- Legacy oil & gas business — still generating the bulk of free cash flow.

- Lithium production ambitions — targeting the EV battery supply chain.

- First-mover advantage in carbon capture and storage (CCS) — positioning as a leader in emissions management.

Exxon Trading: Understanding the Energy Giant's Market Operations

Master the art of Exxon trading and learn how to harness the power of a global energy titan to fuel your investment portfolio, all made accessible through platforms like Pocket Option.

Article navigation

- Start trading

- Mastering Exxon Trading: Your Ultimate Guide to Energy Market Investments

- Understanding Exxon Mobil Corporation: A Global Energy Behemoth

- The Mechanics of Exxon Trading

- The Role of Crude Oil in Exxon Investments 🌍

- Analyst Insights and Why Pocket Option is Your Ideal Partner

- Why Choose Pocket Option for Exxon Trading?

- Crafting Your Energy Investment Strategy with Exxon Mobil

Mastering Exxon Trading: Your Ultimate Guide to Energy Market Investments

Navigating the powerful currents of the energy market through Exxon trading can be a highly rewarding venture, and with platforms like Pocket Option, it’s more accessible than ever. In the dynamic world of energy sector trading, Exxon Mobil Corporation (NYSE: XOM) stands as a titan. With a sprawling portfolio that stretches from deep-sea crude oil exploration to the manufacturing of advanced chemical products, a deep understanding of Exxon’s market influence is essential for any serious investor. This article provides a comprehensive look into Exxon Mobil’s trading practices, market position, and the factors that drive its value, offering you the critical insights needed to trade the Exxon Mobil stock with confidence. 📈

Understanding Exxon Mobil Corporation: A Global Energy Behemoth

Overview of Exxon Mobil

Exxon Mobil Corporation, a name synonymous with energy, is a global “supermajor” and a cornerstone of the industry. Its primary activities involve the exploration for and production of crude oil and natural gas. However, its operations are vast and integrated, covering the entire value chain from developing petroleum and chemical products to the global sale of crude oil. A key, but often overlooked, component of its success is Exxon’s formidable trading division. This internal powerhouse works around the clock to optimize the logistics and real-time sale of its energy products, ensuring maximum profitability and responsiveness in a volatile market.

| Trading Aspect | Description |

|---|---|

| Stock Symbol | XOM (NYSE) |

| Market Cap | Approximately $400-450 billion |

| Trading Volume | 8-12 million shares daily |

| Dividend Yield | 3-4% average |

History and Development of XOM

History and Development of XOM

Exxon Mobil’s roots trace back to John D. Rockefeller’s Standard Oil company, established in 1870. The modern corporation was formed in 1999 through the merger of two of Standard Oil’s largest descendants: Exxon and Mobil. This landmark fusion created an energy giant with unparalleled global reach and technological prowess.

Throughout its history, Exxon Mobil has been defined by strategic acquisitions and a relentless commitment to technological advancement. The recent $60 billion acquisition of Pioneer Natural Resources is a testament to this strategy. As noted by financial analysts at Morningstar, this deal “significantly bolsters Exxon’s U.S. shale position, adding a vast, low-cost inventory that is expected to generate high returns for decades to come.” This move not only secures production but also enhances its capabilities in crude trading, exploration, and petrochemical innovation, cementing its status as a competitive leader.

Current Market Position of Exxon Mobil

Today, Exxon Mobil commands a formidable market position as one of the world’s largest publicly traded energy providers, with a market capitalization frequently exceeding $450 billion. Its stock price is a key barometer for the health of the oil and natural gas sector, watched intently by traders and analysts globally. The company’s strategic focus on high-return upstream activities and its expertise in producing essential commodities like crude oil and, increasingly, low-carbon solutions like hydrogen, reinforce its market dominance. As ExxonMobil CEO Darren Woods stated in a recent earnings call, “Our strategy is to be a leader in the energy transition by leveraging our core competencies in technology, project management, and operational excellence.” Global trading operations, with significant hubs in locations like Singapore, highlight its central role in commodity trading and energy market investments, making XOM stock trading a focal point for investors.

The Mechanics of Exxon Trading

What is Exxon Mobil Trading?

