- MetaTrader 5

- TradingView with Pine Script

- Pocket Option Trading Signal Bot

- Python (pandas, NumPy, backtrader)

The Best Trading Strategies Books to Improve Your Trading Results

Mastering the markets requires more than instinct — it demands structure, discipline, and proven knowledge. In this article, we explore the best trading strategies books that offer traders of all levels the tools and systems to build consistency, manage risk, and adapt to evolving financial trends.

Article navigation

The Best Trading Strategies Books: Market Analysis Methods for Success

In the world of trading, understanding various strategies is essential for achieving financial freedom. This article delves into the best trading strategies books, offering a comprehensive guide to methods that can lead to successful trading. Whether you are a beginner or a seasoned trader, these resources can enhance your trading skills and knowledge.

Top 10 Best Trading Strategy Books for Traders of All Levels

Here are ten highly recommended trading strategies books that consistently rank among the best resources for traders:

| Rank | Title | Author | Key Strength |

|---|---|---|---|

| 1 | Trading in the Zone | Mark Douglas | Psychology and mental discipline |

| 2 | Reminiscences of a Stock Operator | Edwin Lefèvre | Timeless market insights |

| 3 | The New Trading for a Living | Dr. Alexander Elder | Comprehensive strategies and risk management |

| 4 | Technical Analysis of the Financial Markets | John J. Murphy | Definitive technical guide |

| 5 | Encyclopedia of Chart Patterns | Thomas Bulkowski | Detailed chart pattern analysis |

| 6 | A Beginner’s Guide to Forex Trading | Matthew Driver | Introductory forex techniques |

| 7 | Come Into My Trading Room | Dr. Alexander Elder | Trading plan development |

| 8 | Japanese Candlestick Charting Techniques | Steve Nison | In-depth candlestick analysis |

| 9 | Market Wizards | Jack D. Schwager | Interviews with top traders |

| 10 | The Art of Trading | Christopher Tate | Blend of psychology and techniques |

These titles represent the best books on trading systems due to their clarity, expert authorship, and practical frameworks.

Understanding Trading Strategies

Trading strategies are systematic approaches that traders use to make informed decisions in the financial markets. They encompass various styles, including day trading, swing trading, and algorithmic trading. By understanding these strategies, traders can tailor their approaches to fit their goals and risk tolerance, ultimately increasing their chances of success in the stock market.

What is a Trading Strategy?

A trading strategy is a predefined set of rules and guidelines that a trader follows to execute trades. These strategies can be based on technical indicators, market analysis, or trading psychology. By adhering to a well-structured trading plan, traders can manage their risks and improve their overall performance in the financial markets.

Expert Insight

“Successful traders treat their methods as businesses. They follow consistent systems, regardless of the market mood.” — Paul Tudor Jones

Pocket Option and Trading Strategy Testing

Pocket Option supports traders by offering an intuitive platform with access to Quick Trading, technical analysis tools, copy trading features, and a demo account. The platform is compatible with desktop and mobile devices and includes real-time market charts and trading signals.

Even those following the best books on trading systems can refine their approach using Pocket Option’s demo and live modes. Thanks to real-time charts, technical indicators, and quick trade features, traders can simulate and analyze different systems directly on the platform.

Day Trading and Swing Trading Strategies

Understanding day trading and swing trading strategies is crucial for traders looking to capitalize on short-term market movements. Each trading style requires a specific approach, including effective risk management and technical analysis. New traders should familiarize themselves with these strategies to enhance their trading performance.

Latest News

As of Q2 2025, institutional interest in swing trading has risen, with hedge funds deploying short-term strategies in sectors with high volatility, such as AI tech and commodities.

Advanced Strategies for Experienced Traders

As traders gain experience, they may seek advanced strategies to further enhance their trading performance. This can include algorithmic trading, options trading strategies, and specialized forex trading techniques. These advanced tactics can help traders maximize their returns while navigating the complexities of the financial markets.

List: Tools for Algorithmic Traders

Real Trader Testimonial

“Using insights from Trading in the Zone and testing setups with Pocket Option helped me transition from guessing to trading with confidence.” — Miguel, active trader

