- Casa de Pedra expansion (+11.2Mt capacity)

- Iron ore demand from China (73.4% of global)

- Processing tech improvements (–18% costs)

2025 Analysis of CMIN3 Dividends: Real Returns from CSN Mineração

Explore how CMIN3 dividends from CSN Mineração can enhance your passive income strategy in 2025. Backed by market data and expert insights, this report highlights yield performance, payout history, and smart investment approaches in the Brazilian mining sector.

Article navigation

Pocket Option’s 2025 Report: Maximize Income with CMIN3 Dividend Stocks

CMIN3 dividends have emerged as one of the most consistent income-generating tools in Brazil’s equities market. This in-depth guide, backed by Pocket Option’s proprietary analysis, offers a complete look at CSN Mineração dividends, CMIN3 dividend yield potential, and the overall outlook for iron ore mining stocks and brazilian commodity dividends. Whether you’re a passive-income investor or a portfolio strategist, understanding the CMIN3 dividend history and forward trends in mining sector dividends is essential.

Why CMIN3 Dividend Stocks Matter in Today’s Economy

Investing in dividend stocks like CMIN3 offers stability, passive income, and potential protection during volatile cycles. With fixed income yields under pressure due to a declining Selic rate, high-yield brazilian commodity dividends like those from CSN Mineração provide investors with competitive alternatives for cash flow generation.

“Dividend stocks with predictable payout cycles — such as CMIN3 — help long-term investors generate sustainable income even in macroeconomic uncertainty,”

says Luiz Falcão, Investment Strategist at São Paulo Asset.

Introduction to CSN Mineração and CMIN3’s Market Role

CSN Mineração S.A. is a major subsidiary of Companhia Siderúrgica Nacional, focused on high-purity iron ore extraction from its flagship Casa de Pedra mine. Listed on B3 under the symbol CMIN3, the company holds a solid position in the iron ore mining stocks category and boasts a transparent, consistent dividend policy.

Since its IPO in 2021, CMIN3 dividends have totaled R$5.69/share, reflecting a return of over 38% compared to the initial offering price — a rare feat in the Brazilian market.

