- Platform Technology Architecture

- Dynamic Pricing Algorithm: Real-time supply and demand matching

- Route Optimization: AI-powered navigation and efficiency systems

- Safety Technology: Driver background checks, GPS tracking, emergency features

- Payment Processing: Integrated financial technology solutions

Uber Stock Dividend Reality

The question of Uber stock dividend remains one of the most frequently asked among investors considering Uber Technologies (NYSE: Uber) for their portfolios. Investors often ask: Does Uber pay dividends? This article explores the full Uber dividend policy, the history of Uber Technologies stock, and its payout prospects. This comprehensive analysis examines Uber's dividend policy, explores why the company has maintained its non-dividend stance, and provides strategic alternatives for income-seeking investors.

Article navigation

Uber’s Current Dividend Status: The Complete Picture

Does Uber stock pay dividends? The definitive answer is no-Uber Technologies has never distributed dividends since its initial public offering in May 2019. This position reflects the company’s strategic focus on growth and market expansion rather than immediate shareholder distributions.

Despite generating substantial free cash flow of $3.4 billion in 2023 (latest available data as of 2025), uber dividend policy prioritizes reinvestment in technology development, global market penetration, and operational efficiency improvements. This approach aligns with typical growth-stage technology companies that prioritize long-term value creation over short-term income distribution.

| Company | Dividend Status | 2023 Free Cash Flow | Market Cap |

|---|---|---|---|

| Uber (Uber) | No Dividend | $3.4B | $142B |

| Lyft (LYFT) | No Dividend | $205M | $6.2B |

| DoorDash (DASH) | No Dividend | $1.1B | $52B |

| Booking Holdings (BKNG) | Share Repurchases | $6.3B | $128B |

Understanding Uber Technologies’ Business Model and Technology

Uber Technologies operates as a mobility and delivery platform, connecting riders, drivers, merchants, and delivery partners through sophisticated technology infrastructure. The company’s core technology includes:

Business Segments

- Mobility: Ride-sharing services across 70+ countries

- Delivery: Food and package delivery through Uber Eats

- Freight: Logistics platform for commercial transportation

The technological sophistication requires continuous investment, which explains why Uber technologies dividend policy focuses on reinvestment rather than distributions.

Why Does Uber Not Pay Dividends? | Uber Technologies Dividend Policy Explained

Why does Uber not pay dividends stems from several strategic imperatives that characterize platform-based technology companies in expansion phases:

Capital Allocation Priorities

| Strategic Priority | Annual Investment | Long-Term Objective |

|---|---|---|

| Global Market Expansion | $1.2-1.8B | Market leadership in mobility |

| Technology Development | $800M-1.2B | AI integration, platform efficiency |

| Financial Stability | Building reserves | Competition resilience |

| Regulatory Compliance | $200-400M | Global operational licensing |

Growth Phase Characteristics

CEO Dara Khosrowshahi stated during Q4 2023 earnings: “Our priority remains investing in our platform’s growth while improving operational efficiency to drive sustainable profitability.” This strategy follows the typical evolution of platform companies:

- Initial Growth Phase: All capital directed toward user acquisition (2009-2019)

- Profitability Phase: Focus on margin improvement while maintaining growth (2020-2024)

- Maturation Phase: Initiation of capital return through share repurchases (Current transition)

The company’s decision reflects a calculated approach to maximizing long-term shareholder value through strategic reinvestment rather than immediate dividend distributions.

Uber’s Share Repurchase Program: Alternative to Dividends

While does uber pay dividends remains answered with “no,” the company announced a significant $7 billion share repurchase authorization in February 2024 (latest strategic update available as of 2025), representing its first formal acknowledgment of shareholder capital return as a priority.

Buyback Advantages Over Dividends

Share repurchases offer several strategic advantages:

- Financial Flexibility: Unlike dividends, buybacks can be adjusted based on business conditions

- Tax Efficiency: Shareholders avoid immediate tax consequences until share sales

- EPS Enhancement: Reducing outstanding shares increases earnings per share

- Market Signal: Demonstrates management confidence in business prospects

CFO Prashanth Mahendra-Rajah emphasized: “This share repurchase program demonstrates the confidence we have in our business and represents a step forward in our capital allocation framework.”

