- No brokerage commission on trades

- Lower entry barrier for beginners

- Enhanced strategy experimentation without cost risk

- More capital directed to positions rather than fees

Commission Free Trading Options: Best Platforms for 2025

In the rapidly evolving financial landscape, commission free trading options are transforming how traders interact with markets. As we move into 2025, understanding the benefits, risks, and tools associated with commission-free trading has become essential. This comprehensive guide explores the platforms, strategies, and expert insights needed to thrive in this environment — with a spotlight on the unique advantages offered by Pocket Option.

Article navigation

- What Are Commission-Free Trading Options?

- Key Benefits:

- Commission-Free Options Trading Platforms Comparison:

- Choosing the Right Broker for Commission-Free Trading Options

- Advanced Options Trading Tools

- Strategies for Commission-Free Trading

- Community Feedback and Real Trader Reviews

- Future Outlook: Should I Enable Commission-Free Options Trading?

- Final Thoughts: Best Options Trading Platform for Beginners?

What Are Commission-Free Trading Options?

Commission-free trading options refer to the ability to trade financial instruments, such as stock options or ETFs, without paying per-trade commissions. This model gained massive traction with platforms like Robinhood and Webull, making trading more accessible to retail investors. However, it’s important to look beyond the lack of fees and evaluate platforms based on their tools, transparency, and overall value.

Key Benefits:

Commission-Free Options Trading Platforms Comparison:

| Platform | Commission on Options | Per Contract Fees | Best For |

|---|---|---|---|

| Robinhood | $0 | $0 | Beginners, simplicity |

| Webull | $0 | $0 | Intermediate traders, charting tools |

| Charles Schwab | $0 | $0.65 | Full-service investing |

| Pocket Option | $0 | N/A | Quick Trading, mobile-first users |

Pocket Option stands out with its fast and intuitive Quick Trading model. With two main actions — Buy or Sell — users can speculate on short-term asset movements with clarity and control.

Choosing the Right Broker for Commission-Free Trading Options

Broker Trust & Performance

When selecting a broker, look at regulation, user feedback, and feature completeness. For example:

- Pocket Option offers a demo account with $50,000 in virtual funds to help new users practice strategy risk-free.

- Users consistently rate Pocket Option highly for platform stability, user interface, and payout speed.

