- Bull Flag Pattern: Appears during an uptrend and signals the continuation of the bullish trend after a brief consolidation.

- Bear Flag Pattern: Emerges during a downtrend and indicates the continuation of the bearish trend following consolidation.

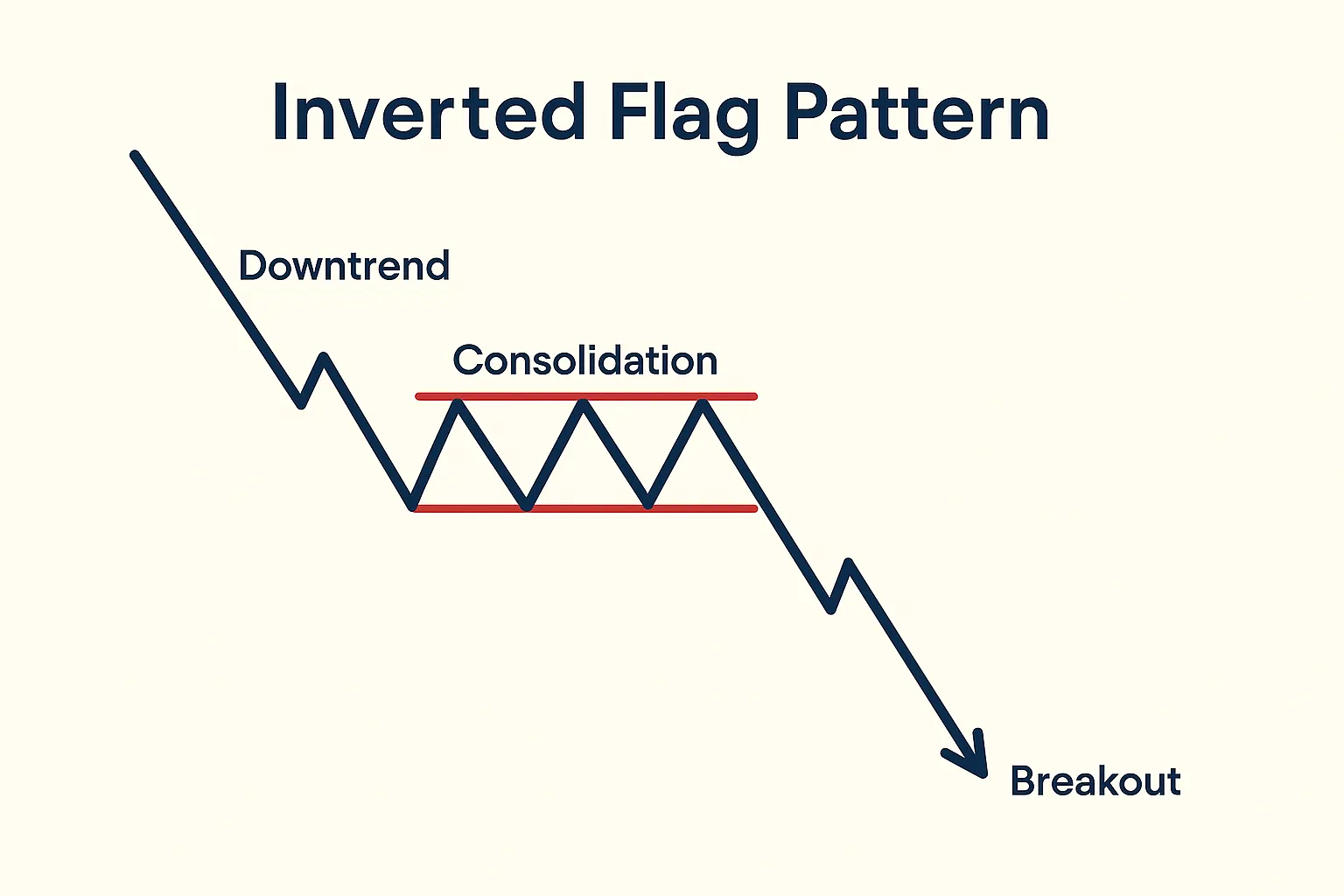

Learn Inverted Flag Trading: Mastering the Bearish Reverse Flag Pattern

Flag patterns are among the most recognized chart formations in technical analysis, offering traders valuable insights into potential market movements. These formations play a critical role in shaping effective trading strategies that capitalize on brief consolidation periods followed by breakouts. Grasping the dynamics of these patterns can significantly enhance a trader's ability to predict price moves and manage risk efficiently. If you're looking to learn inverted flag trading, understanding how the reverse flag pattern works is essential for anticipating bearish breakouts with high probability.

