- Riba (Interest): Any guaranteed profit that does not involve risk sharing.

- Gharar (Uncertainty): Ambiguous or highly speculative contracts.

- Maysir (Gambling): Transactions based on pure chance without real economic activity.

Is Pocket Option Halal According to Islamic Finance Principles?

Is Pocket Option halal? Learn how the platform aligns with Sharia principles for Muslim traders.

Article navigation

- Explore Halal Trading Options

- Understanding Islamic Finance Principles and Pocket Option

- What is an Islamic Halal Account in Pocket Option?

- How to Open an Islamic Halal Account?

- Comparison Table: Islamic Halal Account vs Standard Account

- Trading Model on Pocket Option

- Islamic Scholars’ Perspectives on Modern Trading Platforms

- Tips for Successful Islamic Trading

- Final Thoughts: Is Pocket Option Halal?

Understanding Islamic Finance Principles and Pocket Option

Pocket Option offers a Halal Islamic account option that is designed to adhere to the principles of Islamic finance. It eliminates riba (interest), provides transparency to avoid gharar (uncertainty), and is Sharia-compliant in the trading process. This makes it permissible for those who adhere to Islamic principles. Switching between the Islamic and standard accounts is done in the platform settings.

For observant Muslims, evaluating a financial platform’s compatibility with Islamic law is not optional. It is a core part of responsible participation in modern finance.

Islamic finance forbids:

What is an Islamic Halal Account in Pocket Option?

The Islamic Halal Account in Pocket Option is tailored for traders following Islamic finance. It removes interest, avoids speculative elements, and ensures transparency.

How to Open an Islamic Halal Account?

