- Daily Active User (DAU) growth reached only 1.8%, falling short of the expected 2.7%.

- Average Revenue Per User (ARPU) dropped significantly in key regions: by 6.3% in North America and 4.1% in Europe.

- The company’s operating margin shrank from 31.7% to 28.2% due to rising personnel expenses.

- Q2 2025 revenue guidance of $31.5–34 billion remains below market expectations of $34.8 billion.

Pocket Option Examines Why Is Meta Stock Down Today

Investors observing recent fluctuations in Meta's stock price are frequently asking: "why did Meta stock drop today?" This detailed analysis explores the multifaceted reasons behind the recent downturn, providing valuable insights for strategic investment decisions amid market volatility.

Article navigation

- Analyzing the Recent Drop in Meta Stock

- Key Drivers Behind Meta’s Stock Decline

- Earnings Miss and Revenue Challenges

- Competitive Threats and Market Positioning

- Metaverse Investments: Strategic Risks and Financial Strain

- Regulatory and Legal Challenges

- Technical Analysis Insights

- Investor Sentiment and Psychological Factors

- Comparative Analysis with Tech Sector Peers

- Pocket Option: Practice Trading Meta Price Movements in Real Time

- Conclusion: Navigating Volatility with Strategic Insight

Analyzing the Recent Drop in Meta Stock

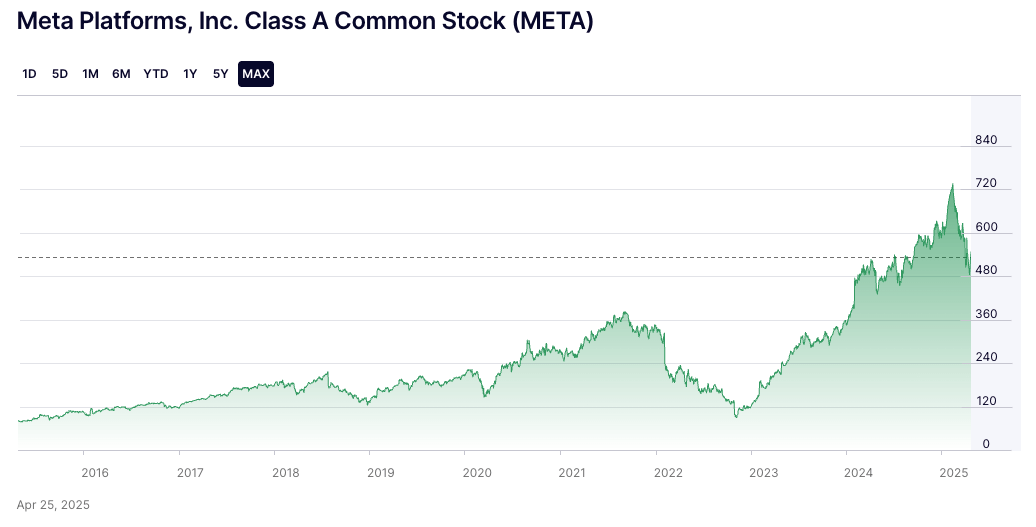

Meta Platforms (NASDAQ: META), previously known as Facebook, has experienced a significant stock decline, dropping over 15% in recent trading sessions, prompting widespread investor inquiries about why Meta stock is down today. The company’s vast user base across Facebook (2.9 billion), Instagram (2 billion), WhatsApp (2.7 billion), and metaverse investments have not prevented a $135 billion reduction in market capitalization. Notably, while broader tech sector declines averaged between 7-9%, Meta underperformed significantly by about 12% due to company-specific challenges.

