- Trade durations starting from 5 seconds

- Instant order execution

- Real-time market data

- Clean, responsive interface

HFX Trading Platforms: Key Features, Top Benefits & How to Get Started

HFX trading focuses on speed and precision. This article covers HFX platforms and why Pocket Option is a top choice.

Article navigation

- What Is an HFX Trading Platform?

- Popular HFX Platforms: A Quick Comparison

- Why Pocket Option Is an Excellent HFX Trading Platform

- Quick Trading – Instant Trade Execution

- Trading Modes Built for Everyone on Pocket Option

- Built-in Analytics and Forecast Tools

- Trade Anywhere, Anytime

- How to Make a Quick Trade on Pocket Option

- Extra Features That Make a Difference

- Conclusion

What Is an HFX Trading Platform?

Quick Definition

An HFX trading platforms enables high-frequency trading, where multiple trades are executed in seconds or minutes. These platforms prioritize execution speed, intuitive tools, and short-term contracts.

Key Requirements

Popular HFX Platforms: A Quick Comparison

| Platform | Features | Best For |

|---|---|---|

| Nadex | Regulated binary and spread trading | Experienced traders |

| IQ Option | Simple design with short-term trades | Beginners |

| Binary.com | Custom contracts, volatility indices | Intermediate traders |

| Pocket Option | Fast execution, social trading, express mode | All skill levels |

Why Pocket Option Is an Excellent HFX Trading Platform

Pocket Option combines professional tools with intuitive usability. Whether you’re a complete beginner or an active trader, this platform adapts to your pace and strategy.

Quick Trading – Instant Trade Execution

⚡Speed matters in HFX. Pocket Option’s ultra-fast execution lets you place trades that start from just 5 seconds.

| What It Is | How to Start | Benefits |

|---|---|---|

| Pocket Option processes Quick Trading at market price | Log in, choose asset, set trade duration and amount, click BUY or SELL | Enables real-time reaction to market movements and reduces slippage risk |

This is especially valuable in volatile markets where timing is everything. With no download required, you can trade instantly from your browser or mobile.

Trading Modes Built for Everyone on Pocket Option

Pocket Option provides flexible trade setups to suit different preferences and levels of experience.

