- Hareketli Ortalamalar: 50 periyotluk basit hareketli ortalama (SMA) seçin. Bu, genel trend yönünü belirlemenize yardımcı olacaktır.

- RSI (Göreceli Güç Endeksi): RSI’yı 14 periyoda ayarlayın, bu aşırı alım ve aşırı satım koşullarını ölçmek için kullanılan standart bir ayardır.

Opsiyon Ticareti Göstergeleri: Her Yatırımcının İhtiyaç Duyduğu Gizli Araçlar

Hızla değişen finans piyasaları dünyasında, opsiyon ticareti göstergeleri sadece yardımcı değil--gereklidir. Onları ticaret pusulanız olarak düşünün, fiyat hareketlerinin fırtınalı sularında size rehberlik eden ve daha iyi, daha bilinçli kararlar almanıza yardımcı olan. Onlar olmadan, piyasalarda gezinmek gözü kapalı yelken açmak gibi hissedebilir.

Article navigation

Opsiyon Ticareti Göstergeleri Tam Olarak Nedir?

Opsiyon ticareti, gelecekte belirli bir fiyattan bir varlığı alma veya satma hakkını veren, ancak zorunluluk getirmeyen sözleşmelerin alım satımını içerir. Bu, tüccarların dayanak varlığa sahip olmadan fiyat hareketlerinden kâr elde etmelerini sağlar.Opsiyon ticareti göstergeleri, piyasanın bir sonraki adımda nereye gidebileceğini tahmin etmeye yardımcı olmak için geçmiş fiyat ve hacim verilerini kullanan yüksek teknolojili hesap makineleri gibidir. Bu göstergeler size bir işleme ne zaman gireceğiniz veya ne zaman çıkacağınız gibi sinyaller verir. Piyasanın yönü hakkında net bilgiler sağlayarak ticaretin karmaşık dünyasını anlaşılması daha kolay hale getirirler.

Neden Bu Göstergeleri Önemsemelisiniz?

Bu araçlar, başarılı bir işlem ile kaçırılan bir fırsat arasındaki farkı yaratabilir. Opsiyon ticareti göstergeleri, ekranınızı dolduran tüm verileri anlamlandırmanıza yardımcı olur. Bir varlığın fiyat hareketini takip ediyor, trend dönüşü arıyor veya risk değerlendirmesi yapıyor olun, göstergeler sizin rehberinizdir.

✔️ Ticaretinizi bir üst seviyeye taşımaya hazır mısınız? Pocket Option’da göstergeleri ÜCRETSİZ olarak kullanmayı deneyin! Kaydolduktan sonra demo hesabınızda 50.000$ kazanın — limit yok, risk yok, sadece saf öğrenme!

Binlerce tüccar zaten burada, şimdi sıra sizde! Hemen bize katılın!

Gösterge türleri

Tüccarların her gün kullandığı en önemli gösterge türlerini inceleyelim:

1. Trend Göstergeleri

Bu göstergeler, piyasanın hangi yöne hareket ettiğini — yukarı, aşağı veya yatay olarak hareket edip etmediğini belirlemenize yardımcı olur.

| Gösterge | Neden Harika | Ne Yapar |

|---|---|---|

| Hareketli Ortalamalar | Trendleri erken tespit etmek | Piyasanın zaman içinde nereye gittiğini göstermek için fiyat verilerini düzleştirirler. |

| ADX (Ortalama Yön Endeksi) | Trend gücünü bulmak | Bir trendin ne kadar güçlü olduğunu söyler, böylece ona dahil olup olmama kararını vermenize yardımcı olur. |

| Ichimoku Kinko Hyo | Fiyat yönünü tahmin etmek | Size destek, direnç ve trend sinyallerini tek bir görünümde veren eksiksiz bir sistemdir. |

2. Momentum Göstergeleri

Momentum göstergeleri hız göstergeleri gibidir — fiyatın ne kadar hızlı hareket ettiğini gösterirler. Bir varlığın aşırı alım veya aşırı satım durumunda olabileceğini bilmenize yardımcı olurlar, bu da bir tersine dönüşü işaret edebilir.

