- Analyze the stock’s performance history

- Assess investor sentiment post-split

- Determine if the split aligns with long-term objectives

AMC 10 to 1 Stock Split: Complete Analysis for Investors

The upcoming AMC 10 to 1 stock split, specifically a 1-for-10 reverse stock split, has garnered significant attention from investors and the financial markets. As AMC Entertainment prepares for this transition, it's essential for shareholders to understand what this means for their investments, particularly regarding the implications for AMC common stock and the number of shares they hold.

Article navigation

Understanding the Reverse Stock Split

A reverse stock split is a corporate action that consolidates the number of existing shares into fewer, more valuable shares. In the case of AMC, the company will complete a 1-for-10 reverse stock split, meaning that every 10 shares of AMC common stock will be converted into one new share. This action is often viewed as a way to boost the stock price, making it more attractive to investors and aligning with listing requirements on the New York Stock Exchange.

What is a Reverse Stock Split?

A reverse stock split is the opposite of a traditional stock split, where a company increases its number of outstanding shares while decreasing the share price accordingly. With a reverse split, AMC Entertainment aims to improve the share price of AMC common stock, which has faced volatility in recent months. This strategic move is intended to create a healthier perception of the stock in the financial markets, potentially drawing in more institutional investors.

“Reverse stock splits can be useful in resetting investor expectations and attracting new interest, particularly when done for strategic positioning,” — David Trainer, CEO of New Constructs, equity research firm.

How Does a Reverse Split Work?

The mechanics of a reverse split are fairly straightforward. For AMC shareholders, this means that if they currently own 100 shares of AMC common stock before the split, they will hold 10 shares after the 1-for-10 reverse split is completed on August 24, 2023. The total market value of their investment remains the same, but the share price increases proportionately. This adjustment is crucial during times when the stock price needs stabilization to prevent further declines.

Reasons for Conducting a Reverse Stock Split

Companies like AMC Entertainment may pursue a reverse stock split for several reasons. One primary motivation is to enhance the stock price, which can help regain compliance with stock exchange listing requirements and attract new investors. Additionally, it may improve the overall market perception of the AMC stock, particularly after periods of decline. For shareholders, understanding these reasons is vital as they navigate potential impacts on their investments, especially with the upcoming conversion of preferred equity, or APE shares, into common stock.

The 1-for-10 Reverse Stock Split Explained

The amc stock reverse split date is officially set for August 24, 2023, marking a key milestone for both institutional and retail investors tracking AMC Entertainment’s restructuring efforts.

Details of the 1-for-10 Reverse Split

The 1-for-10 reverse stock split planned by AMC Entertainment is a significant event for shareholders, occurring on August 24, 2023. This means that for every 10 shares of AMC common stock currently held, shareholders will receive one new share. This type of reverse split is intended to consolidate the number of shares and increase the share price, ultimately enhancing investor perception and maintaining compliance with the New York Stock Exchange listing requirements. This strategy may also positively influence the future outlook of AMC stock, especially as the company seeks to stabilize its financial position.

