- If CPI is higher than expected: It signals that inflation is heating up. To cool the economy down, the SARB might consider raising interest rates. Higher interest rates make holding the Rand more attractive to foreign investors, which increases demand and strengthens the currency (e.g., USD/ZAR goes down).

- If CPI is lower than expected: It suggests inflation is under control or slowing. This gives the SARB room to potentially cut interest rates to stimulate the economy. Lower interest rates can make the Rand less attractive, causing it to weaken (e.g., USD/ZAR goes up).

What Time is CPI in South Africa: A Crucial Strategy for Forex Traders

According to the latest data from Statistics South Africa (Stats SA), the Consumer Price Index is released monthly at 11:30 AM SAST, creating crucial trading opportunities that savvy forex traders capitalize on within minutes of publication.

Article navigation

- What Time is CPI Released in South Africa: Complete Trading Guide

- CPI Release Schedule and Timing in South Africa

- Understanding CPI Impact on Forex Trading

- Historical CPI Release Patterns and Market Response

- Your Trading Cockpit: Preparing with Pocket Option

- Strategic Trading Approaches for CPI Releases

- Risk Management During CPI Announcements

- Technology and Platform Considerations

What Time is CPI Released in South Africa: Complete Trading Guide

Ever watched a currency chart go absolutely wild and wondered what just happened? More often than not, a major economic data release is the culprit. For traders focused on the South African Rand (ZAR), one of the most explosive events is the monthly Consumer Price Index (CPI) announcement. Understanding the exact timing of South Africa’s CPI release is fundamental for forex traders who want to capitalize on the predictable volatility it creates.

The CPI South Africa release schedule follows a precise monthly pattern that directly impacts ZAR trading and broader currency volatility across African markets. For traders using quick and responsive trading platforms, the CPI announcement represents one of the most significant economic events that can trigger substantial price movements. This comprehensive guide explores everything you need to know about CPI release timing, market impact, and strategic trading approaches to get you ready for action.

CPI Release Schedule and Timing in South Africa

Statistics South Africa (Stats SA) is the official body that publishes the Consumer Price Index data. This happens monthly, typically falling on the third Wednesday of the month that follows the reference period. The release is incredibly precise: it occurs at 11:30 AM South African Standard Time (SAST). Think of it as a recurring appointment in your trading calendar. A great practical tip is to set a recurring alarm on your phone for 11:15 AM SAST on the third Wednesday of each month. This simple habit ensures you’re always settled and ready before the market moves.

Key Timing Information: The CPI data is released at 11:30 AM SAST. This is equivalent to 9:30 AM UTC during standard time. Be mindful of daylight saving changes in other regions, which could shift this to 10:30 AM UTC.

CPI Release Time Conversions (2024-2025)

| Time Zone | Local Time | Trading Session Impact |

|---|---|---|

| South Africa (SAST) | 11:30 AM | Mid-morning local trading |

| London (GMT) | 9:30 AM | Early European session |

| New York (EST) | 4:30 AM | Pre-market hours |

| Tokyo (JST) | 6:30 PM | Evening Asian session |

“The CPI release at 11:30 AM SAST is strategically timed to capture maximum market attention during the overlap of African and European trading sessions, creating optimal conditions for ZAR volatility.”Dr. Sarah Mitchell, Senior Economist at African Markets Research Institute, 2025

Understanding CPI Impact on Forex Trading

So, why does this one number cause such a stir? The Consumer Price Index is the primary measure of inflation. It directly influences the monetary policy decisions of the South African Reserve Bank (SARB). Here’s the simple logic:

When CPI figures exceed or miss market expectations, it often signals these potential interest rate adjustments, strengthening or weakening the Rand against major currencies.

Key Trading Considerations:

- Pre-release positioning: The real buzz begins 30-60 minutes before the 11:30 AM release. You’ll see volatility increase as traders place their bets.

- Immediate reaction: The first 5-15 minutes after the release are pure chaos and opportunity. This is where the most significant price swings occur.

- Sustained impact: The effects of a major CPI surprise aren’t over in 15 minutes. The data can set the tone and influence ZAR trends for the next several trading sessions.

- Cross-currency effects: Keep an eye on USD/ZAR, EUR/ZAR, and GBP/ZAR. These pairs are known for their significant movement during the release.