Introduction to Flag Patterns

A flag pattern is a type of continuation pattern in technical analysis, which typically signals a brief consolidation phase before the previous trend continues. This chart pattern resembles a flag on a pole, with the pole representing the strong price movement that preceded the consolidation (the flag). Flag patterns are essential for traders because they help forecast potential price movements by identifying periods of consolidation, followed by breakouts that indicate the continuation of the prior trend.

Types of Flag Patterns

Flag patterns are divided into two main categories, each offering distinct cues about the potential direction of the market. Recognizing these formations is crucial in formulating precise trading strategies:

Key Takeaway: Both bullish and bearish flag patterns point toward continuation, with the primary difference being the trend they follow–upward or downward.

Importance of Flag Patterns in Trading

Flag patterns play a pivotal role in trading, offering reliable signals for trend continuation. When traders accurately identify these patterns, they can time their entries and exits more precisely, optimizing potential profits while minimizing losses. This ability is especially beneficial in volatile markets, where fast decision-making is crucial. Recognizing the formation of a flag pattern enables traders to anticipate the next price move and establish strategic positions that align with the prevailing trend.

Understanding the Inverted Flag Pattern

The inverted flag pattern is a variation of the bear flag pattern, often called the reverse flag pattern. This formation plays an essential role for traders looking to capitalize on bearish market conditions.

Characteristics of the Inverted Flag Pattern

The inverted flag pattern is a bearish continuation formation characterized by a steep decline followed by a brief consolidation period. This consolidation period forms the “flag” portion of the pattern and appears upside down compared to typical flag formations. Once the price breaks below the consolidation phase, it signals the continuation of the downtrend, presenting an opportunity to enter short positions. Traders can use the inverted flag pattern to predict further declines in price, enhancing their ability to capitalize on a downtrend.

Expert Insight: According to market analysts, the inverted flag pattern is often more reliable in markets with high volatility. This pattern’s success is largely tied to the strength of the downtrend and the breakout from consolidation. As Alex Turner, a seasoned trader, explains, “Identifying the inverted flag pattern in a downtrend is crucial for predicting price moves. The breakout phase confirms the trend continuation, allowing traders to capitalize on further declines.”

Identifying the Inverted Flag Pattern on Charts

Identifying an inverted flag pattern involves spotting the distinct shape on a price chart. Typically, the formation starts with a sharp price decline, followed by a brief period of consolidation. This consolidation often appears as a slight upward or horizontal move. Once the price breaks out of the consolidation phase and resumes the downtrend, the pattern is confirmed.

Breakout Confirmation: The inverted flag pattern is confirmed when the price breaks below the lower boundary of the consolidation phase, signaling the continuation of the downtrend. Traders can then look for short positions to capitalize on the bearish momentum.

Bear Flag vs. Inverted Flag Pattern

Though both patterns signal bearish continuation, there are subtle differences between them:

| Feature | Bear Flag Pattern | Inverted Flag Pattern |

|---|---|---|

| Trend Direction | Bearish continuation | Bearish continuation |

| Consolidation Direction | Slight upward consolidation | Slight upward or horizontal consolidation |

| Breakout Confirmation | Price breaks downward after consolidation | Price breaks downward after consolidation |

Market Conditions for Bear Flags

One of the most effective ways to learn inverted flag trading is by combining the reverse flag pattern with volume analysis. Bear flags typically form under market conditions characterized by strong downward momentum. During these phases, market participants anticipate further declines, and the consolidation phase is usually accompanied by a decrease in volume. The breakout from the flag formation, however, is usually accompanied by a surge in volume, confirming the continuation of the bearish trend.

| Market Feature | Bear Flag Pattern |

|---|---|

| Trend | Downtrend |

| Volume Behavior | Decreases during consolidation, increases during breakout |

| Ideal Entry | Enter short position when the price breaks below consolidation |

Tip: Always monitor the volume during the consolidation phase. A surge in volume upon breakout is a critical indicator for confirming the validity of the bearish trend.