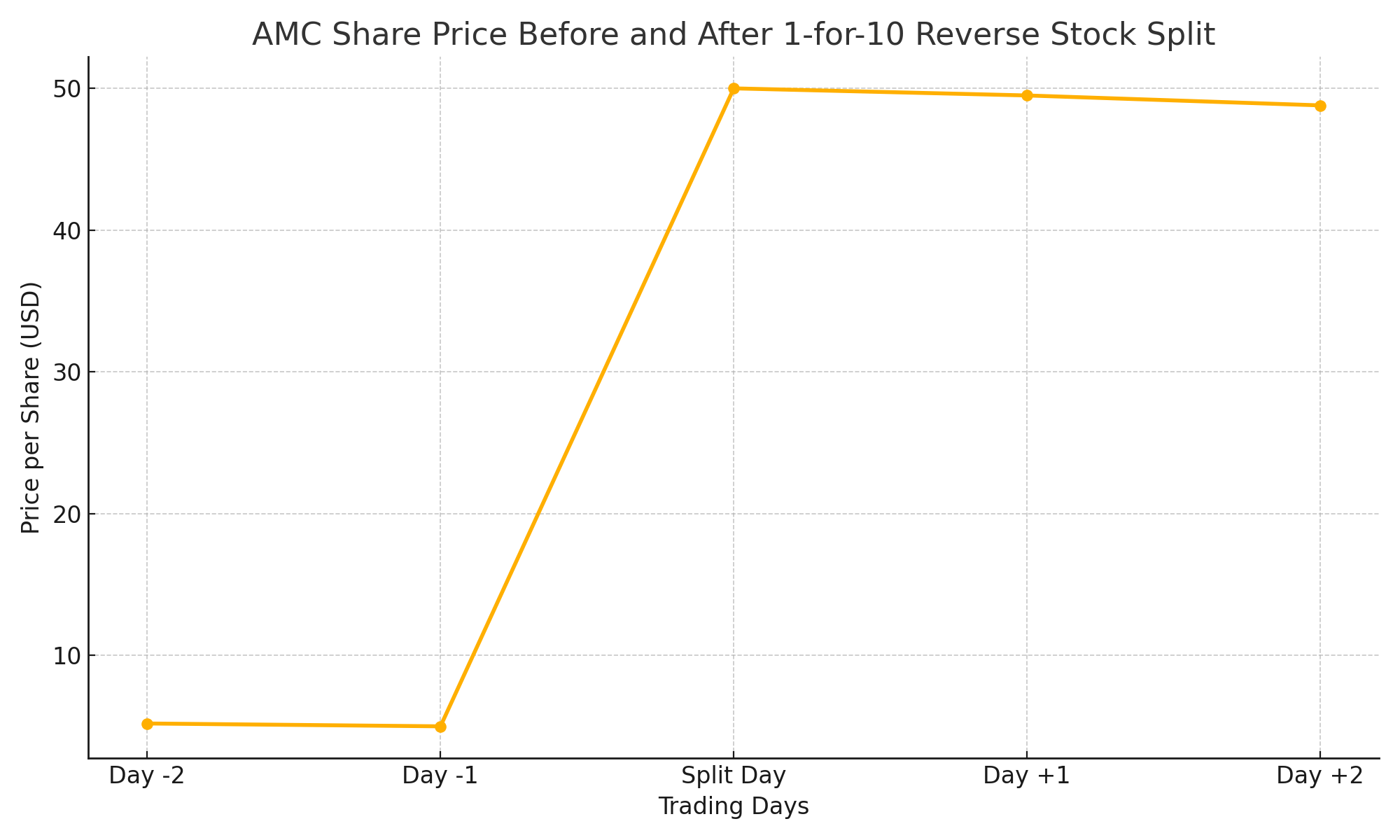

Impact on AMC Stock Price

The impact of the 1-for-10 reverse stock split on AMC’s stock price is a critical consideration for investors. While the total market value of an investment in AMC common stock remains unchanged immediately following the split, the share price is expected to rise proportionately. This can lead to a more favorable market perception, potentially attracting new investors who may have previously shied away from lower-priced shares. Moreover, the stabilization of the stock price through this reverse split may also mitigate the risk of further declines, which is crucial for the long-term viability of AMC Entertainment in the competitive landscape of the entertainment industry.

Market Reactions and Investor Sentiment

The market reactions to the announcement of the reverse stock split have been mixed, reflecting varying investor sentiment. Many shareholders are optimistic that the consolidation of AMC shares will enhance the value of their holdings, while others express concerns about the implications of such a move. Discussions across platforms like Reddit indicate that some investors view the reverse split as a necessary step towards improving the company’s financial health. As AMC moves towards the completion of the reverse stock split and conversion of preferred equity, it will be essential to monitor how these changes affect overall investor sentiment and the stock’s performance in the financial markets.

AMC Entertainment and APE: What You Should Know

Relationship Between AMC and APE Shares

The relationship between AMC common stock and APE shares is crucial for investors to understand, especially as the split approaches. APE shares, or AMC preferred equity units, were introduced to raise capital while providing shareholders with a distinct asset class. Following the reverse split, the conversion of APE shares into AMC common stock will play a significant role in determining the stock price and market dynamics. Investors should monitor how this conversion impacts their overall holdings and the perceived value of both classes of shares as they navigate the financial markets.

Effects of the Reverse Split on APE

The effects of the reverse stock split on APE shares could be profound, as the conversion process is expected to alter the landscape for both AMC common stock and APE units. As AMC Entertainment moves forward with consolidating shares, the APE shares will transition into common stock, impacting the total number of shares available in the market. This could lead to fluctuations in share price and investor sentiment, especially if APE holders perceive their units as a stepping stone to enhanced value through conversion. Understanding these dynamics will be vital for shareholders as they assess the future of their investments.