Exxon trading, executed by its sophisticated global trading division, is the nerve center of the corporation’s commercial operations. It’s far more than just selling oil; it involves a complex web of activities aimed at maximizing the value of every molecule the company produces. This division engages in the real-time purchase and sale of a wide array of energy products–crude oil, natural gas, refined fuels, and specialty chemical products.

An expert insight often missed by retail investors is how this division creates a competitive moat. While smaller producers sell their oil at benchmark prices, Exxon’s traders use advanced analytics and a global logistics network to arbitrage regional price differences, manage risk with derivatives, and blend different grades of crude to meet specific refinery needs, adding several dollars of value to every barrel sold. This dynamic capability is crucial for maintaining a competitive edge.

How to Trade Exxon Stocks

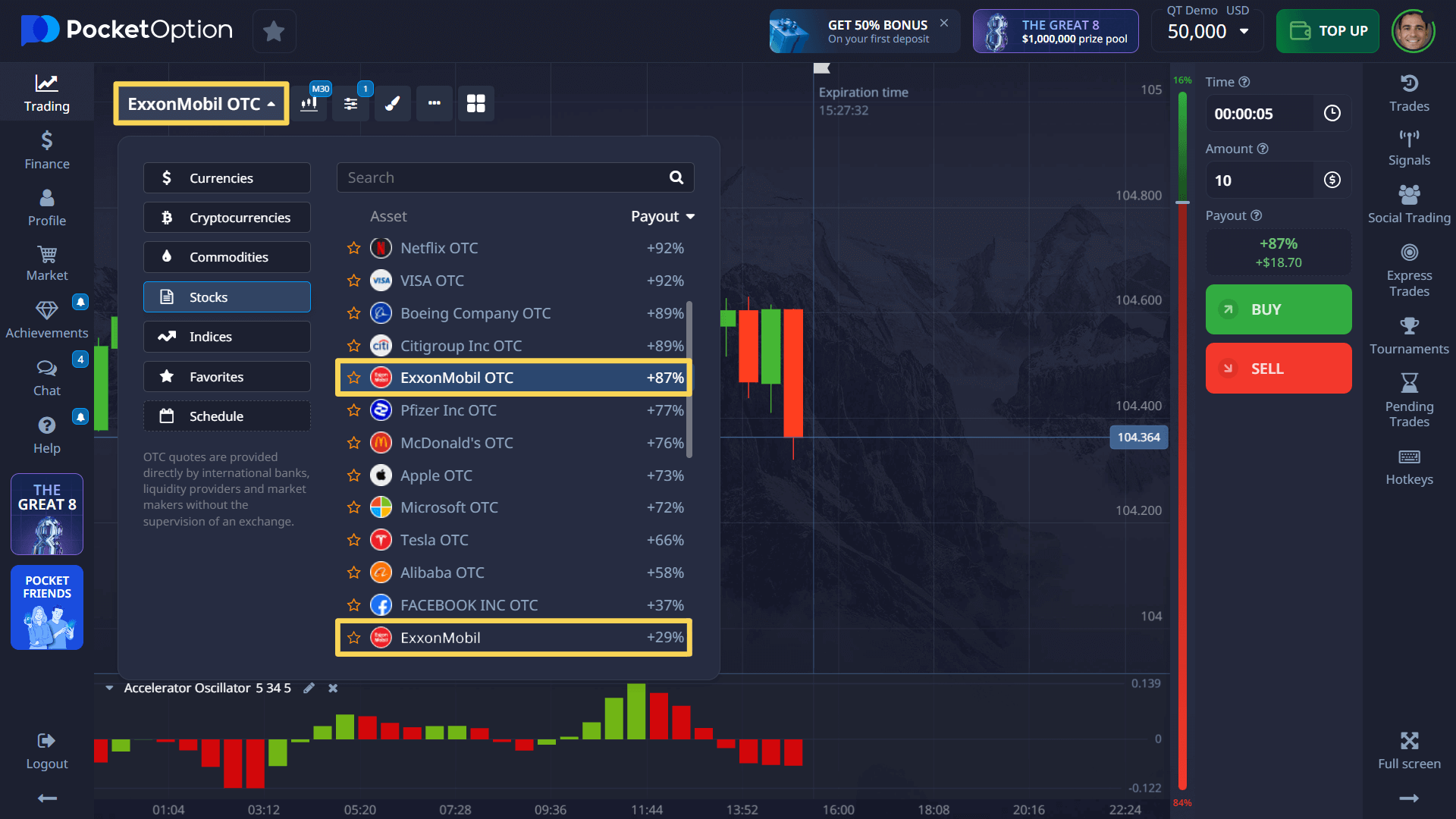

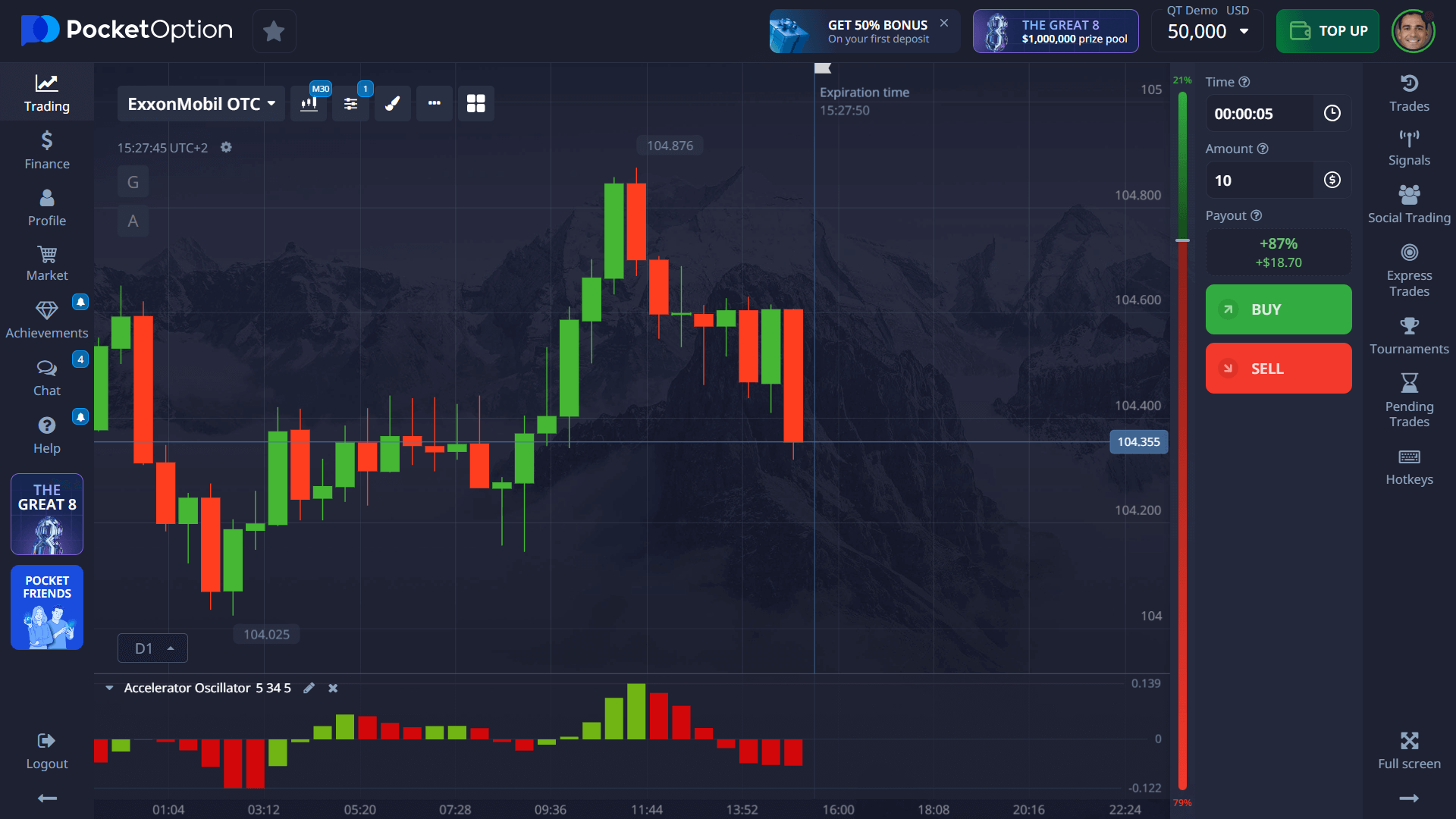

Trading the Exxon Mobil stock (XOM) offers a direct way to invest in the company’s performance. Traditionally, this required opening an account with a stockbroker. Today, platforms like Pocket Option have democratized access, allowing you to trade on the price movements of XOM and over 100 other assets with unprecedented ease.

