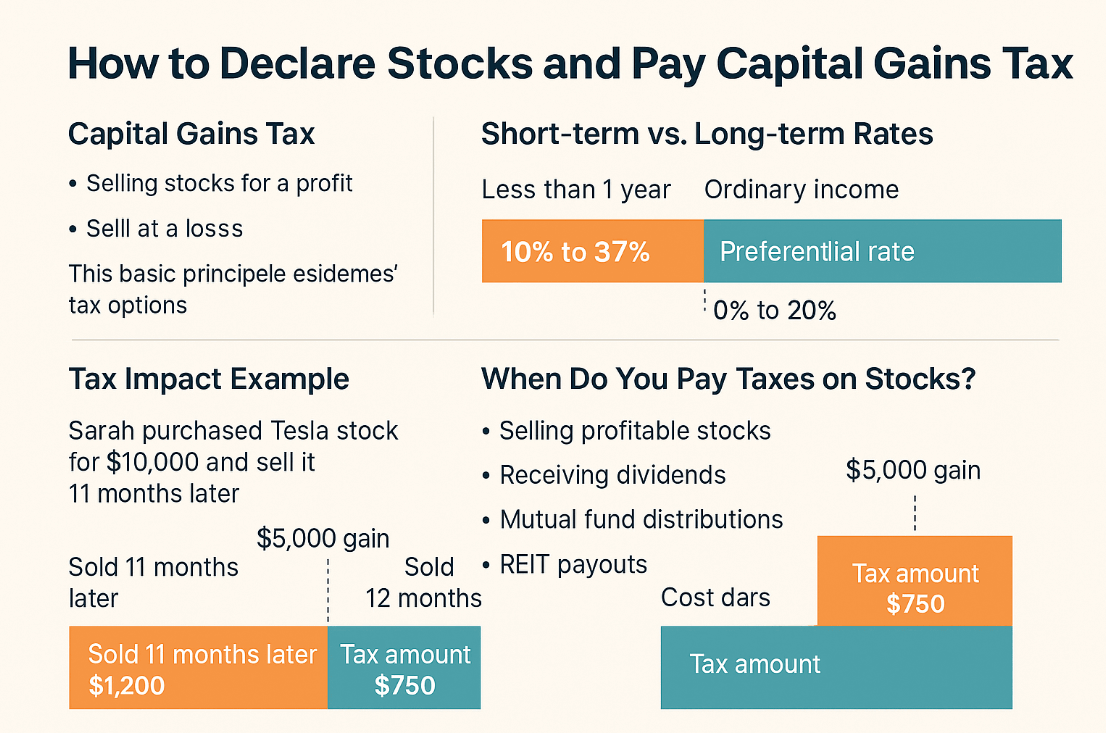

- Selling for a profit: Tax applies in the year of sale

- Receiving dividends: Taxed annually as income

- Mutual fund distributions: Reported when distributed

- REIT payouts: Often taxed at income rates

How to Declare Stocks and Pay Capital Gains Tax

Understanding how to declare stocks and manage capital gains tax is crucial for investors at any level. Whether you're an experienced trader or just beginning your journey in the markets, grasping your tax obligations helps you avoid costly errors and build a compliant, tax-efficient investment strategy.

Article navigation

- Why It Matters

- What Is Capital Gain?

- Short-Term vs Long-Term Capital Gains Tax

- When Do You Pay Taxes on Stocks?

- Do I Pay Taxes on Stocks I Don’t Sell?

- Do You Pay Taxes on Investments If You Don’t Sell?

- Do I Have to Report Stocks on Taxes If I Made Less Than $1,000?

- Does Selling Stock Count as Income?

- Do I Have to Pay Tax on Stocks If I Sell and Reinvest?

- How to Declare Stocks on Your Tax Return

- Stock Tax Calculator: Your Best Friend

- Smart Tax-Saving Strategies

- Common Tax Mistakes to Avoid

- When to Get Professional Help

- Alternative: Simplify with Pocket Option

- Final Thoughts

Why It Matters

According to IRS statistics, thousands of taxpayers misreport investment income every year. This leads to audits, penalties, and lost profits. A major reason is confusion around when and how to declare stock-related income. This article provides a comprehensive guide to ensure you’re well-prepared come tax time.

What Is Capital Gain?

A capital gain occurs when you sell a stock for more than you paid. For example, if you purchase a share for $1,000 and later sell it for $1,500, your capital gain is $500. Conversely, if you sell it for $800, you incur a capital loss of $200.

Short-Term vs Long-Term Capital Gains Tax

The U.S. tax system treats gains differently based on how long you hold an asset:

| Holding Period | Tax Category | Typical Rate |

|---|---|---|

| Less than 1 year | Short-term capital gains tax | 10% – 37% (ordinary income) |

| More than 1 year | Long-term capital gains | 0%, 15%, or 20% depending on income |

Example: Sarah bought Tesla stock for $10,000 and sold it 11 months later for $15,000. She made a $5,000 profit, which is subject to her 24% ordinary income rate. Her tax bill: $1,200. Had she waited one more month, her tax rate would’ve been 15%, or $750—a $450 difference.

