- Deposit the Minimum to Get Started: Start with just $50–100 on a real account. Keep the remaining funds as reserve capital to scale gradually.

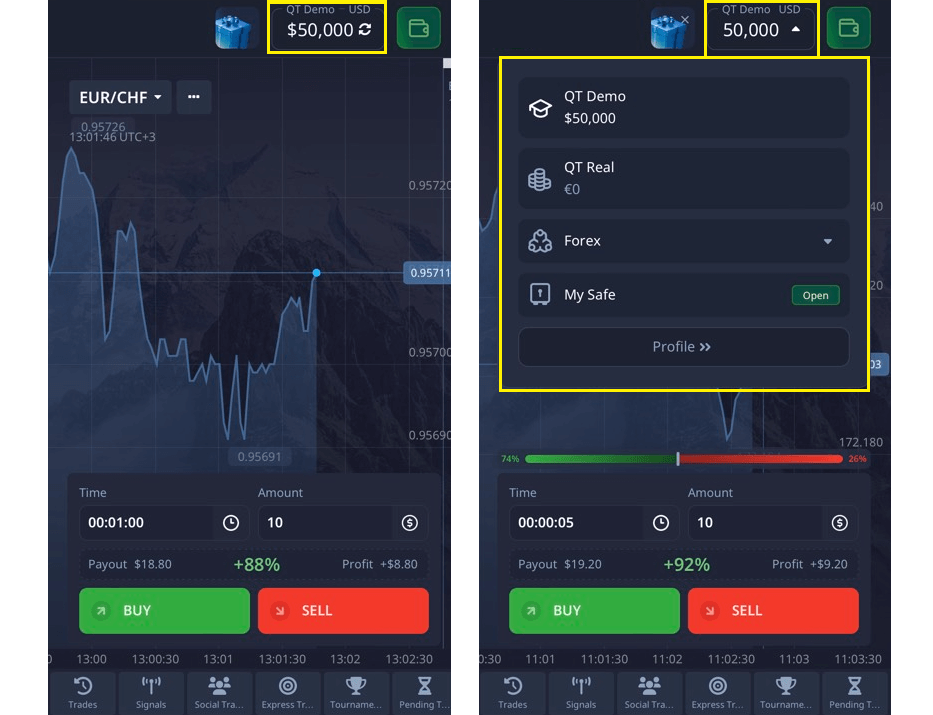

- Practice First, Trade Second: Use the demo account with $50,000 to test indicators and strategies before risking real funds.

- Set Rules for Capital Allocation: Trade with only 2–3% of your capital per position. For a $500 account, this means $10–$15 per trade max.

- Use Short-Term Assets: Trade OTC or volatile assets with fast expiration (15 sec – 5 min) to practice real decision-making.

- Stick to One Strategy at a Time: Choose a method (e.g., RSI + support/resistance) and master it. Don’t jump between systems.

- Keep a Trading Journal: Document every trade — entry, reasoning, result. Review weekly to eliminate emotional decisions.

- Scale Slowly Once You’re Consistent: After at least 20 winning trades at your base size, consider increasing trade amount by 1–2%.

Your First $500 in Day Trading: How to Start Smart and Succeed

Day trading has become accessible to those with modest initial capital. Understanding how to start day trading with $500 — or day trading with 500 dollars — means mastering the fundamentals, managing risk, and sticking to proven methods. In this article, you'll find expert-backed strategies, real-world results, and actionable tools for beginners and intermediate traders on platforms like Pocket Option.

Article navigation

- Understanding the Basics of Day Trading with 500 Dollars

- Real Success Stories

- Step-by-Step Plan: How to Start Day Trading with $500 and Grow Fast

- Essential Tools and Platforms for Day Trading with 500 Dollars

- Example: Opening a Trade on Pocket Option

- Risk Management Strategies for Beginners

- Effective Trading Methods to Start Day Trading with $500

- Key Performance Metrics to Track

- Time Management for New Traders

- What Traders Say About Pocket Option

- Conclusion

- Try the $50,000 Demo Without Risk

Understanding the Basics of Day Trading with 500 Dollars

Starting your trading journey with $500 requires careful planning and strategic execution. Many successful traders began with similar amounts, proving that initial capital size isn’t the primary factor for success. According to Martin Geller, senior market analyst at AlphaEdge Group, “Small capital builds discipline. It forces you to focus on risk, which is the foundation of good trading.”

