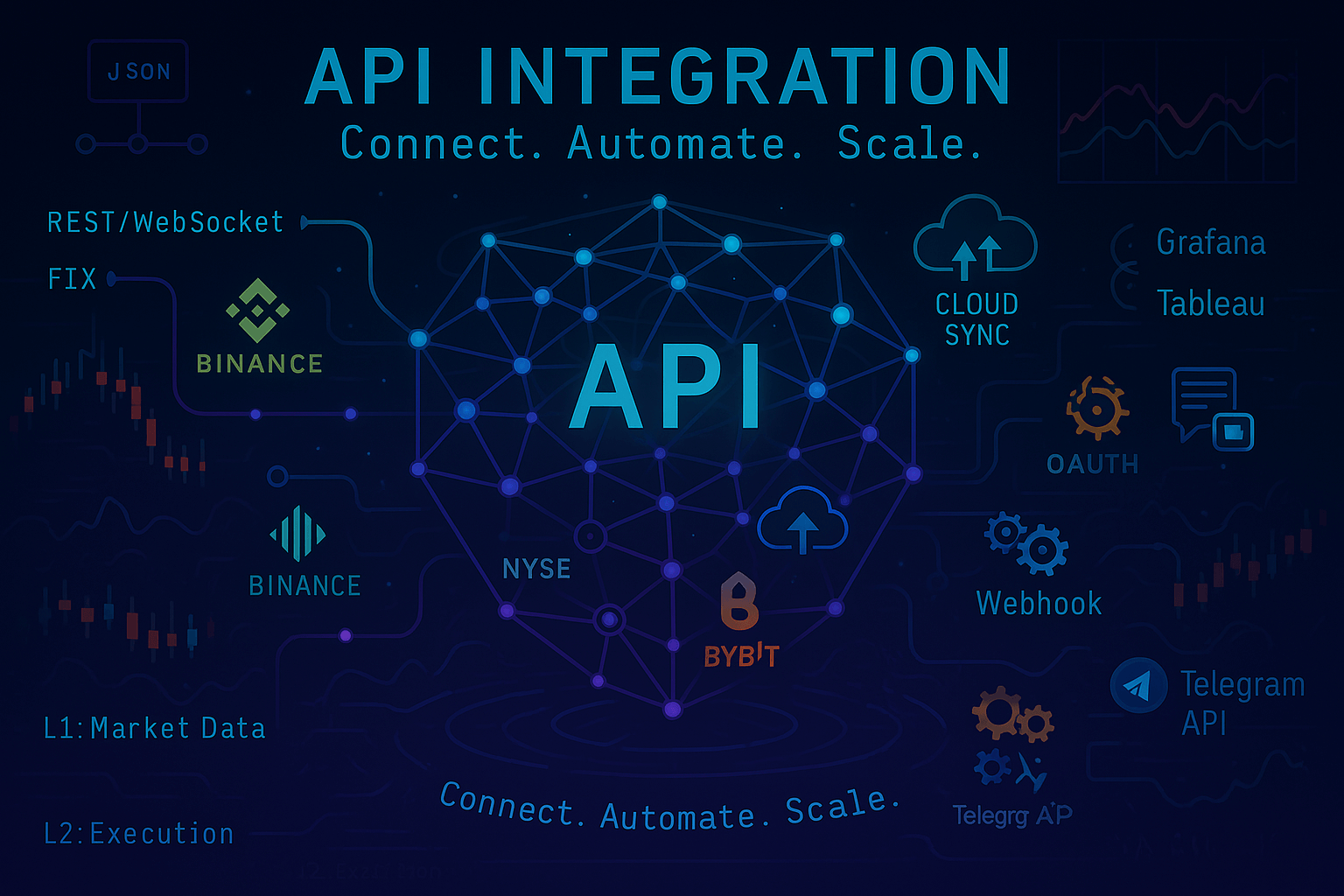

- Algorithm: Strategy logic based on market indicators

- Execution Engine: Sends trade commands to platforms

- Data Integration: Access to real-time price feeds and APIs

Integrating Trading Bots with External Tools

In 2025, trading bots integrated with tools like TradingView and Telegram boost Pocket Option automation and efficiency.