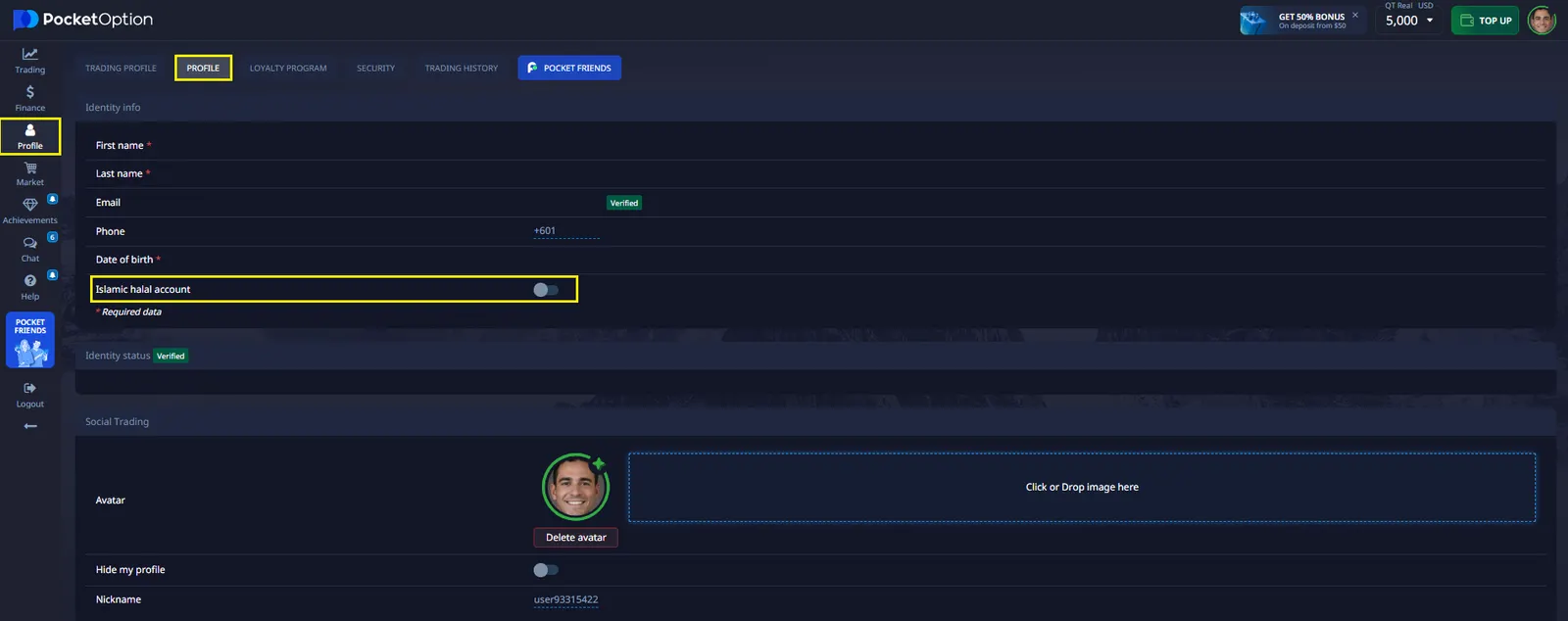

Follow these steps:

- Register an account on Pocket Option.

- Go to your Account Settings.

- Select the Islamic Account option.

- Start trading with Shariah-compliant features.

Activate your Islamic account and the system will automatically configure your account according to the principles of Islamic finance.

Comparison Table: Islamic Halal Account vs Standard Account

| Feature | Islamic Halal Account | Standard Account |

|---|---|---|

| Shariah Compliance | ✅ Yes | ❌ No |

| Riba (Interest) | ❌ Excluded | ✅ Present |

| Gharar (Uncertainty) | ❌ Avoided | ⚠️ Possible |

| Asset Restrictions | ✅ Yes | ❌ No |

| Access to Cryptocurrencies | ⚠️ Limited | ✅ Full Access |

*If you have an Islamic account enabled, some trading assets, including cryptocurrencies, may not be available. To access the full list of assets, you will need to switch your account from Islamic to regular. You can do this by going to your account settings and changing the Islamic account switch.

