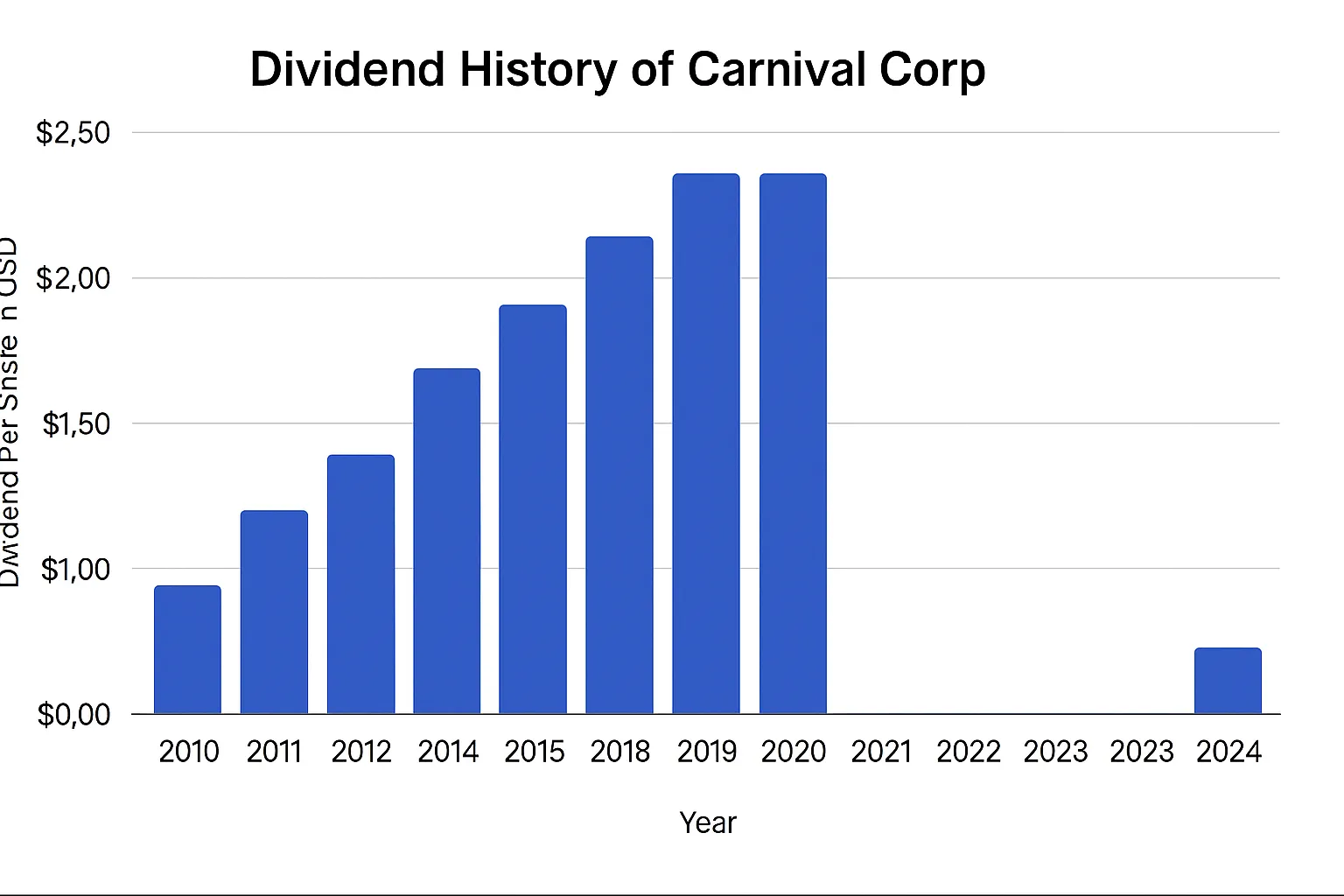

- 2017: $1.60 per share total

- 2018: $2.00 per share total

- 2019: $2.00 per share plus a $0.50 special dividend 🟢

CCL Stock Dividend Fundamentals and Investment Potential

CCL stock dividend offers investors a reliable opportunity to earn passive income amid the cruise industry's ongoing recovery.

