- For the Day Trader: The primary benefit is the immediate access to real-time market data and rapid execution. The ability to scalp small price movements using one-click trading and detailed short-term charts is a game-changer.

- For the Swing Trader: The advanced charting tools are invaluable. Swing traders can analyze daily or hourly charts, apply technical indicators to identify multi-day trends, and set precise stop-loss and take-profit orders to manage their positions over several days or weeks.

- For the Long-Term Investor: A portfolio management dashboard provides a clear, consolidated view of all holdings. Investors can track performance, analyze diversification, and use integrated news and analyst reports to make informed decisions about rebalancing their portfolio for long-term growth. 📈

The Ultimate Trading Dashboard: Your Command Center for Market Mastery in 2025

The modern financial market requires sophisticated tools for analysis and decision-making. A trading dashboard represents the cornerstone of successful market operations, combining crucial data streams, analytical tools, and execution capabilities in one interface.

Article navigation

- Introduction into Ultimate Trading Dashboard

- What is a Trading Dashboard? The Trader’s Cockpit

- Core Features: The Engine of the Best Trading Dashboard 2025

- Unlocking Your Potential: Benefits for Every Type of Trader

- Crafting Your Winning Strategy

- Choosing the Right Trading Platform: A 2025 Comparison

- Beyond the Dashboard: An Ecosystem of Success

Introduction into Ultimate Trading Dashboard

In the high-stakes, fast-paced world of finance, every second and every piece of information counts. According to a report by Statista, the number of online trading users is projected to reach over 2 billion by 2028. In this increasingly crowded arena, your edge is your information. Are you ready to seize control of your financial future? The key lies in a powerful trading dashboard, the command center for modern investors and the very tool that can elevate your strategy. For traders looking to get started with an intuitive platform, Pocket Option offers a comprehensive trading dashboard designed to turn market data into profitable decisions.

This guide will delve into what makes the best trading dashboard 2025, how to leverage its features for maximum profit, and why it’s the most critical tool in your trading arsenal.

What is a Trading Dashboard? The Trader’s Cockpit

Think of a trading dashboard as a pilot’s cockpit. It’s a sophisticated digital interface that consolidates all critical flight instruments and data onto a single, manageable market overview screen. As financial thought leader James Clear puts it, “You do not rise to the level of your goals. You fall to the level of your systems.” A trading dashboard is precisely that system for a trader. Instead of navigating multiple windows and platforms, a trader gets a unified view of the market, their portfolio, and potential opportunities.

This trading platform interface is designed to streamline the entire trading process, from analysis to execution. It provides a constant stream of real-time market data, advanced analytical tools, and direct trading capabilities at your fingertips. With features like customizable widgets, interactive charts, and dynamic watchlists, you can meticulously track stocks, ETFs, indices, and currencies, allowing you to react to market shifts with precision and confidence. It’s not just a window to the market; it’s your control panel for navigating it.

📌 Pocket Option has a well-designed interface with easy access to a variety of features and training, trade in a comfortable environment

Core Features: The Engine of the Best Trading Dashboard 2025

A truly effective trading dashboard is more than just a collection of charts. It’s an integrated ecosystem of tools designed to work in harmony. Here’s a breakdown of the essential features that separate a basic platform from a top-tier trading tools interface.

| Feature | In-Depth Description | Why It’s Crucial for You |

|---|---|---|

| Real-Time Data Streaming | Provides instantaneous price quotes, bid/ask spreads, and volume data. A study cited by the Financial Times highlighted that even millisecond delays can erode a significant portion of a high-frequency trader’s potential profits, underscoring the critical need for instantaneous data. | In volatile markets, a few seconds’ delay can be the difference between profit and loss. Real-time data ensures your decisions are based on the absolute latest information. |