| Gösterge | Neden Harika | Ne Yapar |

|---|---|---|

| RSI (Göreceli Güç Endeksi) | Tersine dönüşleri yakalamak | Fiyat hareketlerinin gücünü ölçer, bir varlığın ne zaman aşırı alım veya aşırı satım durumunda olduğunu işaret eder. |

| Stokastik Osilatör | Trend değişimlerini tahmin etmek | Bir trend tersine dönmek üzereyken size erken uyarı işaretleri verir. |

| MACD (Hareketli Ortalama Yakınsama Iraksama) | Trend değişimlerini tespit etmek | Potansiyel trend dönüşlerini tespit etmek için iki hareketli ortalama arasındaki ilişkiyi takip eder. |

3. Volatilite Göstergeleri

Bir fiyatın ne kadar dalgalanabileceğini hiç merak ettiniz mi? Bu göstergeler, riskinizi daha iyi yönetebilmeniz için piyasanın ne kadar vahşi olabileceği hakkında bir fikir verir.

| Gösterge | Neden Harika | Ne Yapar |

|---|---|---|

| Bollinger Bantları | Piyasa stresini ölçmek | Fiyatların hareketli ortalamadan ne kadar uzakta olduğunu gösterir, volatiliteyi değerlendirmenize yardımcı olur. |

| Average True Range (ATR) | Vahşi hareketleri tahmin etmek | Bir varlığın belirli bir süre içinde ne kadar hareket ettiğini ölçer — riski değerlendirmek için mükemmeldir. |

| Keltner Kanalları | Piyasa sakinliğini veya kaosunu kontrol etmek | Piyasanın ne zaman çılgınca hareket ettiğini görmenize yardımcı olmak için volatiliteyi kullanarak üst ve alt bantlar oluşturur. |

4. Hacim Göstergeleri

Bu göstergeler piyasanın kalp atışı gibidir — size ne kadar aktivite olduğunu söylerler. Hacimde bir artış görürseniz, bu piyasanın “Büyük bir şey oluyor!” dediği gibidir.

| Gösterge | Neden Harika | Ne Yapar |

|---|---|---|

| On-Balance Volume (OBV) | Fiyat hareketlerini doğrulamak | İşlem hacmine dayalı olarak bir varlığa giren veya çıkan para akışını takip eder. |

| Accumulation/Distribution (A/D) | Gizli gücü tespit etmek | Bir varlığın alım veya satım baskısında artış görüp görmediğini ortaya çıkarır. |

Pratik Örnek: Temel Bir Ticaret Stratejisi İçin Basit Göstergelerin Kullanımı

Ticarete ve opsiyon ticareti için göstergelerin kullanımına başlamanıza yardımcı olmak için, iki popüler göstergeyi birleştiren basit bir stratejiyi inceleyelim: Hareketli Ortalamalar ve RSI (Göreceli Güç Endeksi). Bu temel yaklaşım, işlemleriniz için iyi giriş ve çıkış noktalarını belirlemenize yardımcı olabilir.

Adım 1: Göstergeleri Ayarlama

Bu strateji için grafiğinize iki gösterge eklemeniz gerekecek:

Adım 2: Hareketli Ortalama ile Piyasa Trendini Belirleme

- Fiyat 50 periyotluk hareketli ortalamanın üzerindeyse, bu bir yükseliş trendini gösterir.

- Fiyat 50 periyotluk hareketli ortalamanın altındaysa, bu bir düşüş trendini gösterir.

Adım 3: RSI ile Aşırı Alım/Aşırı Satım Koşullarını Arama

- RSI 70’in üzerinde olduğunda, piyasa aşırı alım olarak kabul edilir, bu da fiyatın aşağı yönlü potansiyel bir tersine dönüşünü işaret edebilir.

