- Not listed on any legitimate stock exchange

- No independent audit or transparent reporting

When Will Skyway Stock Be Listed -- Comprehensive Perspective for Investors

This is a controversial question in the investment community. Many wonder if skyway stocks ever up the floor or if it’s just hype without substance. This article will provide factual information, risk analysis, and evaluation strategy suggestions for individual investors.

Article navigation

What is Skyway and Where Does Skyway Stock Come From?

Skyway stock refers to shares issued by Skyway Technologies—a self-proclaimed elevated transport project headquartered in Belarus. The project is heavily promoted with promises of “buying shares in the early stage, multiplying profits when listed.”

Understanding the Skyway Concept

Skyway refers to an elevated transport system based on string technology, designed to reduce traffic congestion and environmental impact. It is spearheaded by engineer Anatoly Yunitskiy and his Skyway Group. The concept is particularly attractive to those seeking futuristic infrastructure investments—but it must be scrutinized before investing.

📌 Expert Insight

“Skyway bears the typical hallmarks of speculative infrastructure schemes: unclear valuation basis, extended pre-IPO timelines, and unverifiable project milestones. This does not mean it’s fraudulent by default—but it demands extreme caution.”

— Elena Matskevich, Senior Analyst on Frontier Markets, EquityScan Global

Key Features of the Project

Skyway promotes high-speed, above-ground lightweight vehicles and eco-technoparks. These aspects are marketed as eco-friendly innovations, making Skyway appear progressive and sustainable. However, this narrative often overshadows the lack of transparency and official regulation—crucial issues for those considering how to buy Skyway shares.

When Will Skyway Stock Be Listed?

When will Skyway stock be listed is a question that frequently appears in the project’s online seminars. However, as of 2025, no evidence or official skyway IPO listing date has been announced.

📌 Expert Statement on Risk Exposure

“We analyzed Skyway in the context of emerging market IPOs. The lack of third-party auditing or regulatory confirmation places it below acceptable investment thresholds in regulated portfolios.”

— Lucas Tang, CFA, Head of Risk Strategy, FinBridge Research (2025 Report)

| Content | Current Reality |

|---|---|

| IPO Documentation | None |

| Financial Disclosure | Not transparent |

| Exchange | Not listed anywhere |

Current Investment Offers and “Skyway IPO Listing Date” Rumors

The Skyway Invest Group actively promotes pre-IPO offers through seminars and online ads, claiming that shares will rise significantly once listed. However, there is no reliable source confirming the actual skyway IPO listing date. As a result, many investors remain skeptical.

