- Initial Margin – the capital required to enter a futures trade

- Maintenance Margin – the minimum amount to keep the trade open

- Margin Call – occurs when account equity falls below maintenance margin

How Much Money Do You Need to Start Trading Futures

How much to start trading futures? Learn the minimum account, margin, and costs to trade confidently.

Article navigation

- Start Trading Futures Today

- Understanding Futures Trading

- Futures vs Forex: Which is Better?

- Basics of Futures Contracts

- Minimum Capital Requirements for Futures Trading

- Understanding Margin Requirements

- Trading Platforms and Brokers

- Recommended Starting Capital

- Developing a Trading Plan

- Opening a Futures Trading Account

- Can You Trade Futures With $100?

- Can I Trade Futures With $200?

- Can I Trade Futures With $5?

- Do You Need $25,000 to Trade Futures?

- Can a Beginner Trade Futures?

- How Much Money Do You Need to Start Trading Futures Reddit?

- Pocket Option: A Smart Start for Futures-Style Traders 🎯

- Ready to Take the First Step?

Understanding Futures Trading

Futures trading is a form of speculation where a trader enters a legally binding agreement—called a futures contract—to buy or sell an asset at a specified future date for a predetermined price. These contracts are standardized and traded on exchanges such as CME. As a futures trader, your success depends on understanding the markets, using leverage wisely, and following a well-defined trading strategy. If you are wondering what is future trading in practical terms, it refers to entering an agreement to buy or sell an asset at a set price on a future date, allowing traders to profit from price movements in either direction.

Futures vs Forex: Which is Better?

When comparing futures vs forex, the key differences lie in regulation, leverage, trading hours, and liquidity. Futures contracts are standardized and traded on regulated exchanges, while forex is a decentralized market. For beginners, futures offer more transparency, although forex provides higher flexibility. Both markets offer day trading opportunities. Ultimately, when comparing futures vs forex which is better, the right choice depends on your trading strategy, risk tolerance, and preferred level of market regulation.

Basics of Futures Contracts

Futures contracts are available in various sizes and asset classes, including commodities, indices, currencies, and energy. Micro futures and e-mini futures are scaled-down versions of standard contracts that allow traders to gain exposure with lower capital outlay. These are ideal for day trading or testing strategies on a smaller scale.

Minimum Capital Requirements for Futures Trading

The futures trading minimum account size depends on your broker and the type of contracts you trade. Your futures trading account can be opened with as little as $500 if you’re trading micro contracts through discount brokers. However, professional platforms like NinjaTrader or Tradovate may require a minimum account of $5,000 to $25,000, especially for active intraday trading.

For example, the minimum amount to trade futures Binance can start as low as $100, depending on leverage and contract type. The Binance futures minimum order size varies by asset, and the Binance futures minimum trade amount may differ from traditional brokers. The binance futures minimum trade amount may vary by asset, but it is generally designed to support small-scale retail traders, providing flexible entry into the market.

| Broker Type | Typical Minimum Account | Notes |

|---|---|---|

| Discount Broker | $500–$2,500 | Great for micro and beginners |

| Full-Service Brokerage | $5,000–$10,000 | Includes tools and advisory |

| Active Trader Platform | $25,000+ | For full-time trading and high volume |

How much money do you need to start trading futures for beginners is one of the most frequently asked questions. While the exact amount depends on the broker and contract type, most beginners can start with $1,000 to $3,000, especially when using micro contracts.

Additionally, how much money do you need to trade micro futures is typically lower — often starting around $500 — making them accessible even for those with limited capital.

Understanding Margin Requirements

Margin is a key concept in futures. It represents the collateral required to open and maintain a position:

Using leverage, traders can control large contract values (e.g., $100,000+) with just a few thousand dollars. However, it magnifies both profit and loss.

Trading Platforms and Brokers

Your choice of trading platform affects everything: costs per contract, order execution, and tools. Consider the following:

- CME Micro contracts on Webull or thinkorswim

- Commission-free trading on Tradovate, ideal for active users looking for low-cost entry points

- NinjaTrader for advanced charting and strategy automation

Always evaluate per-trade fees, margin policies, and asset availability.

- Trade futures on Webull for direct access to CME Micro contracts through a user-friendly interface.

- Explore advanced tools and educational resources on thinkorswim for futures market analysis.

- How much do you need to trade futures on NinjaTrader? For micro contracts, you may need as little as $400–$1,000, but standard contracts require more capital.

- Wondering how much money do you need to trade futures on Tradovate? Many traders start with $500, especially when trading commission-free micro contracts.

Recommended Starting Capital

Even if the margin requirement is low, proper risk control requires more capital. If you’re asking yourself how much money do you need to start trading futures, the answer largely depends on your goals—whether you’re learning, trading part-time, or pursuing it full-time. Here are suggestions:

| Goal | Suggested Capital | Why |

|---|---|---|

| Learn/Simulate | $2,000–$5,000 | Practice with micro futures, avoid risk |

| Part-time Trade | $10,000–$30,000 | Supports multiple positions and losses |

| Full-time Trader | $50,000+ | Stability, diversification, per trade risk control |

If you are specifically targeting tech-heavy indexes, you might ask: how much do you need to trade Nasdaq futures? For micro Nasdaq contracts, many brokers allow starting with $500 to $1,000, but trading full-size contracts typically requires at least $15,000 to $25,000.