- RSI 30’un altında olduğunda, piyasa aşırı satım olarak kabul edilir, bu da fiyatın yukarı yönlü potansiyel bir tersine dönüşünü işaret edebilir.

Adım 4: İşleme Girme

- Alım (Call) Opsiyonu İçin: Fiyat 50 periyotluk SMA’nın üzerindeyse (bir yükseliş trendini gösterir) ve RSI 30’un altındaysa (varlığın aşırı satıldığını gösterir), bu bir alım (call) opsiyonuna girmek için iyi bir zaman olabilir.

- Satım (Put) Opsiyonu İçin: Fiyat 50 periyotluk SMA’nın altındaysa (bir düşüş trendini gösterir) ve RSI 70’in üzerindeyse (varlığın aşırı alındığını gösterir), bu bir satım (put) opsiyonuna girmek için iyi bir zaman olabilir.

Adım 5: Çıkış Noktasını Belirleme

- Take Profit: Önceki fiyat dalgalanmalarına veya direnç seviyelerine dayalı bir kâr hedefi belirleyin.

- Stop Loss: Potansiyel kayıpları sınırlamak için yakın zamandaki fiyat seviyelerinin hemen üstüne veya altına bir stop loss yerleştirin.

Örnek Senaryo:

Diyelim ki 5 dakikalık bir grafiğe bakıyorsunuz. Bir varlığın fiyatı şu anda 50 periyotluk hareketli ortalamanın üzerinde, bu bir yükseliş trendini gösteriyor. Aynı zamanda, RSI 30’un altında bir değer gösteriyor, bu da varlığın aşırı satıldığını öne sürüyor. Buna dayanarak, fiyatın yukarı doğru geri sıçramasını bekleyerek bir alım (call) opsiyonuna girmeye karar veriyorsunuz.

Bu Strateji Neden İşe Yarar:

Bu basit strateji, Hareketli Ortalamanın trend takip gücünü ve RSI’nın momentum içgörülerini birleştirir. Genel piyasa yönünü doğrulayarak ve aşırı satım veya aşırı alım koşullarını arayarak, bu strateji işlemlere daha iyi zamanlama ile girmenize yardımcı olur, başarı şansınızı artırır.

Pocket Option’da Opsiyon Ticareti İçin Göstergeler

Pocket Option’da, kullanımınıza sunulan araçlar sadece temel göstergelerden çok daha fazlasıdır. Ticaretinizi bir sonraki seviyeye taşımanıza yardımcı olan 30’dan fazla güçlü göstergeye erişiminiz var. Fiyat hareketlerini tahmin etmek, trendleri tespit etmek veya riskleri yönetmek mi istiyorsunuz? Bu araçlar size destek olur.

Pocket Option Göstergelerini Öne Çıkaran Nedir?

- 30+ Gösterge: Bollinger Bantları’ndan MACD’ye kadar, piyasayı analiz etmek için çeşitli araçlar kullanabilirsiniz.