When Will Uber Pay Dividends? Expert Insights on Uber Stock Dividend

Industry experts provide varying perspectives on Uber’s potential dividend timeline. According to Morgan Stanley analyst Brian Nowak: “Uber’s path to dividend initiation depends on achieving sustainable free cash flow margins above 15% while maintaining competitive market position.”

Probability Timeline Analysis

| Timeframe | Dividend Probability | Key Prerequisites |

|---|---|---|

| 1-2 Years | Very Low (5-10%) | Dramatic FCF acceleration |

| 3-5 Years | Low-Moderate (20-35%) | Sustained profitability, reduced growth investment |

| 6-8 Years | Moderate (40-60%) | Market maturation, stable competitive position |

| 8+ Years | High (70-85%) | Full platform maturity |

Financial Metrics for Dividend Consideration

Goldman Sachs transportation analyst Eric Sheridan notes: “Uber would likely need annual free cash flow of $6-8 billion with 15-20% sustainable margins before considering dividend initiation.”

| Financial Metric | Current Status | Dividend Prerequisite |

|---|---|---|

| Annual Free Cash Flow | $3.4B (2023) | $6-8B stable |

| FCF Margin | ~9-10% | 15-20% sustainable |

| Growth Rate | 15-20% annual | Single-digit mature rate |

| Market Position | Dominant in key markets | Consolidated leadership |

Income-Generating Strategies for Uber Investors

Does Uber pay a dividend may be answered negatively, but investors can implement sophisticated strategies to generate income from Uber positions while maintaining growth exposure.

Options-Based Income Generation

Uber’s moderate to high implied volatility creates opportunities for income strategies:

Covered Call Strategy

- Income Potential: 6-10% annually

- Risk Profile: Limited upside beyond strike price

- Implementation: Sell monthly calls 10-15% out-of-the-money

- Typical Yield: 0.5-0.9% monthly (6-10% annualized)

Cash-Secured Put Strategy

- Income Potential: 5-9% annually

- Risk Profile: Obligation to purchase shares at strike

- Best For: Investors seeking entry at lower prices

Collar Strategy

- Income Potential: 3-5% annually

- Risk Profile: Protected downside, limited upside

- Suitable For: Conservative income seekers

Portfolio Construction Approaches

Professional portfolio manager Sarah Chen from Meridian Capital observes: “Uber’s non-dividend status requires strategic portfolio construction to balance growth potential with income needs.”

The Barbell Strategy

- Allocation: 65% dividend stocks (3-4% yield) + 35% growth stocks including Uber

- Target Outcome: Balanced income and growth exposure

- Risk Management: Diversified across income and appreciation assets

Yield Offset Approach

- Method: Pair Uber with high-yield investments

- Example: Uber (7% position) + REITs (15% position) + Dividend ETFs (78% position)

- Result: Achieve target portfolio income while maintaining growth exposure

Is Uber Technologies a good investment?

Uber Technologies presents a compelling growth investment opportunity based on several factors:

Positive Investment Factors:

- Dominant market position in ride-sharing and delivery

- Strong free cash flow generation ($3.4B in 2023, latest data)

- Expanding global market presence

- Technology platform advantages

Investment Considerations:

- High competition in key markets

- Regulatory challenges in various jurisdictions

- Economic sensitivity of discretionary spending

- No dividend income for income-focused investors

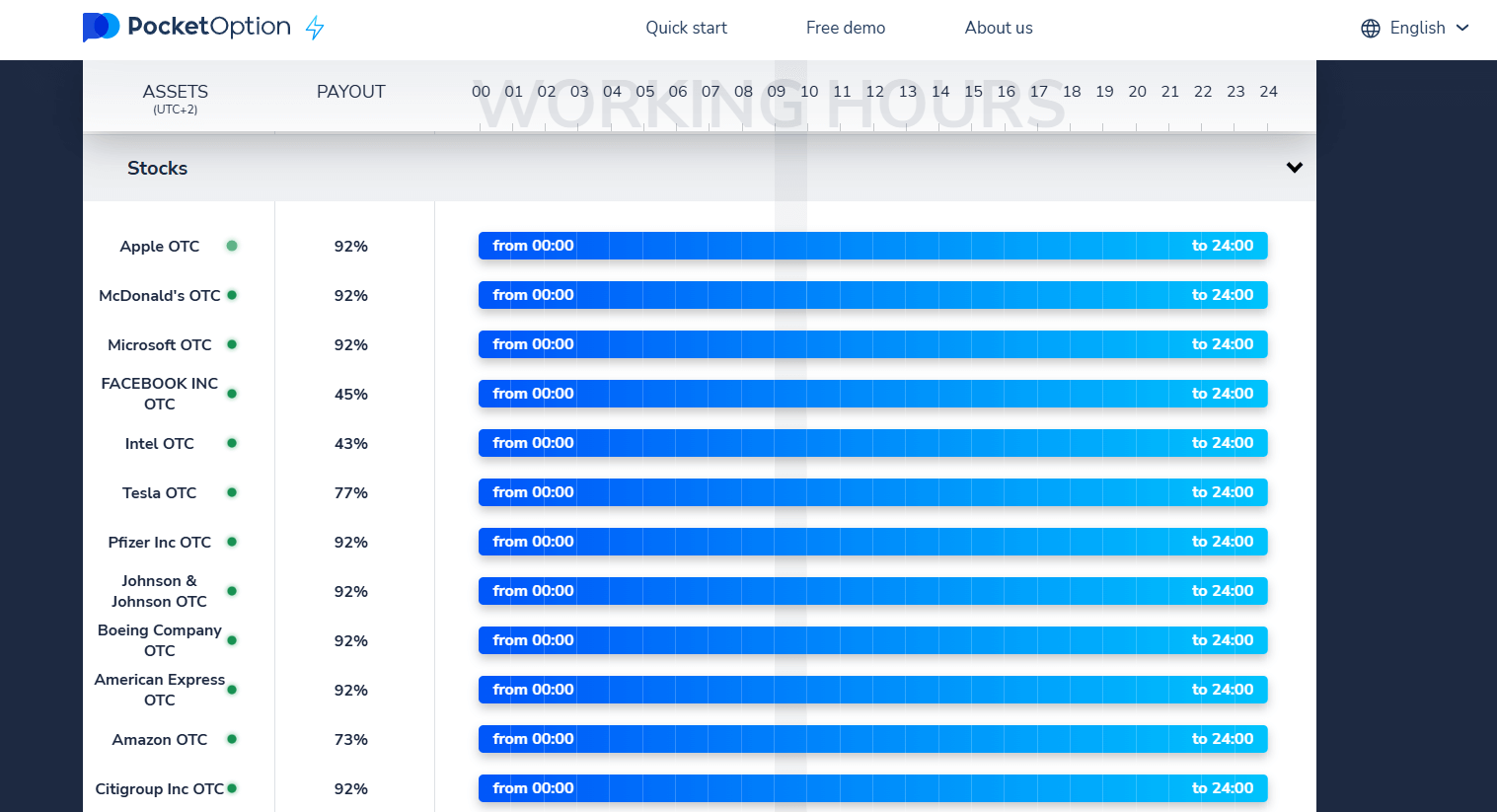

Trading Uber with Pocket Option: Advanced Strategies

While traditional stock ownership provides one avenue for Uber exposure, Pocket Option offers sophisticated trading opportunities across 100+ assets with advanced technology and rapid execution capabilities.

