- Call Options – You bet the price will go up.

- Put Options – You bet the price will go down.

Options Trading South Africa

Options trading South Africa is becoming a more prominent strategy for investors looking to tap into the dynamic financial markets. With economic uncertainty and global market volatility, many are turning to derivative instruments to hedge, speculate, or simply diversify. In this comprehensive and expert-backed guide, we’ll explore not just the mechanics of options, but real examples, practical advice, insights from experienced traders, and tools that actually help you succeed. This is not a sales pitch — it’s a critical look at what works and what doesn't in the South African context. Whether you’re exploring the best options trading platform South Africa offers or want a step-by-step trading app for beginners, this guide will equip you.

Article navigation

- What Is Options Trading?

- What is the best broker for options trading?

- How Much Money Do You Need to Start Option Trading?

- Example: How to Trade Options on a Traditional Platform vs Pocket Option

- Which Trading Platform Is Legit in South Africa?

- Pocket Option’s Unique Approach: Quick Trading

- How to Open a Forex Demo Account (Step-by-Step)

- Tools You’ll Actually Use

- Expanded Section: Options Trading Strategies

- Common Mistakes Traders Make (And How to Avoid Them)

- Final Thoughts: Is Options Trading (or Quick Trading) for You?

What Is Options Trading?

Options are contracts that allow (but do not oblige) a trader to buy or sell an underlying asset at a set price within a defined timeframe. There are two types:

These contracts are commonly used for speculation, income generation, or portfolio hedging. In South Africa, options are typically available through trading brokers offering derivatives linked to indices, commodities, and currencies. We’ll walk through a practical example below.

Example:

Let’s say you buy a call option on a gold mining stock listed on the JSE with a strike price of R100. If the stock rises to R115 before expiration, your option becomes profitable. If it stays below R100, your maximum loss is the premium paid.

What is the best broker for options trading?

With a growing number of trading platforms available to South African investors, choosing the right broker can feel overwhelming. Factors like regulation, cost structure, platform usability, available instruments, and support for beginners all play a critical role in shaping your trading experience. Below is a comparative overview of some of the most trusted and frequently used options trading brokers — both local and international — to help you make an informed choice.

| Broker/Platform | Commission Structure | Options Available | Min Deposit | Notable Features |

|---|---|---|---|---|

| Pocket Option | Fixed Payout Model | Quick Trading | $5 | Browser-based, Up to 92% returns |

| IG Markets | Variable, volume-based | Traditional Options | R4000 | Advanced analytics, global markets |

| Plus500 | Spread-based | CFDs on Options | $100 | Intuitive platform, leverage tools |

| Deriv | Low commissions | Binary and digital options | $5 | Variety of assets, user-friendly |

| EasyEquities | Low stock commissions | Limited Derivatives | R5 | Ideal for beginners, local focus |

This comparative overview helps identify which platform may be best suited depending on your budget, strategy, and asset preferences.

⚠️ Note: Pocket Option does not offer traditional options. Instead, Quick Trading lets you forecast whether an asset will rise or fall. If you’re right, you can earn up to 92%.

How Much Money Do You Need to Start Option Trading?

Contrary to popular belief, you don’t need thousands to begin. Here’s a breakdown:

- Minimum deposits: Many platforms allow trading from as little as $50–$100.

- Realistically: To trade with manageable risk, $200–$500 is a safer starting range.

- Example: A beginner trading one call option on a South African equity might pay R400 in premium + fees.

💡 Tip: Always start with a demo. Real trades should only begin when you understand how strike prices, premiums, and expiry dates interact.