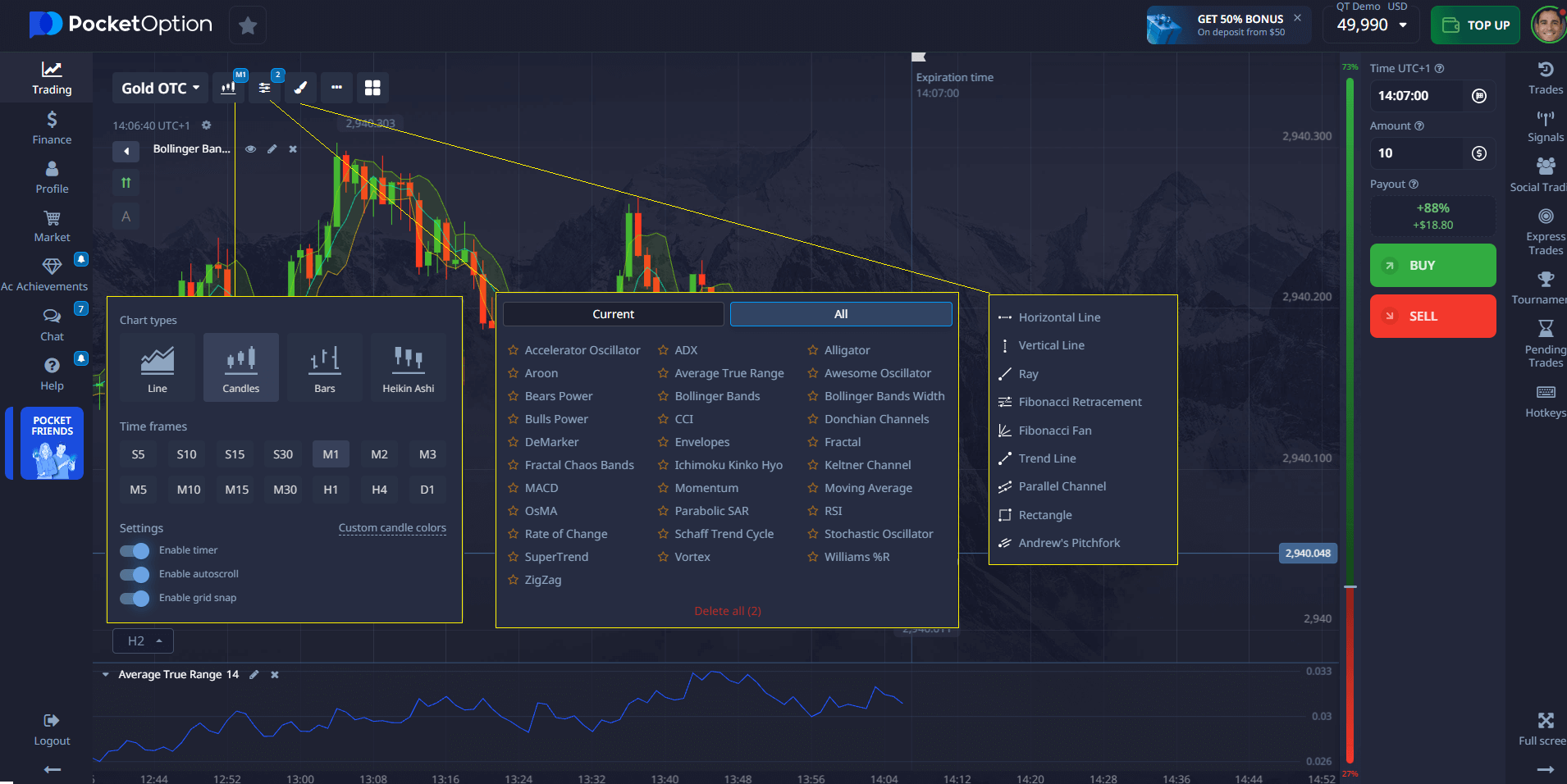

🚩 Pocket Option: Your Edge in Trading the Inverted Flag Pattern

The inverted flag pattern is a high-potential chart formation that many professional traders track closely. It begins with a sharp downward move (known as the flagpole), followed by a brief consolidation phase–a counter-trend channel that typically slopes upward. The real opportunity comes when the price breaks down, signaling a likely continuation of the bearish trend.

🎯 Want to trade these breakouts with precision? Here’s where Pocket Option gives you a serious edge:

🔧 Why Use Pocket Option for Inverted Flag Trading?

- 📊 Advanced Charting Tools

Benefit: Draw trendlines, identify breakout levels, and track price action in real time - ⏱️ 24/7 Trading via OTC

Benefit: Spot and act on inverted flag setups even when traditional markets are closed - 📈 30+ Technical Indicators

Benefit: Confirm pattern breakouts using RSI, MACD, moving averages, and more - 💼 100+ Tradable Assets

Benefit: Apply your flag trading strategy to stocks, forex, crypto, and commodities

💡 Expert Insight:

“Trading the inverted flag requires not just pattern recognition, but execution speed and accuracy. Platforms like Pocket Option make it easy to spot, analyze, and act on these patterns–whenever they happen.”

