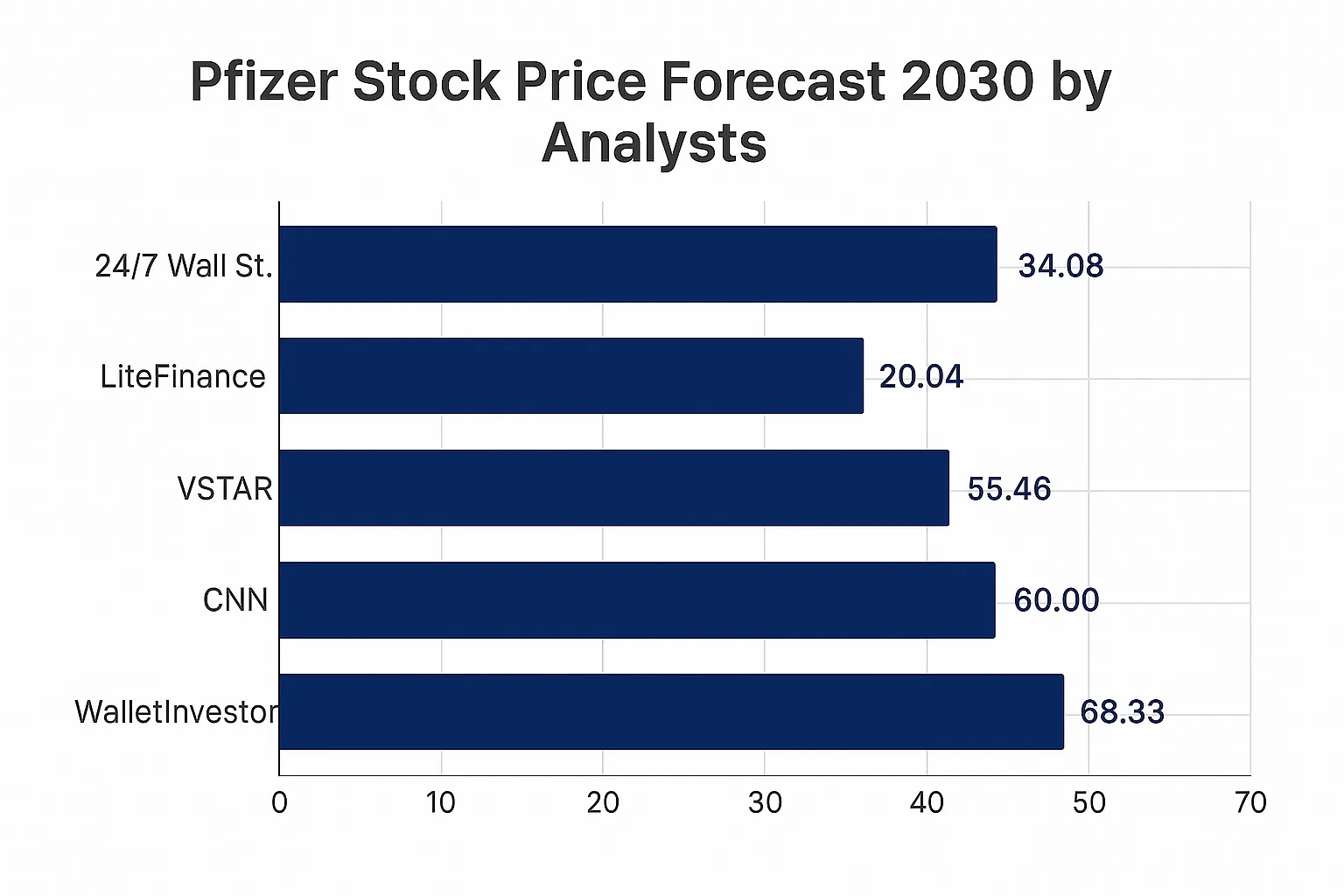

- WalletInvestor: ~$68

- CNN Money: Up to $75

- Reddit sentiment: Cautious optimism, noting current undervaluation

- LiteFinance: $14.76–$20.04 (bearish outlook)

- VSTAR: $44–$108 (bullish scenario)

Pfizer Stock Price Forecast 2030: Expert Insights, Analysis & How to Trade on Pocket Option

The Pfizer stock price forecast 2030 reflects deep market optimism — driven by its oncology pipeline, dividend stability, and strategic expansion — supported by expert views and proven trading strategies. In this detailed analysis, you’ll get fresh quotes from top analysts, unique insights, real trader feedback, and a step‑by‑step Pocket Option trade example for Pfizer. This guide merges the best of market fundamentals with actionable trading strategies.