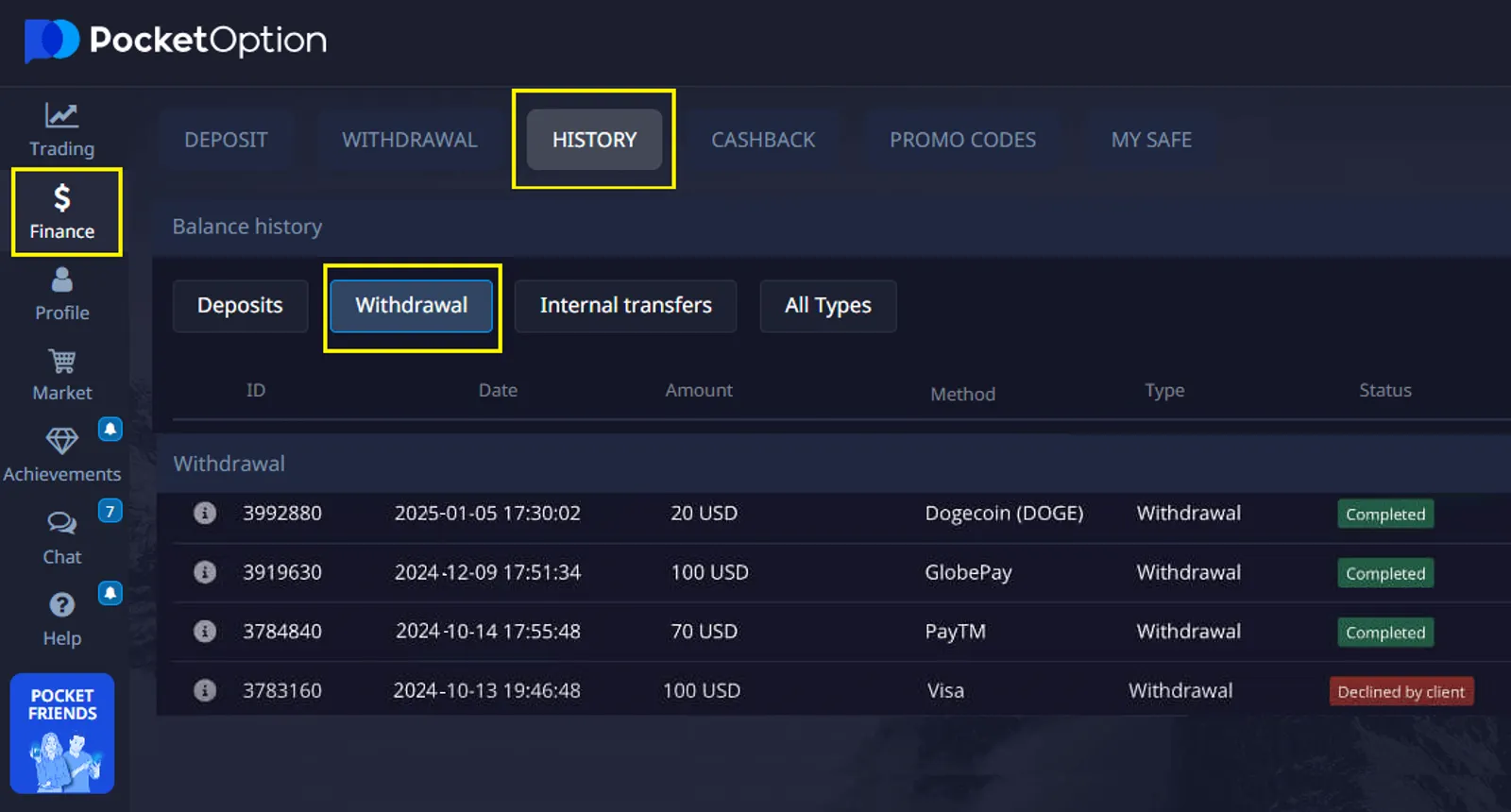

Pocket Option Commission and Payouts

- Pocket Option payout percentage can reach up to 92% on certain assets.

- There are no hidden trading fees, and no Pocket Option withdrawal fees, but often remain competitive.

- Pocket Option model ensures transparent and cost-effective trading.

Affiliate Program

Pocket Option’s affiliate program is designed to reward you for referring new traders. When someone you refer registers, deposits, and starts trading, you can earn a commission based on their trading activity. The commission structure is competitive and can be a great way to generate an additional income stream.

Advanced Options Trading Tools

Successful options trade requires more than low fees. To make informed, timely decisions in volatile markets, traders must rely on a robust suite of analytical and execution tools.

Essential Tools for Serious Traders:

- Options chains with Greeks (Delta, Theta, Vega, Gamma) to evaluate time decay, volatility impact, and directional exposure.

- Futures/options evaluation tools that assess implied volatility, open interest, and expiration cycles.

- Risk calculators and profit/loss simulators that model trade outcomes and help manage complex multi-leg strategies.

- Strategy builders for visualizing potential trades and comparing payout/risk across different legs and expiry dates.

Where Platforms Stand Out:

- Charles Schwab and Interactive Brokers are renowned for their institutional-level platforms offering ThinkOrSwim-style modeling, custom scripting, and backtesting environments. These are ideal for quantitative and high-frequency traders.

