- Smart contract execution

- File storage and consensus services

- Transaction fees in USD-equivalent terms

- Staking for network security

Hedera (HBAR) Price Prediction: What’s Next for This Crypto?

HBAR price prediction is one of the most closely followed topics among digital asset analysts and enterprise-grade blockchain investors. As the crypto market gears up for the next bull run, questions about HBAR's future value, particularly around April 2025, are intensifying. In this in-depth analysis, we offer a detailed hbar price prediction supported by technical indicators, expert commentary, historical data, and forecasts for 2025, 2026, and beyond.

Article navigation

- Introduction to Hedera and HBAR

- Hedera Price History and Volatility Patterns

- HBAR Price Prediction 2025: Expert Insights

- Technical Analysis Tools: HBAR Price Models

- HBAR in Broader Crypto Context

- Long-Term HBAR Forecasts

- Pocket Option Perspective: Trading Opportunities

- What to Expect from Hedera (HBAR)

Introduction to Hedera and HBAR

What is Hedera Hashgraph?

Hedera Hashgraph is a decentralized public ledger built on a unique hashgraph consensus mechanism. Unlike typical blockchains, the Hedera network ensures near-instantaneous finality, low fees, and strong security using asynchronous Byzantine fault tolerance (aBFT). It is designed for enterprise adoption, and its volatility profile is markedly different from traditional DeFi chains.

“Hedera is an enterprise-first DLT with strong governance and unmatched performance metrics.” — Dr. Leemon Baird, Co-Founder of Hedera

The Hedera Governing Council, featuring names like Google, IBM, and Boeing, ensures stable direction and long-term commitment to adoption.

Overview of the HBAR Token

HBAR is the utility token of the Hedera ecosystem and powers:

Tracking the HBAR price prediction next bull run 2025 involves analyzing its usage in enterprise use cases, current tokenomics, and on-chain activity. The latest hedera hbar april 2025 news performance includes major tokenization pilots and ecosystem grants aimed at expanding developer tools.

Why HBAR Price Prediction Matters

Predicting the price of HBAR isn’t just about speculation—it’s about understanding long-term blockchain viability and assessing the role of Hedera in next-generation financial infrastructure. The HBAR price prediction 2025 and beyond helps:

- Retail investors time entries/exits

- Institutions gauge enterprise DLT maturity

- Developers assess ROI on building in the Hedera network

Hedera Price History and Volatility Patterns

Historical Price Review

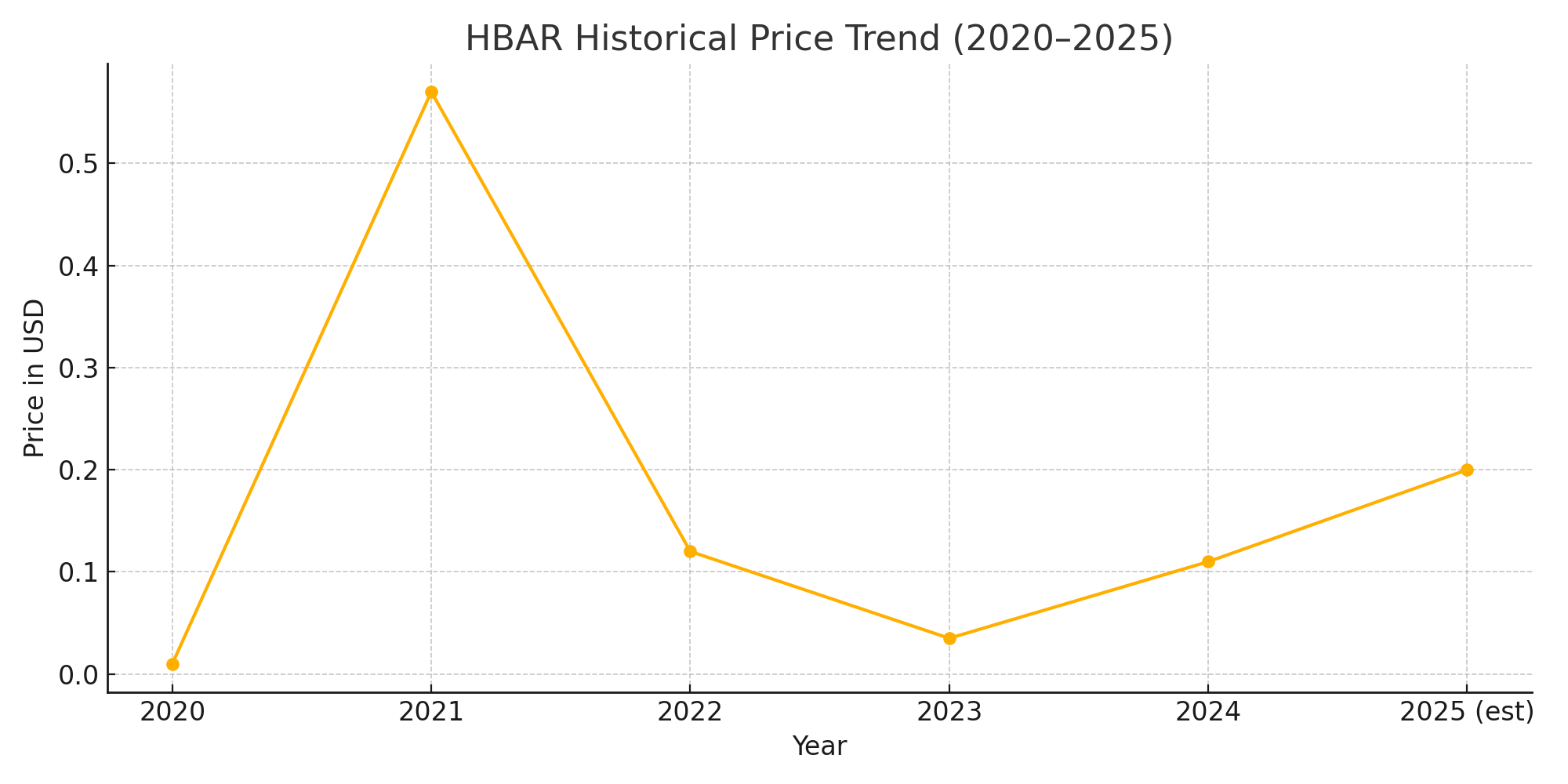

HBAR debuted in 2019 and has gone through several major crypto price cycles:

- March 2020 crash: Price dropped to ~$0.01 USD

- September 2021: All-time high (ATH) of $0.57

- 2022–2023 Crypto Winter: Price bottomed around $0.035

- 2024 Recovery: Gradual increase to the $0.10–0.12 range

Hedera HBAR enterprise adoption volatility remains a critical variable. Its price is less reactive to retail hype but moves on tech updates and council announcements.

Hedera HBAR Enterprise Adoption 2025 Volatility Trends

Adoption from enterprises and central banks exploring tokenized assets using the HTS (Hedera Token Service) could define the hbar volatility enterprise adoption 2025 scenario. So far in 2025, developments include:

- DLA Piper extending its TOKO platform on Hedera

- Standard Bank testing micropayment systems

- Growing momentum for CBDC pilot discussions

HBAR Price Prediction 2025: Expert Insights

Analyst Commentary

“HBAR could outperform during the next bull cycle due to its energy-efficient consensus and enterprise-grade governance.” — Erik Zhu, Senior Analyst, Satori Capital

“Hedera’s unique fixed-fee model and high throughput give it a clear edge in high-volume, low-latency environments.” — Rachel Lin, DeFi Researcher