Article navigation

- Understanding Pfizer’s Market Position

- Pfizer Stock Price Forecast 2024–2025: The Near Horizon

- Analyst Insights and Growth Expectations

- Pfizer Stock Price Forecast 2030: What Analysts Say

- What Are the Key Factors Driving Pfizer’s Stock Price and How Are They Expected to Impact Its Future Valuation?

- Technical Analysis: Support, Resistance & Trends

- Sentiment & Social Influence on Pfizer Stock Prediction 2030

- Pfizer Futures and Options: Expanding Trading Possibilities

- Pfizer Futures and Pocket Option Quick Trading

- Real Trader Reviews on Pocket Option

- Fundamental Analysis: Financial Strength

- Comparing Pfizer with Industry Peers

- Market Sentiment and Media Influence

- Three Practical Investment Strategies for PFE Stock

- Final Thoughts: Should You Invest in Pfizer Stock for 2030?

Understanding Pfizer’s Market Position

Pfizer Inc. (NYSE: PFE) is one of the largest pharmaceutical companies globally, known for its extensive drug portfolio and significant R&D investment. Its acquisition of Seagen for $43 billion has strengthened its presence in oncology — a segment forecast to drive substantial growth through 2030. With revenues normalizing post-pandemic, the company is strategically shifting focus to cancer treatments, vaccines, and gene therapy.

Pfizer Stock Price Forecast 2024–2025: The Near Horizon

Pfizer stock price forecast 2025 suggests a recovery phase after pandemic revenue peaks. Analysts anticipate a range of $38–$44 depending on new drug success and market adoption. The Pfizer stock price forecast 2024 projects moderate consolidation with targets between $33–$40. Some analysts also discuss Pfizer stock price forecast Tomorrow, especially around earnings announcements and FDA approvals.

Analyst Insights and Growth Expectations

The Pfizer stock price forecast 2030 is largely bullish among institutional investors and platforms like WalletInvestor and CNN. WalletInvestor projects a 2030 price target of approximately $68, while CNN Money places a high estimate closer to $75. The Pfizer stock price forecast 2030 reddit community also reflects cautious optimism, highlighting undervaluation in the current market.

Table: Yearly Price Estimates

| Year | Low Estimate | High Estimate | Average Forecast |

|---|---|---|---|

| 2024 | $33 | $40 | $36.5 |

| 2025 | $38 | $44 | $41 |

| 2026 | $42 | $48 | $45 |

| 2030 | $60 | $75 | $68 |

| 2040 | $80 | $110 | $95 |

Pfizer Stock Price Forecast 2030: What Analysts Say

Expert opinions on Pfizer stock forecast 2030 vary, contributing to diverse Pfizer stock price predictions:

Expert Quotes:

- “Pfizer will grow earnings by almost 14% annually over the next 3–5 years.” – The Motley Fool (via Nasdaq)

- “$20B in new revenue from product launches + $25B from deals by 2030.” – Barron’s

- “They’re so big… hard to grow fast enough for Wall Street.” – Prof. Lawton Burns, Wharton

- “In this business, you have to lean forward.” – Dr. Albert Bourla, Pfizer CEO

The Pfizer stock price forecast 2030 walletinvestor places the stock at around $68 by 2030, based on algorithmic analysis of long-term trends, earnings potential, and risk-adjusted valuation. WalletInvestor highlights Pfizer’s recovery from pandemic-driven volatility and emphasizes oncology pipeline growth as a key driver.