Pocket Option Platform Advantages

Technology Infrastructure:

- Advanced charting tools with 20+ technical indicators

- Real-time market data and price feeds

- Mobile and desktop trading platforms

- Quick trading execution with minimal latency

Trading Features:

- Multiple asset classes beyond traditional stocks

- Flexible position sizing and risk management tools

- Educational resources for strategy development

- Community-driven trading insights

Experienced trader Michael Rodriguez shares: “Pocket Option’s platform technology allows for sophisticated strategy implementation that complements traditional investment approaches. The quick trading capabilities enable responsive portfolio management.”

Risk Management with Pocket Option

The platform’s risk management tools help traders implement strategic approaches:

- Position Sizing: Precise control over exposure levels

- Stop-Loss Integration: Automated risk control mechanisms on MT platforms

- Portfolio Diversification: Access to multiple asset classes

- Real-Time Analytics: Performance tracking and strategy optimization

Trader Testimonials: Real Experience with Pocket Option

James Thompson, Portfolio Manager: “Pocket Option’s technology infrastructure supports sophisticated trading strategies that complement long-term investment approaches. The platform’s reliability and execution speed meet professional standards.”

Elena Vasquez, Independent Trader: “The educational resources and community features on Pocket Option enhanced my understanding of complex trading strategies. The platform’s user interface makes strategy implementation straightforward.”

Robert Kim, Financial Advisor: “Clients appreciate Pocket Option’s transparent approach and comprehensive trading tools. The platform serves both newcomers and experienced traders effectively.”

Comparative Analysis: Uber vs. Dividend-Paying Alternatives

Understanding Uber stock dividend limitations requires comparing total return potential against traditional dividend investments:

3-Year Total Return Comparison

| Investment Approach | Current Income | 3-Year Total Return | Volatility |

|---|---|---|---|

| Uber (Uber) | 0% dividend yield | ~25% (variable) | High |

| Uber + Covered Calls | 6-10% synthetic yield | ~15-20% (more stable) | Moderate |

| S&P 500 Dividend Aristocrats | 2.5-3.5% dividend yield | ~10-12% including dividends | Low-Moderate |

| Technology Dividend ETFs | 1.5-2.5% dividend yield | ~12-15% including dividends | Moderate |

Risk-Adjusted Analysis

Financial advisor Dr. Patricia Williams notes: “Uber’s total return potential can outperform traditional dividend investments under favorable market conditions, though investors must accept higher volatility and more active management requirements.”

Investment Strategies by Life Stage

The optimal approach to Uber dividend absence varies significantly based on investor demographics and financial objectives:

Growth Phase Investors (25-40 years)

- Recommended Allocation: 5-10% of portfolio

- Strategy: Full growth exposure without income overlay

- Rationale: Time horizon allows for volatility tolerance and growth maximization

Transition Phase Investors (40-55 years)

- Recommended Allocation: 3-7% of portfolio

- Strategy: Partial options overlay (25-50% of position)

- Implementation: Gradual transition from growth to income focus

Income Phase Investors (55+ years)

- Recommended Allocation: 0-4% of portfolio

- Strategy: Full options overlay or strategic pairing

- Focus: Income generation with limited growth exposure

Expert Insights: Future Dividend Outlook

Industry expert Dr. Amanda Foster from Columbia Business School provides perspective: “Uber technologies dividend policy reflects the company’s strategic position in a rapidly evolving transportation technology sector. Dividend initiation would signal platform maturity, but current reinvestment opportunities suggest continued growth focus.”

Dividend Initiation Scenarios

Optimistic Scenario (5-7 years):

- Market leadership consolidation

- Autonomous vehicle technology integration

- Sustainable 20%+ free cash flow margins

- Initial dividend yield: 0.5-1.0%

Conservative Scenario (8-12 years):

- Full market maturation

- Reduced technology investment requirements

- Stable competitive environment

- Initial dividend yield: 1.0-1.5%

Alternative Income Investments for Consideration

Investors seeking immediate income while maintaining technology sector exposure might consider:

High-Yield Technology Alternatives

| Company | Dividend Yield | Sector Focus | Risk Profile |

|---|---|---|---|

| Microsoft (MSFT) | 0.7% | Cloud computing | Low |

| Apple (AAPL) | 0.5% | Consumer technology | Low-Moderate |

| Intel (INTC) | 1.5% | Semiconductors | Moderate |

| IBM (IBM) | 4.8% | Enterprise technology | Moderate-High |

Technology-Focused Dividend ETFs

- Technology Select Sector SPDR Fund (XLK): 0.7% yield

- Vanguard Information Technology ETF (VIT): 0.8% yield

- iShares U.S. Technology ETF (IYW): 0.6% yield

Risk Assessment and Portfolio Integration

Does Uber pay a dividend concerns require comprehensive risk assessment for portfolio integration:

Uber-Specific Risks

- Regulatory Risk: Government policy changes affecting ride-sharing

- Competition Risk: Market share pressure from competitors

- Economic Risk: Discretionary spending sensitivity

- Technology Risk: Platform disruption possibilities

Portfolio Risk Management

- Diversification: Limit Uber allocation to 3-7% of total portfolio

- Sector Balance: Complement with defensive dividend-paying sectors

- Geographic Diversification: Include international dividend opportunities

- Time Diversification: Implement systematic investment approaches

Summary: Strategic Approach to Uber’s Dividend Reality

The persistent question does Uber stock pay dividends reflects investor desire for income generation from high-growth technology companies. While Uber maintains its focus on reinvestment over distributions, strategic investors can implement sophisticated alternatives to achieve income objectives.

Key Strategic Takeaways:

- Uber Dividend Timeline: Dividend initiation likely remains 5-8 years away

- Income Alternatives: Options strategies can generate 6-10% synthetic yields

- Portfolio Integration: Strategic allocation balances growth and income needs

- Risk Management: Diversification essential for Uber positions

- Platform Advantages: Pocket Option provides sophisticated trading tools for strategy implementation

Professional portfolio construction considers Uber Technologies dividend policy and the absence of a Uber stock dividend as factors among many in achieving optimal risk-adjusted returns. The combination of strategic allocation, income overlay techniques, and sophisticated trading platforms like Pocket Option enables investors to optimize returns while managing dividend policy limitations.

Ready to implement advanced trading strategies? Pocket Option’s comprehensive platform supports sophisticated approaches to technology investments with professional-grade tools and educational resources. Discuss this and other topics in our trading community!

FAQ

Does Uber stock pay dividends currently?

No, Uber Technologies, Inc. (NYSE: UBER) does not currently pay dividends to shareholders and has never done so since its initial public offering in May 2019. This represents a deliberate strategic decision rather than a financial limitation. Despite generating approximately $3.4 billion in free cash flow in 2023, Uber's management prioritizes reinvesting capital into platform expansion, technological development, market consolidation, and building financial stability rather than distributing it as dividends. CEO Dara Khosrowshahi has consistently emphasized the company's focus on growing gross bookings, expanding adjusted EBITDA margins, and generating free cash flow as primary financial objectives. This approach aligns with typical capital allocation strategies of technology platform companies in their growth and early profitability phases, where reinvestment in the business is seen as creating more long-term shareholder value than immediate cash distributions.

When might Uber start paying dividends?

Uber is unlikely to initiate dividends in the near term, with probability analysis suggesting a 5-10% chance within 1-2 years, increasing to 20-35% within 3-5 years, and 40-60% within 6-8 years. Several financial and strategic milestones would typically precede dividend initiation, including: annual free cash flow reaching $6-8 billion (compared to current $3.4 billion), FCF margins expanding to 15-20% (currently ~9-10%), and annual growth rate moderating to single digits (currently 15-20%). Uber has recently taken its first step toward shareholder capital return by announcing a $7 billion share repurchase authorization in February 2024, which represents a significant milestone in its financial evolution. If Uber eventually initiates dividends, it would likely begin with a modest yield of 0.4-0.8% (similar to early tech dividend programs) and a conservative payout ratio of 10-15% of free cash flow. However, a data-supported alternative perspective suggests Uber might follow companies like Alphabet in perpetually favoring share repurchases over traditional dividends.

