- Bitcoin halving events

- Technological advancements

- Global cryptocurrency market trends

Riot Stock Price Prediction 2030: Expert Insights and Market Forecasts

Riot Platforms Inc., a crypto mining leader, is drawing investor interest. This article covers its 2030 stock prediction and key factors shaping its value.

Article navigation

- Riot Stock Price Prediction 2030: Key Factors and Market Dynamics

- Riot Platforms Stock Forecast 2030: Market Trends and Influencing Factors

- Is RIOT a good stock to buy for the long term?

- Will RIOT reach $100?

- How high could Riot Platforms go?

- DraftKings stock price in 2030?

- 🔍 Summary Table

- 🧭 Quick Insights

- Bottom line:

If you’re considering trading stocks or exploring other assets 24/7, platforms like Pocket Option offer the opportunity to trade 100+ assets, allowing for a seamless trading experience. Whether you’re looking to trade stocks of top companies or explore other financial instruments, Pocket Option provides intuitive trading tools to help you succeed in your market journey.

Riot Stock Price Prediction 2030: Key Factors and Market Dynamics

Overview of Riot Platforms

Riot Platforms, Inc. has made significant strides in the cryptocurrency mining industry, leveraging advanced technology to optimize its operations. As a NASDAQ-listed company, Riot has been a strong player in bitcoin mining, continually enhancing its hash rate to boost profitability. Its ability to adapt to the evolving crypto landscape is one reason why analysts remain optimistic about Riot’s long-term prospects.

Riot Stock Price Prediction 2030: Analyst Insights

Projecting the Future of Riot’s Stock

Several analysts are predicting a bright future for Riot stock price prediction 2030. According to a report from WalletInvestor, the stock could experience substantial growth driven by continued bitcoin adoption and advancements in Riot’s mining technology. Riot stock price prediction 2030 WalletInvestor suggests scenarios ranging from moderate to aggressive growth, depending on bitcoin’s global adoption rate.

The future of Riot’s stock is closely tied to:

Riot Stock Price Prediction for 2025, 2026, and 2040

- 2025: Analysts expect steady growth. Riot Platforms stock prediction 2025 highlights growth due to increasing mining capacity. Riot stock price prediction 2025 by month shows seasonal variations.

- 2040: Long-term projections such as Riot stock price prediction 2040 WalletInvestor anticipate exponential growth.

