- Knowledge and strategy — Options require understanding of pricing models, volatility, and time decay.

- Risk management — Position sizing and hedging play a crucial role in long-term success.

- Capital discipline — Unlike stocks, options can expire worthless, so over-leveraging can lead to rapid losses.

Can Option Trading Make You Rich: Unlocking Financial Success

Option trading has long been a subject of fascination for those seeking financial prosperity. Many wonder, "Can option trading make you rich?"

Article navigation

- Can Option Trading Make You Rich?

- Key Factors

- Comparing Quick Trading on Pocket Option vs Classic Options

- Can You Become an Options Millionaire?

- Options Trading as a Tool for Wealth Building

- Financial Freedom and Successful Options Traders

- Risks of Relying on Options for Wealth

- Pocket Option Quick Trading as an Accessible Alternative

Can Option Trading Make You Rich?

The question “can option trading make you rich” attracts both beginners and professionals in financial markets. Options are complex instruments that allow traders to control large positions with relatively small capital. The potential for significant profits is real, but so are the risks. In this article, we explore how wealth can be built through options trading, what experts say, and how platforms such as Pocket Option provide an alternative approach with Quick Trading.

Key Factors

Options have been responsible for creating fortunes but also for wiping out portfolios. According to the Options Clearing Corporation (OCC), the global options market handles over 10 billion contracts annually, making it one of the most actively used derivatives markets in the world.

To understand whether options trading wealth is achievable, traders must consider three main factors:

As Bloomberg analysts noted in 2024, around 15% of retail traders generate consistent profits from options, while the majority struggle due to lack of strategy and discipline. This shows that the potential to get rich options trading exists, but it is far from guaranteed.