Key Drivers Behind Meta’s Stock Decline

An in-depth examination of why Meta stock is down today identifies five crucial factors responsible for an 18% quarterly decline, alarming both retail and institutional investors:

| Factor | Description | Impact (%) |

|---|---|---|

| Financial Performance | Q1 revenue shortfall of $843 million, a growth deceleration from 25% to 17%, and a 13.2% drop in advertising returns | 31% |

| Competitive Landscape | TikTok’s rising popularity and Apple’s privacy updates reducing ad targeting effectiveness | 27% |

| Regulatory Concerns | Potential fines of $3.7 billion and antitrust investigations | 15% |

| Metaverse Investments | Reality Labs’ continuous losses and delayed profitability | 22% |

| Macroeconomic Pressures | High interest rates, inflation, and tech capital outflows | 5% |

Earnings Miss and Revenue Challenges

One of the key reasons for Meta’s stock drop today in 2025 is the lingering impact of the company’s disappointing financial results for the first quarter of the year. Although the challenges began back in 2024—when earnings per share missed analyst forecasts by $0.37, causing an immediate 8.4% after-hours decline—the situation has continued to deteriorate in 2025.

The main concerns weighing on investors this year include:

These indicators continue to exert pressure on Meta’s stock, fueling the current downward trend.

Competitive Threats and Market Positioning

Meta’s competitive challenges significantly explain why Meta stock is down today:

- TikTok dominates the Gen Z demographic, redirecting $4.3 billion in ad budgets.

- YouTube and Snapchat also gained substantial market share, intensifying competition.

- Apple’s ATT policy reduced Meta’s ad effectiveness, increasing customer acquisition costs by 155% and causing a $12.8 billion revenue shortfall annually.

Metaverse Investments: Strategic Risks and Financial Strain

Meta’s ambitious metaverse strategy, led by Reality Labs, faces significant criticism due to substantial financial losses ($4.3 billion in Q1 2024 alone). Investors remain skeptical given extended profitability timelines and disappointing consumer adoption rates (3.5 million Quest units sold vs. 6.8 million projected).

Regulatory and Legal Challenges

Regulatory headwinds, including antitrust investigations and substantial privacy-related fines, significantly burden Meta. Recent cases and compliance have added roughly $14.3 billion in costs since 2019, creating further downside pressure on Meta stock.

Technical Analysis Insights

Technical Overview of Meta Platforms as of April 2025

In April 2025, Meta Platforms (NASDAQ: META) continues to exhibit signs of technical weakness despite recent attempts at recovery. After peaking in February, the stock has declined by approximately 25%, raising investor concerns about its short- to medium-term momentum.

Current Technical Signals

- Moving Averages: As of April 29, 2025, Meta’s 50-day simple moving average (SMA) stands at $594.85, while the 200-day SMA is at $577.46. The current share price of $549.74 is trading below both levels, signaling a sustained bearish trend.

- Relative Strength Index (RSI): The RSI is currently at 49.79, indicating neutral market sentiment with no immediate signs of overbought or oversold conditions.

- MACD: The MACD indicator remains negative at -18.07, reflecting continued bearish momentum in the price action.

- Volume: Trading volume remains moderate, with no significant spikes that might suggest strong institutional accumulation or a trend reversal.

Meta’s technical indicators in April 2025 point to a weakening outlook. The stock is trading below key moving averages, and the negative MACD suggests persistent selling pressure. However, the neutral RSI and lack of high-volume selloffs may imply a consolidation phase or a slowdown in the downward momentum. All eyes now turn to the upcoming Q1 2025 earnings report on April 30, which could serve as a major catalyst for a directional move.

Investor Sentiment and Psychological Factors

Investor psychology has also significantly influenced Meta’s recent downturn:

- Analyst downgrades rose 375% in April, significantly lowering price targets.

- Negative sentiment increased dramatically across social media platforms and retail investor forums.

- Institutional narratives have shifted negatively, reinforcing pessimism in the market.

Comparative Analysis with Tech Sector Peers

Meta’s year-to-date stock decline of 27.4% starkly contrasts its tech peers, such as Apple (-6.8%), Microsoft (+2.7%), and Amazon (-1.8%), highlighting company-specific vulnerabilities rather than sector-wide issues.

