- Strategic Thinking – Build repeatable systems instead of relying on luck.

- Self-Awareness – Spot emotional patterns that lead to poor decisions.

- Pattern Recognition – Detect profitable setups and recurring mistakes.

- Performance Review – Understand not just what happened, but why.

- Discipline – Make data-driven decisions, not impulsive ones.

Mastering the Option Trading Journal

An option trading journal is a crucial tool for traders looking to improve their performance and make more informed decisions. By meticulously recording and analyzing trades, traders can identify patterns, strengths, and weaknesses in their strategies.

What is it?

An option trading journal is more than a list of past trades — it’s a foundation for long-term success. Traders who track not only outcomes but also the reasoning, emotions, and market context behind each trade gain a major edge. A journal helps refine strategies, reduce emotional decisions, and build discipline.

On Pocket Option, journaling is streamlined. The platform provides tools like the Trading History section for in-depth analysis and the Trades panel for live session tracking. These features make it easier to create a comprehensive, actionable trading journal.

Why Keep a Journal?

Journaling helps bring structure to your trading journey:

If you’re using fast trades on Pocket Option — such as predicting short-term price moves — a trading journal becomes essential. High-frequency trading generates lots of data, and only by reviewing your trades can you improve over time.

What to Log in Your Journal

| Element | Example |

|---|---|

| Asset | EUR/USD |

| Trade Time | 14:05–14:10 |

| Direction | Up |

| Entry Reason | RSI oversold |

| Emotion | Confident |

| Result | Profit |

| Market Context | News-driven volatility |

Pocket Option: Built-In Tools for Journaling

Pocket Option doesn’t offer classic options — instead, it features ⚡ Quick Trading where you simply predict price direction and can earn up to 92% profit online, no downloads needed.

