- Diversify timeframes, even if trading full port.

- Always define stop loss levels.

- Avoid overtrading after losses; full port requires mental clarity.

Capital Markets Pro Full Port Meaning Trading Expertise

Understand what "full port" means and how it impacts trading strategies and portfolio management.

Article navigation

Understanding Full Port Meaning in Trading

Full port trading refers to the practice of managing an entire trading portfolio, encompassing various assets such as stocks, forex, options, and cryptocurrencies. This concept allows traders to assess their holdings and make strategic decisions based on the performance of their entire investment landscape. By understanding full porting in trading, traders can evaluate their risk management strategies and optimize their trading process to achieve successful trading outcomes.

Defining Full Port Trading

At its core, full port trading means utilizing a comprehensive approach to manage and monitor all assets within a trading account. This includes not only the assets currently held but also the potential for new trades. Traders engage in this practice to analyze the average price of their investments and understand how different trading methods can be applied to enhance profitability. By grasping the meaning of full port, traders can effectively navigate through various trading terms and concepts.

Importance of Full Port in Portfolio Management

The significance of full port in portfolio management cannot be overstated. It allows traders to maintain a holistic view of their investments, promoting better decision-making when buying and selling assets. Furthermore, full porting encourages the diversification of investments, which is essential for mitigating risks associated with day trading or forex trading. By incorporating full port strategies, traders can align their trading goals with risk management practices, ensuring a balanced approach to their financial endeavors.

Practical Considerations and Expert Insights

Experts advise caution with full port trading. According to Thomas Lee, a veteran portfolio manager:

“Allocating your full capital into a single or narrow group of trades is not inherently flawed—it’s the lack of exit strategy and emotional control that destroys portfolios.”

Common Misconceptions about Full Port

There are several misconceptions surrounding full port trading that can mislead traders. One common belief is that full porting is only relevant for experienced traders, which is not true. New traders can also benefit from understanding the concept of full port, as it lays the foundation for effective trading strategies. Additionally, some may think that full port trading limits flexibility in making quick trades, but in reality, it enhances the trader’s ability to adapt to market changes while maintaining a comprehensive view of their portfolio performance.

Trading Terms Every Trader Should Know

Key Trading Terminology Explained

Every trader must familiarize themselves with essential trading terminology to navigate the financial market effectively. Understanding basic concepts such as “bull” and “bear” markets, “short position,” and “moving average” can empower traders to make informed decisions. In forex trading, terms like “pips” and “leverage” are crucial for managing trades. Furthermore, the concept of full port meaning is integral for evaluating one’s entire trading account. By mastering these trading terms, traders can communicate effectively with brokers and peers, enhancing their trading strategies and ultimately leading to successful trading outcomes.

Key Scenarios Where Full Port May Work

- Earnings season with high implied volatility

- Trend breakouts confirmed by volume

- When macro news aligns with technical setups

Day Trade vs. Full Port Trading

The distinction between day trading and full port trading is significant in the realm of trading strategies. Day trading involves executing numerous trades within a single trading day, capitalizing on short-term price movements. In contrast, full port trading encompasses the management of a trader’s entire portfolio, focusing on both long-term and short-term strategies. Day traders often seek quick profits and utilize specific day trading tips to maximize their trades, while full port traders prioritize risk management and diversification. Understanding these differences enables traders to adopt the approach that best aligns with their financial goals and risk tolerance.

Is Full Port Trading for You?

- Do you have a proven strategy?

- Can you handle losing the full capital?

- Are you disciplined in taking profits?

If any of the above feels uncomfortable, a more balanced approach may be better suited.

Essential Terms for Every Trader

For any trader, a solid grasp of essential terms is vital for effective portfolio management. Terms like “buy and sell,” “trading account,” and “options trading” are foundational in executing trades successfully. Additionally, understanding the average price of investments and the implications of different trading methods can significantly impact trading decisions. Full port meaning, as discussed earlier, further highlights the importance of maintaining a comprehensive view of one’s assets. By integrating these trading terms into their vocabulary, traders can enhance their trading techniques, engage more effectively with different markets, and ultimately achieve better results in their trading endeavors.

Strategies for Effective Full Port Trading

Developing a Full Port Trading Strategy

Developing a full port trading strategy is essential for maximizing the effectiveness of a trader’s portfolio. This strategy involves a comprehensive understanding of the assets held within a trading account, including stocks, forex, and cryptocurrency. By incorporating risk management techniques and analyzing the average price of investments, traders can create a robust plan that aligns with their financial goals. Additionally, traders should consider diversifying their asset allocation to enhance potential returns while minimizing risk exposure. The concept of full port is integral to this process, enabling traders to assess their entire portfolio’s performance.

Pocket Option and Full Port Trading

Pocket Option doesn’t require users to buy or sell actual assets. ⚡Main Pocket Option feature: you simply forecast whether the price will go up or down. If your forecast is correct, you can earn up to 92% profit. This setup makes Pocket Option an appealing platform to test high-conviction strategies like full port trading in a low-risk environment:

- Trades from $1

- Deposit from $5

- No downloads needed (web-based)

- Built-in indicators and trader sentiment tools

- Copy trading and cashback features

Real Trader Reviews:

“Pocket Option allows me to execute my strategy fast and clean. Even using full port setups, I can manage risk smartly thanks to low entry size.” — Carlos D.

“The clarity and speed of the platform are unmatched. Great for aggressive traders.” — Anna M.

Risk Management Techniques for Traders

Effective risk management techniques are vital for traders engaged in full port trading to safeguard their investments. Implementing stop-loss orders, position sizing, and maintaining a balanced trading account can significantly reduce potential losses. By understanding the trading methods that work best for their individual strategies, traders can create a safety net that protects against market volatility. Furthermore, continuous monitoring of market trends and staying informed about trading terminology helps traders make timely decisions. This proactive approach allows traders to navigate the financial market confidently, enhancing their overall trading performance.