Developing a Trading Plan

Every futures trader needs a detailed trading strategy. Include:

- Target markets (e.g., commodities, equity indices)

- Entry/exit criteria

- Daily risk limits per trade

- Margin usage and capital allocation

This structure reduces emotional trading and enhances discipline.

Opening a Futures Trading Account

Understanding how much money do you need to start trading futures is essential before funding your account. Always consider not just the broker’s minimum, but also the capital needed for proper risk control. To start, choose a brokerage that supports the products you want. Then:

- Complete the application (financial and identity details)

- Fund the account to meet initial margin

- Practice using the trading platform

- Start small with micro futures

Can You Trade Futures With $100?

Not realistically. While margin on micro contracts might be low, most brokers require $500–$1,000 minimum. $100 is not enough even for one futures trade.

Can I Trade Futures With $200?

Similar to above—no. With $200, you can explore demo platforms, but not meet initial margin requirements for live positions, even in micro futures.

Can I Trade Futures With $5?

No broker allows real trades with $5. However, simulated trading platforms can provide educational practice.

Do You Need $25,000 to Trade Futures?

Only if you’re a high-volume active trader or using strategies that require multiple positions and large margin buffers. You can start with less on micro contracts.

Can a Beginner Trade Futures?

Yes, a beginner can trade futures with the right education, demo trading, and capital. Before getting started, beginners often ask: how much money do I need to trade futures? The answer varies, but micro contracts allow you to begin with a smaller account while gaining exposure to real market conditions. Starting with micro futures, using a reliable trading platform, and setting realistic goals is key.

How Much Money Do You Need to Start Trading Futures Reddit?

Community discussions on Reddit often suggest at least $2,000-$3,000 to begin with micro futures trading. While some claim to start with less, most agree that adequate capital is key to surviving early losses and learning phases.

