- Previewing files in-terminal: NNN supports previewing text files, images, and PDFs directly in the terminal, reducing the need to open separate applications.

- Batch operations: Users can rename, delete, or move multiple files at once, improving efficiency when managing large datasets or log archives.

- Clipboard integration: Easily copy or cut files and paste them into different directories using intuitive shortcuts.

- File syncing and export: NNN enables exporting file lists and syncing data across directories or even servers–perfect for backing up trading strategy files.

- Plugin system: With over 100 plugins available, users can add disk usage analytics, quick media previews, or tools tailored for developers and traders.

- Custom configuration: Users can tailor key bindings, behaviors, and themes via

.config/nnn/init.vimor environment variables. - Integration with scripting tools: NNN works seamlessly with

rsync,scp,sed, and custom shell scripts, opening automation possibilities for frequent trading tasks.

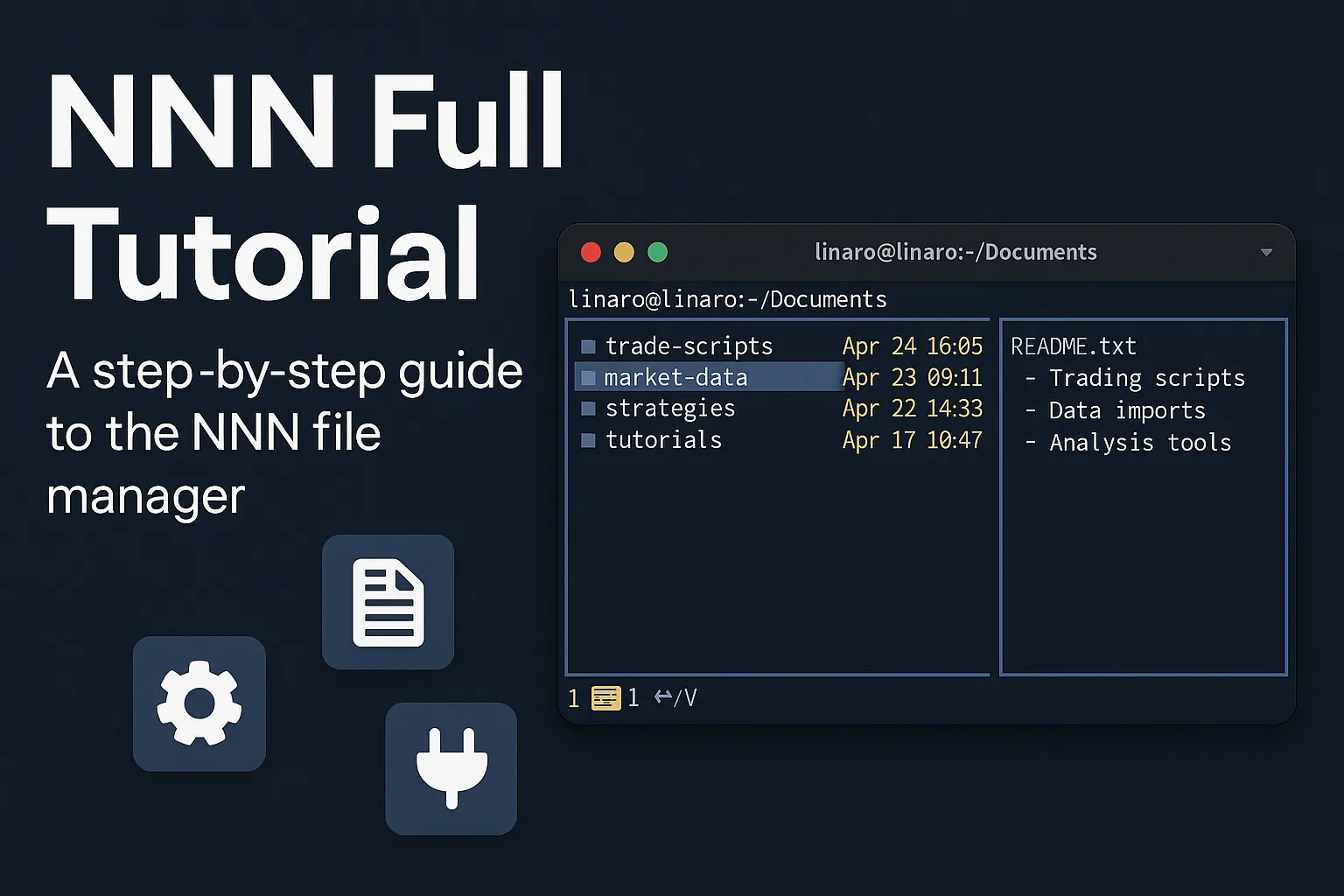

Understanding the NNN File Manager: NNN full Tutorial

In the realm of file management, NNN stands out as a powerful, open-source terminal file manager designed to streamline navigation and manipulation of files within a command-line interface. Particularly popular among Linux and macOS users, NNN offers a minimalist yet highly efficient approach to managing files, making it a favorite among those who prefer terminal-based workflows. This nnn full tutorial will walk you through everything you need to know to master it—from installation to expert tips.

What is NNN?

