- Institutional footprint: Hedge funds and banks don’t place small orders — they accumulate or distribute assets in blocks, creating visible price patterns.

- Market structure analysis: By studying these blocks, traders can see where supply and demand imbalance exists.

- Liquidity zones trading: Order blocks often overlap with liquidity pools, where retail stop losses cluster.

TradingPro Academy Order Block Trading Mastery

Order block trading is a powerful price action strategy that helps traders follow institutional footprints and anticipate major market moves. By learning to spot order blocks, you can trade in sync with smart money instead of guessing trends.

Article navigation

- Master Order Block Trading Today Trade smarter with order block strategy on Pocket Option. Start Now

- What Is Order Block Trading?

- Why Order Blocks Matter for Retail Traders

- Types of Order Blocks: Bullish vs Bearish

- How to Identify Institutional Trading Levels

- Using Order Blocks Across Timeframes

- Combining Order Blocks with Market Structure Analysis

- Practical Example: EUR/USD Order Block Trade

- Order Block Trading Strategy Explained

- Smart Money Concepts Tutorial: How Order Blocks Fit In

- Advanced Tools for Order Block Strategy

- Pros & Cons of Order Block Trading

- Case Studies: Successful Order Block Trades

- How to Apply Order Block Trading on Pocket Option

Master Order Block Trading Today

Trade smarter with order block strategy on Pocket Option.

Start Now

What Is Order Block Trading?

At its core, order block trading is about identifying price zones where institutional traders executed large buy or sell orders. These zones act as powerful support and resistance areas that often precede strong price reversals or continuations.

📊 According to a 2023 Institutional Trading Report by JP Morgan, nearly 70% of market volume in forex comes from institutional activity, confirming the importance of learning how to read their behavior.

Why Order Blocks Matter for Retail Traders

Institutional players dominate global markets, and retail traders often find themselves on the losing side of sudden reversals. By learning to spot order blocks, you can trade with smart money, not against them.

| Retail Traders | Institutional Traders |

|---|---|

| Trade small positions | Trade in massive blocks (millions) |

| Use indicators (RSI, MACD) | Focus on liquidity zones & market structure |

| Stop losses near obvious levels | Hunt liquidity to fill positions |

| React emotionally to news | Plan accumulation/distribution weeks ahead |

👉 By mastering order block strategy, you essentially follow the footprints of institutions instead of competing blindly.

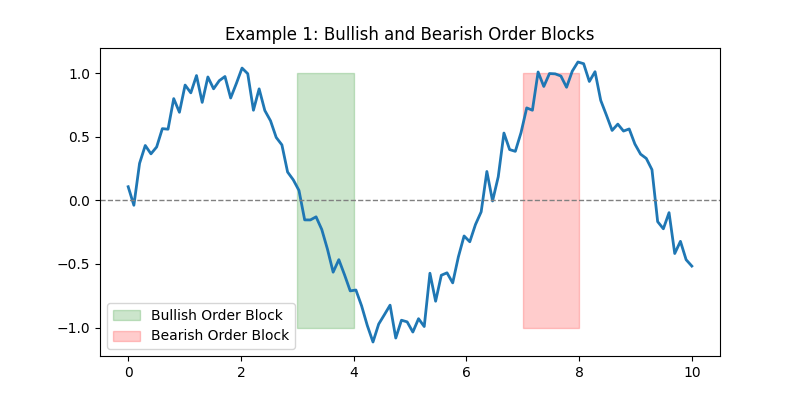

Types of Order Blocks: Bullish vs Bearish

Order blocks fall into two primary categories:

- Bullish order blocks → formed by heavy institutional buying, usually seen before upward moves.

- Bearish order blocks → created by strong selling pressure, often signaling trend reversals downward.

📌 Example:

In 2022, Apple stock (AAPL) showed a clear bullish order block at the $130 level. Hedge funds accumulated aggressively, and the price later rallied above $170 within three months.

This illustrates how order block trading can provide early entry zones with reduced risk.

How to Identify Institutional Trading Levels

Identifying an order block requires both technical observation and context:

- Look for sharp price moves following a consolidation.

- Identify clusters of candles (usually 2–6) before the breakout.

- Confirm with volume spikes or footprint charts.

- Use order flow trading tools to validate institutional activity.

