- Boost per-share price to enhance credibility

- Attract index and institutional fund interest

- Separate GE’s industrial focus post-GE Vernova and GE Aerospace creation

GE Stock Reverse Split: What You Need To Know About Your Shares

GE’s 1-for-8 reverse stock split in 2023 changed pricing and ownership. This article covers its impact and how to trade similar events on Pocket Option.

Article navigation

- Understanding the GE Reverse Stock Split

- Shareholder Impact: What You Receive and What It Means

- The Mechanics Behind the Split: How GE Executed It

- GE Ticker Performance and Share Trading Trends Post-Split

- Advanced Trading Strategies with Pocket Option

- Expert Forecasts and Long-Term Outlook

- Summary: Why the GE Reverse Stock Split Matters

This article provides a comprehensive breakdown of the GE stock reverse split, including historical references to the GE stock reverse split history, including events like the GE stock reverse split 2021 and GE stock reverse split 2022, expert perspectives, and strategies on how to trade similar market events—especially using platforms like Pocket Option.

If you’re unsure about how your holdings were impacted or need to recalculate your ownership, consider using a GE stock split calculator.

Understanding the GE Reverse Stock Split

What is a Reverse Stock Split?

A reverse stock split is a corporate restructuring tool where a company reduces the number of outstanding shares, thereby increasing the price per share. In the case of the GE reverse stock split, eight existing shares were combined into one. For every 80 shares pre-split, a shareholder would now hold just 10.

“Reverse splits are often misunderstood. They don’t destroy value; they repackage it for clearer market visibility.” — Richard Bernstein, CEO of RBA

Unlike a forward split, which increases share quantity, a reverse split boosts price per share, often to meet listing requirements or attract long-term institutional investors. Historically, shares of GE have rarely undergone such restructuring, making the 2023 event especially noteworthy in GE stock split history.

The GE split also serves as an educational case study for retail and institutional investors alike.

Reasons Behind GE’s Decision

Following the GE Healthcare (GEHC) spinoff, the 1-for-8 reverse split aimed to:

“GE’s split was not about vanity pricing—it was a tactical reset to support their transformation agenda.” — Liz Ann Sonders, Chief Investment Strategist, Charles Schwab

The GE stock split aligns with broader corporate realignment as the conglomerate refocused on aviation and energy, as of GE reverse split August 2023.

Shareholder Impact: What You Receive and What It Means

What GE Shareholders Received

| Pre-Split Shares | Post-Split Shares | Action Taken |

|---|---|---|

| 8 | 1 | Shares consolidated |

| 9 | 1 + cash for 1/8 | Fractional share paid out |

| 80 | 10 | Straight conversion |

GE shareholders with partial lots received cash in lieu of fractional shares. This created taxable events for some.

Tax and Financial Implications

Cash received may result in capital gains. GE provided detailed IRS Form 1099-B for affected accounts.

“Taxable events triggered by fractional shares often go unnoticed. Document them early to avoid IRS surprises.” — Laura Saunders, Senior Tax Writer, WSJ

We recommend investors review all GE common stock activity in 2023 and consult professionals.

The Mechanics Behind the Split: How GE Executed It

Structural Adjustment and Market Cap

GE adjusted its capital structure without diluting value:

| Metric | Pre-Split | Post-Split |

|---|---|---|

| Share Price | $10 | ~$80 |

| Outstanding Shares | ~8 billion | ~1 billion |

| Market Cap | $80B | $80B |

“General Electric executed a textbook reverse stock split—clean, timely, and efficiently absorbed by markets.” — Brian Belski, BMO

GE’s success partly stemmed from its pre-split communication and precision. Most brokerage platforms automatically adjusted accounts.

The Role of GE Vernova and GE Aerospace

The split allowed GE to better segment its operations:

- GE Vernova: Focused on energy transition and renewables

- GE Aerospace: Positioned as a pure-play aviation growth engine

These divisions now report independently, simplifying valuation models.

GE Ticker Performance and Share Trading Trends Post-Split

GE Stock in 2023 and 2024

GE’s ticker remained intact after the GE stock reverse split date, but its price trajectory drew new attention. As the stock climbed post-split, short-term traders seized opportunities.

