- Access to market depth and one-click trading operations

- Over 80 built-in MT5 indicators and graphical tools

- Multi-currency strategy testing using historical data

- Integrated economic calendar

- Flexible trading with 6 order types and 21 timeframes

- Advanced charting tools for precise technical analysis

MT5: Exploring Modern Trading Tools and MetaTrader 5 Features

Explore MetaTrader 5 features to enhance strategies and trade smarter in fast-paced markets.

Article navigation

- What is MetaTrader 5 and How Does This Platform Improve Trading?

- MT5 vs MT4: Key Differences

- How to Access MT5 on Pocket Option

- Technical & Analytical Tools in MT5

- Automated Trading with MT5 Expert Advisors

- Adjusting Leverage on MT5

- Trade Anywhere: Device Compatibility

- Deposits & Withdrawals

- Advantages of Trading with MT5 on Pocket Option

- Conclusion: Why MT5 is the Smart Choice for Today’s Traders

📈 “According to Finance Magnates, over 55% of retail brokers now offer MetaTrader 5 due to its enhanced functionality and growing demand among professional traders.”

What is MetaTrader 5 and How Does This Platform Improve Trading?

MetaTrader 5 is a professional trading platform designed for trading currencies, stocks, indices, commodities, and cryptocurrencies. As the successor to MT4, it introduces expanded capabilities including algorithmic trading, advanced charting, economic news feeds, and built-in strategy testing.

Key MetaTrader 5 Features:

🔗 MT5 is available on Pocket Option: Select it in the platform settings and unlock professional trading tools instantly.

✨ Expert Insight: “The added depth of market (DOM) and integrated fundamental data make MT5 a clear winner for traders who rely on both technical and macroeconomic signals,” says Aaron Grunfeld, analyst at DailyFX.

MT5 vs MT4: Key Differences

| Feature | MT4 | MT5 |

|---|---|---|

| Order Types | 4 | 6 (incl. Buy/Sell Stop Limit) |

| Timeframes | 9 | 21 |

| Market Depth | No | Yes |

| Economic Calendar | No | Yes |

| Multi-Asset Trading | No | Yes |

| Strategy Tester | Single-currency | Multi-currency |

| Execution Speed | Standard | High |

These upgrades make MT5 a truly professional trading platform for traders seeking smarter and faster executions.

⭐ Statistic: “MetaQuotes reports that in 2024 alone, over 80% of new brokerage integrations favored MT5 over MT4.”