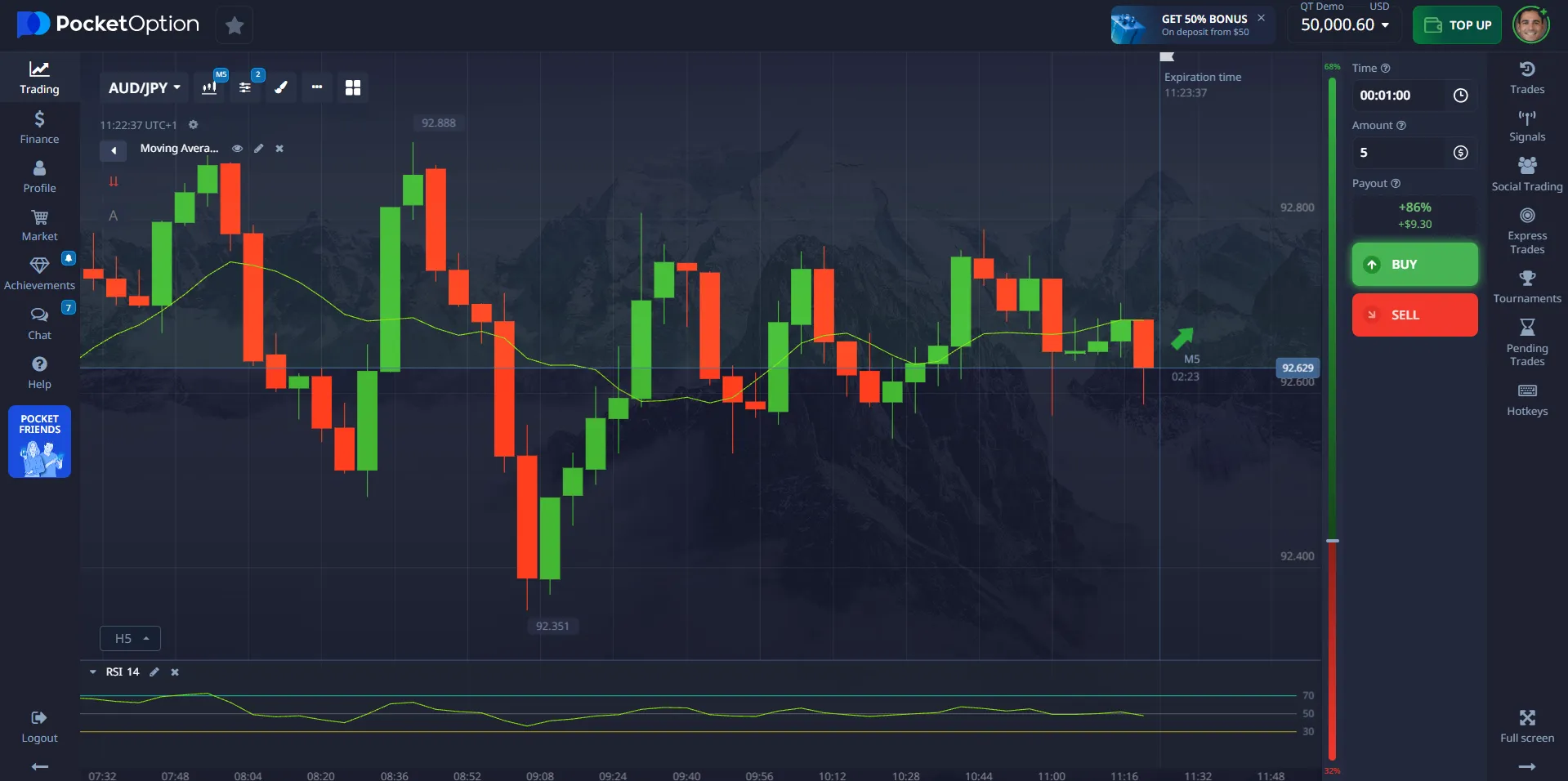

| Advanced Charting Suite | Offers a full range of chart types, drawing tools, and 100+ technical indicators. Market wizards like Paul Tudor Jones have stated that they spend their days “looking at charts,” proving that this visual analysis is the bedrock of professional trading. | This allows for deep technical analysis to identify trends, predict market reversals, and pinpoint exact entry and exit points. It’s the foundation of any robust trading strategy. |

| Customizable Workspace | Enables users to design their own financial dashboard design by arranging widgets, charts, and data feeds. This reduces cognitive load, allowing traders to process information more effectively and make less-fatigued decisions. | Your strategy is unique, and your dashboard should reflect that. Customization puts the information you care about front and center, eliminating noise and improving focus. |

| Direct Investing & Execution | Allows for one-click trade execution directly from the chart or watchlist. Supports various order types like Market, Limit, Stop-Loss, and Take-Profit to enforce a disciplined trading plan. | Speed and efficiency are paramount. Direct execution minimizes slippage and allows you to act instantly on an opportunity without navigating away from your analysis. |

| Integrated News & Analytics | A built-in feed for financial news, economic calendars, and analyst ratings. A true trading analytics platform provides insights without leaving the interface, preventing costly distractions. | Fundamental analysis is just as important as technical. This feature helps you understand the “why” behind market movements and anticipate volatility around key events. |