Real Success Stories

Sarah Chen, a former accountant, started day trading with 500 dollars in 2024. Her systematic approach led to consistent growth over six months.

| Month | Return | Strategy Used |

|---|---|---|

| 1 | 8% | Scalping |

| 3 | 15% | Momentum Trading |

| 6 | 45% | Mixed Approach |

Step-by-Step Plan: How to Start Day Trading with $500 and Grow Fast

Here’s a focused 7-step approach with practical allocation tips:

Essential Tools and Platforms for Day Trading with 500 Dollars

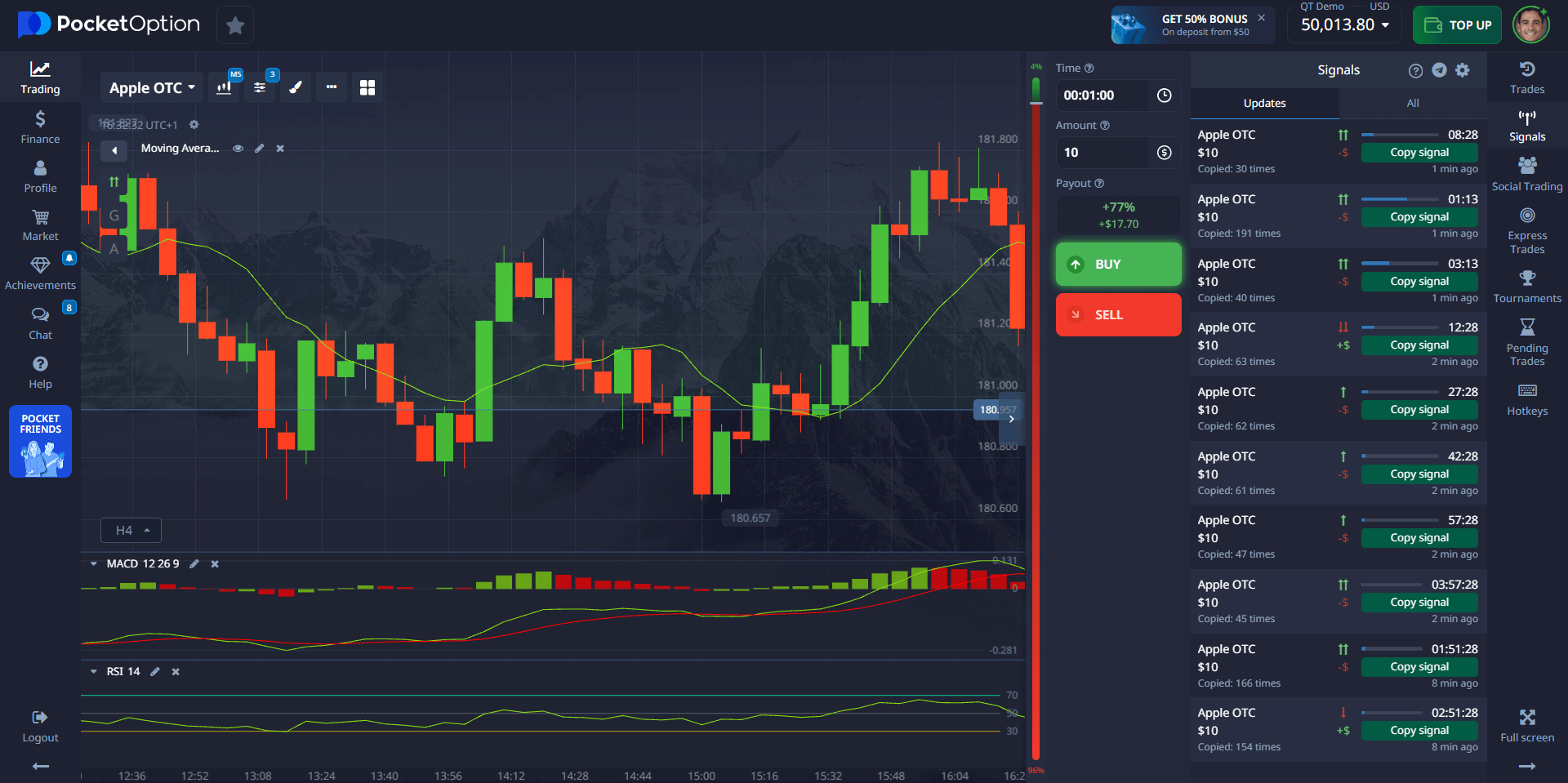

Pocket Option and similar platforms offer user-friendly terminals with key tools for beginners. Successful traders typically utilize:

- Technical analysis indicators (RSI, MACD, Bollinger Bands)

- Risk management calculators

- Market sentiment tools

- Integrated trading journal

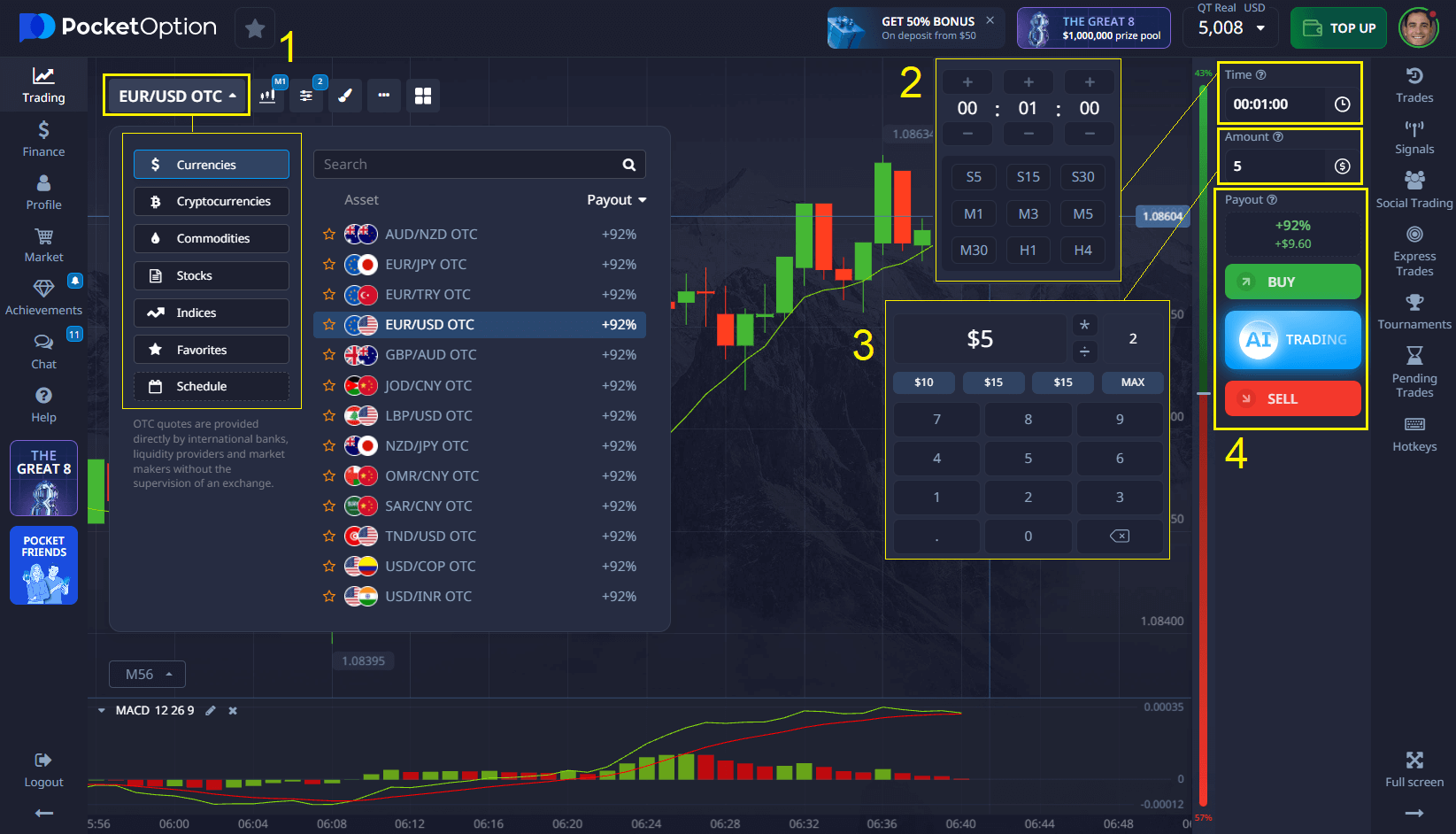

Example: Opening a Trade on Pocket Option

- Select an asset from the trading interface (e.g., EUR/USD).