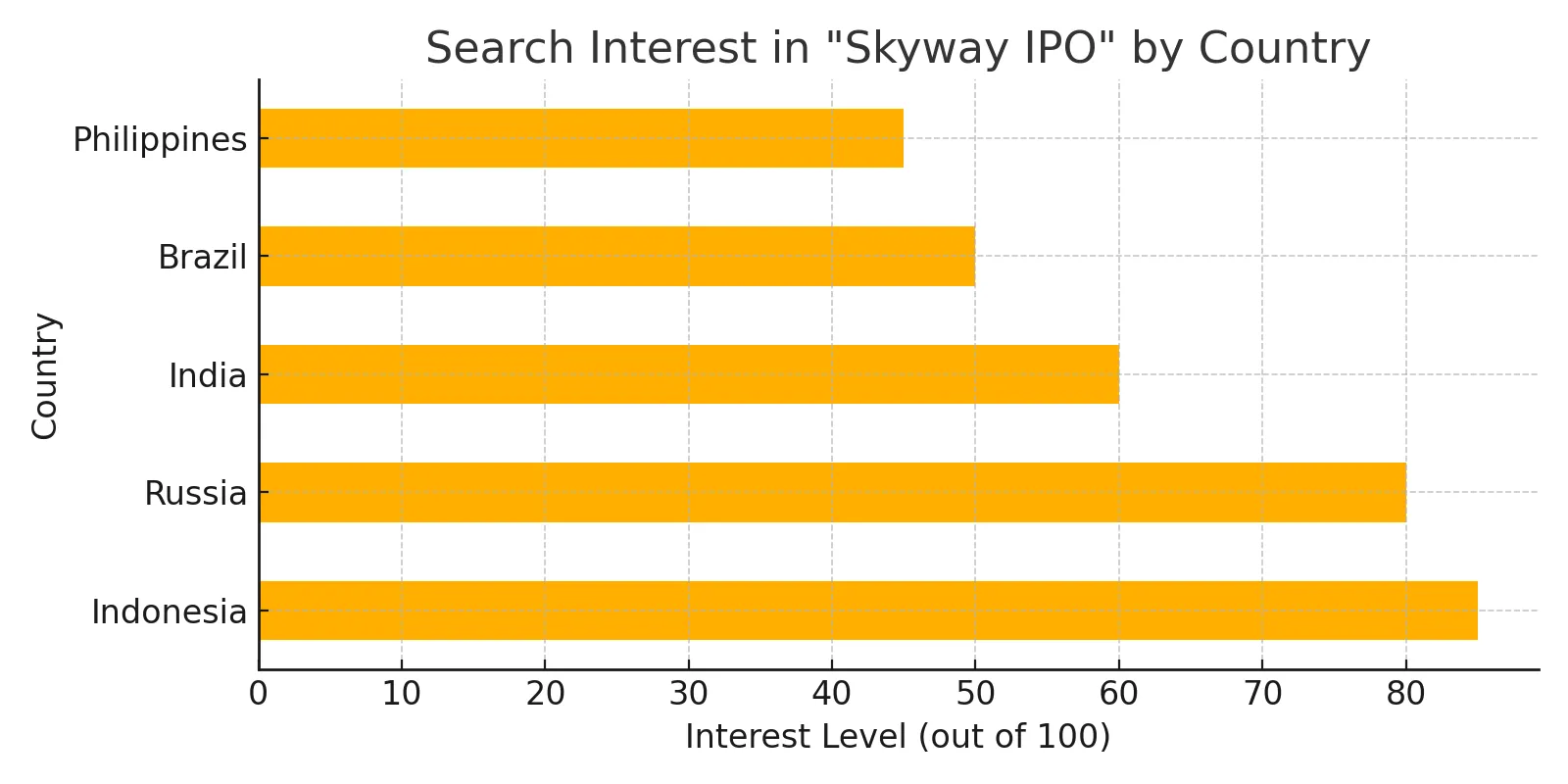

Public Perception and Global Trends

In international communities, the term skyway beursgang (Dutch for Skyway IPO) is gaining search volume—but still no verified IPO roadmap exists. Public interest is fueled by social media, not regulatory filings.

📌 Analyst Commentary on “skyway stocks ever up the floor”

The phrase “skyway stocks ever up the floor” reflects a dangerous narrative in unregulated markets where hype replaces financial due diligence. Experts emphasize that without verifiable listing mechanisms or historical financial disclosures, such optimism is speculative at best.

Is Skyway Stock a Scam or Just High Risk? (skyway scam vs. Real IPO Patterns)

The phrase Skyway stock scam is appearing with increasing frequency. Some warning signs:

- Not regulated by Securities Commission

- Capital raising model resembles financial pyramid scheme

- Lack of actual commercial products

Risks Involved in Skyway Investments

Investors must be aware of systemic risks, including regulatory barriers in Belarus, vague dividend structures, and ongoing questions about asset backing. Despite promises of payout when listed, no mechanism is provided for how Skyway Capital reviews or issues dividends.

