- Federal Reserve Policy: Aggressive interest rate increases to combat inflation

- Inflation Concerns: Persistent above-target inflation readings

- Economic Growth: Strong GDP growth reducing demand for safe-haven bonds

- Fiscal Policy: Increased government spending and debt issuance

- Market Sentiment: Risk-on environment favoring equities over bonds

TLT Analysis

Recent data from 2025 shows TLT has experienced significant volatility amid rapidly rising Treasury yields, with inflation concerns and central bank policy shifts creating challenging conditions for long-term bond investors.

Article navigation

- Start trading

- Why TLT is Going Down: Comprehensive Analysis of Treasury Bond ETF Decline

- Understanding TLT and Its Market Dynamics

- Federal Reserve Impact on Bond Market Volatility

- Inflation and Economic Growth Pressures

- Market Structure and Technical Analysis

- Navigating Market Challenges with Pocket Option

- Investment Strategies in a Rising Rate Environment

Why TLT is Going Down: Comprehensive Analysis of Treasury Bond ETF Decline

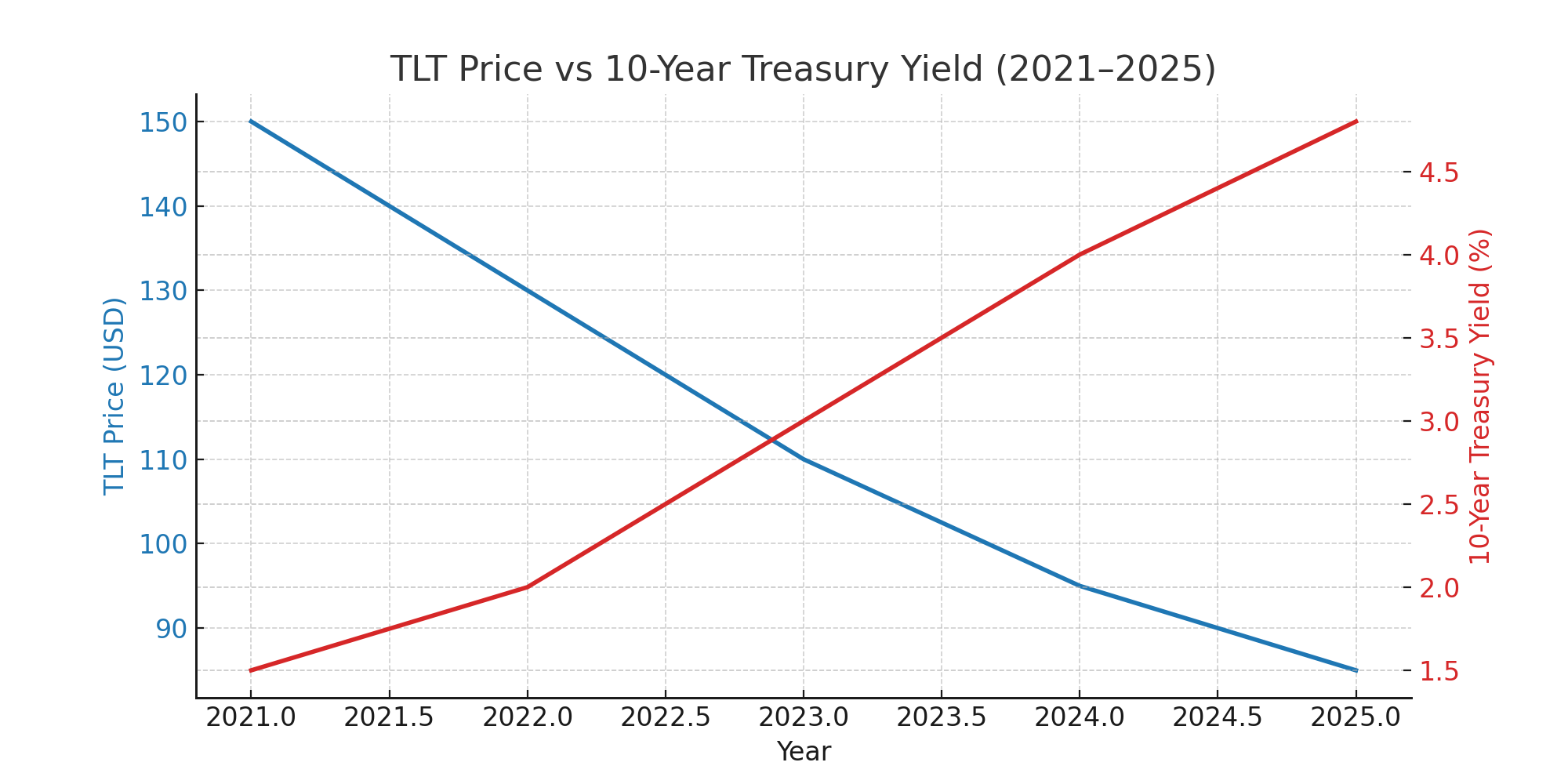

The iShares 20+ Year Treasury Bond ETF (TLT) has faced substantial pressure throughout 2025, leaving many investors questioning the underlying causes of its persistent decline. Understanding why TLT is experiencing downward momentum requires examining the complex interplay between Federal Reserve policy, inflation expectations, and macroeconomic shifts that fundamentally impact long-term Treasury yields.

As interest rates continue their upward trajectory, the inverse relationship between bond prices and yields has created significant headwinds for TLT holders. The primary cause of TLT’s decline stems from rapidly rising long-term Treasury yields, driven by persistent inflation fears and aggressive central bank tightening policies.

Understanding TLT and Its Market Dynamics

The TLT ETF tracks U.S. Treasury bonds with maturities of 20 years or more, making it particularly sensitive to changes in long-term interest rates. When Treasury yields rise, bond prices fall, creating an inverse correlation that directly impacts TLT’s value. This fundamental relationship explains much of the recent volatility.

“The bond market is experiencing one of its most challenging periods in decades, with long-term Treasury yields reaching levels not seen since the early 2000s. This creates significant pressure on instruments like TLT,” notes fixed income strategist Sarah Mitchell in early 2025.

📈 In such a complex market, having a reliable platform is key. Pocket Option provides the tools and analytics to help traders navigate this volatility and spot potential opportunities. 💰