What Are the Key Factors Driving Pfizer’s Stock Price and How Are They Expected to Impact Its Future Valuation?

- Oncology Pipeline: The integration of Seagen brings cutting-edge antibody-drug conjugates (ADCs) to Pfizer’s portfolio, critical for future cancer treatments.

- Patent Expiry & Replacement: Loss of exclusivity for older drugs is being addressed by newer therapies and strategic R&D investment.

- Global Expansion: Markets like India are crucial — many analysts provide a Pfizer India share price target 2030 between ₹600–₹750, citing local production and generics strategy.

- Economic and Regulatory Trends: Interest rates, drug pricing reform, and FDA approval pipelines influence investor confidence.

Factor Table

| Factor | Description |

|---|---|

| Oncology Expansion | Boosted by Seagen’s ADC technology |

| Revenue Replacement | Diversifying beyond COVID-19 vaccines |

| R&D and Approvals | Ongoing FDA approvals and trial results |

| India’s Growth | Pfizer India share price target 2030: ₹600–₹750 |

| Stable Dividends | Yielding ~4%, appealing to long-term investors |

| Market Regulation | Policy shifts impacting drug pricing |

Technical Analysis: Support, Resistance & Trends

From a technical perspective, the Pfizer stock price forecast relies on key moving averages. The 200-day MA is hovering near $36, suggesting support. Resistance levels at $40 and $47 must be broken for sustained bullish movement. Momentum indicators (RSI and MACD) currently show consolidation with potential for breakout in Q4 2025.

Sentiment & Social Influence on Pfizer Stock Prediction 2030

Social platforms influence short-term sentiment:

- Reddit: Trending bullish on oncology results

- Twitter/Financial News: Sentiment spikes post-announcements

The Pfizer price prediction 2030 is frequently debated on forums, showing growing interest in its post-COVID fundamentals.

Pfizer Futures and Options: Expanding Trading Possibilities

Pfizer futures contracts, while less liquid than equities, offer another way for investors to speculate long-term. These are mostly utilized by institutional hedgers, but retail platforms like Pocket Option offer accessible alternatives with active market hours.

Pfizer Futures and Pocket Option Quick Trading

On Pocket Option, you can trade Pfizer stock 24/7 using the intuitive Quick Trading interface. This platform enables you to act on both bullish and bearish forecasts instantly:

- Asset: Pfizer (PFE)

- Forecast: Short-term bullish breakout after FDA approval of oncology drug

- Trade: Click “Buy”

- Duration: 5 minutes

- Result: 92% return if the stock price ends higher

Pocket Option empowers users to trade over 100 assets, including major stocks, indices, and cryptocurrencies. Whether you’re following a Pfizer stock prediction 2030 or testing strategies on a demo account, the platform offers the tools and analytics needed to succeed.

Real Trader Reviews on Pocket Option

User Testimonials:

- “The app is amazing. I trade Pfizer every earnings day.” – Taein C.

- “Made 10 trades today, all positive. Demo helped me a lot.” – Mark B.

✅ Join thousands using Pocket Option for 100+ assets including Pfizer.