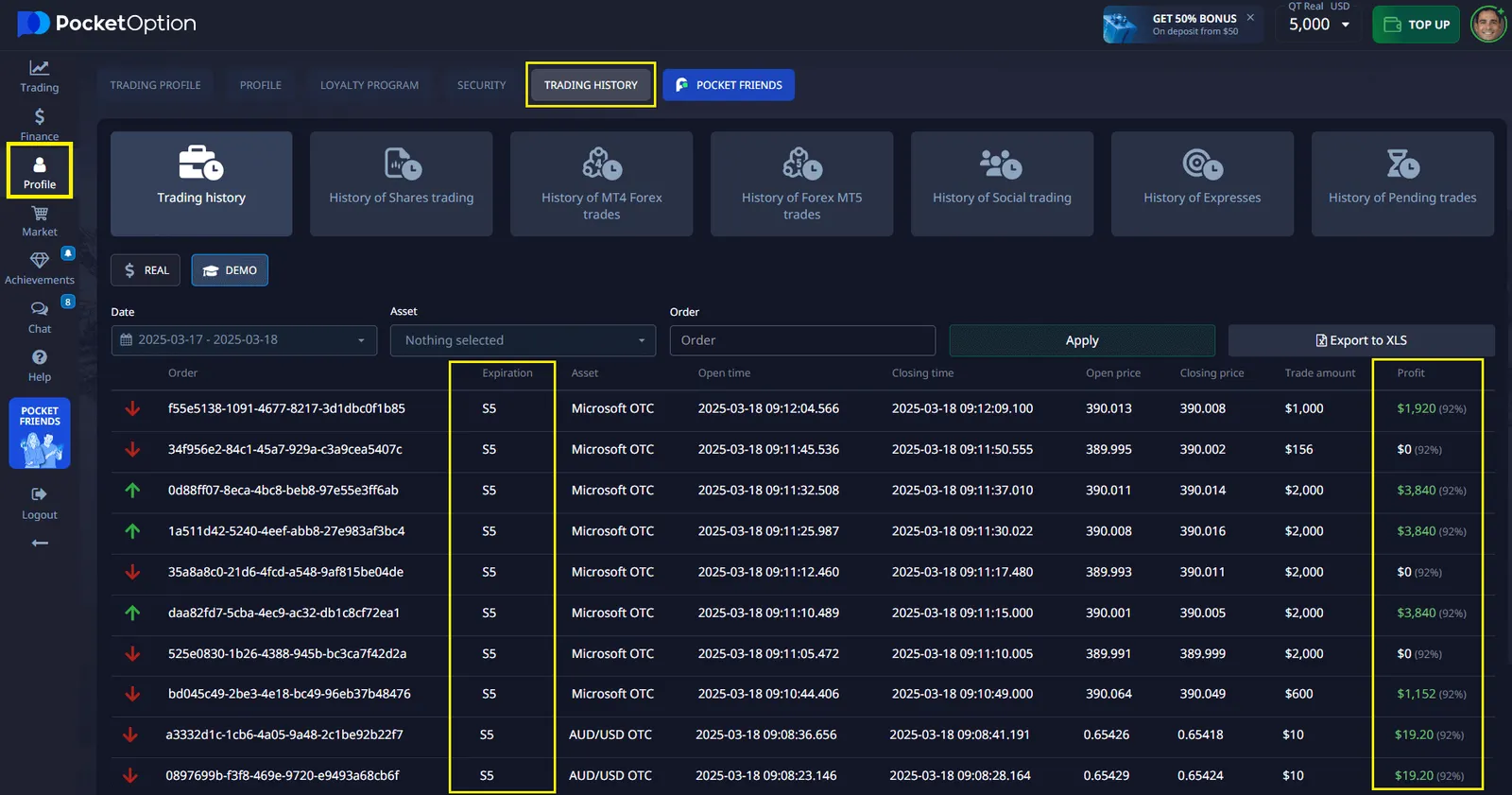

Trades History Section on Pocket Option

The Trading History page on Pocket Option gives traders full access to their past trades, including:

- Order ID and timestamps

- Asset and trade type

- Entry and expiry times

- Profit or loss outcome

This section helps you construct a visual equity curve, track win/loss ratios, and monitor your strategy’s performance over time. Whether you’re analyzing long-term growth or short-term behavior, this data helps you see the full picture.

Pocket Option empowers you not just to trade — but to learn and evolve with every session. The Trading History page is the foundation of this process.

