- Payroll Deduction System: Associates contribute between 1% to 15% of their eligible compensation through automatic payroll deductions

- Purchase Periods: Stock purchases typically occur quarterly, allowing for dollar-cost averaging benefits

- Holding Requirements: Certain vesting periods may apply to maximize tax advantages

- Dividend Participation: Associates receive proportional dividend payments on owned shares

- Transfer Options: Shares can be held in company accounts or transferred to personal brokerage accounts

Walmart Associate Stock: Building Wealth Through Employee Ownership

Recent data shows Walmart's Associate Stock Purchase Plan has delivered consistent returns for employee participants, with over 85% of enrolled associates maintaining their positions through 2024's market volatility.

Article navigation

- Walmart Associate Stock Purchase Plan: Building Wealth Through Employee Ownership

- Understanding the Walmart Associate Stock Purchase Plan Structure

- Eligibility Requirements and Enrollment Process

- Financial Benefits and Investment Advantages

- Historical Performance Context

- Risk Factors and Considerations

- Broaden Your Trading Skills with Pocket Option

- Step-by-Step Enrollment Guide

Walmart Associate Stock Purchase Plan: Building Wealth Through Employee Ownership

The Walmart Associate Stock Purchase Plan (ASPP) represents one of corporate America’s most accessible pathways for employees to build long-term wealth through company ownership. As retail giant Walmart continues expanding its digital footprint and strengthening market position, understanding how associates can participate in this growth becomes increasingly valuable for financial planning.

For example, trading platforms like Pocket Option offer complementary tools for analyzing stock performance patterns that can help associates make informed decisions about their participation timing and investment strategies within the ASPP framework.

Understanding the Walmart Associate Stock Purchase Plan Structure

The Walmart Associate Stock Purchase Plan operates as an Employee Stock Purchase Program (ESPP) that allows eligible associates to purchase WMT shares at potentially discounted rates through systematic payroll deductions. The program demonstrates Walmart’s commitment to sharing company success with its workforce while creating aligned incentives between employee performance and shareholder value.

“Employee stock purchase programs like Walmart’s ASPP create a powerful alignment between workforce motivation and company performance. When employees become shareholders, they develop a deeper investment in operational excellence.”Sarah Chen in 2025

📈 Ready to analyze market trends like a pro? Pocket Option provides advanced charting tools that can help you understand the performance of stocks like WMT, empowering you to make smarter financial decisions. 💡

Key Program Components

| Plan Feature | Traditional ESPP | Walmart ASPP | Brokerage Account |

|---|---|---|---|

| Purchase Method | Payroll deduction | Payroll deduction | Manual investment |

| Minimum Investment | 1% of salary | 1% of eligible pay | $1-100+ per trade |

| Tax Advantages | Qualified disposition benefits | Potential tax deferral | Standard capital gains |

| Dollar Cost Averaging | Automatic | Automatic | Manual timing required |

| Administrative Fees | Usually minimal | Company-absorbed | Per-trade commissions |

Eligibility Requirements and Enrollment Process

Walmart associate stock program eligibility typically extends to full-time and part-time associates who meet specific tenure and hours-worked requirements. The enrollment process involves several straightforward steps that associates can complete during designated enrollment periods.

“The democratization of corporate ownership through programs like Walmart’s ASPP represents a significant shift toward inclusive capitalism.”Dr. Marcus Rodriguez in 2025