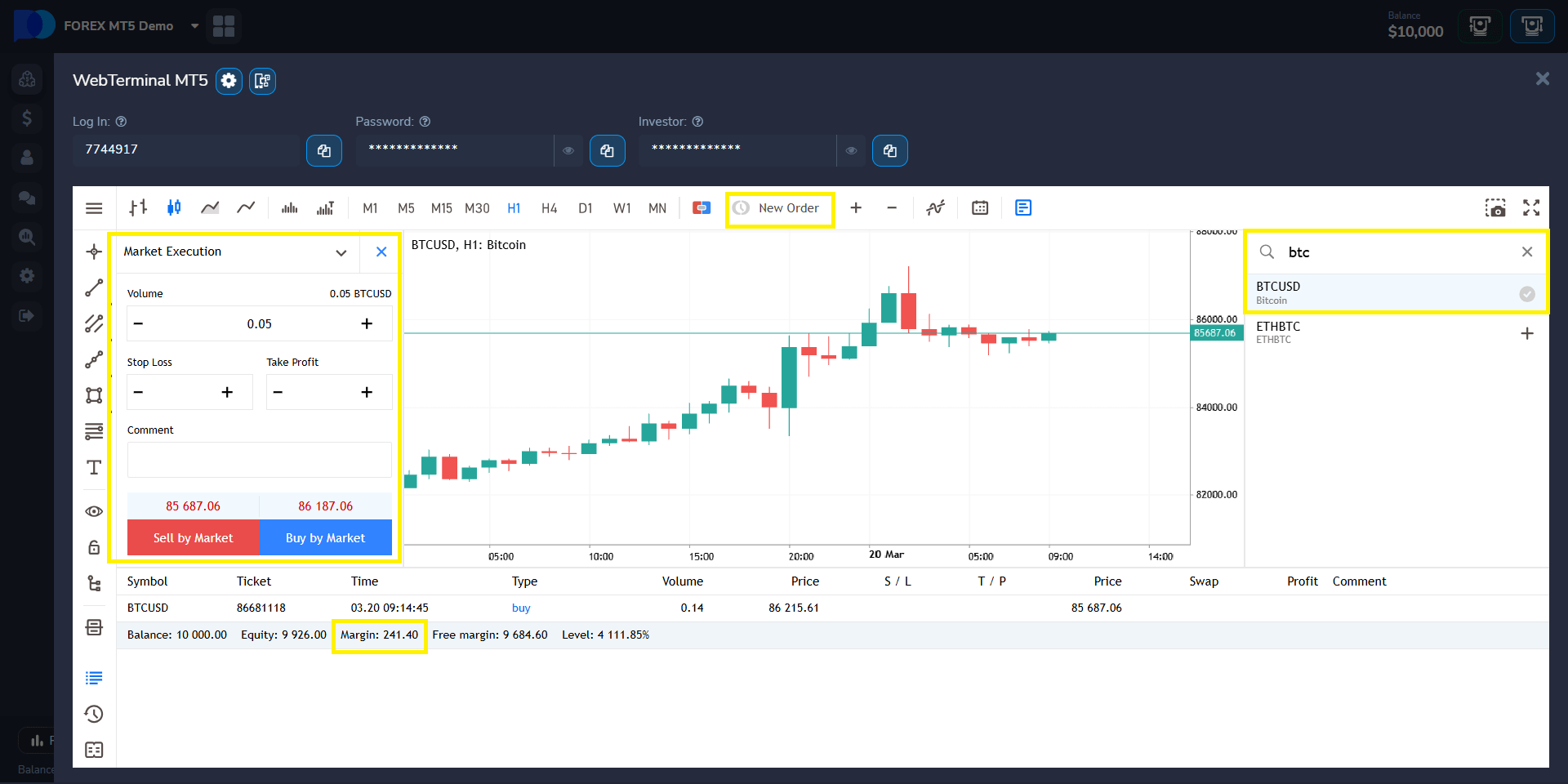

How to Access MT5 on Pocket Option

You can use MetaTrader 5 via:

- Web version (no installation needed)

- Mobile apps for Android/iOS

- Desktop terminal for full-feature functionality

Steps to Get Started:

- Create a Pocket Option account

- Select MT5 in the trading platform options

- Choose an asset and set up charts, indicators, and leverage

- Use trading bots or copy trading tools to automate decisions

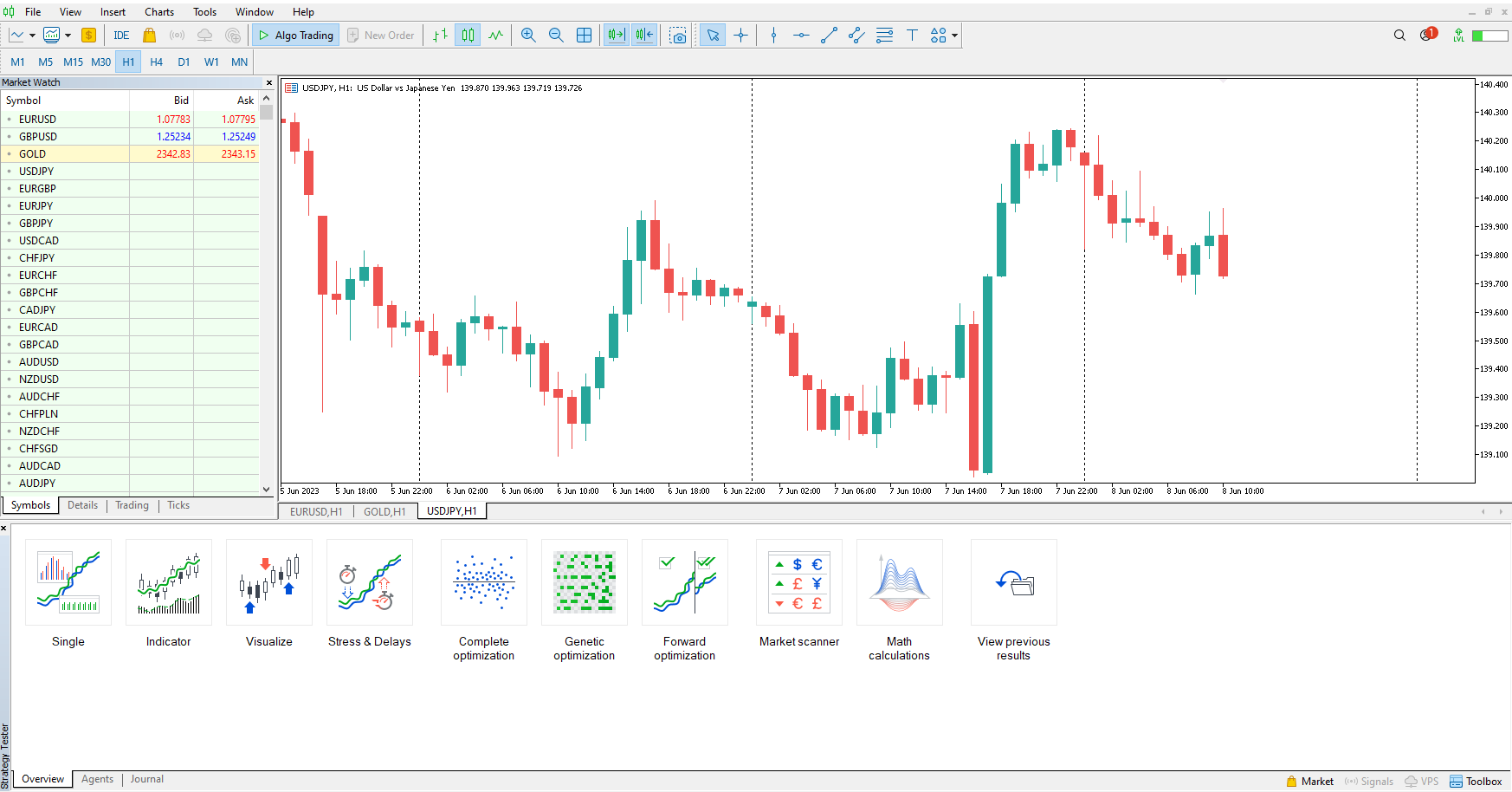

Technical & Analytical Tools in MT5

MetaTrader 5 provides a vast array of analytical capabilities:

Popular Chart Types:

- Line charts

- Bar charts

- Japanese candlesticks

Analytical Tools:

- 80+ built-in MT5 indicators

- Trend tools: moving averages, Bollinger Bands

- Oscillators: RSI, MACD

- Fibonacci levels, pitchforks, Gann tools

- Custom indicators with MQL5 scripting

Example: A trader analyzing USD/JPY may use Bollinger Bands with RSI on a 15-minute chart to time short-term reversals.

🔄 Expert Tip: “Combining trend indicators with volume data can increase entry accuracy by up to 20%,” notes Marina Thorne, portfolio manager at FXStreet.

Automated Trading with MT5 Expert Advisors

Automated trading, or algorithmic trading, is a standout feature:

Benefits:

- Execute trades based on custom-coded strategies

- Operate 24/7 without manual input

- Reduce emotional decisions

- Test performance using backtesting tools

Traders can download bots from the MT5 Market or create their own using MQL5.

