- Individual investors can invest up to $50,000 annually in foreign securities

- Proper documentation and compliance with foreign exchange regulations required

- All transactions must be conducted through licensed financial institutions

- Tax obligations apply to both domestic and foreign investment gains

Pocket Option: Can Vietnamese people buy foreign stocks

With global markets expanding and Vietnamese investors increasingly seeking international diversification opportunities, accessing foreign stocks has become more feasible than ever through modern trading platforms.

Article navigation

- Can Vietnamese Investors Buy Foreign Stocks? Complete Legal Guide

- Legal Framework for Vietnamese International Investment

- Benefits of Investing in US Stocks and Global Markets

- Start Your Global Trading Journey with Pocket Option

- Risk Management for Vietnamese International Investors

- Investment Strategies for Vietnamese Global Investors

Can Vietnamese Investors Buy Foreign Stocks? Complete Legal Guide

The question of whether Vietnamese investors can buy foreign stocks has gained significant traction as the country’s economy continues to integrate with global markets. With the rise of international stock market platforms and evolving regulations, Vietnamese citizens now have unprecedented access to global investment opportunities.

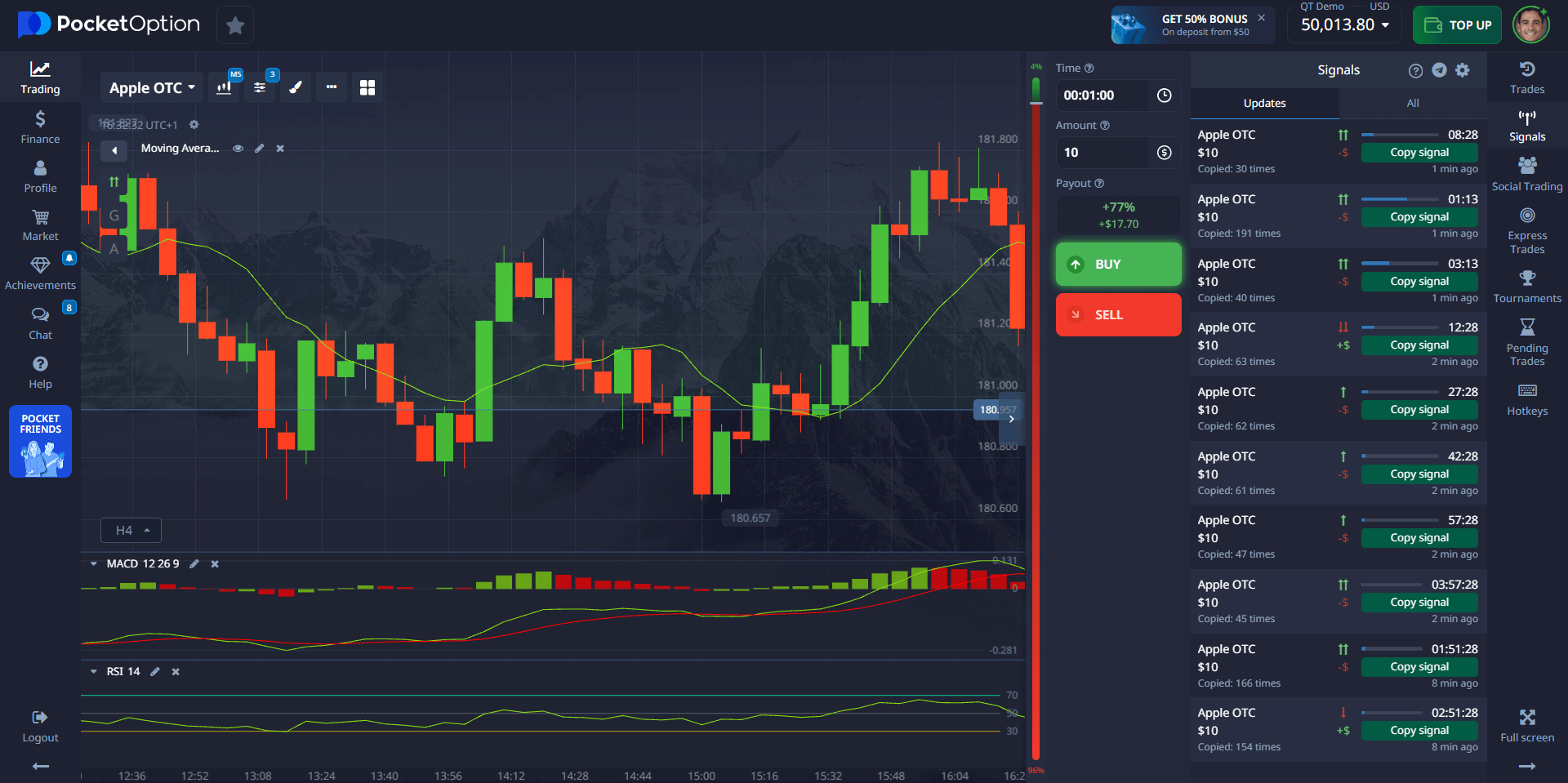

For example, platforms like Pocket Option have made it possible for Vietnamese traders to access international markets with user-friendly interfaces and comprehensive support. This accessibility has opened doors to portfolio diversification beyond domestic markets.

Ready to explore global markets? 📈 Pocket Option provides a seamless gateway for Vietnamese investors to access over 100+ assets instantly!

Legal Framework for Vietnamese International Investment

Understanding the legal regulations Vietnam has established for international investment is crucial for any Vietnamese investor considering foreign markets. The State Bank of Vietnam and the Ministry of Finance have created specific guidelines that govern cross-border investments.

“Vietnamese regulations have evolved significantly to support international investment, with clearer frameworks now in place for individual investors seeking global market exposure.” – Vietnam Investment Review, 2025