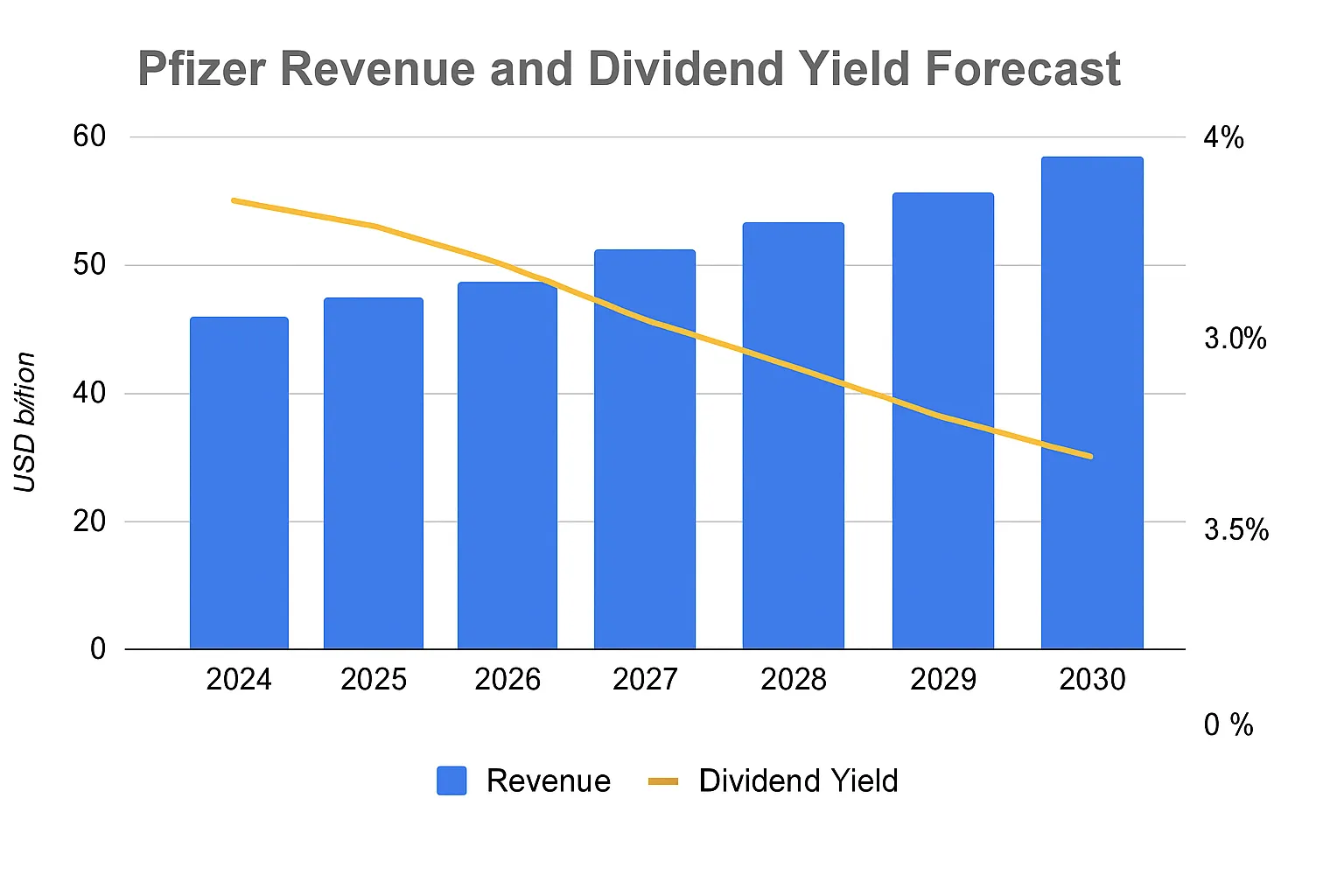

Fundamental Analysis: Financial Strength

Pfizer’s 2024 revenue is projected to be $58 billion, down from the pandemic high of $81 billion in 2022. However, earnings per share (EPS) are stabilizing, and dividend yield remains over 4%, which supports long-term investor interest. Analysts from Morgan Stanley and Morningstar maintain a “Hold” rating with upside potential depending on 2025 earnings.

| Metric | 2022 | 2023 | 2024 (Est.) |

|---|---|---|---|

| Revenue (Billion) | $81 | $60 | $58 |

| EPS | $3.85 | $2.90 | $2.65 |

| Dividend Yield | 3.8% | 4.1% | 4.2% |

Comparing Pfizer with Industry Peers

Compared to Merck (MRK) and Johnson & Johnson (JNJ), Pfizer is currently trading at a more attractive price-to-earnings ratio. This valuation gap reflects the post-COVID market adjustment, but analysts believe it offers a buying opportunity.

| Company | P/E Ratio | Dividend Yield | 2030 Forecast (avg) |

|---|---|---|---|

| Pfizer (PFE) | 12.5 | 4.2% | $68 |

| Merck (MRK) | 15.3 | 2.9% | $135 |

| J&J (JNJ) | 17.1 | 2.6% | $180 |

Market Sentiment and Media Influence

The Pfizer stock prediction 2030 is shaped heavily by media coverage and sentiment indicators. Mentions of “Pfizer” in financial media rose 18% in Q2 2025 after positive oncology news. Reddit and Twitter communities also influence short-term volatility, underscoring the importance of staying informed.

