- Total Value Locked (TVL): The TVL in DeFi protocols, which represents the total amount of assets staked and locked in the ecosystem, has surged, reaching over $123 billion in 2025.

- User Growth: The number of unique wallets interacting with DeFi protocols has grown to over 14.2 million by mid-2025.

- Ethereum’s Dominance: Ethereum continues to be the king of DeFi, hosting over 63% of all protocol activity and commanding a TVL of over $78 billion.

Ethereum Price Prediction $100,000: Can ETH Reach This Milestone?

The idea of a single Ethereum coin being worth $100,000 is a concept that captures the imagination of investors and technologists worldwide. Is it a distant dream or a tangible future? This Ethereum price prediction 100000 is more than just speculation; it's an analysis rooted in technological evolution, economic shifts, and expanding adoption. In this comprehensive deep dive, we will explore the fundamental drivers, market dynamics, and technical milestones that could pave the way for ETH to reach this monumental valuation. From the profound impact of its technological upgrades to the explosive growth of decentralized finance (DeFi), we'll dissect the factors that make this a compelling conversation for any serious investor. 📈

Article navigation

- The Fundamental Case: Why $100,000 Isn’t Just a Dream

- Market Cap Analysis: What a $100K ETH Really Means

- DeFi Growth: The Unstoppable Engine of Ethereum 🚀

- Enhanced Technical Analysis and the Road to the Ethereum 100K Target

- How to Engage with Ethereum’s Future on Pocket Option

- Risks and Considerations for Your Blockchain Investment

- A Vision for a Decentralized Future 🌍

The Fundamental Case: Why $100,000 Isn’t Just a Dream

At its core, Ethereum is not just a cryptocurrency; it is a decentralized global computer. This fundamental utility is the primary driver of its value. Unlike Bitcoin, which primarily functions as a store of value, Ethereum’s blockchain allows developers to build and deploy smart contracts and decentralized applications (dApps). This capability has made it the foundational layer for thousands of innovations, including DeFi, Non-Fungible Tokens (NFTs), and Web3 gaming.

A pivotal moment in its history was “The Merge” in September 2022, which transitioned the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This was a critical part of the Ethereum 2.0 impact, delivering two transformative benefits:

Drastic Energy Reduction: The shift to PoS cut Ethereum’s energy consumption by over 99.95%. This addresses major environmental concerns and makes ETH a more attractive asset for ESG-conscious institutional investors. According to Bloomberg, this upgrade positioned Ethereum as the “greenest” major crypto asset, giving it a reputational boost with climate-focused funds.

“Ultrasound Money” Narrative: Under PoS, the issuance of new ETH was slashed dramatically. Combined with the EIP-1559 fee-burning mechanism, which has removed millions of ETH from circulation, the supply can become deflationary during periods of high network activity. This supply-tightening dynamic makes ETH an increasingly scarce asset, a powerful catalyst for price appreciation. “Ethereum may be the first digital asset to achieve negative net issuance while scaling,” noted Chris Burniske, partner at Placeholder VC.

The Ethereum roadmap continues with ambitious upgrades like Pectra, expected in 2025, which aims to further improve efficiency and user experience. These continuous improvements signal a commitment to long-term viability and scalability, reinforcing the bullish case for a significant ETH price forecast.

Market Cap Analysis: What a $100K ETH Really Means

To understand the scale of a $100,000 Ethereum, we must look at its market capitalization. With a circulating supply of roughly 120 million ETH, a price of $100,000 would imply a market cap of approximately $12 trillion.

How does this compare to the world’s largest assets today?

| Asset/Company | Approximate Market Cap (2024-2025) | Implied ETH Market Cap at $100K |

|---|---|---|

| Gold | ~$13-14 Trillion | ~$12 Trillion |

| Apple Inc. | ~$3 Trillion | ~$12 Trillion |

| Microsoft Corp. | ~$3 Trillion | ~$12 Trillion |

| Total Crypto Market (2021 Peak) | ~$3 Trillion | ~$12 Trillion |

Source: Data compiled from various financial reports and market trackers.