Article navigation

- Start Automated Trading 🚀

- Integration of Trading Bots with External Tools

- Automated Trading: Smarter, Faster Decisions

- What is Automated Trading?

- Benefits of Automation

- Core Components of a Trading Bot

- Automatic Trading – how to set up bots

- Overview of TradingView as a Trading Platform

- TradingView + Pine Script: Alert Systems

- Using Telegram for Real-time Trading Alerts

- Leveraging Excel for Market Data Analysis

- Zapier: Linking to CRMs and Analytics Platforms

- Recommendations

- Developing Your Trading Strategies

- Automated Trading: Pros and Cons

- Emotional vs. Algorithmic Trading

- Choosing Brokers and Platforms

- Top Automated Solutions

- Advanced Techniques

Integration of Trading Bots with External Tools

Automated trading has revolutionized the financial market, allowing traders and investors to execute trades with minimal manual intervention. By leveraging cutting-edge technology and sophisticated algorithms, traders can optimize their trading strategies, streamline trading processes, and effectively manage their trading accounts.

Automated Trading: Smarter, Faster Decisions

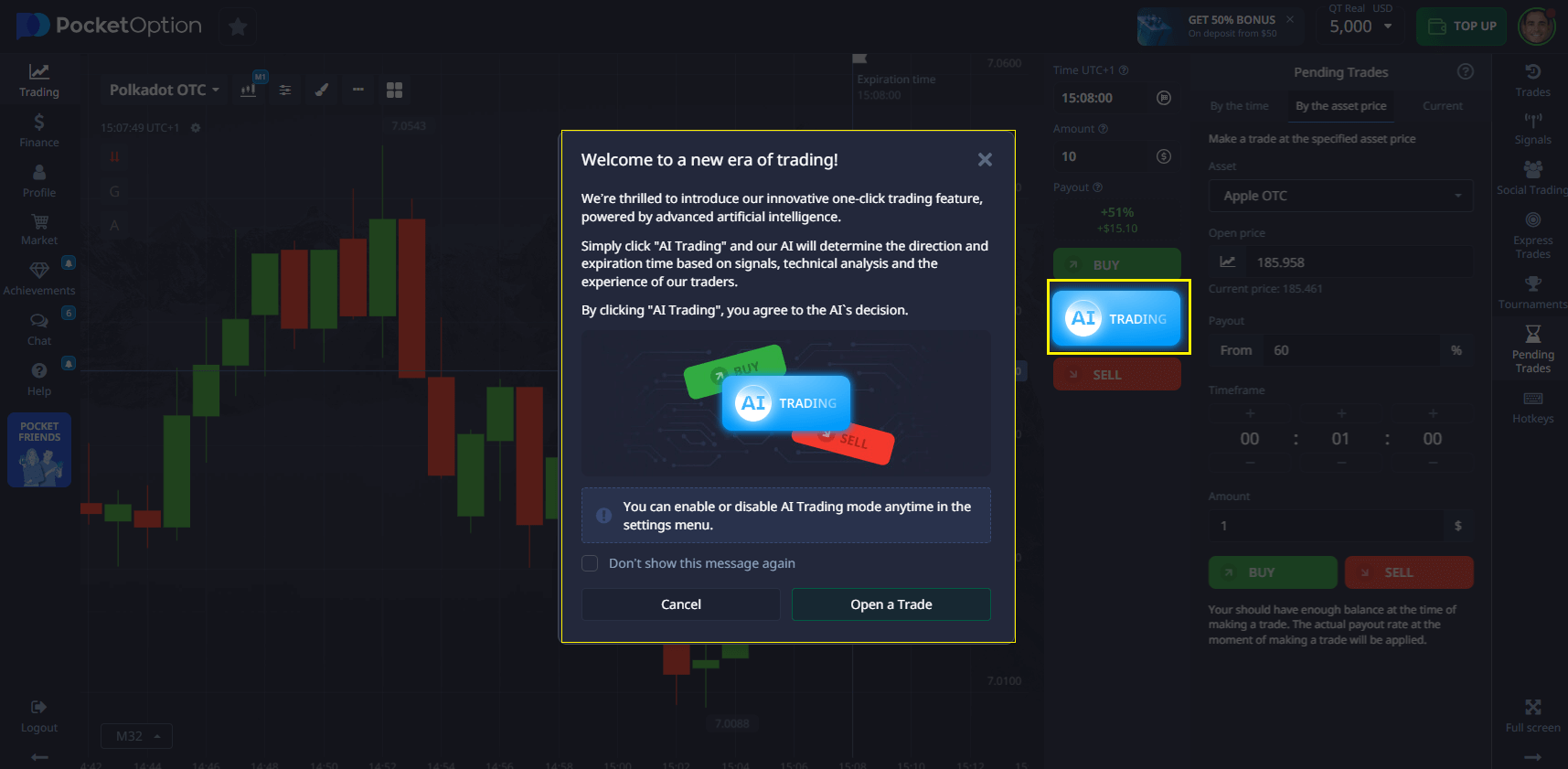

Automated trading uses computer programs to execute trades based on predefined criteria. By relying on algorithms that analyze market data in real time, traders can capitalize on opportunities faster and with more precision.

What is Automated Trading?

It involves algorithmic strategies that automatically place trades based on technical indicators like moving averages and price volatility. This method reduces the need for manual intervention and allows for high-frequency trading.

Benefits of Automation

| Benefit | Description |

|---|---|

| Speed | Executes trades in milliseconds |

| Emotion-Free Decisions | Follows logic, not feelings |

| Backtesting | Tests strategies on historical data |

| Multi-Market Monitoring | Manages trades across several markets simultaneously |

These features lead to more consistent, data-driven trading outcomes.

Core Components of a Trading Bot

These components work together to automate strategy deployment and order execution.

Automatic Trading – how to set up bots