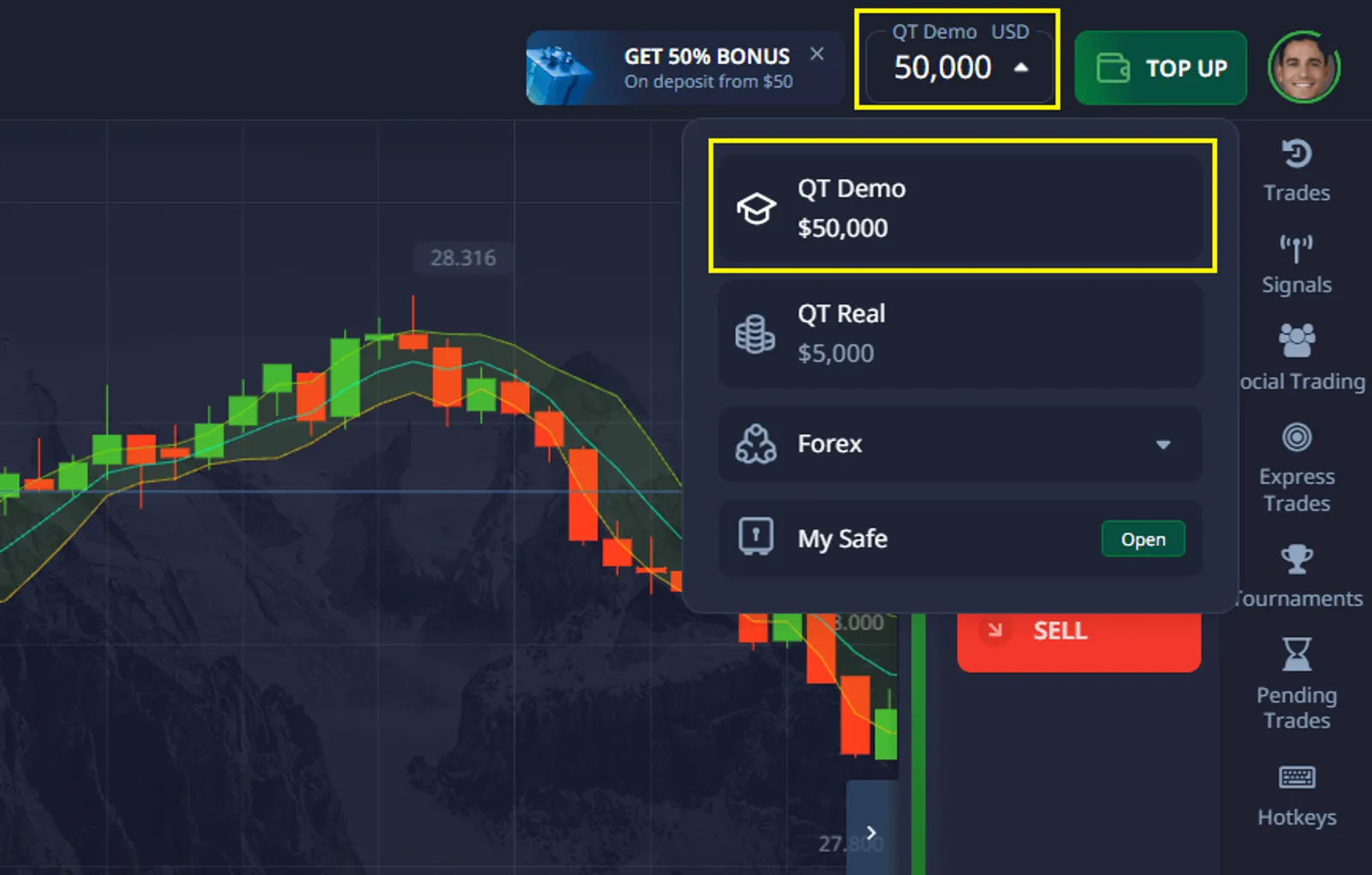

1. Demo Trading

| What It Is | How to Start | Benefits |

|---|---|---|

| A risk-free way to practice trading with virtual funds | Sign up and access demo account from the dashboard | Perfect for beginners to test strategies and learn the platform |