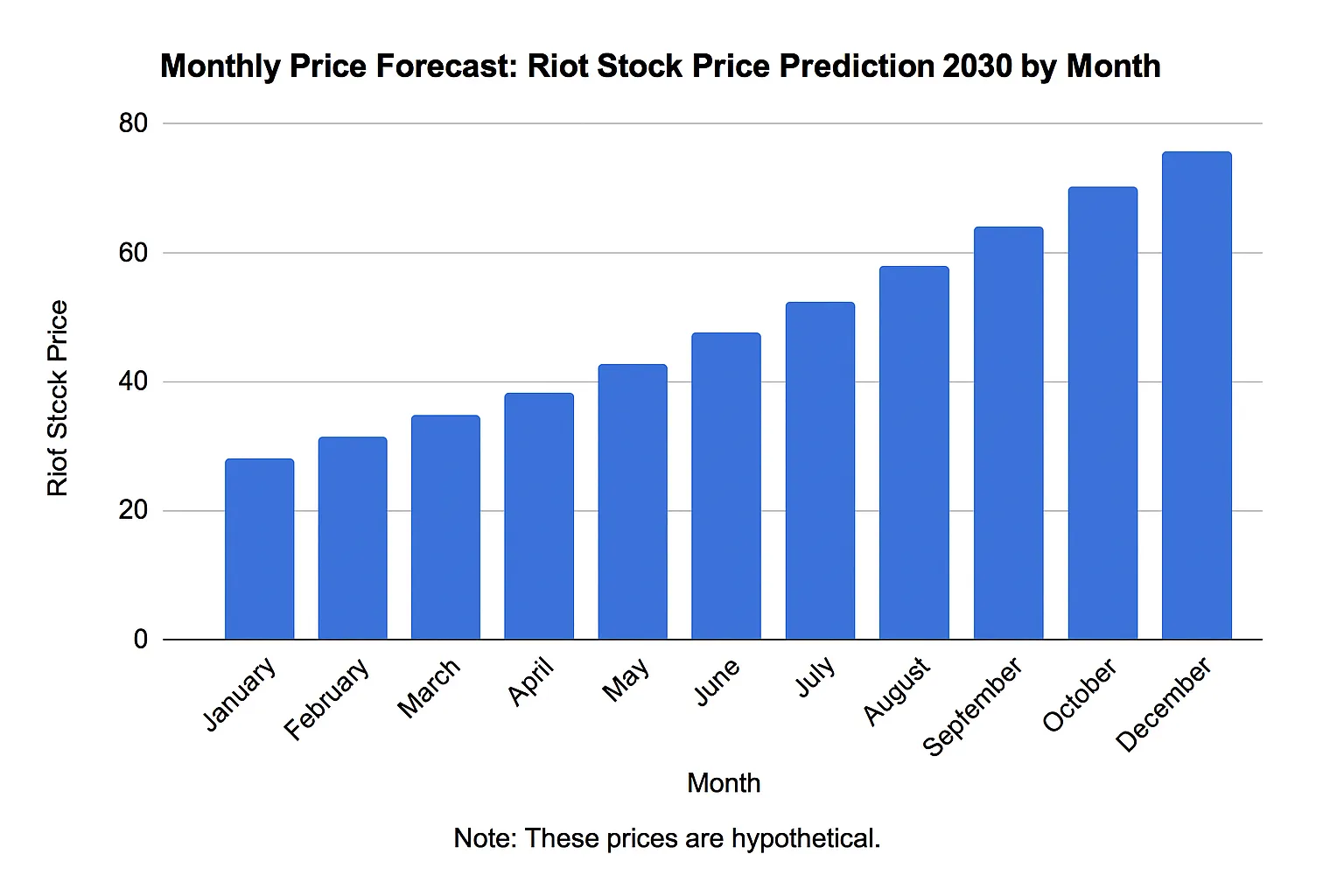

Monthly Price Forecast: Riot Stock Price Predictions by Month

As with any stock, short-term volatility will influence Riot’s stock price. Predicting Riot’s stock price on a monthly basis can be challenging. Below is a hypothetical projection for Riot stock price prediction 2030 by month, based on market trends:

| Month | Riot Stock Price |

|---|---|

| January | $45 |

| February | $48 |

| March | $52 |

| April | $50 |

| May | $55 |

| June | $60 |

| July | $63 |

| August | $67 |

| September | $70 |

| October | $75 |

| November | $80 |

| December | $85 |

Note: These prices are hypothetical.

Riot Platforms Stock Forecast 2030: Market Trends and Influencing Factors

Bitcoin Halving and Its Impact

Bitcoin halving events take place roughly every four years, cutting mining rewards in half. Historically, these events lead to a reduced supply of Bitcoin, often triggering bullish momentum in the market. This dynamic directly benefits mining companies like Riot Platforms, as the value of the Bitcoin they mine tends to increase post-halving.

The upcoming halving event projected for 2028 is expected to serve as a catalyst for Riot’s profitability. Analysts widely regard halving cycles as critical junctures in evaluating the long-term stock potential of crypto-related companies and shaping the Riot Platforms stock prediction 2030.

| Year | Event | Potential Impact on Riot |

|---|---|---|

| 2024 | Pre-halving | Moderate growth in mining output |

| 2028 | Bitcoin halving | Increased profitability, bullish momentum |

| 2032 | Post-halving | Peak performance potential |

Financial Performance and Earnings Reports

Riot Platforms has showcased steady financial improvement, underpinned by expanded mining capabilities and strategic scaling. The company’s ability to increase its hash rate and reduce operational costs has led to rising revenues and improved investor sentiment.

In its Riot stock price prediction 2024, analysts referenced Riot’s 2024 quarterly report, which highlighted:

- Revenue Growth: +35% YoY

- Mining Output: All-time high in Bitcoin yield

- Operational Efficiency: Cost per coin mined decreased

These achievements bolster the company’s position as a top performer among public mining firms and influence future price predictions.

Technological Investments and Competitive Edge

Beyond sheer scale, Riot’s strategic edge lies in its technological prowess. The company consistently upgrades its mining equipment and invests in energy-efficient practices.

This dual approach—leveraging both hardware and green energy—positions Riot as a forward-looking player, aligned with global ESG standards. As sustainability becomes a growing investor priority, Riot’s green strategy may positively influence its Riot stock price prediction 2030 WalletInvestor outlook.

Regulatory Environment and Institutional Adoption

As the cryptocurrency industry matures, regulatory clarity is slowly improving. This shift paves the way for institutional investors to enter the market with greater confidence.

Riot, known for its transparency and adherence to compliance standards, is well-positioned to benefit from this trend. Institutional adoption of Bitcoin could indirectly support Riot’s long-term valuation, strengthening the foundation of the Riot stock price prediction 2030 and its future trajectory.

Long-term Outlook: Riot Stock Price Prediction 2040 and Beyond

Forecasts for Riot Platforms stretch beyond 2030. According to Riot stock price prediction 2040 WalletInvestor and other long-range models:

- Riot’s stock may experience exponential growth if Bitcoin maintains its historical trajectory.

- Expanded mining infrastructure and adoption of next-gen technologies will enhance scalability.