This market cap analysis for $100K price reveals that for Ethereum to reach this target, it would need to achieve a valuation comparable to all the gold in the world. While this is an immense figure, it’s not outside the realm of possibility in a future where the digital economy runs on decentralized rails. For Ethereum to become the “trust layer” for global finance, tokenized real-world assets, and the internet of value, a multi-trillion-dollar valuation becomes a logical conclusion. This ambitious $100000 target hinges on Ethereum capturing a significant share of traditional financial markets.

“If Ethereum becomes the backbone of tokenized finance, $100,000 isn’t extreme – it’s a conservative estimate,” said Raoul Pal, former Goldman Sachs executive and founder of Real Vision.

DeFi Growth: The Unstoppable Engine of Ethereum 🚀

Decentralized Finance (DeFi) is arguably Ethereum’s killer application. It aims to rebuild the entire financial system–lending, borrowing, trading, insurance–on the blockchain, without intermediaries. The growth in this sector has been exponential.

DeFi adoption metrics paint a clear picture of this expansion:

This explosive DeFi growth is a direct demand driver for ETH. Every transaction, every smart contract execution, and every dApp interaction on Ethereum requires gas fees paid in ETH. As DeFi expands, the demand for ETH as the network’s native fuel increases, creating sustained buying pressure.

| Metric | 2023 | 2024 | Mid-2025 |

|---|---|---|---|

| Global DeFi TVL | ~$50 Billion | ~$87.5 Billion | ~$123.6 Billion |

| Unique DeFi Wallets | ~49.8 Million | ~83.2 Million | ~14.2 Million* |

| ETH Locked in DeFi | ~$30 Billion | ~$50 Billion | ~$78.1 Billion |

*Note: User metric methodologies can vary between data providers, with some counting total historical users and others counting recent active users.

According to Messari Research, Ethereum’s role as the settlement layer for DeFi has remained dominant despite the rise of alternative L1s. Their 2025 Q2 report emphasized that “Ethereum remains the king of composability, network effects, and developer mindshare.”