Table: Valid vs Fake Order Blocks

| Valid Order Block | Fake Order Block |

|---|---|

| Strong impulse move after block | Weak breakout, no follow-through |

| Clear consolidation before move | Random price stall |

| Volume confirms activity | Low or flat volume |

| Market structure shift present | No structural change |

💡 Expert Tip: Senior trader Michael Huddleston (ICT) highlights that “valid order blocks are always tied to a break in market structure, not random sideways movement.”

Using Order Blocks Across Timeframes

One of the strengths of order block trading is its flexibility:

- Day traders use 5M or 15M charts to catch short-term moves.

- Swing traders focus on H4 and Daily order blocks for stronger trends.

- Position traders analyze Weekly/Monthly blocks for macro setups.

👉 Example: A trader on GBP/USD may find a bullish block on the Daily chart, then refine the exact entry on the 15M chart to minimize risk.

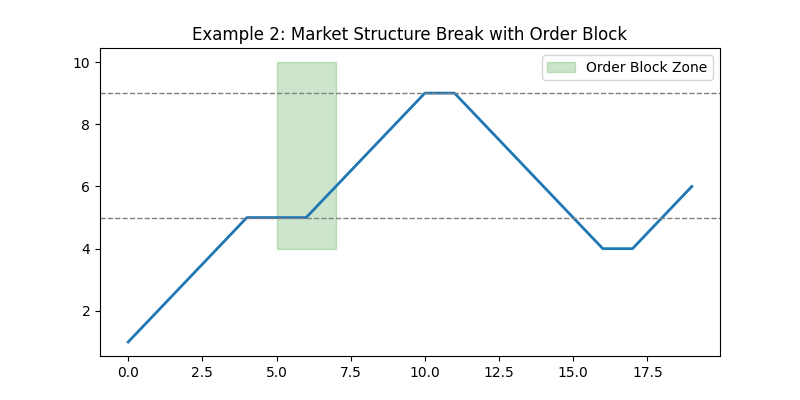

Combining Order Blocks with Market Structure Analysis

Order block trading becomes most powerful when paired with market structure analysis.

- A bullish block near a higher-low indicates strong continuation potential.

- A bearish block after a lower-high suggests trend resumption downward.

This is where smart money concepts supply demand zones overlap with order block zones, giving high-probability setups.

Practical Example: EUR/USD Order Block Trade

Let’s walk through a real case:

- In March 2023, EUR/USD consolidated around 1.0650.

- A bullish order block formed with high volume.

- Market broke structure upwards toward 1.1000.

- Traders entering near the block risked only 20 pips but captured a 250-pip rally.

👉 On Pocket Option, you can test this kind of setup instantly with forex or even apply it on stocks and crypto, all within a single platform.

Order Block Trading Strategy Explained

The order block trading strategy is designed to align retail traders with institutional activity by identifying areas on the chart where large buy or sell orders have been executed. Unlike simple support and resistance levels, order blocks reflect real zones of institutional demand or supply.