“I started with R300 on a broker account, blew it. Switched to demo, learned, and now grow slowly but consistently.” — Emanuel, trader since 2021

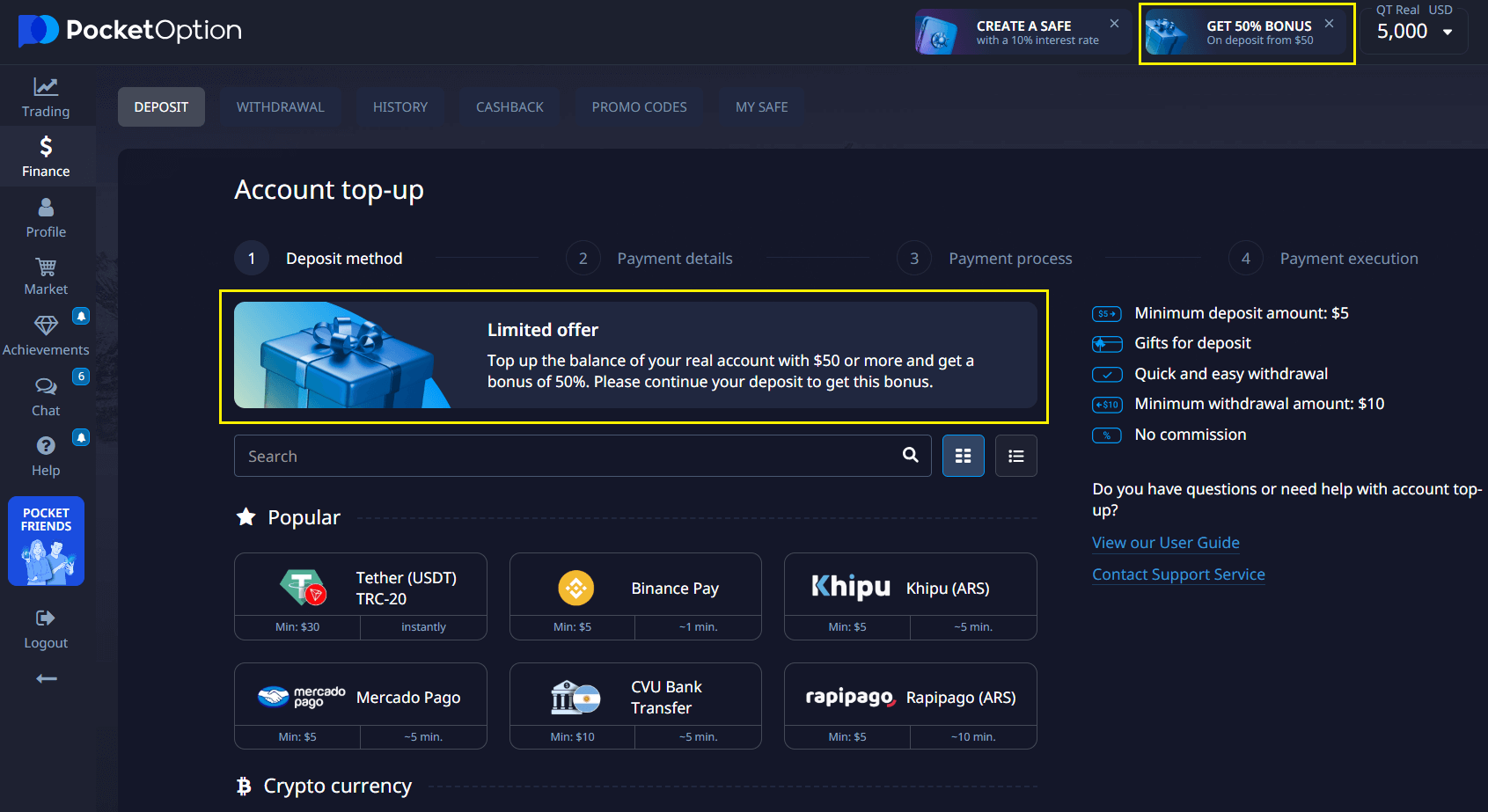

Minimum deposit on Pocket Option starts from \$5.

Example: How to Trade Options on a Traditional Platform vs Pocket Option

🧠 Classic Options Trading Example (IG Markets)

- Scenario: You want to buy a call option on a global tech stock.