Trading Model on Pocket Option

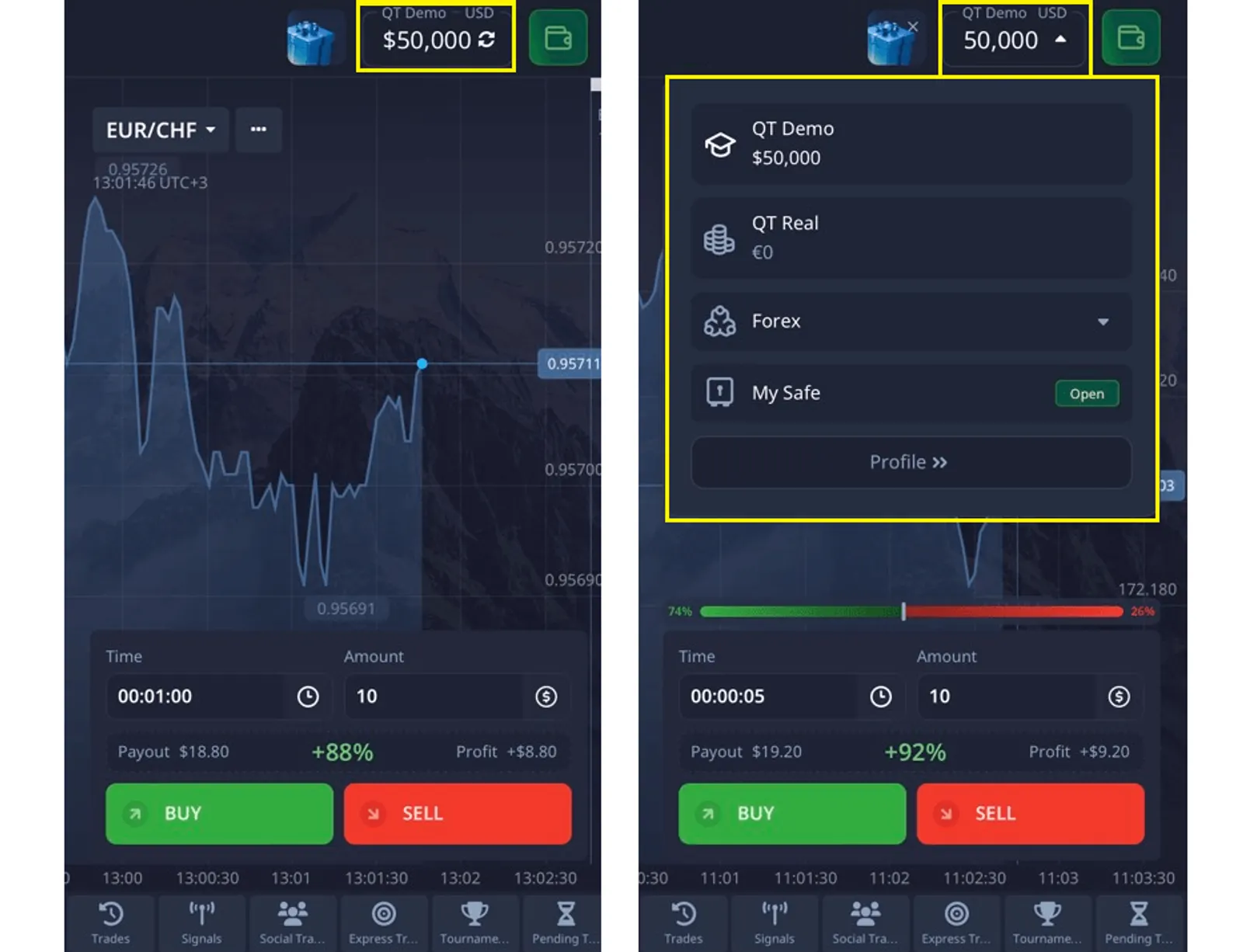

⚡ Main Pocket Option feature: You don’t need to buy or sell assets — you simply forecast whether the price will go up or down. If your forecast is correct, you can earn up to 92% profit. What is the percentage of profit – is known in advance. You can select an asset for trading by sorting assets by this percentage of profitability. The platform is available online through your browser, with no download required. Also use the mobile app right now for Ios and Android! Try on demo!

This quick forecast mechanism is central to Pocket Option’s design and must be assessed from a Shariah perspective for its speculative risks.

Islamic Scholars’ Perspectives on Modern Trading Platforms

Opinions vary:

- Conservative scholars reject most forms of speculative trading as haram.

- Moderate scholars allow limited, non-leveraged trades with asset linkage.

- Progressive scholars examine economic purpose over technical structure.

Notably, Pocket Option does not hold certification from major Islamic finance boards. However, the availability of a dedicated halal account and transparent fee structure may appeal to moderate or progressive viewpoints.

Tips for Successful Islamic Trading

To optimize faith-aligned trading:

- Study Islamic finance basics

- Monitor financial trends

- Use risk management tools

- Leverage educational resources

- Begin with a demo account

Final Thoughts: Is Pocket Option Halal?

The answer depends on the approach you take:

- Using Islamic Halal Accounts with swap-free structure avoids riba.

- Avoiding speculative behavior and choosing trades tied to real markets reduces maysir and gharar.

- However, conservative scholars may still advise caution due to the platform’s predictive trading nature.

FAQ

What makes a trading platform halal or haram?

A trading platform is considered halal when it avoids interest (riba), excessive uncertainty (gharar), and gambling-like speculation (maysir). It should offer transparent fee structures and deal with real assets.

Does Pocket Option offer Islamic accounts?

Yes, Pocket Option provides a swap-free Islamic Halal Account with no interest fees and enhanced transparency.

How can Muslim traders use Pocket Option in a more Shariah-compliant way?

Muslim traders can use Pocket Option's swap-free accounts, trade with their own capital instead of leverage, close positions before overnight fees apply, and focus on instruments connected to real assets.

Are all assets available in the Islamic account?

No, some high-risk or speculative assets (e.g., certain cryptocurrencies) may be restricted.

Can I switch from a standard to an Islamic account?

Yes, switching is available through the platform settings.