NNN, commonly referred to as a terminal file manager, is a lightweight, fast, and easy-to-navigate tool that allows users to efficiently handle files and directories using a command-line interface. It is an open-source project available on platforms like GitHub, providing comprehensive file management capabilities without the graphical overhead typical of traditional desktop file managers.

Key Features of NNN File Manager

The NNN file manager boasts a range of features that enhance its utility. With its plugin support, users can extend its functionality to manage various tasks. Some of its notable features include:

These features make it particularly suitable for users interested in trading signals, online trading setups, or organizing educational content for blog trading. In fact, traders often use NNN to manage CSV datasets, synchronize configuration files, and prepare folders for automated market analysis scripts.

Why Use NNN for File Management?

Choosing NNN for file management offers several advantages:

- Speed and Minimalism: NNN is lightweight and fast, ideal for systems with limited resources.

- Keyboard-Driven Efficiency: Navigation using hotkeys speeds up workflows.

- Plugin Ecosystem: Extend NNN to match your use case–be it development, market analysis, or trading education.

- Integration: Works seamlessly with tools like Vim and tmux.

Getting Started with NNN

How to Install NNN on Linux

Here’s how to install NNN depending on your distribution:

| Distribution | Command |

|---|---|

| Ubuntu | sudo apt install nnn |

| Fedora | sudo dnf install nnn |

| Arch | sudo pacman -S nnn |

| macOS | brew install nnn |

Basic Use of NNN: A Quickstart Guide

Launch NNN by typing:

nnnNavigate using arrow keys or h and l. Open files with Enter. Exit with q.

Navigation Tips in NNN

Efficient navigation within NNN is key to leveraging its full capabilities:

| Key | Action |

|---|---|

h |

Go up a directory |

l |

Open selected directory/file |

q |

Exit |

. |

Toggle hidden files |

b |

Bookmark current directory |

Set cd on quit to enable directory persistence with this line in .bashrc:

export NNN_TMPFILE="/tmp/nnn-last-dir"Advanced Features of NNN

Using Bookmarks for Efficient Navigation

Bookmark directories using b, then revisit them with the g key. You can jump directly to important folders such as forex trading projects or your downloaded market analysis files.

Exporting and Syncing Files in NNN

Batch operations allow for quick file copying or movement. Export a file list using the ^W command. Integration with rsync or scp makes syncing simple.

Introduction to NNN Plugins

NNN’s plugin manager can be installed from GitHub and includes tools like:

| Plugin | Functionality |

|---|---|

| preview-tui | Text and image preview |

| nmount | Auto mount drives |

| disk-usage | Analyze folder sizes |

Working with the Command Line

Understanding Command Line Operations in NNN

The terminal interface enables scriptable, precise control. Rename files, adjust permissions, or initiate batch downloads using commands within or outside NNN.

Using NNN with Linux Terminal

Start NNN from anywhere:

nnnPair it with Vim for editing or scp for secure transfers.

CLI vs Graphical File Management

| Feature | CLI (NNN) | GUI File Managers |

|---|---|---|

| Speed | High | Medium |

| Resource Usage | Low | High |

| Scripting | Yes | No |

| Learning Curve | Steep | Gentle |

Tips and Best Practices

Avoiding Common Mistakes with NNN

- Don’t delete directories without confirming their contents.

- Avoid misusing plugins without reading the docs.

- Always back up configuration files.

Best Tools for NNN File Management

- Vim: For quick edits

- Ranger: For comparison

- Pocket Option: For trading-based automation and signals

Quick Notes for Effective Use of NNN

- Use

bfor bookmarks - Use

^Wfor export - Create aliases for frequent tasks

Expert Quotes & Insights

“The real strength of NNN lies in its extensibility. You can tailor it to act as a trading dashboard, script manager, or dev suite with the right plugins.”- Igor Novikov, Senior Linux Consultant

“For active traders, the combination of NNN and terminal analytics tools can offer unmatched speed compared to browser-based solutions.”- Elena Simic, Trading Educator & Author

Final Thoughts

NNN is more than just a file manager. It’s a customizable, fast, and powerful tool for anyone who lives in the terminal. Whether you’re coding, researching forex trading, or managing educational content for your blog trading, NNN provides a flexible base to build your workflow.

Use it in tandem with Pocket Option’s tools–like their trading bots and educational resources–to streamline both your system operations and market decisions.

FAQ

What does the NNN full form signify, and why is it crucial in real estate?

The NNN full form represents "triple net lease" a lease agreement where the tenant covers property taxes, insurance, and maintenance costs. It's crucial because it assures landlords a steady income without these expense burdens, making it a favored choice in commercial real estate.

How does a single tenant triple net lease differ from a multi-tenant triple net lease?

In a single tenant triple net lease, one tenant occupies the entire property, taking on all NNN expenses, which lowers vacancy risk and simplifies management. A multi-tenant triple net lease involves multiple tenants, potentially increasing management complexity but offering more diversified income.

What are the key benefits of a triple net lease for landlords?

A triple net lease provides landlords with a steady income void of additional expenses, reduced management responsibilities, and potential asset value growth due to high demand for NNN properties, making it an appealing investment option.