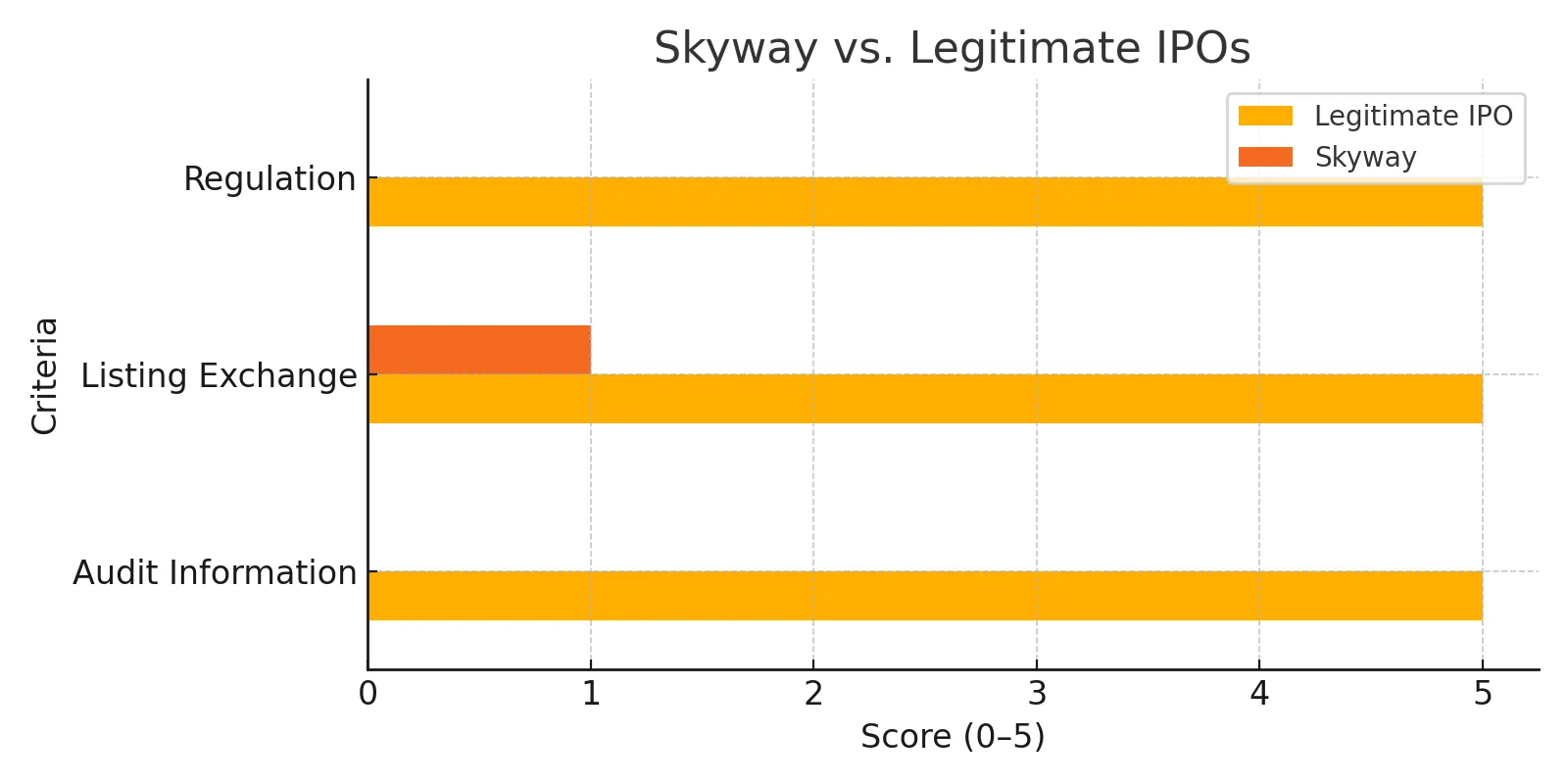

Comparing Skyway with Legitimate IPOs

| Criteria | Legitimate IPO | Skyway |

|---|---|---|

| Audit Information | Big4 auditors | None |

| Listing Exchange | HOSE, Nasdaq… | Unclear |

| Regulation | Securities Commission | Not in the system |

How Skyway Differs from Traditional Transport

While Skyway’s marketing compares it to high-growth infrastructure companies, it differs fundamentally from traditional transport businesses. Conventional rail or metro projects are subject to licensing, engineering audits, and urban planning laws. Skyway bypasses these through conceptual marketing and investor outreach rather than verified development.

When Will Skyway Stock Be Listed — Should You Trust or Doubt?

With what’s currently available, the question when will Skyway stock be listed has no reliable answer. Don’t place expectations on empty promises from brokers.

Challenges and Unfulfilled Promises

Multiple investors have shared that promises of “listing within months” have circulated since 2018. In reality, the lack of regulatory recognition and listing efforts casts doubt on any short-term Skyway IPO listing date. The Ecotechnopark, while positioned as a prototype site, has not translated into commercial contracts or investor returns.

📌 Unique Risk Pattern Observation

Skyway’s prolonged “pre-IPO” phase—ongoing for over 8 years—is atypical even in frontier markets. According to IPO lifecycle benchmarks, most legitimate IPOs list within 2–3 years of opening to investors.

What Should You Do If You’ve Already Bought Skyway Stock?

Investors should prepare for high risk and reassess their entire portfolio. Limit “averaging down” or continued investment in the absence of verified financial data.

Dealing with Empty Promises and “Skyway Capital Reviews”

For those researching how to buy Skyway shares or checking Skyway Capital reviews, it’s crucial to understand that most feedback comes from internal marketing. No third-party investment analyst or regulatory agency has endorsed the project. If you’ve already invested, focus on protecting capital and avoid further exposure without legal and financial clarity.

How Pocket Option Helps Evaluate High-Risk Stocks

Pocket Option does not offer Skyway stock, but supports investors in evaluating listed stocks through technical tools such as RSI, Bollinger Bands, MACD. From there, investors can learn to recognize transparent models.

⚡ Main Pocket Option feature: You don’t need to buy or sell assets — simply forecast whether the price will go up or down. If your prediction is correct, you can earn up to 92% profit per trade. No downloads required — everything works directly in your browser.

| Category | Key Features |

|---|---|

| Ease of Use |

|

| Trading Opportunities |

|

| Engagement & Community |

|

| Financial Benefits |

|

| Education & Support |

|

| Demo Account |

|

Final Thoughts

When will Skyway stock be listed? The answer still has no authentic basis. Investing in Skyway stock carries high risk without thorough verification. Investors need to be cautious and prioritize companies that are transparent, licensed, and have clear roadmaps. Discuss this and other topics in our community!

FAQ

What is Skyway stock?

It's internally issued stock by Skyway Technologies, lacking financial transparency.

When will Skyway stock be listed?

Currently, there are no official plans or IPO documentation.

Is Skyway stock a scam?

Many experts warn of high risk and unclear financial model.

What should investors do if they've already bought Skyway?

Limit additional investment, prepare an exit strategy if needed.

Should I monitor Skyway on Pocket Option?

No. Pocket Option only supports transparent stocks with clear listings.