🤖 Pocket Option users can use AI trading, signal bots, and even participate in Telegram Signal Bot systems for MT5-based strategies.

✨ Insight: Traders using automation reported a 35% improvement in trading consistency, based on a survey by Traders Union in 2023.

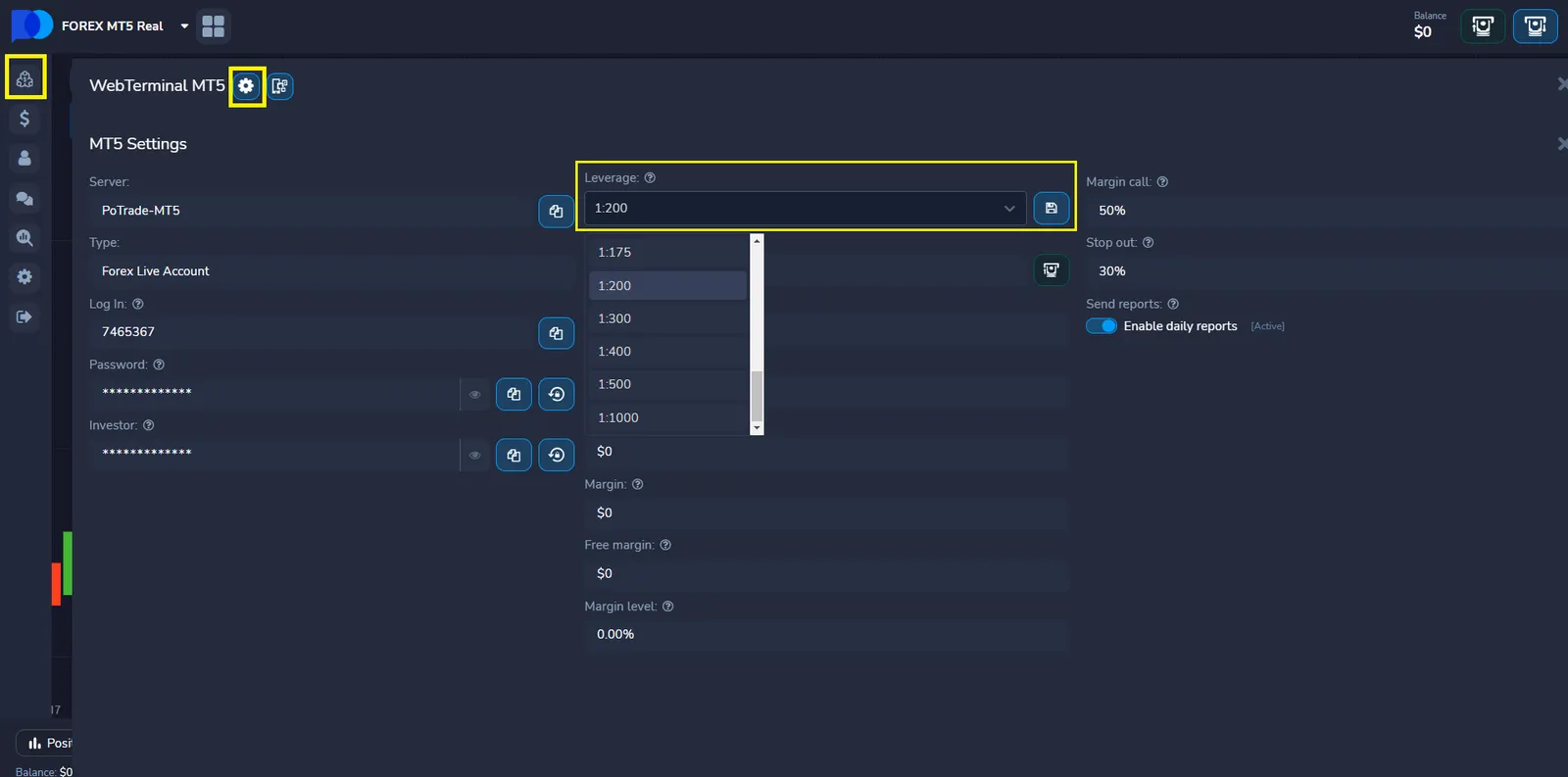

Adjusting Leverage on MT5

Managing leverage is crucial for controlling risk and increasing exposure strategically.