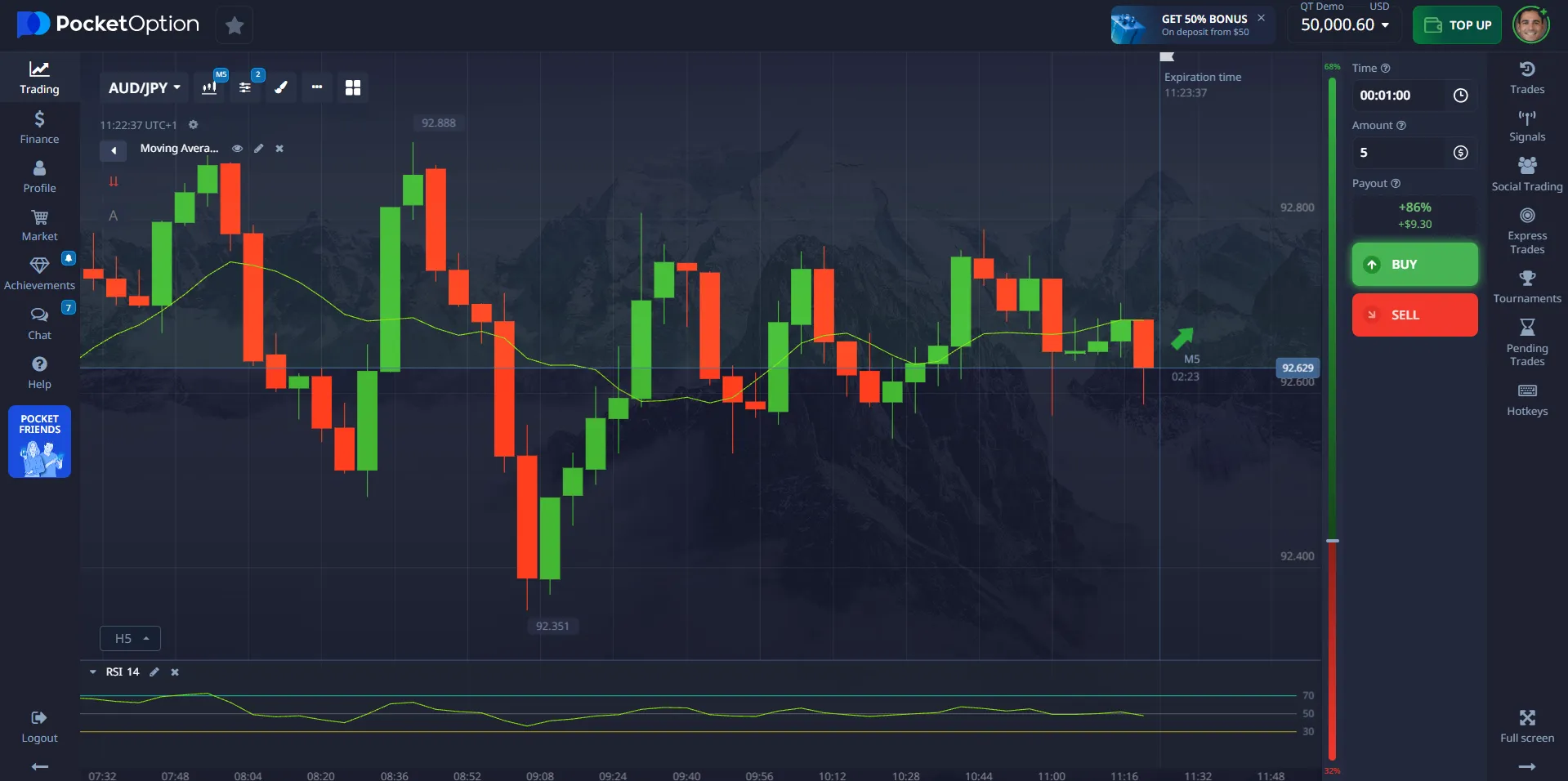

Comparing Quick Trading on Pocket Option vs Classic Options

Traditional options on exchanges such as the CBOE involve strike prices, expirations, and premiums. Traders may use calls or puts for hedging or speculation.

Pocket Option, however, introduces a simplified approach known as Quick Trading:

| Feature | Classic Exchange Options | Pocket Option Quick Trading |

|---|---|---|

| Entry cost | Premium (variable) | From $1 per trade |

| Expiration choice | Days to months | Seconds to minutes |

| Complexity | Requires option pricing models | Simple Buy/Sell decision |

| Example action | Buy call, sell put, spread strategies | Click Buy if expecting price increase, Sell if expecting price decrease |

Quick Trading removes the complexity of strike selection and premiums. A trader simply decides whether the price will move up or down in a chosen short timeframe. This makes the process accessible but still tied to risk.

Can You Become an Options Millionaire?

Stories of a so-called options millionaire are not myths. For instance, hedge fund managers such as Paul Tudor Jones and retail traders during the 2020–2021 market volatility generated millions from well-timed options trades. According to CNBC, during the 2021 “meme stock rally,” some traders turned $30,000 into more than $1 million through call options on GameStop.

However, such cases are the exception rather than the rule. For every story of extraordinary gain, there are thousands of traders who lost capital.

Key insight: options trading profits can be large due to leverage, but the same leverage magnifies losses.

Options Trading as a Tool for Wealth Building

Can options support wealth building options strategies? Yes, but only under specific conditions:

- Covered calls — Selling calls against owned stock generates premium income.

- Protective puts — Used to limit downside in volatile markets.

- Spreads — Limiting both risk and reward, suitable for long-term wealth growth.

The Financial Times reported in 2023 that institutional investors often use options for high return investments combined with risk reduction. For retail traders, the approach must be adjusted — the focus should be on consistency rather than speculation.

Financial Freedom and Successful Options Traders

For some, options become a path to financial freedom trading. Traders who systematically build a strategy, manage risks, and reinvest profits may grow wealth steadily.

Examples include:

- Successful options traders at institutions who earn consistent annual returns of 10–20%.

- Independent traders using disciplined strategies like iron condors or calendar spreads for steady income.

But remember: most retail traders who attempt to get rich options trading quickly, without education, fail to achieve sustainable results.

Risks of Relying on Options for Wealth

Options are high return investments, but the risks are just as high. According to Bank of America, more than 70% of short-term retail option positions in 2023 expired worthless.

Main risks include:

- Time decay (Theta) eating away at the option’s value.

- Volatility crush after earnings reports.

- Leverage risk — small market moves may result in complete loss of premium.

This is why many experts recommend using options as part of a diversified portfolio rather than the sole investment method.

Pocket Option Quick Trading as an Accessible Alternative

Unlike classical options, Pocket Option’s Quick Trading provides a simplified Buy/Sell choice without strike prices or premiums. This lets beginners focus on market direction and risk control rather than contract mechanics.