Key Factors Driving TLT’s Decline

Federal Reserve Impact on Bond Market Volatility

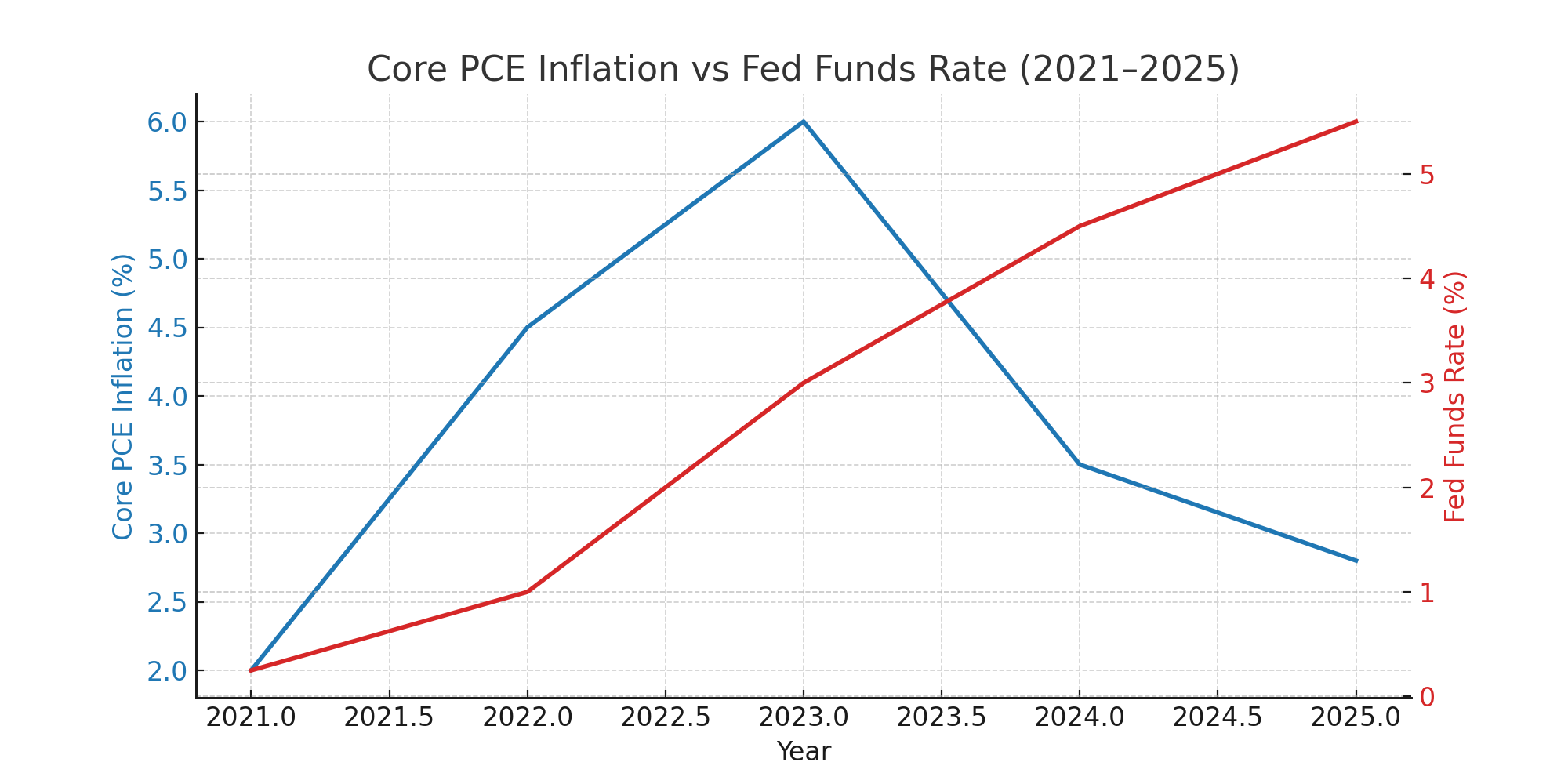

The Federal Reserve’s monetary policy decisions have been the primary driver of TLT’s performance in 2025. As the central bank continues its fight against inflation, expectations for sustained higher interest rates have fundamentally altered the bond market landscape.

| Fed Action | Impact on Long-Term Yields | Effect on TLT |

|---|---|---|

| Rate Increases | Yields Rise | Price Declines |

| Hawkish Guidance | Forward Curve Steepens | Duration Risk Increases |

| Balance Sheet Reduction | Supply Pressure | Liquidity Concerns |

| Communication Strategy | Volatility Spikes | Price Uncertainty |

“Central bank communication has become increasingly important in 2025, with each Fed statement carefully scrutinized for signals about future policy direction. This has amplified volatility in long-duration instruments like TLT,” explains monetary policy analyst Dr. James Rodriguez.

🚀 Don’t let market volatility scare you! With Pocket Option, you can practice your strategies on a demo account and use advanced tools to make informed decisions in real-time. 💡

Inflation and Economic Growth Pressures

Persistent inflationary pressures have created a challenging environment for long-term bonds. As inflation expectations remain elevated, real yields have increased, making TLT less attractive to investors seeking inflation protection. The strong economic growth narrative has further reduced demand for safe-haven assets.