Pocket Option: Practice Trading Meta Price Movements in Real Time

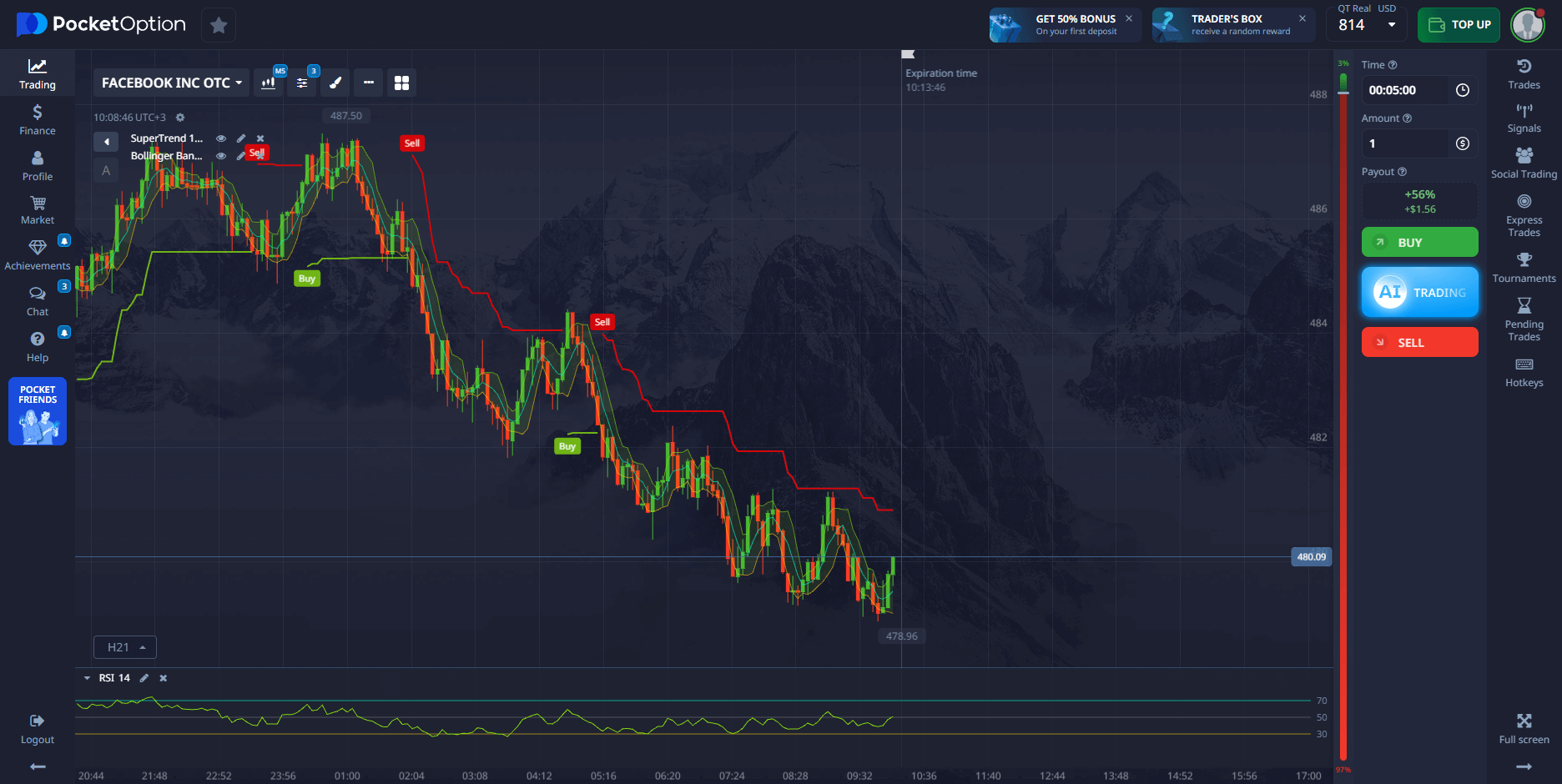

Understanding why Meta stock is down today is essential for making informed investment decisions. Pocket Option is a trading platform that enables users to capitalize on market volatility — without actually buying or owning shares. Instead of purchasing the asset, traders predict whether the price of Meta (or another listed asset) will go up or down within a selected time frame.