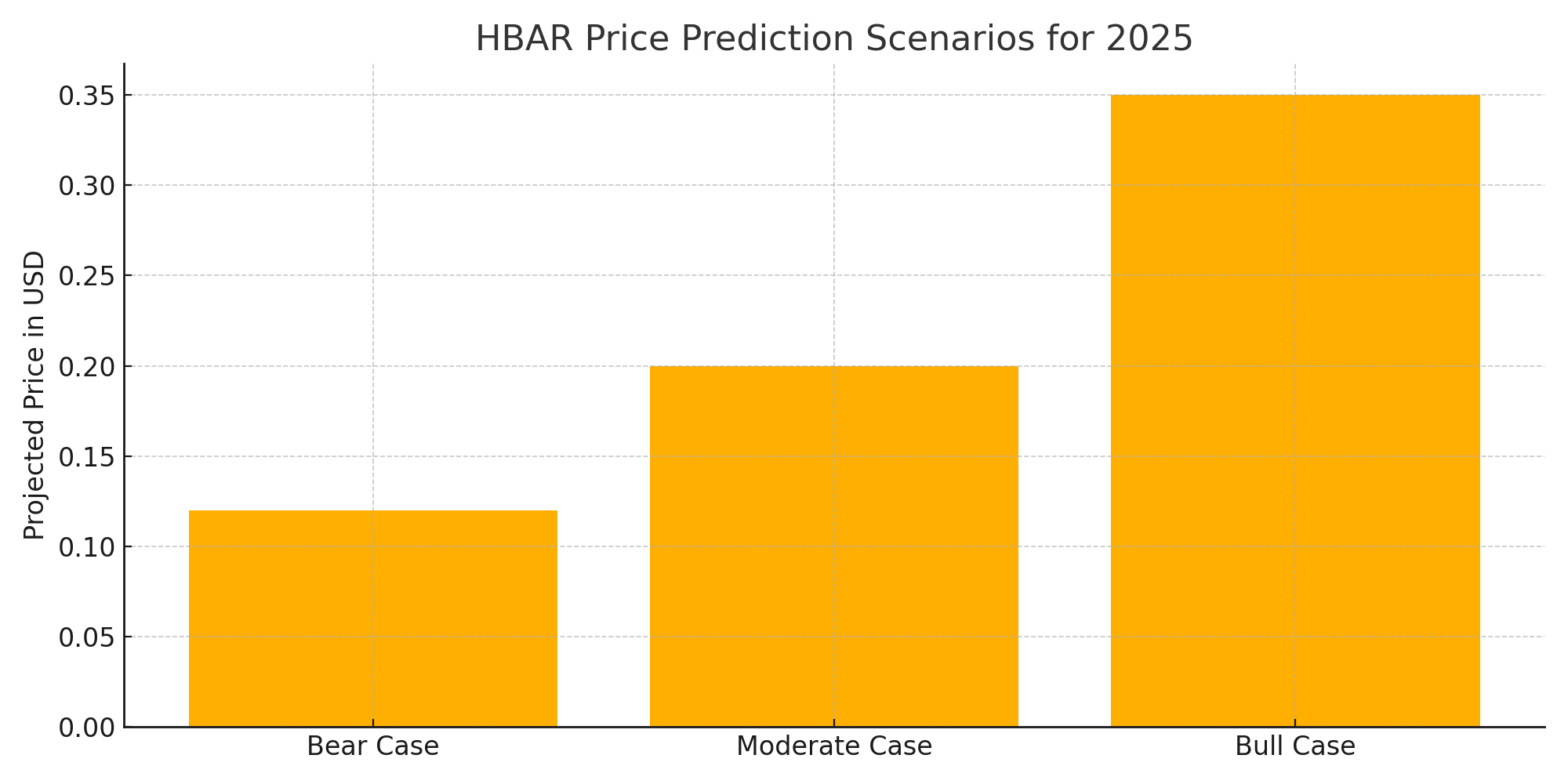

Key Price Prediction Ranges

| Source | Prediction Range |

|---|---|

| CoinCodex | $0.20–0.26 |

| DigitalCoinPrice | $0.18–0.24 |

| Changelly | $0.25–0.30 (upside to $0.38) |

| CryptoNewsZ | $0.22 base; $0.35 if adoption accelerates |

This variation highlights the importance of volatility models and technology rollouts in shaping the HBAR price prediction next bull run.

HBAR Price April 2025 Outlook

HBAR’s price in April 2025 has seen gradual upward movement, testing resistance at $0.11 after ecosystem upgrades. Analysts predict a breakout toward $0.14–0.16 if momentum sustains and institutional volume enters.

Technical indicators suggest a bullish pattern forming, supported by 50- and 100-day EMA convergence.

Technical Analysis Tools: HBAR Price Models

Moving Averages and Confluence Zones

- EMA-50 and EMA-200: Bullish crossover completed in Q1 2025

- MACD: Trending upward with histogram divergence

- RSI: 63, indicating sustained buying pressure

These models support a mid-term hbar price prediction 2025 of $0.20 if bullish momentum continues.

Support and Resistance Zones

| Level | Type |

|---|---|

| $0.045 | Strong Support |

| $0.11 | Psychological Barrier |

| $0.14 | Short-Term Target |

| $0.18 | Mid-Term Resistance |

| $0.25+ | Bull Market Target |

Breaking $0.18 could signal entry into a steep rally phase typical of prior cryptocurrency bull cycles.