Macroeconomic Indicators Affecting TLT

- Core PCE Inflation: Remaining above Fed’s 2% target

- Labor Market Strength: Low unemployment supporting wage growth

- GDP Growth: Robust economic expansion reducing recession fears

- Consumer Spending: Sustained demand driving economic activity

- Corporate Earnings: Strong profits supporting risk-on sentiment

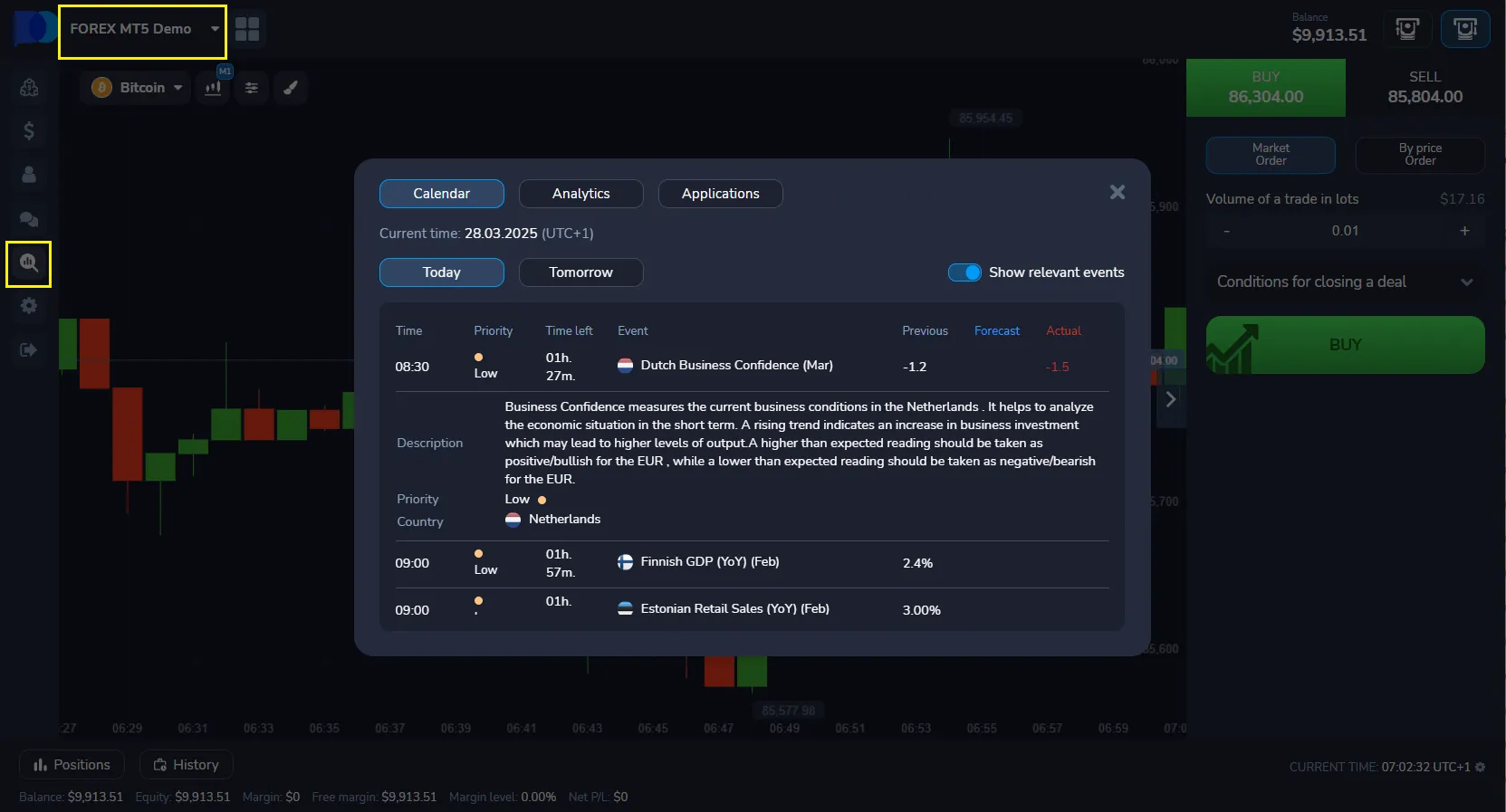

For example, traders on the Pocket Option trading platform have observed increased volatility in Treasury-related instruments as economic data continues to surprise to the upside. The platform’s technical analysis tools help traders identify key support and resistance levels during these volatile periods.

