- 📈 Amplifies position size from 1:1 to 1:1000

- 💹 Supports forex trading, stocks, indices, and commodities

- ⚙️ Adjustable leverage ratios via MT4 and MT5 platforms

- ⚠️ Requires strong risk management strategies

- 🖥️ Available for all accounts–no asset-based leverage limits

Leverage Max Trading: What It Means and How to Use It

Leverage Max on Pocket Option lets traders boost positions up to 1:1000, increasing both potential profits and risks. Learn how to use it strategically.

Article navigation

- What Is Leverage Max Trading?

- Key Features of Leverage Max on Pocket Option

- Why Traders Use Maximum Leverage

- Understanding Leverage Ratios and Margin Requirements

- Setting Up Leverage on Pocket Option

- Choosing the Right Leverage Level

- Risk Management in Leverage Trading

- Analyzing the Market When Using Leverage

- User Reviews: Leverage Max on Pocket Option

- Conclusion: Is Leverage Max Right for You?

What Is Leverage Max Trading?

Leverage Max trading refers to using the highest available leverage–up to 1:1000 on Pocket Option–to control a larger position in the market with a relatively small deposit. The leverage ratio determines how much borrowed capital a trader can use compared to their own funds. For example, a 1:100 leverage ratio means a trader can control $100,000 worth of assets with just $1,000 in their trading account.

📌 Main keyword usage: Leverage Max trading allows traders to engage in high leverage trading, making large trades even with minimal capital.

💬 “Leverage is a double-edged sword. It magnifies both returns and losses. A prudent trader always prioritizes risk control over greed.” — David Finnerty, former currency strategist at Bloomberg.

Key Features of Leverage Max on Pocket Option

Why Traders Use Maximum Leverage

Leverage enables traders to:

- Take larger positions without increasing their deposit

- Use margin trading techniques to optimize capital allocation

- Execute short-term strategies like scalping with higher exposure

However, higher leverage means tighter margin requirements and faster liquidation risks in volatile markets.

📊 According to a 2024 report by Finance Magnates, 71% of traders who used leverage above 1:500 saw increased profitability–but also greater drawdowns. The key difference? Those who succeeded had strict position sizing and risk management protocols.

Understanding Leverage Ratios and Margin Requirements

Here’s a table to illustrate how leverage affects margin:

| Leverage Ratio | Position Size | Required Margin | Minimum Deposit Needed |

|---|---|---|---|

| 1:1 | $1,000 | 100% | $1,000 |

| 1:50 | $50,000 | 2% | $1,000 |

| 1:100 | $100,000 | 1% | $1,000 |

| 1:500 | $500,000 | 0.2% | $1,000 |

| 1:1000 | $1,000,000 | 0.1% | $1,000 |

Formula Reminder:

Required Margin = Position Size / Leverage Ratio

🧮 Example: A trader with a $500 deposit opens a $50,000 trade with 1:100 leverage.

Required Margin = 50,000 / 100 = $500

Setting Up Leverage on Pocket Option

Step 1: Register an Account

- Enter Your Details — Provide a valid email, create a password, and select your preferred currency.

- Confirm Your Email — Check your inbox and click the verification link to activate your account.