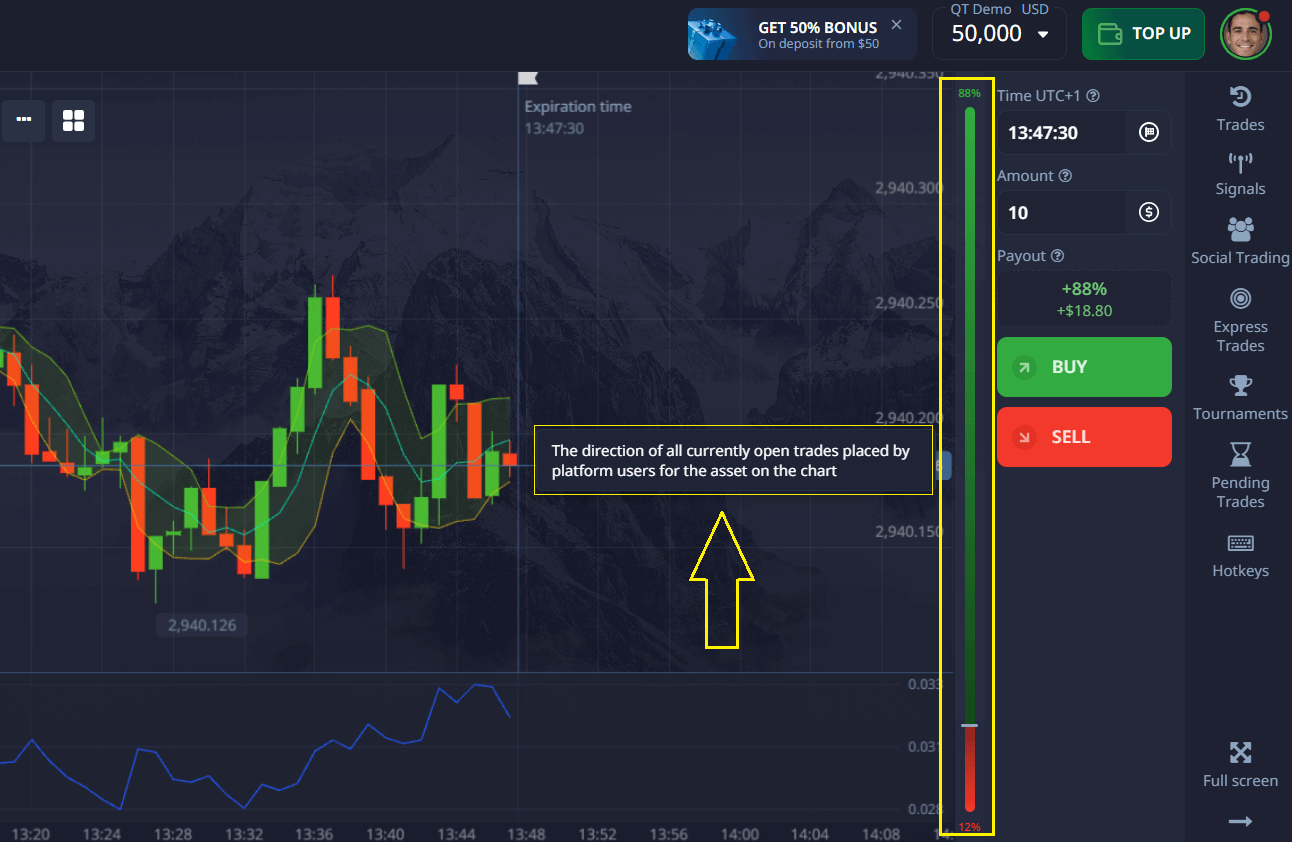

- Analyze the chart using sentiment indicators or technical tools.

- Enter the trade amount — starting from $1.