When the clock strikes 11:30 AM SAST, every second counts. ⚡️ With Pocket Option’s rapid execution, you’re equipped to act on CPI data the moment it drops, not seconds later when the opportunity has passed.

Historical CPI Release Patterns and Market Response

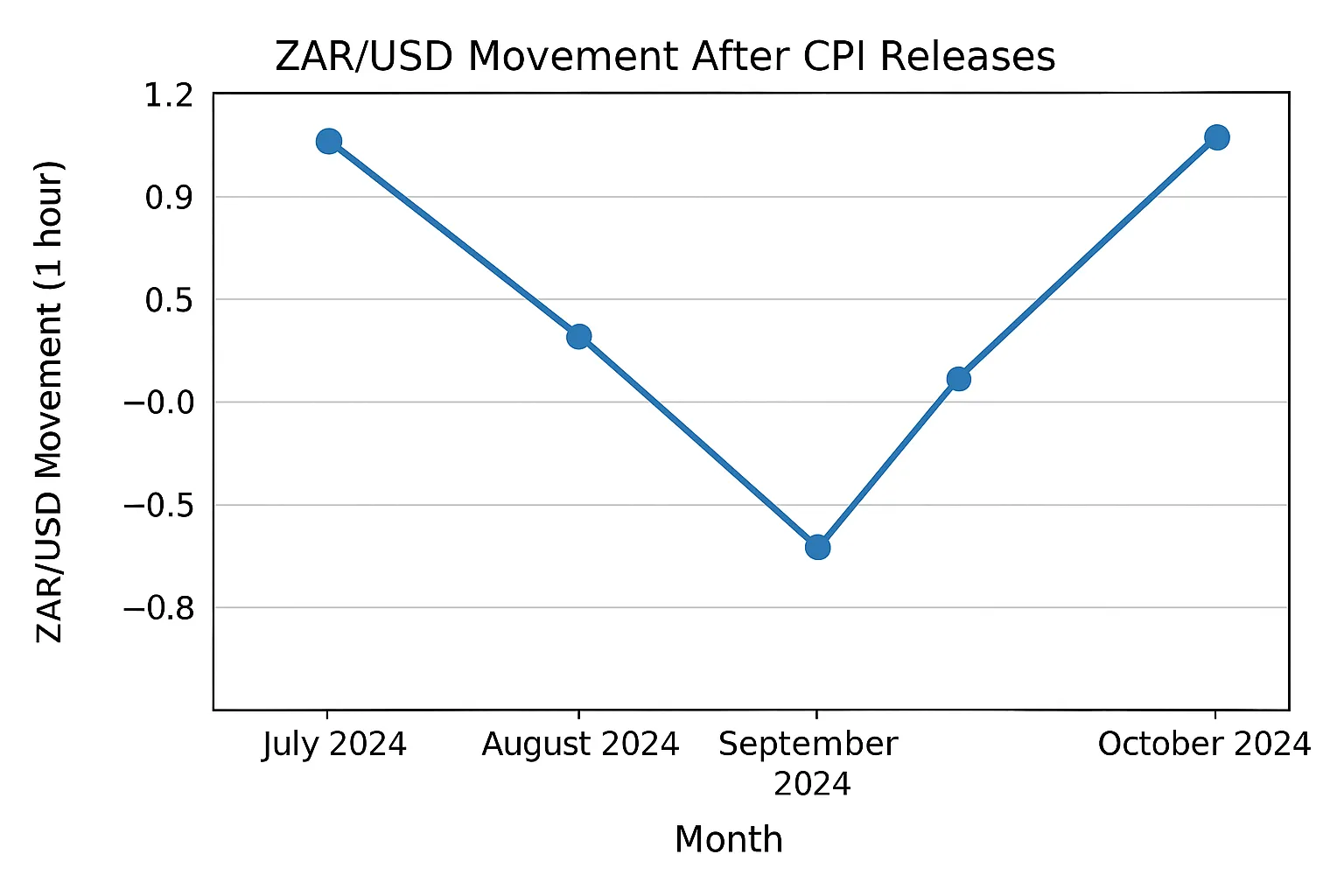

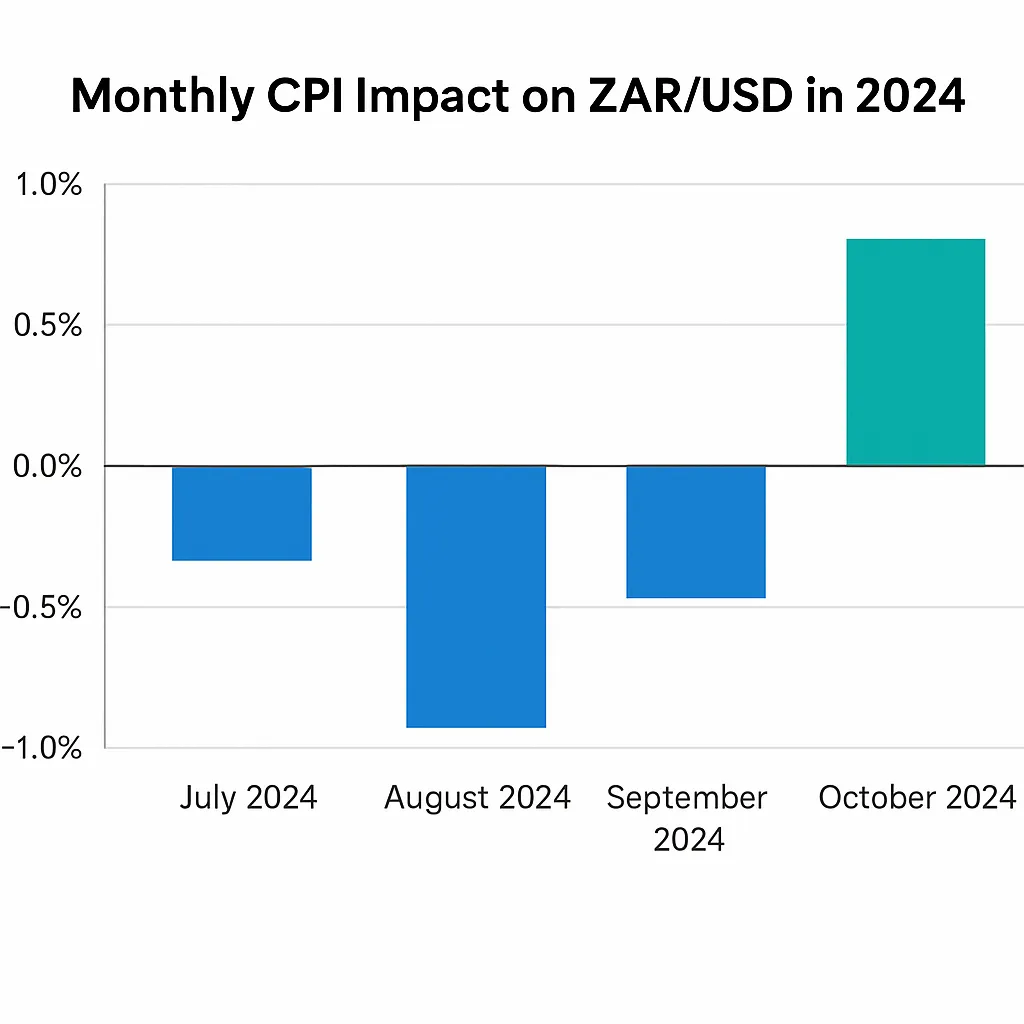

Analyzing historical data helps you understand the market’s personality. Look at the table below. In October 2024, the actual CPI was lower than the market expected, signaling cooling inflation. The market reacted by strengthening the ZAR, likely anticipating that the central bank wouldn’t need to act aggressively to fight inflation. Use this historical data not as a crystal ball, but as a guide to understanding market psychology and potential reaction patterns.

Recent CPI Impact Analysis (2024)

| Month | CPI Reading | Market Expectation | ZAR/USD Movement (1 hour) |

|---|---|---|---|

| October 2024 | 2.8% | 3.1% | +1.2% (ZAR strengthened) |

| September 2024 | 3.8% | 3.5% | -0.8% (ZAR weakened) |

| August 2024 | 4.4% | 4.3% | -0.5% (ZAR weakened) |

| July 2024 | 4.6% | 4.8% | +0.9% (ZAR strengthened) |

“The 11:30 AM release time creates a perfect storm for volatility as it coincides with peak European trading activity while African markets remain highly liquid.”Marcus Thompson, Head of FX Strategy at Cape Town Trading Solutions, 2025

Your Trading Cockpit: Preparing with Pocket Option

While understanding the CPI is crucial, having the right tools is what turns knowledge into potential profit. A prepared trader is a confident trader, and your platform should be your fortress. Here’s how Pocket Option equips you for high-volatility events:

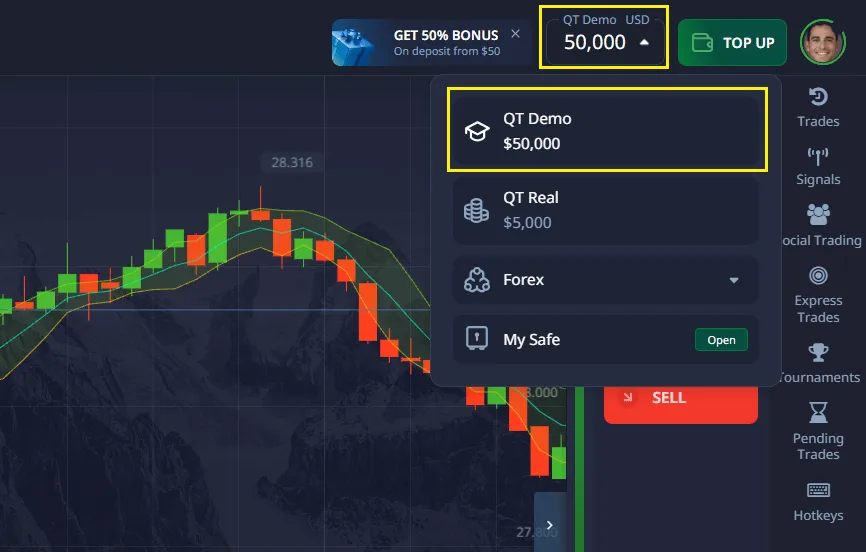

- Start Small, Dream Big: You don’t need a massive bankroll to get started. Begin your live trading journey with a minimum deposit of just $5 (note that this can vary based on your region and chosen payment method).

- Practice Makes Perfect: Before you trade a live CPI event, hone your strategy risk-free on a $50,000 demo account. Use it to test your reaction times, practice setting stop-losses during volatile spikes, and get a feel for the market’s rhythm without risking a single dollar.

- A World of Opportunity: With over 100+ assets, your opportunities aren’t limited to a single event. While you’re watching ZAR pairs on CPI day, you can also find setups in stocks, indices, commodities, and other currencies.

- Knowledge is Power: Dive into our free educational hub. It’s packed with strategies, articles, and video tutorials that can help you build a solid trading foundation, from understanding forex basics to advanced technical analysis for news trading.

- Compete and Win: Feel like your strategy is sharp? Join regular tournaments to test your skills against other traders from around the globe and compete for a prize fund.

Even if a specific ZAR pair isn’t your main focus, the principles of trading news events are universal. The resources on Pocket Option are designed to make you a more prepared and confident trader for any major economic announcement.

Don’t just guess, strategize! 🧠 Pocket Option’s free knowledge base and video tutorials are your secret weapon for building a winning game plan before the next CPI release.

Strategic Trading Approaches for CPI Releases

Successful CPI trading is 90% preparation and 10% execution. The monthly release pattern allows you to develop a systematic approach that you can refine over time.