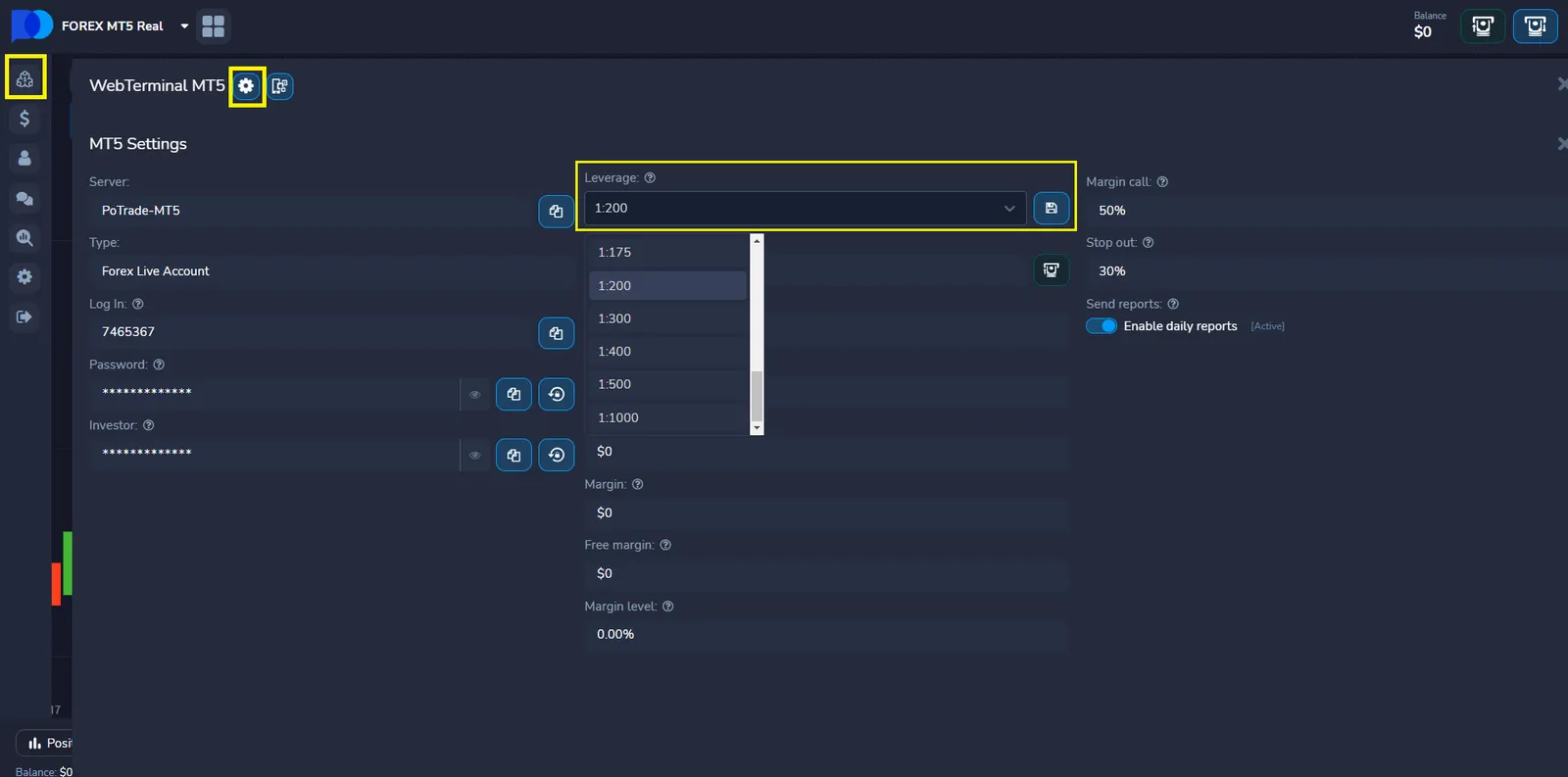

Step 2: Set Up Leverage

Once registered, traders can configure leverage settings directly through the trading panel:

- Log in — Access your newly created Pocket Option account.

- Select a Platform — Open MetaTrader 4 or 5 for forex and CFD trading.

- Navigate to Account Settings — Locate the leverage settings and choose your preferred ratio (1:1 — 1:1000).

- Confirm Changes — Save your settings to apply the selected leverage to your trades.

⚠️ Important: Adjusting leverage influences margin requirements and potential risks. Before making changes, traders should evaluate their strategies and risk tolerance levels.

Pocket Option provides traders with flexible leverage conditions, helping them maximize their capital efficiency in the market.

⚠️ Important: Selecting higher leverage reduces margin requirements but increases exposure to volatility.

Choosing the Right Leverage Level

| Trader Profile | Recommended Leverage | Risk Strategy |

|---|---|---|

| Beginner | 1:10 — 1:50 | Conservative |

| Intermediate | 1:100 — 1:500 | Balanced |

| Advanced | 1:500 — 1:1000 | Aggressive |

Choosing leverage depends on:

- Your trading experience

- Your risk appetite

- Your account balance

- Current market volatility

📝 Pro Tip: If you’re scalping or using high-frequency trading strategies, higher leverage may suit you. For long-term investors, lower leverage ratios are typically safer.