For example, you can open a short-term prediction that asset price will fall within the next 5 minutes. If the forecast is correct, you receive a fixed profit. This model is particularly useful during high volatility periods — such as after disappointing earnings reports or breaking news.

Demo: to support beginner traders, Pocket Option provides a free demo account with virtual funds. This allows users to safely test strategies, analyze price behavior, and become familiar with the platform before trading with real money.

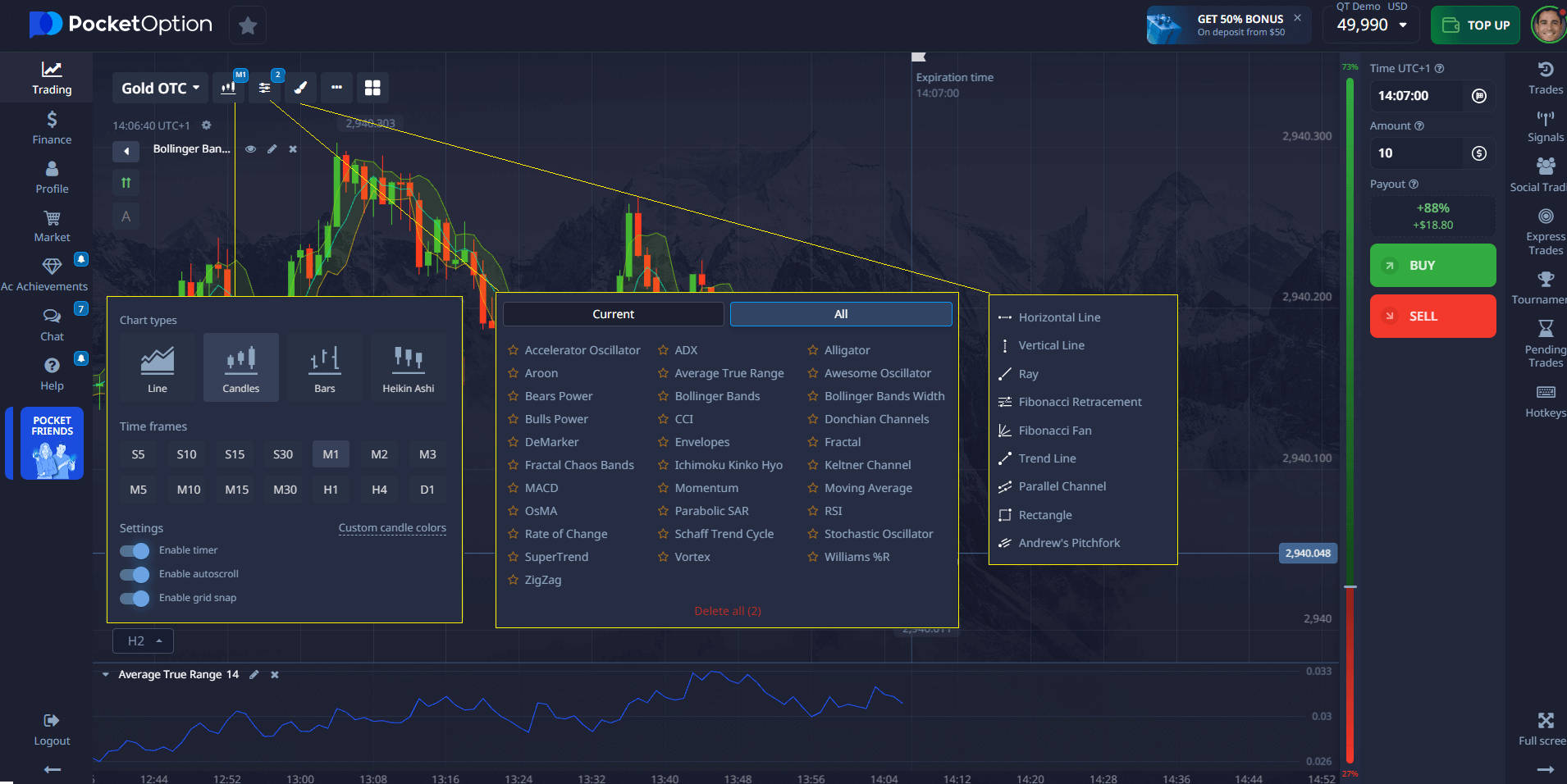

Technical analysis: the platform also offers a comprehensive technical analysis toolkit, including moving averages, RSI, MACD, and others. In the “Technical Analysis” section, these indicators can be applied directly on the trading chart.