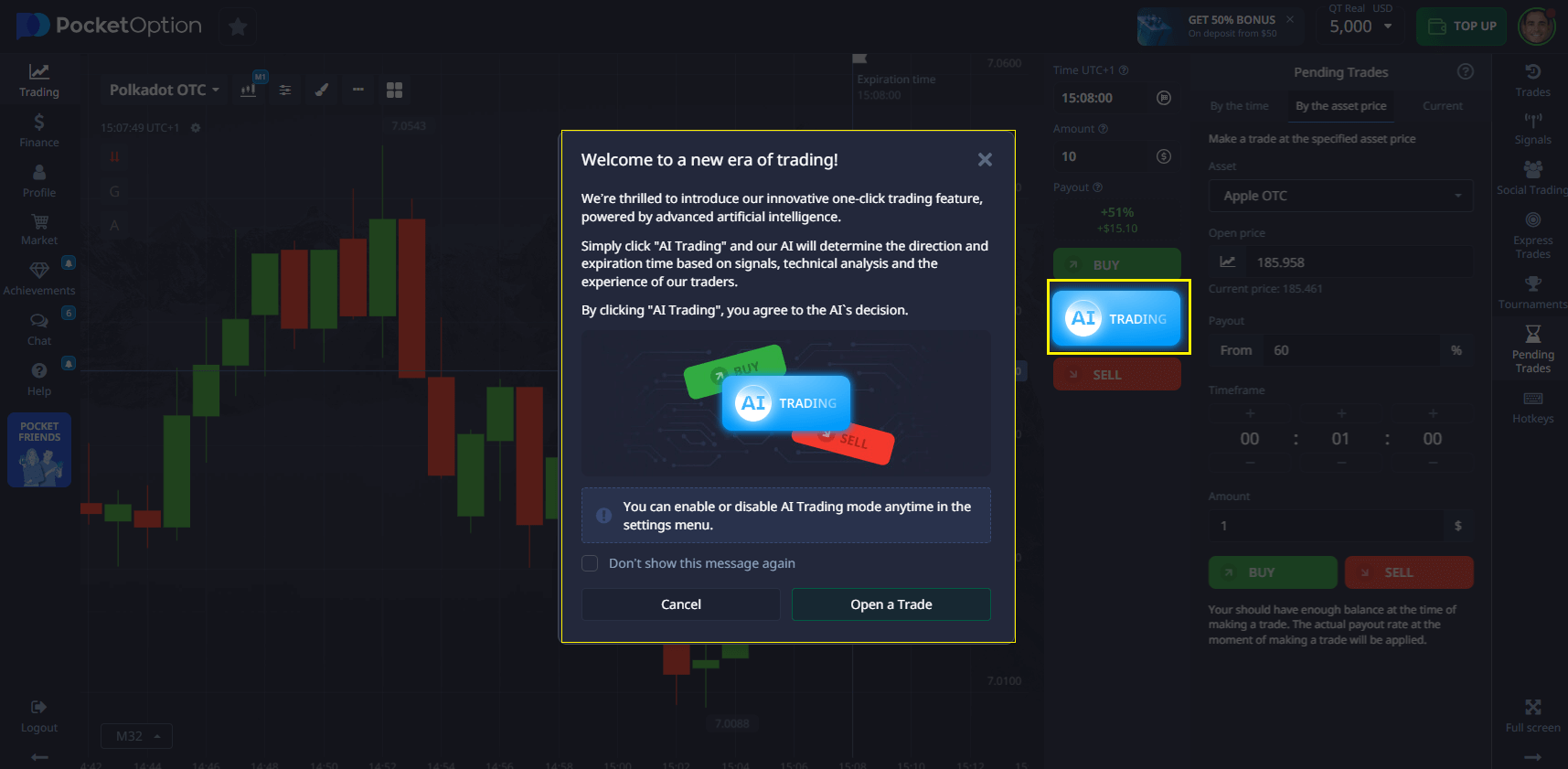

- Pocket Option, meanwhile, is rapidly evolving with advanced tools tailored for practical use:

- AI-powered trading bots that respond to predefined signals and automate entries.

- Integrated copy trading where users can replicate top trader strategies with real-time visibility and control.

- Seamless mobile trading across iOS, Android, and Desktop ensures on-the-go access without losing depth in analysis.

This makes Pocket Option a compelling choice not just for entry-level users, but for advanced traders seeking a balanced mix of accessibility, speed, and intelligence in execution.

Strategies for Commission-Free Trading

Many traders specifically search for Commission free options trading Robinhood to benefit from zero-fee structures combined with a simple user interface. While Robinhood offers a solid entry-level experience, it’s crucial to compare features, tools, and support available on other platforms before committing fully. Popular platforms include Robinhood, Webull, and Pocket Option, all offering mobile-friendly apps and rich educational resources.

