- ❌ Entering trades without analyzing volume

- ❌ Ignoring order blocks near equal levels

- ❌ Trading during low liquidity sessions

- ✅ Confirming EQH/EQL zones with multiple timeframes

EQL Meaning Trading: Comprehensive Explanation of Equity Levels

The understanding of Equity Levels (EQL) is crucial for traders navigating the complexities of financial markets.

What is EQL?

By grasping the concept of EQL, traders can make informed decisions regarding entry and exit points while analyzing price action and market structure. In this article, we will delve deep into what EQL means in trading, its significance, and the role of liquidity in trading strategies. We’ll also explore related concepts such as EQH trading meaning and what does EQL mean in trading, ensuring comprehensive coverage.

EQL, short for Equity Levels, refers to specific price points in financial trading where traders identify potential areas for market entry or exit. This abbreviation encapsulates the idea of recognizing equal highs and lows within price movements, which are instrumental for understanding market trends. What does EQL mean in trading often revolves around identifying symmetrical price behaviors that indicate potential reversals or continuations.

💡 EQH Trading Meaning Explained

The EQH trading meaning (Equal Highs) reflects consistent market resistance. When price reaches similar high points repeatedly, it signals a key level where institutional players might be accumulating orders. Recognizing EQH and EQL meaning trading terms helps traders align with market makers and avoid being trapped by false breakouts.

✅ Pro Tip: Use EQH levels with indicators like RSI or Trader’s Sentiment on Pocket Option to confirm exhaustion before placing a trade.

Understanding Equal Highs and Equal Lows

Equal highs (EQH) and equal lows are foundational concepts in the realm of trading, particularly when analyzing price action within various time frames. These price levels indicate points at which the market has previously reversed or consolidated, allowing traders to identify significant key levels for potential entry and exit points. By understanding these concepts, traders can refine their strategies and enhance their market analysis.

Definition of Equal Highs (EQH)

Equal highs (EQH) refer to price levels on a chart where the market has reached the same peak multiple times, suggesting a strong resistance level. This occurrence indicates that sellers have consistently stepped in at this price, making it a crucial point for traders. Recognizing EQH enables traders to anticipate potential reversals and plan their bullish or bearish orders accordingly, which is essential for a successful trading strategy.

Definition of Equal Lows

Equal lows denote price levels where the market has tested the same low on multiple occasions, indicating strong support. This trading concept signifies that buyers have consistently entered the market at this point, leading to potential trend reversals. By analyzing equal lows, traders can identify opportunities to place trades, ensuring that their strategies align with market movements and liquidity conditions.

📋 Checklist: Avoid These Mistakes When Using EQL/EQH

📊 Comparative Table: EQL vs EQH vs FVG

| Concept | Definition | Application |

|---|---|---|

| EQL | Equal Lows; indicates repeated support levels | Look for long entries at double bottom zones |

| EQH | Equal Highs; indicates strong resistance | Watch for trend exhaustion or liquidity traps |

| FVG | Fair Value Gap; price gaps used to identify imbalance or retracement zones | Used with SMC strategies for sniper entries |

Common Mistakes When Trading Equal Levels

Traders often fall into common mistakes when trading equal highs and lows, such as ignoring market structure or the context surrounding these levels. Failing to consider liquidity and price movement can lead to misguided entries and exits. Additionally, over-relying on equal levels without a comprehensive analysis of accompanying price action may result in ineffective trading decisions. Being aware of these pitfalls is vital for improving overall trading performance.