What alternatives do income-focused investors have with Uber stock?

Income-focused investors can implement several effective strategies to generate cash flow from Uber positions despite the absence of dividends. The most accessible approach is covered call writing, which involves selling call options against existing Uber shares. This typically yields 0.5-0.9% monthly income (6-10% annualized) while retaining upside potential up to the strike price. Additional options strategies include cash-secured puts (5-9% annual income) and collar strategies (3-5% annual income with downside protection). Beyond options, portfolio construction alternatives include the barbell strategy (allocating approximately 65% to dividend stocks yielding 3-4% and 35% to growth stocks including Uber), yield offset approaches (pairing Uber with specific high-yield investments to achieve target portfolio income), and systematic harvesting (selling 1-2% of appreciated Uber shares quarterly to create predictable cash flow). These approaches allow investors to maintain Uber exposure for growth potential while generating current income that often exceeds traditional dividend yields, though with different risk profiles and implementation requirements.

How does Uber's share repurchase program affect investors?

Uber's $7 billion share repurchase authorization announced in February 2024 represents the company's first formal capital return initiative and signals an important inflection point in its financial evolution. This program benefits investors in several ways: It potentially reduces the outstanding share count, which can increase earnings per share (EPS) even if total earnings remain constant; it demonstrates management confidence in the company's financial position and future prospects; it provides tax efficiency compared to dividends, as shareholders don't incur immediate tax consequences until they sell shares; and it offers the company financial flexibility to adjust repurchase activity based on market conditions, business needs, and share price. The buyback program also aligns with the typical progression of technology platform companies, which generally favor share repurchases as their first capital return mechanism before considering traditional dividends. For income-focused investors, while buybacks don't provide direct cash flow, they can enhance total return through potential share price appreciation and signal a maturing financial approach that may eventually lead to dividend consideration. CFO Prashanth Mahendra-Rajah specifically noted that the program "represents a step forward in our capital allocation framework," suggesting an evolving approach to shareholder returns.

How should different investor types approach Uber in their portfolios?

The optimal approach to Uber varies significantly based on investor profiles, time horizons, and specific objectives. Growth-focused investors (typically ages 25-40) with long time horizons might allocate 5-10% of their portfolios to Uber with full growth exposure and no income overlay, taking advantage of the company's expansion potential and tolerating higher volatility. Balanced investors (ages 40-55) transitioning toward income generation might maintain a 3-7% allocation while implementing partial options strategies on 25-50% of the position, creating moderate income while preserving some growth exposure. Income-primary investors (age 55+) might limit Uber to 0-4% of portfolios with full options overlay strategies or strategic sector pairing to generate necessary cash flow while maintaining modest growth exposure. A particularly effective approach for pre-retirees involves a gradual transition: maintaining core Uber positions for growth while incrementally expanding options overlay strategies to generate increasing income as retirement approaches. This creates a personalized "glide path" from growth to income that accommodates changing financial needs while potentially outperforming both pure growth and pure income approaches during the transition period.

Is Uber going to pay dividends?

Current evidence (as of 2025) suggests dividend initiation remains unlikely within the next 3-5 years. Does Uber pay dividends will likely remain answered negatively until the company achieves higher free cash flow margins and reduced growth investment requirements. Industry analysts project potential dividend consideration only after Uber reaches mature platform status with sustainable 15-20% free cash flow margins.

What is Uber's address for taxes?

For tax reporting purposes, Uber Technologies Inc. maintains its principal executive offices at: 1515 3rd Street, San Francisco, CA 94158, United States

Where is Uber's principal place of business?

Uber's principal place of business is San Francisco, California, where the company maintains its headquarters and primary operations. The company also operates significant facilities in: Amsterdam, Netherlands (International headquarters) ; New York City, New York (East Coast operations); Chicago, Illinois (Central operations); Multiple technology centers globally