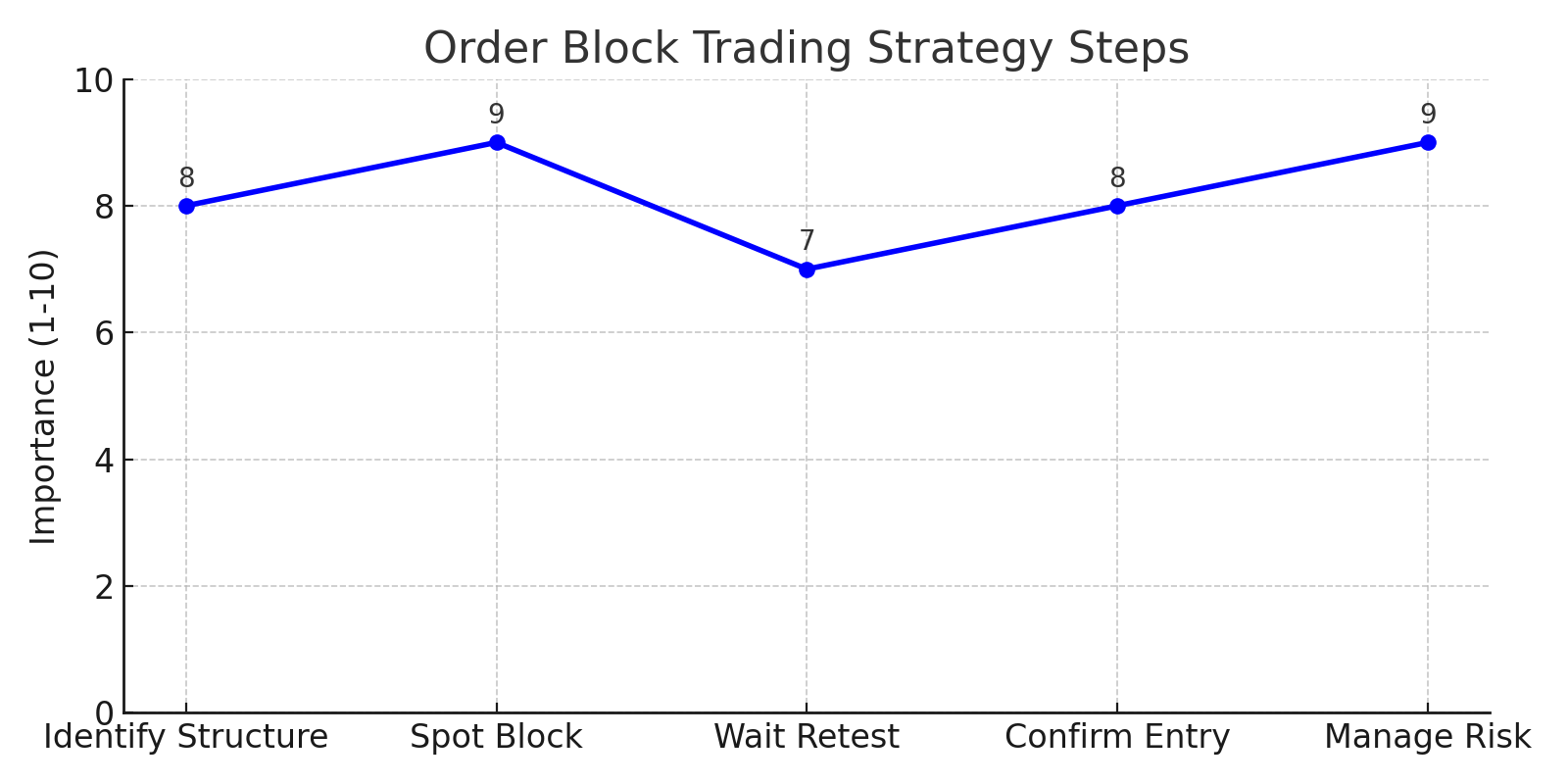

How the strategy works:

- Identify market structure – define whether the market is trending or ranging.

- Spot the order block – usually the last bullish or bearish candle before a strong impulsive move.

- Wait for a retest – institutions often re-enter the market, and price revisits these zones.

- Confirm entry – use candlestick rejection, liquidity sweeps, or order flow trading confirmations.

- Manage risk – place stop-loss just beyond the order block and target liquidity zones or recent highs/lows.

👉 Example: On EUR/USD, if the trend is bullish and a bullish order block forms at 1.0800, traders may enter on the retest with a tight stop below the block, targeting the next liquidity zone around 1.1000.

This order block trading strategy is widely used by professional traders because it provides high-probability setups with favorable risk-to-reward ratios.