- Choose the underlying asset (e.g., Apple stock or FTSE index).

- Select the option type: Call or Put.

- Define the strike price and expiration date. For example, Call at $150 expiring in 30 days.

- Check the premium you must pay — this is your maximum loss.

- Place the order via your broker’s platform (which may include extra margin or complex fee structures).

- Monitor until expiration. If the stock exceeds $150, you can exercise or sell the option.

⏳ Complexity: Requires understanding of time decay, implied volatility, and margin.

💰 Typical minimums: R4000–R8000, depending on the asset and broker.

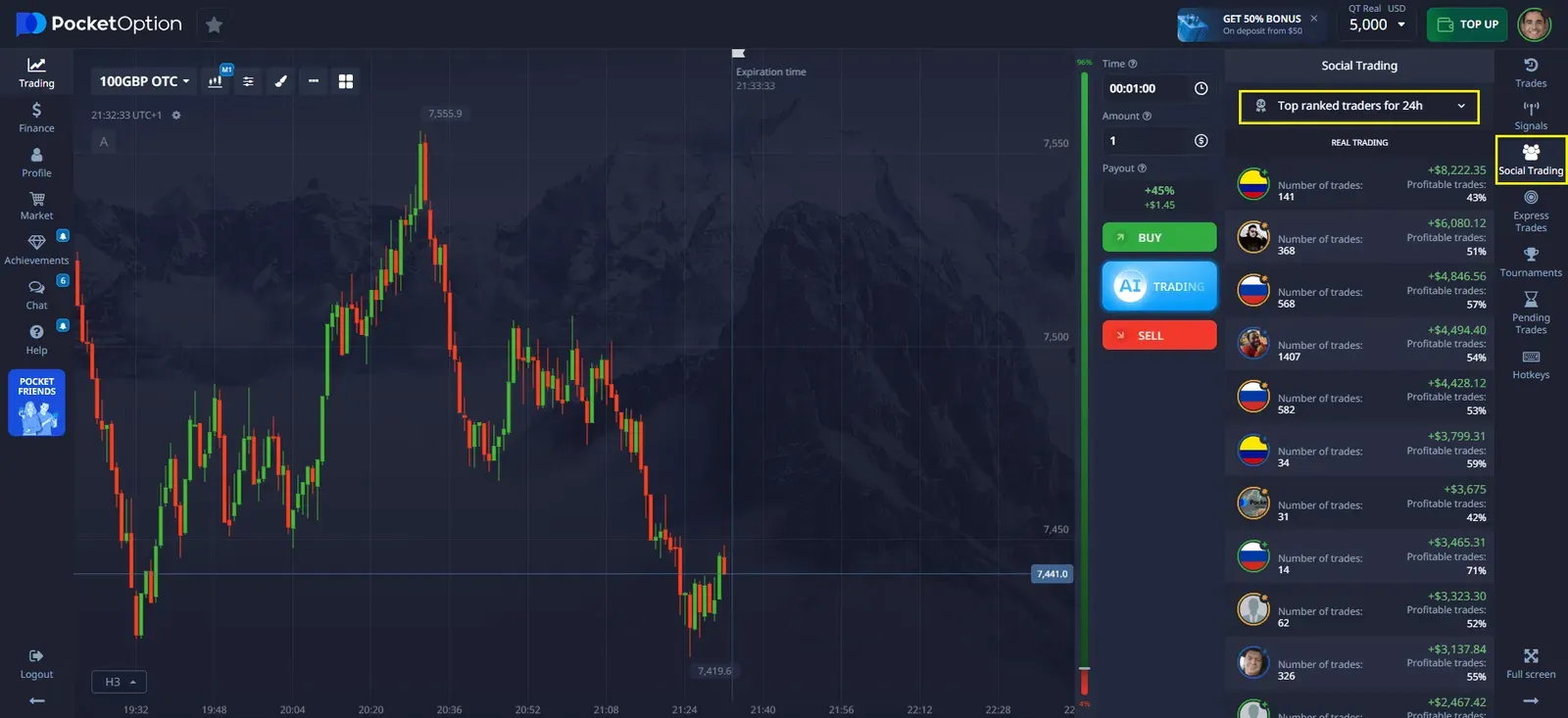

⚡ Pocket Option Quick Trading Example (Simplified Entry)