With Pocket Option, you can start with a minimal deposit of just $5 and practice your strategies on an unlimited demo account before committing real capital. This is a crucial step recommended by trading experts to familiarize yourself with market volatility without financial risk. Furthermore, Pocket Option offers 24/7 trading on popular stocks like Exxon through OTC (Over-the-Counter) assets, meaning you’re not limited to standard market hours. This flexibility allows you to react to global news and market shifts whenever they happen.

Understanding Live Quotes for XOM

A live quote for XOM is more than just a price; it’s a snapshot of the market’s current sentiment and activity. Understanding its components is vital for effective oil stock trading.

| Metric | Example Value | What It Means for Traders |

|---|---|---|

| Last Price | $112.69 | The most recent price at which XOM was traded. This is the baseline for current valuation. |

| Bid-Ask Spread | $111.24 – $111.75 | The gap between the highest buyer’s price (bid) and the lowest seller’s price (ask). A tight spread indicates high liquidity. |

| Day’s Volume | 15-20 Million | The number of shares traded. According to market technicians, volume confirms trends. A price rise on high volume is more significant than one on low volume. |

| Dividend Yield | ~3.55% | The annual dividend as a percentage of the stock price. XOM is a “Dividend Aristocrat,” having increased its dividend for over 40 consecutive years. |

| P/E Ratio | ~11.5 | The Price-to-Earnings ratio. Compares the company’s stock price to its earnings per share. A lower P/E can indicate a stock is undervalued relative to its peers. |

By analyzing these components, traders can gauge market liquidity, sentiment, and potential entry or exit points for their trades.

The Role of Crude Oil in Exxon Investments 🌍

Crude Oil Market Overview

The crude oil market is the lifeblood of Exxon Mobil’s business. The prices of benchmark crudes like Brent and West Texas Intermediate (WTI) are influenced by a complex interplay of factors. The International Energy Agency (IEA) recently reported that while global demand growth is expected to slow slightly, it will still reach record highs, driven by emerging markets and the aviation sector. This creates a tense balance with rising non-OPEC supply, making the market highly sensitive to any disruption. Geopolitical tensions, global economic health, and inventory levels are critical variables that create both risks and opportunities in crude trading.

Exxon’s Impact on Crude Trading

As a producer of millions of barrels of oil equivalent per day, Exxon Mobil is not just a participant in the crude market; it is a market-shaping force. Its global trading arm, with a major presence in hubs like Singapore, optimizes the flow of crude oil from its production sites to refineries and customers worldwide. An expert insight is that Exxon’s influence extends to price discovery itself. Their large, long-term contracts and physical trading volumes provide crucial data points that inform the global price benchmarks used by the entire industry.

Factors Influencing Crude Prices

A successful energy investment strategy requires a deep understanding of the myriad factors that can send crude prices soaring or tumbling.

| Factor | Description & Expert Insight | Direct Impact on Exxon Mobil |

|---|---|---|

| Geopolitical Events | Conflicts, sanctions, or instability in key regions. As a recent report from the Council on Foreign Relations states, “The weaponization of energy policy is a growing risk, making supply chains more fragile than at any point in the last decade.” | Can lead to higher revenue from price spikes but also increases operational risks and security costs in affected areas. |

| Global Supply & Demand | Decisions by OPEC+ and demand from major economies. A senior commodity strategist at Goldman Sachs recently commented, “We see a structurally tight market ahead, as years of underinvestment in new supply will clash with resilient demand.” | Higher demand and controlled supply boost profits. Conversely, a supply glut or economic slowdown can compress margins. |

| The U.S. Dollar | A stronger dollar makes dollar-priced oil more expensive for other countries. This inverse correlation is a fundamental principle of commodity trading. | A stronger dollar can negatively impact revenues earned in foreign currencies, but it also affects the cost of international operations. |

| Alternative Energy Growth | The adoption of EVs and renewables. However, BloombergNEF forecasts that even with rapid EV growth, oil demand from transportation will remain substantial for decades, especially in aviation and shipping. | Exxon is investing in low-carbon solutions, including a massive hydrogen project in Baytown, to diversify and adapt to this transition. |

| Inventory Levels | Weekly reports from the EIA on crude stockpiles. Professional traders watch not just the headline number, but the “days of supply” figure, which provides better context on market tightness. | Unexpected draws in inventory suggest strong demand and can boost prices, directly benefiting Exxon’s sales. |