- 2023 low: $73 (adjusted)

- 2024 projection: $96–$108 (consensus target)

“Post-split setups often fuel short squeezes. GE was no exception.” — Dan Ives, Equity Analyst

The GE stock reverse split today continues to impact price perception, fund inclusion criteria, and margin requirements for retail accounts.

Advanced Trading Strategies with Pocket Option

Pocket Option offers a simplified yet powerful way to trade major financial events—like the GE reverse stock split—without needing to purchase full shares or maintain a brokerage account. The platform is designed for fast, intuitive decision-making, particularly around high-volatility periods.

Unlike traditional investing where you must buy and hold shares, Pocket Option allows you to predict whether the price of stock will rise or fall within selected timeframes. This opens opportunities for short-term profits, especially around corporate events like stock splits, earnings announcements, or spinoffs like GE Healthcare (GEHC).

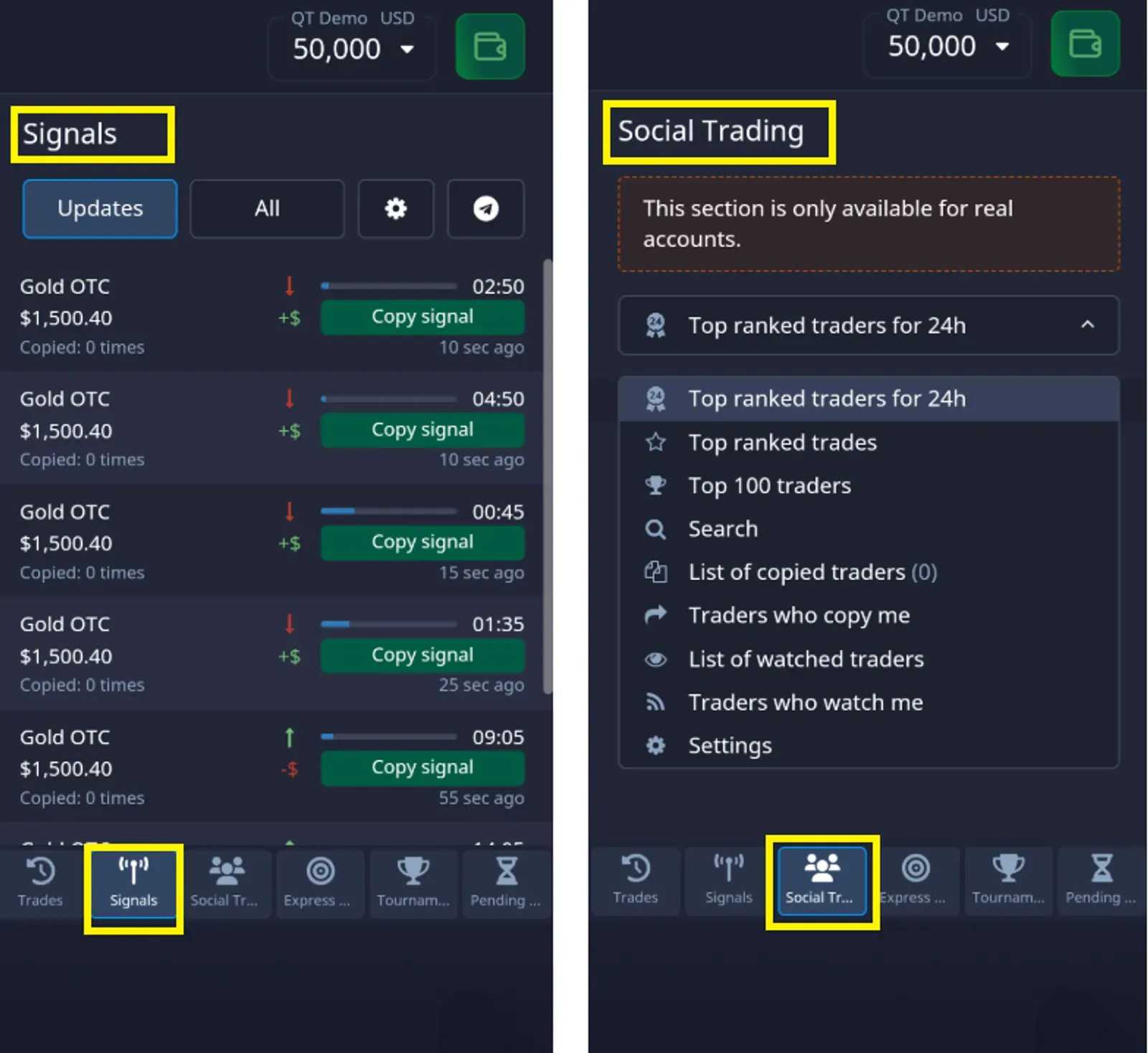

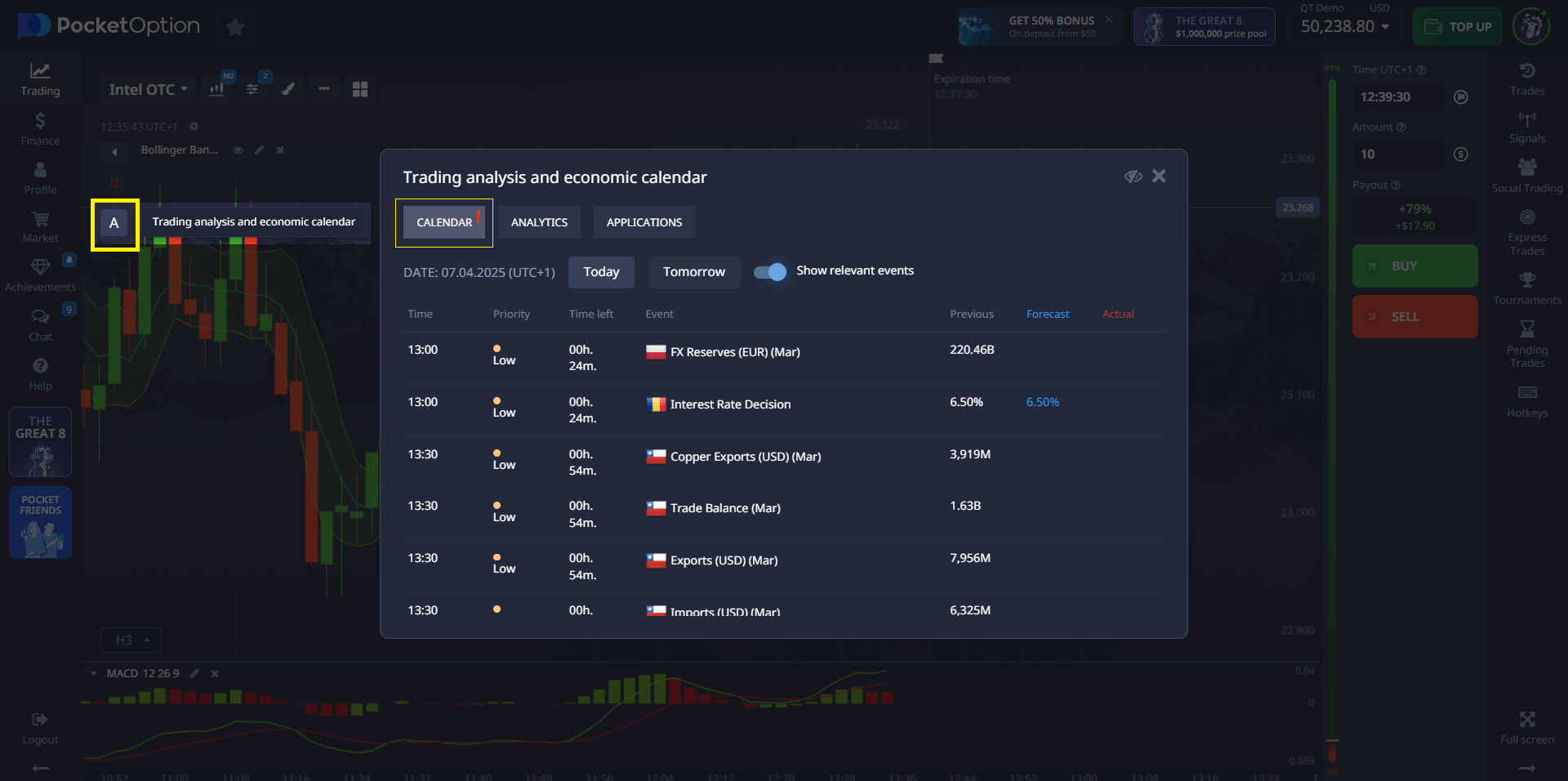

You can trade using:

- Quick Trading mode: Ideal for capturing momentum within seconds or minutes

- Technical indicators: Like RSI, MACD, Bollinger Bands, and moving averages

- News-based trading: Reacting immediately to events such as reverse splits, dividend declarations, or executive leadership changes

Pocket Option also provides:

- Demo account with $50,000 in virtual funds to practice

- Social trading tools to copy strategies of top-performing traders

- Mobile and desktop access with no download required

This makes it an ideal platform for retail traders who want to capitalize on high-impact financial news without deep market infrastructure.

Real Trader Feedback

“Split announcements are one of the best catalysts for momentum trades. Pocket Option’s simplicity makes it easy to act.” — Sofia K.

“I anticipated movement during GEHC earnings and got in early using MACD and Bollinger Bands.” — Marc L.

Try Pocket Option from $5 or with demo for free !

Trade Opportunities During Reverse Splits

- Trend trading during market overreaction

- News-based price spikes post-split or dividend declarations

Expert Forecasts and Long-Term Outlook

What Analysts Expect for 2024–2025

- Morningstar: sees 18% upside in GE Aerospace with new engine contracts

- Goldman Sachs: added GE to its “Top Industrials” basket for Q3 2024

Strategic Investor Insights

“GE’s leaner structure post-split makes it easier to value and project. GE Vernova’s IPO could unlock further upside.” — Katie Stockton, Founder, Fairlead Strategies

Unique Insight:

GE now has the benefit of sector clarity:

- Investors valuing aviation focus on GE Aerospace

- ESG investors track GE Vernova

- Healthcare analysts watch GEHC, the former unit

Summary: Why the GE Reverse Stock Split Matters

The GE stock reverse split of 2023 marked a turning point for General Electric. It helped the conglomerate sharpen its operational focus and enhance its perception in public markets. Shareholders experienced better price optics, improved ETF inclusion prospects, and greater clarity over GE common stock holdings.

Whether you’re a GE shareholder, day trader, or ETF fund manager, the reverse split and its ripple effect across 2023–2024 offer insight into how corporate actions can transform investor behavior and stock performance.

FAQ

What exactly happened during the GE stock reverse split?

In August 2021, General Electric executed a 1-for-8 reverse stock split, meaning shareholders received 1 new share for every 8 shares previously owned. The share price increased proportionally while the total company value remained unchanged.

Did the GE stock reverse split affect the company's market value?

No, the reverse split didn't directly change GE's market capitalization. While the share price increased by a factor of 8, the number of outstanding shares decreased by the same factor, leaving the total market value unchanged.

How did the reverse split affect options and derivatives?

Options contracts were adjusted to reflect the new share structure. Strike prices increased by a factor of 8, and the number of contracts was reduced proportionally to maintain equivalent positions for options holders.

What was the GE stock price before reverse split?

Before the 1-for-8 reverse split in August 2021, GE shares traded around $12-13 per share. After the split, the price was adjusted to approximately $100-104 per share.

Can I trade GE stock on Pocket Option?

Pocket Option offers various trading instruments, but availability of specific stocks like GE depends on the platform's current offerings. Check the available assets on Pocket Option to confirm if GE stock or related derivatives are available for trading.

Should I sell my GE stock before the reverse split?

Selling before a reverse split depends on your investment goals. There is no automatic loss or gain from the reverse split itself. Long-term investors may hold through the event, especially if they believe in GE’s restructuring plans. However, traders seeking to capitalize on short-term volatility might consider taking action based on technical signals or corporate announcements.

What happens to my GE stock after a reverse split?

Your existing GE shares were consolidated. For every 8 shares of GE, you received 1 new share. If you owned a non-multiple of 8, such as 9 or 17 shares, you received cash in lieu of the fractional share. The total value of your investment initially remained the same, just with fewer shares at a higher price.

Is a reverse stock split a good thing?

A reverse stock split is not inherently good or bad—it is a strategic financial decision. In GE's case, it was used to enhance the stock’s appeal to institutional investors, raise its share price, and support its post-spinoff restructuring. If the underlying company fundamentals are strong, the reverse split can support long-term shareholder value.