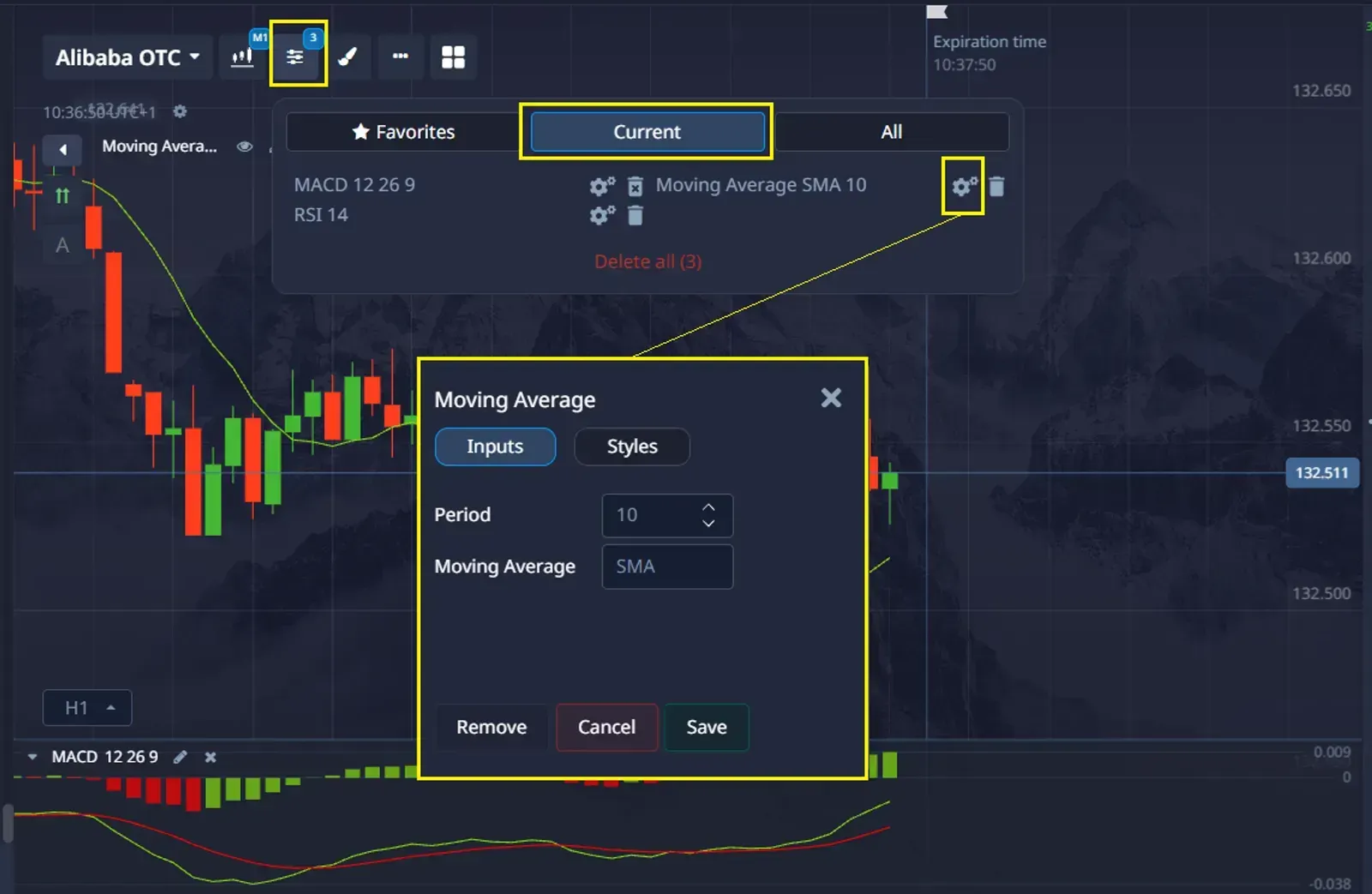

- Favoriler Özelliği: En çok kullandığınız göstergeleri süper hızlı erişim için favorilerinize ekleyin.

- Özelleştirme: Her göstergenin ayarlarını ticaret stratejinize uyacak şekilde ayarlayın.

- Basit Arayüz: Pocket Option’ın kullanıcı dostu arayüzü, dik bir öğrenme eğrisi olmadan bu göstergelere erişimi kolaylaştırır.

Pocket Option’ın Göstergeleriyle Neler Yapabilirsiniz

| Gösterge Türü | Sizin İçin Ne Yapabilir |

|---|---|

| Trend Göstergeleri | Fiyat hareketinin yönünü belirleyin (örn., Hareketli Ortalamalar, ADX). |

| Momentum Göstergeleri | Fiyat değişimlerinin hızını takip edin (örn., RSI, MACD, Stokastik Osilatör). |

| Volatilite Göstergeleri | Fiyat dalgalanmalarını ölçün (örn., Bollinger Bantları, ATR). |

| Hacim Göstergeleri | Hacme dayalı fiyat hareketlerini doğrulayın (örn., OBV, A/D). |

Pocket Option’da Göstergeleri Nasıl Kullanırsınız

Artık göstergelerin ne kadar harika olduğunu bildiğinize göre, işte onları nasıl kullanacağınız:

- Göstergenizi Seçin: Pocket Option platformunda “Göstergeler” bölümüne gidin.

