- Automation – eliminates the need for manual input.

- High execution speed – instant order placement and cancellation.

- Flexibility – enables the programming of trading strategies.

- No human factor – removes emotional decision-making errors.

- Data access – real-time market information retrieval.

API Trading Essentials

In today's fast-paced financial landscape, api trading has emerged as a game-changing technology, revolutionizing the way traders and investors interact with markets. This innovative approach leverages Application Programming Interfaces (APIs) to automate trading processes, access real-time data, and execute sophisticated strategies with unprecedented speed and efficiency.

API Trading: A Complete Guide

API Trading is an automated trading method that allows programs to interact with trading platforms without manual input. Using API for trading helps traders automate trading strategies, integrate algorithmic trading, and respond quickly to market changes.

Key Features of API Trading

Trading APIs provide traders with multiple functions that simplify the trading process. These include automated order placement, risk management, and real-time market data collection.

Benefits of API Trading

How Does API Trading Work?

The process of using API for trading can be broken down into several steps:

| Step | Description |

|---|---|

| Connection | Establishing a connection with the broker’s server. |

| Data retrieval | Accessing quotes, order books, and news. |

| Order execution | Automatically opening and closing trades. |

| Position monitoring | Tracking current assets and orders. |

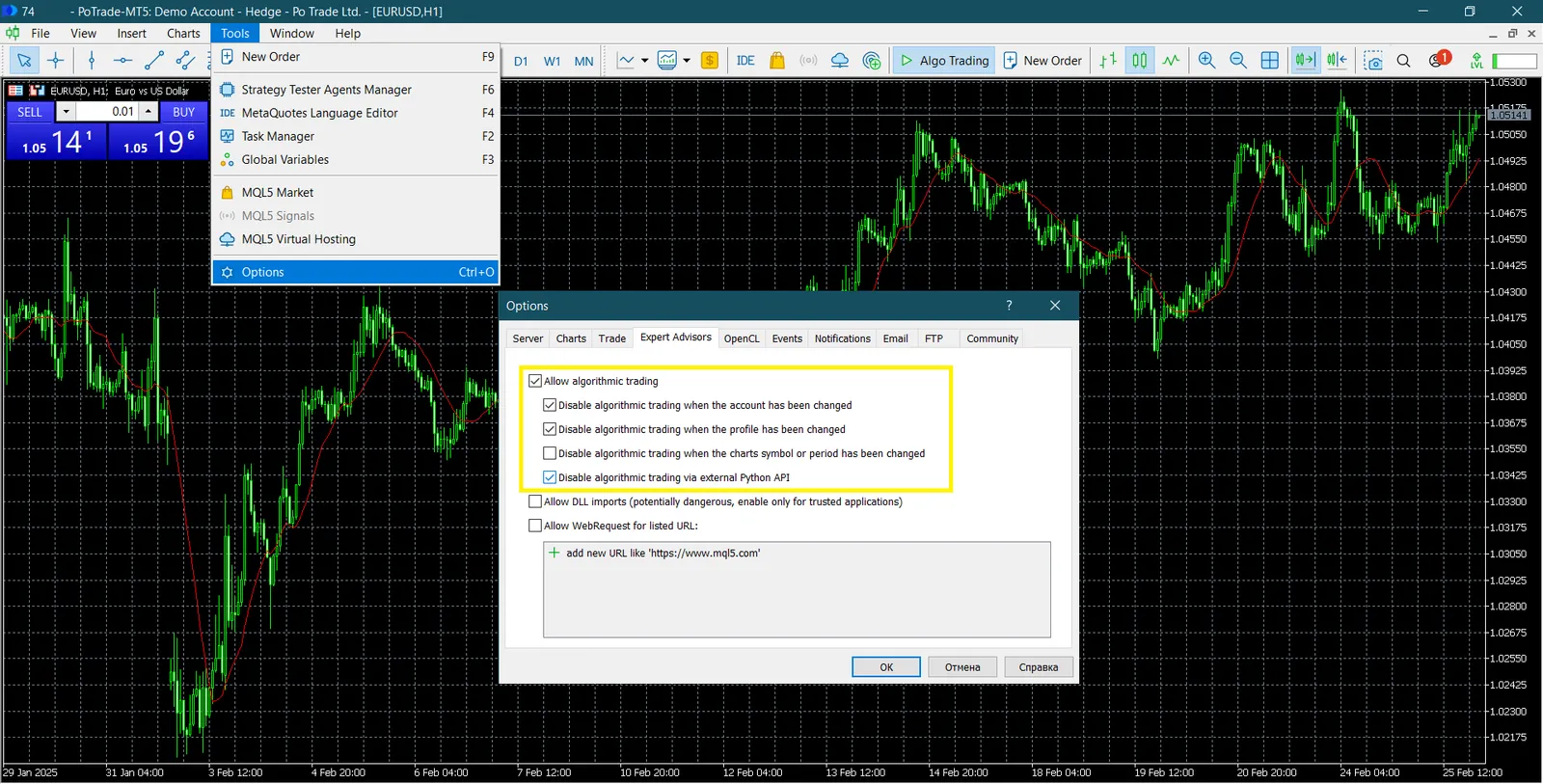

MetaTrader 5 (MT5) provides a built-in API that allows for the automation of trading operations, integration of third-party applications, and processing of market data.

Types of Trading APIs

There are several types of trading APIs, each serving different functions and use cases:

REST API

- Uses the HTTP protocol.

- Suitable for retrieving market data and placing orders.

- Limited by slower update speeds.

WebSocket API

- Enables real-time data streaming.

- Used for high-frequency trading.

- Allows for rapid market response.

FIX API

- Used by institutional traders and large funds.

- Provides low-latency order execution.

- Requires complex integration and significant resources.

Key Factors in Choosing a Trading API

When selecting a trading API, consider the following factors:

- Compatibility – support for required platforms and exchanges.

