- Trigger account restrictions (e.g., 90-day limits on buying power)

- Reduce day trading privileges

- Lead to financial trading penalties

Trading Violations

In the fast-paced world of financial markets, understanding and adhering to trading regulations is crucial for investors and traders alike. Trading violations can have serious consequences, ranging from account restrictions to legal repercussions.

Understanding Trading Violations: Avoiding Common Cash Account Violations

Trading violations are breaches of financial trading regulations set by regulatory authorities or brokerage firms. These breaches can disrupt the settlement process and affect a trader’s buying power, access to funds, or even account status. Types include good faith violations, freeride violations, cash liquidation violations, and more.

Table: Common Trading Rule Violations

| Violation Type | Description |

|---|---|

| Good Faith Violation | Selling a security without having paid with settled funds |

| Freeride Violation | Selling before paying for a security with own funds |

| Cash Liquidation | Selling an asset solely to cover a previous purchase using unsettled cash |

“Many beginner investors make the mistake of assuming cash availability simply because their account balance shows a positive number — without checking if the funds are settled,” — says Rob Donovan, compliance officer at a U.S.-based brokerage.

Why Understanding Violations Matters

Ignorance isn’t bliss when it comes to trading law violations. Violations can:

According to FINRA’s 2024 enforcement statistics, over 4,300 individuals received warnings or restrictions due to improper use of cash accounts — 22% higher than the previous year.

Understanding and preventing these violations ensures smoother trading and long-term profitability.

Key Cash Account Violations Explained

Good Faith Violations

This occurs when a trader buys a security and sells it without waiting for the purchase to settle (T+2). Example:

You buy Stock A on Monday with unsettled funds, and sell it on Tuesday to fund another trade. This is a good faith violation.

Consequences:

- 90-day restriction on buying power

- Loss of good faith status

Prevention Tips:

- Wait for trades to settle before using funds

- Track the T+2 rule carefully

“Using unsettled funds before they’re ready is like spending tomorrow’s paycheck today — and brokers take that very seriously,” — explains market educator Lydia Raines.

Freeride Violations

These violations involve selling a security bought with unsettled funds before the purchase is fully paid. Example:

You buy $1,000 worth of shares with no cash, hoping to sell for profit before payment clears.

Consequences:

- Account freeze for 90 days

- Only settled cash can be used for future trades

| Feature | Good Faith Violation | Freeride Violation |

|---|---|---|

| Cause | Use of unsettled sale proceeds | Buying without cash |

| Common in | Active cash accounts | Day trading |

| Result | Limited buying power | Account lock |

Cash Liquidation Violations

This violation happens when a trader sells a position solely to pay for a previously executed trade that lacked funds.

Example: You purchase Stock B on Monday without funds. On Wednesday, you sell Stock C to pay for Stock B.

Impact:

- Multiple violations can lead to full restriction on the account

- Disrupts account settlement flow

Industry Note: According to a 2023 Charles Schwab report, 68% of new cash account holders didn’t fully understand cash liquidation rules during their first 90 days.

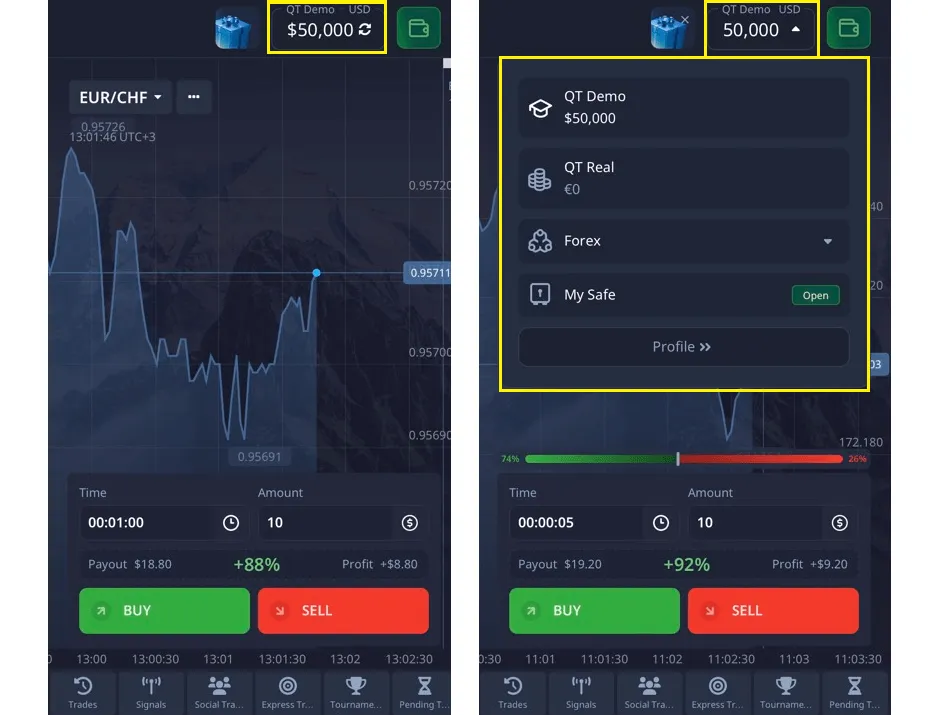

The Cash Account Advantage (And Responsibility)

What Is a Cash Account?