Key Advantages of Quick Trading on Pocket Option

| 🚀 Feature | 📌 Description |

| 💵 Low entry | Start trading with deposits from $5 (varies by region). |

| 🤖 Automation | Use signals, bots, and copy trading for strategy support. |

| ⚡ Fast outcomes | Results in seconds to minutes, instant feedback on trades. |

| 🎯 Small trades | Open positions from just $1, manage risk effectively. |

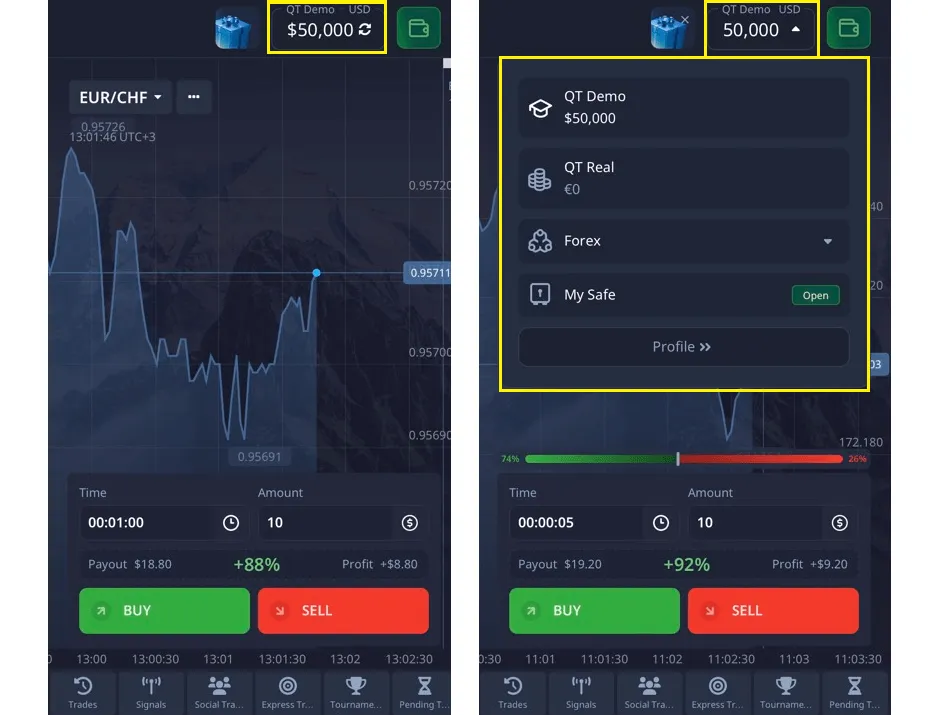

| 🎮 Demo account | Practice with a $50,000 demo balance risk-free. |

| 📱 Mobility | Trade on Windows, Mac, iOS, Android anytime. |

| 💳 Quick funds | Deposits via cards, e-wallets, crypto; withdrawals in hours–days. |

👉 Quick Trading may not guarantee an options millionaire path, but it offers a practical way to build decision-making skills and test strategies with lower risk than classical options.

FAQ

Can you get rich from options trading?

Yes, but only a small percentage of traders achieve long-term wealth. Most fail due to lack of risk management and unrealistic expectations.

Is options trading profitable?с

Can you get rich from options trading? Yes, but only a small percentage of traders achieve long-term wealth. Most fail due to lack of risk management and unrealistic expectations.

How much money can you make trading options?

Profits range from small consistent gains to extraordinary windfalls. Some retail traders have become millionaires, but most earn modest returns or lose capital.

What are the risks of options trading?

Major risks include time decay, volatility shifts, leverage losses, and complete capital loss if positions are not managed correctly.

What is the success rate for option traders?

The success rate varies widely. Studies suggest that about 30% of option traders are profitable, with only a small percentage achieving significant wealth.

How much capital do I need to start option trading?

While you can start with a few hundred dollars, most successful traders recommend having at least $5,000 to $10,000 to properly manage risk and diversify.

Is option trading riskier than stock trading?

Options can be riskier due to their leverage and time sensitivity. However, they can also be used to manage risk in a portfolio when used correctly.

How long does it take to become proficient in option trading?

Most traders report taking 1-2 years of consistent study and practice to become consistently profitable. Mastery can take several years.

Are there any guaranteed strategies in option trading?

There are no guaranteed strategies in any form of trading. Even well-tested strategies can fail under certain market conditions. Always be prepared for potential losses.

CONCLUSION

Options trading can make you rich, but it requires education, discipline, and risk management. Pocket Option’s Quick Trading provides a simplified alternative, making it easier for traders to practice and develop skills without the complexity of traditional derivatives.

Start trading