— Laura Chen, CMT, Senior Market Technician at TrendSignals

✅ Whether you’re a beginner learning inverted flag trading or a seasoned trader looking to refine entries, Pocket Option helps you analyze and react with confidence.

Trading Strategies Using the Inverted Flag Pattern

Entry and Exit Points

When trading the inverted flag pattern, traders typically enter a short position when the price breaks below the consolidation phase. The key to maximizing profits lies in precise entry and exit points. Traders often utilize technical analysis tools, such as support and resistance levels, to identify potential price targets.

Exit Strategy: Traders set exit points based on the expected price move following the breakout. A stop-loss is usually placed just above the consolidation phase to protect against any unexpected reversals.

| Entry Strategy | Exit Strategy | Stop-Loss Placement |

|---|---|---|

| Enter when price breaks below consolidation | Exit based on technical targets | Set stop-loss above consolidation |

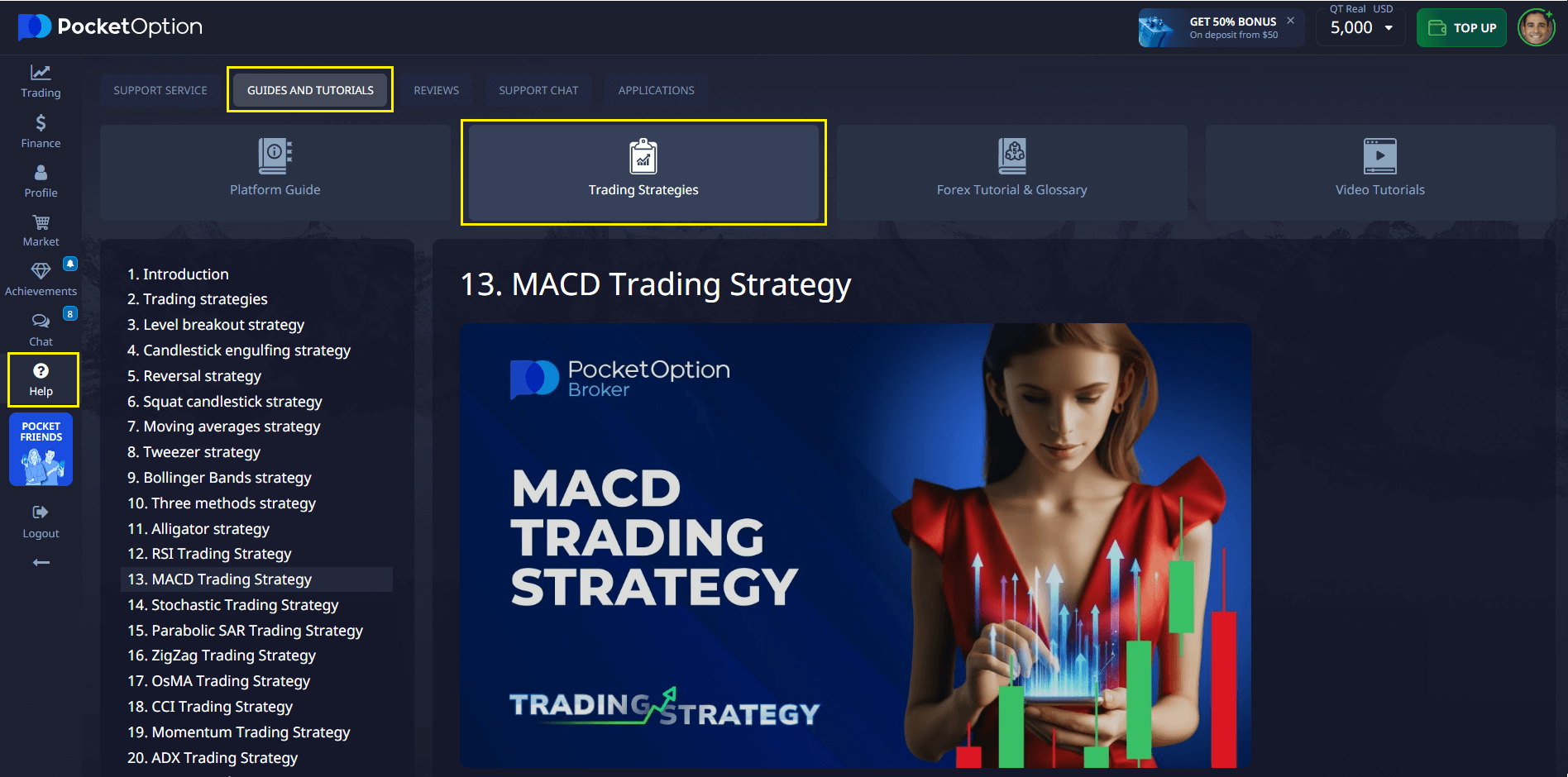

Learn strategies on Pocket Option

Risk Management Techniques

Effective risk management is vital in maximizing the potential of the inverted flag pattern. Traders use stop-loss orders to limit potential losses, placing them just above the consolidation phase. Additionally, position sizing is crucial to ensure that the trade aligns with the trader’s overall risk tolerance. Combining these techniques enables traders to mitigate adverse price moves while capitalizing on market trends.

Expert Tip: “Position sizing is a vital part of risk management,” explains Linda Green, a financial consultant. “When trading patterns like the inverted flag, controlling risk through smaller position sizes helps protect capital while allowing for bigger wins when the trend plays out.”

Combining Inverted Flags with Other Technical Analysis Tools

To enhance trading strategies, traders often combine the inverted flag pattern with other technical tools like RSI, MACD, or moving averages. These indicators help confirm the strength of the trend and provide more confidence in potential entry and exit points.

For example, traders might look for a downtrend confirmed by a moving average crossover to coincide with the breakout of the inverted flag. This combination can increase the probability of a successful trade setup.

Successful Trading with Flag Patterns

Case Studies of Successful Trades

Real-world examples of successful trades involving flag patterns provide invaluable insights for traders. A trader might enter a short position when an inverted flag pattern appears after a bearish trend. By entering at the breakout and exiting near a key support level, the trader can capitalize on the continuation of the downtrend.

Common Mistakes to Avoid

While flag patterns provide valuable signals, misidentification and poor execution can lead to costly mistakes. Some common errors include:

- Misidentifying a bullish flag as a bearish flag, leading to incorrect trades.

- Entering the trade too early, before the breakout occurs.

- Failing to set a stop-loss, which can result in significant losses if the market reverses.