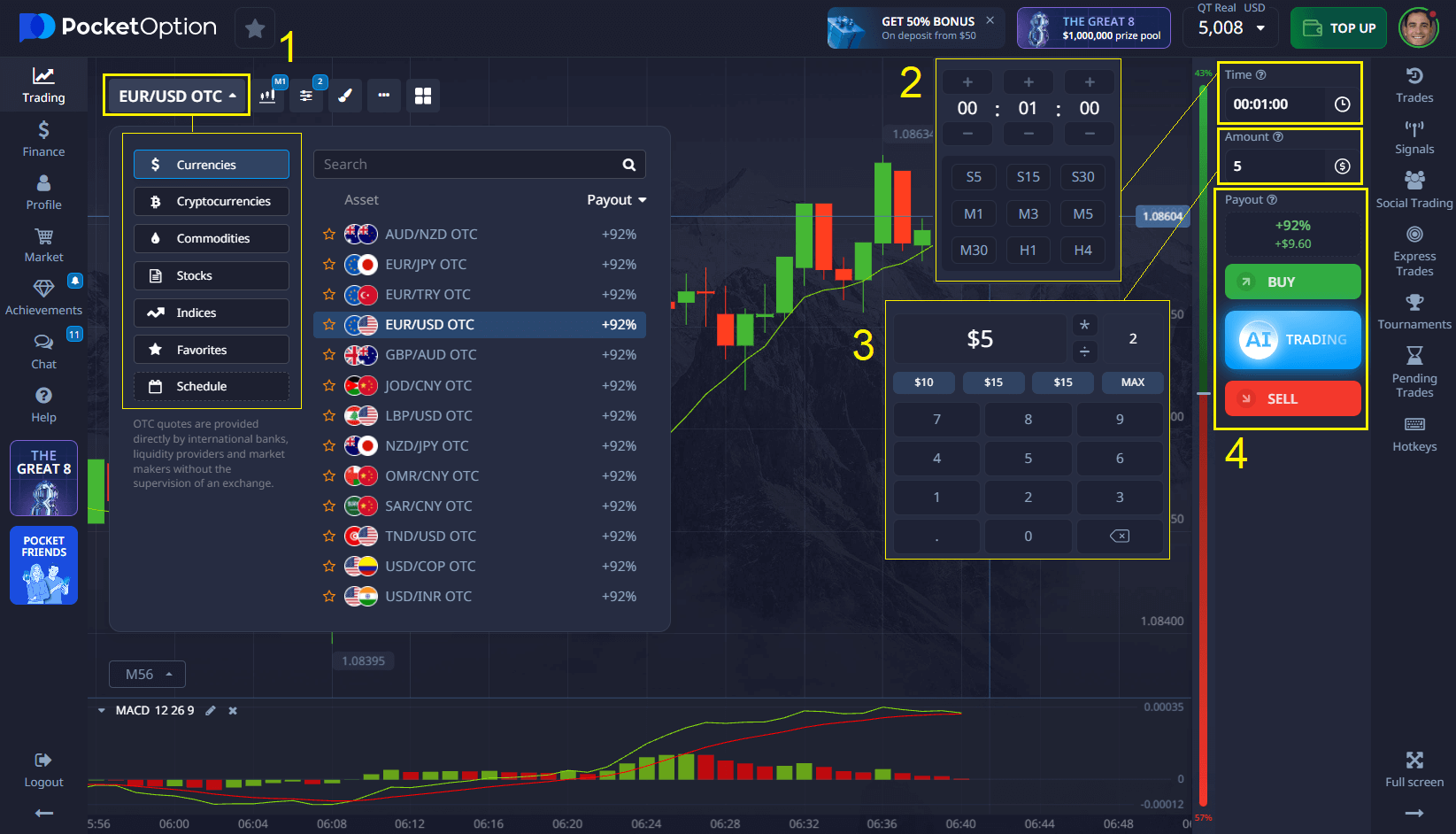

Scenario: You want to forecast if EUR/USD will rise in the next minute.