When Do You Pay Taxes on Stocks?

When do you pay taxes on stocks? You pay taxes in the year the taxable event occurs:

Do I Pay Taxes on Stocks I Don’t Sell?

Do I pay taxes on stocks I don’t sell? Generally, no. The IRS uses a realization principle—you don’t pay capital gains tax until the asset is sold. However, dividend income from unsold stocks is still taxable annually.

Do You Pay Taxes on Investments If You Don’t Sell?

The question “do you pay taxes on investments if you don’t sell” follows the same logic. Unless the investment produces taxable income (like interest or dividends), no tax is due until realization.

Do I Have to Report Stocks on Taxes If I Made Less Than $1,000?

Absolutely. Do I have to report stocks on taxes if I made less than $1,000? Yes. The IRS requires all capital gains and losses to be reported, regardless of the amount. Even if your net gain is small or zero, you must declare it on Schedule D.

Does Selling Stock Count as Income?

Yes, but with nuance. Does selling stock count as income? It counts as capital gains income, which is taxed differently from wages or interest. Short-term gains are taxed as ordinary income, while long-term gains benefit from lower rates.

Do I Have to Pay Tax on Stocks If I Sell and Reinvest?

Do I have to pay tax on stocks if I sell and reinvest? Unfortunately, yes. Selling is a taxable event, regardless of what you do with the proceeds. The IRS taxes the sale itself, not how you use the money afterward.

Real Insight: Reinvesting doesn’t exempt you from capital gains tax. To avoid taxes, consider using tax-deferred accounts like IRAs.

How to Declare Stocks on Your Tax Return

Let’s walk through how to declare stocks step by step:

- Collect 1099-B and 1099-DIV forms from your broker

- Use Form 8949 to detail each stock sale

- Transfer totals to Schedule D for capital gains and losses

- Include dividends on Schedule B if necessary

- Attach all forms to Form 1040

Keeping accurate purchase and sale records is essential to properly report cost basis and holding periods.

Stock Tax Calculator: Your Best Friend

Using a stock tax calculator can help estimate your tax liability before selling. These tools account for:

- Holding period

- Income bracket

- Expected capital gain

- Offset from losses

Many brokers offer built-in calculators on their platforms.

Smart Tax-Saving Strategies

Here’s how experienced investors reduce their stock tax liability:

- Hold assets for over a year to qualify for lower tax rates

- Harvest tax losses by selling underperforming stocks

- Use tax-deferred accounts like Roth IRA or 401(k)

- Donate appreciated stock to charity for a deduction

- Time your trades to fall in lower income years

Common Tax Mistakes to Avoid

Avoid these pitfalls to stay on the IRS’s good side:

- Not reporting small gains or dividend income

- Incorrectly labeling short-term trades as long-term

- Forgetting about wash sale rules

- Relying solely on broker-provided summaries without checking them

When to Get Professional Help

Seek a tax advisor if you:

- Trade frequently or use multiple brokerages

- Have stock options or RSUs

- Invest internationally

- Need help with tax-loss harvesting

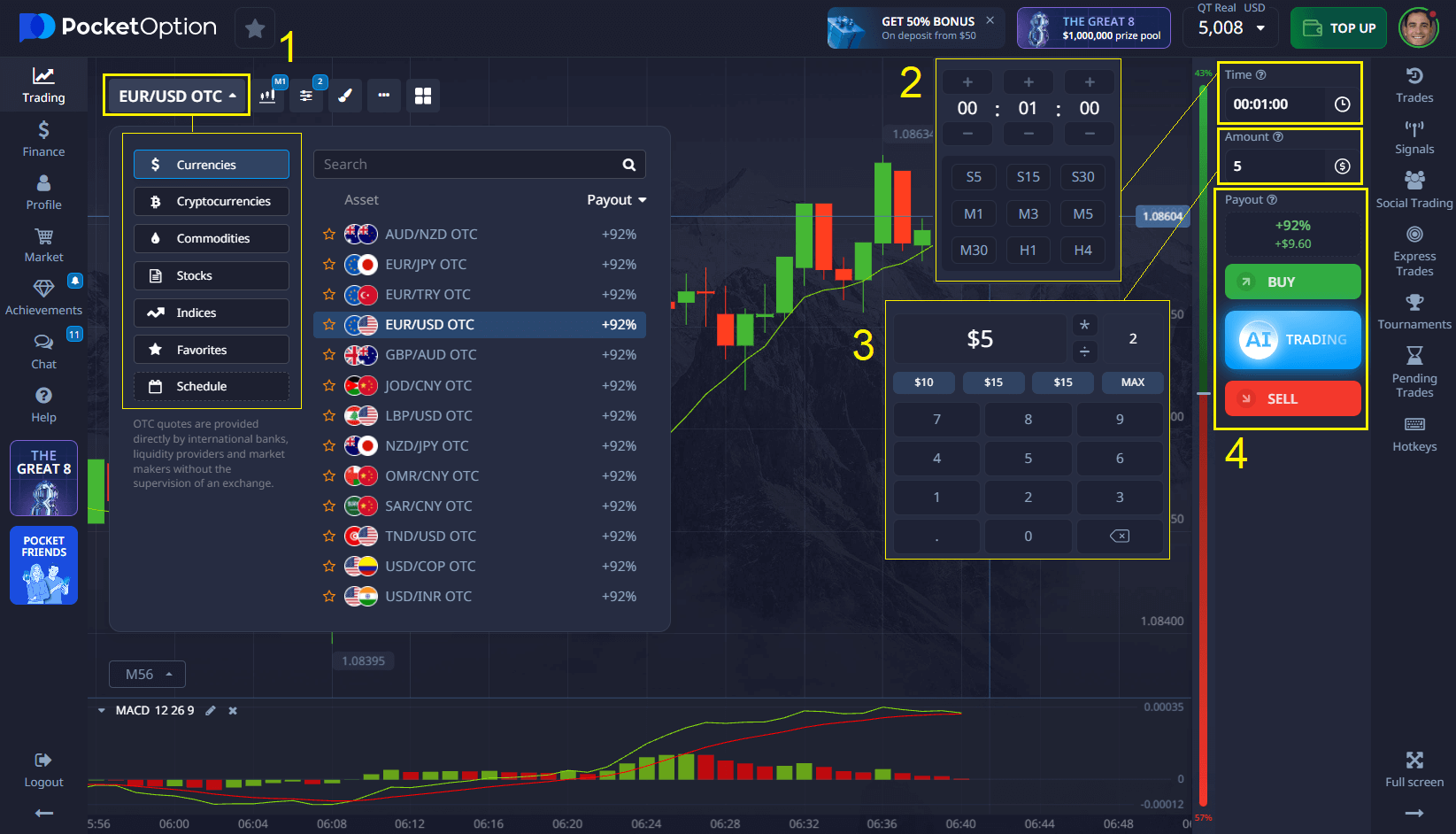

Alternative: Simplify with Pocket Option

Tired of managing complex tax forms? Pocket Option offers an alternative approach: Quick Trading, where you don’t own the asset but predict its price movement.

Why it’s simpler:

- No capital gains from asset ownership

- No dividend income to declare

- No need to calculate holding periods or cost basis

“Switching to prediction-based trading significantly simplified my tax season,” says trader Anna Thompson. “I focus on market strategy instead of paperwork.”

Final Thoughts

Whether you’re reporting a $100 gain or $100,000, managing stock taxes requires knowledge, discipline, and proper planning. From understanding how to declare stocks to knowing do I have to pay tax on stocks if I sell and reinvest, your success depends on compliance and strategy. Don’t overlook small transactions. Use a stock tax calculator, maintain accurate records, and consider professional advice if your trading grows in volume or complexity. And if you want to trade without the traditional tax burden, platforms like Pocket Option provide a simplified entry into market speculation. Just make sure the method you choose fits your financial and compliance goals. Discuss this and other topics in our community!

Always consult a tax professional or CPA before filing to ensure compliance with the latest IRS guidelines.

FAQ

Do I need to declare stocks even if I didn't sell any during the year?

Yes, all stock positions held as of 12/31/2024 must be declared in the "Assets and Rights" form, regardless of whether you made any sales. Declare the acquisition value of the shares, not their current market value. Omitting this information creates inconsistencies with data already sent by B3 to the Federal Revenue Service.

How can I offset losses in stock operations to reduce taxes?

Losses in common operations can be offset exclusively with future profits of the same type, with no expiration period. For day trading losses, compensation is only valid with profits from other day trades. Keep separate control by category and declare all losses in the year they occurred to ensure your right to future compensation.

How do I declare stocks received through inheritance or donation without paying taxes twice?

Stocks received through inheritance should be declared at the value stated in the judicial declaration of the estate. For donations, use the value assigned in the public deed. In both cases, in the description, specify "Shares received by inheritance/donation according to process/deed No. X". This value will be your new basis for calculating any future capital gains.

Why must I declare dividends if they are tax-exempt? What's the difference compared to JCP?

Dividends, although exempt, must be declared in the "Exempt Income" form to justify the increase in assets. Interest on Own Capital (JCP) is subject to a 15% withholding tax and must be reported under "Income with Exclusive Taxation". Failure to declare these amounts, even with tax already withheld, may generate tax issues due to omission of income, with penalties of up to 150% of the amount due.

Do I Need to Declare My Shares?

Do I need to declare my shares? Simply owning shares doesn't require declaration, but any income from those shares (dividends, capital gains from sales) must be reported.

Do I Have to File a 1099 for Stocks?

Do I have to file a 1099 for stocks? You don't file these forms yourself – brokers send 1099-B and 1099-DIV forms to you and the IRS. Use this information when preparing your return.

Do I Need to Declare My Stocks?

Do I need to declare my stocks? You must declare any stock transactions that resulted in gains or losses, plus dividend income and other taxable events from your holdings.

How to Declare Stocks on Taxes?

How to declare stocks on taxes involves completing Schedule D of your tax return with detailed transaction information including purchase dates, sale dates, and amounts.