To maximize the potential of automated trading, integration with various trading platforms is crucial. Utilizing platforms like TradingView allows traders to access advanced charting tools and market analysis. Additionally, incorporating communication tools like Telegram ensures traders receive real-time alerts, while Excel can be leveraged for comprehensive market data analysis, enhancing decision-making processes.

Overview of TradingView as a Trading Platform

TradingView stands out as a premier trading platform that provides traders with a rich set of tools for charting, analysis, and social trading. It enables the integration of automated trading bots that can execute trades based on user-defined algorithms. The platform’s community features also allow traders to share and develop trading strategies collaboratively, enhancing the overall trading experience.

TradingView + Pine Script: Alert Systems

TradingView is one of the most popular platforms for technical analysis, offering access to charts, indicators, and alert systems. Pine Script is its built-in scripting language used to create custom indicators and strategies. Integrating TradingView with trading bots such as MT2Trading or Autobot Signal opens up full automation capabilities on the Pocket Option platform.

How the Integration Works

- Traders develop a strategy on TradingView using Pine Script that triggers alerts when certain conditions are met (e.g., moving average crossovers).

- Alerts are sent via webhook or email and relayed to the trading bot, which then executes trades on Pocket Option automatically.

- Studies show that signal accuracy based on TradingView alert systems can reach up to 75%, especially when using indicator combinations like RSI and MACD.

Pine Script Code Example

// EMA Crossover Strategy

strategy(“EMA Cross Strategy”, overlay=true)

fastEMA = ema(close, 12)

slowEMA = ema(close, 26)

plot(fastEMA, color=color.green)

plot(slowEMA, color=color.red)

if crossover(fastEMA, slowEMA)

strategy.entry(“Buy”, strategy.long)

if crossunder(fastEMA, slowEMA)

strategy.entry(“Sell”, strategy.short)

This code generates buy or sell signals that a bot can use for automatic trading. Design and test strategies in TradingView, then integrate them with bots like MT2Trading to automate trading based on powerful analytics without manual execution.