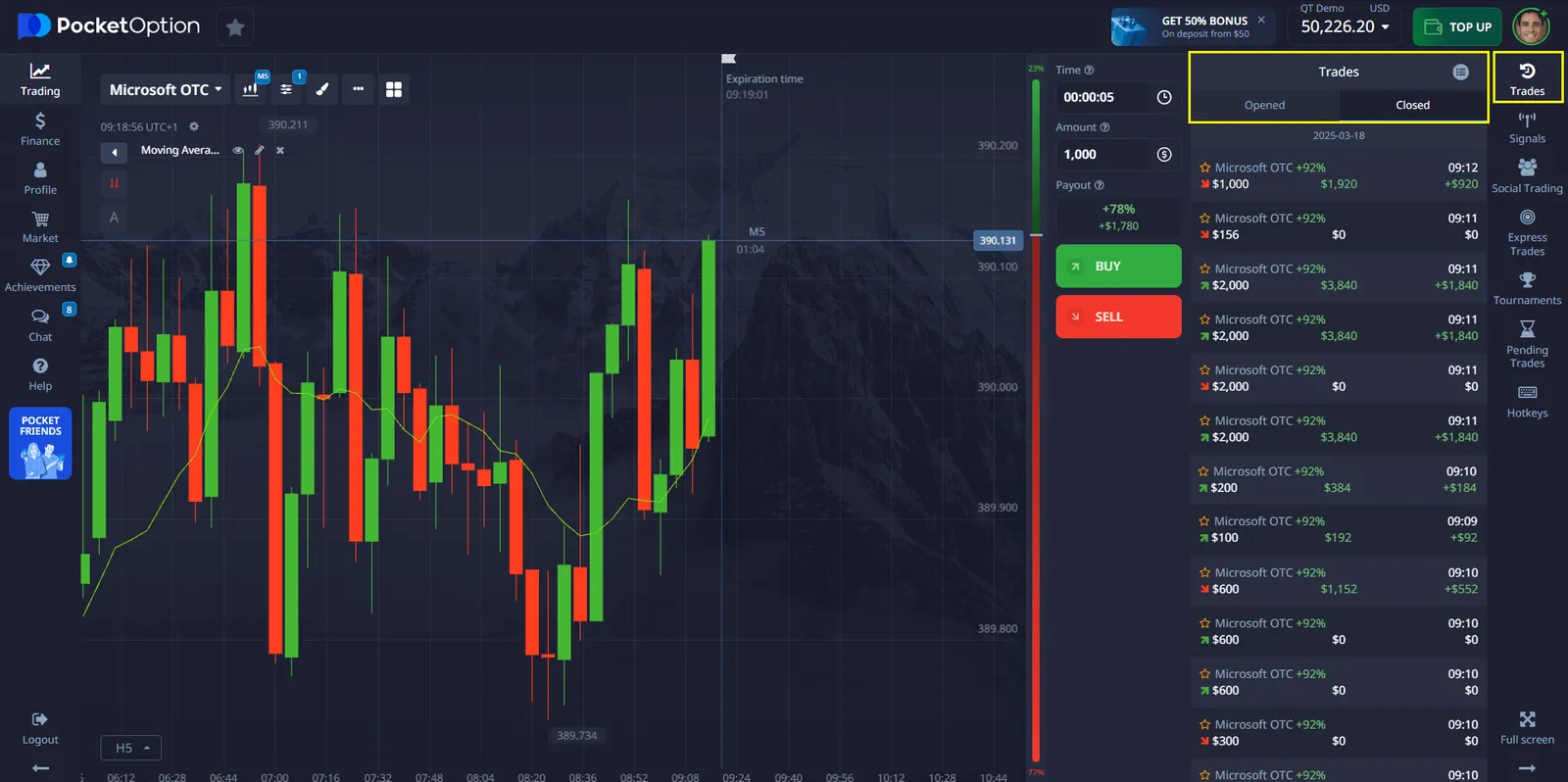

“Trades” Panel for Real-Time Monitoring

During active trading sessions, the “Trades” button on the right side of the Pocket Option interface allows you to:

- View open positions in real time

- Check trade details instantly

- Monitor active expiration timers

- Stay aware of your risk exposure

This live monitoring tool helps you stay focused and alert, especially when placing multiple trades or managing high-frequency sessions. You can also compare your real-time actions with your journal notes to improve consistency.

How to Maximize Your Journal

- Build a Template – Standardize your entries for faster review.

- Track Emotions – Log how you felt before and after each trade.

- Add Market Context – Note news, trends, or technical levels.

- Review Weekly – Dedicate time for honest reflection.

- Rate Decisions – Score each trade for discipline and execution.

- Use Visual Tools – Convert data into graphs or charts.

Conclusion

An option trading journal is your personal feedback loop — a tool to reflect, refine, and grow. With Pocket Option’s features like Trading History and real-time Trades monitoring, tracking your activity becomes seamless and insightful.

Whether you’re testing strategies, managing fast trades, or improving discipline, your journal turns experience into measurable progress.

⚡ Don’t just trade. Understand your trades.

FAQ

What is an option trading journal and why is it important?

An option trading journal is a record-keeping tool used by traders to document their trades, strategies, and performance. It's important because it helps traders analyze their decisions, identify patterns, and improve their trading strategies over time.

How often should I update my option trading journal?

It's best to update your option trading journal consistently, ideally after each trade or at the end of each trading day. This ensures that your records are accurate and that you don't forget important details about your trades.

What information should I include in my option trading journal?

Your option trading journal should include trade details (entry and exit points, position size, profit/loss), market conditions, your emotional state, reasons for entering and exiting trades, and any post-trade analysis or lessons learned.

Can I use a spreadsheet for my option trading journal?

Yes, a spreadsheet can be an effective tool for maintaining an option trading journal. Many traders use Excel or Google Sheets to create customized templates that suit their specific needs and trading style.

How can I use my option trading journal to improve my trading performance?

Regularly review your journal entries to identify patterns in your trading behavior, assess the effectiveness of your strategies, and pinpoint areas for improvement. Use this information to refine your approach, manage risk more effectively, and make more informed trading decisions.