- Grafiğinize Uygulayın: İstediğiniz göstergeye tıklayın ve grafiğinize uygulayın.

- Ayarları Özelleştirin: Göstergenin ayarlarını ticaret stilinize uyacak şekilde ayarlayın.

- Piyasa Koşullarını Analiz Edin: Trendleri, momentumu ve volatiliteyi tespit etmek için göstergeyi kullanın.

- Daha Akıllıca Ticaret Yapın: Bu göstergelerden elde edilen bilgilerle donatılmış olarak, daha bilinçli ticaret kararları alın.

Pocket Option’ın Gizli Sosu: Hızlı Ticaret

Pocket Option’ın ana özelliği Hızlı Ticaret’tir. İşte burası ilginçleşiyor: varlıkları doğrudan alıp satmak yerine, belirli bir süre içinde fiyatın yükselip düşeceğini tahmin ediyorsunuz. Doğru tahmin ederseniz, %92’ye kadar kâr elde edebilirsiniz. Bu, geleneksel opsiyonların tüm karmaşıklıkları olmadan hızlı tempolu, yüksek ödüllü bir ticaret yapma şeklidir.

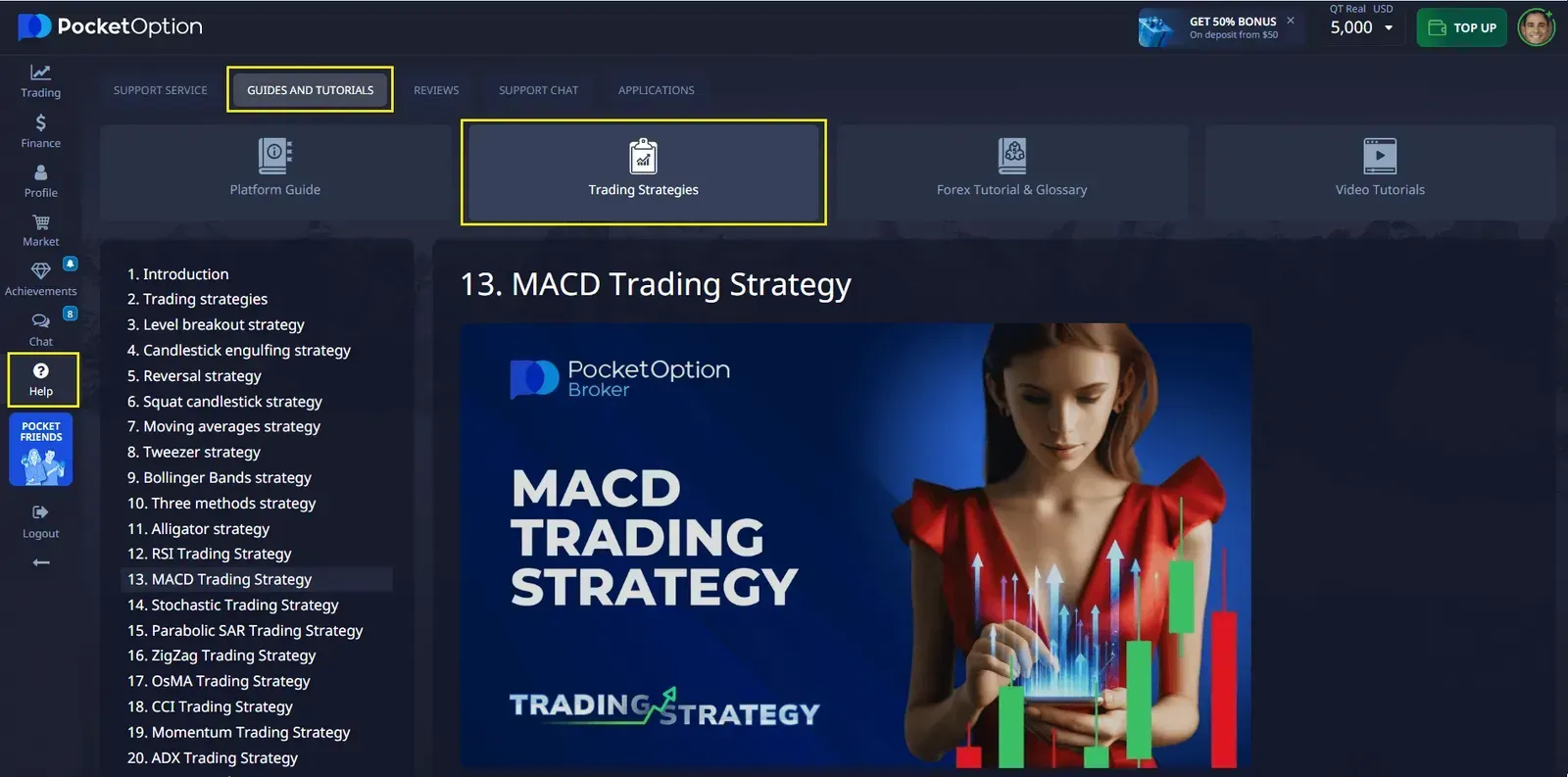

Ticaret Stratejileri Hakkında Daha Fazla Bilgi Edinin

Ticaretinizi bir üst seviyeye çıkarmak mı istiyorsunuz? Pocket Option platformuna gidin ve Yardım bölümünü kontrol edin. Burada, hem temel hem de ileri düzey stratejiler sunan Kılavuzlar ve Öğreticiler bulacaksınız, ayrıca göstergelerin ve diğer temel ticaret araçlarının nasıl kullanılacağına dair video talimatları da bulabilirsiniz.

Pocket Option’ı Mobilde Deneyin