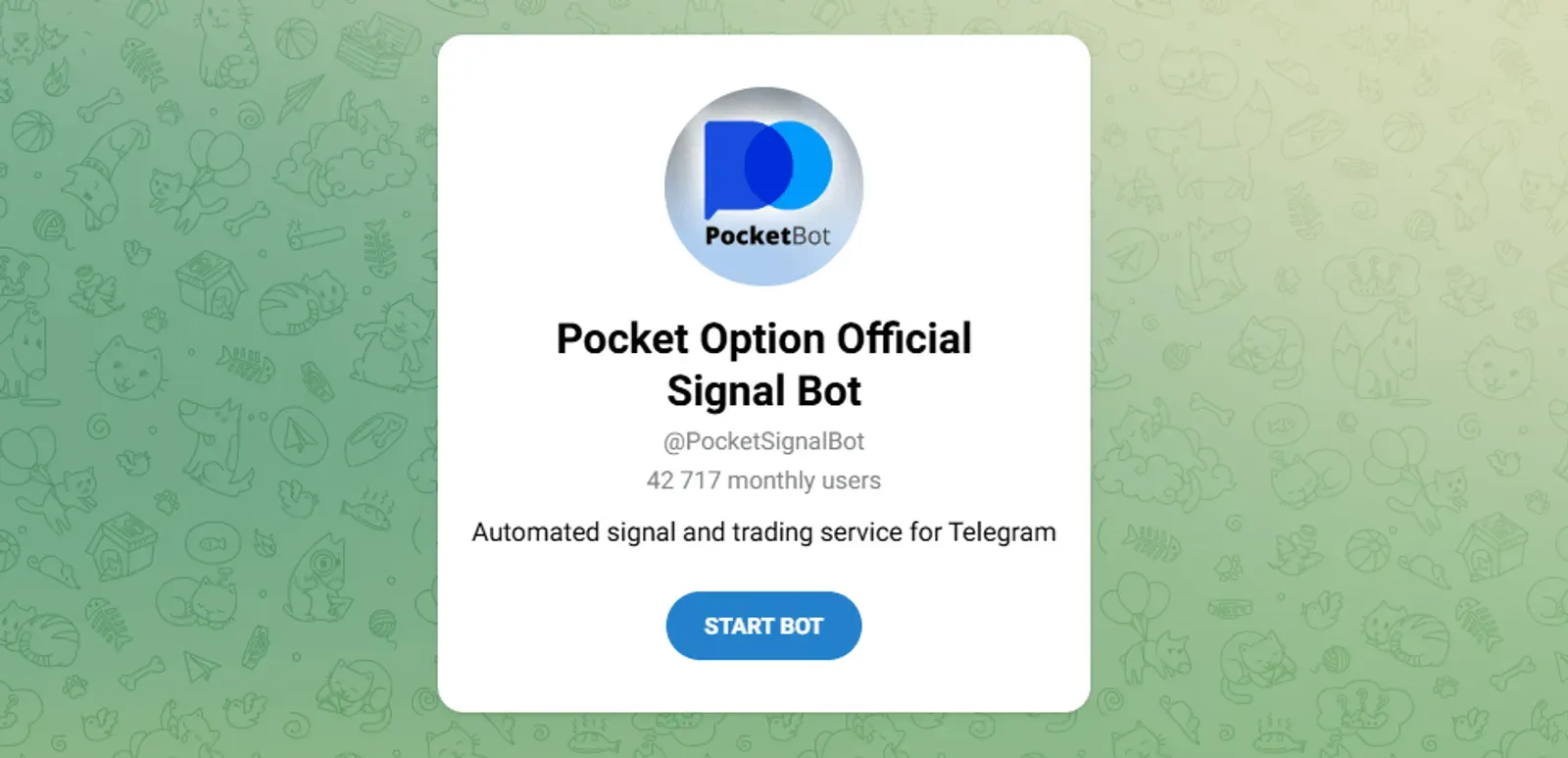

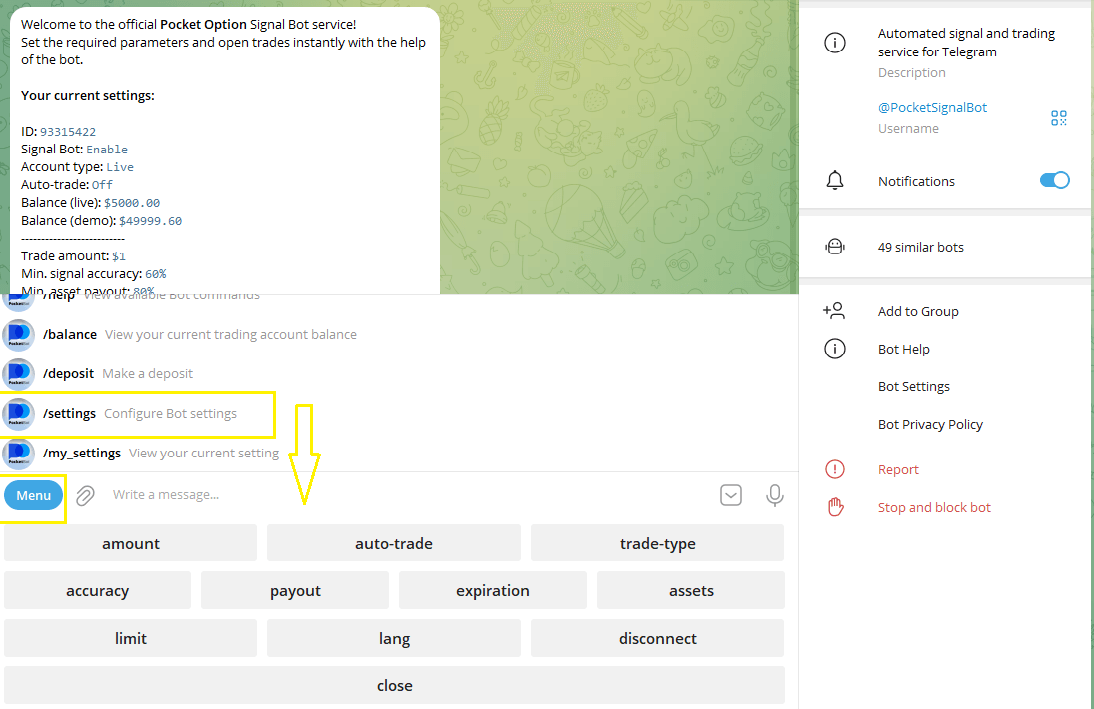

Using Telegram for Real-time Trading Alerts

Integrating Telegram into the automated trading framework is invaluable for ensuring timely communication. This messaging platform allows traders to receive real-time trading alerts directly to their devices. By automating notifications related to trade executions, market volatility, and significant price movements, traders can respond swiftly to changes in the financial market, thus optimizing their trading strategies.

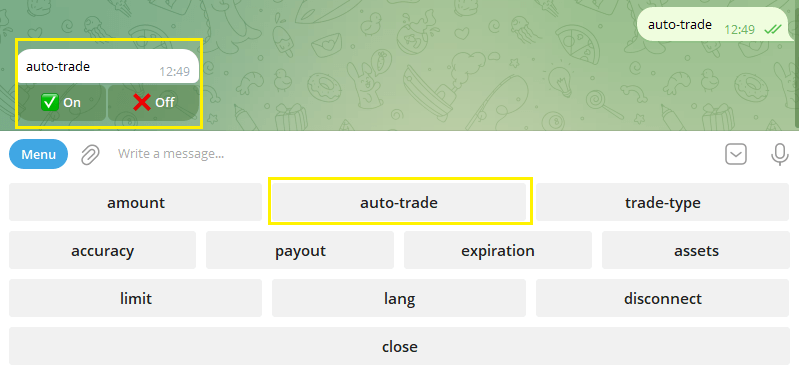

Telegram Bots: Notifications and Manual Control

Telegram bots have become essential tools for traders, offering real-time notifications and trade control. In 2025, bots like 2Bot and other open-source solutions support Telegram integration, making it convenient to trade even from a mobile device.

Functions of Telegram Bots

- Trade Notifications: Receive instant messages about each trade, including asset, direction (Buy/Sell), expiration time, and result.

- Manual Control: Send commands to start or stop trading, adjust settings, or switch strategies.

- Balance Monitoring: Track account status and drawdown in real time.

Usage Example

A trader sets up a bot to send trade notifications via Telegram. If a losing streak occurs, the trader can send a command to pause trading or switch strategies without logging in to Pocket Option.

Use Telegram bots for timely trade monitoring and control, especially when you’re away from your computer. This allows for quick response to market changes.

Leveraging Excel for Market Data Analysis

Excel serves as a powerful tool for market data analysis within the realm of automated trading. Traders can utilize Excel to organize and manipulate large datasets, enabling them to perform in-depth analyses of market trends and trading performance. This capability supports the development and refinement of trading algorithms, ultimately leading to more informed and effective trading decisions.