Three Practical Investment Strategies for PFE Stock

- Dividend Capture: Buy before the ex-dividend date and sell after the dividend is paid.

- News-Based Quick Trading: Use Pocket Option to capitalize on FDA news or earnings reports.

- Long-Term Holding: Build a position and reinvest dividends for compounding growth.

Final Thoughts: Should You Invest in Pfizer Stock for 2030?

The overall outlook for Pfizer is positive. The Pfizer stock forecast 2030 benefits from strong fundamentals, a promising oncology pipeline, and strategic expansion. Whether you’re a passive investor or an active trader using Pocket Option, PFE stock offers compelling opportunities. As with all investments, due diligence is key. But if you’re asking whether Pfizer belongs in a forward-looking portfolio — especially one supported by robust tools like Pocket Option — the answer is increasingly yes.

🔥 Ready to act? Start trading Pfizer on Pocket Option now and capitalize on expert-backed forecasts.

📈 Open a demo account today and explore Quick Trading strategies with Pfizer and 100+ global assets.”

FAQ

What factors will most influence Pfizer's stock price by 2030?

The most influential factors for Pfizer's 2030 stock price include its pipeline success rate, patent cliff navigation, emerging market expansion, operational efficiency initiatives, and the regulatory environment for pharmaceutical pricing. Of these, pipeline productivity typically carries the greatest weight in long-term pharmaceutical valuations.

What dividend potential might Pfizer stock offer by 2030?

Pfizer has historically maintained a strong dividend program, with consistent dividend growth averaging 5-7% annually. By 2030, depending on the company's growth trajectory and capital allocation priorities, the dividend yield could range from 3.5-6.0%, with total dividend returns potentially representing a substantial portion of overall investor returns.

How does Pfizer compare to other major pharmaceutical companies for long-term investment?

Pfizer generally offers a balanced risk-reward profile relative to other major pharmaceutical companies. While potentially offering less explosive growth than smaller biotechnology firms, it provides greater stability through portfolio diversification, financial resources, and established commercial infrastructure. Compared to peers like Merck, Johnson & Johnson, and Novartis, Pfizer's relative attractiveness depends largely on pipeline productivity and patent cliff management success.

Should retail investors consider Pfizer for retirement portfolios targeting 2030?

Pfizer may be appropriate for retirement portfolios with a 2030 horizon, particularly for investors seeking dividend income with growth potential. However, appropriate position sizing remains essential, with pharmaceutical investments typically representing only one component of a diversified healthcare allocation. Investors should consider their overall portfolio construction, risk tolerance, and income requirements when evaluating Pfizer's suitability for retirement accounts.

What is Pfizer stock price target for 2030?

The Pfizer stock price forecast for 2030 ranges between $60 and $75, with an average estimate of $68, according to analysts such as WalletInvestor, CNN Money, and VSTAR. Some bullish scenarios even suggest targets as high as $108, depending on the success of its oncology pipeline and global expansion.

What is Pfizer stock price prediction for 2025?

The Pfizer stock price prediction for 2025 is between $38 and $44, with analysts expecting moderate recovery driven by new drug launches and stabilization of revenue streams post-COVID-19. The average forecast stands at $41.

How high is Pfizer stock expected to go?

In a long-term bullish scenario, Pfizer stock could reach $75 by 2030 or even higher, up to $108, if its oncology strategy succeeds and global markets respond favorably. The ultra-long-term forecast by WalletInvestor and others predicts potential highs of $95–$110 by 2040.

What is Pfizer stock price forecast for 2026?

For 2026, the forecasted range is between $42 and $48, with a base estimate of $45. This outlook assumes continued growth in oncology revenues, successful integration of Seagen, and stable investor sentiment.