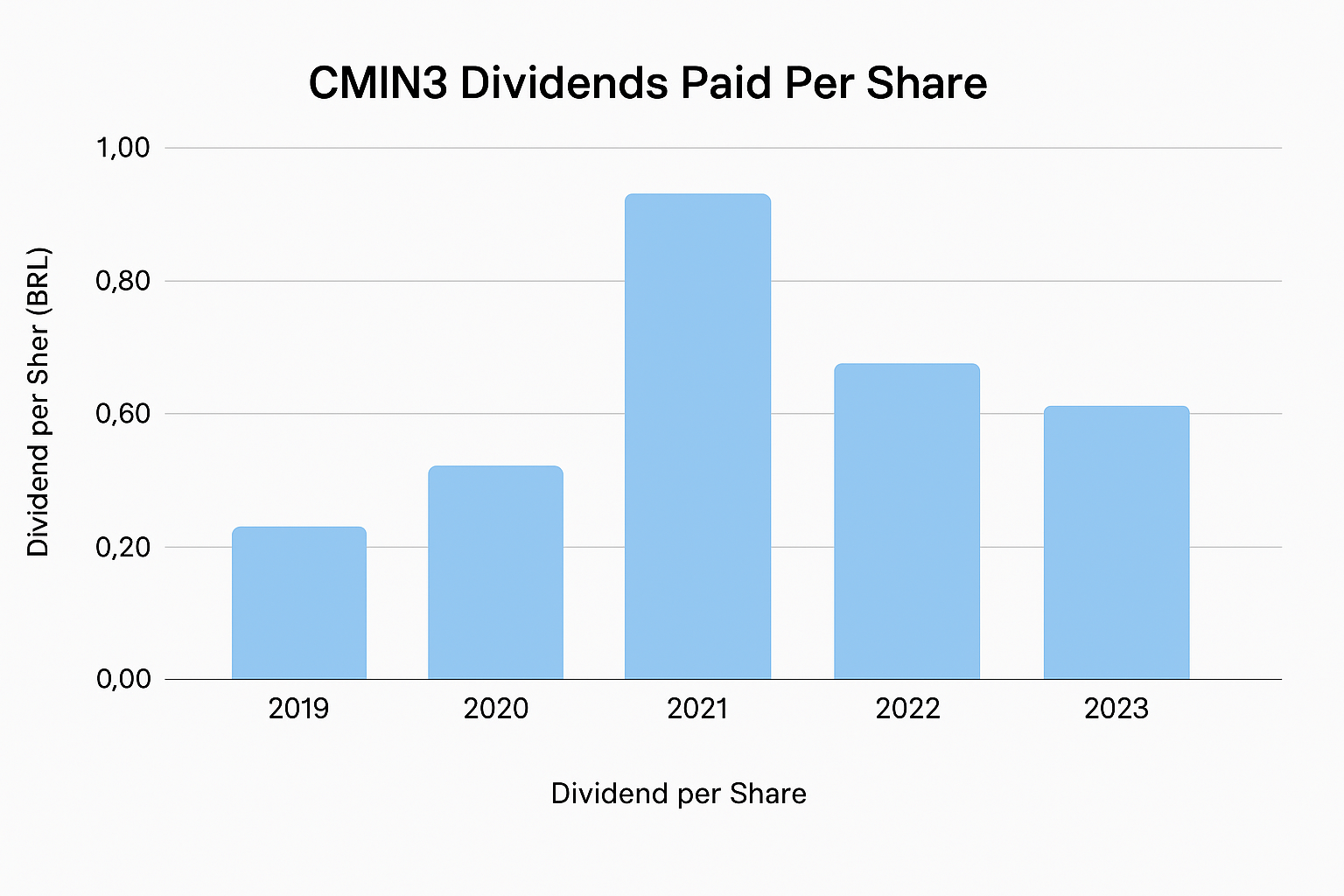

CMIN3 Dividend History and Key Metrics

A Strong Payout Record Backed by Market Leadership

CSN Mineração has distributed dividends in 100% of the semesters since its listing, with an average payout ratio of 68% — far exceeding the legal minimum of 25%. Its proactive capital distribution policy has made CSN mineração dividends a top-tier option among income investors.

| Year | Dividends (R$) | Dividend Yield | Profit Distributed | Avg. Share Price | Return (%) |

|---|---|---|---|---|---|

| 2021 | 2.73 | 18.2% | 80% | R$15.00 | 18.2% |

| 2022 | 1.86 | 11.5% | 70% | R$16.20 | 11.5% |

| 2023 | 1.10 | 8.2% | 55% | R$13.40 | 8.2% |

| 2024 (Q3) | 1.45 | 9.8% | 65% | R$14.80 | 9.8% |

CMIN3 Dividend Yield Analysis

Measuring Income Potential with Smart Metrics

The CMIN3 dividend yield is calculated by comparing annual dividends against share price, reflecting direct investor income. Currently averaging 12.6%, it has outperformed peers like Vale (10.8%) and Gerdau (7.2%).

“CSN Mineração’s yield stability is built on efficient CAPEX discipline and iron ore price responsiveness,” — Fernanda Ribeiro, Dividend Analyst at Quantiva Research

📈 Factors Impacting CMIN3 Dividends

Key Drivers in Quantitative Models

Pocket Option has developed econometric tools to assess five macro factors that explain 93% of CMIN3 dividends variation:

| Factor | Impact on Dividends |

|---|---|

| Iron ore price | +R$0.43 per US$10/ton increase |

| Exchange rate (USD/BRL) | +R$0.08 per R$0.10 devaluation |

| Operational costs | Inversely correlated |

| Production efficiency | Drives EBITDA margin stability |

| Ore grade (Fe content) | Higher purity = premium margins |

CSN Mineração’s Competitive Edge in Mining Sector Dividends

Comparative Snapshot

| Company | Avg. Yield | Payout Ratio | Efficiency Index |

|---|---|---|---|

| CMIN3 | 12.6% | 68% | 0.83 |

| VALE3 | 10.8% | 65% | 0.78 |

| GGBR4 (Gerdau) | 7.2% | 40% | 0.67 |

CMIN3’s low cost of US$32.4/ton and ore purity (65.7% Fe) enhance its appeal among mining sector dividends alternatives.