- Choose an asset (e.g., EUR/USD, Gold, or a stock).

- Analyze the chart using built-in tools like trend indicators or the “Traders’ Sentiment” gauge.

- Enter trade amount starting from just $1 — highly accessible for beginners.

- Set trade duration — from 5 seconds on OTC assets up to several hours.

- Make your prediction:

- If you believe price will go up, click BUY.

- If you believe price will go down, click SELL.

- If your forecast is correct, you earn up to 92% profit — instantly.

🎯 Extra features for real accounts starting from just $5:

- Copy-trading successful traders

- Cashback on trades

- Fast deposit/withdrawal options

- Exclusive strategies and indicators

✅ No complex mechanics. No spreads. Transparent risk/reward shown before entry. Learn more about earning here.

Which Trading Platform Is Legit in South Africa?

To avoid scams, always trade on regulated platforms. Here are three options:

- Pocket Option – Not a traditional options broker, but offers Quick Trading: a forecast-based high-speed tool with up to 92% payouts. Simple, browser-based interface.

- IG Markets – Offers structured options on indices and forex. High minimums.

- EasyEquities – Popular for stock trading; offers limited derivative access.

🛡️ Checklist before you choose:

- License? ✅

- Transparent fees? ✅

- Demo account? ✅

- Clear educational support? ✅

Pocket Option’s Unique Approach: Quick Trading

- No need to own the asset — Just predict price direction.

- Payouts up to 92% within minutes.

- Browser-based platform — No installations needed.

- Perfect for learning — Combine demo and live modes.

🎯 Quick Trading suits:

- Beginners learning market behavior.

- Traders seeking high-speed opportunities.

- Users tired of overcomplicated broker interfaces.

Try Quick Trading in demo mode and experience market dynamics without risking money.

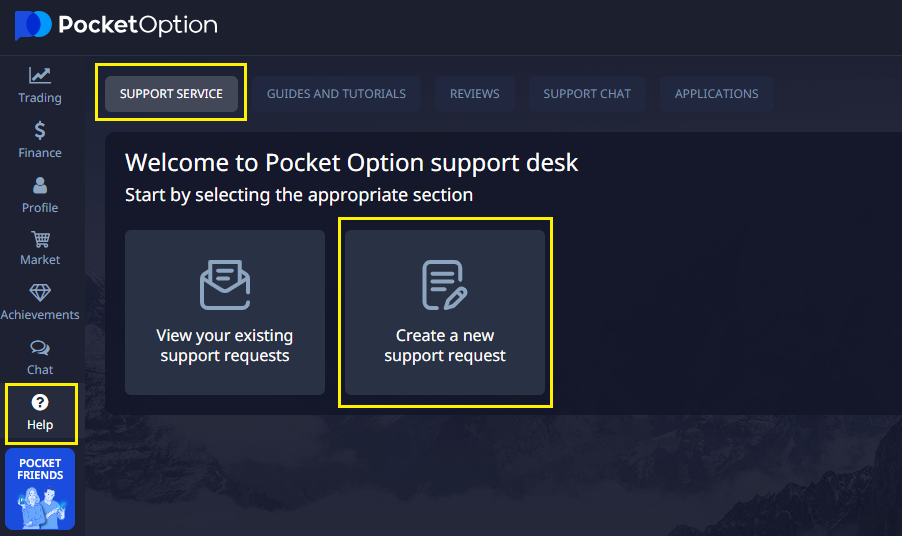

How to Open a Forex Demo Account (Step-by-Step)

- Go to Pocket Option

- Click “Register”

- Choose Demo Account.