- Set the trade time — from 5 seconds for OTC assets.

- Predict the direction: press BUY if you expect the price to rise, SELL if you think it will fall.

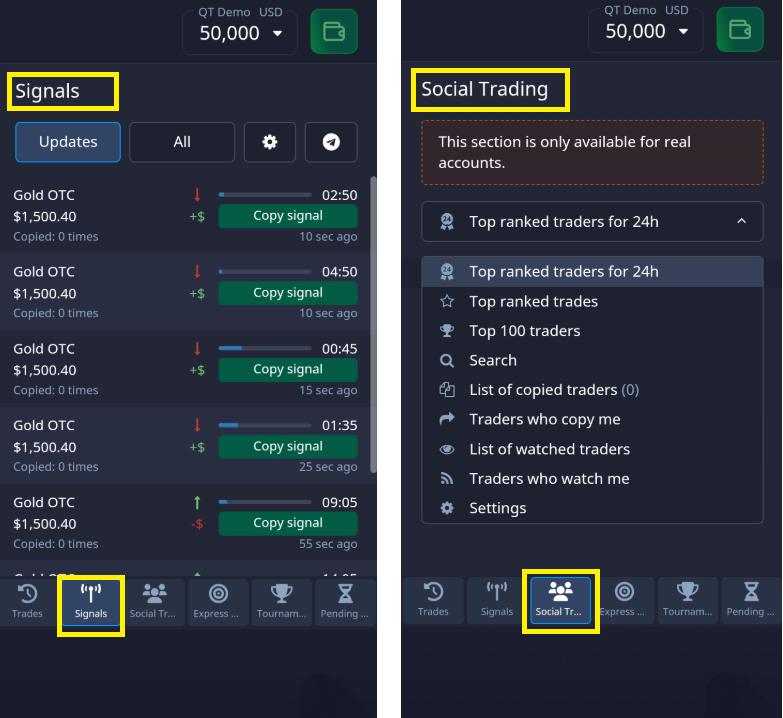

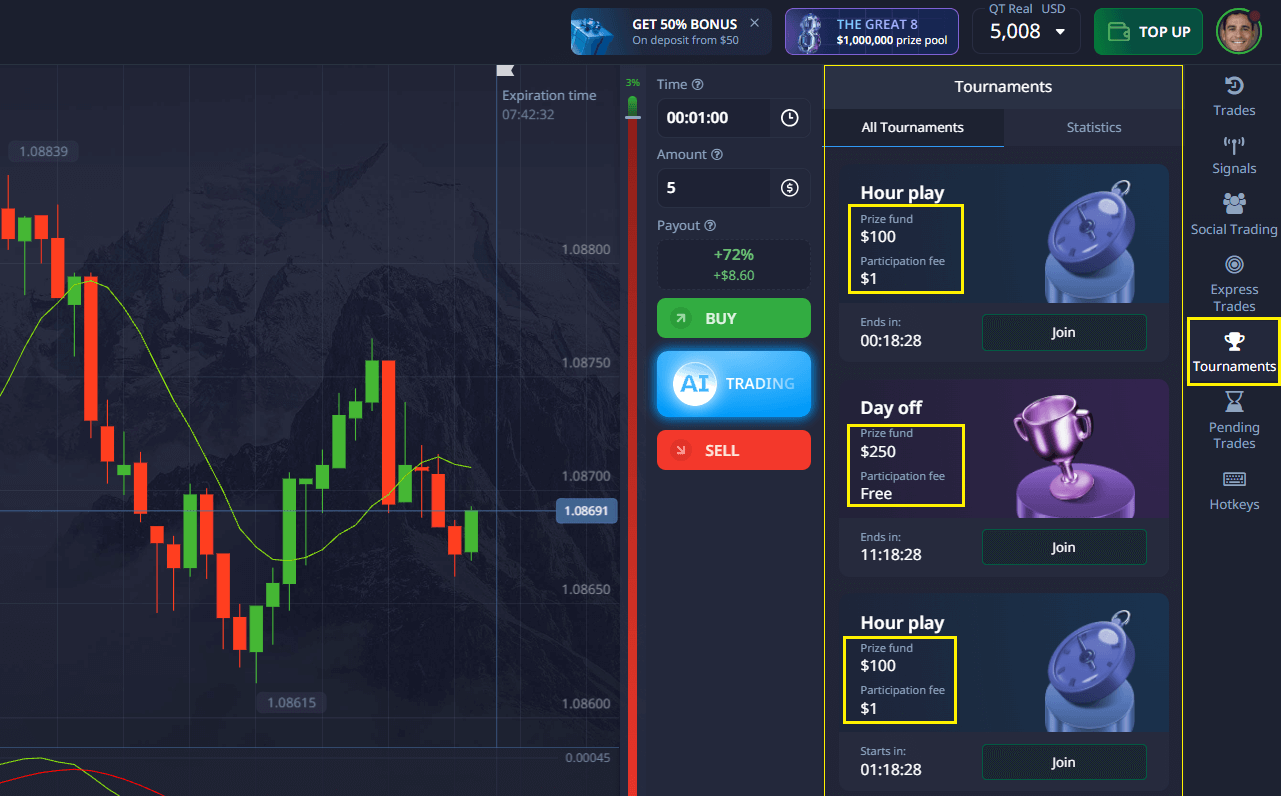

If your prediction is correct, you earn a return — up to 92%, visible in the interface before confirming your trade. On a real account (minimum $5 deposit), additional features include Copy Trading, cashback on trades, and tournaments 👇

Risk Management Strategies for Beginners

| Capital Size | Max Risk per Trade | Suggested Stop Loss |

|---|---|---|

| $500 | $10 | 2% |

| $750 | $15 | 2% |

| $1000 | $20 | 2% |

Expert Tip: “Never risk more than 2% per trade. It’s better to miss a trade than to blow up your capital,” says Elena Horowitz, risk manager at QuantBridge.

Effective Trading Methods to Start Day Trading with $500

Learning how to start day trading with $500 means choosing strategies that match your capital. Start with:

- Breakout Trading — Focus on price breakouts after consolidation.

- Range Trading — Identify and trade support/resistance zones.

- News-Based Trading — Use the built-in economic calendar.

- Pattern Recognition — Look for flags, wedges, and head-and-shoulders.

Key Performance Metrics to Track

| Strategy | Win Rate | Average Return |

|---|---|---|

| Scalping | 60% | 0.5–1% |

| Day Trading | 55% | 2–3% |

| Swing Trading | 45% | 5–7% |

Pro Insight: Pocket Option allows you to test each strategy on a demo account before committing real funds. This is ideal for refining your approach.

Time Management for New Traders

- Market research: 1 hour daily

- Active trading sessions: 2–3 hours

- Post-trade journaling: 30 minutes

⏱️ Consistency beats intensity. Allocate dedicated blocks daily — not all-day screen time.

What Traders Say About Pocket Option

“I started with the demo and moved to real trading in two weeks. The interface is intuitive, and the quick trade execution helped me build confidence.” — David M.

“What I love is the Copy Trading function. I followed two top traders, and in the first month, I had a 17% return. Amazing for someone starting with $10.” — Alina R.

Conclusion

Success in day trading with 500 dollars requires disciplined execution of proven strategies and smart use of tools like those provided by Pocket Option. Documented success stories, expert tips, and careful planning show that $500 can be more than enough to begin a serious