💼 Pocket Option and Trading with EQH/EQL

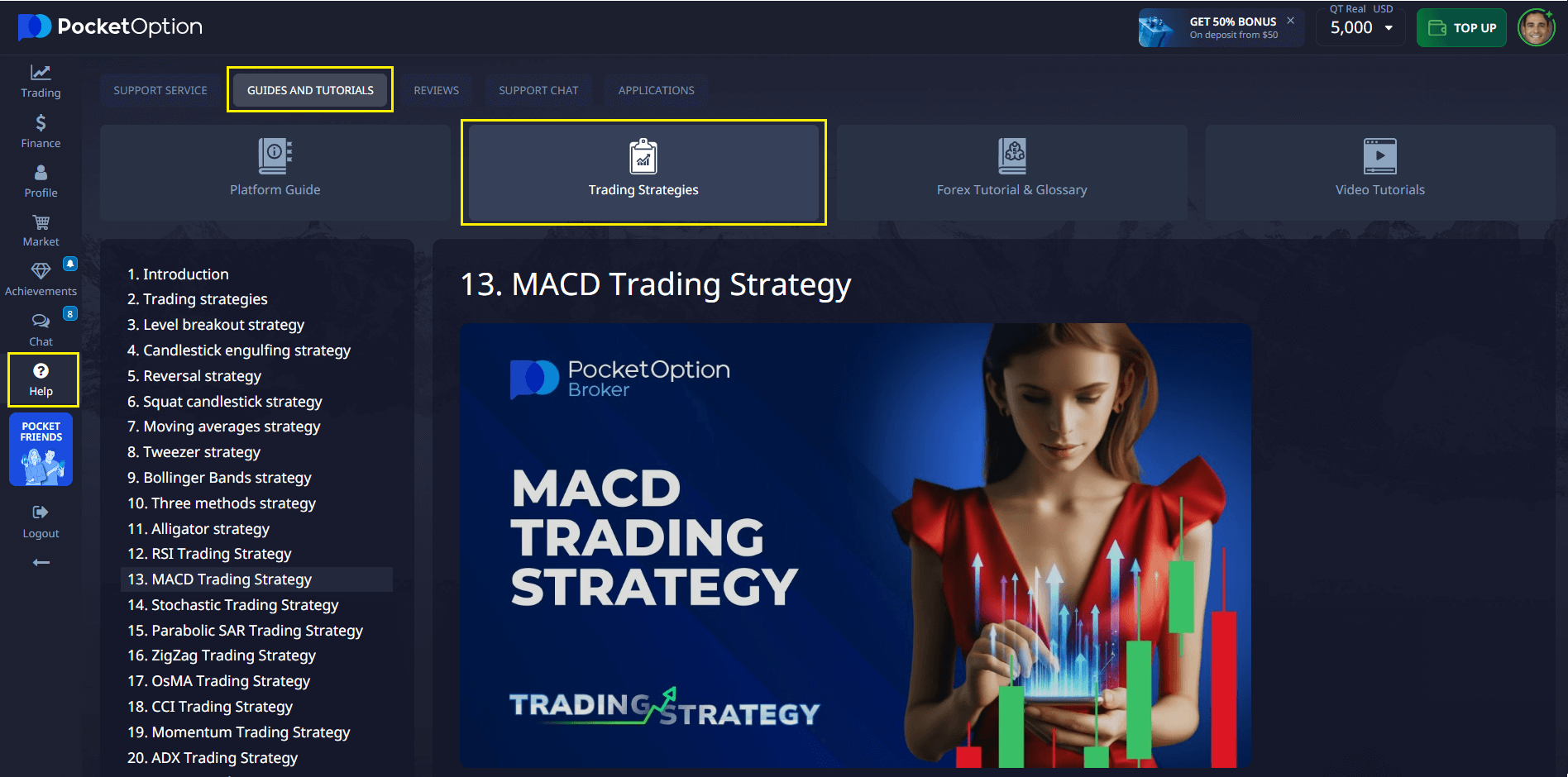

🧪 How to Practice EQH/EQL in Demo Mode

Before risking real capital, traders can sharpen their skills by applying EQH/EQL strategies in Pocket Option’s free demo mode. This mode allows for unlimited virtual trading with all real-market features:

- Log in or register on Pocket Option.

- Switch to Demo mode from the top right panel.

- Choose any asset (e.g., EUR/USD, BTC/USD).

- Identify repeated price levels (EQH or EQL).

- Use indicators like RSI or MACD to confirm signals.

- Enter a short-term trade to test your strategy.