Her zaman hareket halindeyseniz, Pocket Option mobil uygulaması en iyi arkadaşınızdır. Hem Android hem de iOS için mevcuttur ve masaüstü sürümüyle aynı güçlü göstergeler ve grafiklerle hareket halindeyken ticaret yapmanızı sağlar.

Pocket Option Mobil Uygulamasıyla Başlayın:

- Uygulamayı İndirin: Android veya iOS’ta ücretsiz edinin.

- Kaydolun: Pocket Option’da ücretsiz bir hesap için kaydolun.

- Ticarete Başlayın: Uygulamayı kullanarak göstergeleri uygulayın ve nerede olursanız olun varlıkları analiz edin.

FAQ

Opsiyon ticaretinde en güvenilir göstergeler nelerdir?

En güvenilir göstergeler arasında Hareketli Ortalamalar, RSI, MACD ve Bollinger Bantları bulunur, her biri opsiyon ticaretinde belirli analitik amaçlara hizmet eder.

Aynı anda kaç gösterge kullanmalıyım?

Çelişen sinyallerden kaçınmak ve net bir analiz sürdürmek için 2-3 tamamlayıcı gösterge kullanılması önerilir.

Göstergeler piyasa hareketlerini doğru bir şekilde tahmin edebilir mi?

Göstergeler, kesin tahminler yerine olasılığa dayalı sinyaller sağlar. Kapsamlı bir analiz stratejisinin parçası olarak kullanılmalıdırlar.

Opsiyon ticareti göstergelerinde hacmin rolü nedir?

Hacim göstergeleri, fiyat hareketlerini doğrular ve piyasa katılımının gücünü göstererek ticaret sinyallerini doğrulamaya yardımcı olur.

Gösterge ayarlarımı ne sıklıkla düzenlemeliyim?

Gösterge ayarları aylık olarak veya piyasa koşulları önemli ölçüde değiştiğinde gözden geçirilmelidir, ancak sık ayarlamalar önerilmez.