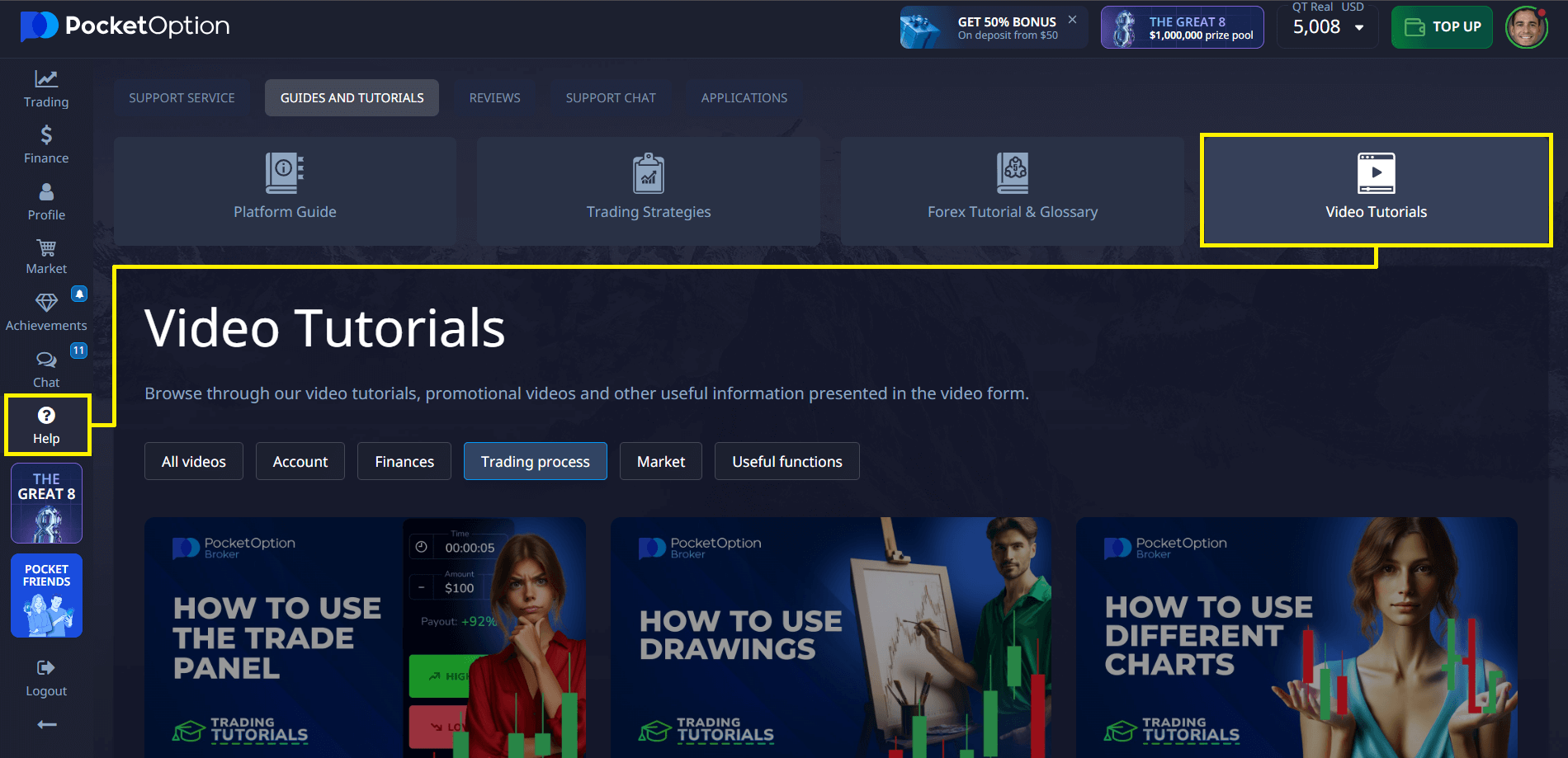

🎓 New to investing? Pocket Option’s free educational resources and training videos can demystify trading, giving you the confidence to manage your ASPP shares and explore new financial opportunities. 🚀

Standard Eligibility Criteria

- Employment Status: Active Walmart associate in good standing

- Service Period: Minimum employment duration (typically 90-180 days)

- Work Hours: Meeting minimum weekly hour requirements

- Geographic Location: Employment in participating regions/countries

- Position Classification: Inclusion in eligible job categories

In practice, associates can evaluate their stock purchase decisions using analytical tools available on platforms like Pocket Option, which provide technical analysis capabilities for understanding WMT stock trends and making informed participation decisions.

Financial Benefits and Investment Advantages

The Walmart Associate Stock Purchase Plan offers several compelling advantages that distinguish it from traditional investment approaches. These benefits extend beyond simple stock ownership to encompass tax efficiency, automatic investment discipline, and participation in one of America’s largest retail success stories.

| Benefit Category | Associate Advantage | Annual Impact | Long-term Value |

|---|---|---|---|

| Dollar Cost Averaging | Automatic investment timing | Reduced volatility exposure | Enhanced compound returns |

| Dividend Income | Quarterly dividend payments | Current yield: ~3.2% | Growing income stream |

| Tax Efficiency | Potential deferral benefits | Reduced current tax burden | Optimized after-tax returns |

| Convenience | Payroll automation | No manual investment required | Consistent wealth building |

| Company Growth | Direct participation in success | Share price appreciation | Long-term wealth accumulation |

