- Selling Bitcoin for USD or EUR via a crypto exchange 🏦

- Using a Bitcoin ATM to get cash on the spot

- Making a transfer BTC to another wallet or peer-to-peer (P2P) buyer

How to Withdraw Money from Bitcoin: The Top Comprehensive Approach

Want to know how to withdraw money from Bitcoin quickly and securely? This guide covers everything from cashing out BTC to bank transfers, avoiding high blockchain fees, and staying safe while managing your crypto.

Article navigation

- Start trading

- Understanding How to Withdraw Money from Bitcoin

- What Is a Bitcoin Withdrawal?

- How to Withdraw Bitcoin Safely

- Common Issues with Bitcoin Withdrawals

- Choosing the Right Wallet

- Peer-to-Peer (P2P) Options

- Using Bitcoin ATMs

- Crypto Exchanges and Bank Accounts

- Alternative Withdrawal Methods

- Why Pocket Option Can Complement Your Crypto Journey

Understanding How to Withdraw Money from Bitcoin

Before you can withdraw bitcoin to bank accounts or cash out bitcoin into fiat, it’s essential to understand how the process works. How to withdraw money from Bitcoin is one of the most common questions crypto holders ask.

At its core, Bitcoin withdrawals mean transferring BTC from your bitcoin wallet to another wallet, a crypto exchange, or a connected bank account. This can involve:

Expert Insight: According to CoinDesk, average blockchain fees dropped 25% in 2024 due to wider SegWit adoption — meaning cheaper withdrawals for users who choose the right network.

What Is a Bitcoin Withdrawal?

A Bitcoin withdrawal is simply the act of moving BTC from one location to another — usually from a crypto exchange to your personal wallet, or from a wallet to fiat.

Getting it right is critical: one wrong character in the wallet address can result in permanent loss of funds.