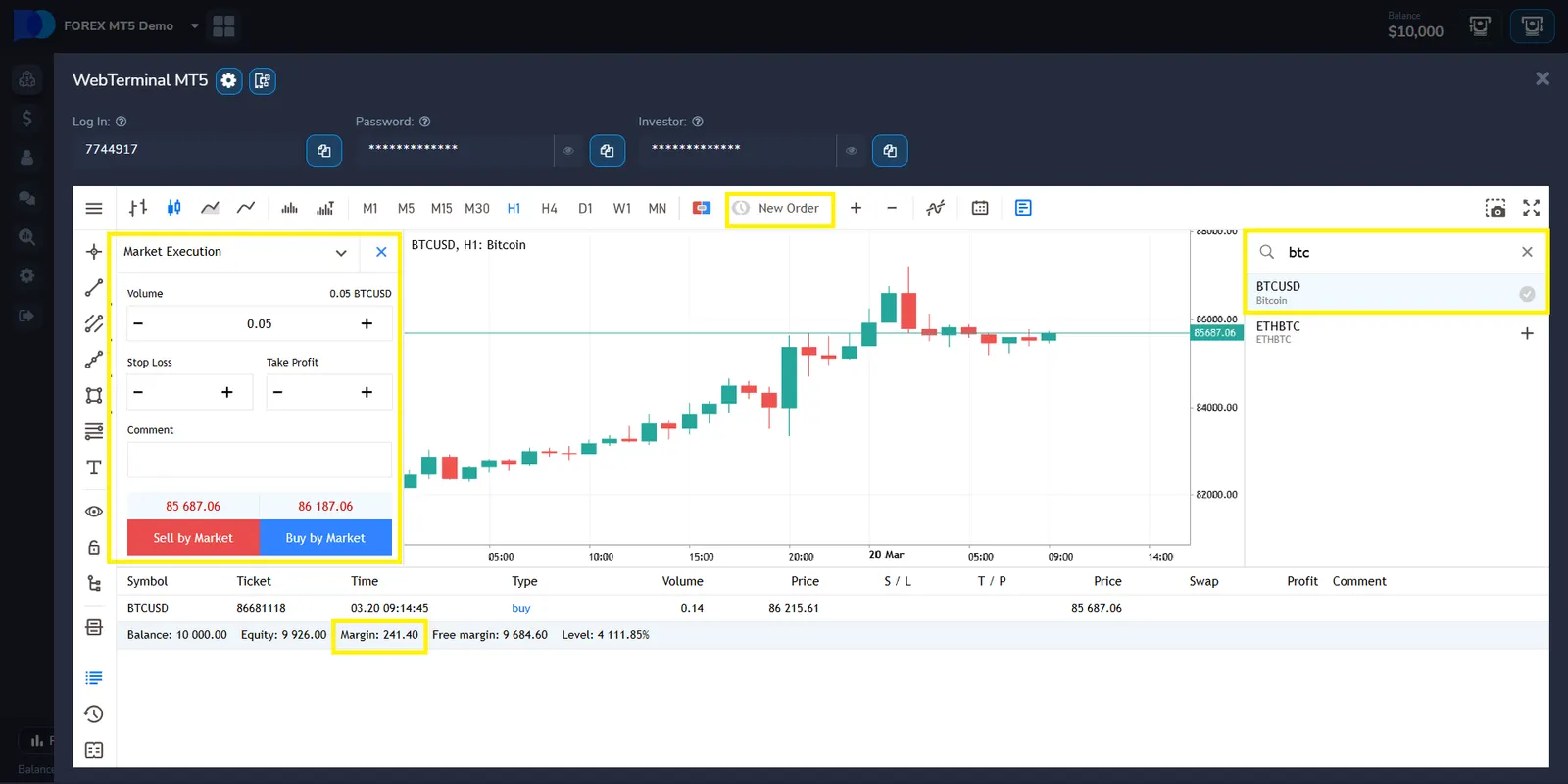

2. MetaTrader

| What It Is | How to Start | Benefits |

|---|---|---|

| Professional platform integrated with Pocket Option, supports Forex & CFDs | Sign up on Pocket Option, open MT5 or MT4 from Pocket Option website and log in with your account | Advanced charting tools, multiple timeframes, algorithmic trading, full technical suite |

