- Bitcoin Acquisition: The company purchased an additional 15,355 BTC, bringing its total holdings to 553,555 BTC, valued at over $52 billion at current prices. This acquisition was funded through the sale of common and preferred stock, raising approximately $1.42 billion. Source: coindesk.com

- Stock Performance: Following the Bitcoin purchase, MSTR shares experienced a 5.33% increase, reflecting investor optimism about the company’s commitment to cryptocurrency. Source: StocksToTrade

- Financial Challenges: Despite the positive market response, Strategy reported a significant unrealized loss of $5.91 billion on its digital asset holdings in Q1 2025. This led to a net loss for the quarter, partially offset by a $1.69 billion income tax benefit. Sources: StocksToTrade, MarketScreener

- Regulatory Scrutiny: The substantial losses have attracted attention from regulatory bodies, with multiple law firms initiating investigations into potential securities law violations related to the company’s digital asset strategy. Source: StocksToTrade

Advanced Quantitative MSTR Stock Forecast 2030

Where is MicroStrategy (MSTR) headed by 2030? With its bold Bitcoin strategy, MicroStrategy's future is closely tied to the crypto market's fate. In this article, we break down expert forecasts, recent developments, and the key risks that could shape MSTR’s stock performance by the end of the decade.

Article navigation

- Understanding MSTR: MicroStrategy’s Business Model

- MSTR Stock Price History (2015–2025)

- MicroStrategy (MSTR) Stock Forecast for 2030

- Factors Influencing MSTR’s Future Performance

- Recent Developments

- Trading MSTR: Strategic Considerations

- Risks and Considerations

- 💡 Trading Alternatives on Pocket Option

- Conclusion

Understanding MSTR: MicroStrategy’s Business Model

MicroStrategy Incorporated (NASDAQ: MSTR) is a business intelligence company that has garnered significant attention due to its substantial Bitcoin holdings. The company’s strategy involves integrating Bitcoin into its treasury, making its stock performance closely tied to the cryptocurrency’s market movements. Let’s delve into the MSTR stock forecast 2030 to gauge its potential trajectory.

Sources: Seeking Alpha, Financetabellen.nl, StockAnalysis

MSTR Stock Price History (2015–2025)

Over the past decade, MSTR’s stock price has experienced significant volatility, largely influenced by Bitcoin’s price fluctuations.

| Year | Opening Price (USD) | Closing Price (USD) | Annual % Change |

|---|---|---|---|

| 2015 | 16.31 | 17.93 | +10.4% |

| 2016 | 17.11 | 19.74 | +10.1% |

| 2017 | 19.78 | 13.13 | -33.5% |

| 2018 | 13.18 | 12.78 | -2.7% |

| 2019 | 12.86 | 14.26 | +11.7% |

| 2020 | 14.43 | 38.86 | +172.4% |

| 2021 | 42.52 | 54.45 | +40.1% |

| 2022 | 55.83 | 14.16 | -74.0% |

| 2023 | 14.50 | 63.16 | +346.2% |

| 2024 | 68.52 | 289.62 | +358.5% |

| 2025 | 300.01 | 369.25 | +23.0% |

Data sourced from Macrotrends and Yahoo Finance

MicroStrategy (MSTR) Stock Forecast for 2030

MicroStrategy’s (MSTR) stock performance is closely tied to Bitcoin’s trajectory, given the company’s substantial BTC holdings. Analysts have provided varied forecasts for MSTR’s price by 2030, reflecting differing assumptions about Bitcoin’s future and MicroStrategy’s business strategy.

Analyst Price Predictions for 2030

| Source | Forecasted Price in 2030 | Notes |

|---|---|---|

| StockScan.io | $2,115.04 | Assumes significant Bitcoin appreciation and continued accumulation by MicroStrategy. |

| Financhill | $1,000–$1,500 | Based on Bitcoin reaching $150K+ and MicroStrategy’s BTC holdings appreciating accordingly. |

| CoinPriceForecast | $1,112 | Predicts steady growth aligned with Bitcoin’s performance. |

| Telegaon | $715.64 | Conservative estimate considering potential market fluctuations. |

| FutureValueJournal | $942.47 | Balanced forecast factoring in Bitcoin trends and MicroStrategy’s financials. |

Factors Influencing MSTR’s Future Performance

Bitcoin’s Price Volatility

MicroStrategy’s heavy investment in Bitcoin means that any significant fluctuation in BTC’s price directly impacts MSTR’s stock value. Analysts note that a drop to $135.26 in MSTR could trigger panic selling, affecting both the stock and Bitcoin markets.