- Use $50,000 virtual funds to test your strategies.

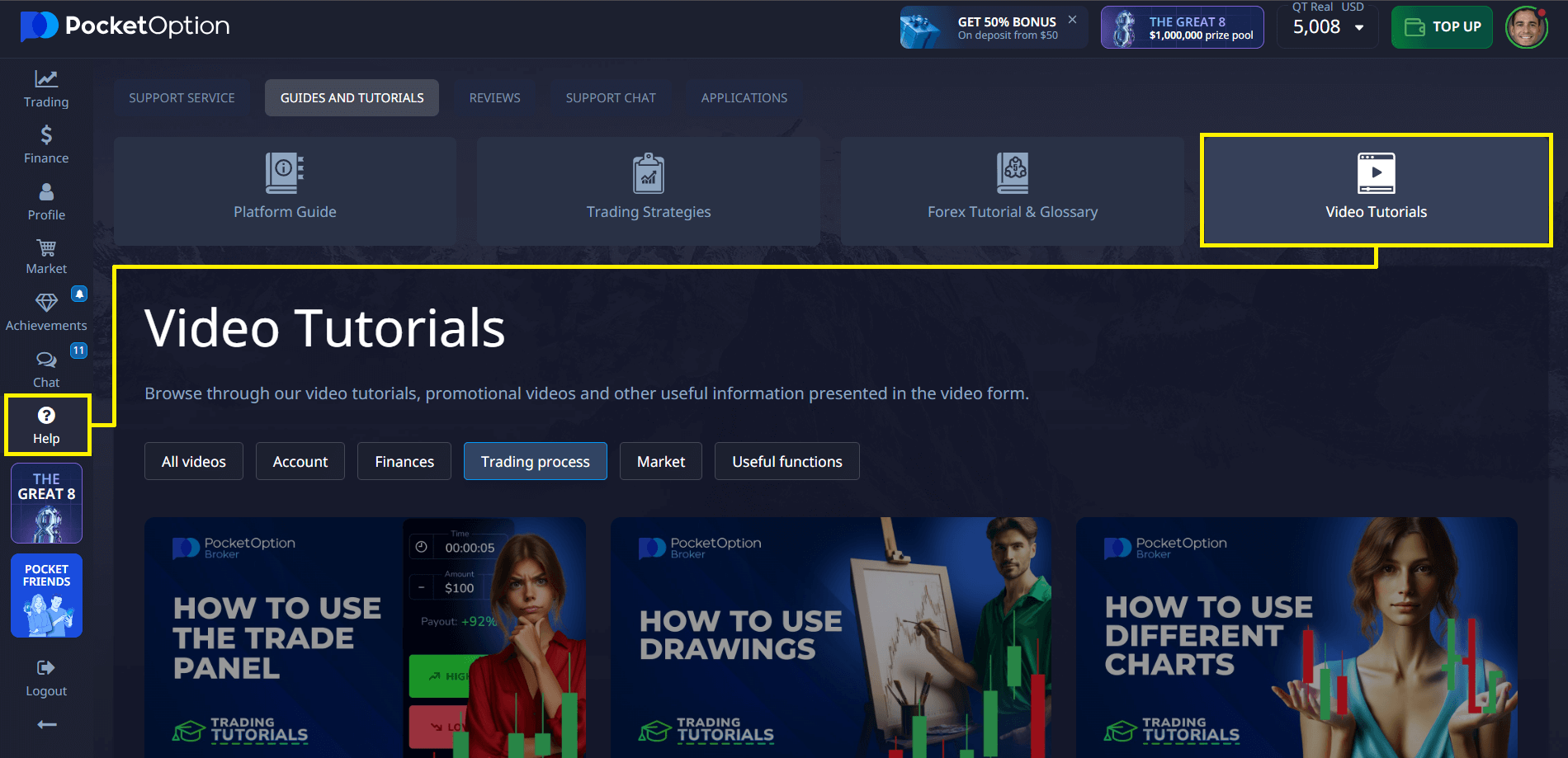

- Explore charts, indicators, and Quick Trading tools.