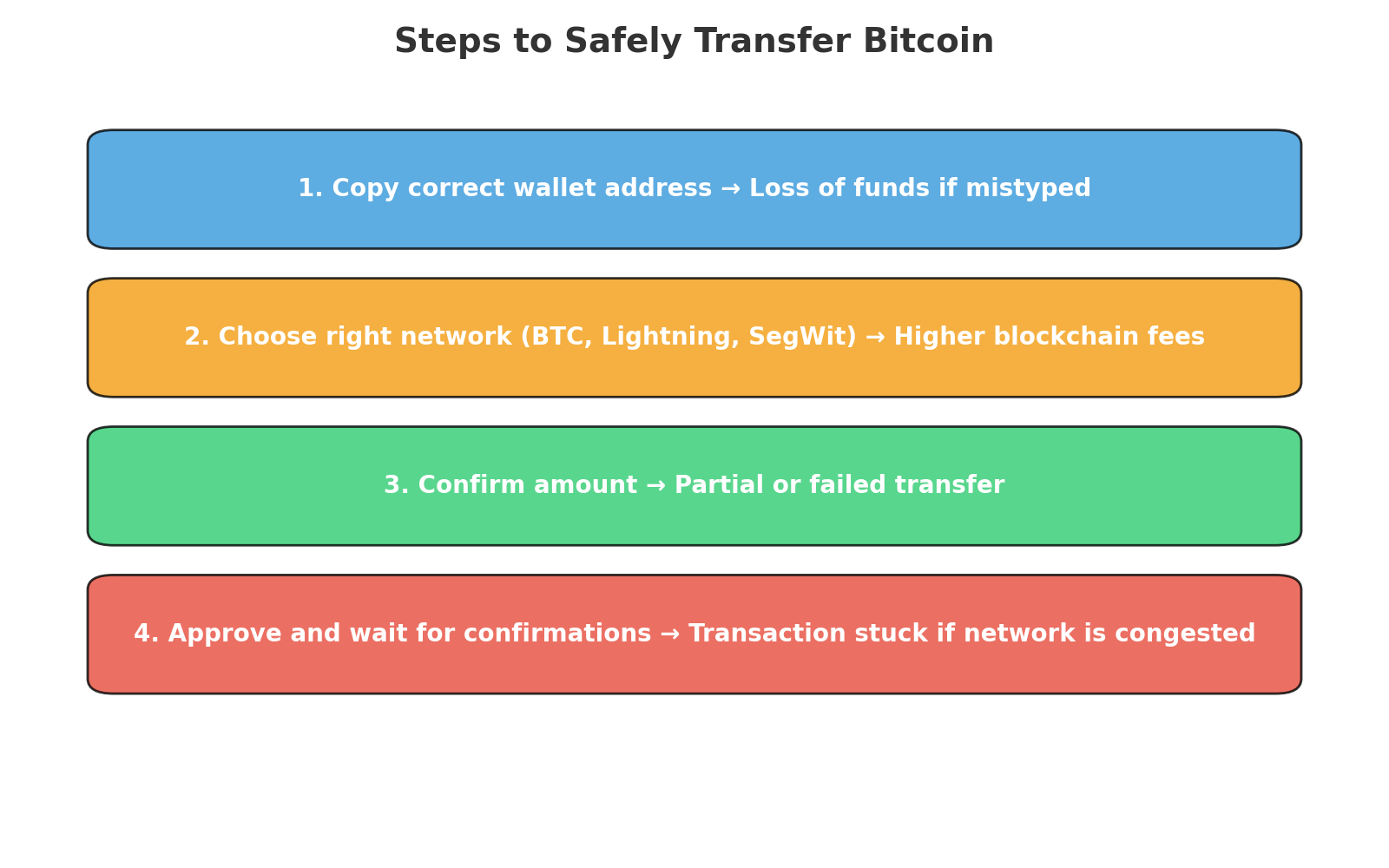

| Step | Action | Risk if Done Wrong |

|---|---|---|

| 1 | Copy correct wallet address | Loss of funds if mistyped |

| 2 | Choose right network (BTC, Lightning, SegWit) | Higher blockchain fees |

| 3 | Confirm amount | Partial or failed transfer |

| 4 | Approve and wait for confirmations | Transaction stuck if network is congested |

How to Withdraw Bitcoin Safely

When you search “how to withdraw money from Bitcoin,” you usually want a step-by-step solution. Here’s the most reliable process:

- Select a Crypto Exchange or Wallet – Choose platforms like Coinbase, Binance, or Kraken.

- Verify Your Account – Complete KYC to enable withdrawals.

- Sell Bitcoin for USD (or your local currency) – This step lets you lock in market price.

- Transfer Funds to Your Bank – Withdraw bitcoin to bank using ACH, SEPA, or wire transfer.

- Watch for Blockchain Fees – Some exchanges let you pick a cheaper time for transfer.

Pro Tip: Schedule withdrawals during low-traffic hours (early morning UTC) to minimize blockchain fees.

Common Issues with Bitcoin Withdrawals

| Issue | Description | Solution |

|---|---|---|

| High Blockchain Fees | Can exceed $10 during peak hours | Use SegWit or Lightning Network |

| Bank Rejection | Some banks block crypto transfers | Use a friendly bank or fintech (Revolut, Wise) |

| Delayed Processing | Exchange security checks slow payouts | Verify ID in advance to avoid delays |

| Lost Funds | Wrong address or network | Always triple-check before confirming |

Choosing the Right Wallet

Your bitcoin wallet is the first line of defense. Hardware wallets (Ledger, Trezor) are ideal for long-term storage, but hot wallets (Trust Wallet, MetaMask) are more convenient for frequent withdrawals.

Checklist for Wallet Selection:

- ✅ Supports fast transfer BTC

- ✅ Displays real-time network fees

- ✅ Compatible with your bank or exchange

- ✅ Good reputation & security history

Peer-to-Peer (P2P) Options

If you want to cash out bitcoin privately, P2P marketplaces like Paxful, Binance P2P, and LocalBitcoins (now discontinued but replaced by similar platforms) connect you directly with buyers.

| Advantage | Example |

|---|---|

| Lower Fees | Some buyers pay market price with 0% platform fee |

| Flexible Payments | Bank transfer, PayPal, or even cash |

| Privacy | Avoids centralized exchanges |

⚠️ Security Tip: Always trade with verified users and use escrow to prevent fraud.