| Economic Indicator | Current Level | Impact on Bonds | TLT Response |

|---|---|---|---|

| 10-Year Treasury Yield | 4.8% | Negative | Sharp Decline |

| 30-Year Treasury Yield | 5.1% | Very Negative | Significant Pressure |

| Core PCE | 2.8% | Negative | Duration Risk Premium |

| Fed Funds Rate | 5.50% | Curve Pressure | Yield Curve Impact |

“The current macroeconomic environment presents unique challenges for long-duration bonds, with multiple headwinds converging to create sustained pressure on instruments like TLT,” observes portfolio manager Lisa Chen in her 2025 market outlook.

Market Structure and Technical Analysis

From a technical perspective, TLT has broken through several key support levels, indicating potential for further downside. The ETF’s price action reflects broader institutional repositioning away from long-duration assets amid changing market conditions.

In practice, traders often apply moving average analysis to identify trend direction in TLT. The 50-day and 200-day moving averages have both turned bearish, confirming the downtrend. Many participants on the Pocket Option platform utilize these technical indicators alongside fundamental analysis to make informed trading decisions.

📊 Technical analysis is crucial, and Pocket Option makes it easier. Use our built-in indicators and educational resources to master chart patterns and improve your trading accuracy! 🎯

“Technical analysis reveals that TLT remains in a clear downtrend, with multiple resistance levels overhead limiting any potential rebounds. The combination of fundamental and technical factors suggests continued pressure,” states technical analyst Mark Thompson.

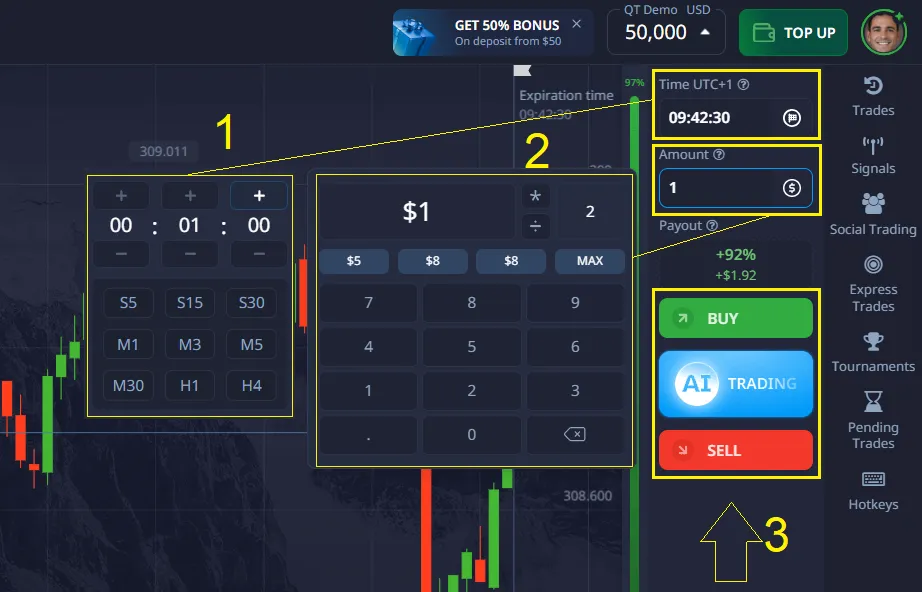

Navigating Market Challenges with Pocket Option

While the environment for long-duration bonds like TLT is challenging, it also creates opportunities for agile traders. To succeed in such conditions, having access to the right platform and educational resources is essential. Pocket Option is designed to empower traders of all levels to navigate today’s dynamic markets. Whether you’re analyzing trends or testing new ideas, the platform provides a comprehensive toolkit.

Here’s how Pocket Option can help you start your trading journey:

- Risk-Free Practice: Start with a $50,000 demo account to test your strategies without any financial commitment.

- Low Entry Barrier: Begin live trading with a minimum deposit starting from just $5, which may vary depending on your region and payment method.