HBAR in Broader Crypto Context

Comparing with Layer-1 Competitors

Hedera stands out in:

- Transaction finality speed (~3-5 sec)

- Fixed, low transaction fees

- Network energy efficiency

- Enterprise governance structure

Sentiment from Reddit and Community Forums

Hbar price prediction reddit discussions reveal cautious optimism, with users noting:

- Enterprise utility > meme token hype

- Frustration over centralized perception

- Faith in Hedera’s 10-year roadmap and council

Long-Term HBAR Forecasts

HBAR Price Prediction 2026

- Moderate Case: $0.28–0.35

- Bull Case: $0.50+ if cross-chain and staking adoption scales

- Bear Case: $0.10–0.12 if competition accelerates (e.g., Avalanche, Aptos)

HBAR Price Prediction 2030

- High Scenario: $1.00–1.50 if Hedera powers national identity, CBDC, or global payment rails

- Base Case: $0.45–0.65 with sustained adoption and throughput improvements

HBAR Price Prediction 2040

- Potential to reach $5–10 if positioned as the leading enterprise DLT with mainstream tokenization

- Risks include being overshadowed by modular blockchains or falling behind Ethereum’s zk-rollup ecosystem

“Will HBAR reach $10? Only if real-world assets, finance, and identity systems move to DLT at scale. It has the tech, but the race is long.” — Ansel Wang, Tokenomics Advisor