Using Bitcoin ATMs

Bitcoin ATMs are now available in over 80 countries 🌎. They allow you to sell bitcoin for USD or local currency instantly.

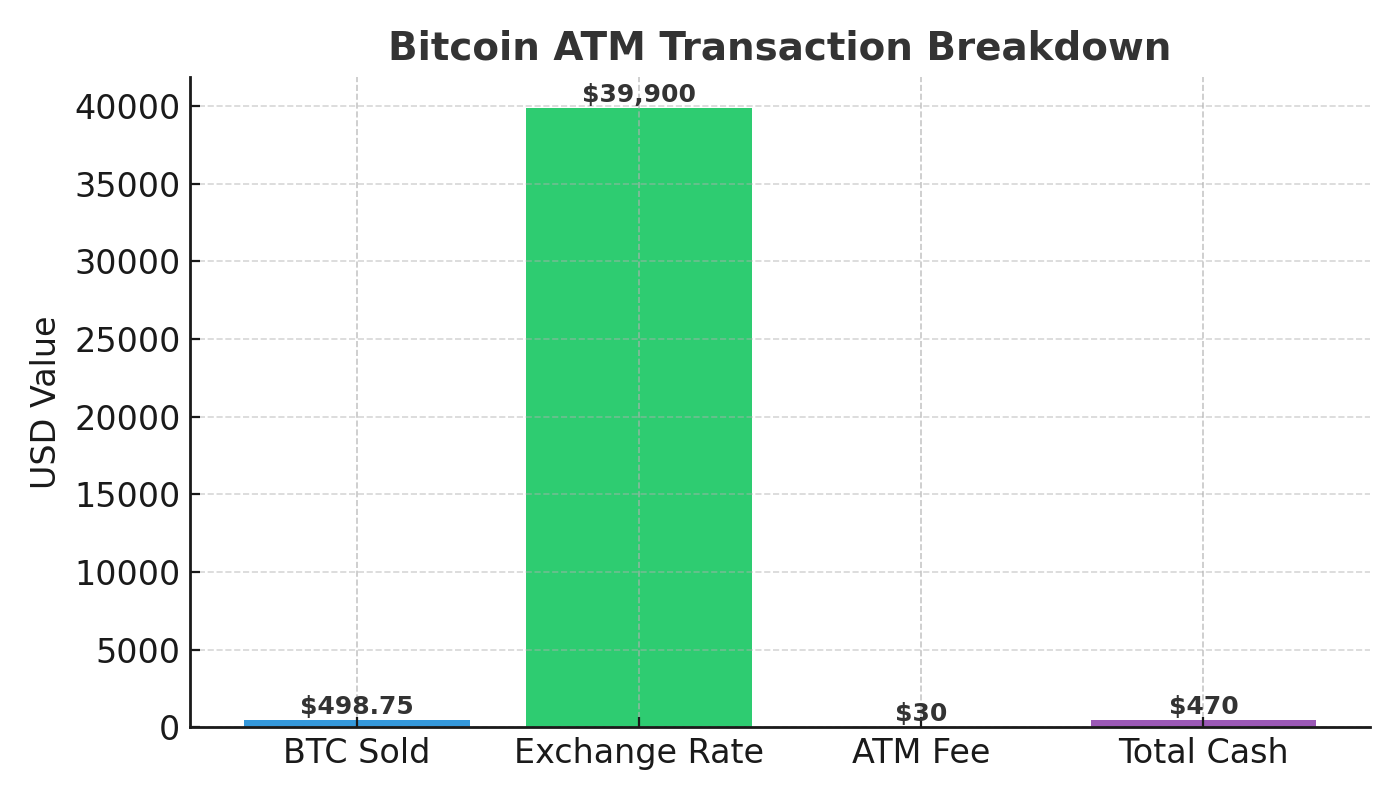

Example: A $500 BTC sale at a Bitcoin ATM might cost:

| Item | Amount |

|---|---|

| BTC Sold | 0.0125 BTC |

| Exchange Rate | $39,900 |

| ATM Fee | 6% ($30) |

| Total Cash | $470 |

They are convenient but expensive — use for emergencies, not regular withdrawals.