“Walmart’s consistent dividend growth over decades makes the ASPP particularly attractive for associates focused on building retirement income streams.”Jennifer Walsh in 2025

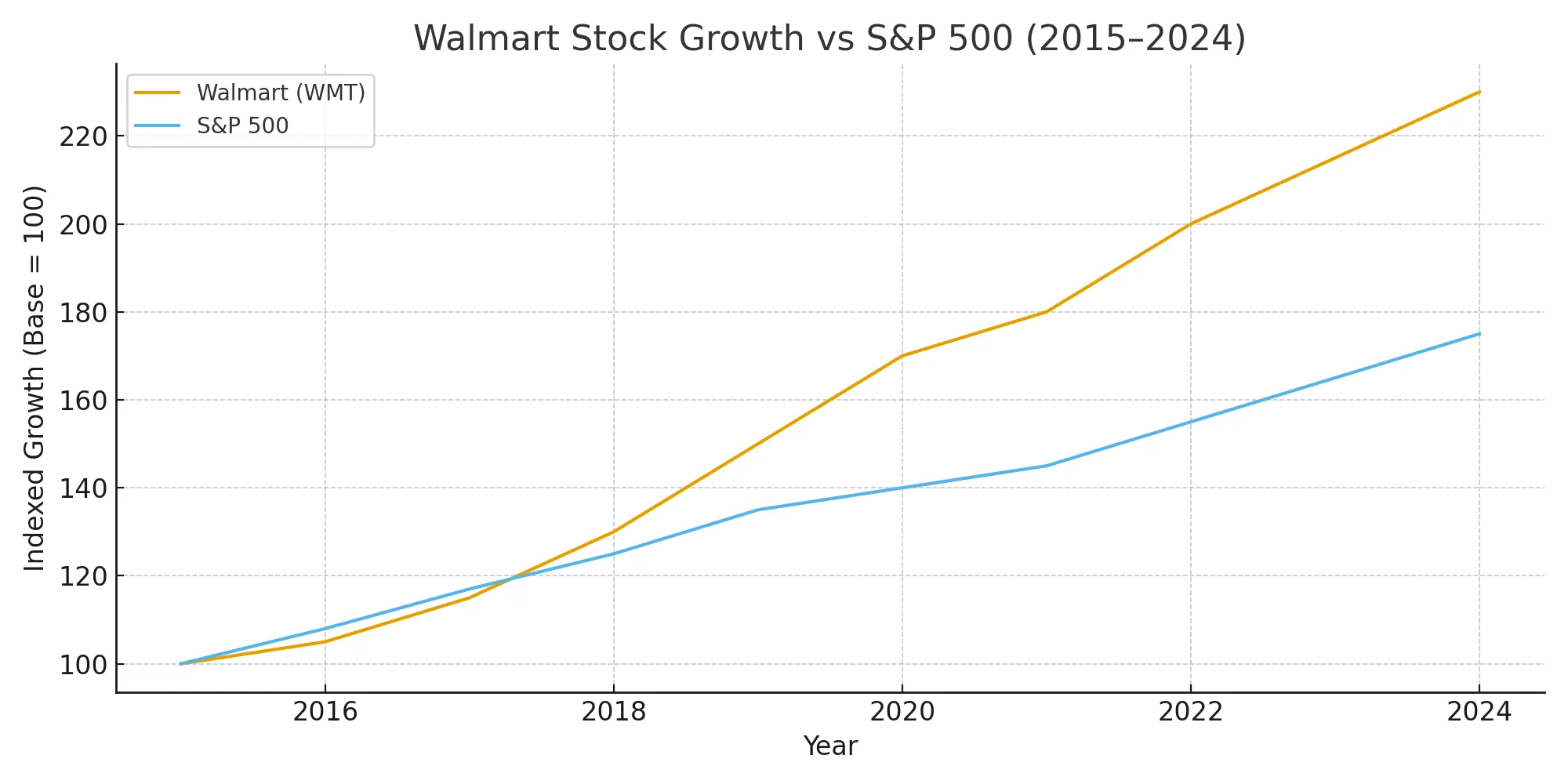

Historical Performance Context

Walmart stock has demonstrated remarkable resilience through multiple economic cycles, providing ASPP participants with exposure to one of the world’s most stable large-cap investments. The company’s evolution from traditional retail to omnichannel commerce leader creates multiple growth vectors for associate investors.