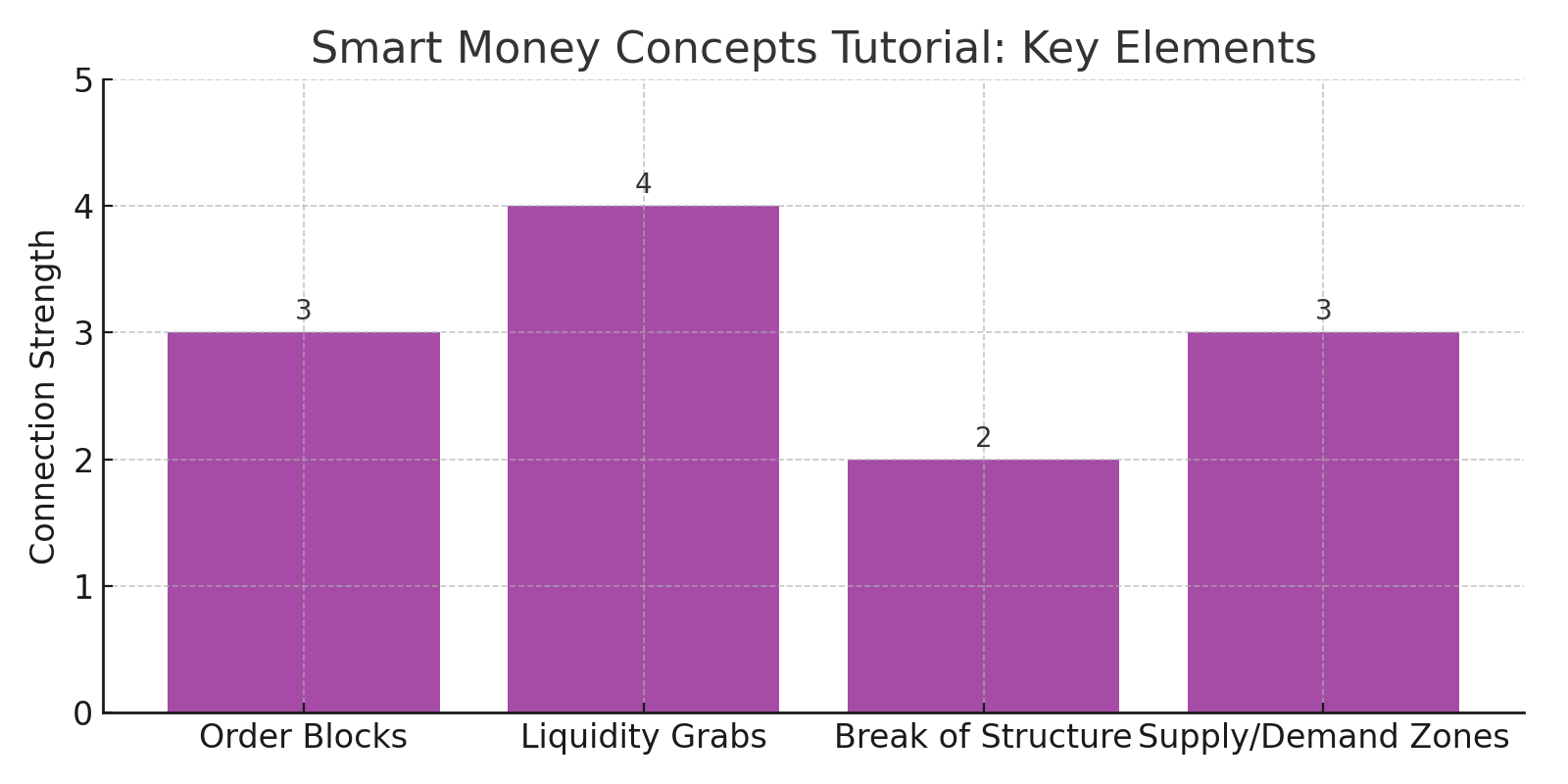

Smart Money Concepts Tutorial: How Order Blocks Fit In

Order block trading is a key part of smart money concepts (SMC), a methodology that focuses on understanding how institutional traders move markets.

In this smart money concepts tutorial, order blocks are explained as zones where banks and hedge funds accumulate or distribute positions. They are often linked with:

- Liquidity grabs – institutions sweep stop losses to trigger liquidity before moving price.

- Break of structure (BOS) – a new high or low that confirms direction after an order block forms.

- Supply and demand zones – broader areas that overlap with institutional footprints.

📌 Example: A bearish order block forms just above a liquidity pool where many retail traders placed stop-losses. Institutions trigger those stops to fill their sell orders, creating a strong downward move.

By combining order blocks with other smart money concepts supply demand zones, traders can better understand the intentions of institutional players and avoid common retail traps.