Try the $50,000 Demo Without Risk

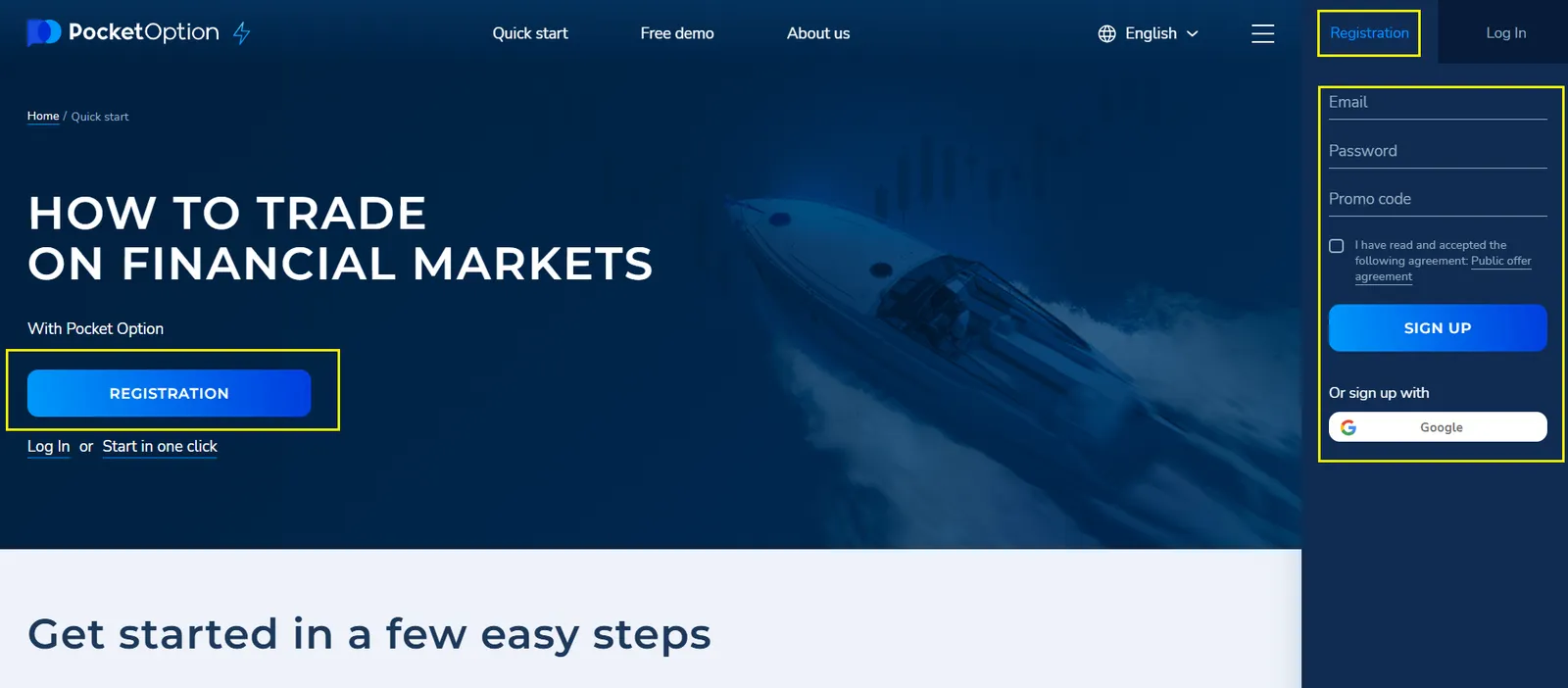

Curious but not ready to go live? Start with a Pocket Option practice account — you’ll get $50,000 in virtual funds immediately after registration.

- Practice your strategy with no risk

- Test indicators and observe how assets move

- Use real charts in demo mode

Once you’re ready, switch to a live account from just $5 to unlock:

- Copy Trading features

- Cashback on trades

- Trading tournaments

- Full platform access

FAQ

What is the minimum time commitment needed for day trading?

Successful day trading typically requires 3-4 hours daily for market analysis, active trading, and review.

Can I start day trading part-time?

Yes, many successful traders begin part-time while maintaining other employment, focusing on specific market hours.

What percentage of $500 should I risk per trade?

Conservative traders recommend risking no more than 1-2% ($5-10) per trade when starting with $500.

Which markets are best for small capital trading?

Forex and cryptocurrency markets often provide good opportunities for small capital traders due to their accessibility.

How long does it take to become profitable?

Most successful traders require 3-6 months of consistent practice to develop profitable strategies, though individual results vary.

How can I start day trading with $500?

Begin by selecting a reliable platform like Pocket Option, practicing on a demo account, then applying risk-managed strategies with a real account starting from just $5.

Is $500 enough to become a profitable trader?

Yes, many traders have built consistent profits starting with small capital. The key lies in education, discipline, and using smart tools.

What’s the safest strategy for beginners?

Trend-following or range-trading strategies with small trade sizes are ideal for new traders.

How can I use Pocket Option to learn trading?

Use the free demo, study their educational center, and test multiple strategies in real time without risking your own money.

Can I copy other traders on Pocket Option?

Yes — once you deposit into a live account, the Copy Trading feature allows you to follow successful traders automatically.