- Dividend Growth: Walmart has increased its dividend for over 50 consecutive years

- Market Leadership: Dominant position in essential retail categories

- Digital Transformation: Significant e-commerce and technology investments

- International Expansion: Growing presence in emerging markets

- Supply Chain Innovation: Advanced logistics and distribution capabilities

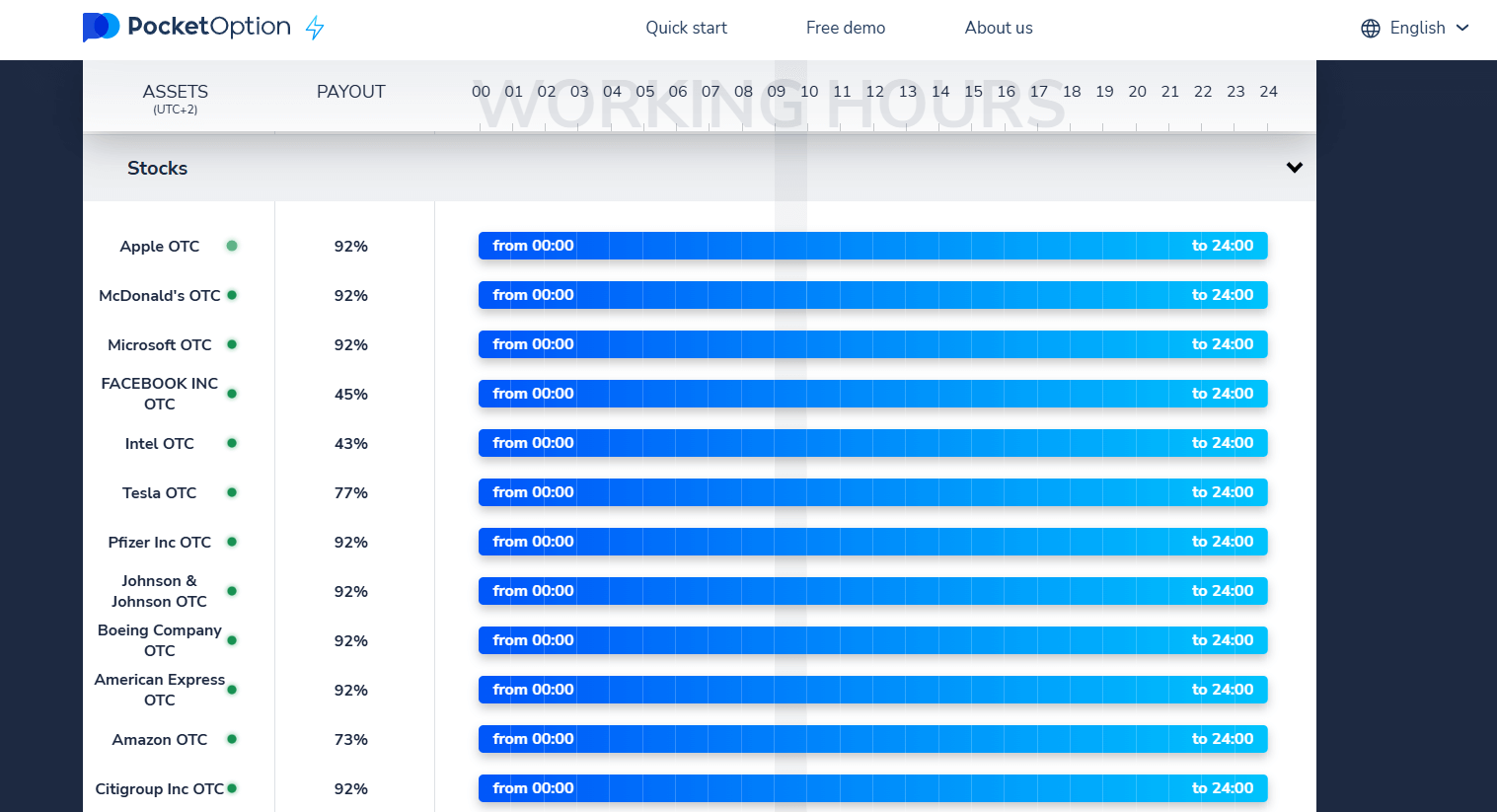

✨ While the ASPP focuses on one company, Pocket Option opens the door to over 100+ assets, allowing you to diversify your portfolio and explore global markets alongside your employee stock plan. 🌍

Risk Factors and Considerations

While the Walmart Associate Stock Purchase Plan offers significant advantages, associates should understand potential risks and limitations associated with concentrating investment assets in their employer’s stock. Prudent financial planning requires balancing ASPP participation with broader diversification strategies.