✅ No credit card or documents required.

Tools You’ll Actually Use

| Tool/Resource | Purpose |

|---|---|

| Options Calculator | Plan trade outcomes |

| Options Chain | Browse contracts and analyze trends |

| Technical Analysis Software | Detect patterns and entries |

| Economic Calendar | Stay ahead of impactful news |

| Education Academy (PO) | Learn via tutorials, guides & webinars |

Expanded Section: Options Trading Strategies

Different strategies suit different market conditions and trader experience levels. Below are common strategies explained with realistic scenarios:

- Covered Call — Ideal for conservative traders

Scenario: You own 100 shares of a local retail stock currently trading at R50. You sell a call option with a strike price of R55. If the stock stays below R55, you keep the premium and your shares.

Why use it? Generate income from stock holdings.

Risk level: Low to moderate - Long Call — Bullish strategy with limited risk

Scenario: You expect a rise in a bank stock before earnings. You buy a call option. If the stock jumps 10%, your profit can be significant compared to the premium paid.

Why use it? High reward potential.

Risk level: Moderate - Long Put — Bearish play or insurance

Scenario: You believe a tech stock is overvalued. Buying a put allows you to profit if the stock falls.

Why use it? Protect gains or bet on declines.

Risk level: Moderate - Bull Call Spread — Limited gain/loss, bullish view

Scenario: Buy a call option at strike R100 and sell another at R110. You cap both your profit and loss.

Why use it? Efficient use of capital.

Risk level: Moderate - Iron Condor — Neutral strategy for range-bound markets

Scenario: You believe the index will stay between 65,000 and 67,000. You sell both a call and put at those levels while buying further out-of-the-money options to hedge.

Why use it? Profit from low volatility.

Risk level: High

Each strategy comes with a trade-off. Beginners are encouraged to simulate these through demo platforms before trading with real capital.

Common Mistakes Traders Make (And How to Avoid Them)

Let’s be real: most beginners lose money at first. Here’s why:

- Overtrading: If you’re making 20 trades a day, odds are you’re not following a plan.

- Ignoring volatility: Options pricing relies heavily on implied volatility.

- No exit strategy: Don’t just know when to enter — plan when to exit.

- Too much leverage: It looks tempting. It burns fast.

- Failure to journal: Track what works and what doesn’t.

🧠 “I lost money for 6 months straight. Once I started logging every trade in Notion and journaling my thinking — results flipped.” — Shannon T., former engineer

Final Thoughts: Is Options Trading (or Quick Trading) for You?

Options trading South Africa is not a magic bullet. It’s a skill. If you’re risk-conscious, willing to learn, and have a plan — this can become a powerful tool in your portfolio. If you prefer simpler mechanics and faster outcomes, Quick Trading by Pocket Option might fit your style better.

🎓 Take a course, backtest strategies, and never risk money you can’t afford to lose.

FAQ

Is options trading legal in South Africa?

Yes, options trading is legal in South Africa and is regulated by the Financial Sector Conduct Authority (FSCA).

What is the minimum capital required to start options trading in South Africa?

The minimum capital required varies depending on the broker and the specific options strategy. Some brokers may allow you to start with as little as R1,000, while others may require higher initial deposits.

Can I trade options on international markets from South Africa?

Yes, many South African brokers offer access to international options markets, allowing you to trade options on foreign exchanges.

How are profits from options trading taxed in South Africa?

Profits from options trading are generally subject to capital gains tax in South Africa. However, tax treatment may vary depending on individual circumstances, and it's advisable to consult with a tax professional.

What qualifications do I need to become an options trader in South Africa?

While formal qualifications are not strictly required, a solid understanding of financial markets, options theory, and risk management is essential. Many traders pursue financial education or professional certifications to enhance their knowledge and credibility.