Future Outlook for AMC and APE Investors

The future outlook for AMC and APE investors hinges on the successful execution of the reverse split and subsequent conversions. With the share price anticipated to stabilize post-split, there is potential for renewed investor interest, particularly from institutional players who may have previously avoided lower-priced shares. Furthermore, the overall financial health of AMC Entertainment will be under scrutiny as the company navigates these changes. Investors should remain vigilant and informed about market conditions and their implications for both AMC common stock and APE shares as they plan their investment strategies.

Is it Better to Buy After a Stock Split?

Buying after a stock split or reverse stock split depends on investor goals. Post-split, the perceived value often improves, which may invite new interest. However, the fundamentals of the company remain unchanged. It’s important to:

A reverse stock split like the AMC 10 to 1 stock split may boost visibility, but careful evaluation is key before making buy decisions.

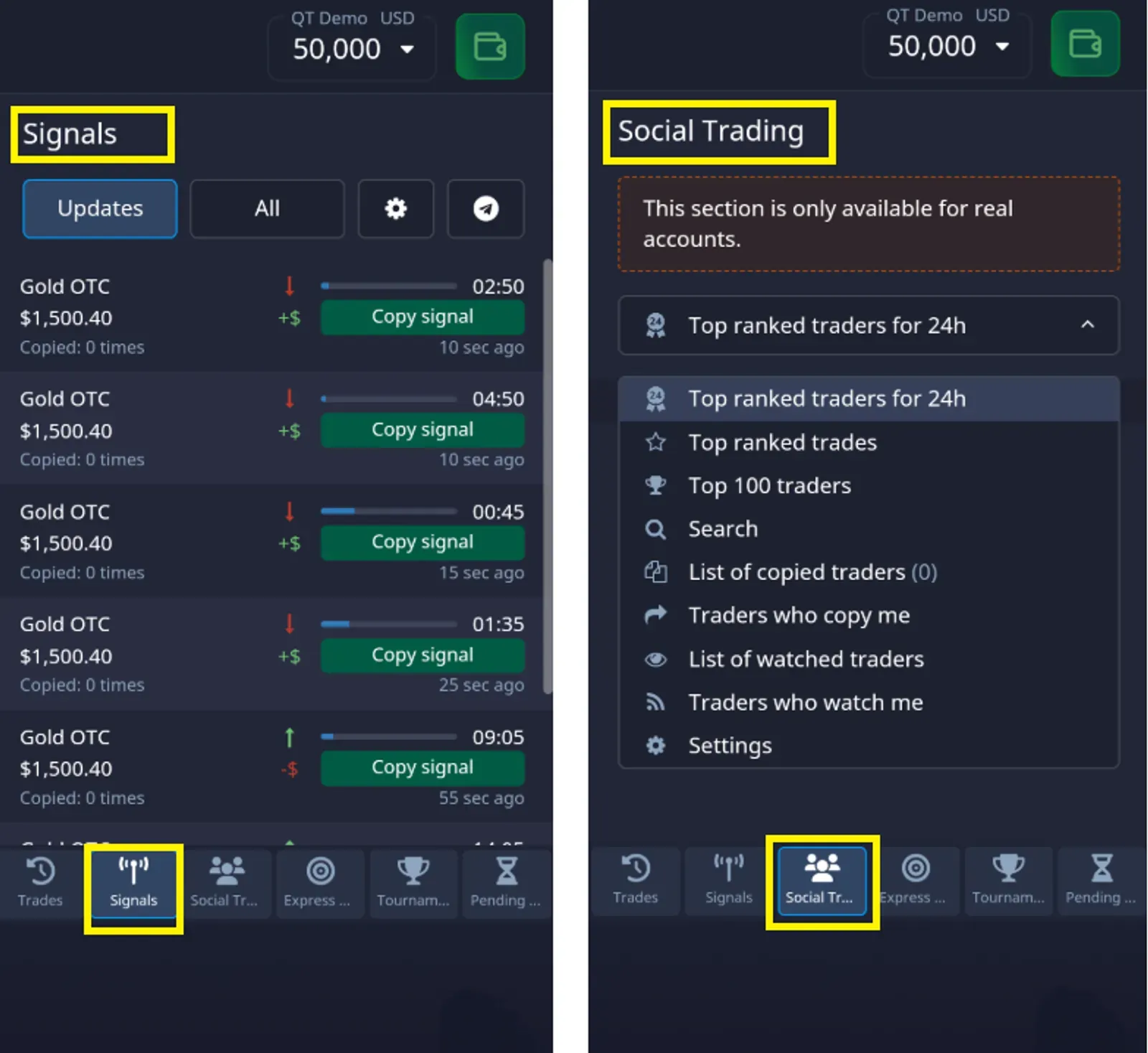

Pocket Option: A Unique Trading Platform

Pocket Option is a simplified trading platform where you don’t need to buy or sell assets directly — instead, you simply forecast whether the price will go up or down. If your forecast is correct, you can earn up to 92% profit. The platform is available online through your browser, with no need to download anything. Key features include:

| Feature | Benefit |

|---|---|

| Trades from $1 | Manageable risk for beginners and pros alike |

| Copy trading | Follow strategies of successful traders |

| Instant execution | Real-time reaction to stock news and splits |

| OTC assets availability | Trade even on weekends or outside stock market hours |

“I’ve used Pocket Option during volatile events like the AMC reverse stock split—it’s fast, reliable, and gives real-time analysis tools.” – Luis R., trader

Considerations for Investors

Potential Risks of the Reverse Stock Split

While the reverse stock split may offer advantages, it also carries potential risks that investors should consider. One significant concern is the possibility of the stock price falling post-split, as seen in various historical cases where companies experienced declines after similar actions. Investors must be aware that the consolidation of shares does not inherently guarantee an increase in value. Moreover, if market perception remains negative, this could hinder the intended benefits of the reverse split and lead to volatility in AMC shares, making it essential to approach this transition cautiously.

Long-term vs Short-term Investment Strategies

Investors must weigh their long-term versus short-term strategies in light of the impending reverse stock split. For short-term traders, the immediate aftermath of the split could present opportunities to capitalize on price fluctuations. In contrast, long-term investors may need to focus on the broader implications of AMC’s financial health and market positioning beyond the split. By considering their investment goals, shareholders can develop strategies that align with their risk tolerance and expectations for AMC common stock’s performance in the evolving financial landscape.

- Short-term benefits: volatility-based gains

- Long-term concerns: market perception, company fundamentals

- Mixed reactions from analysts and communities like Reddit

Advice for Navigating AMC Stock Post-Split

Navigating AMC stock post-split requires a strategic approach and careful monitoring of developments surrounding the company. Investors should stay informed about key dates, such as the record date for the reverse stock split and the subsequent conversion of APE shares. Building a diversified portfolio that includes AMC shares may also mitigate risks associated with potential volatility. Engaging in discussions on platforms like Reddit can provide insights from other investors and enhance understanding of market sentiment. Ultimately, maintaining a long-term perspective while being adaptable to market changes will be crucial for successfully managing investments in AMC Entertainment.

Conclusion

The AMC 10 to 1 stock split, officially known as the AMC APE reverse stock split, is a pivotal moment for shareholders. While it introduces potential for greater market appeal and compliance advantages, it also requires careful consideration of risks, investor strategy, and broader market conditions. Trading platforms like Pocket Option provide a flexible way to engage with events like this split.

Join the conversation and gain more insight—Discuss this and other topics in our community!

FAQ

Does the AMC 10 to 1 stock split change the value of my investment?

No, the stock split doesn't change your investment's total value. If you owned 10 shares worth $5 each before the split (total $50), you would own 1 share worth $50 after the split. The proportional ownership of the company remains the same.

What happens if I own a number of shares not divisible by 10?

If you owned a number of shares not divisible by 10 (like 25 shares), you would typically receive 2 shares plus cash for the fractional share value (0.5 shares) after the 10-to-1 reverse split. Most brokers don't handle fractional shares and pay cash equivalents instead.

Is a reverse stock split like the AMC 10 to 1 stock split good or bad for investors?

A reverse stock split itself is neither inherently good nor bad. It's a neutral corporate action that doesn't affect total investment value. However, it can signal underlying company issues that necessitated the split, and market perception can affect post-split performance.

How does the AMC APE reverse stock split relate to the main AMC stock split?

The AMC APE (AMC Preferred Equity) reverse stock split was part of AMC's broader financial restructuring strategy alongside the 10-to-1 reverse split of common stock. Both actions were designed to address different aspects of the company's capital structure and market positioning.

Will AMC's stock price automatically go up after the reverse split?

While the stock price mathematically increases immediately after a reverse split (by the split ratio), this doesn't guarantee sustained price appreciation. Long-term price performance depends on business fundamentals, market conditions, and investor sentiment rather than the split itself.