“The key to successful ESPP participation is balancing company loyalty with portfolio diversification. Associates should view ASPP as one component of a comprehensive investment strategy.”David Kim in 2025

Primary Risk Categories

- Concentration Risk: Over-exposure to single company performance

- Employment Correlation: Job security and investment returns linked to same entity

- Market Volatility: Stock price fluctuations affecting account values

- Liquidity Constraints: Potential restrictions on share sales timing

- Tax Complexity: Understanding optimal holding periods and tax implications

Traders often apply diversification principles by using platforms like Pocket Option to complement their ASPP holdings with exposure to different asset classes, sectors, and geographic regions, thereby reducing overall portfolio risk while maintaining growth potential.

Broaden Your Trading Skills with Pocket Option

While the Walmart ASPP is an excellent tool for building wealth through a single company, platforms like Pocket Option empower you to become a more well-rounded investor. Even if a specific asset like WMT isn’t available for trading, the skills you learn are universally applicable. Pocket Option provides a robust environment to practice and grow, featuring:

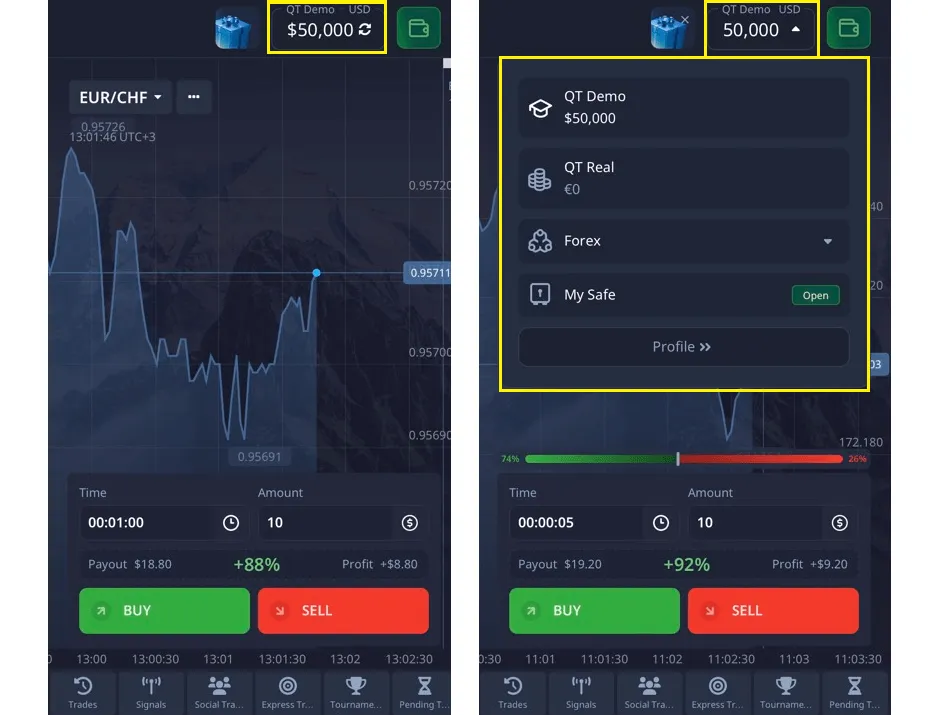

- Accessible Starting Point: Begin your trading journey with a minimum deposit as low as $5, which can vary based on your region and payment method.

- Risk-Free Practice: Hone your skills on a free demo account pre-loaded with $50,000 in virtual funds. Test strategies without any financial commitment.

- Diverse Asset Selection: Explore over 100 trading assets, including currencies, commodities, and indices, to learn about different markets and diversify your knowledge.

- Comprehensive Education: Access a free, extensive knowledge base filled with trading strategies, Forex guides, and educational videos designed to help you start and advance your trading career.

- Competitive Environment: Participate in trading tournaments to test your abilities against other traders and win prizes.

Using Pocket Option is a practical way to apply the principles of market analysis and risk management, making you a more informed manager of your overall investment portfolio, including your ASPP shares.

Step-by-Step Enrollment Guide

Successfully joining the Walmart Associate Stock Purchase Plan requires understanding the enrollment process, making informed contribution decisions, and setting up proper account management. The following guide provides associates with a comprehensive roadmap for ASPP participation.