Crypto Exchanges and Bank Accounts

Linking your exchange to your bank is the most common way to withdraw bitcoin to bank accounts.

Bloomberg reports that over 70% of crypto investors prefer direct bank withdrawals due to lower cost compared to ATMs or P2P.

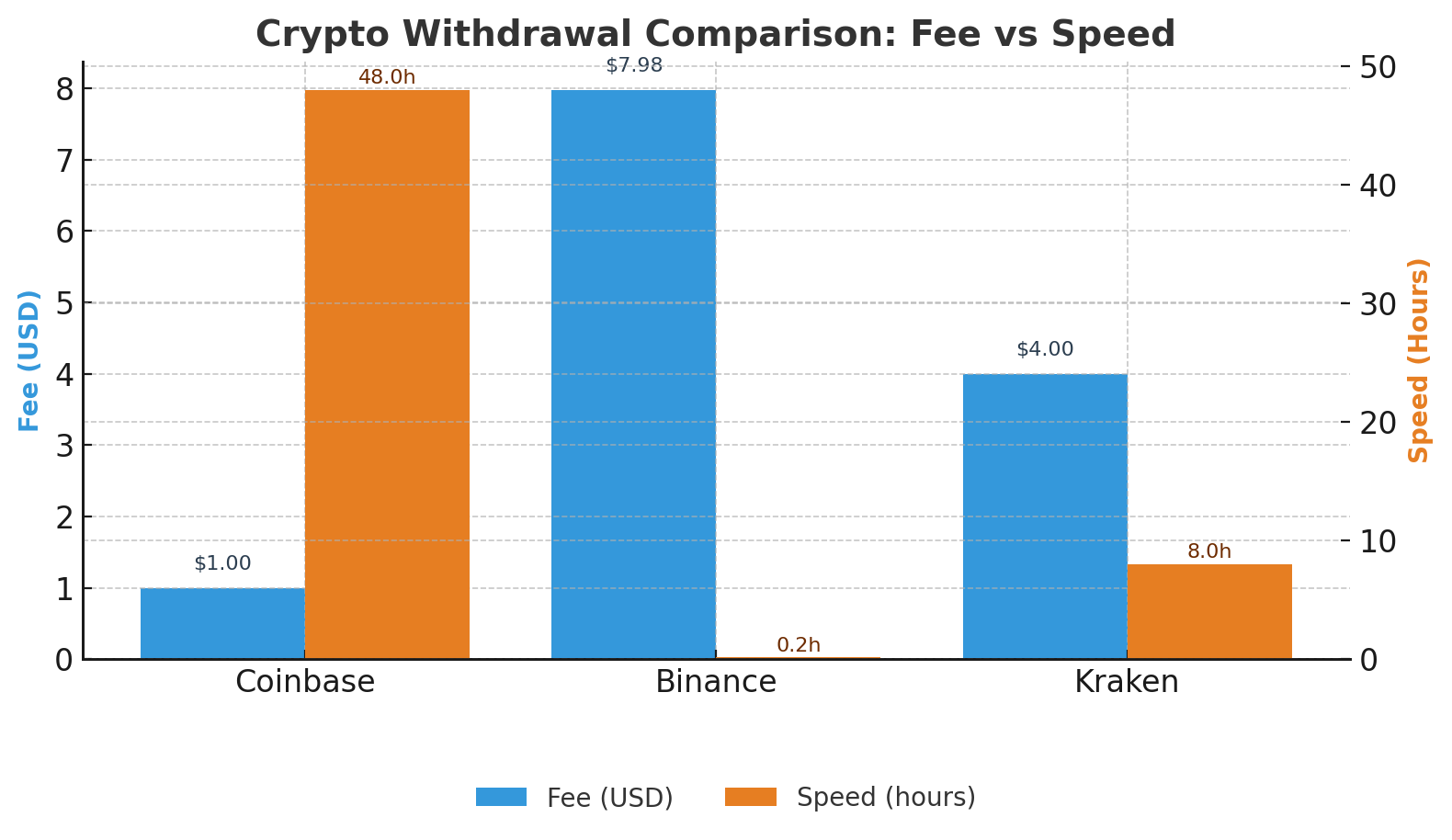

Withdrawal Fees: What to Expect

| Platform | Typical Fee | Speed |

|---|---|---|

| Coinbase | $1 + network fee | 1-3 days |

| Binance | 0.0002 BTC | ~10 min (network-dependent) |

| Kraken | $4 (USD wire) | Same-day if early |

Expert Note: If you plan to move large sums, splitting withdrawals across multiple transactions can help you save on fees and reduce compliance checks.

Alternative Withdrawal Methods

- Stablecoins (USDT/USDC): Convert BTC to stablecoins to avoid price drops during withdrawal.

- BitPay or Crypto.com Cards: Spend crypto directly like cash 💳.

- OTC Desks: Ideal for whales or businesses — negotiated rates, lower slippage.

Expert Recommendations

- 🕒 Time Your Withdrawals: Cheaper at night or weekends.

- 🛡️ Use Two-Factor Authentication: To prevent hacks.

- 📊 Track Market Prices: Sell bitcoin for USD when price peaks.

- 📂 Keep Tax Records: IRS and EU require reporting crypto sales.

Why Pocket Option Can Complement Your Crypto Journey

Pocket Option lets you trade 100+ assets 24/7 — including stocks, forex, and OTC crypto assets — while you manage your Bitcoin withdrawals (You can top up your account using Bitcoin at Pocket Option).

- ✔️ $5* minimum deposit & free $50,000 demo account

- ✔️ AI Trading & Telegram Signal Bot

- ✔️ Social Trading & Tournaments with prizes 🏆

- ✔️ Over 50 payment methods for deposits & withdrawals

“I converted my BTC profits into USD, deposited $50 on Pocket Option, and doubled it in two weeks.” — Daniel M.

“The demo account let me practice crypto trading before risking real funds.” — Julia R.

*minimum deposit may vary depending on geo and payment method