Current Regulatory Status

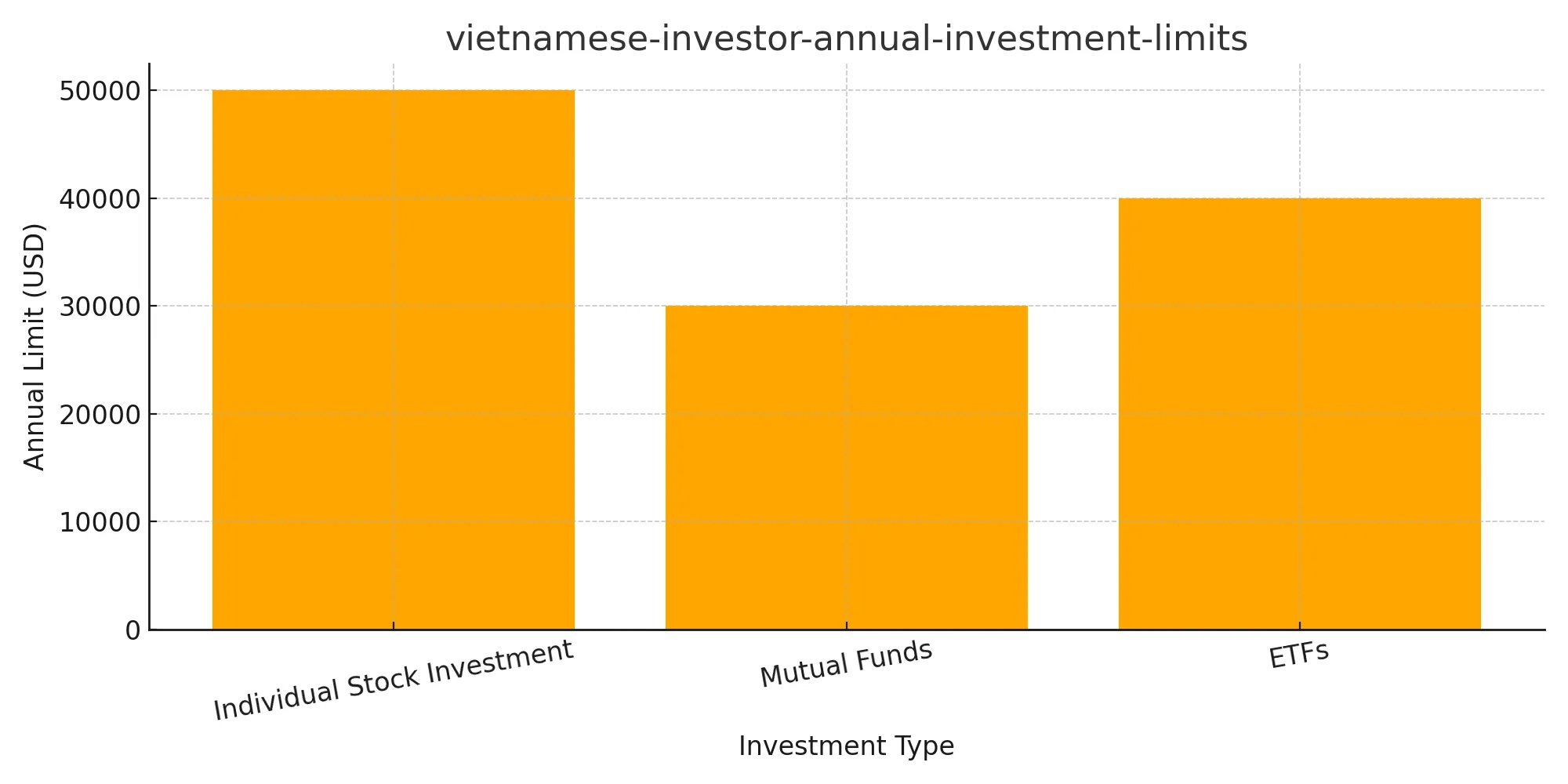

| Investment Type | Annual Limit (USD) | Documentation Required | Processing Time |

|---|---|---|---|

| Individual Stock Investment | $50,000 | ID, Bank Statements, Investment Declaration | 5-10 business days |

| Mutual Funds | $30,000 | ID, Risk Assessment, Fund Prospectus | 3-7 business days |

| ETFs | $40,000 | ID, Trading Account, KYC Documents | 2-5 business days |

Navigating legal frameworks is easier when your platform is built for accessibility. 🌍 With Pocket Option, you can start your global trading journey with confidence and minimal hassle.

Benefits of Investing in US Stocks and Global Markets

Investing in US stocks and other international markets offers Vietnamese investors several compelling advantages. The American stock market, being the world’s largest and most liquid, provides access to industry-leading companies and innovative sectors not available domestically.

“Diversification across global markets has become essential for Vietnamese investors looking to protect their portfolios against local market volatility and currency fluctuations.” – Financial Times Asia, 2025

Key Advantages Include:

- Portfolio diversification across different economies and sectors

- Access to world-class companies like Apple, Microsoft, and Tesla

- Exposure to emerging technologies and ESG investment opportunities

- Potential for higher returns compared to domestic markets

- Currency diversification benefits

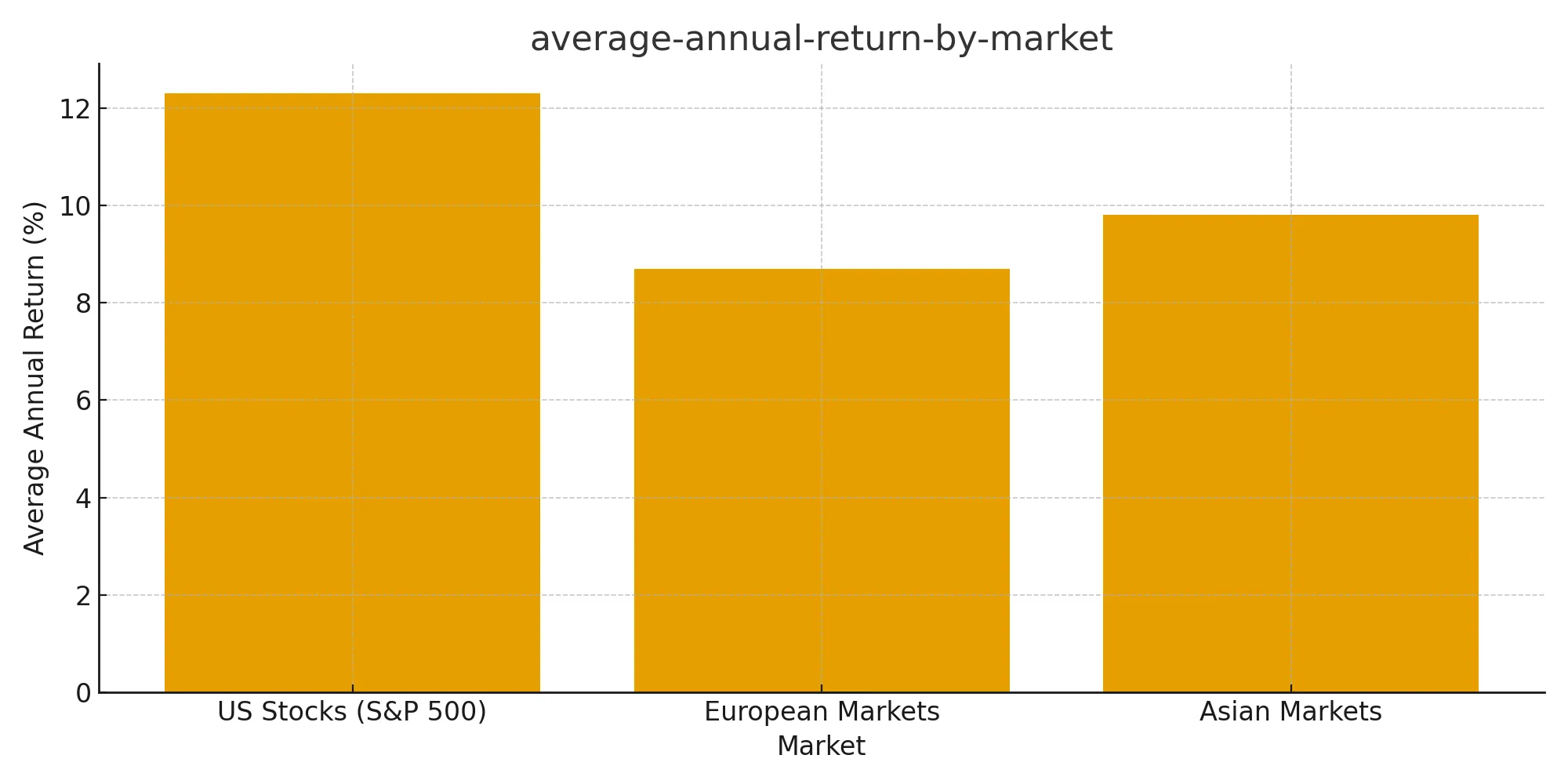

| Market | Top Sectors | Average Annual Return (5-year) | Volatility Level |

|---|---|---|---|

| US Stocks (S&P 500) | Technology, Healthcare, Financials | 12.3% | Medium |

| European Markets | Industrials, Consumer Goods, Energy | 8.7% | Medium-High |

| Asian Markets | Technology, Manufacturing, Real Estate | 9.8% | High |

Start Your Global Trading Journey with Pocket Option

While direct stock purchase is one avenue, platforms like Pocket Option offer a flexible and accessible way to engage with the price movements of global assets. This can be an excellent starting point for investors looking to gain exposure without the complexities of direct foreign brokerage. Instead of buying a full share, you can trade on the value of assets, making it a dynamic way to participate in the market.

Here’s how Pocket Option empowers Vietnamese traders:

- Low Entry Barrier: Start your trading career with a minimum deposit of just $5, which may vary based on your region and chosen payment method.

- Risk-Free Practice: Before committing real funds, you can hone your strategies on a free demo account pre-loaded with $50,000 in virtual funds.

- A World of Assets: Gain access to over 100 trading assets, including currency pairs, commodities, and stock indices, allowing for true portfolio diversification.

- Free Education Hub: Accelerate your learning with Pocket Option’s extensive knowledge base. It includes free guides on trading strategies, educational videos, and tutorials to help you start your journey.

- Competitive Trading: Test your skills and compete for prizes in regular trading tournaments, adding an exciting dimension to your investment experience.

The potential for higher returns is exciting! 💰 Pocket Option equips you with the tools and a free demo account to practice and seize those opportunities.

Risk Management for Vietnamese International Investors

Effective risk management is essential when Vietnamese investors venture into international markets. The complexity of cross-border investing introduces unique challenges that require careful consideration and strategic planning.