Analyst Insights and Why Pocket Option is Your Ideal Partner

Current Analyst Ratings for XOM

Analyst ratings for Exxon Mobil provide a valuable consensus on the stock’s prospects. Prashant Rao, an analyst at Citi, recently upgraded the stock, noting, “Exxon’s advantaged projects in Guyana and the Permian Basin are set to deliver significant volume growth and free cash flow, supporting a leading dividend yield among peers.” While the consensus is often a “Moderate Buy,” opinions vary. Some analysts express caution, citing the execution risk on large-scale low-carbon projects and the inherent volatility of commodity prices. A balanced view is crucial; investors should use these ratings as a starting point for their own research.

Long-Term Predictions for Exxon Stocks

Looking ahead, long-term predictions for petroleum stocks like Exxon (XOM) are increasingly tied to their role in the energy transition. The expert consensus is that Exxon’s future success will rest on a “trio of cash engines”:

Key Numbers and Forecasts

- Revenue outlook: Analysts project ExxonMobil’s total revenue to hover around $380–400 billion annually through 2027, assuming Brent crude averages $75–80 per barrel.

- Dividends & buybacks: Exxon returned $32 billion to shareholders in 2024 ($14 billion in dividends and $18 billion in share repurchases). Management has pledged to keep shareholder returns in the $30–35 billion annual range through 2027.

- Carbon capture: Exxon aims to build a CCS capacity of 100 million metric tons annually by 2030, which could represent an $8–10 billion market opportunity.

- Lithium plans: Pilot production is expected to begin in 2027, with potential annual capacity of 100,000 tons by early 2030s.

Strategic Insight

A unique recommendation from market veterans is to view XOM not just as an oil stock, but as a long-term capital return vehicle. The strategy is less about timing oil price peaks and more about steadily accumulating shares to benefit from Exxon’s massive and consistent capital return programs.

| Factor | 2024–2027 Outlook | Investor Impact |

|---|---|---|

| Annual Free Cash Flow | $40–50 billion (oil at $75–80/bbl) | Supports dividends + buybacks |

| Dividend Yield | 3.4–4.0% | Stable income stream |

| Share Buybacks | $17–20 billion/year | Boosts EPS & stock support |

| CCS Investment | $15 billion planned by 2030 | Decarbonization hedge |

| Lithium Growth | Pilot in 2027 → scale-up in 2030s | Exposure to EV megatrend |