Pocket Option: A Smart Start for Futures-Style Traders 🎯

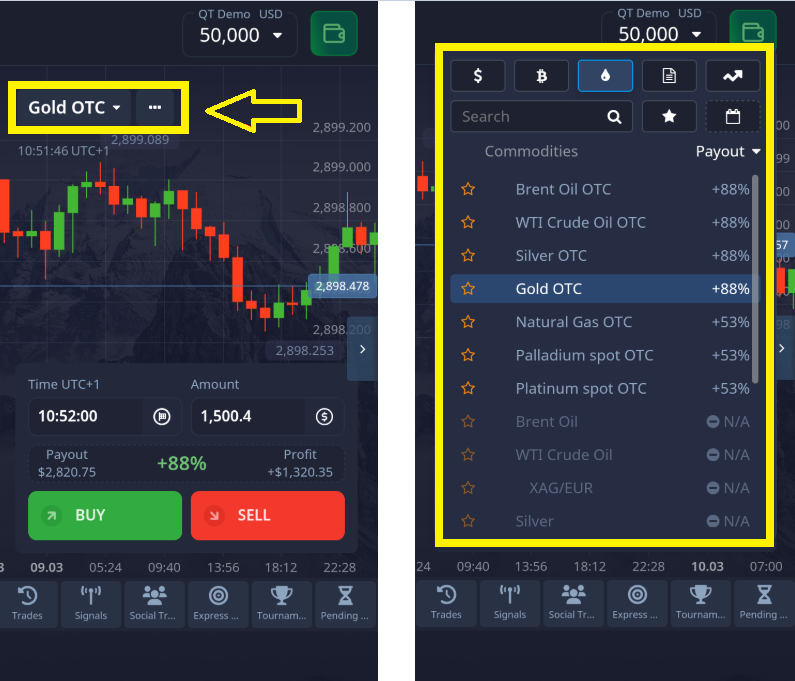

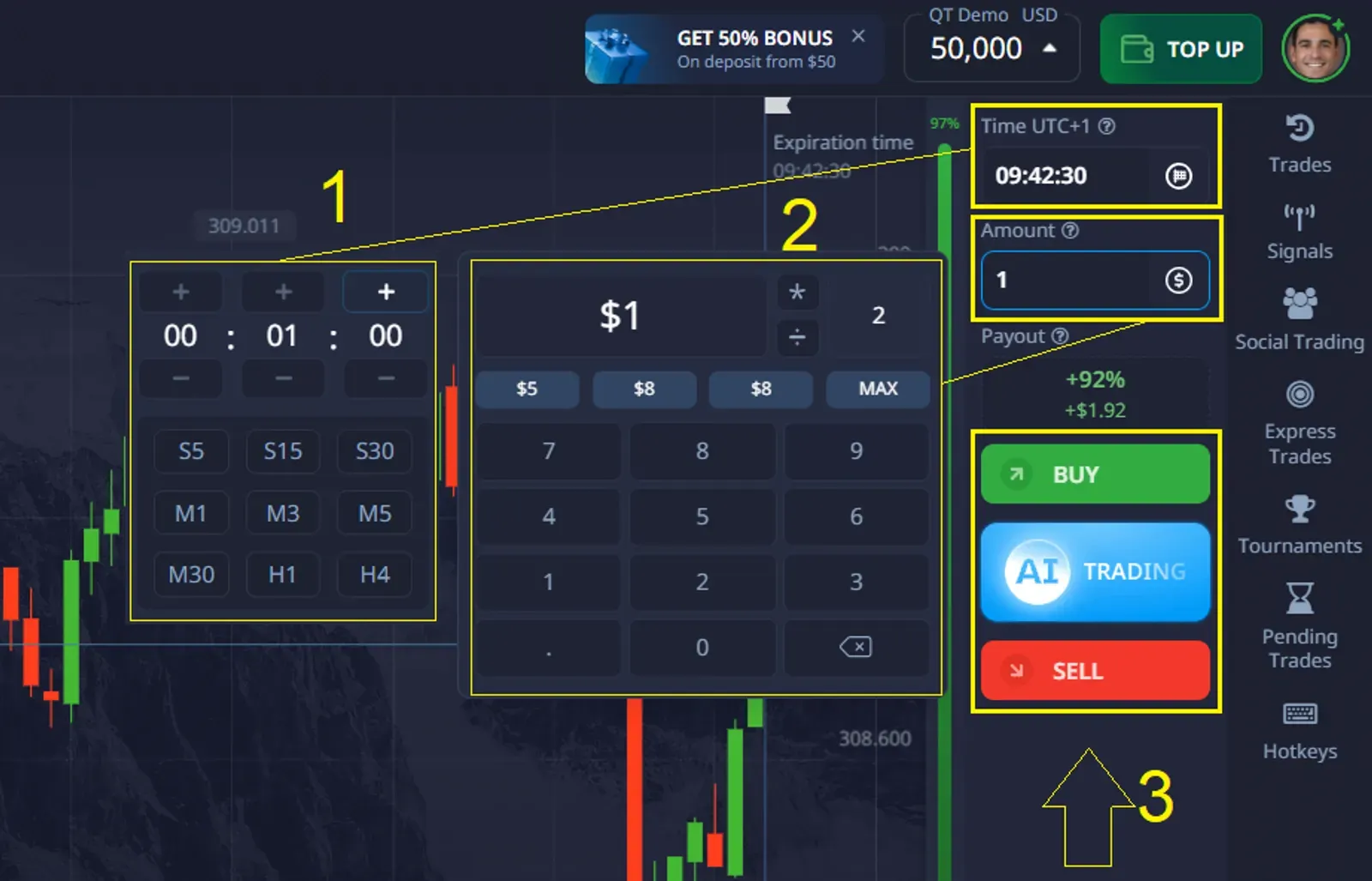

If you’re looking for a practical and affordable gateway into futures-style trading, Pocket Option is a great choice:

- Start trading from just $1 per contract

- Minimum deposit starts at $5

- Built-in risk management tools, over 30 indicators, and economic calendar

- Copy-trading features to learn from successful futures traders

- Instant demo account with $50,000 virtual balance

Pocket Option replicates many of the features that matter most to a futures trader—strategy, speed, and smart capital management—with much lower barriers.

Ready to Take the First Step?

Now that you know what it takes to start trading futures—capital, brokers, margins, and strategy—it’s time to take action. Whether you choose traditional platforms or want to begin with Pocket Option’s flexible system, the most important move is to start with discipline and clear goals.

Join the discussion and explore these topics further in our community!

FAQ

What is the absolute minimum I need to start trading futures?

The absolute minimum varies by broker and contract type. For micro futures, you might start with as little as $2,000-$3,000. Standard futures contracts typically require $5,000-$10,000 minimum. However, starting with just the minimum is risky as it leaves little room for error or market fluctuations.

Do different futures markets have different capital requirements?

Yes, capital requirements vary significantly between markets. For example, E-mini S&P 500 futures typically require higher margins ($12,000+) than agricultural futures like corn ($1,500+). This is because of differences in contract value and market volatility.

Can I trade futures part-time with a small account?

You can trade part-time with a smaller account, especially if you focus on micro futures contracts. However, even for part-time trading, having at least $5,000-$10,000 is recommended to implement proper risk management and avoid quick depletion of your capital during learning phases.

Are there ways to practice futures trading without risking real money?

Yes, most brokers offer paper trading or simulator accounts where you can practice with virtual money. This is an excellent way to learn the mechanics of futures trading before committing real capital. Once comfortable, you can start with a properly funded real account.

How much should I budget for ongoing fees and commissions?

Budget approximately $200-$500 monthly for commissions and fees if you're an active trader (10+ trades per day). This includes per-contract commissions ($0.50-$5.00), exchange fees, data subscriptions, and potentially platform fees. Less active traders might spend considerably less, perhaps $50-$100 monthly.

How much money do you need to trade e-mini futures?

Trading E-mini contracts usually requires a margin of $5,000 to $10,000 or more depending on market volatility and broker policies.

What is the minimum amount to trade futures Binance?

On Binance, you can start futures trading with as little as $100, depending on the contract and leverage used.