HBAR Price Prediction Tomorrow

- Minor pullback to $0.105 for liquidity

- Bounce expected if Bitcoin holds $70K and altcoin dominance increases

Pocket Option Perspective: Trading Opportunities

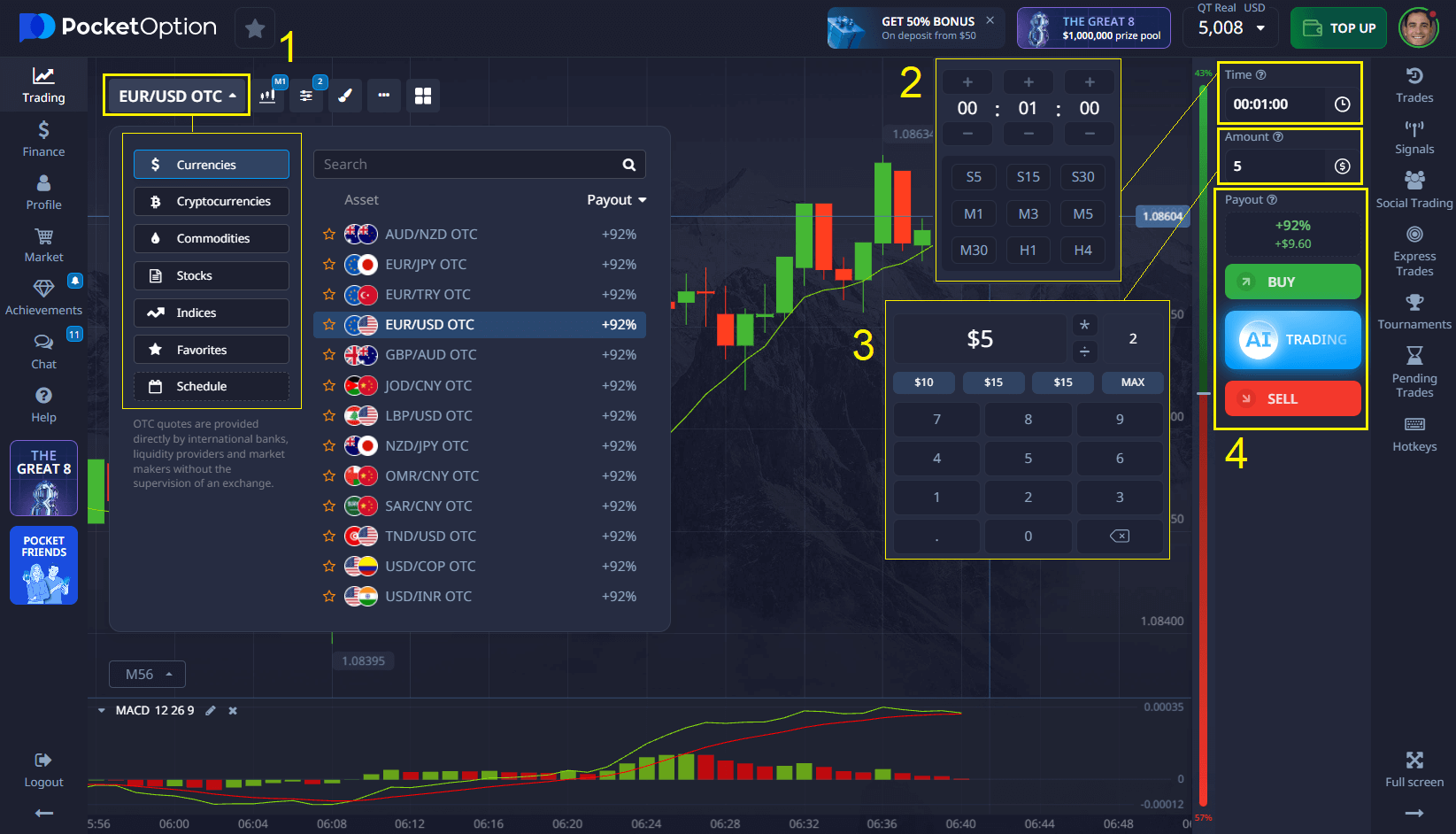

While HBAR itself isn’t listed on Pocket Option, the platform enables traders to capitalize on crypto trends with:

- Quick Trading mode for volatility-based setups

- Advanced indicators: EMA, RSI, MACD, Fibonacci tools

- Market event triggers: reacting to token listings, airdrops, and ecosystem upgrades

“I can trade similar assets on Pocket Option with great execution speed and copy trading.” — Hiroshi, breakout trader

“Pocket Option’s simplicity helps me test altcoin volatility patterns even if I don’t hold the asset itself.” — Sophie, technical scalper

What to Expect from Hedera (HBAR)

The HBAR price prediction 2025 hinges on a combination of:

- Technology adoption by institutions

- Favorable regulatory clarity

- Strong network upgrades and roadmap execution

- Performance during the next bull cycle

While volatility remains, Hedera’s structural advantages make it a top contender for the future of tokenized assets and decentralized enterprise operations.

Whether it reaches $0.30 in 2025 or $10 by 2040 depends on long-term execution and demand. Keep your eyes on hedera hashgraph hbar volatility enterprise adoption, especially as April 2025 unfolds.

“Smart investors track utility and adoption. That’s where Hedera shines.” — Ava L., Blockchain Portfolio Manager

FAQ

What makes Hedera Hashgraph different from traditional blockchain networks?

Hedera Hashgraph uses a hashgraph consensus algorithm rather than a traditional blockchain, which allows for faster transaction speeds and greater scalability. This technology enhances security and efficiency, making it attractive for enterprise usage.

How does the governance model of Hedera Hashgraph influence its market position?

Hedera's governance model, involving a council of major global companies, provides stability and strategic direction. This unique structure attracts enterprises seeking a reliable and sustainable platform, thereby enhancing Hedera's market position.

What are the potential risks associated with investing in HBAR?

Investing in HBAR carries risks such as market volatility, regulatory uncertainties, and competition from other cryptocurrencies. Investors should conduct thorough research and stay informed about market developments.

How can technological upgrades impact HBAR's price?

Technological upgrades can significantly boost HBAR's appeal, potentially leading to higher demand and price increases. Improved technology can enhance user experience and broaden Hedera's adoption across industries.

What role do partnerships play in HBAR's price movement?

Partnerships with major firms can drive demand for HBAR, as they validate Hedera's technology and expand its use cases. Such collaborations can lead to surges in HBAR's price, especially if they involve influential industry players.

What will HBAR be worth in 2025?

The HBAR price prediction 2025 suggests that the token could see substantial growth, depending on several factors such as enterprise adoption, regulatory clarity, and market sentiment. Analysts predict a price range of $0.20–$0.30 for HBAR in 2025, with optimistic scenarios pointing toward $0.35 if adoption accelerates and institutional interest grows. The price will likely be influenced by developments in Hedera Hashgraph's technology and the broader crypto market conditions.

Could HBAR hit $100?

While it's unlikely that HBAR will reach $100 in the near term, the HBAR price prediction 2040 scenario speculates that it could hit that level if Hedera becomes a dominant platform in areas like tokenized assets, central bank digital currencies (CBDCs), and enterprise solutions. This would require widespread adoption, significant technological advancements, and a favorable market environment. For now, however, $100 remains a highly ambitious target.

Can HBAR reach $5?

In the long run, HBAR could reach $5 if Hedera Hashgraph continues to build upon its enterprise adoption, particularly in sectors like finance, supply chain, and healthcare. As Hedera scales to handle national and global tokenization projects, such as CBDCs and large-scale decentralized applications, the potential for growth becomes clearer. This would depend on the volatility, adoption rates, and technological developments in the upcoming years.