Commission Free Trading Options for Beginners

| Strategy Type | Description |

|---|---|

| Covered Calls | Income from stock ownership |

| Protective Puts | Insurance against a decline |

| Iron Condors | Balanced approach for neutral outlook |

Pocket Option offers free options trading app features and Quick Trading simulations using a demo account.

💡 Expert Insight:

“Commission-free platforms encourage experimentation — but successful trading still depends on knowledge and discipline.” — Dr. Emily Harding, CFA

Community Feedback and Real Trader Reviews

According to Commission free trading options Reddit, most users highlight ease of access, low cost, and intuitive interfaces.

Real user testimonials:

- “Pocket Option changed my trading game. The demo helped me test strategies without pressure.” — Lucas M.

- “Withdrawals are smooth, interface is intuitive.” — Jin S.

- “Their affiliate model is unlike anything else.” — Amira B.

Future Outlook: Should I Enable Commission-Free Options Trading?

Trends for 2025

- More access to ETFs, mutual funds, and stock strategies

- Increased use of automation and smart order routing

- Platform UX improvements and expanded IRA compatibility

Analyst Outlook

“The future of retail trading lies in intelligent brokerage solutions that remove barriers, like fees, and enhance education.” — Harold Green, MarketWatch

Final Thoughts: Best Options Trading Platform for Beginners?

Whether you prefer Robinhood options fees simplicity or Webull options fees with advanced charting tools and detailed analytics, Pocket Option delivers a uniquely competitive experience tailored to both beginners and seasoned traders.

Here’s what sets Pocket Option apart:

- Competitive payouts up to 92%, giving traders a real edge in profitability.

- No trading commission, allowing you to retain more of your earnings with each transaction.

- Low Pocket Option fees, including flexible withdrawal structures and no deposit fees.

- Access to a wide range of assets including ETFs, mutual funds, and fractional shares, enhancing your portfolio diversification.

- Fractional investing enables you to buy into high-value stocks and ETFs with small amounts.

- IRA support means you can trade within a tax-advantaged environment, a rare feature in commission-free platforms.

This platform combines speed, simplicity, and flexibility — all without compromising on functionality. From a streamlined mobile app to advanced trading bots and risk-management tools, Pocket Option is engineered for real-world results.

📌How does Pocket Option make money? Through smart revenue channels including spreads on trades, premium tools and services, and a robust affiliate program that supports its global network of partners.

FAQ

How does Pocket Option differentiate from other commission-free platforms?

Pocket Option offers more than 100 financial instruments and educational tools developed by certified experts. The platform also stands out for its transparency about its business model, publishing detailed quarterly reports.

Are commission-free trading options really free?

Although there are no explicit commissions, there are implicit costs such as wider spreads and possible slippage. For 92% of retail investors with operations below R$5,000, the model represents an average savings of 4.3%.

Which strategies work better on commission-free platforms?

High-frequency strategies such as scalping, price averaging, and regular rebalancing become economically viable. Pocket Option data shows an average daily ROI of 0.5% for scalping, impossible in models with commission.

Are there specific risks when using commission-free trading options?

Yes, they include average slippage of 0.08% during high volatility periods, increased spreads on certain instruments, and a tendency toward excessive trading. Pocket Option implements automated alerts when it detects potentially harmful patterns of frequent trading.

What is commission free options trading?

Commission free options trading refers to the ability to buy and sell options contracts without paying a per-trade or per-contract commission fee. It allows traders to execute strategies more affordably, retain more profits, and engage in higher-frequency trading with less cost friction.

Can you make $1000 a day trading options?

While it's possible for experienced traders using high capital and risk-managed strategies to earn $1000 or more daily, it's not typical for most. Consistent profitability in options trading requires discipline, technical skill, and a solid understanding of market dynamics.

Does anyone offer free options trading?

Yes. Platforms like Pocket Option, Robinhood, and Webull offer commission-free options trading. However, traders should be aware of other potential costs such as spreads, inactivity fees, or premium tools.

Who offers commission free trading?

Several leading brokers now offer commission-free trading for stocks, ETFs, and options, including Robinhood, Webull, Charles Schwab, and Pocket Option. Each varies in features, so traders should compare based on tools, asset availability, and user experience.