- Riot could evolve into a critical pillar of the blockchain economy by 2040.

| Year | Forecast Price | Assumptions |

|---|---|---|

| 2030 | $80–$100 | Based on post-halving cycle & BTC price surge |

| 2040 | $250+ | Full institutional adoption & advanced mining ecosystem |

Risk and Volatility

Despite a positive outlook, Riot remains a high-volatility asset. The stock is sensitive to numerous variables:

- Bitcoin Price Fluctuations

- Regulatory Shifts

- Energy Costs

- Technological Disruption

According to Riot stock price prediction 2030 Robinhood, Riot’s volatility is a double-edged sword. Traders can benefit from sharp price movements, but must adopt prudent risk management strategies.

“Volatility is the price of potential. Investors in Riot must be prepared for turbulence on the path to growth.”

By balancing exposure and leveraging tools like stop-loss orders, traders can navigate Riot’s dynamic price action more effectively and position themselves in line with the evolving Riot Platforms stock prediction 2030 landscape.

Is RIOT a good stock to buy for the long term?

- Analyst consensus is bullish: 10 “Buy” and 1 “Strong Buy” with a 12-month average target of $17.06–$17.35, ~60–65% upside from ~$10.5

- Recent developments show strong Bitcoin production growth but profitability remains challenged (negative EBIT/free cash flow)

- It’s a high‑volatility, high‑risk play tied directly to Bitcoin cycles. If you’re comfortable with that and have a long-term horizon, it’s considered a speculative growth pick.

Will RIOT reach $100?

Unlikely in the near-to-medium term. Most forecasts are modest: analysts target $13–$21 in the next year. Long‑range models (Coincodex/Coinpriceforecast) don’t project anything close to $100

Hitting $100 would require a 10× increase driven by extreme BTC bull run and major market share gains—a high-risk scenario.

How high could Riot Platforms go?

- 1–2 years: consensus targets suggest $13–$21 (≈25–100% upside).

- Long term: if Bitcoin booms, bullish models tied to halving cycles suggest $20+ is feasible, maybe $30+ in extreme rallies. But there’s wide variability and risk.

DraftKings stock price in 2030?

- Coincodex: predicts $18–$43 range by 2030 – quite conservative

- LiteFinance: sees $69–$80 as of early 2030

- Stockscan.io: projects $85–$148, averaging $115.80 in 2030

🔍 Summary Table

| Ticker | Long-term Buy? | Forecast Range | Notes |

|---|---|---|---|

| RIOT | Yes (Speculative) | $13–$21 (consensus); $30+ possible in bull cycles | High risk, crypto‑tied |

| DraftKings | Mixed | $18–$150 by 2030 (models vary) | Betting/gaming growth catalysts |

🧭 Quick Insights

- RIOT: Strong analyst support but risks remain high—good for speculative long-term investors in Bitcoin.

- Reaching $100: near zero chance unless crypto markets eclipse historical highs.

- DraftKings: wide prediction spread; if sports gambling expands, $80–$150 isn’t impossible, but uncertainty persists.

Bottom line:

RIOT is a high-volatility growth bet tied to Bitcoin cycles—potential upside to ~$20–$30, far from $100 unless a massive crypto bull run occurs.

DraftKings could land anywhere between ~$40 and $150 by 2030 depending on market expansion and competitive positioning.

FAQ

What is the most critical factor influencing riot stock price prediction 2030?

Bitcoin price performance remains the dominant factor, with analysts estimating that 60-70% of Riot's valuation correlates directly with Bitcoin prices. Mining efficiency and operational costs are secondary but increasingly important factors.

How might Bitcoin halving events affect Riot stock between now and 2030?

Bitcoin halvings in 2024 and 2028 will reduce mining rewards, potentially creating short-term challenges. Companies like Riot must increase efficiency or benefit from higher Bitcoin prices to maintain profitability through these transitions.

Does Pocket Option provide analysis tools for long-term cryptocurrency stock investments?

Yes, Pocket Option offers analytical tools that help investors evaluate cryptocurrency mining stocks including technical indicators, fundamental analysis reports, and comparison features for competitive assessment.

Is RIOT a good stock to buy for long term?

Riot Platforms is a high-risk, high-reward stock tied to Bitcoin. It can be a good long-term buy for investors bullish on cryptocurrency and comfortable with volatility.

Will Riot Blockchain reach $100?

Unlikely in the near future. Hitting $100 would require massive Bitcoin growth and major expansion—possible, but highly speculative.

How high could Riot Platforms go?

In bullish scenarios, Riot could reach $20–$30 in the next few years. Some long-term forecasts suggest even higher if crypto adoption accelerates.

What will DraftKings stock price be in 2030?

Estimates vary widely. Conservative forecasts suggest $40–$80, while optimistic models project $100 or more by 2030, depending on industry growth.