Enhanced Technical Analysis and the Road to the Ethereum 100K Target

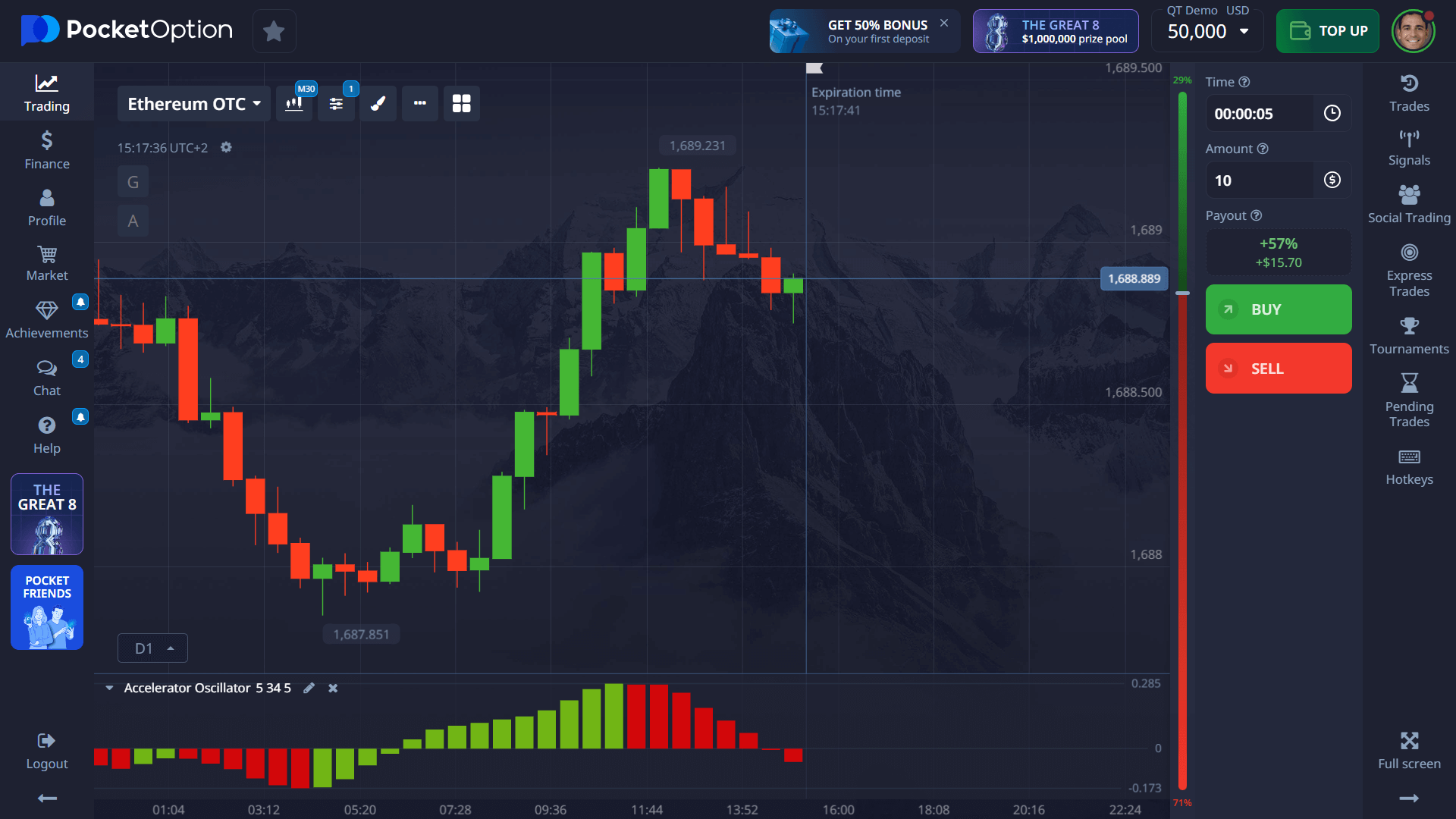

While fundamentals paint the long-term picture, technical analysis helps us map the potential path. The journey to the Ethereum 100K target will not be a straight line. It will be marked by cycles of bullish advances and healthy corrections, defined by key support and resistance levels.

A comprehensive crypto market analysis must consider these technical factors:

- Psychological Levels: Key price milestones such as $10,000, $20,000, and $50,000 will act as significant psychological barriers and support zones. Breaking through these levels will require immense momentum.

- Moving Averages: On a long-term chart, the relationship between the 50-month and 100-month moving averages can help define the macro trend. As long as the price remains above these averages, the long-term bullish structure is intact.

- Fibonacci Retracement/Extensions: After setting new all-time highs, traders will use Fibonacci extension levels to project potential future price targets. A move to $100,000 would represent a significant extension from previous cycle tops.

- Logarithmic Growth Curves: Many analysts use logarithmic regression models to chart the long-term growth trajectory of assets like Bitcoin and Ethereum. These models suggest that while growth may slow in percentage terms over time, the upward trend could continue for many years, making a six-figure ETH prediction plausible over a longer time horizon.

Currently, technical indicators show a bullish long-term trend for Ethereum, with the asset trading above key moving averages and showing strong momentum. However, short-term volatility is always a factor, with pullbacks to support levels like $3,500 being part of a healthy market structure.

As noted by Benjamin Cowen, founder of IntoTheCryptoverse: “A move to $100K ETH requires not just momentum but time. The best fits are post-2030 cycles, assuming macro and liquidity support.”