📣 “Practicing in demo mode with EQH setups gave me the confidence to trade live without fear of making beginner mistakes.” — Carlos Mendez, beginner trader

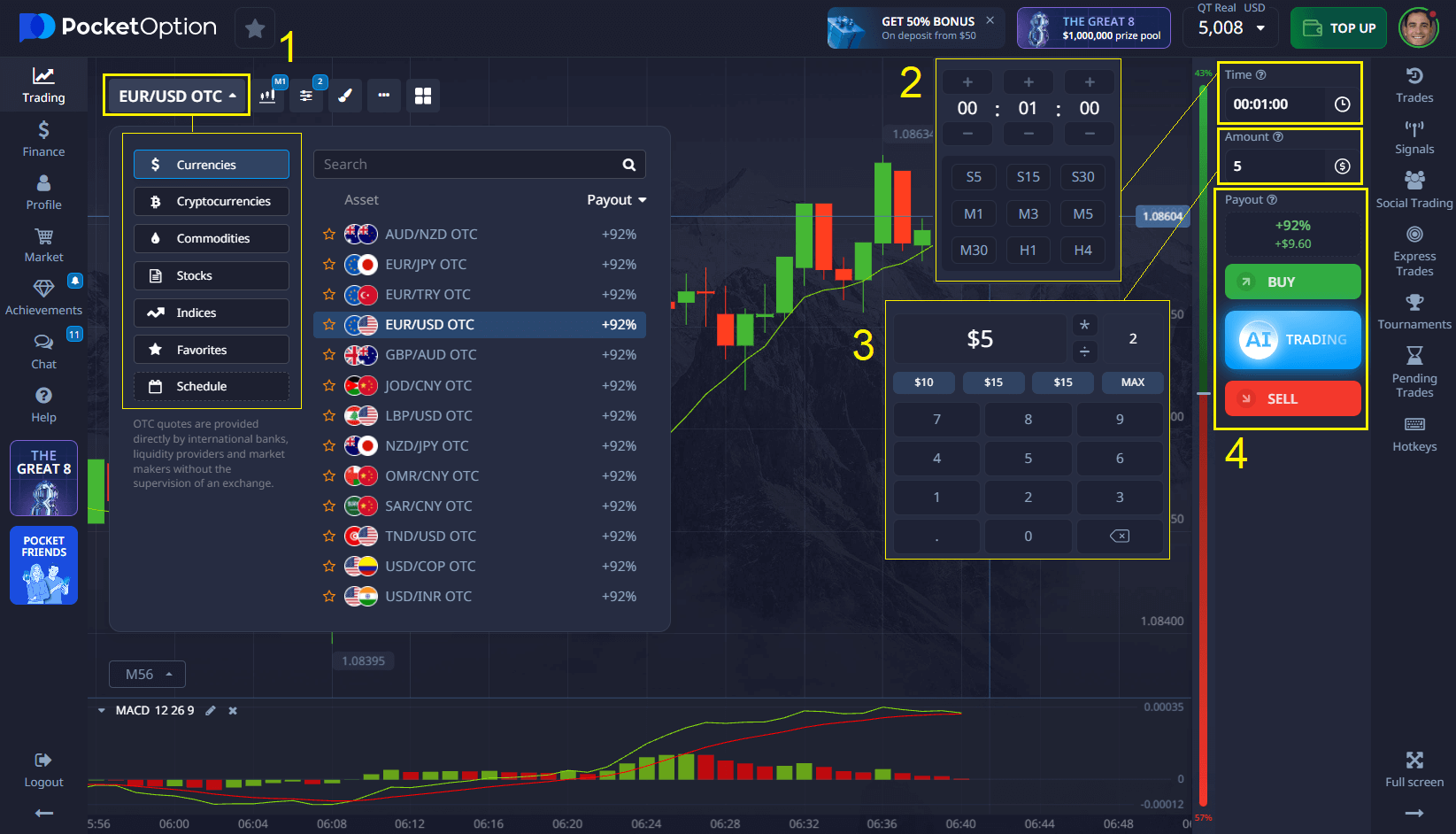

Pocket Option is ideal for applying strategies based on equal highs (EQH) and equity levels (EQL). With its fixed-time trades, you can forecast whether price will go up or down based on resistance and support formed at these levels.

🎯 Example: Trading EQH on Pocket Option

- Open EUR/USD asset

- Identify repeated highs near 1.09100

- Wait for price to touch that level again

- Use a 1-minute trade predicting a fall

💬 “Pocket Option’s interface is so intuitive, I was able to apply my EQH strategy on my first day.” – Jessica Tanaka, active trader

*minimum deposit may vary depending on geo and payment method

Price Movement and EQL

Price movement plays a crucial role in understanding equity levels (EQL) as it reflects the behavior of market participants. Recognizing how price action interacts with equal highs and lows can help traders gauge market sentiment and make informed decisions. By studying price movement, traders can adapt their strategies to align with prevailing trends and volatility, ultimately enhancing their trading success.