FAQ

How do I transfer Bitcoin to my bank account?

You first sell Bitcoin on a crypto exchange (like Coinbase, Binance, or Kraken) for fiat currency (USD/EUR), then use the exchange’s withdrawal feature to send the money to your linked bank account.

What is the safest way to cash out Bitcoin?

The safest method is to use a reputable crypto exchange with strong security (2FA, withdrawal whitelist) and verified accounts, then withdraw to a trusted bank or card.

Can I withdraw Bitcoin without fees?

Completely fee-free withdrawals are rare, but you can minimize costs by choosing exchanges with low withdrawal fees, using SegWit addresses, and scheduling transfers during low network congestion.

Is Pocket Option available in all countries?

Pocket Option is available in many countries worldwide, but regulatory restrictions may apply in certain regions. Before using Pocket Option for Bitcoin withdrawals, check if the service is permitted in your jurisdiction. The platform's availability may change as cryptocurrency regulations evolve globally.

How can I minimize fees when withdrawing Bitcoin?

To minimize withdrawal fees, consider these strategies: choose exchanges with lower fee structures; withdraw larger amounts less frequently rather than multiple small withdrawals; time your withdrawals during periods of lower network congestion; use P2P platforms for potentially lower fees; and compare fee structures across different platforms before committing to a withdrawal method.

Final Thoughts

Knowing how to withdraw money from Bitcoin efficiently can save you time, money, and frustration. Whether you prefer to cash out bitcoin through an exchange, withdraw bitcoin to bank, or use a crypto exchange card, understanding blockchain fees and security measures is key. With the right mix of strategy and tools like Pocket Option, you can keep your capital working for you — even after converting BTC to cash. 🚀

Start trading