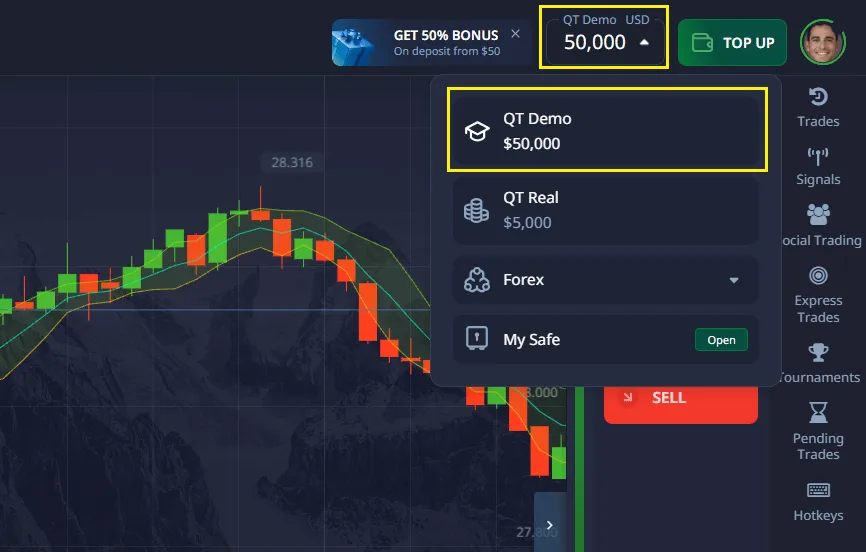

| Demo Account Access | A risk-free environment with virtual funds to test the platform’s features and practice strategies. This is a non-negotiable feature for building what experts call “screen time”–the experience of watching and reacting to live market movements without financial risk. | An unlimited demo account, like the one on Pocket Option, is the perfect sandbox for refining your skills. This is your opportunity to make mistakes and learn from them for free. |

Unlocking Your Potential: Benefits for Every Type of Trader

A state-of-the-art trading dashboard offers tailored benefits that cater to different trading styles and goals. A report from the CFA Institute Journal Review noted that traders who utilize a systematic, tool-based approach consistently outperform those who trade on impulse.

Crafting Your Winning Strategy

A powerful tool is only as good as the strategy behind it. A trading dashboard is the ultimate canvas for developing, testing, and executing your unique approach to the markets.

How to Develop Your Investment Strategy

Building a robust strategy is a methodical process. Renowned trading psychologist Dr. Brett Steenbarger emphasizes that elite performers focus on a repeatable process, not just outcomes. Your dashboard is where you build and execute that process, removing emotional guesswork.

- Define Your Goals and Risk Tolerance: Are you aiming for rapid growth or steady income? How much are you willing to risk per trade? Answering these questions is your foundation.

- Choose Your Market and Assets: Will you trade forex, stocks, commodities, or cryptocurrencies? A platform like Pocket Option offers over 100+ assets, including OTC stocks that allow for 24/7 trading, giving you the flexibility to operate in any market condition.

- Master Your Analysis: Use the dashboard’s charting tools to learn technical analysis. At the same time, keep an eye on the economic calendar and news feeds for fundamental insights.

- Practice in a Risk-Free Zone: This is where a demo account becomes indispensable. Before you invest a single dollar, you can test your strategy with virtual money. Platforms with a low entry barrier, like Pocket Option’s $5 minimum deposit (may vary depending on geo and payment method) and unlimited demo account, are perfect for transitioning from practice to real trading without significant financial pressure. Don’t just learn–practice.

Automating Your Trades for Peak Efficiency

In today’s market, automation is a significant competitive advantage. Bloomberg reports that algorithmic trading, once the exclusive domain of Wall Street giants, now accounts for over 70% of all market volume. Platforms that offer AI and copy trading are democratizing this power for retail investors.

Pocket Option, for example, enhances its trading dashboard with several powerful automation and social features:

- AI Trading: Utilize smart algorithms that analyze market conditions and execute trades based on predefined criteria, ensuring you never miss an opportunity.

- Social Trading: This revolutionary feature allows you to automatically copy the trades of proven, successful traders. The global social trading market is expected to surpass $3.7 billion by 2028, according to Market Research Future, proving that leveraging collective intelligence is one of the fastest-growing trends in finance. It’s an incredible way to learn and earn simultaneously.