How Price Action Affects EQL

Price action directly influences equity levels by illustrating how the market reacts at equal highs and lows. Analyzing price movement around these levels can provide insights into the strength of a trend or the likelihood of a reversal. Traders can use this information to time their entries and exits more effectively, leading to improved trading outcomes and better risk management in their strategies.

Identifying Equal Levels in Price Movement

Identifying equal levels in price movement requires keen observation of historical data on charts. Traders should look for repeated highs and lows within various time frames to establish significant support and resistance levels. By pinpointing these equal highs and lows, traders can effectively utilize them as reference points for their trades, enhancing their ability to navigate the complexities of the market with confidence.

Accuracy of Equal Highs and Lows

The accuracy of equal highs and lows is vital for traders aiming to implement robust trading strategies. While these levels often serve as reliable indicators of market sentiment, fluctuations in liquidity and external market factors can impact their effectiveness. Thus, traders should use equal highs and lows in conjunction with other tools, such as fair value gaps (FVG) and market structure analysis, to enhance their decision-making process and achieve greater trading success.

Institutional Trading and Inefficiency

Understanding Institutional Trading Dynamics

Understanding institutional trading dynamics is crucial for retail traders looking to refine their strategies. Institutions often engage in large-scale trades that can significantly influence market liquidity and price movement. By analyzing how these entities operate, traders can gain insight into potential market inefficiencies that may arise. The actions of institutional traders often create significant equal highs and lows that can be used as reference points for retail traders. Recognizing these dynamics enables traders to align their strategies with institutional behavior, enhancing their potential for successful trading outcomes.

How Inefficiency Impacts EQL

Inefficiency in the market can have profound implications on the relevance of EQL in trading. When liquidity is low, the establishment of equal highs and lows may become less reliable, leading to potential false signals. Traders must be aware of these inefficiencies and adapt their strategies accordingly, using EQL as a guide but not as the sole determinant for entry and exit points. Understanding how market inefficiencies manifest allows traders to refine their approach, ensuring that they capitalize on genuine price movements rather than reacting to misleading signals.

Liquidity Considerations in Forex Trading

Liquidity considerations are paramount in Forex trading, as they directly impact the effectiveness of EQL. High liquidity often results in smoother price movements and more reliable equal highs and lows, while low liquidity can lead to erratic price action and false breakouts. Forex traders need to assess liquidity conditions before executing trades, particularly around major news events or market openings. By understanding how liquidity affects their strategies, traders can enhance their ability to identify significant order blocks and make informed decisions aligned with current market conditions, ultimately improving their overall trading performance.

🎯 Expert Insight: Why EQH and EQL Work

“Retail traders often underestimate the precision of equal highs and lows. Institutions use these levels to hunt for liquidity.” — David Trainer, CEO of New Constructs

“EQH zones are magnets for stop hunts. Combining them with volume analysis and smart money concepts can change the game.” — Linda Grainger, market analyst

Ready to Apply These Concepts?

The concepts of eql meaning trading and eqh meaning trading are not just definitions — they are actionable elements in a trader’s toolkit. By mastering equal highs, equal lows, and liquidity interpretation, traders can avoid common pitfalls and approach the markets with precision. Tools like Pocket Option enhance this process with visual sentiment indicators, risk control tools, and ultra-fast execution.

FAQ

What exactly does EQL stand for in trading terminology?

EQL stands for Equity Level in trading terminology. It represents the current total value of your trading account, including the balance plus any unrealized profits or minus any unrealized losses from open positions.

How is EQH meaning trading different from EQL?

While EQL (Equity Level) shows your current account value, EQH (Equity High) represents the highest point your equity has reached during a specific period. EQH is used primarily for performance tracking and drawdown calculations.

How often should I monitor my EQL when trading?

You should monitor your EQL regularly during active trading sessions, especially when holding multiple positions or trading volatile markets. Many traders check their equity level before opening new positions and periodically throughout the day.

What does EQL mean in trading risk management?

In risk management, EQL serves as the baseline for calculating appropriate position sizes. Conservative traders typically risk no more than 1-2% of their equity per trade, while more aggressive approaches might use 5-10% of equity, depending on market conditions and strategy.