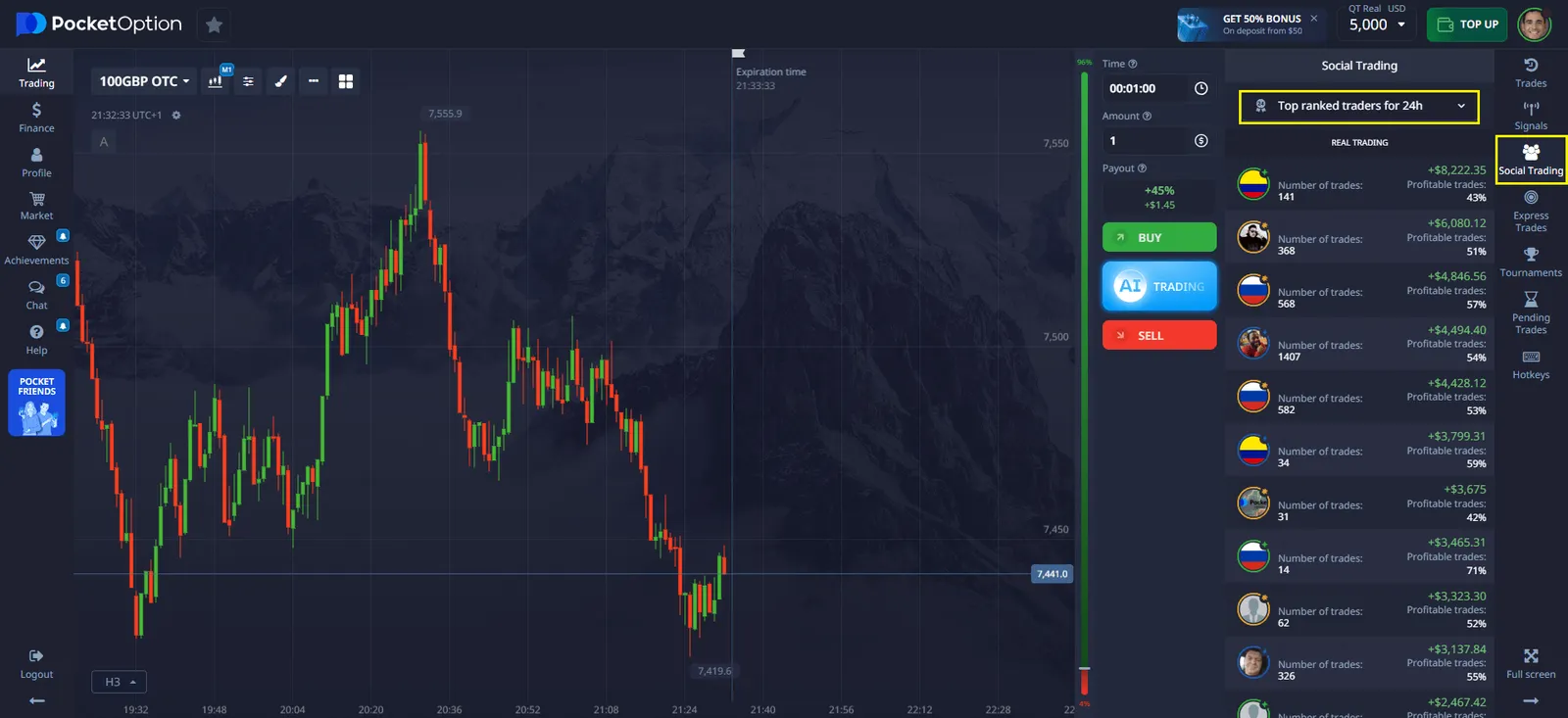

3. Social Trading

| What It Is | How to Start | Benefits |

|---|---|---|

| Copy trades from top-performing traders in real time | Go to the “Social Trading” tab, view profiles, and click “Follow” | Learn from experienced traders and earn passively by mirroring their trades |