- Processing speed – latency in executing requests.

- Security – protection of data and API keys.

- Functionality – access to order books, historical data.

- Cost – potential fees for API usage.

Popular API for Trading Solutions

Many trading APIs are available on the market, each with unique features.

| API | Type | Features |

|---|---|---|

| Binance API | WebSocket, REST | High processing speed, large liquidity pool. |

| Kraken API | REST, WebSocket | Supports margin trading and staking. |

| MetaTrader API | FIX, REST | Suitable for algorithmic forex trading. |

| Interactive Brokers API | FIX, REST | Access to various markets and a wide range of instruments. |

| Alpaca API | REST, WebSocket | Ideal for the US stock market. |

Main Risks of API Trading

Despite its advantages, API trading carries several risks:

- Technical failures – unstable broker servers.

- Coding errors – incorrect execution of trading strategies.

- High-frequency trading risks – losses due to sharp price fluctuations.

- Cyber threats – API key leaks and unauthorized access.

To minimize risks, traders should use secure authentication methods, conduct regular strategy testing, and implement loss limits.

FAQ

What is API trading?

An API for trading is an interface that allows software to interact with trading platforms, automate strategies, and process market data in real-time.

How does API trading differ from traditional trading?

API trading allows for faster execution, automation of strategies, and the ability to process large amounts of data in real-time, unlike traditional manual trading methods.

What are the main benefits of using trading APIs?

The main benefits include automation, increased speed and accuracy, the ability to implement complex strategies, and scalability in managing multiple accounts or strategies simultaneously.

Are there any risks associated with API trading?

Yes, risks include technical failures, algorithm errors, market volatility, data quality issues, and regulatory compliance challenges. Proper risk management is crucial.

How can I get started with API trading?

To get started, you should define your trading goals, select a suitable API provider, develop and test your trading algorithm, set up the necessary infrastructure, and gradually transition from paper trading to live trading with careful monitoring.

What are the most popular trading APIs?

Popular trading APIs include Binance API, Kraken API, MetaTrader API, Interactive Brokers API, and Alpaca API. The choice depends on the market type and trading strategy.