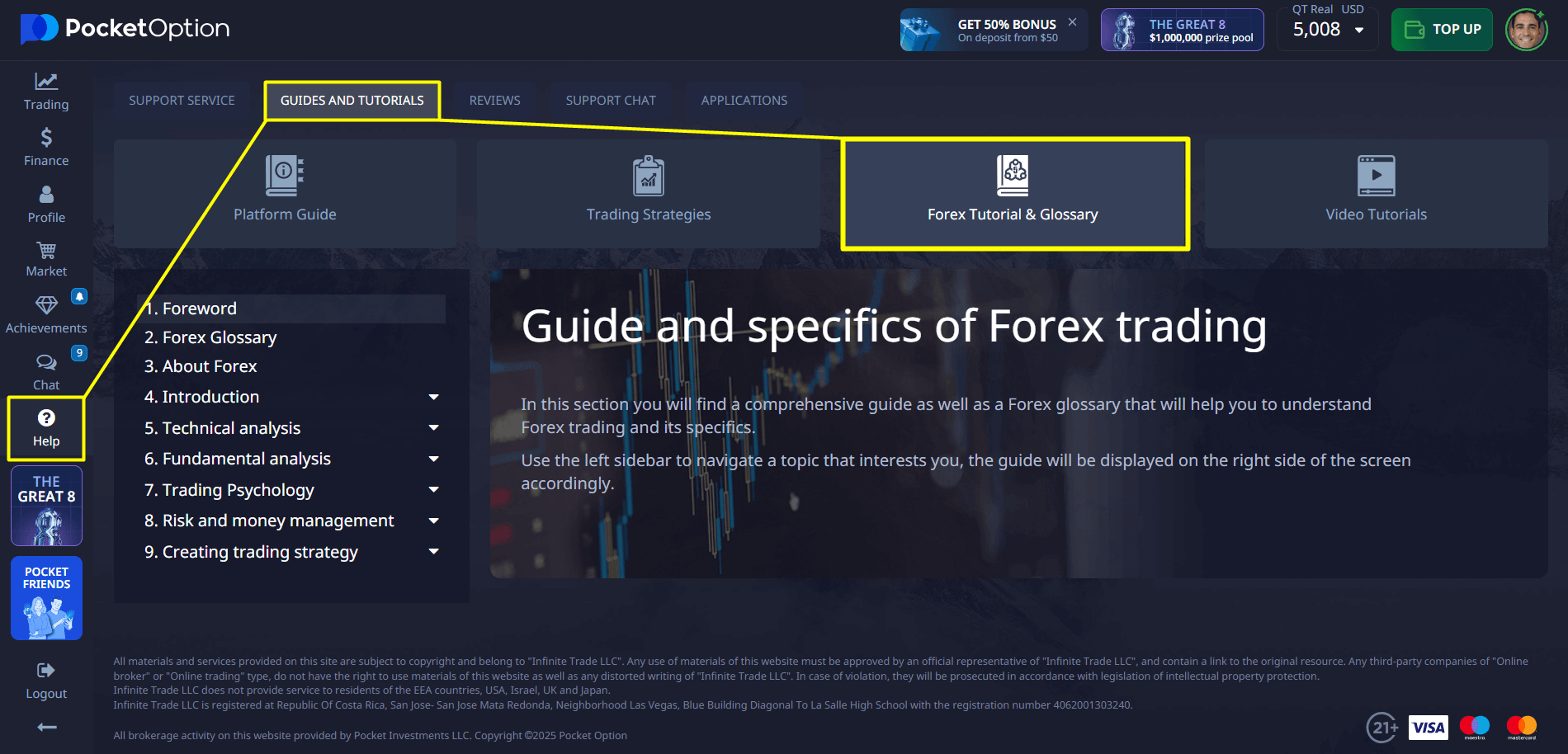

Why is Pocket Option a good platform to apply EQH and EQL strategies?

Pocket Option offers a unique environment for EQH and EQL strategy testing thanks to its fast execution, intuitive demo mode, and built-in technical indicators like RSI, MACD, and Trader’s Sentiment. These tools help confirm equal levels and identify potential reversals. Its $1 minimum trade and fixed-time format make it accessible for applying precision-based strategies even for beginners. Plus, you can visually test your EQL setups without the pressure of real capital in demo mode.