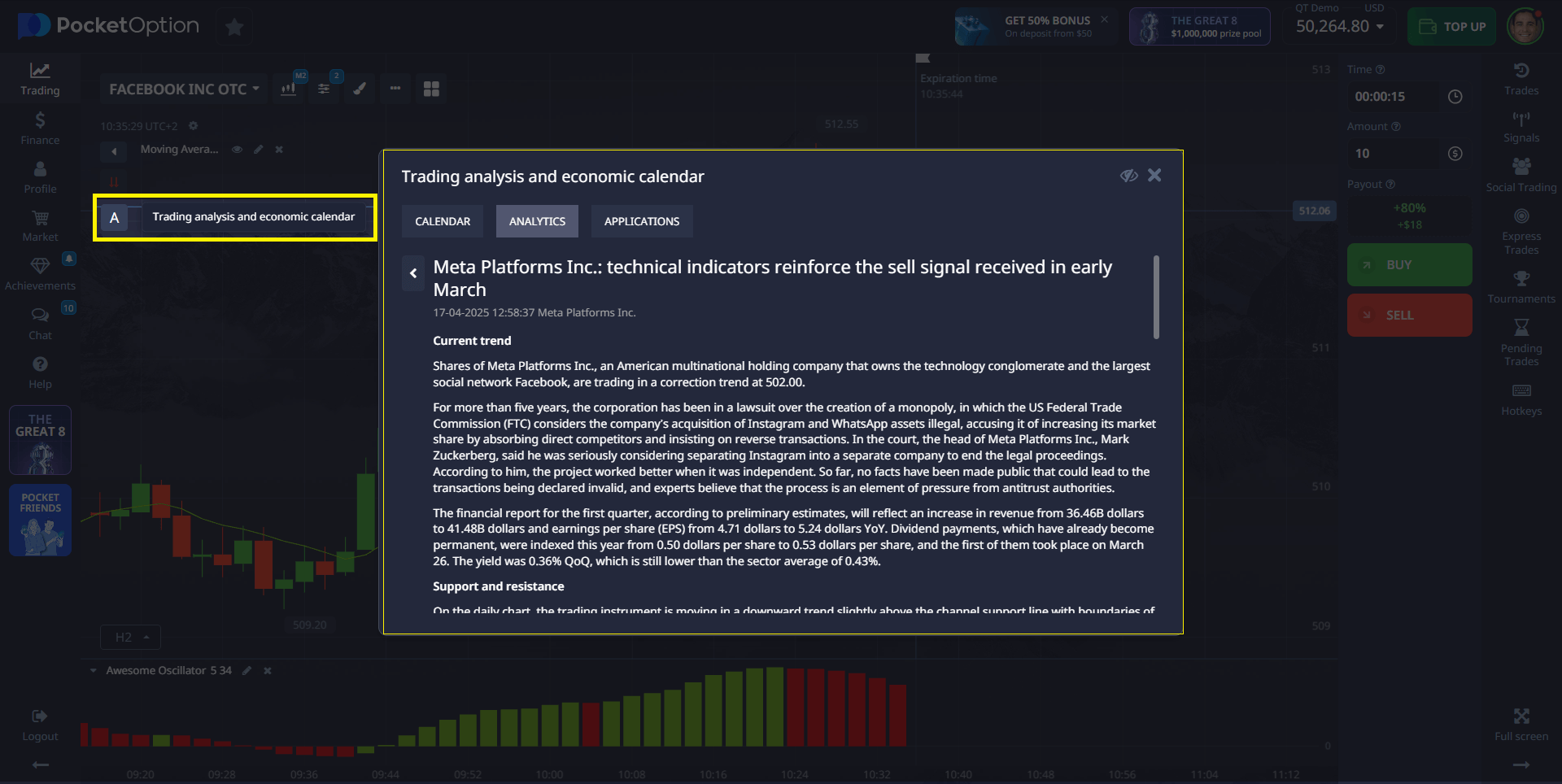

Economic calendar: in addition, Pocket Option features a built-in economic calendar that displays upcoming market events and corporate earnings. Even if there are no Meta-specific announcements at the moment, traders can monitor macroeconomic indicators and tech sector reports to understand why stocks like Meta are falling today — and respond accordingly.

These tools make Pocket Option a powerful resource not only for practicing but also for simulating real-world trading scenarios. Without owning any stock, traders can forecast price direction and improve their decision-making skills in a live market environment.

Conclusion: Navigating Volatility with Strategic Insight

Meta’s recent stock decline reflects complex internal and external challenges, from earnings misses and competitive pressures to regulatory headwinds and technical breakdowns. However, its solid fundamentals (large user base, robust cash flows) suggest potential undervaluation amidst current market pessimism. Platforms like Pocket Option empower investors with tools and practice environments to effectively navigate volatility and capitalize on strategic market opportunities.

FAQ

What are the main reasons why Meta stock is down today?

Meta stock's decline can be attributed to several factors including disappointing quarterly earnings, ongoing challenges with Apple's privacy changes affecting ad targeting, significant metaverse investments with uncertain returns, increasing competition from platforms like TikTok, and broader market selloffs affecting technology stocks. These pressures collectively create downward momentum on the share price.

How do Apple's privacy changes continue to affect Meta's business model?