Tips for Mastering Flag Trading Strategies

To master trading flag patterns, traders should practice recognizing these patterns using historical data. Also, utilizing complementary technical indicators like moving averages or RSI alongside the flag formation can improve the accuracy of trade setups.

Future Trends in Flag Patterns

Flag patterns, including the inverted flag pattern, play a critical role in identifying continuation trends in the market. By mastering the identification of these patterns and implementing effective trading strategies, traders can capitalize on market trends and make more informed trading decisions. Understanding when and how to trade based on technical analysis and risk management techniques is essential for success in bearish markets. With the advent of AI-based tools and more sophisticated trading platforms like Pocket Option, traders will have enhanced capabilities to identify and analyze flag patterns with greater accuracy. As technology evolves, traders can expect more powerful tools to aid in their trading journey.

FAQ

How much money do I need to trade inverted flag?

The amount of money needed to trade depends on the size of the position and leverage used. It's important to start with a demo account or a small amount and progressively increase as you gain experience.

How to start trading inverted flag for beginners?

To start, begin by learning how to identify inverted flag patterns on charts. Use demo accounts to practice and familiarize yourself with the technical indicators that confirm these patterns.

What is the best inverted flag trading strategy?

The best strategy involves entering a short position when the price breaks below the consolidation phase, setting a stop-loss above the consolidation, and using indicators like RSI or MACD to confirm the trend continuation.

Can beginners succeed with learning inverted flag trading?

Yes! Beginners can succeed by practicing with demo accounts and slowly building their understanding of technical analysis. Focus on perfecting pattern recognition and combining it with other analysis tools.

How to improve learning inverted flag trading results?

Consistent practice and backtesting are key to improving your results. Also, use risk management techniques like stop-loss orders and keep learning from expert insights to refine your strategy.

What is the main function of the inverted flag pattern in trading?

The main function of this setup is to indicate the continuation of a bearish trend. It assists traders in identifying potential opportunities to enter short positions following a price drop and consolidation phase.

How can traders verify the authenticity of an inverted flag pattern?

Traders can verify the authenticity by analyzing the trading volume. A decrease in volume during the flag's formation followed by a breakout with increased volume offers a stronger confirmation of the pattern.

Is the inverted flag pattern applicable to markets other than stocks?

Absolutely, this setup is versatile and applicable to various financial markets, including commodities and forex. Its principles remain consistent across different asset classes.