🧠 “New traders often underestimate the power of compounding risk. The smartest leverage users are often those who use less of it.” — Kathy Lien, Managing Director at BK Asset Management.

Risk Management in Leverage Trading

Using maximum leverage brokers requires disciplined risk management:

| Risk Level | Leverage Range | Recommended Stop-Loss (% of Deposit) |

|---|---|---|

| Conservative | 1:1 — 1:50 | 2% |

| Moderate | 1:100 — 1:500 | 5% |

| Aggressive | 1:500 — 1:1000 | 10% |

📌 Risk Management Tools:

- Set stop-loss and take-profit levels

- Monitor your free margin closely

- Diversify trading positions

- Avoid using full account balance per trade

Analyzing the Market When Using Leverage

Pocket Option provides robust tools for traders who use leverage:

- Technical Indicators — for accurate price movement forecasting

- Market Depth Tool — visualizes order book levels

- Volatility Scanner — helps assess ideal leverage ratio in fast-moving markets

- Charting Tools — including Fibonacci retracement, trendlines, candlestick patterns

🧠 Example Use Case: A trader uses RSI and Fibonacci levels to confirm entry on a highly leveraged EUR/USD trade. The indicator suggests a reversal, and the trader applies a 1:500 leverage to maximize the move.

User Reviews: Leverage Max on Pocket Option

| Feature | Average Rating | Highlights |

|---|---|---|

| Leverage Flexibility | 4.8 / 5 | Ranges from 1:1 to 1:1000 |

| Trading Execution | 4.6 / 5 | Fast and reliable order placements |

| Risk Management Tools | 4.2 / 5 | Useful but requires discipline |

| Platform Tools | 4.7 / 5 | Rich technical and market analysis features |

Conclusion: Is Leverage Max Right for You?

Leverage Max trading offers significant benefits to active traders, including higher exposure, increased opportunity for returns, and capital efficiency. However, it’s critical to combine high leverage with robust trading strategies and strict risk management.

If you’re a trader looking to scale your positions, analyze price movement, or explore margin trading opportunities, Pocket Option’s Leverage Max feature gives you all the tools you need–paired with flexibility, advanced charts, and a secure trading environment.

📊 Whether you’re trading forex, commodities, or stocks–leverage amplifies both gains and losses. Choose wisely and always trade responsibly. 🎯 Ready to try Leverage Max trading? Start with a demo account or go live on Pocket Option and experience the power of high leverage trading today!

FAQ

What is leverage max trading?

Leverage Max trading is the use of maximum available leverage (1:1000) to control large market positions with a small deposit.

What’s the risk of high leverage trading?

The risk is increased losses if the market moves against your position. Use stop-loss and risk management.

Is leverage the same for all assets on Pocket Option?

Yes, Pocket Option offers up to 1:1000 leverage across all supported asset classes.

How is margin calculated?

Margin = Position Size / Leverage Ratio.

Can beginners use high leverage?

It's not recommended. Start with lower leverage (1:10 – 1:50) and increase as you gain experience.

What is the maximum leverage available for retail traders?

While Pocket Option offers up to 1:1000, many regulated brokers in the EU or Australia cap retail leverage at 1:30 due to ESMA and ASIC rules.

How does high leverage affect trading risk?

It increases both potential returns and losses. Trades can be liquidated quickly if the market moves against you without sufficient margin.

Which brokers offer the highest leverage ratios?

Offshore brokers like Pocket Option, Exness, and FBS offer leverage up to 1:1000 or more, while regulated brokers often have stricter caps.

What are the regulations on maximum leverage worldwide?

The EU (ESMA) limits leverage to 1:30, Australia (ASIC) to 1:30, and Japan to 1:25. Brokers operating outside these jurisdictions may offer higher leverage.

How to calculate position size with maximum leverage?

Divide your account balance by the margin requirement (Position Size = Account Balance × Leverage Ratio).