Company’s Bitcoin Accumulation Strategy

MicroStrategy continues to acquire Bitcoin, holding 499,096 BTC as of the latest reports, valued at over $41 billion. This aggressive accumulation strategy is central to the company’s long-term vision and significantly influences its stock performance.

Financial Performance and Market Sentiment

Recent earnings reports show a net loss of $3.20 per share, missing analysts’ expectations. Despite this, the market remains focused on the company’s Bitcoin strategy, with analysts maintaining a “Strong Buy” consensus.

Recent Developments

In April 2025, MicroStrategy, now operating under the name Strategy Incorporated, made headlines with several significant events:

Trading MSTR: Strategic Considerations

Given MicroStrategy’s significant exposure to Bitcoin, trading MSTR requires careful analysis of cryptocurrency market trends. Investors should consider the following:

- Market Volatility: Bitcoin’s price fluctuations can lead to significant swings in MSTR’s stock price.

- Regulatory Environment: Ongoing investigations and potential regulatory changes could impact the company’s operations and stock performance.

- Financial Health: While the company’s aggressive Bitcoin strategy has garnered attention, the associated financial risks and recent losses highlight the importance of monitoring its financial statements and strategic decisions.

Risks and Considerations

- Bitcoin Volatility: MSTR’s heavy investment in Bitcoin makes it susceptible to the cryptocurrency’s price swings.

- Regulatory Risks: Potential government regulations on cryptocurrencies could adversely affect MSTR’s operations and stock price.

- Market Sentiment: Investor perception of cryptocurrencies and tech stocks can lead to rapid changes in MSTR’s stock value.