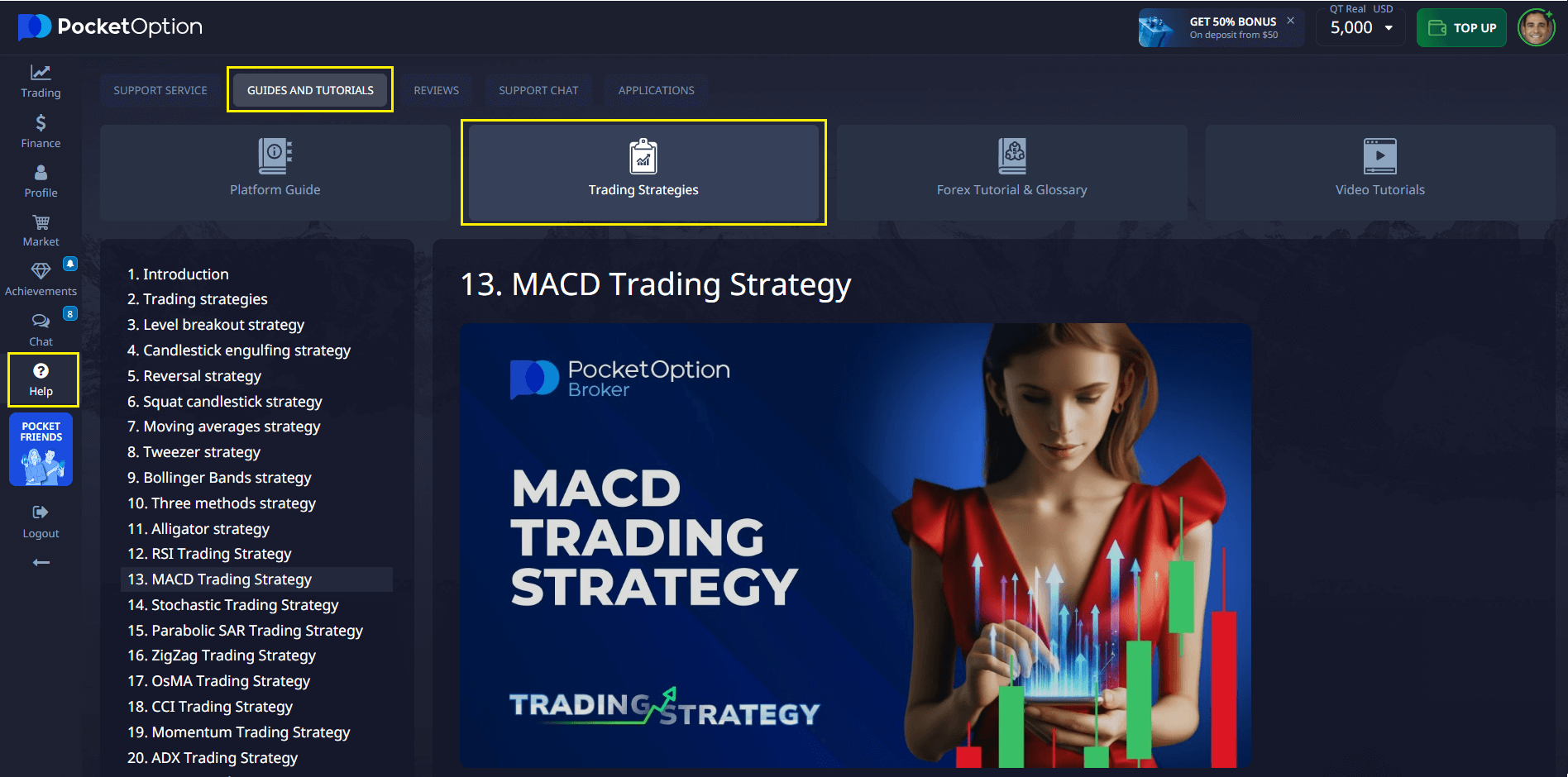

Explore More: Pocket Option’s Education Section

In addition to reading the best trading strategies books, you can deepen your knowledge through the Pocket Option Education section. It features video tutorials, Forex glossaries, and strategy guides that break down complex concepts into practical insights. Whether you’re a beginner learning the basics or a seasoned trader refining your methods, these resources offer a hands-on way to strengthen your trading decisions and build lasting confidence.

Final Thoughts

Expanding your knowledge with the best trading strategies books and integrating structured approaches into your trading can lead to consistent performance improvements. Whether you’re just starting or fine-tuning your existing trading approach, reading a trusted trading strategies book is a necessary step toward success.

Platforms like Pocket Option complement your education by providing tools that support your trading decisions in real-time. Remember, each trading system has nuances, and what works for one person may not suit another. Stay informed, test ideas, and always manage risk.

💬 Let’s keep the conversation going: Discuss this and other topics in our community!

FAQ

What should traders look for in the best trading strategies books?

Focus on books offering clear methodology, practical examples, and comprehensive risk management approaches.

How frequently should trading methods be reviewed?

Regular review every 3-6 months helps adapt to changing market conditions.

What makes technical analysis important for traders?

Technical analysis provides structured methods for market assessment and trade timing.

How do successful traders implement book knowledge?

Through careful testing, documentation, and gradual implementation of selected strategies.

What role does market psychology play in trading?

Understanding market psychology helps predict price movements and maintain emotional control.