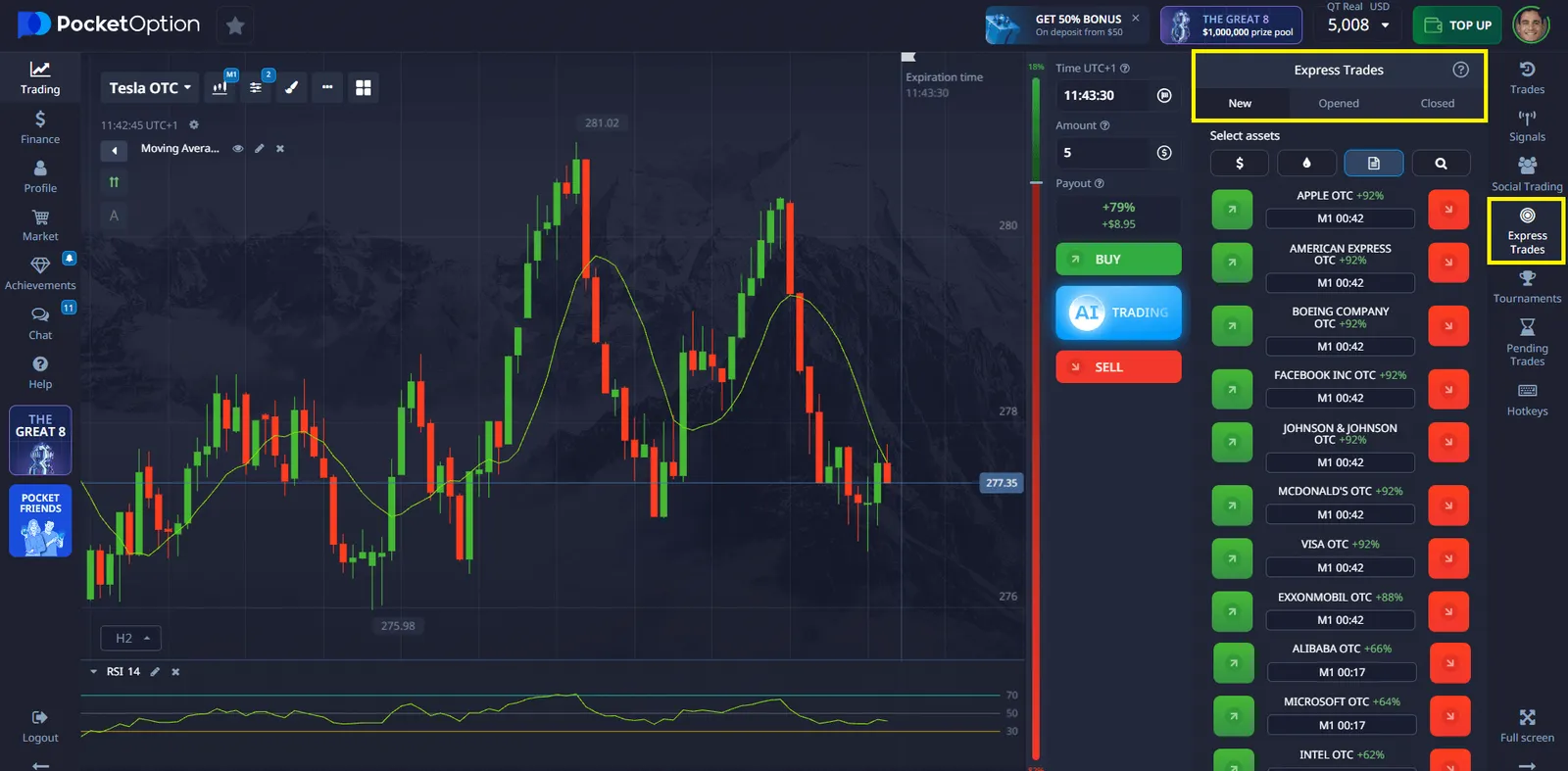

3. Express Trading

| What It Is | How to Start | Benefits |

|---|---|---|

| Combine multiple trades into a single bet to increase payout potential | Select “Express” in the trading interface, choose several assets, place the express trade | Higher payouts with combined forecasts; adds strategic variety |

Built-in Analytics and Forecast Tools

Make smarter decisions with the tools built right into the platform.

| Feature | What It Is | How to Use | Benefits |

|---|---|---|---|

| Trader Sentiment Indicator | Shows how other users are predicting price direction | View indicator below the asset chart before opening a trade | Useful for crowd analysis and market mood |

| Charting Tools | Includes technical indicators like RSI, Bollinger Bands, MACD | Click “Indicators” on the left panel and select tools to overlay on your chart | Helps analyze trends and spot potential entry/exit points |

| Trading History | View detailed logs of past trades | Access “History” from the left menu | Learn from past performance, improve your strategy |

Trade Anywhere, Anytime

Whether you’re at your desk or on the go, Pocket Option keeps you connected.

Ways to trade:

- Web Browser: Fully functional platform, no download needed.

- Mobile App: Available for iOS and Android, with full trading tools.

You’re always one tap away from analyzing, predicting, and executing a trade.