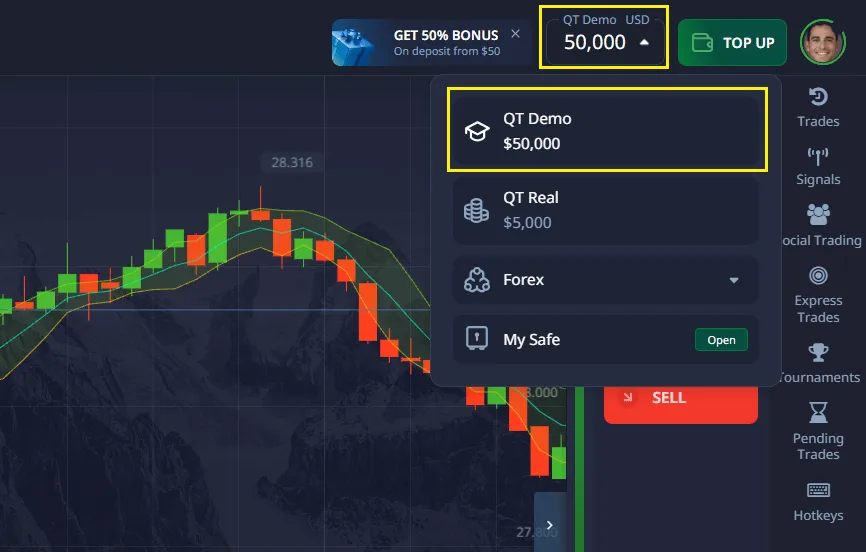

👉 Pocket Option makes it simple to practice these setups risk-free on a free demo account before applying them live with just a $5 deposit (the amount may vary depending on the geo and payment method).

Advanced Tools for Order Block Strategy

Traders often enhance their order block setups with advanced tools. The volume profile helps visualize the institutional footprint, order flow trading tools such as footprint charts provide deeper confirmation of buying and selling pressure, while classic indicators like moving averages and RSI add context for trend and momentum. Used together, these methods make order block trading more accurate and reliable.

📲 On Pocket Option, you can also enhance your results with built-in features:

- AI Trading 🤖 — automate strategies efficiently.

- Social Trading — copy successful traders.

- Tournaments — compete for rewards.

- Flexible payments with 50+ methods globally.

Pros & Cons of Order Block Trading

| Pros | Cons |

|---|---|

| Aligns with institutional trading levels | Requires deep technical knowledge |

| High accuracy when combined with market structure | Possible false signals without volume confirmation |

| Works across all assets (Forex, Stocks, Crypto) | Time-intensive to master |

| Provides tight stop-loss zones | Psychological discipline required |

Case Studies: Successful Order Block Trades

- Apple (AAPL, 2022) → Bullish order block at $130, price rallied 30% in 3 months.

- Bitcoin (BTC, 2021) → Bearish order block near $59,000 signaled sell-off toward $48,000.

- EUR/USD (2020) → Weekly bullish order block around 1.0800 preceded a multi-month rally above 1.2000.

These examples show how institutional trading levels define long-term market moves.

How to Apply Order Block Trading on Pocket Option

Pocket Option makes testing order block setups seamless:

- Practice on unlimited demo account without risk.

- Trade 100+ assets (Forex, Stocks, Crypto) 24/7.

- Deposit from just $5 (it can vary depending on the geo and payment method) and withdraw easily.

- Use bonuses and promo codes to boost capital.

- Access tutorials and strategies directly inside the platform.

Pocket Option provides a simple and flexible way to test and apply order block setups. With risk-free practice on a demo account, access to 100+ assets around the clock, low entry deposits, bonuses, and learning tools, the platform makes it easier for traders to grow skills and trade smarter with confidence.

FAQ

What is order block trading?

Order block trading is a strategy that focuses on identifying price zones where institutions like banks and hedge funds placed large buy or sell orders. These zones act as supply and demand levels, often leading to strong reversals or continuations.

How to identify order blocks?

Look for consolidation before a sharp move, a strong impulsive breakout, a noticeable volume spike, and a shift in market structure. The last bullish or bearish candle before the move often marks the order block.

Do order blocks work in trading?

Yes, they work well when combined with confirmation tools like volume analysis and market structure analysis. Order blocks highlight institutional trading levels, but traders should be cautious of false signals and avoid treating every consolidation as a valid block.

How to trade the order block strategy?

First, define the market trend on higher timeframes. Then identify the order block zone, wait for price to return, and confirm entry with rejection candles or order flow trading signals. Place a stop-loss just beyond the block and target liquidity zones or recent highs/lows for exits.

What timeframes work best for order block trading?

While order blocks can be identified on any timeframe, higher timeframes (4H, daily, weekly) typically provide more reliable signals due to increased institutional participation.

Final Thoughts

Order block trading is more than just a technical setup — it is a method of reading market structure and aligning your trades with institutional activity. By identifying valid order blocks, combining them with market structure analysis, and applying smart money concepts, traders can significantly improve accuracy and risk management. While the strategy requires patience and practice, the rewards are substantial when executed correctly. Pocket Option provides an excellent environment to test and apply order block strategies: from a free unlimited demo account and a minimum deposit of just $5 to over 100 assets available 24/7, AI trading, social trading, tournaments, and flexible payment options. Whether you are just starting your trading journey or already have experience, Pocket Option makes it easier to put order block trading into action and trade smarter, with the tools and flexibility you need to succeed.

Start trading