Apple's App Tracking Transparency (ATT) framework has severely limited Meta's ability to track users across apps and websites, reducing ad targeting effectiveness and measurement capabilities. This has increased customer acquisition costs for advertisers on Meta's platforms, making their ad spend less efficient and potentially driving budget allocation to alternative platforms, directly impacting Meta's revenue growth.

Is Meta's heavy investment in the metaverse hurting its stock price?

Yes, Reality Labs (Meta's metaverse division) continues to report substantial quarterly losses that impact the company's overall profitability. Investors remain concerned about the multi-billion dollar annual expenditure with uncertain returns and a potentially decade-long timeline to profitability. The market appears skeptical about whether these investments will ultimately generate returns justifying their current impact on financial metrics.

How does Meta's stock performance compare to other major tech companies?

Meta has generally underperformed relative to tech peers like Microsoft, Apple, and Alphabet during recent market volatility. While the entire tech sector faces macroeconomic headwinds, Meta's specific challenges with advertising revenue growth, higher metaverse investment costs, and competitive pressures have resulted in more pronounced stock price weakness compared to more diversified tech giants.

What potential catalysts could drive a recovery in Meta's stock price?

Several developments could trigger a Meta stock recovery, including better-than-expected quarterly results showing advertising resilience, announcements of strategic cost-cutting measures, user growth acceleration across core platforms, successful monetization of newer features like Reels, favorable regulatory developments, or demonstrations of concrete metaverse progress that changes investor perception about long-term return potential.