CCL Stock Dividend: Essential Information for Carnival Corporation Investors

In an investing world driven by both growth and income, CCL stock dividend has become a compelling focus for investors seeking long-term returns from the travel and leisure sector. With Carnival Corporation leading the global cruise market, understanding its dividend potential is crucial. Even though CCL is not directly tradable on Pocket Option, traders can benefit from monitoring such stocks via our advanced asset tools, learning from market dynamics and incorporating those insights into Quick Trading strategies.

Understanding Carnival Corporation and CCL

Overview of Carnival Cruise Lines

Carnival Cruise Lines, part of the Carnival Corporation portfolio, is one of the largest operators in the cruise industry. With over 90 ships across various global brands, Carnival serves millions of travelers annually. Their wide-ranging destinations and market penetration in North America, Europe, and Asia have made them a pillar of the leisure sector investment landscape.

Despite challenges in recent years, the cruise industry recovery is underway, bolstered by strong booking demand, pent-up travel interest, and loosening global travel restrictions. According to Bloomberg, Carnival’s booking volumes in mid-2025 surpassed pre-pandemic levels for the first time, indicating rising investor confidence.

As a result, the Carnival dividend has regained relevance among income-seeking investors.

Key Metrics for CCL Dividend Investors

Before investing in CCL stock dividend, understanding its metrics is critical:

| Metric | Details |

|---|---|

| Dividend Yield | Historically 3%–4% before 2020 |

| Payout Ratio | Peaked near 80%, now more conservative |

| Ex-Dividend Date | Varies quarterly |

| Dividend Frequency | Typically quarterly |

These numbers provide a quick pulse check on CCL’s dividend sustainability analysis.

📌 Expert Insight: “Carnival has shown remarkable resilience post-2020, but its dividends will remain tied to operational cash flow recovery,” says Danielle Hart, Equity Strategist at Morningstar.

Dividend Overview and History

Current CCL Dividend Details (2025)

As of Q3 2025, Carnival has resumed dividend payouts after suspensions during the pandemic years. The current annualized dividend stands at $0.60 per share, signaling growing confidence in sustainable earnings.

| Quarter | Dividend per Share | Announcement Date | Payment Date |

|---|---|---|---|

| Q1 2025 | $0.15 | Jan 25, 2025 | Feb 15, 2025 |

| Q2 2025 | $0.15 | Apr 27, 2025 | May 15, 2025 |

Historical Highlights

Carnival has a long track record of dividend payouts. Prior to the 2020 suspension, CCL provided steady increases:

These historical benchmarks reflect the firm’s commitment to shareholder value.

Special Dividends

Special dividends like the $0.50 payout in 2019 occur during periods of exceptional profit. While not predictable, they often coincide with operational booms, serving as a morale booster for long-term investors.

Expert Quote: “Special dividends are a strong confidence signal. Carnival only issues them when liquidity reserves are robust,” notes Jim Cramer, host of CNBC’s Mad Money.

Ex-Dividend and Payment Dates

Understanding dividend logistics is essential. The ex-dividend date determines eligibility: if you buy CCL stock on or after this date, you won’t receive the upcoming payout.

| Key Term | Definition |

|---|---|

| Record Date | The company records eligible shareholders |

| Ex-Dividend Date | Buy before this to get the next dividend |

| Payment Date | When funds are distributed to eligible investors |

Investment Strategies with CCL Dividend Stocks

Evaluating CCL Dividend Yield

CCL dividend yield has fluctuated over the years due to pandemic disruptions. Here’s a comparative look:

| Year | Avg Stock Price | Dividend | Yield |

|---|---|---|---|

| 2018 | $60 | $2.00 | 3.3% |

| 2019 | $50 | $2.50* | 5.0% |

| 2025 | $15 | $0.60 | 4.0% |

*Includes special dividend

Tips for Investing in Carnival Corp

- ✅ Diversify across travel, energy, and tech sectors

- 📊 Use platforms with real-time data like Yahoo Finance and TipRanks

- ⏰ Align entry with ex-dividend dates

- 🔎 Track macro indicators affecting the tourism stock analysis

💡 Pocket Option offers trading on 100+ assets 24/7, including top travel and hospitality stocks — all with a free demo and low deposit.