- Verify Eligibility: Confirm employment status, tenure requirements, and program availability

- Access Enrollment Portal: Log into Walmart’s associate benefits platform during open enrollment

- Review Plan Documents: Carefully read program terms, conditions, and tax implications

- Select Contribution Rate: Choose payroll deduction percentage (1% to 15% typically)

- Designate Beneficiaries: Name account beneficiaries for estate planning purposes

- Submit Enrollment: Complete and confirm all required enrollment information

- Monitor Account: Track contributions, purchases, and account performance regularly

“The enrollment process is designed for simplicity, but the investment decisions require careful consideration of personal financial goals and time horizons.”Lisa Martinez in 2025

Maximizing ASPP Value Through Strategic Planning

Successful participation in the Walmart Associate Stock Purchase Plan requires more than simple enrollment—it demands strategic thinking about contribution levels, tax optimization, and integration with broader financial goals. Associates who approach ASPP participation with a comprehensive plan typically achieve superior long-term outcomes.

Optimization Strategies

- Contribution Timing: Consider market valuation cycles when adjusting participation levels

- Tax Planning: Understand holding period requirements for optimal tax treatment

- Diversification Balance: Limit ASPP to appropriate percentage of total investment portfolio

- Rebalancing Discipline: Periodically evaluate whether to hold, sell, or transfer shares

- Emergency Planning: Maintain adequate liquidity outside of ASPP holdings

For example, many associates complement their ASPP participation by using platforms like Pocket Option to gain exposure to different asset classes and trading strategies, creating a more balanced approach to wealth building while maintaining their Walmart stock foundation.

FAQ

How does the Walmart Associate Stock Purchase Plan work?

The ASPP allows eligible Walmart associates to purchase company stock through automatic payroll deductions ranging from 1% to 15% of eligible compensation. Purchases typically occur quarterly, and associates receive actual WMT shares that can be held long-term or sold according to program rules.

What are the main benefits of participating in Walmart's ESPP?

Key benefits include automatic dollar-cost averaging, dividend participation, potential tax advantages, convenient payroll deduction investment, and direct participation in Walmart's long-term growth. Associates also benefit from the discipline of systematic investing without manual intervention.

Are there any risks associated with the Walmart Associate Stock Plan?

Primary risks include concentration in a single stock, correlation between employment and investment performance, market volatility affecting share values, and potential liquidity restrictions. Associates should consider diversification strategies to mitigate these risks.

Can I sell my Walmart associate stock shares anytime?

Share sale timing depends on specific plan rules and may include vesting periods or blackout windows. Associates should review plan documents for exact terms regarding share sales, transfers, and any holding requirements that may affect tax treatment.

How are dividends handled in the Walmart ASPP?

Associates who own Walmart shares through the ASPP receive proportional dividend payments, typically distributed quarterly. Dividends can often be reinvested automatically to purchase additional shares or paid out in cash according to associate preferences.

What happens to my Walmart stock if I leave the company?

Upon leaving Walmart, associates typically retain ownership of vested shares purchased through the ASPP. Specific rules regarding account management, transfer options, and ongoing dividend participation depend on plan terms and the nature of employment separation.

Are there tax implications for Walmart associate stock ownership?

Yes, tax implications include potential benefits from qualified disposition holding periods, ordinary income treatment for certain transactions, and capital gains considerations. Associates should consult tax professionals for personalized advice based on their specific situations.

How can I track my Walmart ASPP account performance?

Associates can typically access account information through Walmart's benefits portal, which provides details on contributions, share purchases, current values, and dividend payments. Many associates also use external tools to analyze broader market context and investment performance.

CONCLUSION

The Walmart Associate Stock Purchase Plan represents a powerful wealth-building tool that combines accessibility, convenience, and growth potential in a single program. By understanding eligibility requirements, benefits, risks, and optimization strategies, associates can make informed decisions about participation levels and integration with broader financial planning objectives. As Walmart continues its transformation into a technology-driven, omnichannel retail leader, ASPP participants gain direct exposure to one of the world's most resilient and adaptive large-cap investments. The combination of automatic investing discipline, dividend income, and capital appreciation potential creates compelling value for associates committed to long-term wealth accumulation. Success with the ASPP requires balancing company loyalty with prudent diversification, understanding tax implications, and maintaining realistic expectations about investment timelines and outcomes. Associates who approach the program as one component of comprehensive financial planning typically achieve the best results over time.

Start trading