Excel/Google Sheets: Reporting Automation

Excel and Google Sheets are powerful tools for data analysis and reporting, helping traders track the performance of their trading bots. In 2025, traders can automate deal data collection and analyze results for informed decisions.

How the Integration Works

- Most bots, including MT2Trading, allow exporting trade history in CSV format, which can be easily imported into Excel or Google Sheets.

- Using formulas and macros, you can calculate key metrics: profitability, drawdown, win rate, and average trade size.

- Google Sheets supports API integration, allowing live data uploads.

Example Analysis in Excel

Create a table where each row is a trade, and columns include date, asset, direction, stake, result, and balance. Use functions like SUMIF or AVERAGEIF to calculate total profit and other metrics.

Regularly analyze your bot’s performance using Excel or Google Sheets. This helps identify strategy weaknesses and improve risk management.

Zapier: Linking to CRMs and Analytics Platforms

Zapier is an automation platform that connects various apps without coding. In 2025, traders use Zapier to integrate trading data with CRMs, analytics tools, and other services.

Examples of Integrations

- Add Trades to CRM: Set up Zapier to send trade data to systems like Salesforce or HubSpot for activity analysis.

- Drawdown Alerts: Trigger automated Slack or email notifications when drawdown reaches 10%.

- Google Sheets Analytics: Automatically upload trade data to Google Sheets for advanced analysis.

Usage Example

A trader configures Zapier to forward trade data to Google Sheets. Using Google Apps Script, ROI is calculated automatically and weekly reports are sent by email.

Use Zapier to automate routine tasks like reporting and notifications so you can focus on trading and market analysis.

Recommendations

- Develop strategies on TradingView using Pine Script and integrate them with bots for automatic trading.

- Set up Telegram bots for mobile monitoring and control.

- Use Excel or Google Sheets to analyze performance and track results.

- Automate routine tasks with Zapier to boost efficiency.

With these integrations, you can build a flexible and powerful trading system that works 24/7 and aligns with your goals.

Developing Your Trading Strategies

To succeed in automated trading, it’s crucial to build effective strategies tailored to market conditions. Use algorithmic principles to develop systems that analyze data, identify trends, and execute trades across platforms.

Algorithmic Trading Strategies

These strategies rely on mathematical models and automation to make decisions. From simple moving average crossovers to complex multi-indicator algorithms, automation boosts trading efficiency and accuracy.

Backtesting Your System

Backtesting helps validate strategy performance using historical data. It identifies strengths and weaknesses, guiding refinements before real-time implementation.

Using Technical Indicators

Integrate indicators like moving averages, RSI, and Bollinger Bands into your bots. These tools help detect trends and determine entry/exit points, enabling automated, rule-based trading.

Automated Trading: Pros and Cons

Pros

- High-speed execution across platforms

- Emotion-free decisions based on data

- Consistent application of strategy

Cons

- Risks from technical failures or disconnections

- Lack of market awareness without supervision

Regular monitoring is vital to minimize these risks.

Emotional vs. Algorithmic Trading

Emotional trading can lead to impulsive decisions. Algorithmic systems follow pre-set rules, promoting discipline and data-driven actions.

Choosing Brokers and Platforms

Broker Selection Criteria

- Low-latency platforms

- Diverse instruments (stocks, crypto)

- Competitive fees

- Regulatory compliance and responsive support

Evaluating Platforms

Ideal platforms support bot integration, offer advanced charting tools, backtesting, and active communities. These features empower strategic and flexible trading.

Top Automated Solutions

- Adaptable trading algorithms

- Integration with TradingView and Telegram

- Tools for automation, analysis, and alerts

Advanced Techniques

Real-Time Data Use

Real-time feeds sharpen algorithm responsiveness, improving trade timing and precision.

Opportunities in Stocks & Crypto

Bots can scan both markets for patterns and optimal trade points. Staying updated on market news enhances this capability.

Advanced Algorithmic Approaches

Utilize strategies like arbitrage, market making, and trend following. Machine learning enables self-optimizing algorithms, while built-in risk management protects against losses.

Discuss this and other topics in our community!

Comments 1