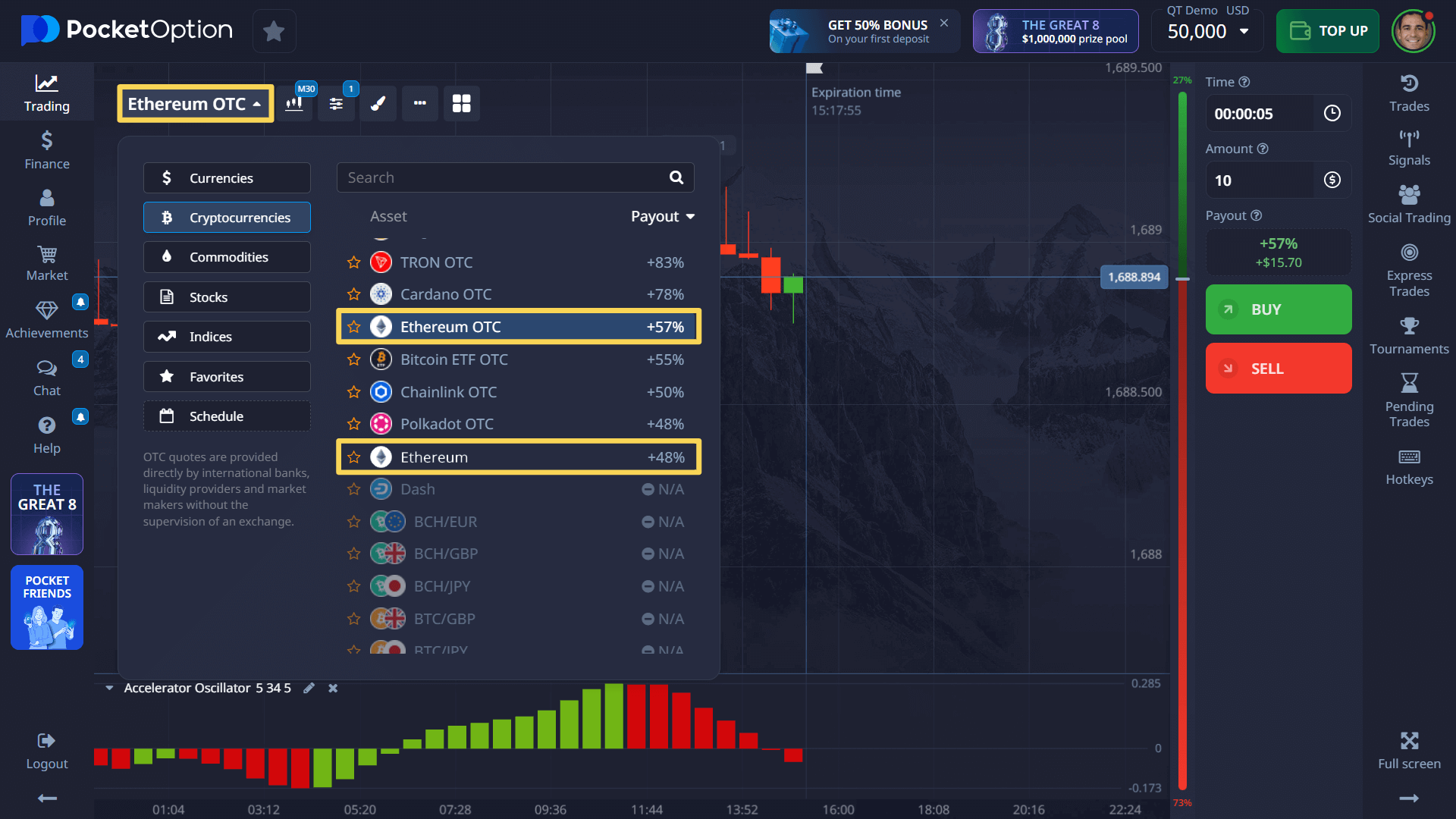

Use built-in technical analysis tools on Pocket Option

How to Engage with Ethereum’s Future on Pocket Option

This long-term Ethereum price prediction 100000 is fascinating, but how can you engage with the market’s movements today? Whether you’re a seasoned trader looking to hedge or a newcomer wanting to explore the world of crypto, having the right platform is crucial.