- Signal Telegram Bot: Receive real-time trading signals directly to your Telegram app, allowing you to act on expert analysis even when you’re away from your main screen.

Automating processes frees you from having to be glued to your screen, allowing you to focus on the bigger picture of your investment journey. 💡

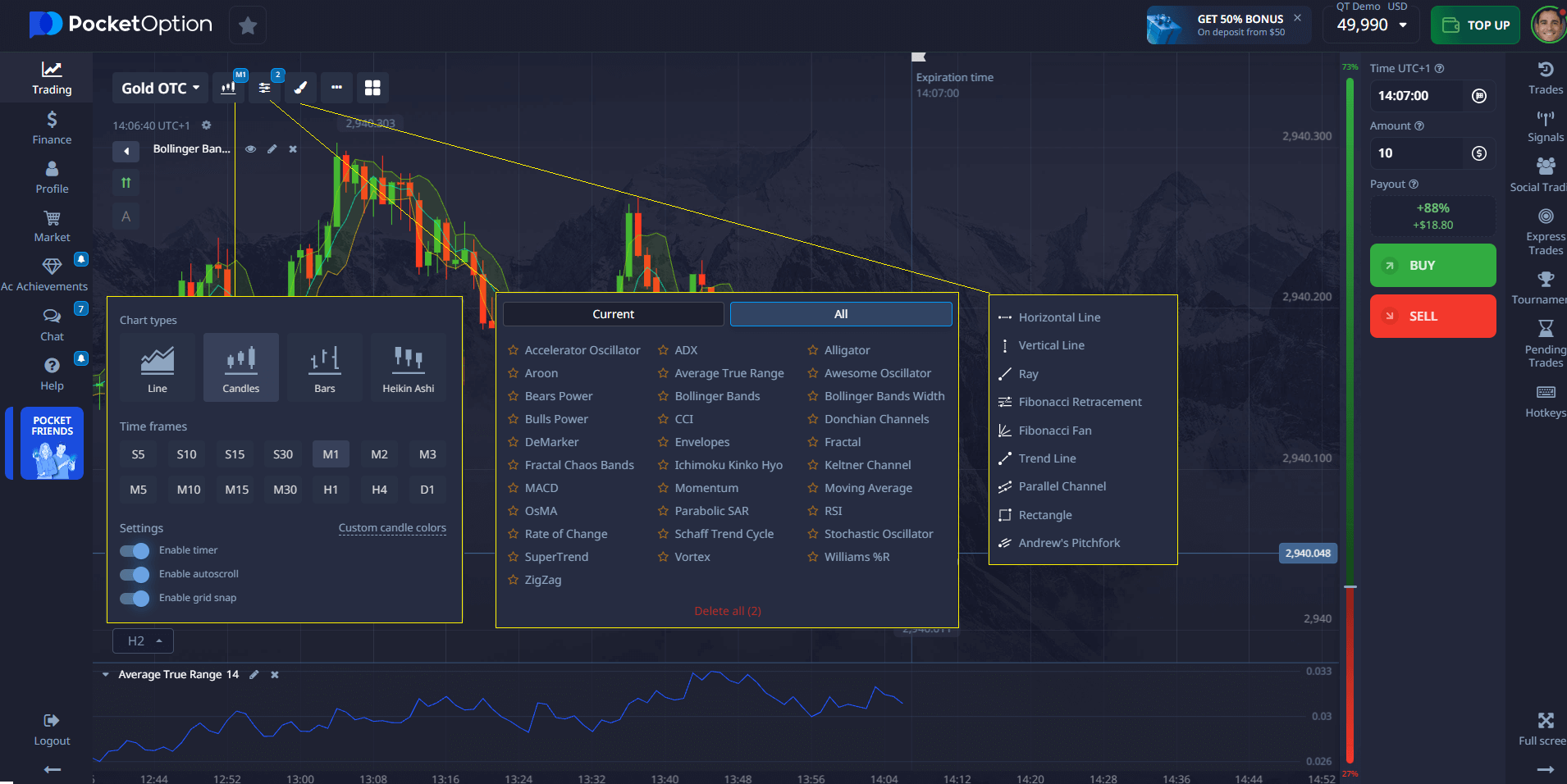

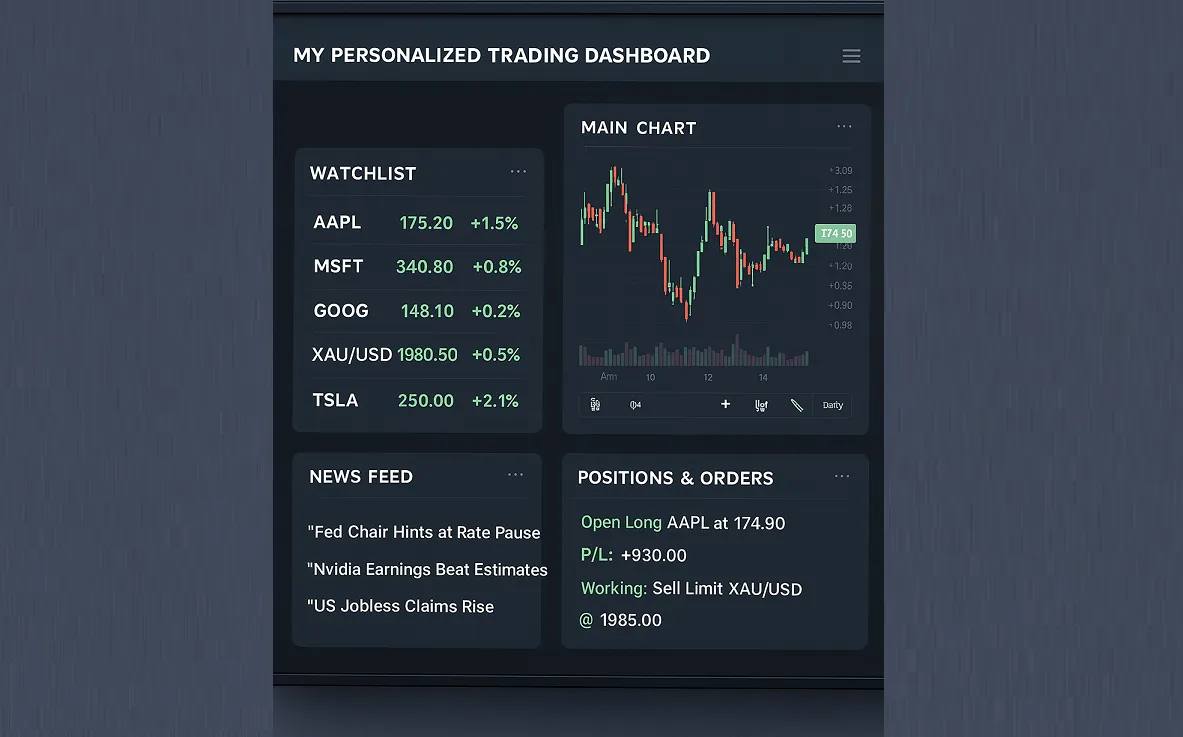

Personalizing Your Dashboard: A Glimpse into a Demo Workspace

The power of a great trading dashboard lies in its adaptability. The goal of financial dashboard design is to create an environment that feels intuitive to you. This isn’t just about comfort; it’s about performance. A well-organized workspace reduces decision fatigue, a major pitfall for active traders.

This mock-up demonstrates how you can arrange your market dashboard to see your favorite assets, analyze a specific chart, monitor breaking news, and track your live positions all at once. This level of personalization is key to efficient and stress-free trading.

Choosing the Right Trading Platform: A 2025 Comparison

Selecting the right platform is the most important decision you’ll make. Forbes Advisor recently highlighted that for 2025, the best platforms are those that combine “low costs, robust educational resources, and advanced technology.” This trifecta is what separates fleeting apps from long-term trading partners.

Here’s a comparative look at some popular platforms for 2025:

| Platform | Minimum Deposit | Key Features | Demo Account | Best For |

|---|---|---|---|---|

| Pocket Option | From $5 | Social Trading, 100+ Assets (24/7 OTC), AI Trading, Tournaments, Bonuses, 50+ Payment Methods, Mobile App. | Yes, Unlimited | Beginners and experienced traders looking for high flexibility, low entry cost, and innovative features. |

| TradingView | $0 | Best-in-class charting tools, massive community and scripting language (Pine Script). Integrates with multiple brokers. | Yes, for charting and paper trading. | Technical analysts and traders who want the most powerful charting tools available. |

| eToro | $50 – $200 | Strong focus on Social and Copy Trading, user-friendly interface, good for stocks and crypto. | Yes, with $100k virtual funds. | Traders focused primarily on copy trading and community interaction. |

| Webull | $0 | Commission-free stock/ETF trading, decent charting tools, strong mobile app, access to IPOs. | Yes, paper trading available. | US-based stock traders looking for a low-cost mobile-first experience. |

While each platform has its strengths, Pocket Option stands out for its accessibility and feature-rich environment. The combination of a tiny $5 minimum deposit, an unlimited demo account, and advanced tools like Social and AI trading creates a platform that truly grows with you–from your first practice trade to complex, automated strategies. Your journey deserves a platform that can keep up with your ambition.