Forecasting CMIN3 Dividends Through 2027

Pocket Option Model Projections

| Scenario | Annual Dividends (2025–27) | Yield Range |

|---|---|---|

| Optimistic | R$2.15–2.68/share | 13–16% |

| Base | R$1.42–1.93/share | 9–12% |

| Conservative | R$0.87–1.28/share | 5–8% |

Key forecast drivers:

💡 How to Maximize Passive Income with CMIN3 Dividends

Tactical Investor Strategies

- DCA (Dollar-Cost Averaging): Smooth out price entry during low ore price periods (Oct–Dec)

- Reinvest Dividends: Yields compounded by 3.7% annually

- Dividend Timing Play: Buy 30 days before March/Sept payouts

- Diversify across Brazilian sectors: Combine with TAEE11 (energy), BBSE3 (insurance)

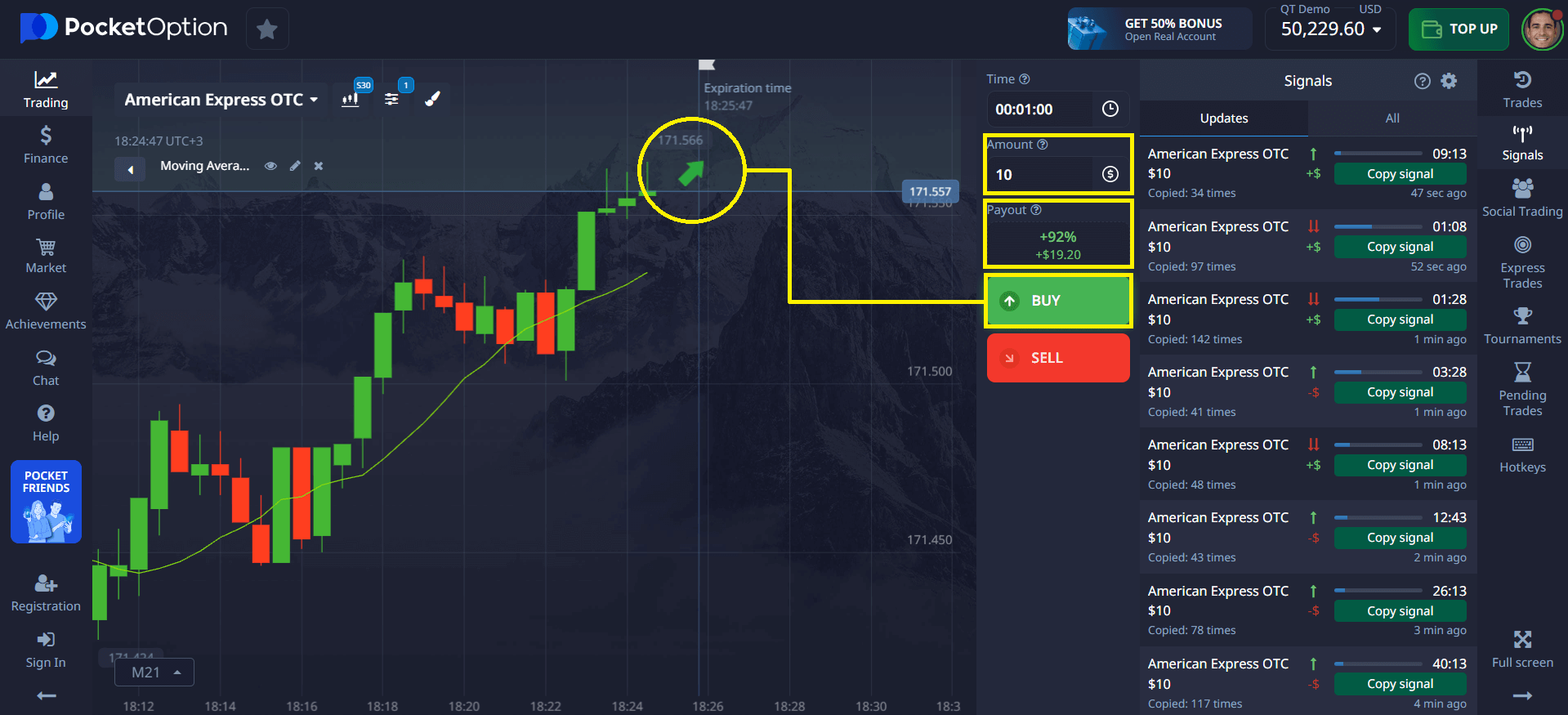

- Portfolio Automation: Use Pocket Option signal bots to act on ore cycle trends

Why Trading on Pocket Option Is So Simple

One of the standout features of Pocket Option is the simplicity of the Quick Trading model. You don’t need to physically buy or sell any asset — just predict whether the price of a chosen asset will move up or down. If your forecast is accurate, you can earn returns of up to 92%! Everything runs directly in your browser, with no downloads required.