A cash account requires all trades to be paid with funds already available. Unlike margin accounts, no borrowing is allowed.

Benefits:

- Lower risk of margin calls

- Simpler compliance with regulatory trading rules

- Ideal for learning with real or demo accounts

Pocket Option Advantage: Pocket Option offers a free unlimited demo account, helping you learn risk-free before entering real trades.

Unique Insight: For disciplined traders, cash accounts can be a powerful psychological tool — they promote capital management and delayed gratification, which are key to long-term success.

Difference: Cash vs. Margin Account

| Feature | Cash Account | Margin Account |

|---|---|---|

| Funding | Uses own settled funds | Borrows funds from broker |

| Risk Level | Lower | Higher |

| Violations Risk | Good faith, freeride, liquidation | Margin call, interest penalties |

Best Practices to Avoid Violations

Practical Tips:

- Track Settlement Dates: Always respect the T+2 rule.

- Avoid Using Unsettled Funds: Don’t execute trades unless your funds are fully available.

- Use Pocket Option Demo: Practice with real market data and zero risk.

Strategic Habits:

- Monitor your buying power before placing trades

- Set alerts for pending settlements

- Review your trading history regularly

“The best way to avoid violations is to trade slower. You don’t have to catch every wave. Missing one is better than wiping out,” — recommends Arjun Mehta, CFA.

Understanding Regulatory Context

SEC Trading Violations and Legal Compliance

The U.S. Securities and Exchange Commission (SEC) enforces strict rules on trade settlements and reporting. Violating these may constitute SEC trading violations or securities violations, attracting investigation and fines.

Regulatory Focus Areas:

- Insider trading rules: Avoid trading on material non-public info

- Market manipulation violations: Don’t engage in pump-and-dump or misleading orders

- Regulatory compliance trading: Adhere to broker-dealer and account funding rules

Real Case Example:

A retail trader was fined over $10,000 by FINRA for repeated freeride violations in a cash account. The brokerage flagged excessive violations, triggering mandatory education and trade suspension.

Stat Highlight: SEC enforcement brought 780 actions in FY 2023, with over $5.8 billion in financial remedies.

To better understand platform security and compliance, many traders also explore whether Pocket Option is safe before committing real funds.

Leveraging Pocket Option for Smart Trading

Pocket Option is designed for traders who want flexibility, speed, and simplicity — without the hidden traps of margin trading. Here’s why traders prefer Pocket Option:

- ✅ Trade 100+ assets including stocks, crypto, forex 24/7

- 📆 Join trading tournaments & win real prizes

- 🧰 Use AI Trading and Telegram Signal Bot for smarter entries

- ✨ Copy successful traders using Social Trading tools

- 💳 Over 50 deposit methods including crypto & e-wallets

- 🎁 Boost deposits with bonuses & promo codes

- 📃 Access free educational materials and support

- 📱 Download the Pocket Option mobile app for 1-minute trades

Whether you’re starting out or already live, Pocket Option ensures you stay ahead — and compliant.

FAQ

What are common trading violations?

Common trading violations include good faith violations, freeride violations, and cash liquidation violations. These usually happen when traders use unsettled funds or fail to pay for trades correctly.

What happens if you violate trading rules?

Violations can lead to 90-day restrictions on your account, limited buying power, account freezes, or regulatory scrutiny from organizations like the SEC.

How to avoid trading violations?

Use only settled cash, track settlement dates (T+2), avoid overtrading, and practice using demo accounts like Pocket Option’s risk-free demo mode.

What are SEC trading penalties?

The SEC may impose fines, suspend trading privileges, or bring enforcement actions if violations involve insider trading, market manipulation, or repeated regulatory breaches.

What is a cash trading violation?

A cash trading violation occurs when an investor buys and sells securities in a cash account without having sufficient settled funds to cover the trades. This can include free-riding and good faith violations.

How can I avoid margin account trading violations?

To avoid margin account trading violations, regularly monitor your account balance, understand day trading rules, maintain a cash cushion, and stay informed about margin requirements.

What are the consequences of repeated trading violations?

Repeated trading violations can lead to account restrictions, forced liquidation of positions, suspension of trading privileges, financial penalties, and in severe cases, legal action or permanent bans from trading.

How long do trading violation penalties typically last?

The duration of penalties can vary, but many restrictions, such as those resulting from cash account violations, typically last for 90 days. However, more severe or repeated violations may result in longer-lasting consequences.

Can trading violations affect my credit score?

Generally, trading violations do not directly impact your credit score. However, if violations lead to unpaid debts or legal action, these consequences could potentially affect your credit in the long run.

Final Thoughts: Stay Safe, Stay Informed

Trading rule violations can sneak up on even experienced traders. But by understanding how violations happen, using tools like Pocket Option’s demo account, and staying within your settled cash balance, you can avoid penalties and grow your portfolio. Being proactive is the best way to protect your capital — and your trading freedom. Always remember to respect the T+2 settlement cycle, ensuring that trades are executed only with fully settled funds. Avoid the temptation to use unsettled cash, and instead rely on strategic, well-planned trades. Utilize a demo account to test strategies in real time without risk, and stay informed about the latest SEC regulations and your broker’s compliance rules. Stay smart. Trade safe. Profit with clarity.

Start trading