- Diverse Asset Portfolio: Trade on over 100 assets, including currencies, commodities, and stocks, allowing you to diversify away from struggling instruments.

- Free Education: Access a rich knowledge base with free educational videos, tutorials, and guides on Forex and trading strategies to build your skills.

- Competitive Environment: Participate in trading tournaments to compete with other traders and win prizes.

These features are designed to help you build confidence and experience, turning market analysis like the one in this article into actionable trading ideas.

Investment Strategies in a Rising Rate Environment

Given the challenging environment for TLT, investors are reassessing their bond allocation strategies. Alternative approaches include shorter-duration instruments, inflation-protected securities, and tactical allocation adjustments based on market conditions.

Alternative Bond Investment Approaches

- Short-Duration ETFs: Reducing interest rate sensitivity

- Floating Rate Securities: Benefiting from rising rates

- TIPS: Protection against inflation erosion

- International Bonds: Diversification across rate cycles

- Credit Strategies: Focus on corporate bonds over Treasuries

“Successful bond investing in 2025 requires adapting to the new interest rate reality. Traditional buy-and-hold strategies for long-duration bonds face significant challenges,” advises fixed income specialist Maria Gonzalez.

FAQ

What is TLT and why is it important?

TLT is the iShares 20+ Year Treasury Bond ETF that tracks long-term U.S. government bonds. It's important because it serves as a benchmark for long-duration fixed income investments and reflects investor sentiment about long-term interest rates and economic conditions.

Why does TLT fall when interest rates rise?

TLT falls when interest rates rise due to the inverse relationship between bond prices and yields. When new bonds are issued at higher rates, existing bonds with lower rates become less attractive, causing their prices to decline to maintain competitive yields.

Is now a good time to buy TLT?

The timing depends on your investment horizon and risk tolerance. Current conditions suggest continued pressure on long-duration bonds, but some investors see potential value for long-term positions if rates eventually stabilize or decline.

How can I protect my portfolio from rising bond yields?

Consider diversifying into shorter-duration bonds, floating rate securities, TIPS, or alternative income strategies. Some investors also use tactical allocation adjustments based on interest rate expectations.

What factors could cause TLT to recover?

TLT could recover if inflation declines significantly, the Fed pivots to cutting rates, economic growth slows substantially, or geopolitical events increase demand for safe-haven assets.

How volatile is TLT compared to other bond ETFs?

TLT is among the most volatile bond ETFs due to its long duration exposure. Its price sensitivity to interest rate changes is significantly higher than shorter-duration alternatives.

Should I hold TLT for the long term despite current challenges?

Long-term holding depends on your investment goals and belief about future interest rate cycles. While current conditions are challenging, cycles eventually turn, potentially benefiting patient long-term investors.

How do economic calendars affect TLT trading?

Economic calendars are crucial for TLT trading as Fed meetings, inflation data, employment reports, and GDP releases can cause significant price movements. Traders monitor these events closely for volatility opportunities.

Conclusion

The decline in TLT reflects fundamental shifts in the interest rate environment and broader macroeconomic conditions. Rising long-term Treasury yields, driven by persistent inflation and aggressive Federal Reserve policy, have created sustained pressure on long-duration bonds. Understanding these dynamics is crucial for making informed investment decisions in the current market environment. While TLT faces significant headwinds, successful investors recognize that market cycles eventually turn. The key lies in understanding current conditions, managing risk appropriately, and maintaining flexibility as market conditions evolve. Whether through tactical allocation adjustments, alternative bond strategies, or patient long-term positioning, investors have multiple approaches to navigate this challenging environment. For traders looking to capitalize on bond market volatility, platforms like Pocket Option provide the tools and analysis needed to identify opportunities in Treasury-related instruments. The combination of technical analysis capabilities and real-time market data helps traders make informed decisions during periods of heightened volatility. Looking ahead to 2025, the bond market will likely continue facing pressure from evolving monetary policy and economic conditions. Staying informed about Federal Reserve decisions, inflation trends, and global economic developments will be essential for navigating the complex landscape of fixed income investing.

Access Market Analysis Tools