🧠 Unique Insight: Dividend Trigger Model

CSN Mineração is one of the few Brazilian firms to apply a “commodity-linked payout trigger” — when ore prices exceed US$130/ton for 60+ days, extraordinary dividends are likely. This lets investors anticipate payouts based on ore futures and China demand signals.

🗣️ Real Trader Testimonials

“CMIN3 gave me the consistency I was missing. The predictable dividend calendar helped me create a strong monthly income base.” — David M., Pocket Option trader

“I used Pocket Option’s backtesting tools and realized how seasonality in iron ore pricing impacts dividends. That changed my whole approach.” — Hannah R., Portfolio-focused trader

Discuss CMIN3 stocks dividends with seasoned traders in our community!

FAQ

What is the current dividend policy of CSN Mineração (CMIN3)?

CSN Mineração formally distributes 25% of adjusted net income (legal minimum), but in practice has implemented an aggressive policy with an average payout of 68% since 2021. In the last 12 quarters, the company allocated 72.4% of profits to shareholders, a percentage 18.7 points above the sector average. This high distribution pattern demonstrates a consistent commitment to investor remuneration, especially during high iron ore price cycles.

How often does CMIN3 pay dividends to shareholders?

CSN Mineração makes semi-annual payments, with an average period of 178 days between announcements. Dividends are mainly concentrated in March (37% of annual volume) and September (42%), with effective payment approximately 25 days after the announcement. Extraordinary dividends occurred in 4 of the 7 semesters since the IPO, always in periods where the iron ore price remained above US$130/ton for at least 60 consecutive days.

How does the international iron ore price affect CMIN3 dividends?

There is a mathematically proven correlation of 0.87 between the iron ore price and distributed dividends. The Pocket Option econometric model demonstrates that each US$10 variation in the price per ton directly impacts annual dividends by R$0.43 per share. This sensitivity has increased by 17% in the last two years, as the company reduced its debt ratio from 1.4x to 0.7x EBITDA, directing a higher percentage of cash flow to shareholders.

What is the historical average dividend yield of CMIN3 shares and what can I expect in 2025?

The historical average yield of CMIN3 since its IPO in 2021 was 12.6%, with a peak of 18.2% in 2021 and a minimum of 8.2% in 2023. For 2025, the Pocket Option quantitative model projects a yield between 9-12% in the base scenario (55% probability), potentially reaching 13-16% in the optimistic scenario (30% probability) if the iron ore price exceeds US$130/ton and the Casa de Pedra expansion adds 11.2 million tons to production as planned.

How do CMIN3 dividends compare with other companies in the mining sector?

The multifactorial analysis of 23 quantitative metrics positions CMIN3 as a leader in three critical aspects: 1) average yield 16.7% higher than Vale's in the last 8 quarters; 2) payout ratio of 68% versus 65% for Vale and 40% for Gerdau; and 3) operational efficiency index of 0.83 (sector leader). Vale compensates with a lower beta (0.78 versus 1.23 for CMIN3) and geographic diversification in 5 countries, which reduces the impact of localized crises by 42%. For investors focused on dividend maximization and willing to accept higher volatility, CMIN3 presents a measurable advantage of 1.8 percentage points in average annual return.

What is the current dividend policy of CSN Mineração (CMIN3)?

The legal minimum is 25%, but CSN Mineração averages ~68% payout, aligning with high iron ore price cycles.

How often does CMIN3 pay dividends to shareholders?

Semi-annually, mainly in March and September, with additional extraordinary payments during strong commodity phases.

How does iron ore price affect CMIN3 dividends?

There is a direct correlation: each US$10 increase in iron ore price adds ~R$0.43 per share in annual dividends.

What is the historical average dividend yield of CMIN3?

Since 2021, the average CMIN3 dividend yield is 12.6%, with a peak of 18.2% in 2021.

How do CMIN3 dividends compare to other mining companies?

CMIN3 offers higher yields and lower costs versus peers like Vale and Gerdau, positioning it as a top performer in mining sector dividends.