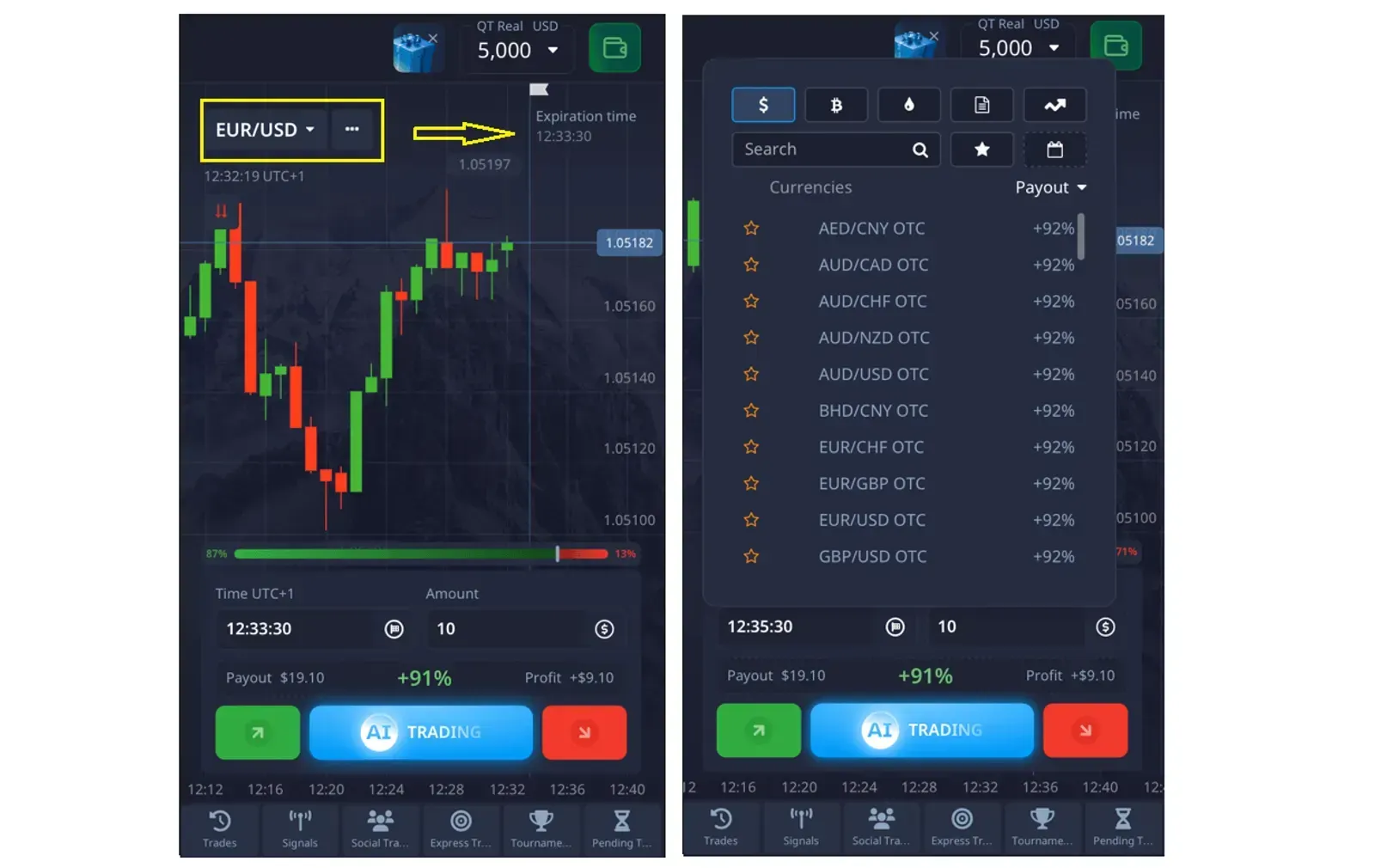

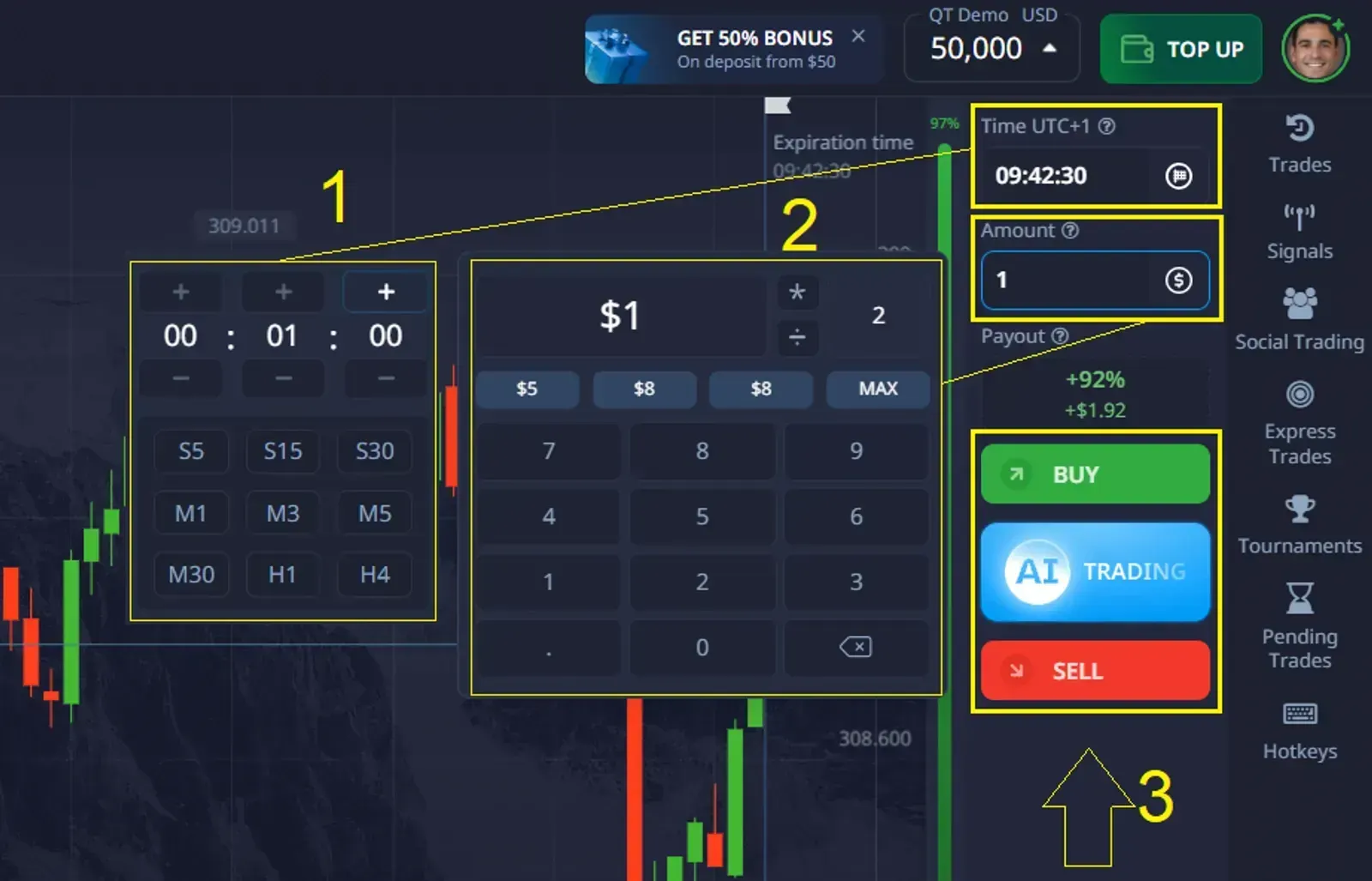

How to Make a Quick Trade on Pocket Option

✅ Follow these steps to place your first HFX trade in under a minute:

- Choose an asset (e.g., EUR/USD, Tesla stock, Bitcoin)

- Analyze the chart using indicators or sentiment tools

- Set trade amount (minimum $1) and duration (from 5 seconds)

- Predict direction:

- Click BUY if you think price will go up

- Click SELL if you expect it to go down

- Wait for expiration — if your forecast is right, you’ll earn a profit of up to 92%

Extra Features That Make a Difference

- No downloads required — trade in your browser

- Low entry threshold — start with just $5 deposit

- Multilingual support — platform available in 20+ languages

- Free demo account — switch at any time

- Bonus system — rewards for deposits and trading activity

Conclusion

HFX trading is all about fast decisions, fast moves, and fast profits. If you’re ready to explore this trading style, Pocket Option is the perfect place to start. It combines instant execution, smart tools, and a user-first design that makes high-frequency trading accessible to everyone.

Set up your demo account today, explore the platform, and see if HFX fits your strategy — one second at a time.

FAQ

How important is mobile access in modern trading?

Mobile access is crucial for maintaining market awareness and managing positions when away from the primary trading station.

How do execution speeds affect trading performance?

Fast execution speeds are critical for capturing optimal prices and implementing time-sensitive strategies effectively.

What does HFX mean in trading?

It stands for High-Frequency Forex trading — a style where you place many trades with very short durations.

Is Pocket Option good for HFX trading?

Yes. It offers fast execution, simple interface, and multiple short-term trading options.

Can I try HFX on Pocket Option without real money?

Absolutely. You get a free demo account with virtual funds to practice risk-free.

What’s the minimum amount to start trading?

You can deposit as little as $5 and start trading with $1 per trade.

Do I need to download anything to use Pocket Option?

No — you can trade directly from your web browser, or download the mobile app if you prefer.