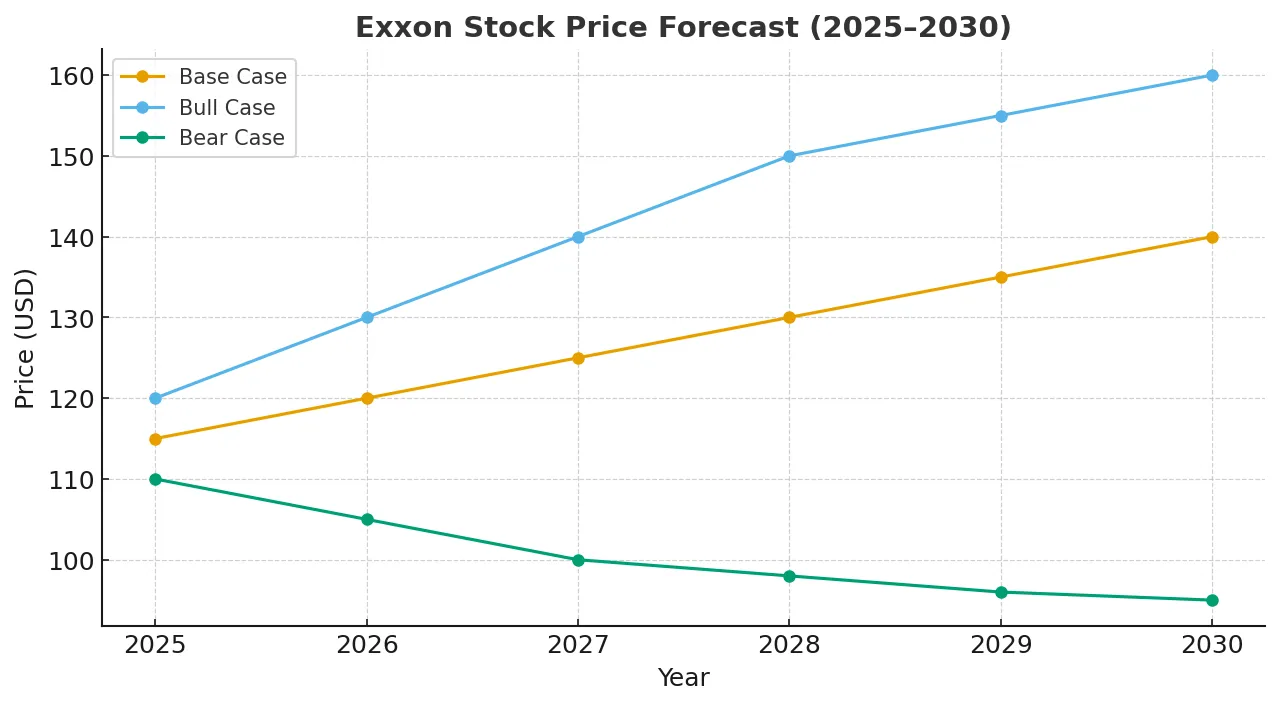

Analyst Forecast

- Consensus target price for 2026–2027: $135–145/share (vs. ~$110 today).

- Upside scenario (oil > $100): up to $160/share.

- Downside scenario (oil < $65): ~$95/share, cushioned by dividends.

📌 Investor takeaway: Exxon’s resilience comes from its dividend aristocrat status (41 consecutive years of dividend growth), aggressive buybacks, and diversification into CCS and lithium. This combination makes Exxon less a pure “oil play” and more a long-term compounding machine.

Why Choose Pocket Option for Exxon Trading?

Whether you’re executing a short-term trade based on an earnings beat or building a long-term position, Pocket Option provides a powerful and user-friendly platform packed with features designed for your success.

- 🤖 AI Trading: Automate your trades using smart algorithms to enhance efficiency and capitalize on market opportunities without being glued to your screen.

- 📈 Social Trading: New to the energy market? Copy the trades of successful, seasoned traders to learn their strategies and profit from their expertise.

- 🏆 Tournaments: Compete against other traders in exciting tournaments. It’s a great way to hone your skills, win prizes, and showcase your trading prowess.

- 🎁 Bonuses and Promo Codes: Boost your trading capital with generous deposit bonuses and regular promo codes.

- 💳 Flexible Payments: With over 50 deposit and withdrawal methods, managing your funds is fast, secure, and convenient for users worldwide.

- 📚 Learning Materials & Support: Access a wealth of tutorials, strategies, and market analysis to sharpen your skills. Plus, reliable customer support is always available to assist you.

- 📱 Mobile App: Trade anytime, anywhere. Whether you have a spare minute in traffic or on your lunch break, the Pocket Option app lets you make a forecast and profit from the right decision on the go.

Crafting Your Energy Investment Strategy with Exxon Mobil

Short-Term Trading Strategies

For short-term traders, volatility is an opportunity. A key recommendation is to build a trading plan before entering a position.

- Catalyst Trading: Trade around specific events like OPEC meetings or EIA inventory reports. Pro Tip: Don’t just trade the news itself, but the market’s reaction to the news, which can often be counterintuitive. Use the Pocket Option demo account to practice this.

- Technical Swings: Use indicators like Bollinger Bands and RSI on the Pocket Option platform to identify overbought or oversold conditions, providing clear entry and exit signals for short-term swing trades.

Long-Term Investment Considerations

Long-term investors should focus on the bigger picture and Exxon’s fundamental strengths.

- Dividend Reinvestment (DRIP): A powerful wealth-building tool. Automatically reinvesting Exxon’s substantial dividends to buy more shares creates a compounding effect that can dramatically increase your total return over time.