Beyond the Dashboard: An Ecosystem of Success

The best trading dashboard 2025 doesn’t exist in a vacuum. It’s part of a larger ecosystem designed to support your growth. As trading educator Mark Douglas noted, “The best traders have an edge, and they know how to exploit that edge.” A supportive ecosystem helps you find and sharpen your edge.

Pocket Option exemplifies this by building a comprehensive trading environment:

- Tournaments 🏆: Compete against other traders in regular tournaments. It’s a fantastic way to test your skills under pressure, win real prizes, and gain recognition in the community.

- Bonuses and Promo Codes: Get more trading power with deposit bonuses and other promotions, giving you an extra edge in the market.

- Flexible Payments: With over 50 deposit and withdrawal methods, managing your funds is convenient and secure, no matter where you are in the world.

- Learning Materials & Support: Access a wealth of tutorials, guides, and strategies. Combined with responsive 24/7 customer support, you’re never left without help.

- A Powerful Mobile App 📱: The market doesn’t wait. Whether you’re on your way to work or have a spare minute, the mobile app lets you analyze, trade, and profit on the go.

FAQ

What is a trading dashboard?

A trading dashboard is a sophisticated digital interface that consolidates all critical market data, analytical tools, and trading functions onto a single screen. It serves as a trader's command center, streamlining the entire process from analysis to execution by providing a unified view of the market, your portfolio, and potential opportunities.

How to use a trading dashboard?

A trading dashboard is used to develop, test, and execute your trading strategy. This involves defining your financial goals and risk tolerance, choosing your markets, and using the dashboard's charting tools and news feeds for analysis. It is also essential for practicing strategies in a risk-free demo account before committing real funds.

Best trading dashboard features?

Customizing a trading dashboard involves arranging its various components—such as charts, widgets, and data feeds—to suit your unique trading strategy. The goal is to create an intuitive layout that places the information you care about most front and center, which helps to reduce noise and improve focus for better decision-making.

How to customize a trading dashboard?

Customizing a trading dashboard involves arranging its various components—such as charts, widgets, and data feeds—to suit your unique trading strategy. The goal is to create an intuitive layout that places the information you care about most front and center, which helps to reduce noise and improve focus for better decision-making.

What makes a trading dashboard effective?

A trading dashboard becomes effective through real-time data integration, customizable layouts, reliable execution systems, and comprehensive analytical tools that match your trading strategy.

How often should I update my dashboard configuration?

Review and adjust your dashboard configuration monthly or when market conditions significantly change. Regular updates ensure optimal performance and relevance to current trading conditions.

Can I use multiple trading dashboards simultaneously?

Yes, using multiple dashboards can be beneficial for monitoring different markets or strategies. However, ensure your hardware can handle multiple data feeds without performance issues.

What security features should I look for in a trading platform?

Essential security features include two-factor authentication, encrypted data transmission, secure socket layer (SSL) protection, and regular security audits by third-party organizations.

How do I optimize dashboard performance for high-frequency trading?

Optimize by minimizing unnecessary indicators, using efficient data feeds, maintaining strong internet connectivity, and employing powerful hardware with sufficient processing capabilities.

CONCLUSION

The trading dashboard has evolved from a simple price chart into a sophisticated, all-in-one command center. It is the single most important tool for anyone serious about navigating the financial markets. Legendary investor Peter Lynch famously said, "The person that turns over the most rocks wins the game." In the digital age, your trading dashboard is the tool that lets you turn over more rocks, faster and more efficiently than ever before. By providing real-time market data, a powerful trading analytics platform, and a customizable portfolio management dashboard, it empowers you to make faster, smarter, and more profitable decisions. Choosing a platform that not only provides these tools but also supports your growth is paramount. With its low barrier to entry, innovative features like Social Trading, and a commitment to education, Pocket Option offers one of the most compelling and complete trading experiences available today. It’s time to stop just watching the market and start commanding it. Are you ready to build your command center?

Start trading