depending on payment methods).

What tools are available for AUDUSD analysis?

You can use built-in indicators, trend lines, and sentiment tools for your AUDUSD analysis.

What's the minimum trade size for AUDUSD trading?

You can start trading from just $1 per position on Pocket Option.

What session is best for AUD/USD?

The most active session for trading AUD/USD is the Asian session (00:00–09:00 GMT), especially during the Sydney–Tokyo overlap. Volatility often increases again during the London open.

Is AUD/USD a buy or sell?

As of the latest market structure, AUD/USD is in a correction phase with potential bullish setups forming above support. However, whether it is a buy or sell depends on your time frame, strategy, and confirmation signals like RSI or price action.

What are the best trading hours for AUD/USD?

The best hours to trade AUD/USD are between 00:00 and 03:00 GMT (Sydney–Tokyo overlap) and 07:00 to 10:00 GMT (Tokyo–London overlap), when volume and volatility are highest.