- Strategic Monitoring: Don’t just “buy and forget.” Monitor the progress of Exxon’s Low Carbon Solutions business. An expert insight is to watch for key policy developments, like the finalization of the 45V tax credit rules in the U.S., which will be a major catalyst for the profitability of their hydrogen projects.

- Valuation Discipline: Even for a long-term hold, it’s wise to buy during periods of market pessimism. Use valuation metrics like the P/E ratio and Price-to-Cash-Flow to identify when XOM is trading below its historical averages.

Diversifying with Pocket Option

While investing in a giant like Exxon Mobil offers exposure to a wide range of energy and chemical products, true portfolio diversification is what protects you from risk. As the saying goes, “Don’t put all your eggs in one basket.” Pocket Option is the ideal platform for this, allowing you to build a resilient portfolio from a single account.

- Stocks: Trade not only Exxon but other sectors like tech (Apple, Tesla) and consumer goods (Amazon).

- Commodities: Hedge your energy position by trading precious metals like gold, which often moves inversely to risk assets.

- Forex: Take positions on currency pairs to capitalize on global macroeconomic trends.

- Indices: Gain broad market exposure by trading indices like the S&P 500.

By combining a core holding in a stable, dividend-paying company like Exxon with tactical trades across other asset classes on Pocket Option, you can build a robust energy investment strategy that is prepared for any market condition.

Ready to power up your portfolio and apply these expert insights? The market waits for no one.

FAQ

What is the minimum amount needed to start exxon trading?

The minimum amount depends on your chosen method. For direct stock purchases, you need enough to buy at least one share (approximately $100-120). Some platforms like Pocket Option offer CFD trading with lower minimums. ETFs containing ExxonMobil stock may cost $30-150 per share.

How do exxonmobil trading operations affect stock price?

ExxonMobil's trading operations impact profitability through supply chain optimization and risk management. Successful trading can boost quarterly earnings, potentially increasing stock value. However, trading losses or market disruptions can negatively affect stock performance.

Is exxon trading suitable for beginners?

Beginners can engage in exxon trading, but should start with education about energy markets and ExxonMobil fundamentals. Consider beginning with smaller positions, using demo accounts, or investing through energy ETFs that include ExxonMobil alongside other companies for diversification.

What trading platforms support ExxonMobil stock trading?

Most major brokerages support ExxonMobil stock trading, including Fidelity, Charles Schwab, TD Ameritrade, and Robinhood. For CFD trading, platforms like Pocket Option offer exposure to ExxonMobil price movements without owning the underlying asset.

How often does ExxonMobil pay dividends to shareholders?

ExxonMobil typically pays dividends quarterly (four times per year). The company has a history of dividend payments and has maintained or increased its dividend for many consecutive years, making it popular among income-focused investors.

When to buy Exxon shares?

The timing of an Exxon purchase depends on the investor’s goals. Long-term holders often add shares during oil price downturns to maximize the effect of dividends and buybacks over time. Short-term traders, on the other hand, may prefer to enter positions around earnings releases, OPEC announcements, or technical support and resistance levels. Another common strategy is dollar-cost averaging, which means buying shares at regular intervals to reduce exposure to short-term volatility.

What affects Exxon stock price?

The price of Exxon shares is shaped by a combination of oil and gas market dynamics, including Brent and WTI fluctuations, OPEC+ decisions, and global supply-demand balances. Broader economic conditions such as GDP growth and inflation play a role, as do geopolitical events in energy-producing regions. Company-specific fundamentals, like quarterly earnings, capital spending, and the scale of buyback programs, also contribute significantly to stock performance.

Is Exxon a good stock to buy?

Exxon is widely regarded as a reliable long-term investment. It has the status of a dividend aristocrat with more than 40 consecutive years of dividend increases. The company combines steady cash flows from its oil and gas operations with growing investments in areas like carbon capture and lithium. Analysts currently see Exxon’s fair value around $135–145 per share for 2026–2027, and with dividends yielding 3–4% annually, the stock is often considered a solid option for income-focused investors.

How to trade Exxon stock?

ExxonMobil (XOM) shares can be traded directly on the New York Stock Exchange through a brokerage account. Some investors also prefer indirect methods, such as using ETFs with significant Exxon exposure, options contracts, or CFDs on platforms like Pocket Option. For beginners, the safest approach is to start with a demo account to practice before trading with real money.