🎯 Insight: For passive income seekers, mixing dividend-paying stocks like CCL with high-frequency trading on Pocket Option can diversify income streams and enhance returns — especially when supported by smart tools and live market insights.

CCL Dividend Growth Potential

What Drives Growth?

- Cruise capacity returning to full fleet

- Rising ticket prices

- Strong onboard spending

- Cost optimization

CCL’s reinvestments into modern ships and sustainable technologies support long-term profit margin expansion, which is crucial for future cruise line dividends.

Dividend Sustainability Analysis

CCL’s payout ratio has been reset post-pandemic. It now hovers around 35%, giving room for dividend growth without compromising reinvestment needs.

| Year | EPS | Dividend | Payout Ratio |

|---|---|---|---|

| 2019 | $4.20 | $2.50 | 59% |

| 2025 | $1.70 | $0.60 | 35% |

Market Trends and CCL Stock Performance

How Market Trends Influence CCL

The travel stock dividends segment is highly sensitive to economic cycles:

- High inflation can suppress bookings

- Oil prices impact fuel costs

- Health crises affect cruise demand

Yet, cruise lines historically outperform during post-recession expansions, offering recovery-driven returns.

📈 Barron’s 2025 cruise report projects 12–15% annual stock gains through 2027, making leisure investments a resilient choice.

Forecasting Dividend Increases

Given the forecasted revenue growth and stabilized operations, analysts like Zacks and CFRA expect CCL to raise dividends by 10–20% over the next 12 months.

FAQ

What is the current CCL stock dividend yield?

Currently, Carnival Corporation has suspended its dividend payments, resulting in a 0% dividend yield. The company halted dividends in 2020 due to financial challenges and has not yet reinstated them as it focuses on strengthening its balance sheet.

When did Carnival Corporation last pay a dividend?

Carnival Corporation last paid a quarterly dividend in early 2020 before suspending payments. The company had previously maintained a consistent dividend payment history for many years prior to this suspension.

What conditions must be met for CCL to reinstate dividends?

For dividend reinstatement, Carnival likely needs to achieve consistent profitability, substantially reduce its debt load, generate positive free cash flow, and see stable booking patterns. Financial analysts suggest these conditions may take several quarters or years to achieve.

How does CCL's dividend history compare to other cruise lines?

Similar to other major cruise operators like Royal Caribbean, Carnival maintained regular dividend payments before 2020. The industry-wide dividend suspensions were a direct response to unprecedented disruptions, with no major cruise line yet reinstating full dividend programs.

What is CCL dividend yield?

As of Q3 2025, the CCL dividend yield is approximately 4.0%, based on a $0.60 annual payout and a $15 stock price. This makes CCL an attractive option for investors focused on cruise line dividends and leisure sector investment strategies.

Is CCL dividend safe?

CCL’s dividend is considered reasonably safe for the current payout level. The company maintains a payout ratio of around 35%, which provides a buffer for sustainability while supporting reinvestment. However, as with all travel stock dividends, external market risks should be considered.

When is CCL dividend payment?

CCL typically distributes dividends on a quarterly basis. For 2025, payments were made in February and May, with future dates to be announced in advance. To qualify, investors must own the stock before the ex-dividend date.

Does CCL pay dividends?

Yes, as of 2025, Carnival Corporation (CCL) has resumed dividend payments after a temporary suspension during the pandemic. The company currently pays a quarterly dividend of $0.15 per share, reflecting its ongoing financial recovery and commitment to shareholder returns.

Final Thoughts

Investing in the CCL stock dividend can be an effective strategy for both income and growth. While direct CCL trading isn’t available on Pocket Option, the platform empowers you to track and trade top-performing travel and tourism assets with ease. 👉 Whether you’re exploring cruise line dividends or diversifying your leisure sector investment, Pocket Option offers smart tools for informed decision-making.

Start trading