Utilizing Day Trading Techniques within Full Port

Integrating day trading techniques within a full port trading strategy can offer traders unique advantages. Day traders focus on short-term price movements, executing multiple trades throughout a trading day to capitalize on fleeting market opportunities. By combining these techniques with a full port perspective, traders can manage risks effectively while pursuing quick profits. This approach requires a firm grasp of trading terms and the ability to swiftly analyze market conditions. Ultimately, blending day trading strategies with full port management enhances a trader’s ability to adapt and respond to changing market dynamics.

Exploring the Meaning of Full Port in Cryptocurrency Trading

Full Port Trading in Crypto Markets

Full port trading in crypto markets involves managing a portfolio that includes various digital currencies and tokens. Traders engaged in cryptocurrency trading must navigate a highly volatile market, making it crucial to apply the concept of full port effectively. This approach allows traders to evaluate their overall exposure to different cryptocurrencies and make informed buy and sell decisions based on market trends. By understanding the unique aspects of crypto assets and employing sound trading strategies, traders can enhance their chances of successful trading outcomes in this dynamic environment.

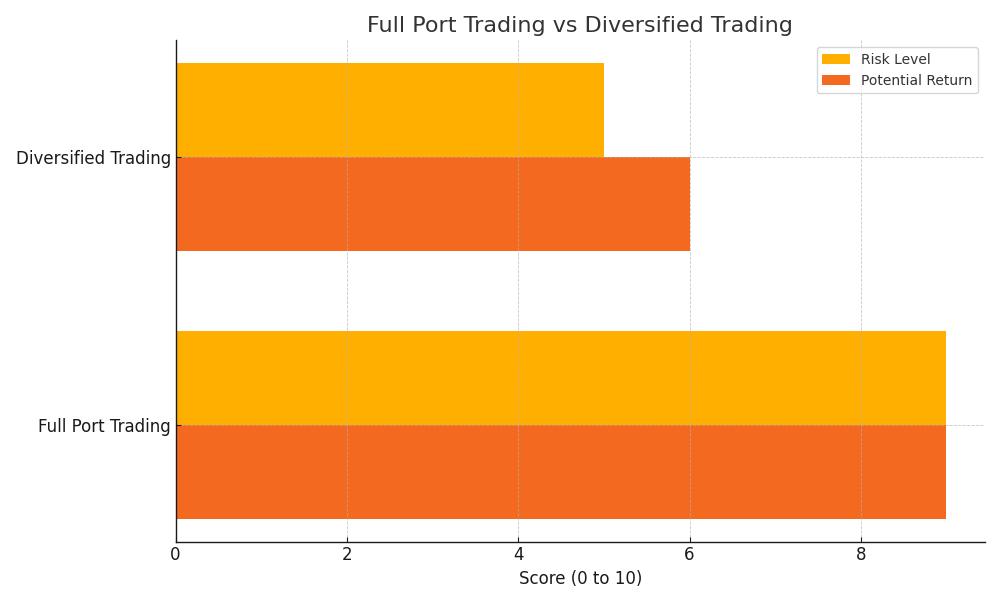

Is Full Port Trading Worth It?

| Trading Style | Risk Level | Potential Return | Recommended For |

|---|---|---|---|

| Full Port Trading | Very High | Very High | Advanced traders only |

| Diversified Trading | Moderate | Steady | Beginners & Investors |

Benefits and Challenges of Full Port in Cryptocurrency

There are both benefits and challenges associated with full port trading in cryptocurrency markets. On one hand, managing a full port allows traders to diversify their investments across various coins, reducing the risk of significant losses. This diversification can lead to improved overall performance when some assets appreciate in value. However, challenges arise from the rapid fluctuations in cryptocurrency prices, which require traders to remain vigilant and adaptable. Understanding the risks and mastering essential trading terminology can empower traders to navigate these challenges effectively while maximizing the potential benefits of their full port strategy.

Trends in Cryptocurrency Full Port Trading

Trends in cryptocurrency full port trading continuously evolve as market dynamics change. Recently, an increasing number of traders are adopting automated tools and algorithms to enhance their trading strategies, allowing for more efficient portfolio management. This trend is particularly beneficial in the fast-paced crypto environment, where quick decision-making is crucial. Additionally, there is a growing emphasis on risk management techniques, with traders seeking to balance their portfolios by strategically investing in both established coins and emerging tokens. Staying informed about these trends is essential for traders aiming to leverage the full port concept effectively in their cryptocurrency endeavors.

Conclusion

The full port meaning trading style can be profitable for those with strategy, discipline, and experience. However, it remains one of the riskiest tactics and is best suited to traders who are aware of its pitfalls.

Platforms like Pocket Option offer a space to test high-risk strategies without the pressure of large capital outlays. Whether you’re an aggressive trader or exploring various styles, always combine confidence with control.

Discuss this and other topics in our community!

FAQ

What is the main principle of full port meaning trading?

It's a comprehensive approach to portfolio management where all positions are managed as part of an integrated strategy, focusing on overall portfolio performance rather than individual trades.

How often should I rebalance my portfolio?

Regular rebalancing is recommended, typically monthly or quarterly, depending on market conditions and your strategy's requirements.

What are the key risk management principles?

Essential principles include position sizing, correlation analysis, and maintaining stop-loss levels for all positions.

How can I measure the success of my trading strategy?

Track key metrics like overall portfolio return, maximum drawdown, risk-adjusted returns, and consistency of performance.

What tools are necessary for effective portfolio management?

Required tools include portfolio tracking software, risk management systems, and market analysis platforms.