This is where Pocket Option stands out. It offers a powerful yet user-friendly gateway to the financial markets. For those interested in blockchain investment, Pocket Option provides the tools to act on your market insights. You can start with a minimal deposit of just $5, or practice your strategies risk-free on an unlimited demo account. 💡

The platform isn’t just for crypto; you can trade over 100+ assets, including stocks of popular companies, often 24/7 with OTC assets. This flexibility allows you to build a diversified trading portfolio all in one place.

Practical Strategies and Tools on Pocket Option

Pocket Option is designed to empower traders of all levels. It goes beyond simple buy-and-sell orders by offering a suite of advanced features that can enhance your trading journey:

- Social Trading: New to the market? Use Social Trading to automatically copy the trades of successful, experienced traders. It’s a fantastic way to learn and potentially profit simultaneously.

- AI Trading & Signals: Leverage the power of automation. Use AI-driven algorithms and the Signal Telegram Bot to get trading ideas and execute them with greater efficiency.

- Tournaments & Bonuses: Add a competitive edge to your trading. Participate in tournaments to compete against others and win prizes. Boost your trading capital with generous deposit bonuses and promo codes.

- Mobile App: The market never sleeps, and neither does your opportunity. With the Pocket Option mobile app, you can trade anytime, anywhere. Whether you have a spare minute in traffic or on your lunch break, you can make a forecast and act on it instantly. 📱

Risks and Considerations for Your Blockchain Investment

No honest financial analysis is complete without a discussion of the risks. The path to $100,000 is fraught with challenges, and it’s essential to be aware of them.

- Extreme Volatility: The crypto market is known for its wild price swings. An asset can lose a significant portion of its value in a short period.

- Regulatory Uncertainty: Governments worldwide are still formulating their approach to cryptocurrencies. Unfavorable regulations could stifle innovation and negatively impact prices.

- Technological Competition: While Ethereum is the current leader, numerous other blockchains (so-called “Ethereum killers”) are competing for market share.

- Macroeconomic Headwinds: Global economic factors, such as recessions or shifts in monetary policy, can impact all risk assets, including cryptocurrencies.

A successful blockchain investment strategy involves acknowledging these risks and managing them through diversification, proper position sizing, and continuous education. Platforms like Pocket Option offer learning materials and a demo account to help you build these essential skills. 🛡️

Cathie Wood (ARK Invest) highlighted in a recent interview that “Ethereum is a critical part of the Web3 stack, but it must evolve faster than its competition — Solana, Avalanche, and others are not far behind in developer traction.”

A Vision for a Decentralized Future 🌍

The Ethereum price prediction 100000 is more than a price target; it’s a thesis about the future of technology and finance.

“We’re witnessing the early innings of a shift in financial infrastructure. Ethereum is building the rails,” said Eric Balchunas, senior ETF analyst at Bloomberg.

While some analysts believe the Ethereum 100K target is a post-2030 possibility, the foundational pillars are being laid today. The combination of a deflationary supply, immense network effects, and a thriving developer ecosystem creates a powerful formula for long-term value appreciation.

Expert Recommendation: Traders should watch Layer 2 adoption, ETF inflows, and staking participation rates as leading indicators of Ethereum’s trajectory over the next five years.

For those ready to be part of this financial revolution, the time to learn, practice, and engage is now.

FAQ

Can Ethereum really reach $100,000?

Yes, but it would require massive adoption, institutional investment, and significant market growth.

What would drive Ethereum to $100K?

Key drivers include Ethereum 2.0 upgrades, DeFi expansion, deflationary tokenomics, and mainstream adoption.

How long would it take ETH to reach $100,000?

Analysts suggest post-2030 is a realistic timeline under bullish conditions.

What are the barriers to Ethereum hitting $100K?

Major obstacles include regulatory risks, technical challenges, and competition from rival blockchains.

Is $100,000 Ethereum realistic?

It’s ambitious but not impossible, especially if Ethereum becomes the backbone of tokenized global finance.

What role does Ethereum 2.0 play in price growth?

Ethereum 2.0 enhances scalability, energy efficiency, and supply reduction—key factors in long-term price appreciation.