Pre-Release Preparation Strategies

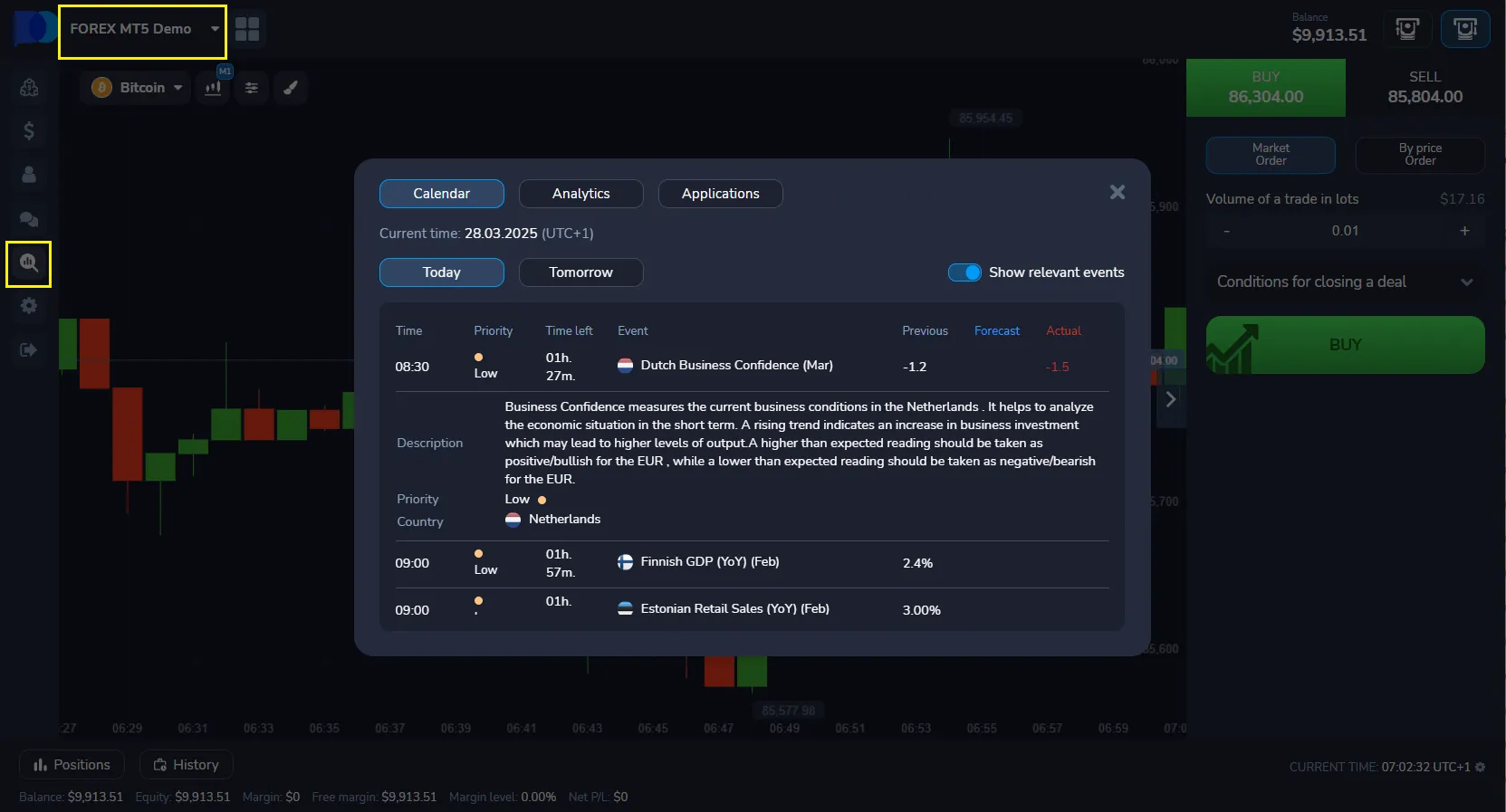

- Economic calendar monitoring: Know the exact date and time weeks in advance. Mark it, and check it daily in the week leading up to the release.

- Consensus analysis: What does the market expect? Look for the “consensus” or “forecast” figure on financial news sites. The bigger the difference between the forecast and the actual number, the bigger the potential market move.

- Technical setup: Before the news hits, identify key support and resistance levels on the ZAR pair charts. These levels can act as potential targets or turning points after the release. Have your trend lines and key moving averages drawn.

- Risk parameters: This is non-negotiable. Decide your maximum position size and where your stop-loss will be before you enter a trade. Emotions run high during volatile moves; your pre-defined plan is your anchor.

- Platform readiness: Be logged into your trading platform at least 15 minutes before the release. Ensure your internet connection is stable and you’re ready to execute.

“The key to CPI trading success lies in preparation and discipline. Having a clear plan before 11:30 AM SAST is non-negotiable.”Jennifer Adams, Professional Forex Trader and Author, 2025

Risk Management During CPI Announcements

CPI releases can create “slippage” and extreme volatility that can humble even the most experienced traders. Effective risk management is what separates gamblers from traders.

- Position sizing: It’s wise to reduce your standard position size by 30-50% when trading high-impact news. This protects your capital from unexpectedly violent swings.

- Stop-loss placement: Use wider stops than you normally would. The initial price swings can be erratic and might trigger tight stops prematurely before the price settles into a clearer trend.

- Multiple timeframe analysis: Keep an eye on the 1-minute, 5-minute, and hourly charts simultaneously. The short-term charts show you the immediate reaction, while the longer-term charts help you see the bigger picture and where the price might be headed.