“Managing currency risk is perhaps the most critical aspect of international investing for Vietnamese citizens, as exchange rate fluctuations can significantly impact returns.” – Vietnam Economic Times, 2025

Primary Risk Categories

- Exchange rate risk – VND fluctuations against foreign currencies

- Political and regulatory risks in target markets

- Market volatility and liquidity concerns

- Information asymmetry and language barriers

- Time zone differences affecting trading decisions

In practice, traders often apply hedging strategies through platforms that offer currency risk management tools. For example, some international trading platforms provide built-in currency hedging options to help mitigate these risks.

Investment Strategies for Vietnamese Global Investors

Developing effective investment strategies requires understanding both global market trends and the specific needs of Vietnamese investors. Success in international markets often depends on adapting proven strategies to local circumstances and regulatory requirements.

“Vietnamese investors who have succeeded in international markets typically employ a combination of dollar-cost averaging and sector rotation strategies.” – Investment Strategy Quarterly, 2025

Recommended Approaches

- Start with established blue-chip stocks from developed markets

- Gradually diversify across sectors and geographical regions

- Implement systematic investment plans to reduce timing risks

- Focus on companies with strong fundamentals and growth prospects

- Consider ESG investment criteria for long-term sustainability

Traders often apply these strategies through modern platforms that provide comprehensive market analysis and real-time data access, enabling informed decision-making across multiple time zones and markets.

“The integration of technology platforms has democratized access to global markets, making sophisticated investment strategies available to individual Vietnamese investors.” – Asia Financial Review, 2025

Why wait to build a global portfolio? 🚀 With Pocket Option’s advanced features and educational resources, you can start applying sophisticated strategies today!

FAQ

Is it legal for Vietnamese citizens to invest in US stocks?

Yes, Vietnamese citizens can legally invest in US stocks within the annual limit of $50,000, provided they comply with local foreign exchange regulations and use licensed financial institutions or approved international trading platforms.

How can Vietnamese investors manage currency risks when buying foreign stocks?

Currency risks can be managed through diversification across multiple currencies, using currency-hedged investment products, timing investments during favorable exchange rates, and maintaining a balanced portfolio that includes both domestic and international assets.

What platforms support Vietnamese users for international stock trading?

Several international trading platforms accept Vietnamese customers, including Pocket Option and other regulated brokers. These platforms typically offer multilingual support, local payment methods, and compliance with Vietnamese regulatory requirements.

Are there restrictions on transferring money for foreign investments?

Yes, Vietnamese investors must comply with foreign exchange regulations, including documentation requirements and annual limits. All transfers must be conducted through authorized banks and properly declared to relevant authorities.

What are the tax implications for Vietnamese investors in foreign stocks?

Vietnamese investors are subject to capital gains tax on foreign investment profits, and must also consider potential withholding taxes in the countries where they invest. Professional tax advice is recommended for complex international portfolios.

How do Vietnamese investors access real-time market data for international stocks?

Most modern trading platforms provide real-time market data, news feeds, and analytical tools. Vietnamese investors can access this information through desktop and mobile applications, ensuring they stay informed about global market developments.

What are the best sectors for Vietnamese investors to consider in international markets?

Technology, healthcare, and consumer goods sectors often provide good diversification benefits for Vietnamese investors. ESG-focused investments are also gaining popularity, offering both growth potential and sustainable investment principles.

Can Vietnamese investors participate in IPOs of foreign companies?

Access to foreign IPOs depends on the specific platform and regulatory approvals. Some international trading platforms offer IPO participation to qualified Vietnamese investors, subject to minimum investment requirements and regulatory compliance.

CONCLUSION

Conclusion: Expanding Investment Horizons The ability for Vietnamese investors to buy foreign stocks represents a significant opportunity for portfolio diversification and wealth building. With proper understanding of legal regulations Vietnam has established, combined with effective risk management strategies, Vietnamese citizens can successfully navigate international stock markets. The future looks promising for Vietnamese international investors, with continued regulatory improvements and technological advances making global stock markets more accessible than ever. Success in this endeavor requires careful planning, continuous education, and the use of reliable trading platforms that understand the unique needs of Vietnamese investors. As market trends continue to evolve and ESG investment principles gain prominence, Vietnamese investors who embrace international diversification will be well-positioned to capitalize on global opportunities while managing risks effectively. The journey into international investing begins with education, preparation, and choosing the right platform to support your investment goals.

Start Trading International Stocks Today