| Step | Action |

|---|---|

| 1 | Go to Account Settings |

| 2 | Select “Change Leverage” |

| 3 | Choose desired ratio (1:1 to 1:1000) |

| 4 | Confirm changes |

Using the right leverage helps balance risk and reward.

Trade Anywhere: Device Compatibility

Whether you’re commuting or working remotely, MT5 keeps you connected:

| Version | Description |

|---|---|

| Web | Browser-based, no download needed |

| Mobile App | Trade on-the-go with Android and iOS support |

| Desktop | Full MT5 capability on Windows/macOS |

Your data is synced in real time, offering seamless multi-device access.

Deposits & Withdrawals

MetaTrader 5 accounts on Pocket Option support convenient payments:

How to Deposit:

- Go to “Deposit“

- Choose one of 50+ payment methods (card, crypto, e-wallets)

- Enter amount and confirm

How to Withdraw:

- Go to “Withdrawal”

- Enter withdrawal amount

- Wait for processing and approval

Advantages of Trading with MT5 on Pocket Option

By choosing MetaTrader 5 on Pocket Option, traders gain access to:

- 100+ trading assets including stocks of top global companies

- Advanced charting and technical tools

- Real-time economic news and analytics

- Social Trading and copy-trading features

- Bonuses and promo codes to boost deposit power

- Tournaments for skill-based competitions

- Reliable customer support and educational materials

🚀 Whether you’re new or experienced, Pocket Option + MT5 offers the flexibility and power you need.

Conclusion: Why MT5 is the Smart Choice for Today’s Traders

MetaTrader 5 isn’t just an upgrade — it’s a complete trading ecosystem. With its robust analytical framework, support for multi-asset trading, and automated trading systems, it delivers unmatched precision, speed, and versatility. On Pocket Option, MT5 becomes even more powerful with integrated tools, seamless interface options, and instant access to global assets.

🔹 Ready to make smarter trading decisions? Switch to MT5 and join the future of intelligent trading today.

FAQ

What's the difference between MT4 and MT5?

MT4 is mainly focused on Forex trading and offers fewer order types and timeframes. MT5 supports multi-asset trading, more indicators, economic calendars, and faster execution.

How to migrate from MT4 to MT5?

You need to open a new MT5 account through your broker (e.g., Pocket Option) and manually transfer trading strategies or use conversion tools for EAs and indicators.

What are the new features in MetaTrader 5?

MT5 introduces market depth, integrated news and economic calendar, 21 timeframes, 6 order types, multi-currency testing, and stock trading capabilities.

How does MT5 handle multiple asset trading?

Through integrated multi-asset support and specialized tools for each market type.

What programming capabilities does MT5 offer?

Comprehensive MQL5 language support for custom indicators and automated trading systems.

Can MT5 support institutional trading needs?

Yes, with professional-grade tools including advanced risk management and portfolio analysis.

How does MT5 compare to other modern platforms?

It offers enhanced technical capabilities and broader market access options.

What security measures does MT5 implement?

Multiple security layers including data encryption and secure authentication protocols.

Can you trade stocks on MetaTrader 5?

Yes, MT5 allows trading not only Forex but also stocks, commodities, and cryptocurrencies — making it a truly multi-asset platform.

Is MetaTrader 5 better than MetaTrader 4?

For traders seeking a more complete and versatile solution, yes. MT5 offers a broader range of tools and faster execution, but some Forex-only traders still prefer MT4's simplicity.