- News flow monitoring: Watch for any additional commentary from Stats SA officials or immediate analysis from major news outlets, as this can add to the market’s momentum.

Professional Tip: Set alerts 30 minutes before the 11:30 AM SAST release time to ensure you’re prepared for the market reaction, regardless of your global location.

Nervous about trading the news? 🤔 Practice your CPI strategy on the Pocket Option $50,000 demo account. It’s the perfect sandbox to build confidence without the risk!

Technology and Platform Considerations

The speed of the CPI market reaction demands a platform that won’t lag or freeze. This is where a robust platform is non-negotiable. Milliseconds matter, and a delay can be the difference between a profitable trade and a loss. Pocket Option is engineered for stability and speed, especially during high-traffic events, ensuring your orders are executed when you need them to be.

Modern trading platforms offer features specifically designed for news trading, including built-in economic calendars, volatility alerts, and rapid execution capabilities. As Trading Technology Specialist Robert Chen notes, “Platform stability during CPI releases separates professional-grade trading environments from amateur setups. Milliseconds matter when trading inflation data,” (2025).

“Understanding the 11:30 AM SAST release pattern gives South African traders a home-field advantage that shouldn’t be underestimated.”Patricia Williams, Senior Market Analyst at Johannesburg Financial Services, 2025

With the right preparation, risk management, and platform, traders anywhere in the world can leverage this key event.

FAQ

What is CPI and why does it matter for forex traders?

Consumer Price Index (CPI) measures inflation by tracking the change in prices of goods and services. For forex traders, CPI data directly influences central bank policy decisions, making it a crucial driver of currency strength and volatility, particularly for the South African Rand.

What trading strategies work best during CPI releases?

Effective strategies include pre-positioning based on consensus expectations, breakout trading immediately after release, and volatility trading using straddle approaches. Risk management is paramount, with reduced position sizes and wider stop-losses recommended.

How should I manage volatility after CPI news in South Africa?

Monitor the initial market reaction for 15-30 minutes, avoid overtrading in the immediate aftermath, use trailing stops to protect profits, and watch for potential reversal patterns as the initial volatility subsides.

Can CPI data from South Africa affect other African currencies?

Yes, South African CPI can influence regional currencies due to South Africa's economic prominence in the region. The ZAR often serves as a proxy for African emerging market sentiment, affecting currencies like the Botswana Pula and Namibian Dollar.

What time zone adjustments should international traders consider?

International traders must convert 11:30 AM SAST to their local time zones. Remember that South Africa doesn't observe daylight saving time, so the UTC offset remains constant at +2 hours year-round, while other regions may shift.

How far in advance are CPI release dates announced?

Stats SA typically publishes the release calendar at the beginning of each year, providing traders with monthly CPI announcement dates well in advance. This allows for comprehensive planning and strategy development around these important economic events.

Where can I find the latest CPI release schedule for South Africa?

Statistics South Africa (Stats SA) publishes the official release calendar on their website. Additionally, major economic calendars from Bloomberg, Reuters, and trading platforms typically list the exact dates and times for upcoming CPI announcements.

How does CPI impact ZAR/USD trading specifically?

Higher-than-expected CPI readings typically strengthen the ZAR against the USD as markets anticipate potential interest rate increases by the South African Reserve Bank. Lower readings often weaken the ZAR as they suggest reduced likelihood of hawkish monetary policy.

CONCLUSION

Understanding the precise timing of CPI releases in South Africa—every month at 11:30 AM SAST—provides forex traders with a significant strategic advantage. This knowledge, combined with proper preparation, risk management, and platform selection, can transform CPI announcements from uncertain market events into calculated trading opportunities. The Consumer Price Index remains one of the most influential economic indicators for ZAR trading, offering both experienced traders and newcomers the chance to capitalize on inflation-driven market movements. As South African economic data continues to impact regional and global markets, staying informed about CPI timing and market reaction patterns becomes increasingly valuable. Success in CPI trading requires discipline, preparation, and the right tools. Whether you're trading major currency pairs or exploring quick trading opportunities, understanding these economic fundamentals and their precise timing creates the foundation for informed trading decisions. As global markets continue to evolve and South Africa's economic landscape adapts to new challenges, the importance of timely, accurate economic data interpretation will only grow. Traders who master the rhythm of CPI releases and their market implications position themselves for sustained success in the dynamic world of forex trading.

Learn More Trading Strategies