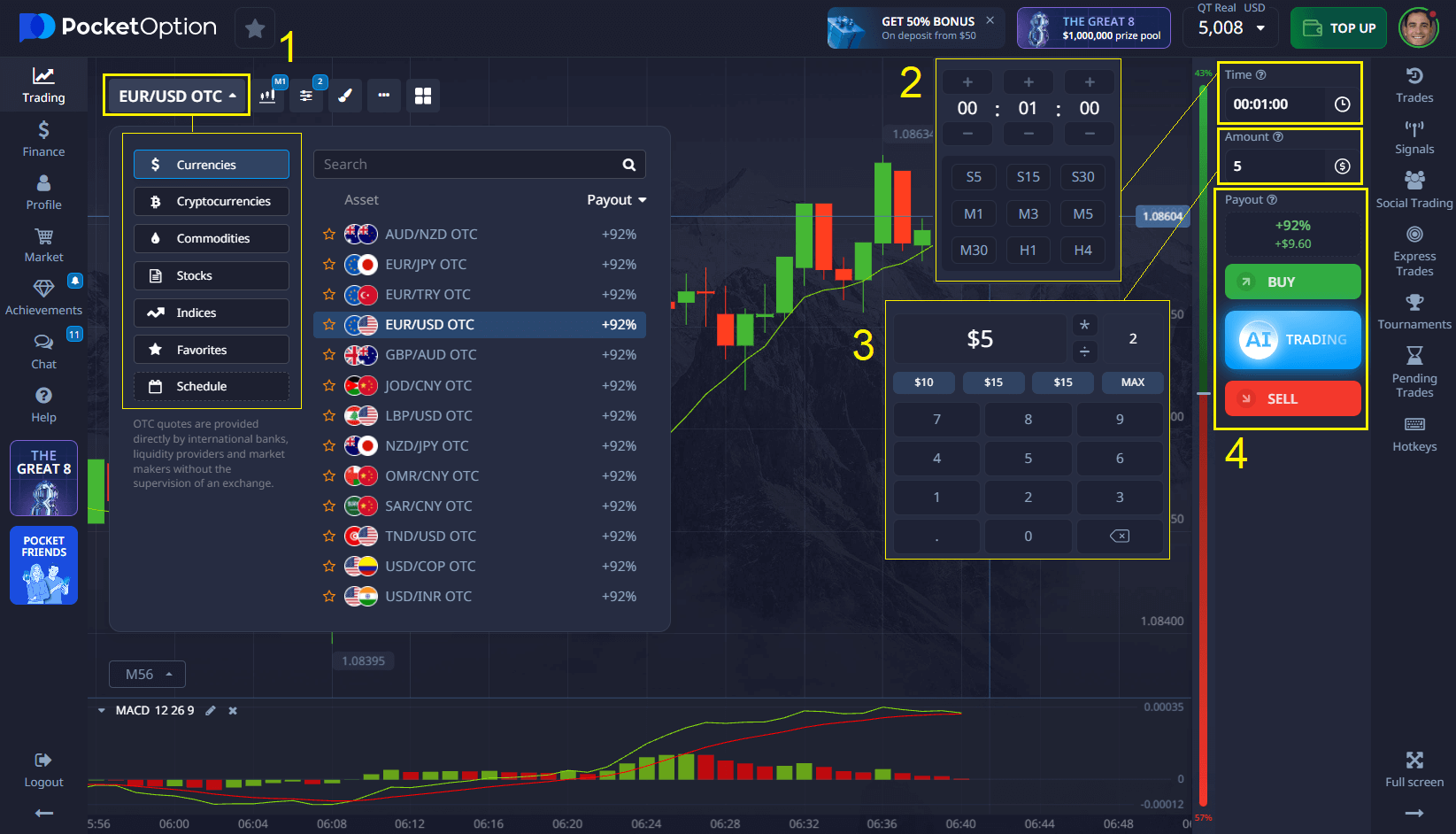

💡 Trading Alternatives on Pocket Option

The platform offers over 100 assets for short-term trading, including cryptocurrencies, forex pairs, and commodities.

📌 Key Features:

- Short-Term Trades: Execute trades with durations as short as 5 seconds.

- Analytical Tools: Utilize over 30 indicators and customizable charts for technical analysis.

- Advanced Features: Engage in copy trading, receive trading signals, and explore AI-driven trading options.

Example Trade Execution:

- Select Asset: Choose a preferred asset from the available list.

- Analyze Chart: Apply desired indicators to assess market trend.

- Set Trade Parameters: Determine trade amount (starting from $1) and duration (minimum of 5 seconds).

- Execute Trade: Forecast price movement direction and click ‘Buy’ or ‘Sell’ accordingly.

- Outcome: If the forecast is correct, earn a profit of up to 92%, as indicated prior to trade execution.

Conclusion

Many investors are closely monitoring the mstr stock price prediction 2030 to assess long-term value potential amid rising demand for data intelligence solutions. MicroStrategy’s stock performance is intricately linked to Bitcoin’s market dynamics. Investors should consider the associated risks and conduct thorough analyses before making investment decisions. For those interested in short-term trading opportunities, Pocket Option provides a versatile platform with a wide range of assets and analytical tools.

FAQ

What makes MSTR stock different from other technology investments?

MSTR represents a unique hybrid investment that combines exposure to a traditional enterprise software business with significant Bitcoin holdings. This dual nature creates distinctive price dynamics where the stock responds both to software industry trends and cryptocurrency market movements. The mathematical correlation between MSTR and Bitcoin prices has strengthened significantly since 2020, with regression analysis showing Bitcoin price movements now explaining approximately 65-75% of MSTR's price variance.

How can I calculate potential MSTR stock valuation for 2030?

To develop your own MSTR stock price prediction 2030, start by separately valuing the software business using discounted cash flow analysis with appropriate growth rates (7-12% annually) and profit margins (20-25%). Then add the market value of Bitcoin holdings by multiplying coins held by projected Bitcoin prices. Finally, apply a strategic premium (typically 5-15%) to account for first-mover advantages. Sophisticated investors use Monte Carlo simulations to generate probability distributions rather than single point estimates.

What statistical methods best capture MSTR's relationship with Bitcoin?

Time-varying beta models and dynamic conditional correlation (DCC) analysis have proven most effective for modeling MSTR's Bitcoin sensitivity. Standard linear regression models often underestimate the relationship during market stress periods. Vector autoregression (VAR) models that incorporate lag effects between Bitcoin price movements and subsequent MSTR price adjustments have achieved R-squared values of 0.72-0.78 in backtesting, significantly outperforming static models.

What risk factors should be incorporated into MSTR valuation models?

Comprehensive MSTR forecasting models should incorporate at least five key risk factors: cryptocurrency regulatory uncertainty (modeled as discrete scenarios), Bitcoin price volatility (using GARCH models), software industry disruption risk (using comparative company analysis), liquidity risk premiums (based on bid-ask spreads and trading volumes), and corporate governance factors (particularly related to Bitcoin acquisition strategies). Pocket Option's risk modeling frameworks enable quantification of these factors using historical data and forward-looking scenario analysis.

How can regression analysis help predict MSTR's future performance?

Multivariate regression analysis helps identify which independent variables most significantly influence MSTR stock prices. By calculating correlation coefficients between MSTR and factors like Bitcoin price movements, software industry growth rates, interest rates, and institutional ownership, investors can develop predictive equations. These equations can then be fed with projected future values of these variables to generate price forecasts. The most robust models incorporate time-varying coefficients that account for the evolving nature of MSTR's business model.